444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The small molecules innovator contract development and manufacturing organization market represents a rapidly evolving sector within the pharmaceutical industry, characterized by specialized service providers offering comprehensive drug development and manufacturing solutions. This market encompasses organizations that partner with pharmaceutical companies to accelerate the development of small molecule therapeutics from early-stage research through commercial manufacturing. The sector has experienced remarkable growth, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% over the next five years, driven by increasing outsourcing trends and the growing complexity of drug development processes.

Market dynamics indicate that pharmaceutical companies are increasingly relying on specialized contract development and manufacturing organizations (CDMOs) to leverage their expertise, reduce development timelines, and optimize costs. The market serves various therapeutic areas including oncology, cardiovascular diseases, central nervous system disorders, and infectious diseases. North America currently dominates the market with approximately 45% market share, followed by Europe and Asia-Pacific regions, which are experiencing rapid expansion due to favorable regulatory environments and cost advantages.

Innovation drivers within this market include advanced analytical technologies, continuous manufacturing processes, and integrated service offerings that span from preclinical development to commercial supply. The increasing prevalence of complex small molecule drugs requiring specialized manufacturing capabilities has further propelled market growth, with specialty pharmaceutical segments accounting for a significant portion of CDMO partnerships.

The small molecules innovator contract development and manufacturing organization market refers to the specialized sector comprising service providers that offer comprehensive drug development and manufacturing services specifically for small molecule pharmaceutical compounds. These organizations serve as strategic partners to pharmaceutical and biotechnology companies, providing expertise in chemistry, manufacturing, and controls (CMC) development, process optimization, analytical testing, and commercial-scale production.

Small molecules are low molecular weight compounds, typically under 900 daltons, that can easily penetrate cell membranes and interact with intracellular targets. Unlike biologics, these compounds are chemically synthesized and represent the majority of currently marketed pharmaceuticals. Innovator CDMOs distinguish themselves from generic manufacturers by focusing on novel drug development, offering specialized capabilities for complex synthesis, and maintaining intellectual property protection for their clients.

Core services provided by these organizations include medicinal chemistry support, process development and optimization, analytical method development and validation, regulatory support, clinical trial material manufacturing, and commercial production. The market encompasses both established pharmaceutical companies seeking to outsource specific functions and emerging biotech firms requiring comprehensive development support to bring their innovations to market.

Strategic market positioning within the small molecules innovator CDMO sector reflects the pharmaceutical industry’s fundamental shift toward specialized outsourcing partnerships. The market has demonstrated resilient growth patterns, with outsourcing penetration rates reaching approximately 35% of total pharmaceutical development activities. This trend is driven by pharmaceutical companies’ need to access specialized expertise, reduce fixed costs, and accelerate time-to-market for new therapeutics.

Key market characteristics include increasing demand for integrated service offerings, growing emphasis on quality and regulatory compliance, and rising adoption of advanced manufacturing technologies. The sector benefits from strong fundamentals including an aging global population, increasing healthcare expenditure, and continuous innovation in drug discovery. Regulatory harmonization across major markets has facilitated cross-border partnerships and enabled CDMOs to serve global pharmaceutical companies more effectively.

Competitive landscape features a mix of large multinational CDMOs with comprehensive capabilities and specialized niche players focusing on specific therapeutic areas or technologies. Market consolidation continues as larger organizations acquire specialized capabilities and expand their geographic reach. The sector’s growth trajectory remains positive, supported by robust pharmaceutical R&D spending and increasing complexity of drug development processes requiring specialized expertise.

Market intelligence reveals several critical insights shaping the small molecules innovator CDMO landscape. The following key insights demonstrate the sector’s strategic importance and growth potential:

Primary growth drivers propelling the small molecules innovator CDMO market encompass both industry-wide trends and specific technological advancements. The pharmaceutical industry’s strategic shift toward asset-light business models has fundamentally transformed how companies approach drug development and manufacturing, creating substantial opportunities for specialized service providers.

Cost optimization pressures represent a significant driver as pharmaceutical companies seek to reduce fixed infrastructure investments while maintaining access to cutting-edge manufacturing capabilities. The complexity of modern drug development requires specialized expertise that many pharmaceutical companies find more cost-effective to access through partnerships rather than internal development. Regulatory complexity has also increased substantially, making specialized regulatory expertise increasingly valuable.

