444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The lentiviral vector contract development and manufacturing organizations (CDMO) market represents a rapidly expanding segment within the biopharmaceutical industry, driven by the increasing demand for advanced gene and cell therapies. Lentiviral vectors have emerged as critical tools for delivering therapeutic genes into target cells, particularly in the development of CAR-T cell therapies, gene therapies, and other innovative treatments. The market encompasses specialized organizations that provide comprehensive services from early-stage vector design and development through large-scale commercial manufacturing.

Market dynamics indicate robust growth driven by the expanding pipeline of gene and cell therapy products entering clinical trials. The sector has experienced significant momentum with over 75% of gene therapy clinical trials utilizing viral vectors, with lentiviral vectors representing a substantial portion of this segment. Contract development and manufacturing organizations specializing in lentiviral vectors have become essential partners for biotechnology companies and pharmaceutical giants seeking to accelerate their therapeutic programs while managing complex manufacturing requirements.

Regional distribution shows North America maintaining the largest market presence, accounting for approximately 45% of global CDMO activities, followed by Europe with 30% market share. The Asia-Pacific region is emerging as a significant growth area, with projected growth rates exceeding 12% annually as companies establish manufacturing capabilities to serve local and global markets.

The lentiviral vector contract development and manufacturing organizations market refers to the specialized sector of service providers that offer comprehensive development, optimization, and manufacturing services for lentiviral vectors used in gene and cell therapy applications. Lentiviral vectors are modified versions of the HIV virus that have been engineered to safely deliver therapeutic genes into target cells, including non-dividing cells, making them particularly valuable for various therapeutic applications.

Contract development and manufacturing organizations (CDMOs) in this space provide end-to-end services including vector design, process development, analytical method development, regulatory support, clinical manufacturing, and commercial-scale production. These organizations serve as critical partners for biotechnology companies, pharmaceutical companies, and academic institutions developing gene and cell therapies, offering specialized expertise and infrastructure that would be prohibitively expensive for most organizations to develop in-house.

Service offerings typically encompass plasmid development, vector production optimization, purification process development, quality control testing, regulatory compliance support, and scalable manufacturing solutions. The market includes both dedicated lentiviral vector specialists and broader CDMOs that have developed specific capabilities in viral vector manufacturing.

Market expansion in the lentiviral vector CDMO sector reflects the broader growth trajectory of the gene and cell therapy industry, with increasing numbers of therapeutic candidates advancing through clinical development phases. The market has witnessed substantial investment in manufacturing capacity and technological capabilities, driven by the success of approved CAR-T cell therapies and the promising pipeline of gene therapy products.

Key market drivers include the growing number of gene therapy clinical trials, increasing adoption of CAR-T cell therapies, regulatory approvals for gene therapy products, and the complexity of lentiviral vector manufacturing that favors outsourcing to specialized providers. Manufacturing challenges associated with lentiviral vector production, including the need for specialized facilities, complex quality control requirements, and regulatory expertise, have created strong demand for CDMO services.

Competitive landscape features a mix of established pharmaceutical service companies expanding into viral vector manufacturing and specialized biotechnology companies focused exclusively on lentiviral vector development and production. The market has seen significant consolidation activity as larger organizations acquire specialized capabilities and expand their service offerings. Technology advancement continues to drive improvements in vector design, production efficiency, and manufacturing scalability.

Strategic insights reveal several critical factors shaping the lentiviral vector CDMO market landscape:

Primary growth drivers propelling the lentiviral vector CDMO market include the expanding pipeline of gene and cell therapy products, increasing regulatory approvals, and growing commercial adoption of approved therapies. The success of CAR-T cell therapies has demonstrated the commercial viability of lentiviral vector-based treatments, encouraging increased investment in development programs and manufacturing capabilities.

