444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America internal combustion engines market represents a dynamic and evolving sector that plays a crucial role in the region’s industrial and transportation landscape. This market encompasses a diverse range of engine technologies, from traditional gasoline and diesel engines to advanced hybrid systems, serving multiple industries including automotive, marine, power generation, and industrial applications. Market dynamics in South America are influenced by the region’s robust automotive manufacturing base, growing industrial sector, and increasing demand for reliable power solutions across various applications.

Regional characteristics significantly impact market development, with countries like Brazil, Argentina, and Colombia leading in both production and consumption of internal combustion engines. The market demonstrates steady growth patterns driven by urbanization, infrastructure development, and the expansion of manufacturing capabilities. Technological advancements in engine efficiency, emission control systems, and fuel flexibility continue to shape market evolution, particularly as environmental regulations become more stringent across the region.

Industry stakeholders are witnessing increased investment in research and development, focusing on cleaner combustion technologies and improved fuel efficiency. The market benefits from growing automotive production in key manufacturing hubs, with several international manufacturers establishing significant operations throughout South America. MarkWide Research analysis indicates that the market is experiencing consistent annual growth of 4.2%, reflecting the region’s expanding industrial base and increasing mechanization across various sectors.

The South America internal combustion engines market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and servicing of engines that generate power through the combustion of fuel within enclosed cylinders. This market includes various engine types such as gasoline engines, diesel engines, natural gas engines, and hybrid systems that serve diverse applications across automotive, industrial, marine, and power generation sectors throughout South American countries.

Market scope extends beyond traditional automotive applications to include stationary power generation, agricultural machinery, construction equipment, marine propulsion systems, and industrial machinery. The definition encompasses both original equipment manufacturer (OEM) engines and aftermarket components, including replacement parts, maintenance services, and engine rebuilding activities that support the operational lifecycle of internal combustion engines across the region.

Strategic positioning of the South America internal combustion engines market reflects a mature yet evolving industry that continues to adapt to changing technological requirements and environmental standards. The market demonstrates resilient growth characteristics supported by strong automotive manufacturing presence, expanding industrial activities, and increasing demand for reliable power solutions across multiple sectors.

Key market drivers include the region’s growing automotive production capacity, infrastructure development projects, and increasing mechanization in agriculture and construction sectors. Brazil dominates the regional market with approximately 65% market share, followed by Argentina and Colombia as significant contributors to market growth. The market benefits from established manufacturing ecosystems that support both domestic consumption and export activities.

Technological evolution remains a critical factor, with manufacturers investing heavily in cleaner combustion technologies, improved fuel efficiency systems, and compliance with evolving emission standards. The market faces transformation pressures from electrification trends while maintaining strong demand for traditional internal combustion solutions across industrial and commercial applications where electric alternatives remain less viable.

Market intelligence reveals several critical insights that shape the South America internal combustion engines landscape:

Automotive industry expansion serves as the primary driver for the South America internal combustion engines market, with increasing vehicle production and sales across the region. Manufacturing investments by international automotive companies continue to strengthen local production capabilities, creating sustained demand for various engine types and configurations.

Infrastructure development projects across South American countries generate substantial demand for construction equipment, generators, and industrial machinery powered by internal combustion engines. Government initiatives supporting infrastructure modernization and urban development create consistent market opportunities for engine manufacturers and suppliers.

Agricultural mechanization represents another significant driver, as farming operations increasingly adopt mechanized equipment to improve productivity and efficiency. The region’s strong agricultural sector requires reliable power solutions for tractors, harvesters, irrigation systems, and processing equipment, driving demand for robust internal combustion engines.

Energy security concerns and the need for reliable backup power solutions contribute to market growth, particularly in the stationary power generation segment. Industrial growth across manufacturing, mining, and processing sectors creates ongoing demand for engines that power various industrial applications and equipment.