Innovation acceleration demands are driving pharmaceutical companies to partner with CDMOs that can provide faster development timelines and specialized capabilities. The growing prevalence of complex small molecules requiring advanced synthesis techniques has created demand for highly specialized manufacturing expertise. Market access requirements in multiple global markets necessitate manufacturing capabilities that meet diverse regulatory standards, favoring CDMOs with international presence and regulatory expertise.

Risk mitigation strategies employed by pharmaceutical companies include diversifying their manufacturing supply chains and accessing backup manufacturing capabilities through CDMO partnerships. The increasing focus on sustainability and environmental compliance is also driving demand for CDMOs with advanced environmental management systems and green chemistry capabilities.

Significant market restraints impact the growth trajectory of the small molecules innovator CDMO sector, presenting challenges that market participants must navigate strategically. These constraints stem from both industry-specific factors and broader economic conditions affecting pharmaceutical development and manufacturing.

Intellectual property concerns remain a primary restraint as pharmaceutical companies must carefully balance the benefits of outsourcing with the need to protect proprietary information and manufacturing processes. The transfer of sensitive technical knowledge to third-party manufacturers creates potential risks that some companies prefer to avoid by maintaining in-house capabilities. Quality control challenges associated with outsourcing critical manufacturing processes can create compliance risks and potential product quality issues.

Regulatory complexity across different markets creates challenges for CDMOs seeking to serve global pharmaceutical clients. Varying regulatory requirements and approval processes can complicate manufacturing strategies and increase compliance costs. Capacity constraints during peak demand periods can limit CDMOs’ ability to serve all potential clients, particularly for specialized manufacturing capabilities.

Economic volatility and currency fluctuations can impact the cost-effectiveness of outsourcing arrangements, particularly for long-term contracts spanning multiple years. The high capital requirements for maintaining state-of-the-art manufacturing facilities and equipment can strain smaller CDMOs’ financial resources. Talent shortage in specialized areas such as process chemistry and regulatory affairs can limit CDMOs’ ability to expand their service offerings and capacity.

Emerging opportunities within the small molecules innovator CDMO market present substantial growth potential for organizations positioned to capitalize on evolving industry trends. These opportunities span technological innovations, geographic expansion, and new service offerings that address unmet market needs.

Digital transformation initiatives offer significant opportunities for CDMOs to differentiate their services through advanced data analytics, artificial intelligence applications, and digital process monitoring. The integration of Industry 4.0 technologies can enhance manufacturing efficiency, reduce costs, and improve quality control processes. Continuous manufacturing adoption represents a major opportunity for CDMOs to offer more efficient and cost-effective production methods.

Geographic expansion into emerging markets presents opportunities for growth as pharmaceutical companies seek to access new markets and reduce manufacturing costs. The development of manufacturing capabilities in regions with favorable regulatory environments and cost structures can provide competitive advantages. Specialty therapeutics growth creates opportunities for CDMOs with specialized capabilities in areas such as oncology, rare diseases, and personalized medicine.

Sustainability initiatives are creating opportunities for CDMOs that can offer environmentally friendly manufacturing processes and green chemistry solutions. The growing emphasis on supply chain resilience following recent global disruptions has created opportunities for CDMOs to provide backup manufacturing capabilities and supply chain diversification. Biosimilar development and complex generic drug manufacturing represent emerging opportunities as patent expirations create new market segments.

Complex market dynamics shape the competitive landscape and growth patterns within the small molecules innovator CDMO sector. These dynamics reflect the interplay between pharmaceutical industry trends, technological advancements, regulatory changes, and economic factors that influence market behavior and strategic decision-making.

Supply and demand equilibrium in the market is influenced by pharmaceutical companies’ outsourcing strategies and CDMOs’ capacity expansion plans. Current market conditions indicate strong demand for specialized manufacturing capabilities, with leading CDMOs reporting capacity utilization rates exceeding 85%. This high utilization creates opportunities for capacity expansion and new market entrants while potentially leading to pricing power for established providers.

