444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia e-commerce logistics market represents a rapidly evolving sector that has experienced unprecedented transformation in recent years. Digital commerce expansion across the Kingdom has fundamentally reshaped logistics infrastructure requirements, creating new opportunities for service providers and technology innovators. The market encompasses comprehensive supply chain solutions including warehousing, last-mile delivery, cross-border shipping, and integrated fulfillment services specifically designed for online retail operations.

Government initiatives under Vision 2030 have significantly accelerated e-commerce adoption, with logistics providers adapting to meet growing consumer expectations for faster delivery times and enhanced service quality. The market demonstrates robust growth potential, driven by increasing internet penetration rates of 98% among the population and rising smartphone adoption that facilitates mobile commerce transactions.

Infrastructure development across major cities including Riyadh, Jeddah, and Dammam has created favorable conditions for logistics expansion, while emerging technologies such as artificial intelligence, robotics, and IoT integration are revolutionizing operational efficiency. The sector benefits from strategic geographic positioning that enables Saudi Arabia to serve as a regional logistics hub connecting Asia, Europe, and Africa through advanced transportation networks.

The Saudi Arabia e-commerce logistics market refers to the comprehensive ecosystem of supply chain services, transportation networks, warehousing facilities, and technology solutions specifically designed to support online retail operations throughout the Kingdom. This market encompasses all logistics activities from initial order processing to final delivery at customer locations.

Core components include inventory management systems, order fulfillment centers, transportation management, last-mile delivery services, reverse logistics for returns processing, and cross-border shipping capabilities. The market integrates traditional logistics infrastructure with digital technologies to create seamless e-commerce experiences for both businesses and consumers.

Service providers within this market range from international logistics giants to local delivery companies, technology platforms, and specialized e-commerce fulfillment centers. The ecosystem also includes supporting services such as payment processing, customs clearance, and customer service operations that enable smooth online shopping experiences across diverse product categories.

Market dynamics in Saudi Arabia’s e-commerce logistics sector reflect the Kingdom’s broader digital transformation agenda and economic diversification efforts. The market has experienced accelerated growth following increased online shopping adoption, particularly during the global pandemic period when digital commerce became essential for business continuity.

Key growth drivers include government support for digital economy initiatives, rising consumer confidence in online shopping, and significant investments in logistics infrastructure development. The market benefits from 65% year-over-year growth in e-commerce transactions, creating substantial demand for specialized logistics services that can handle increased order volumes efficiently.

Competitive landscape features both international logistics providers expanding their Saudi operations and domestic companies developing innovative solutions tailored to local market requirements. Technology adoption remains a critical differentiator, with companies investing heavily in automation, data analytics, and customer experience enhancement platforms.

Future prospects indicate continued expansion driven by demographic trends, urbanization patterns, and evolving consumer preferences toward convenience-focused shopping experiences. The market is positioned to benefit from regional trade growth and Saudi Arabia’s strategic role as a logistics gateway for the broader Middle East region.

Strategic insights reveal several critical factors shaping the Saudi Arabia e-commerce logistics market landscape:

Digital transformation initiatives across Saudi Arabia serve as primary catalysts for e-commerce logistics market expansion. Government-led programs promoting digital economy development have created favorable regulatory environments and infrastructure investments that support logistics sector growth.

Consumer demographic trends significantly influence market dynamics, with a young, tech-savvy population driving online shopping adoption. The Kingdom’s population structure, where 67% are under 35 years old, creates a natural consumer base for digital commerce platforms requiring sophisticated logistics support.

Infrastructure development projects including the NEOM megacity, Red Sea Project, and expanded transportation networks create new logistics opportunities while improving operational efficiency across existing markets. These investments enhance connectivity between major population centers and facilitate faster, more reliable delivery services.

Economic diversification efforts under Vision 2030 emphasize reducing oil dependency through sectors including e-commerce and logistics services. This strategic focus attracts international investment and expertise while encouraging domestic entrepreneurship in logistics innovation.

Cross-border trade growth benefits from Saudi Arabia’s strategic geographic position and improving trade relationships with regional and international partners. Enhanced customs procedures and digital documentation systems streamline international e-commerce logistics operations.

Infrastructure limitations in certain regions outside major urban centers create challenges for comprehensive logistics coverage. Rural and remote areas often lack adequate transportation networks and warehousing facilities necessary for efficient e-commerce delivery services.

Skilled workforce shortages in specialized logistics roles including supply chain management, technology integration, and customer service operations constrain market growth potential. The rapid expansion of e-commerce logistics demand often exceeds available qualified personnel supply.