Technological advancement in vector design and manufacturing processes has improved the feasibility and cost-effectiveness of lentiviral vector production, making these therapies more accessible to a broader range of therapeutic applications. Manufacturing outsourcing trends reflect the recognition that specialized CDMO partners can provide more efficient and cost-effective solutions compared to internal manufacturing development.

Regulatory support from agencies such as the FDA and EMA has created clearer pathways for gene therapy development and approval, encouraging increased investment in the sector. The establishment of expedited approval pathways for breakthrough therapies has accelerated development timelines and increased demand for manufacturing services. Investment capital flowing into the gene therapy sector has enabled more companies to advance their programs through clinical development, creating sustained demand for CDMO services.

Manufacturing complexity represents a significant constraint in the lentiviral vector CDMO market, as the production process requires sophisticated technical expertise, specialized equipment, and stringent quality control measures. The high cost of manufacturing remains a barrier to broader adoption, particularly for smaller biotechnology companies with limited financial resources.

Regulatory challenges continue to impact market growth, as the evolving regulatory landscape requires continuous adaptation of manufacturing processes and quality systems. Safety concerns associated with viral vector-based therapies, while generally manageable, require extensive safety testing and monitoring that adds complexity and cost to development programs.

Capacity constraints in the CDMO sector have created bottlenecks, particularly for companies seeking to advance multiple programs simultaneously. The limited pool of experienced personnel with expertise in lentiviral vector manufacturing has created workforce challenges and increased labor costs. Technology transfer complexities between development and manufacturing organizations can create delays and additional costs in program advancement.

Emerging therapeutic applications for lentiviral vectors beyond traditional gene therapy and CAR-T cell therapy present significant growth opportunities. In vivo gene therapy applications are expanding the addressable market for lentiviral vectors, creating new demand for specialized manufacturing services. The development of next-generation vector technologies offers opportunities for CDMOs to differentiate their service offerings and capture premium pricing.

Geographic expansion into emerging markets presents substantial growth potential as regulatory frameworks mature and local manufacturing capabilities develop. Technology partnerships between CDMOs and technology developers can create competitive advantages and access to innovative manufacturing approaches. The growing interest in personalized medicine applications creates opportunities for flexible, small-batch manufacturing capabilities.

Vertical integration opportunities allow CDMOs to expand their service offerings across the development and manufacturing value chain. Platform technology development can enable CDMOs to offer standardized solutions that reduce development timelines and costs for clients. The increasing focus on cost reduction in gene therapy manufacturing creates opportunities for CDMOs that can demonstrate superior efficiency and cost-effectiveness.

Supply and demand dynamics in the lentiviral vector CDMO market are characterized by strong demand growth outpacing capacity expansion, creating favorable pricing conditions for established service providers. Competitive dynamics reflect a market in transition, with traditional pharmaceutical service companies competing against specialized biotechnology firms for market share and client relationships.

Technology evolution continues to reshape market dynamics as new manufacturing approaches and vector designs improve efficiency and reduce costs. Client relationship dynamics emphasize long-term partnerships rather than transactional relationships, as the complexity of lentiviral vector manufacturing requires deep collaboration between CDMOs and their clients. Regulatory dynamics influence market structure as companies with proven regulatory track records command premium positioning.

Investment dynamics show continued capital flow into CDMO capacity expansion and technology development, driven by strong market fundamentals and growth projections. Consolidation dynamics reflect the strategic value of specialized capabilities and the benefits of scale in serving the growing market demand. According to MarkWide Research analysis, the market is experiencing efficiency improvements of approximately 25% annually through technology advancement and process optimization.

Comprehensive market analysis for the lentiviral vector CDMO market employs a multi-faceted research approach combining primary and secondary research methodologies. Primary research includes extensive interviews with industry executives, CDMO service providers, biotechnology companies, pharmaceutical companies, regulatory experts, and technology developers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of company financial reports, regulatory filings, clinical trial databases, patent filings, industry publications, and academic research to validate primary findings and provide comprehensive market context. Market sizing methodologies utilize bottom-up and top-down approaches to ensure accuracy and reliability of growth projections and market segmentation analysis.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research quality and reliability. Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics. Competitive intelligence gathering includes analysis of service provider capabilities, pricing strategies, technology platforms, and market positioning to provide comprehensive competitive landscape insights.