Competitive intensity varies across different market segments, with highly specialized capabilities commanding premium pricing while more commoditized services face pricing pressure. The market exhibits characteristics of both consolidation, as larger CDMOs acquire specialized capabilities, and fragmentation, as niche players emerge to serve specific therapeutic areas or technologies. Client relationship dynamics are evolving toward longer-term strategic partnerships rather than transactional relationships.

Technology adoption cycles significantly impact market dynamics as CDMOs must continuously invest in new capabilities to remain competitive. The pace of regulatory change and evolving quality standards requires ongoing adaptation and investment. MarkWide Research analysis indicates that successful CDMOs are those that can balance operational excellence with continuous innovation and strategic flexibility to adapt to changing market conditions.

Comprehensive research methodology employed in analyzing the small molecules innovator CDMO market encompasses multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. The methodology combines primary research with secondary data analysis to provide a complete market perspective.

Primary research activities include extensive interviews with industry executives, CDMO management teams, pharmaceutical company procurement professionals, and regulatory experts. These interviews provide insights into market trends, competitive dynamics, pricing strategies, and future growth prospects. Survey methodologies capture quantitative data on market size, growth rates, and segment performance across different geographic regions and therapeutic areas.

Secondary research sources encompass industry reports, regulatory filings, company financial statements, patent databases, and academic publications. This comprehensive data collection approach ensures that market analysis reflects both current market conditions and emerging trends. Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings.

Analytical frameworks employed include market sizing models, competitive positioning analysis, trend analysis, and scenario planning. The research methodology incorporates both quantitative analysis of market metrics and qualitative assessment of strategic factors influencing market development. Forecasting models utilize historical data trends, industry growth drivers, and expert insights to project future market development scenarios.

Geographic market distribution reveals distinct regional characteristics and growth patterns within the small molecules innovator CDMO market. Each major region exhibits unique market dynamics influenced by local pharmaceutical industry development, regulatory environments, and economic conditions.

North America maintains market leadership with approximately 45% of global market share, driven by the presence of major pharmaceutical companies, advanced regulatory framework, and substantial R&D investment. The region benefits from a mature pharmaceutical industry, strong intellectual property protection, and well-established CDMO infrastructure. United States dominates the North American market, with significant concentrations of both pharmaceutical companies and specialized CDMOs.

Europe represents the second-largest market with approximately 30% market share, characterized by strong regulatory harmonization through the European Medicines Agency (EMA) and significant pharmaceutical industry presence. Key markets include Germany, Switzerland, United Kingdom, and France, each offering specialized capabilities and expertise. Regulatory alignment across European markets facilitates cross-border manufacturing and supply chain optimization.

Asia-Pacific emerges as the fastest-growing region with growth rates exceeding 12% annually, driven by increasing pharmaceutical R&D investment, favorable cost structures, and improving regulatory environments. China and India lead regional growth, offering significant cost advantages and expanding technical capabilities. Singapore and South Korea are developing as regional hubs for high-value manufacturing and specialized services.

Competitive market structure within the small molecules innovator CDMO sector features a diverse mix of global leaders, regional specialists, and niche technology providers. The competitive landscape continues to evolve through strategic acquisitions, capacity expansions, and technology investments.

Market leaders include established organizations with comprehensive service offerings and global manufacturing networks:

Competitive strategies focus on service integration, geographic expansion, technology advancement, and strategic partnerships. Market participants compete on factors including technical expertise, regulatory compliance, quality systems, capacity availability, and cost competitiveness. Innovation capabilities and specialized expertise in complex synthesis are becoming increasingly important competitive differentiators.

Market segmentation analysis reveals distinct categories within the small molecules innovator CDMO market, each characterized by specific service requirements, growth patterns, and competitive dynamics. Understanding these segments is crucial for strategic positioning and market opportunity identification.

By Service Type:

By Therapeutic Area:

By Company Size:

Detailed category analysis provides specific insights into key market segments, revealing growth patterns, competitive dynamics, and strategic opportunities within each category of the small molecules innovator CDMO market.

Drug Development Services Category: This segment represents the highest-growth area with annual growth rates exceeding 10%, driven by increasing outsourcing of early-stage development activities. Pharmaceutical companies are increasingly partnering with CDMOs for medicinal chemistry support, process optimization, and analytical method development. Integrated service offerings that combine multiple development functions are particularly valued by clients seeking to streamline their development processes.

