444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States roofing market represents a dynamic and essential segment of the construction industry, encompassing residential, commercial, and industrial applications across all fifty states. Market dynamics indicate robust growth driven by infrastructure modernization, extreme weather resilience requirements, and sustainable building practices. The sector demonstrates remarkable adaptability, with traditional materials like asphalt shingles maintaining dominance while innovative solutions including solar-integrated roofing systems and cool roof technologies gain significant traction.

Regional variations significantly influence market patterns, with hurricane-prone southeastern states driving demand for impact-resistant materials, while northern regions prioritize energy efficiency and snow load capabilities. The market experiences consistent growth at approximately 4.2% CAGR, supported by ongoing residential construction, commercial development, and replacement cycles. Technology integration transforms traditional roofing approaches, incorporating smart materials, drone inspection capabilities, and advanced installation techniques that enhance durability and performance.

Sustainability initiatives reshape market preferences, with green roofing solutions capturing approximately 18% market share in urban commercial applications. The sector benefits from favorable regulatory environments promoting energy-efficient building codes and tax incentives for sustainable roofing installations, creating substantial opportunities for market expansion and innovation.

The United States roofing market refers to the comprehensive industry encompassing the manufacturing, distribution, installation, and maintenance of roofing systems across residential, commercial, and industrial sectors throughout the United States, including materials, labor services, and associated technologies.

Market scope extends beyond traditional material supply to include integrated solutions combining weatherproofing, energy efficiency, aesthetic appeal, and technological innovation. The industry encompasses diverse stakeholders including manufacturers, contractors, distributors, architects, and property owners, creating a complex ecosystem that supports building protection and performance enhancement.

Contemporary definitions increasingly incorporate sustainability metrics, smart building integration, and climate resilience factors, reflecting evolving market demands and regulatory requirements. The sector’s meaning continues expanding as roofing systems become integral components of comprehensive building performance strategies rather than standalone protective elements.

Strategic analysis reveals the United States roofing market as a cornerstone of the construction industry, characterized by steady demand growth, technological innovation, and increasing emphasis on sustainable solutions. The market demonstrates resilience through economic cycles, supported by essential replacement needs and continuous new construction activity across diverse geographic regions.

Key performance indicators highlight strong market fundamentals, with residential applications representing approximately 72% of total demand, while commercial and industrial segments contribute 28% combined market share. The sector benefits from demographic trends including urbanization, housing market recovery, and commercial real estate expansion, creating sustained demand across multiple market segments.

Innovation drivers include energy efficiency regulations, extreme weather preparedness requirements, and integration of renewable energy technologies. Market leaders invest heavily in research and development, focusing on advanced materials, installation efficiency, and lifecycle performance optimization. The competitive landscape features both established manufacturers and emerging technology companies, fostering continuous innovation and market evolution.

Market intelligence reveals several critical insights shaping the United States roofing industry’s trajectory and strategic positioning:

Primary growth catalysts propelling the United States roofing market include fundamental demographic, economic, and technological factors that create sustained demand across multiple market segments. Population growth and urbanization trends drive new construction activity, while aging building stock generates consistent replacement and renovation requirements.

Climate considerations increasingly influence market dynamics, with extreme weather events highlighting the importance of resilient roofing systems. Property owners prioritize materials and installation techniques that provide superior protection against hurricanes, hailstorms, and temperature extremes, driving demand for premium products and specialized installation services.

Energy efficiency mandates create substantial market opportunities, with cool roof technologies and solar-integrated systems gaining approximately 23% adoption rate in commercial applications. Government incentives and utility rebate programs support market expansion, while building codes increasingly require energy-efficient roofing solutions.

Technological advancement enables new product categories and installation methods, improving performance while reducing long-term maintenance requirements. Smart roofing systems incorporating sensors, automated maintenance alerts, and integrated renewable energy generation represent emerging growth segments with significant potential.

Significant challenges constrain United States roofing market growth, including labor shortages, material cost volatility, and regulatory complexity that impact market participants across all segments. Skilled workforce availability represents the most critical constraint, with experienced roofers in short supply across many regions, limiting installation capacity and driving up labor costs.