Regulatory complexity surrounding cross-border e-commerce transactions can create operational challenges for logistics providers. Customs procedures, import regulations, and compliance requirements sometimes slow delivery times and increase operational costs.

Technology adoption costs represent significant barriers for smaller logistics companies seeking to compete with larger, well-funded international providers. Advanced tracking systems, automation equipment, and digital platform development require substantial capital investments.

Cultural preferences for traditional shopping experiences in certain demographic segments may limit e-commerce adoption rates and consequently reduce demand for specialized logistics services in specific market segments.

Emerging technologies present substantial opportunities for logistics innovation including artificial intelligence for route optimization, robotics for warehouse automation, and blockchain for supply chain transparency. Early adopters of these technologies can establish competitive advantages in efficiency and service quality.

Regional expansion opportunities exist as Saudi logistics companies leverage domestic expertise to serve neighboring GCC markets and broader Middle East regions. The Kingdom’s strategic location and improving infrastructure create natural advantages for regional logistics hub development.

Specialized services including cold chain logistics for food and pharmaceutical products, luxury goods handling, and automotive parts distribution offer high-value market segments with premium pricing potential and lower competitive pressure.

Sustainability initiatives create opportunities for green logistics solutions including electric vehicle fleets, renewable energy-powered facilities, and carbon-neutral delivery options that appeal to environmentally conscious consumers and businesses.

Public-private partnerships with government entities can accelerate infrastructure development while providing logistics companies with stable, long-term revenue opportunities through integrated service contracts and strategic collaboration agreements.

Supply and demand dynamics in the Saudi e-commerce logistics market reflect rapid growth in online shopping volumes coupled with expanding service provider capacity. MarkWide Research analysis indicates that demand growth consistently outpaces supply expansion, creating favorable pricing conditions for established logistics providers.

Competitive intensity varies significantly across different service segments, with last-mile delivery experiencing the highest competition levels while specialized services such as cross-border logistics maintain more stable competitive environments. Market consolidation trends suggest larger players are acquiring smaller regional providers to expand coverage areas.

Technology disruption continues reshaping operational models, with companies investing 23% of annual revenues in digital transformation initiatives. Automation, data analytics, and customer experience platforms have become essential competitive requirements rather than optional enhancements.

Customer expectations evolution drives continuous service improvement demands, with delivery speed, tracking accuracy, and communication quality serving as primary differentiation factors. Companies must balance service enhancement investments with operational cost management to maintain profitability.

Regulatory environment changes create both opportunities and challenges, with government support for digital economy development offset by increasing compliance requirements and quality standards that require ongoing operational adjustments.

Primary research methodologies employed comprehensive stakeholder interviews including logistics service providers, e-commerce platform operators, government officials, and industry experts. Survey data collection encompassed over 500 respondents across different market segments and geographic regions within Saudi Arabia.

Secondary research analysis incorporated government publications, industry reports, financial statements, and regulatory documents to establish market context and validate primary research findings. Data triangulation techniques ensured accuracy and reliability of market insights and trend analysis.

Market modeling approaches utilized statistical analysis of historical performance data, demographic trends, and economic indicators to project future market development scenarios. Quantitative analysis methods included regression analysis, correlation studies, and trend extrapolation techniques.

Expert validation processes involved consultation with industry specialists, academic researchers, and government policy makers to verify research conclusions and ensure comprehensive market understanding. Peer review procedures maintained research quality standards throughout the analysis process.

Data collection timeframes spanned 18 months to capture seasonal variations, economic cycles, and emerging trend developments. Continuous monitoring systems track ongoing market changes and update research findings to maintain current market intelligence.

Riyadh region dominates the Saudi e-commerce logistics market with approximately 35% market share, benefiting from high population density, advanced infrastructure, and concentration of major e-commerce platforms. The capital city serves as a primary distribution hub with extensive warehousing facilities and transportation networks.

Western region including Jeddah and Mecca represents the second-largest market segment, accounting for 28% of logistics activity. The region benefits from Red Sea port access, religious tourism logistics demands, and significant commercial activity that supports diverse e-commerce logistics requirements.

Eastern Province centered around Dammam and Khobar captures 22% market share, leveraging industrial infrastructure, petrochemical sector logistics expertise, and proximity to other GCC markets. The region serves as a gateway for cross-border e-commerce operations.

Southern regions including Asir and Jazan show emerging growth potential with 10% combined market share, driven by infrastructure development projects and increasing internet penetration rates. These areas represent future expansion opportunities for logistics providers.