Clinical Manufacturing Category: Characterized by specialized requirements for small-batch production, flexible manufacturing capabilities, and rapid turnaround times. This segment benefits from the increasing number of clinical trials and growing complexity of clinical development programs. Quality systems and regulatory compliance are critical success factors, with clients requiring CDMOs that can navigate complex regulatory requirements across multiple markets.

Commercial Manufacturing Category: Represents the largest segment by volume, focusing on cost-effective, high-quality production for marketed products. This category is experiencing growth in specialty pharmaceuticals and complex generics requiring specialized manufacturing expertise. Operational excellence and supply chain reliability are key competitive factors, with clients prioritizing CDMOs that can ensure consistent product availability.

Oncology Therapeutic Area: Demonstrates the strongest growth potential due to the expanding cancer therapeutics market and increasing complexity of oncology drugs. This segment requires specialized containment capabilities, complex synthesis expertise, and stringent quality controls. MWR analysis indicates that oncology-focused CDMOs command premium pricing due to their specialized capabilities and regulatory expertise.

Strategic advantages derived from participation in the small molecules innovator CDMO market extend across multiple stakeholder groups, creating value through specialized expertise, operational efficiency, and strategic flexibility. These benefits drive continued market growth and stakeholder engagement.

For Pharmaceutical Companies:

For CDMO Organizations:

For Healthcare Systems:

Comprehensive SWOT analysis provides strategic insights into the internal and external factors affecting the small molecules innovator CDMO market, enabling stakeholders to understand competitive positioning and strategic opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends are reshaping the small molecules innovator CDMO landscape, driven by technological innovations, changing client expectations, and evolving regulatory requirements. These trends present both opportunities and challenges for market participants.

Digital Transformation Acceleration: CDMOs are increasingly adopting digital technologies including artificial intelligence, machine learning, and advanced data analytics to optimize manufacturing processes and improve quality control. Process analytical technology (PAT) implementation is enabling real-time monitoring and control of manufacturing processes, resulting in improved efficiency and quality outcomes.

Continuous Manufacturing Adoption: The shift from traditional batch manufacturing to continuous processing is gaining momentum, offering advantages in terms of efficiency, quality consistency, and cost reduction. This trend is particularly relevant for high-volume commercial manufacturing and is expected to drive operational efficiency improvements of up to 30% in suitable applications.

Sustainability Focus: Environmental sustainability is becoming increasingly important, with CDMOs investing in green chemistry processes, waste reduction technologies, and renewable energy sources. Sustainable manufacturing practices are becoming a competitive differentiator and client selection criterion.

Supply Chain Resilience: Recent global disruptions have highlighted the importance of supply chain resilience, leading to increased demand for geographically diversified manufacturing capabilities and backup supply arrangements. Regional manufacturing strategies are gaining prominence as pharmaceutical companies seek to reduce supply chain risks.

Personalized Medicine Growth: The increasing focus on personalized medicine and precision therapeutics is creating demand for flexible manufacturing capabilities and smaller batch sizes. This trend requires CDMOs to develop more agile manufacturing processes and specialized capabilities.

Recent industry developments demonstrate the dynamic nature of the small molecules innovator CDMO market, with significant investments, strategic partnerships, and technological advancements shaping the competitive landscape and market trajectory.

Capacity Expansion Initiatives: Major CDMOs are undertaking substantial capacity expansion projects to meet growing demand, with several organizations announcing multi-hundred million dollar facility investments. These expansions focus on specialized capabilities including high-potency compound manufacturing, continuous processing, and advanced analytical services.

Strategic Acquisitions: Market consolidation continues through strategic acquisitions as larger CDMOs seek to expand their capabilities and geographic reach. Recent acquisitions have focused on specialized technologies, niche therapeutic areas, and emerging market presence. Integration strategies emphasize combining complementary capabilities to offer more comprehensive service portfolios.

Technology Partnerships: CDMOs are forming strategic partnerships with technology providers to access cutting-edge manufacturing technologies and digital solutions. These partnerships enable rapid adoption of innovations without requiring substantial internal R&D investment. Collaborative innovation models are becoming more common as organizations seek to share development costs and risks.