Environmental regulations pose significant challenges to the internal combustion engines market, as governments implement stricter emission standards and promote cleaner transportation alternatives. Regulatory compliance costs increase development expenses and may limit market entry for smaller manufacturers unable to invest in advanced emission control technologies.

Electrification trends in the automotive sector create long-term uncertainty for traditional internal combustion engine demand, particularly in passenger vehicle segments. Government incentives for electric vehicles and hybrid technologies may accelerate the transition away from conventional engines in certain applications.

Economic volatility in several South American countries affects consumer purchasing power and industrial investment decisions, potentially impacting engine demand across various sectors. Currency fluctuations and inflation concerns create challenges for manufacturers managing international supply chains and pricing strategies.

Raw material costs and supply chain disruptions can significantly impact manufacturing costs and profitability for engine producers. Skilled labor shortages in advanced manufacturing and engineering roles may limit production capacity expansion and technological development capabilities.

Hybrid technology development presents substantial opportunities for engine manufacturers to bridge the gap between traditional combustion engines and full electrification. Advanced hybrid systems that combine internal combustion engines with electric motors offer improved efficiency while maintaining the reliability and range advantages of conventional engines.

Alternative fuel integration creates opportunities for engines designed to operate on biofuels, natural gas, and hydrogen blends. South America’s abundant renewable energy resources and biofuel production capabilities position the region favorably for developing engines that utilize cleaner fuel alternatives.

Export market expansion offers growth opportunities as regional manufacturers develop capabilities to serve international markets beyond South America. Competitive manufacturing costs and established automotive industry presence provide advantages for expanding into global supply chains.

Aftermarket services represent growing opportunities as the installed base of engines requires ongoing maintenance, rebuilding, and component replacement services. Digital technologies enable new service models including predictive maintenance, remote monitoring, and performance optimization services that create additional revenue streams.

Competitive dynamics in the South America internal combustion engines market reflect a mix of international manufacturers and regional players competing across different market segments. Market consolidation trends continue as larger manufacturers acquire specialized companies to expand their technology portfolios and market reach.

Technology evolution drives continuous innovation in engine design, with manufacturers investing in advanced combustion systems, turbocharging technologies, and integrated electronic control systems. Efficiency improvements of up to 15% in fuel consumption are being achieved through advanced engine management systems and optimized combustion processes.

Supply chain integration becomes increasingly important as manufacturers seek to optimize costs and ensure reliable component availability. Local sourcing initiatives help reduce dependency on imports while supporting regional supplier development and creating more resilient supply chains.

Customer requirements continue evolving toward engines that offer improved fuel efficiency, reduced emissions, enhanced reliability, and lower total cost of ownership. Service capabilities and aftermarket support become key differentiators as customers seek comprehensive solutions rather than just engine products.

Comprehensive market analysis for the South America internal combustion engines market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across key South American markets to gather firsthand market intelligence and validate market trends.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and historical trends. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth and identify emerging opportunities.

Market segmentation analysis examines various dimensions including engine type, application, power output, and geographic distribution to provide detailed market insights. Competitive intelligence gathering involves analysis of major market participants, their strategies, product portfolios, and market positioning.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert review. Regional expertise from local market analysts provides cultural and economic context essential for understanding South American market dynamics and customer preferences.

Brazil dominates the South America internal combustion engines market, representing the largest share due to its extensive automotive manufacturing base and industrial infrastructure. São Paulo state serves as the primary manufacturing hub, hosting major automotive assembly plants and engine production facilities that serve both domestic and export markets.

Argentina maintains a significant market position with strong automotive manufacturing presence and growing industrial sector demand. Buenos Aires province concentrates much of the country’s engine manufacturing and assembly activities, benefiting from established supply chains and skilled workforce availability.

Colombia emerges as a growing market driven by expanding automotive assembly operations and increasing industrial mechanization. Infrastructure development projects and mining sector growth create additional demand for industrial and power generation engines throughout the country.