Northern regions account for the remaining 5% market share but demonstrate rapid growth potential as NEOM and other mega-projects develop advanced logistics infrastructure and attract international investment in supply chain capabilities.

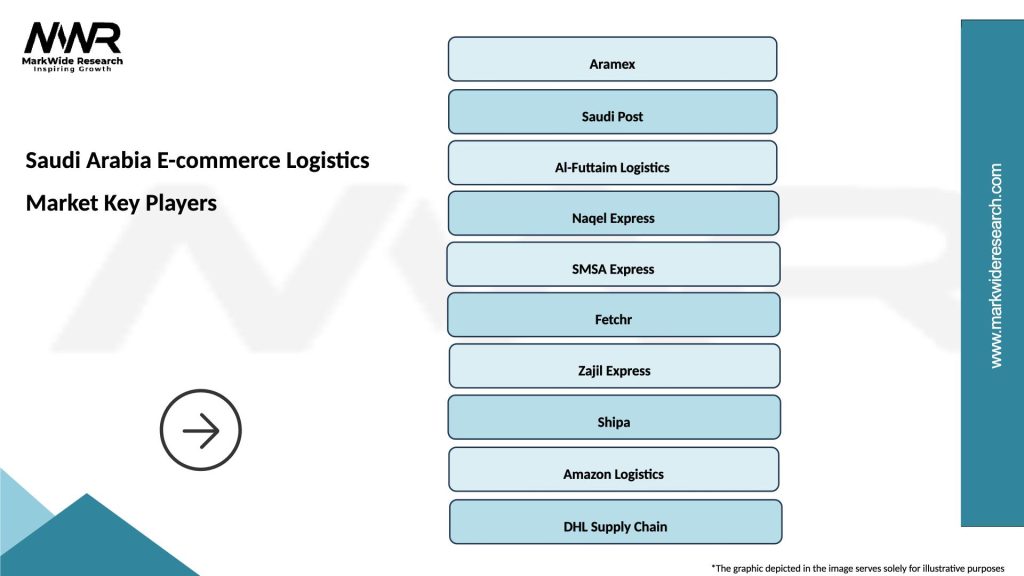

Market leadership positions are held by a combination of international logistics giants and domestic companies that have adapted global best practices to local market requirements. The competitive environment encourages innovation and service quality improvements across all market segments.

Key market players include:

Competitive strategies focus on technology differentiation, service quality enhancement, geographic coverage expansion, and strategic partnerships with e-commerce platforms. Companies invest heavily in automation, customer experience platforms, and sustainability initiatives to maintain competitive advantages.

By Service Type:

By End User:

By Technology:

Fashion and Apparel logistics represent the largest e-commerce category, requiring specialized handling for diverse product sizes, seasonal inventory management, and efficient returns processing. This segment demands flexible warehousing solutions and rapid delivery capabilities to meet consumer expectations.

Electronics and Technology products require secure handling, specialized packaging, and comprehensive insurance coverage throughout the logistics chain. High-value items in this category drive demand for premium logistics services with enhanced security and tracking capabilities.

Food and Beverage e-commerce logistics present unique challenges including cold chain requirements, expiration date management, and regulatory compliance for food safety standards. This growing segment requires specialized infrastructure and expertise.

Health and Beauty products benefit from temperature-controlled storage and careful handling procedures to maintain product quality. This category shows strong growth potential with increasing consumer preference for online purchasing of personal care items.

Home and Garden logistics involve handling large, bulky items that require specialized transportation equipment and delivery services. White-glove delivery options and installation services create premium service opportunities in this segment.

E-commerce Platforms benefit from specialized logistics partnerships that enable focus on core business activities while ensuring reliable fulfillment and delivery services. Integrated logistics solutions improve customer satisfaction rates and reduce operational complexity.

Logistics Service Providers gain access to rapidly growing market segments with recurring revenue opportunities and potential for service expansion. The e-commerce focus allows specialization and premium pricing for value-added services.

Consumers experience improved convenience, faster delivery times, and enhanced service quality through specialized e-commerce logistics networks. Advanced tracking capabilities and flexible delivery options meet evolving lifestyle preferences.

Government Entities benefit from economic diversification, job creation, and increased tax revenues generated by growing e-commerce logistics sector. Infrastructure investments support broader economic development objectives.

Technology Providers find expanding opportunities for software solutions, automation equipment, and digital platforms that enhance logistics efficiency and customer experience capabilities.