Regulatory Milestone Achievements: Several CDMOs have achieved significant regulatory milestones including FDA approvals for new manufacturing facilities and processes. These achievements demonstrate the sector’s commitment to maintaining the highest quality and compliance standards. Regulatory excellence continues to be a key competitive differentiator in client selection processes.

Sustainability Initiatives: Industry leaders are implementing comprehensive sustainability programs including carbon neutrality commitments, waste reduction targets, and green chemistry adoption. These initiatives reflect growing stakeholder expectations and regulatory requirements for environmental responsibility.

Strategic recommendations for stakeholders in the small molecules innovator CDMO market focus on positioning for long-term success while navigating current market dynamics and emerging challenges. These suggestions are based on comprehensive market analysis and industry best practices.

For CDMO Organizations:

For Pharmaceutical Companies:

For Investors:

Market projections for the small molecules innovator CDMO sector indicate continued robust growth driven by fundamental industry trends and evolving pharmaceutical development strategies. The outlook reflects both opportunities and challenges that will shape market development over the next decade.

Growth trajectory analysis suggests the market will maintain strong momentum with projected compound annual growth rates in the range of 7-9% over the next five years. This growth is supported by increasing pharmaceutical outsourcing trends, growing drug development complexity, and expanding global pharmaceutical markets. MarkWide Research forecasts indicate that specialized segments including oncology and rare diseases will experience above-average growth rates.

Technology evolution will continue to drive market transformation, with continuous manufacturing, artificial intelligence, and advanced analytics becoming standard capabilities. The adoption of Industry 4.0 technologies is expected to improve manufacturing efficiency by 20-25% while enhancing quality control and regulatory compliance. Digital integration across the pharmaceutical supply chain will create new opportunities for CDMOs with advanced technological capabilities.

Regional market development will see continued growth in Asia-Pacific markets, with China and India emerging as major manufacturing hubs. European markets are expected to maintain steady growth supported by regulatory harmonization and strong pharmaceutical industry presence. North American markets will continue to lead in terms of innovation and high-value manufacturing services.

Competitive landscape evolution will likely feature continued consolidation as larger CDMOs acquire specialized capabilities and expand their global reach. However, opportunities will remain for niche players with specialized expertise in emerging therapeutic areas or advanced technologies. Strategic partnerships between CDMOs and pharmaceutical companies are expected to become deeper and more integrated, creating mutual value and competitive advantages.

The small molecules innovator contract development and manufacturing organization market represents a dynamic and rapidly evolving sector within the global pharmaceutical industry, characterized by strong growth fundamentals and significant strategic importance. The market’s trajectory reflects the pharmaceutical industry’s continued evolution toward specialized outsourcing partnerships and the increasing complexity of drug development and manufacturing processes.

Key success factors for market participants include specialized technical expertise, operational excellence, regulatory compliance, and the ability to provide integrated service offerings that address clients’ evolving needs. The market rewards organizations that can demonstrate consistent quality, reliability, and innovation while maintaining cost competitiveness. Strategic positioning in high-growth therapeutic areas and emerging markets will be crucial for long-term success.

Market outlook remains positive, supported by robust pharmaceutical R&D spending, increasing outsourcing trends, and growing demand for specialized manufacturing capabilities. The sector’s resilience during recent global challenges demonstrates its strategic importance to the pharmaceutical industry and its ability to adapt to changing market conditions. Technology adoption and digital transformation will continue to drive operational improvements and competitive differentiation.

Stakeholder value creation through the small molecules innovator CDMO market extends beyond immediate commercial benefits to include contributions to healthcare innovation, drug accessibility, and pharmaceutical industry efficiency. As the market continues to mature and evolve, successful participants will be those that can balance operational excellence with strategic innovation while maintaining the highest standards of quality and regulatory compliance.

What is Small Molecules Innovator Contract Development And Manufacturing Organization?

Small Molecules Innovator Contract Development And Manufacturing Organization refers to companies that specialize in the development and manufacturing of small molecule drugs, often providing services to pharmaceutical firms. These organizations play a crucial role in the drug development process, from initial research to final production.

