444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom rotor blade market represents a critical component of the nation’s renewable energy infrastructure, encompassing the manufacturing, maintenance, and technological advancement of wind turbine rotor blades. Market dynamics indicate substantial growth driven by the UK’s commitment to achieving net-zero carbon emissions by 2050 and the government’s ambitious offshore wind capacity targets. The sector has experienced remarkable expansion, with offshore wind capacity growing at approximately 12.5% annually over the past five years.

Industry participants range from established global manufacturers to specialized UK-based companies focusing on advanced composite materials and blade design innovations. The market encompasses various blade lengths and configurations, from smaller onshore turbines to massive offshore installations featuring blades exceeding 100 meters in length. Technological advancements in materials science, aerodynamic design, and manufacturing processes continue to drive efficiency improvements and cost reductions across the sector.

Regional distribution shows concentrated activity along coastal areas, particularly in Scotland, Northern England, and Wales, where favorable wind conditions and established maritime infrastructure support both manufacturing and installation operations. The market benefits from strong government support through renewable energy incentives, research funding, and strategic industrial policies aimed at maintaining the UK’s position as a global leader in offshore wind technology.

The United Kingdom rotor blade market refers to the comprehensive ecosystem encompassing the design, manufacturing, installation, maintenance, and recycling of wind turbine rotor blades within the UK’s renewable energy sector. This market includes all activities related to blade production, from raw material sourcing and composite manufacturing to final assembly and quality testing.

Rotor blades serve as the primary energy capture mechanism in wind turbines, converting kinetic wind energy into rotational mechanical energy through sophisticated aerodynamic design principles. The market encompasses various blade technologies, including traditional fiberglass composites, advanced carbon fiber constructions, and hybrid materials designed to optimize performance while minimizing weight and manufacturing costs.

Market scope extends beyond manufacturing to include specialized services such as blade inspection, repair, refurbishment, and end-of-life recycling solutions. The sector supports a complex supply chain involving raw material suppliers, component manufacturers, logistics providers, and specialized installation contractors, creating significant economic value and employment opportunities across multiple regions.

Strategic positioning of the United Kingdom rotor blade market reflects the nation’s leadership in offshore wind development and commitment to renewable energy transition. The market demonstrates robust growth trajectories supported by favorable regulatory frameworks, substantial investment commitments, and technological innovation across multiple industry segments.

Key performance indicators reveal strong market fundamentals, with blade manufacturing capacity expanding at approximately 8.2% annually to meet growing domestic and export demand. The sector benefits from established supply chains, skilled workforce development programs, and strategic partnerships between UK companies and international technology leaders.

Market differentiation emerges through specialized focus on offshore applications, where UK companies have developed particular expertise in large-scale blade manufacturing and installation techniques suited to challenging marine environments. Innovation priorities include advanced materials development, improved aerodynamic efficiency, and enhanced durability characteristics essential for long-term offshore operations.

Investment trends indicate continued capital allocation toward manufacturing capacity expansion, research and development initiatives, and supply chain optimization. The market attracts both domestic and international investment, supported by government incentives and the strategic importance of renewable energy infrastructure to national energy security objectives.

Fundamental market drivers include accelerating offshore wind deployment, technological advancement requirements, and evolving regulatory standards that favor larger, more efficient turbine installations. The sector demonstrates strong correlation with broader renewable energy adoption trends and government policy initiatives supporting clean energy transition.

Government policy support represents the primary catalyst driving United Kingdom rotor blade market expansion, with ambitious renewable energy targets requiring substantial wind capacity additions over the coming decade. The UK’s commitment to achieving 40GW offshore wind capacity by 2030 creates sustained demand for advanced rotor blade technologies and manufacturing capabilities.

Technological advancement requirements drive continuous innovation in blade design, materials science, and manufacturing processes. Industry demands for improved efficiency, reduced maintenance requirements, and enhanced durability characteristics create opportunities for companies developing next-generation blade technologies. Performance improvements of approximately 15-20% in energy capture efficiency motivate ongoing research and development investments.