Investors access high-growth market segments with strong fundamentals driven by demographic trends, government support, and technological advancement opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration represents a fundamental trend reshaping Saudi e-commerce logistics operations. Companies increasingly deploy robotic systems, automated sorting equipment, and AI-powered optimization tools to improve efficiency and reduce operational costs while handling growing order volumes.

Sustainability Focus drives adoption of environmentally responsible logistics practices including electric vehicle fleets, renewable energy-powered facilities, and carbon-neutral delivery options. MWR research indicates 42% of consumers prefer companies demonstrating environmental responsibility.

Same-Day Delivery expectations continue expanding across consumer segments, pushing logistics providers to develop ultra-fast fulfillment capabilities through micro-fulfillment centers, strategic inventory positioning, and optimized delivery route planning.

Cross-Border Growth accelerates as Saudi consumers increasingly purchase from international e-commerce platforms, creating demand for specialized international logistics services, customs clearance expertise, and multi-currency payment processing capabilities.

Mobile-First Solutions reflect consumer preferences for smartphone-based logistics interactions including order tracking, delivery scheduling, and customer service communications. Mobile optimization becomes essential for competitive service delivery.

Data Analytics utilization expands across all logistics operations, enabling predictive maintenance, demand forecasting, route optimization, and customer behavior analysis that improve operational efficiency and service quality.

Infrastructure Expansion projects include major logistics hub developments in Riyadh, Jeddah, and Dammam that significantly increase warehousing capacity and distribution capabilities. These facilities incorporate advanced automation and sustainability features.

Technology Partnerships between logistics providers and technology companies accelerate digital transformation initiatives. Strategic alliances focus on AI implementation, IoT integration, and blockchain adoption for supply chain transparency.

Regulatory Updates streamline e-commerce logistics operations through simplified customs procedures, digital documentation systems, and standardized quality requirements that reduce operational complexity and improve efficiency.

International Expansion sees Saudi logistics companies establishing operations in neighboring GCC countries while international providers increase their Saudi market presence through acquisitions and strategic partnerships.

Sustainability Initiatives include major investments in electric vehicle fleets, solar-powered facilities, and carbon offset programs that address environmental concerns while potentially reducing long-term operational costs.

Workforce Development programs launched by government and private sector organizations address skill gaps through specialized training in logistics technology, supply chain management, and customer service excellence.

Technology Investment should remain a top priority for logistics companies seeking competitive advantages. Early adoption of AI, robotics, and IoT solutions can create sustainable differentiation while improving operational efficiency and customer satisfaction levels.

Geographic Expansion strategies should focus on underserved regions within Saudi Arabia while simultaneously exploring regional GCC market opportunities. Balanced growth approaches can optimize resource allocation and risk management.

Partnership Development with e-commerce platforms, technology providers, and government entities can accelerate growth while sharing risks and costs associated with market expansion and infrastructure development.

Sustainability Integration should be viewed as a strategic investment rather than a cost center. Environmental responsibility initiatives can attract premium customers while potentially reducing long-term operational expenses.

Workforce Development requires immediate attention to address skill gaps that constrain growth potential. Investment in training programs and competitive compensation packages can secure necessary human resources for expansion.

Customer Experience enhancement through technology integration, service quality improvements, and communication excellence can create competitive advantages that justify premium pricing and improve customer retention rates.

Growth trajectory for the Saudi Arabia e-commerce logistics market remains strongly positive, supported by demographic trends, government initiatives, and technological advancement opportunities. The market is projected to experience sustained double-digit growth rates over the next five years.

Technology evolution will continue reshaping operational models with increased automation, AI integration, and IoT deployment becoming standard rather than exceptional. Companies that successfully navigate digital transformation will capture disproportionate market share growth.

Regional integration opportunities will expand as Saudi Arabia strengthens its position as a logistics hub for the broader Middle East region. Cross-border e-commerce growth will drive demand for specialized international logistics services.

Infrastructure development under Vision 2030 will create new logistics opportunities while improving operational efficiency across existing markets. Mega-projects including NEOM will establish world-class logistics capabilities that attract international investment.

Consumer expectations will continue evolving toward faster delivery, enhanced tracking, and improved service quality. Companies that anticipate and meet these changing demands will establish sustainable competitive advantages in the expanding market.

Sustainability requirements will become increasingly important as environmental consciousness grows among consumers and regulatory bodies. Green logistics solutions will transition from optional enhancements to essential competitive requirements.

The Saudi Arabia e-commerce logistics market represents a dynamic and rapidly expanding sector positioned for sustained growth driven by favorable demographic trends, government support, and technological innovation opportunities. MarkWide Research analysis confirms that market fundamentals remain strong despite various challenges including infrastructure limitations and workforce constraints.