Raw material price fluctuations create planning difficulties for contractors and manufacturers, with petroleum-based products, metals, and specialty materials subject to commodity market volatility. These cost variations impact project profitability and pricing predictability, particularly affecting smaller contractors with limited financial flexibility.

Weather dependency constrains installation schedules and project completion timelines, with seasonal variations significantly impacting market activity patterns. Northern regions experience reduced installation windows due to winter weather, while extreme heat in southern markets limits safe working conditions during summer months.

Regulatory compliance costs burden market participants with increasing administrative requirements, licensing procedures, and safety standards that raise operational expenses. Small contractors particularly struggle with compliance complexity, while larger companies invest substantial resources in regulatory management systems.

Substantial growth opportunities emerge across the United States roofing market through technological innovation, sustainability initiatives, and evolving customer preferences that create new revenue streams and market segments. Smart building integration represents a transformative opportunity, with intelligent roofing systems offering monitoring, maintenance optimization, and energy management capabilities.

Solar roofing integration presents exceptional growth potential, with residential solar adoption rates increasing approximately 15% annually and commercial installations expanding rapidly. This convergence creates opportunities for roofing contractors to diversify services and capture higher-value projects while supporting renewable energy adoption.

Retrofit and renovation markets offer substantial opportunities as building owners prioritize energy efficiency improvements and climate resilience upgrades. Cool roof technologies, improved insulation systems, and weather-resistant materials create recurring revenue opportunities for contractors specializing in building performance optimization.

Geographic expansion opportunities exist in underserved markets and emerging metropolitan areas experiencing rapid growth. Contractors with specialized expertise in sustainable roofing solutions or extreme weather applications can capitalize on regional demand variations and establish competitive advantages in specific market niches.

Complex interactions between supply chain factors, regulatory requirements, and customer preferences shape the United States roofing market’s operational environment. Supply chain resilience becomes increasingly critical as manufacturers and contractors adapt to material availability challenges and transportation cost fluctuations that impact project planning and execution.

Competitive dynamics evolve as traditional roofing companies compete with technology-focused startups and integrated building solution providers. Market consolidation trends create larger regional players while specialized contractors maintain advantages in niche applications and premium services.

Customer behavior patterns shift toward comprehensive building performance solutions rather than isolated roofing projects. Property owners increasingly evaluate roofing investments within broader energy efficiency and sustainability frameworks, creating opportunities for contractors offering integrated services and long-term performance guarantees.

Technology adoption rates vary significantly across market segments, with commercial applications leading innovation adoption while residential markets gradually embrace new technologies. According to MarkWide Research analysis, digital project management tools achieve approximately 67% adoption rate among commercial roofing contractors, compared to 34% adoption in residential applications.

Comprehensive research approaches underpin accurate United States roofing market analysis, incorporating primary data collection, secondary source analysis, and industry expert consultations to ensure reliable market intelligence. Primary research methods include structured interviews with manufacturers, contractors, distributors, and end-users across diverse geographic regions and market segments.

Data collection strategies encompass quantitative surveys measuring market preferences, pricing trends, and adoption patterns, complemented by qualitative research exploring decision-making processes and emerging market requirements. Industry trade associations, government agencies, and professional organizations provide valuable secondary data sources supporting comprehensive market understanding.

Analytical frameworks incorporate statistical modeling, trend analysis, and comparative assessments to identify market patterns and forecast future developments. Geographic segmentation analysis considers regional climate variations, economic conditions, and regulatory environments that influence local market dynamics.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and market participant feedback sessions. Continuous monitoring systems track market developments and update research findings to maintain current and relevant market intelligence for stakeholders.

Geographic market variations significantly influence the United States roofing industry, with distinct regional characteristics driven by climate conditions, economic factors, and regulatory environments. Southeast region dominates market activity with approximately 28% national market share, driven by hurricane preparedness requirements, rapid population growth, and extensive commercial development.