Chile and Peru represent smaller but important markets, particularly for mining and industrial applications where reliable power solutions are essential. MWR analysis indicates that these markets show steady growth rates of 3.8% annually, driven primarily by industrial and commercial applications rather than automotive demand.

Venezuela and Ecuador face market challenges due to economic conditions, but maintain demand for essential applications including power generation and industrial machinery. Market recovery potential exists as economic conditions stabilize and infrastructure investment resumes.

Market leadership in the South America internal combustion engines market is characterized by a combination of global automotive manufacturers and specialized engine producers. The competitive environment reflects diverse strategies ranging from high-volume automotive applications to specialized industrial and marine engines.

By Engine Type:

By Application:

By Power Output:

Automotive segment represents the most dynamic category, with manufacturers focusing on downsized turbocharged engines that deliver improved fuel efficiency without sacrificing performance. Engine downsizing trends show adoption rates of 35% annually as manufacturers respond to fuel economy requirements and consumer preferences for efficient vehicles.

Industrial engines demonstrate steady demand driven by construction, mining, and manufacturing sector growth. Reliability requirements in industrial applications favor proven diesel engine technologies, though natural gas engines gain traction where fuel cost advantages exist.

Power generation category shows resilient growth as businesses and institutions invest in backup power capabilities. Generator set demand increases particularly in areas with unreliable grid power, creating opportunities for both diesel and natural gas engine solutions.

Marine engines benefit from South America’s extensive coastline and inland waterway systems. Commercial fishing and recreational boating activities drive demand for reliable marine propulsion systems, with increasing focus on fuel efficiency and emission compliance.

Agricultural engines support the region’s significant farming sector, with demand driven by mechanization trends and the need for reliable equipment during critical farming seasons. Seasonal demand patterns create opportunities for manufacturers to optimize production and inventory management strategies.

Manufacturers benefit from South America’s established automotive industry infrastructure and skilled workforce, enabling cost-effective production and access to regional markets. Local manufacturing capabilities reduce transportation costs and enable faster response to market demands while supporting export opportunities to neighboring countries.

Suppliers gain from integrated supply chains that support both OEM and aftermarket requirements. Component manufacturers benefit from stable demand patterns and opportunities to develop specialized products for regional market requirements and operating conditions.

Distributors and dealers benefit from comprehensive product portfolios and established service networks that provide ongoing revenue streams through parts sales and maintenance services. Market coverage opportunities exist across diverse geographic regions and application segments.

End users benefit from competitive pricing, local service availability, and products designed for regional operating conditions and fuel quality standards. Total cost of ownership advantages result from local manufacturing, service support, and parts availability.

Government stakeholders benefit from industrial development, employment creation, and technology transfer that supports economic growth and industrial competitiveness. Export capabilities contribute to trade balance improvement and regional economic integration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Downsizing and turbocharging represent dominant trends in automotive engine development, with manufacturers adopting smaller displacement engines equipped with turbochargers to maintain performance while improving fuel efficiency. Three-cylinder engines gain acceptance in compact vehicle segments, demonstrating market penetration growth of 42% over recent years.

Hybridization strategies become increasingly important as manufacturers develop mild hybrid and full hybrid systems that combine internal combustion engines with electric motors. Hybrid technology adoption accelerates particularly in premium vehicle segments and commercial applications where efficiency gains justify additional system complexity.

Alternative fuel compatibility drives engine development toward flexible fuel systems capable of operating on various fuel types including ethanol blends, compressed natural gas, and biodiesel. Flex-fuel engines show strong adoption in markets with established alternative fuel infrastructure and government support policies.

Digital integration transforms engine management through advanced control systems, connectivity features, and predictive maintenance capabilities. Connected engine technologies enable remote monitoring, performance optimization, and predictive maintenance services that improve reliability and reduce operating costs.

Emission control advancement continues with development of more sophisticated after-treatment systems, improved combustion processes, and integration of emission reduction technologies. Regulatory compliance drives investment in cleaner combustion technologies and advanced emission control systems across all engine categories.