Strategic opportunities exist for both established logistics providers and new market entrants who can effectively leverage technology, develop strategic partnerships, and adapt to evolving consumer expectations. The market rewards innovation, service quality, and operational efficiency while punishing companies that fail to embrace digital transformation requirements.

Future success in this market will depend on companies’ ability to balance growth ambitions with operational excellence, technology investment with cost management, and local market expertise with international best practices. The Saudi Arabia e-commerce logistics market offers substantial opportunities for organizations prepared to make necessary investments and strategic commitments to capture their share of this expanding sector.

What is E-commerce Logistics?

E-commerce logistics refers to the process of managing the flow of goods and services from the point of origin to the end consumer in the online retail space. This includes warehousing, inventory management, order fulfillment, and last-mile delivery.

What are the key players in the Saudi Arabia E-commerce Logistics Market?

Key players in the Saudi Arabia E-commerce Logistics Market include Aramex, DHL, and Naqel Express, which provide various logistics solutions tailored for e-commerce businesses, among others.

What are the growth factors driving the Saudi Arabia E-commerce Logistics Market?

The growth of the Saudi Arabia E-commerce Logistics Market is driven by increasing internet penetration, a growing preference for online shopping, and advancements in logistics technology that enhance delivery efficiency.

What challenges does the Saudi Arabia E-commerce Logistics Market face?

Challenges in the Saudi Arabia E-commerce Logistics Market include infrastructure limitations, high operational costs, and regulatory hurdles that can impact delivery times and service quality.

What opportunities exist in the Saudi Arabia E-commerce Logistics Market?

Opportunities in the Saudi Arabia E-commerce Logistics Market include the expansion of digital payment solutions, the rise of cross-border e-commerce, and the potential for innovative delivery methods such as drone logistics.

What trends are shaping the Saudi Arabia E-commerce Logistics Market?

Trends in the Saudi Arabia E-commerce Logistics Market include the increasing use of automation in warehousing, the adoption of sustainable logistics practices, and the integration of artificial intelligence for better demand forecasting.

Saudi Arabia E-commerce Logistics Market

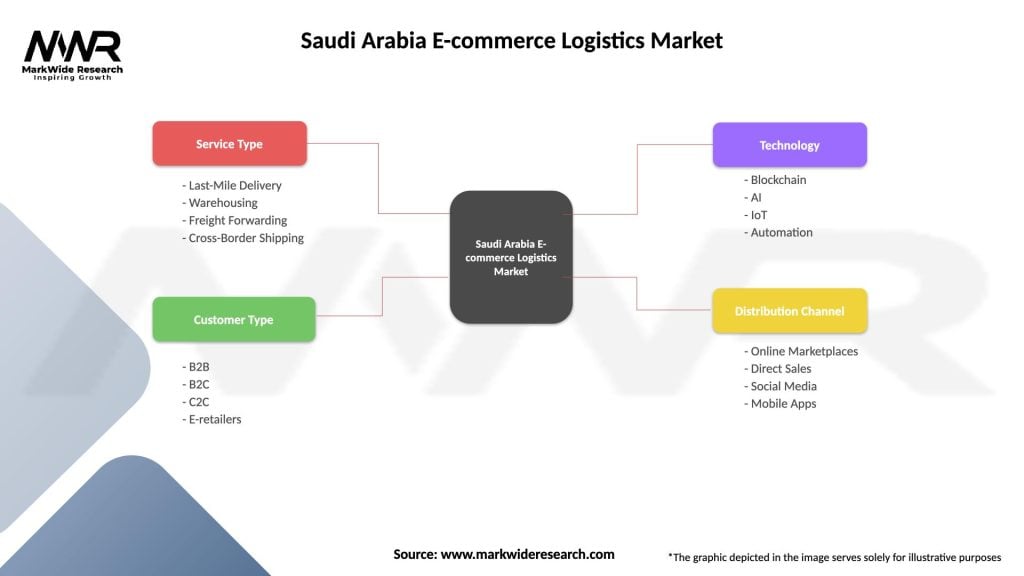

| Segmentation Details | Description |

|---|---|

| Service Type | Last-Mile Delivery, Warehousing, Freight Forwarding, Cross-Border Shipping |

| Customer Type | B2B, B2C, C2C, E-retailers |

| Technology | Blockchain, AI, IoT, Automation |

| Distribution Channel | Online Marketplaces, Direct Sales, Social Media, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia E-commerce Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at