Economic competitiveness of wind energy compared to traditional power generation sources accelerates market adoption and investment commitments. Declining levelized cost of electricity from wind power, combined with rising fossil fuel prices and carbon pricing mechanisms, enhances the economic attractiveness of wind energy projects requiring advanced rotor blade solutions.

Supply chain localization initiatives encourage domestic manufacturing capacity development, reducing dependence on international suppliers and creating local economic benefits. Government support for UK-based manufacturing facilities and research centers strengthens the domestic supply chain while building export capabilities for international markets.

High capital requirements for establishing rotor blade manufacturing facilities create significant barriers to market entry, particularly for smaller companies lacking access to substantial investment capital. Manufacturing facilities require specialized equipment, skilled workforce development, and extensive quality certification processes that demand considerable upfront investment.

Technical complexity associated with large-scale blade manufacturing presents operational challenges, including precision engineering requirements, quality control standards, and logistical considerations for transporting oversized components. Manufacturing tolerances must maintain extremely tight specifications to ensure optimal performance and safety standards.

Supply chain vulnerabilities expose the market to potential disruptions from raw material shortages, transportation delays, or geopolitical factors affecting international trade relationships. Dependence on specialized materials and components from limited supplier networks creates potential bottlenecks in production capacity.

Regulatory compliance requirements impose additional costs and operational complexity, particularly regarding environmental standards, safety certifications, and international trade regulations. Evolving regulatory frameworks require continuous adaptation of manufacturing processes and quality assurance procedures.

Floating offshore wind development presents substantial growth opportunities for specialized rotor blade technologies designed for deepwater applications. This emerging market segment requires innovative blade designs optimized for floating platform installations, creating demand for advanced engineering solutions and manufacturing capabilities.

Export market expansion offers significant revenue potential as UK companies leverage domestic expertise to serve international offshore wind development projects. Growing global demand for offshore wind technology creates opportunities for UK manufacturers to establish international partnerships and supply chain relationships.

Blade recycling solutions represent an emerging market opportunity as first-generation wind turbines reach end-of-life status. Developing comprehensive recycling and material recovery processes addresses environmental concerns while creating new revenue streams and circular economy business models.

Advanced materials development enables next-generation blade designs with improved performance characteristics, reduced weight, and enhanced durability. Innovation in composite materials, manufacturing processes, and design optimization creates competitive advantages and market differentiation opportunities.

Competitive landscape evolution reflects increasing consolidation among major manufacturers while creating opportunities for specialized suppliers focusing on niche applications or innovative technologies. Market dynamics favor companies with strong research and development capabilities, established supply chain relationships, and proven track records in large-scale manufacturing operations.

Technology convergence drives integration between traditional blade manufacturing and emerging technologies such as smart sensors, predictive maintenance systems, and advanced materials science. This convergence creates opportunities for cross-industry collaboration and innovation partnerships that enhance overall system performance and reliability.

Investment patterns show increasing focus on sustainability initiatives, circular economy approaches, and environmental impact reduction throughout the blade lifecycle. Sustainability investments account for approximately 25% of total research and development spending, reflecting industry commitment to environmental responsibility and regulatory compliance.

Market maturation characteristics include standardization of manufacturing processes, establishment of industry best practices, and development of comprehensive supply chain networks. This maturation enables improved cost efficiency while maintaining quality standards essential for long-term market growth and customer satisfaction.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights, including primary research through industry interviews, secondary research from authoritative sources, and quantitative analysis of market trends and performance indicators.

Primary research activities include structured interviews with industry executives, technical experts, and key stakeholders across the rotor blade value chain. These interviews provide qualitative insights into market dynamics, competitive positioning, and future development trends that complement quantitative market data.

Secondary research sources encompass government publications, industry reports, academic research, and company financial disclosures to establish comprehensive understanding of market structure, regulatory environment, and competitive landscape characteristics. Data validation processes ensure accuracy and reliability of all research findings.

Analytical frameworks incorporate statistical modeling, trend analysis, and scenario planning methodologies to develop robust market projections and identify key growth opportunities. Research methodologies align with industry standards and best practices to ensure credibility and actionable insights for market participants.