North American market maintains its position as the largest regional segment, driven by the concentration of biotechnology companies, pharmaceutical giants, and advanced healthcare infrastructure. The region benefits from supportive regulatory frameworks, substantial research and development investment, and early adoption of innovative therapies. United States dominance reflects the presence of leading gene therapy companies and established CDMO providers with extensive lentiviral vector capabilities.

European market represents the second-largest regional segment, with strong growth driven by increasing gene therapy development activities and expanding manufacturing capabilities. Regulatory harmonization across European Union member states has facilitated market development and cross-border manufacturing activities. Key European markets including Germany, United Kingdom, France, and Switzerland have established significant CDMO capabilities and continue to attract investment.

Asia-Pacific region is emerging as a high-growth market segment, with projected growth rates exceeding 15% annually driven by expanding biotechnology sectors, increasing healthcare investment, and developing regulatory frameworks. China and Japan represent the largest Asia-Pacific markets, with growing numbers of gene therapy companies and expanding CDMO capabilities. Singapore and South Korea are developing as regional manufacturing hubs with government support for biotechnology development.

Market leadership in the lentiviral vector CDMO sector is distributed among several categories of service providers, each with distinct competitive advantages and market positioning strategies:

Competitive differentiation factors include manufacturing capacity, technology platforms, regulatory track record, geographic presence, and service breadth. Strategic partnerships between CDMOs and biotechnology companies are becoming increasingly important for securing long-term business relationships and supporting program development from early stages through commercialization.

Service type segmentation reveals distinct market segments based on the range of services provided:

Application segmentation demonstrates the diverse therapeutic areas utilizing lentiviral vectors:

End-user segmentation includes biotechnology companies, pharmaceutical companies, academic institutions, and research organizations, with biotechnology companies representing the largest segment due to their focus on innovative therapy development.

By Technology Platform:

By Manufacturing Scale:

By Geographic Presence: Regional specialization reflects local regulatory requirements, market access considerations, and cost optimization strategies, with multi-regional CDMOs commanding approximately 60% market share due to their ability to serve global development programs.

For Biotechnology Companies:

For Pharmaceutical Companies:

For CDMOs:

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement trends are reshaping the lentiviral vector CDMO landscape through the development of more efficient production systems, improved vector designs, and enhanced purification technologies. Continuous manufacturing approaches are gaining adoption as CDMOs seek to improve efficiency and reduce costs while maintaining quality standards.

Automation integration is becoming increasingly important as CDMOs implement automated systems for vector production, quality control, and data management to improve consistency and reduce labor costs. Single-use technology adoption continues to expand as manufacturers recognize the benefits of reduced contamination risk, improved flexibility, and lower facility costs.

Regulatory harmonization trends are facilitating global development programs as regulatory agencies work to align standards and requirements for gene therapy manufacturing. Quality by design principles are being increasingly adopted to ensure robust manufacturing processes and consistent product quality. Sustainability initiatives are gaining importance as CDMOs implement environmentally friendly manufacturing practices and waste reduction strategies.

Digital transformation is impacting CDMO operations through the implementation of advanced data analytics, process monitoring systems, and digital quality management platforms. MWR data indicates that over 80% of leading CDMOs have implemented or are planning digital transformation initiatives to improve operational efficiency and client service.

Capacity expansion initiatives have dominated recent industry developments as CDMOs respond to growing demand by investing in new facilities and expanding existing manufacturing capabilities. Strategic acquisitions continue to reshape the competitive landscape as larger organizations acquire specialized capabilities and expand their service offerings.