Manufacturing investments continue across the region as international companies expand production capabilities and local manufacturers upgrade facilities. Recent facility expansions in Brazil and Argentina demonstrate continued confidence in regional market growth and export potential.

Technology partnerships between international engine manufacturers and regional companies facilitate technology transfer and local capability development. Joint ventures and licensing agreements enable access to advanced technologies while supporting local manufacturing and employment.

Research and development initiatives focus on developing engines optimized for regional fuel quality, operating conditions, and emission requirements. Local R&D centers established by major manufacturers contribute to technology development and engineering capability building.

Regulatory developments across South American countries introduce more stringent emission standards and fuel quality requirements, driving industry investment in cleaner technologies. Harmonization efforts among regional governments aim to create more consistent regulatory frameworks supporting market integration.

Aftermarket expansion includes development of comprehensive service networks, parts distribution systems, and remanufacturing capabilities. Service digitization initiatives introduce online platforms, mobile applications, and remote diagnostic capabilities improving customer service and operational efficiency.

Strategic focus on technology development and local capability building will be essential for long-term competitiveness in the evolving market landscape. MarkWide Research recommends that manufacturers invest in flexible manufacturing systems capable of producing multiple engine types and configurations to address diverse market requirements.

Market diversification across application segments and geographic regions can help mitigate risks associated with economic volatility and changing automotive trends. Industrial and power generation segments offer stability and growth opportunities that complement automotive market exposure.

Service capabilities development should be prioritized as aftermarket services become increasingly important for customer retention and revenue generation. Digital service platforms and predictive maintenance capabilities can differentiate manufacturers and create competitive advantages.

Sustainability initiatives including alternative fuel compatibility and emission reduction technologies will become increasingly important for regulatory compliance and market acceptance. Investment in clean technologies positions manufacturers favorably for future regulatory requirements and customer preferences.

Partnership strategies with local suppliers, distributors, and service providers can strengthen market position and reduce operational risks. Supply chain localization improves cost competitiveness while reducing exposure to international trade disruptions and currency fluctuations.

Market evolution in the South America internal combustion engines sector will be characterized by continued adaptation to changing technology requirements, environmental regulations, and customer preferences. Growth projections indicate sustained expansion driven by industrial development, infrastructure investment, and ongoing automotive production growth.

Technology transformation will accelerate with increased adoption of hybrid systems, alternative fuels, and advanced engine management technologies. Electrification impact will vary by application segment, with industrial and commercial applications maintaining strong demand for internal combustion solutions while passenger vehicle segments experience gradual transition toward hybrid and electric alternatives.

Regional integration opportunities will expand as trade agreements and economic cooperation initiatives facilitate market access and supply chain optimization. Export potential for South American engine manufacturers will grow as cost competitiveness and quality capabilities improve.

Regulatory environment will continue evolving toward stricter emission standards and fuel quality requirements, driving industry investment in cleaner technologies. Government support for alternative fuels and sustainable transportation solutions will create opportunities for manufacturers developing flexible fuel and hybrid engine systems.

Market maturation will emphasize service capabilities, customer relationships, and total cost of ownership rather than just initial product pricing. Aftermarket growth will accelerate as the installed base of engines expands and customers seek comprehensive service solutions to maximize equipment reliability and efficiency.

South America internal combustion engines market demonstrates resilient growth characteristics supported by diverse application segments, established manufacturing capabilities, and ongoing industrial development across the region. Market fundamentals remain strong despite challenges from electrification trends and environmental regulations, with industrial, commercial, and power generation applications providing stability and growth opportunities.

Strategic positioning for success in this market requires balanced investment in traditional engine technologies and emerging alternatives including hybrid systems and alternative fuel compatibility. Manufacturers that develop comprehensive product portfolios, strong service capabilities, and local market expertise will be best positioned to capitalize on growth opportunities while managing transition risks.