Scotland dominates the United Kingdom rotor blade market with approximately 45% of total manufacturing capacity, benefiting from favorable wind resources, established maritime infrastructure, and supportive government policies. The region hosts major manufacturing facilities and research centers focused on offshore wind technology development.

Northern England represents a significant market concentration, particularly around coastal areas with established industrial infrastructure and skilled workforce availability. The region benefits from proximity to major offshore wind development projects and established supply chain networks supporting blade manufacturing and installation operations.

Wales contributes approximately 20% of UK rotor blade manufacturing capacity, with particular strength in specialized materials development and component manufacturing. The region’s industrial heritage and government support for renewable energy initiatives create favorable conditions for market expansion and technology development.

Southern England focuses primarily on research and development activities, design services, and specialized component manufacturing rather than large-scale blade production. The region’s proximity to major ports and international markets supports export activities and technology transfer initiatives.

Market leadership reflects a combination of international manufacturers with UK operations and domestic companies specializing in offshore wind applications. The competitive environment emphasizes technological innovation, manufacturing efficiency, and supply chain optimization as key differentiation factors.

By Application: The market segments into onshore and offshore applications, with offshore installations representing the fastest-growing segment due to superior wind resources and government policy support. Offshore applications account for approximately 65% of total blade demand, reflecting the UK’s strategic focus on offshore wind development.

By Blade Length: Market segmentation includes small blades (under 50 meters), medium blades (50-80 meters), and large blades (over 80 meters). Large blade segments demonstrate strongest growth as turbine manufacturers pursue increased efficiency through larger rotor diameters and advanced aerodynamic designs.

By Material Type: Traditional fiberglass composites maintain market dominance while carbon fiber and hybrid materials gain market share in premium applications requiring enhanced performance characteristics. Advanced materials represent approximately 30% of total blade manufacturing volume, with continued growth expected.

By End-User: Market segments include utility-scale wind farms, commercial installations, and distributed generation applications. Utility-scale projects dominate demand patterns, particularly for offshore installations requiring large-scale blade manufacturing and specialized installation capabilities.

Offshore Blade Category: This segment leads market growth with specialized designs optimized for marine environments, featuring enhanced corrosion resistance, improved durability, and advanced aerodynamic characteristics. Offshore blades require specialized manufacturing processes and materials to withstand harsh operating conditions while maintaining optimal performance over extended operational lifespans.

Large-Scale Blade Category: Blades exceeding 80 meters in length represent the fastest-growing market segment, driven by turbine manufacturer strategies to maximize energy capture through increased rotor diameters. This category requires advanced manufacturing capabilities, specialized transportation solutions, and innovative installation techniques.

Advanced Materials Category: Carbon fiber and hybrid composite blades gain market traction through superior strength-to-weight ratios, enabling larger blade designs while reducing overall turbine loads. This category attracts premium pricing while offering enhanced performance characteristics essential for next-generation wind turbine applications.

Maintenance and Services Category: Blade inspection, repair, and refurbishment services represent growing market opportunities as installed wind capacity matures and requires ongoing maintenance support. This category includes specialized services such as leading edge protection, lightning protection systems, and performance optimization solutions.

Manufacturing Companies benefit from sustained demand growth, technological advancement opportunities, and government support for domestic production capabilities. The market offers opportunities for capacity expansion, export development, and strategic partnerships with international technology leaders.

Technology Developers gain access to substantial research and development funding, collaboration opportunities with academic institutions, and market validation for innovative blade technologies. The UK market provides an ideal testing ground for next-generation technologies before international market expansion.

Supply Chain Partners benefit from stable demand patterns, long-term contract opportunities, and participation in a growing industrial ecosystem. Raw material suppliers, component manufacturers, and logistics providers gain from sustained market growth and increasing complexity of blade manufacturing requirements.

Government Stakeholders achieve renewable energy policy objectives while supporting domestic industrial development, job creation, and export revenue generation. The market contributes to energy security, carbon emission reduction targets, and economic development in coastal regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Blade Size Escalation continues as manufacturers pursue increased energy capture through larger rotor diameters, with new installations featuring blades exceeding 100 meters in length. This trend drives demand for specialized manufacturing capabilities, transportation solutions, and installation techniques capable of handling oversized components.