Western markets emphasize sustainability and energy efficiency, with California leading solar roofing adoption and cool roof technology implementation. The region’s environmental regulations and utility incentive programs create favorable conditions for innovative roofing solutions, supporting premium product segments and specialized installation services.

Northeast corridor focuses on energy efficiency and weather resistance, with harsh winter conditions driving demand for high-performance materials and installation techniques. Urban density creates opportunities for commercial roofing specialists while historic preservation requirements support specialty restoration services.

Midwest region balances cost-effectiveness with performance requirements, emphasizing value-oriented solutions that provide reliable protection against diverse weather conditions. Agricultural and industrial applications create steady demand for large-scale commercial roofing projects, while residential markets prioritize durability and energy efficiency.

Southwest markets prioritize heat resistance and energy efficiency, with extreme temperature conditions driving demand for cool roof technologies and reflective materials. Rapid urban expansion creates substantial new construction opportunities while water scarcity concerns promote sustainable roofing solutions.

Market leadership in the United States roofing industry reflects a diverse competitive environment featuring established manufacturers, regional contractors, and emerging technology companies. Major players maintain competitive advantages through brand recognition, distribution networks, and comprehensive product portfolios serving multiple market segments.

Competitive strategies emphasize product innovation, contractor support programs, and geographic expansion to capture market share across diverse segments. Companies invest heavily in research and development, focusing on advanced materials, installation efficiency, and integrated building solutions that address evolving customer requirements.

Market segmentation reveals distinct categories within the United States roofing industry, each characterized by unique requirements, growth patterns, and competitive dynamics. By Application: residential applications dominate with approximately 72% market share, while commercial and industrial segments contribute 28% combined share with higher average project values and specialized requirements.

By Material Type:

By End-User:

Residential roofing categories demonstrate distinct growth patterns and customer preferences that shape market development strategies. Asphalt shingle markets benefit from continuous product innovation, with architectural shingles gaining market share through enhanced aesthetics and performance characteristics compared to traditional three-tab products.

Metal roofing segments experience accelerated growth driven by durability advantages, energy efficiency benefits, and expanding color and style options. Residential metal roofing adoption increases approximately 8% annually, supported by longer warranty periods and reduced maintenance requirements that appeal to cost-conscious homeowners.

Commercial roofing categories prioritize performance and lifecycle cost optimization, with single-ply membrane systems dominating through installation efficiency and proven performance records. Cool roof technologies gain traction in commercial applications, supported by energy cost savings and regulatory incentives that improve project return on investment.

Specialty roofing segments including green roofs, solar integration, and historic restoration create niche opportunities for specialized contractors. These categories command premium pricing while requiring advanced technical expertise and specialized installation equipment, creating barriers to entry that protect established market participants.

Manufacturers benefit from diverse market opportunities across residential, commercial, and industrial segments, enabling revenue diversification and risk mitigation through multiple customer bases. Product innovation capabilities create competitive advantages and premium pricing opportunities, while established distribution networks provide market access and customer relationship advantages.

Contractors gain from steady market demand driven by replacement cycles and new construction activity, providing predictable revenue streams and business growth opportunities. Specialization strategies enable premium pricing and reduced competition, while technology adoption improves installation efficiency and project profitability.

Property owners receive enhanced building protection, energy efficiency improvements, and increased property values through modern roofing system installations. Warranty programs and performance guarantees provide long-term cost predictability, while sustainable roofing options support environmental responsibility goals and regulatory compliance.

Distributors benefit from consistent product demand and opportunities to provide value-added services including contractor training, technical support, and inventory management solutions. Market consolidation trends create opportunities for efficient distributors to expand geographic coverage and capture increased market share through superior service capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend reshaping the United States roofing market, with green building certifications and energy efficiency requirements driving material selection and installation practices. Cool roof technologies gain widespread adoption, reducing building energy consumption while supporting urban heat island mitigation efforts in metropolitan areas.