Future success will depend on the industry’s ability to adapt to changing customer requirements, regulatory standards, and competitive dynamics while maintaining the reliability and cost advantages that make internal combustion engines essential for many applications. Continued investment in technology development, manufacturing capabilities, and service excellence will ensure the market’s continued evolution and growth throughout South America.

What is Internal Combustion Engines?

Internal combustion engines are machines that convert fuel into mechanical energy through combustion. They are widely used in various applications, including automobiles, motorcycles, and industrial machinery.

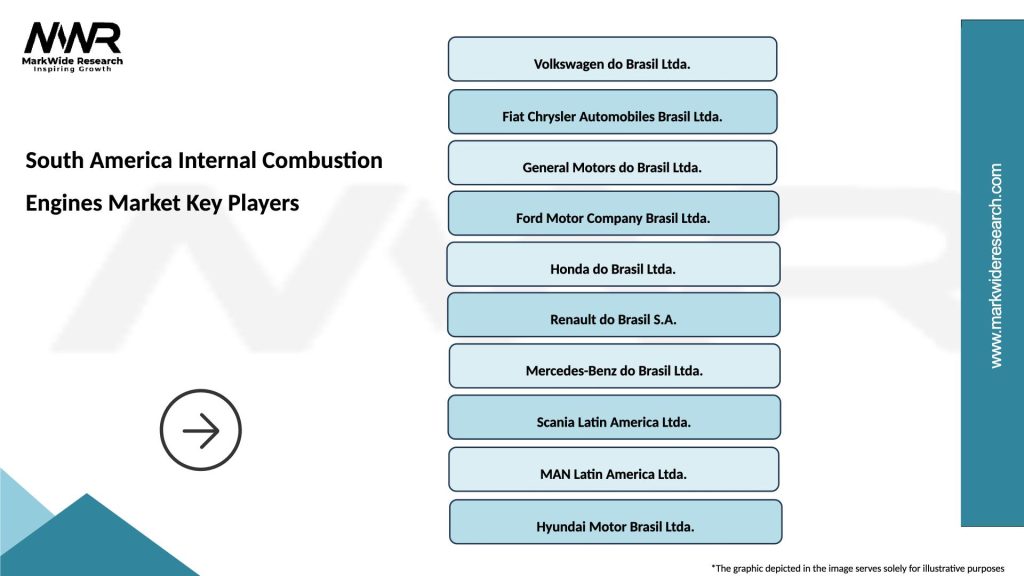

What are the key players in the South America Internal Combustion Engines Market?

Key players in the South America Internal Combustion Engines Market include companies like Volkswagen, General Motors, and Ford, which are known for their extensive range of vehicles powered by internal combustion engines, among others.

What are the growth factors driving the South America Internal Combustion Engines Market?

The growth of the South America Internal Combustion Engines Market is driven by increasing vehicle production, rising demand for transportation, and advancements in engine technology that enhance fuel efficiency and performance.

What challenges does the South America Internal Combustion Engines Market face?

The South America Internal Combustion Engines Market faces challenges such as stringent environmental regulations, the rising popularity of electric vehicles, and fluctuating fuel prices that impact consumer preferences.

What opportunities exist in the South America Internal Combustion Engines Market?

Opportunities in the South America Internal Combustion Engines Market include the development of hybrid engines, increasing investments in infrastructure, and the potential for growth in emerging economies within the region.

What trends are shaping the South America Internal Combustion Engines Market?

Trends shaping the South America Internal Combustion Engines Market include a shift towards more fuel-efficient engines, the integration of advanced technologies such as turbocharging, and a growing focus on reducing emissions.

South America Internal Combustion Engines Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | Gasoline, Diesel, Ethanol, Biodiesel |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Motorcycles, Trucks |

| Technology | Turbocharged, Naturally Aspirated, Hybrid, Direct Injection |

| End User | Fleet Operators, Individual Consumers, Government Agencies, Logistics Providers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Internal Combustion Engines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at