Advanced Materials Adoption accelerates as manufacturers integrate carbon fiber, hybrid composites, and innovative material solutions to achieve optimal strength-to-weight ratios while maintaining cost competitiveness. Material innovation accounts for approximately 35% of total research and development investment in the sector.

Smart Blade Technologies emerge through integration of sensors, monitoring systems, and predictive maintenance capabilities that optimize performance while reducing operational costs. These technologies enable real-time performance monitoring, condition assessment, and proactive maintenance scheduling.

Sustainability Focus intensifies as industry participants develop comprehensive approaches to blade lifecycle management, including recyclable materials, circular economy principles, and end-of-life recovery solutions. Environmental considerations increasingly influence design decisions and manufacturing processes.

Manufacturing Capacity Expansion initiatives include several major facility developments and capacity upgrade projects announced by leading manufacturers. These investments reflect confidence in long-term market growth and commitment to meeting increasing demand for advanced blade technologies.

Research Collaboration Programs between industry participants, academic institutions, and government agencies accelerate technology development and innovation initiatives. MarkWide Research analysis indicates that collaborative research programs have increased by approximately 40% over the past three years, reflecting industry commitment to technological advancement.

Strategic Partnership Agreements between UK companies and international technology leaders create opportunities for knowledge transfer, market access, and joint development programs. These partnerships strengthen the UK’s position in global supply chains while accessing advanced technologies and manufacturing expertise.

Regulatory Framework Updates include revised safety standards, environmental regulations, and certification requirements that influence blade design specifications and manufacturing processes. Industry participants must adapt to evolving regulatory requirements while maintaining competitive positioning and operational efficiency.

Investment Prioritization should focus on advanced manufacturing capabilities, research and development initiatives, and supply chain optimization to maintain competitive positioning in an increasingly complex market environment. Companies should evaluate opportunities for vertical integration and strategic partnerships that enhance operational efficiency and market access.

Technology Development strategies should emphasize breakthrough innovations in materials science, manufacturing processes, and blade design optimization that deliver measurable performance improvements and cost advantages. Innovation investments should target applications with clear market demand and commercial viability within reasonable timeframes.

Market Expansion opportunities require careful evaluation of international markets, regulatory requirements, and competitive dynamics before committing substantial resources to export development initiatives. Companies should leverage UK expertise in offshore applications while adapting to local market requirements and customer preferences.

Sustainability Integration should become a core component of business strategy, encompassing environmental impact reduction, circular economy principles, and stakeholder engagement initiatives. According to MarkWide Research projections, sustainability considerations will increasingly influence customer selection criteria and regulatory compliance requirements.

Market trajectory indicates sustained growth driven by accelerating offshore wind deployment, technological advancement requirements, and government policy support for renewable energy transition. The sector is projected to maintain robust expansion with growth rates of approximately 9.5% annually through the next decade.

Technology evolution will focus on larger blade designs, advanced materials integration, and smart technology incorporation that optimize performance while reducing lifecycle costs. Innovation priorities include floating wind applications, recyclable materials development, and manufacturing process optimization for improved efficiency and sustainability.

Market consolidation trends may accelerate as companies pursue scale advantages, technology access, and supply chain optimization through strategic acquisitions and partnership agreements. This consolidation will likely favor companies with strong financial positions, proven technology capabilities, and established market relationships.

International expansion opportunities will grow as global offshore wind development accelerates and demand for UK expertise increases. MWR analysis suggests that export opportunities could represent 50% of total UK blade manufacturing capacity within the next decade, reflecting growing international recognition of UK technological leadership and manufacturing capabilities.

Strategic positioning of the United Kingdom rotor blade market reflects strong fundamentals, government support, and technological leadership that create favorable conditions for sustained growth and international competitiveness. The market benefits from established offshore wind expertise, advanced manufacturing capabilities, and comprehensive supply chain infrastructure.

Growth prospects remain robust despite challenges related to capital requirements, international competition, and supply chain complexity. The combination of domestic demand growth, export opportunities, and technological innovation creates multiple pathways for market expansion and value creation across the industry ecosystem.