What are the key players in the Small Molecules Innovator Contract Development And Manufacturing Organization Market?

Key players in the Small Molecules Innovator Contract Development And Manufacturing Organization Market include companies like Lonza, Catalent, and WuXi AppTec, which offer a range of services from drug formulation to large-scale manufacturing. These companies are known for their expertise in small molecule production and regulatory compliance, among others.

What are the growth factors driving the Small Molecules Innovator Contract Development And Manufacturing Organization Market?

The growth of the Small Molecules Innovator Contract Development And Manufacturing Organization Market is driven by the increasing demand for innovative therapies, the rise in chronic diseases, and advancements in drug development technologies. Additionally, the trend towards outsourcing manufacturing processes is contributing to market expansion.

What challenges does the Small Molecules Innovator Contract Development And Manufacturing Organization Market face?

Challenges in the Small Molecules Innovator Contract Development And Manufacturing Organization Market include stringent regulatory requirements, high competition among service providers, and the complexity of developing novel small molecules. These factors can impact timelines and costs associated with drug development.

What opportunities exist in the Small Molecules Innovator Contract Development And Manufacturing Organization Market?

Opportunities in the Small Molecules Innovator Contract Development And Manufacturing Organization Market include the growing trend of personalized medicine, increased investment in biotechnology, and the expansion of emerging markets. These factors are likely to create new avenues for growth and collaboration.

What trends are shaping the Small Molecules Innovator Contract Development And Manufacturing Organization Market?

Trends shaping the Small Molecules Innovator Contract Development And Manufacturing Organization Market include the integration of artificial intelligence in drug development, a focus on sustainability in manufacturing processes, and the increasing use of continuous manufacturing techniques. These innovations are enhancing efficiency and reducing costs.

Small Molecules Innovator Contract Development And Manufacturing Organization Market

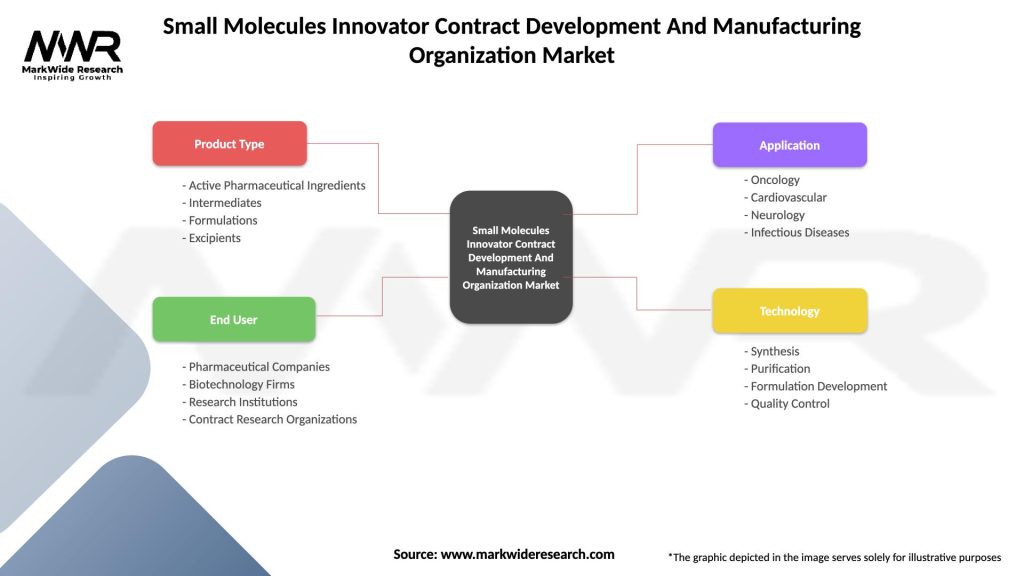

| Segmentation Details | Description |

|---|---|

| Product Type | Active Pharmaceutical Ingredients, Intermediates, Formulations, Excipients |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Application | Oncology, Cardiovascular, Neurology, Infectious Diseases |

| Technology | Synthesis, Purification, Formulation Development, Quality Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Small Molecules Innovator Contract Development And Manufacturing Organization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at