Technology partnerships between CDMOs and technology developers are creating new manufacturing capabilities and improving process efficiency. Regulatory milestone achievements by CDMO clients have validated manufacturing processes and established track records for commercial success. International expansion activities reflect the global nature of gene therapy development and the need for regional manufacturing capabilities.

Quality system enhancements have been implemented across the industry to meet evolving regulatory requirements and client expectations. Workforce development programs are being established to address the shortage of experienced personnel in viral vector manufacturing. Sustainability initiatives are being implemented to reduce environmental impact and improve operational efficiency.

Innovation investments in next-generation manufacturing technologies are positioning CDMOs for future growth and competitive advantage. Client partnership expansions reflect the trend toward long-term strategic relationships rather than transactional service arrangements.

Strategic recommendations for market participants emphasize the importance of building comprehensive service capabilities that span the entire development and manufacturing value chain. Investment priorities should focus on advanced manufacturing technologies, quality systems, and regulatory expertise that provide sustainable competitive advantages.

Partnership strategies should emphasize long-term relationships with innovative therapy developers, particularly those with promising clinical pipelines and strong financial backing. Geographic expansion should be carefully planned to align with regulatory requirements and market opportunities while managing operational complexity.

Technology development investments should focus on next-generation manufacturing approaches that improve efficiency, reduce costs, and enhance product quality. Workforce development initiatives are critical for building the specialized expertise required for successful lentiviral vector manufacturing operations.

Quality system investments should anticipate evolving regulatory requirements and client expectations while providing operational efficiency benefits. Digital transformation initiatives should be prioritized to improve operational visibility, process control, and client communication. Sustainability programs should be implemented to address environmental concerns and improve operational efficiency.

Long-term growth prospects for the lentiviral vector CDMO market remain highly favorable, driven by the expanding pipeline of gene and cell therapy products and increasing commercial adoption of approved therapies. Market maturation is expected to bring improved manufacturing efficiency, reduced costs, and enhanced service quality as the industry gains experience and scale.

Technology evolution will continue to drive improvements in vector design, manufacturing processes, and quality control systems, making lentiviral vector therapies more accessible and cost-effective. Regulatory framework development is expected to provide greater clarity and consistency, facilitating global development programs and reducing regulatory risk.

Competitive landscape evolution will likely see continued consolidation as the market matures and economies of scale become more important. MarkWide Research projects that the market will experience sustained growth rates exceeding 18% annually over the next five years, driven by increasing therapeutic applications and expanding global adoption.

Innovation opportunities in manufacturing technology, vector design, and therapeutic applications will create new growth avenues for market participants. Global expansion of manufacturing capabilities will support the international development and commercialization of lentiviral vector-based therapies. Cost reduction initiatives will make these therapies more accessible to broader patient populations and healthcare systems.

The lentiviral vector contract development and manufacturing organizations market represents a critical component of the rapidly expanding gene and cell therapy industry, providing essential services that enable the development and commercialization of innovative treatments. Market fundamentals remain strong, supported by growing therapeutic pipelines, increasing regulatory approvals, and expanding commercial adoption of gene and cell therapies.

Strategic positioning in this market requires significant investment in specialized capabilities, regulatory expertise, and manufacturing infrastructure, creating barriers to entry that protect established players while rewarding those who successfully build comprehensive service offerings. Technology advancement continues to drive improvements in manufacturing efficiency and product quality, while regulatory framework development provides greater clarity for global development programs.

Future success in the lentiviral vector CDMO market will depend on the ability to build sustainable competitive advantages through technology innovation, operational excellence, and strategic partnerships with innovative therapy developers. The market’s strong growth trajectory and critical role in enabling life-changing therapies position it as an attractive opportunity for organizations with the expertise and resources to succeed in this specialized and rapidly evolving sector.

What is Lentiviral Vector Contract Development And Manufacturing Organizations?

Lentiviral Vector Contract Development And Manufacturing Organizations are specialized companies that provide services for the development and production of lentiviral vectors, which are used in gene therapy and other biopharmaceutical applications.