Success factors for market participants include continued investment in research and development, strategic partnerships with technology leaders, and adaptation to evolving customer requirements and regulatory standards. Companies that successfully navigate these challenges while maintaining operational excellence and innovation focus will capture the greatest opportunities in this dynamic and growing market.

What is Rotor Blade?

Rotor blades are essential components of rotorcraft, such as helicopters and wind turbines, designed to generate lift and thrust. They play a critical role in the performance and efficiency of these machines.

What are the key players in the United Kingdom Rotor Blade Market?

Key players in the United Kingdom Rotor Blade Market include companies like Airbus Helicopters, Leonardo S.p.A, and Rolls-Royce, among others. These companies are involved in the design, manufacturing, and innovation of rotor blades for various applications.

What are the growth factors driving the United Kingdom Rotor Blade Market?

The growth of the United Kingdom Rotor Blade Market is driven by increasing demand for renewable energy sources, particularly in wind energy, and advancements in rotor blade technology. Additionally, the rising need for efficient air transportation solutions contributes to market expansion.

What challenges does the United Kingdom Rotor Blade Market face?

The United Kingdom Rotor Blade Market faces challenges such as high manufacturing costs and stringent regulatory requirements. Additionally, competition from alternative energy sources can impact market growth.

What opportunities exist in the United Kingdom Rotor Blade Market?

Opportunities in the United Kingdom Rotor Blade Market include the development of innovative materials for lighter and more efficient blades and the expansion of offshore wind farms. Furthermore, increasing investments in aerospace technology present significant growth potential.

What trends are shaping the United Kingdom Rotor Blade Market?

Trends in the United Kingdom Rotor Blade Market include the integration of smart technologies for enhanced performance monitoring and the use of composite materials to improve durability. Additionally, there is a growing focus on sustainability and reducing the environmental impact of rotorcraft.

United Kingdom Rotor Blade Market

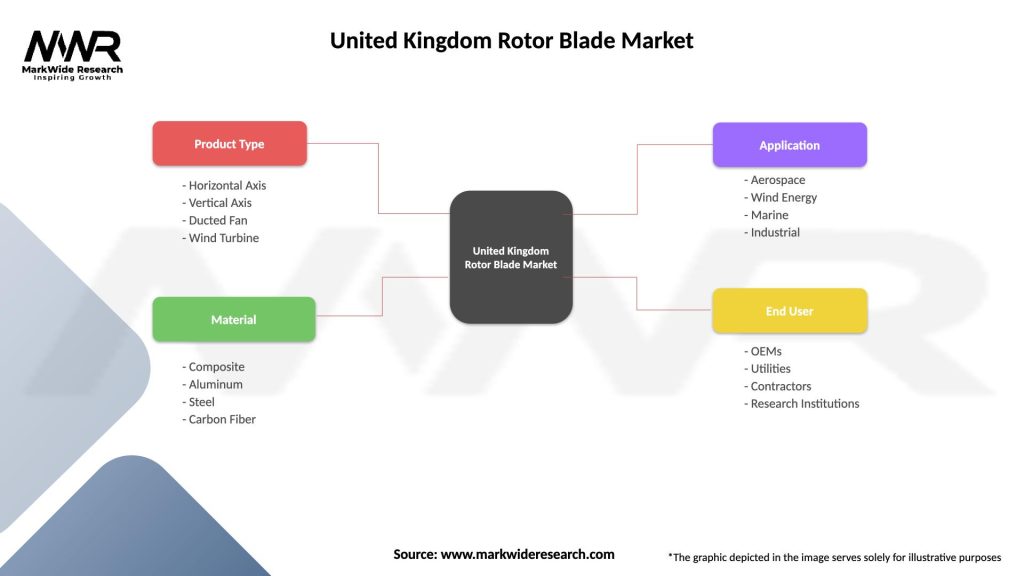

| Segmentation Details | Description |

|---|---|

| Product Type | Horizontal Axis, Vertical Axis, Ducted Fan, Wind Turbine |

| Material | Composite, Aluminum, Steel, Carbon Fiber |

| Application | Aerospace, Wind Energy, Marine, Industrial |

| End User | OEMs, Utilities, Contractors, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Rotor Blade Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at