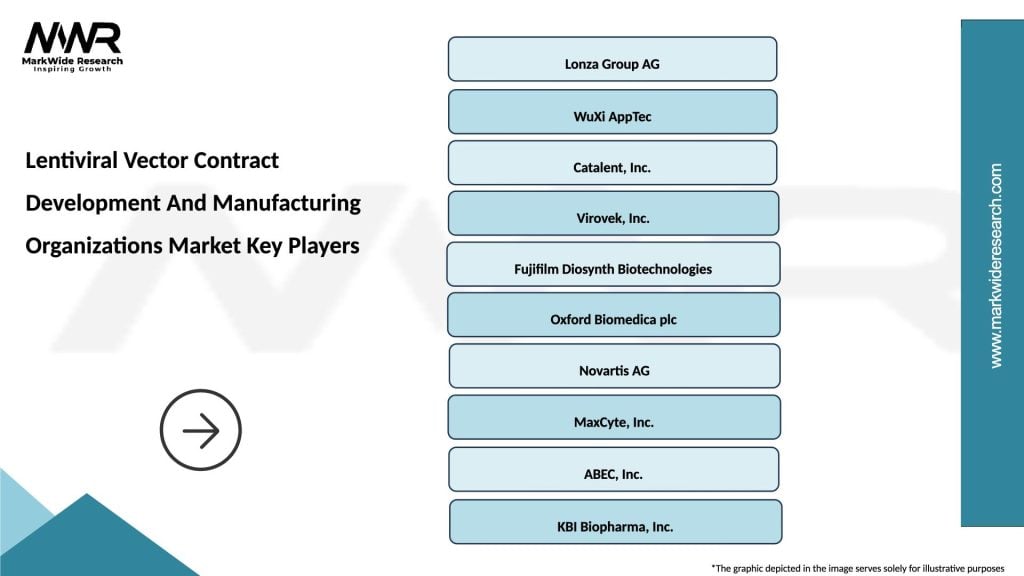

What are the key players in the Lentiviral Vector Contract Development And Manufacturing Organizations Market?

Key players in the Lentiviral Vector Contract Development And Manufacturing Organizations Market include companies like Lonza, WuXi AppTec, and Catalent, which offer comprehensive services in vector development and manufacturing, among others.

What are the growth factors driving the Lentiviral Vector Contract Development And Manufacturing Organizations Market?

The growth of the Lentiviral Vector Contract Development And Manufacturing Organizations Market is driven by increasing investments in gene therapy, rising prevalence of genetic disorders, and advancements in vector technology.

What challenges does the Lentiviral Vector Contract Development And Manufacturing Organizations Market face?

Challenges in the Lentiviral Vector Contract Development And Manufacturing Organizations Market include regulatory hurdles, high production costs, and the complexity of vector design and manufacturing processes.

What opportunities exist in the Lentiviral Vector Contract Development And Manufacturing Organizations Market?

Opportunities in the Lentiviral Vector Contract Development And Manufacturing Organizations Market include the growing demand for personalized medicine, expansion of clinical trials, and collaborations between biotech firms and contract manufacturers.

What trends are shaping the Lentiviral Vector Contract Development And Manufacturing Organizations Market?

Trends in the Lentiviral Vector Contract Development And Manufacturing Organizations Market include the increasing use of automation in manufacturing processes, advancements in purification technologies, and a focus on scalable production methods.

Lentiviral Vector Contract Development And Manufacturing Organizations Market

| Segmentation Details | Description |

|---|---|

| Product Type | Research Vectors, Clinical Vectors, Commercial Vectors, Preclinical Vectors |

| End User | Biotechnology Companies, Pharmaceutical Firms, Academic Institutions, Research Organizations |

| Application | Gene Therapy, Vaccine Development, Cancer Treatment, Genetic Research |

| Technology | Transduction, Packaging, Purification, Quality Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Lentiviral Vector Contract Development And Manufacturing Organizations Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at