Smart roofing systems incorporate sensors, monitoring capabilities, and automated maintenance alerts that transform traditional roofing into intelligent building components. These systems provide real-time performance data, predictive maintenance capabilities, and integration with building management systems that optimize overall facility operations.

Solar integration trends accelerate as photovoltaic technology costs decline and installation techniques improve, creating seamless integration between roofing and renewable energy generation. MWR data indicates solar roofing installations increase approximately 22% annually in residential applications, while commercial installations grow even more rapidly.

Extreme weather resilience becomes increasingly important as climate change intensifies storm severity and frequency. Impact-resistant materials, enhanced fastening systems, and wind-uplift resistance improvements address growing concerns about weather-related damage and insurance requirements.

Digital transformation revolutionizes project management, customer communication, and installation processes through drone inspections, digital documentation, and mobile project management platforms that improve efficiency and customer satisfaction.

Recent industry developments highlight the dynamic nature of the United States roofing market, with technological innovations, strategic partnerships, and regulatory changes shaping future market direction. Manufacturing investments focus on sustainable materials, advanced production techniques, and capacity expansion to meet growing market demand.

Technology partnerships between traditional roofing manufacturers and technology companies create integrated solutions combining materials, sensors, and software platforms. These collaborations accelerate smart roofing development while providing comprehensive building performance solutions that address evolving customer requirements.

Acquisition activities consolidate market participants, with larger companies acquiring specialized manufacturers and regional contractors to expand geographic coverage and technical capabilities. These transactions create more comprehensive service offerings while improving operational efficiency through scale advantages.

Regulatory developments include updated building codes emphasizing energy efficiency, extreme weather resistance, and sustainable materials. State and local governments implement incentive programs supporting cool roof adoption and solar integration, creating favorable market conditions for innovative roofing solutions.

Training initiatives address labor shortage challenges through expanded apprenticeship programs, technical education partnerships, and manufacturer-sponsored training centers that develop skilled roofing professionals and support market growth capacity.

Strategic recommendations for United States roofing market participants emphasize diversification, technology adoption, and sustainability focus to capitalize on emerging opportunities while mitigating market risks. Manufacturers should prioritize research and development investments in sustainable materials, smart roofing technologies, and integrated building solutions that address evolving customer requirements.

Contractors benefit from specialization strategies focusing on high-growth segments including solar integration, commercial retrofits, and extreme weather applications. Technology adoption including project management software, drone inspection capabilities, and digital customer communication platforms improves operational efficiency and competitive positioning.

Geographic expansion opportunities exist in underserved markets and rapidly growing metropolitan areas where construction activity exceeds local contractor capacity. Strategic partnerships with local contractors or acquisition of regional companies provide market entry advantages while leveraging established customer relationships.

Workforce development represents a critical success factor, with companies investing in training programs, competitive compensation packages, and career advancement opportunities to attract and retain skilled professionals. Partnerships with trade schools and apprenticeship programs create sustainable talent pipelines supporting long-term growth strategies.

Customer relationship management becomes increasingly important as market competition intensifies, with successful companies focusing on service quality, warranty programs, and long-term customer support that create competitive advantages and recurring revenue opportunities.

Long-term market projections indicate continued growth for the United States roofing industry, driven by demographic trends, infrastructure modernization requirements, and evolving building performance standards. Residential market expansion benefits from population growth, household formation, and aging housing stock that generates consistent replacement demand across diverse geographic regions.

Commercial market evolution emphasizes building performance optimization, energy efficiency improvements, and smart building integration that create opportunities for advanced roofing systems and comprehensive building solutions. According to MarkWide Research projections, commercial roofing markets demonstrate approximately 5.8% annual growth through increased retrofit activity and new construction development.

Technology integration accelerates as smart building requirements, renewable energy adoption, and building automation systems create demand for intelligent roofing solutions. Solar roofing integration becomes mainstream in residential applications while commercial markets embrace comprehensive building performance management systems.

Sustainability requirements intensify through regulatory mandates, corporate environmental responsibility initiatives, and customer preferences that prioritize environmentally responsible building solutions. Green roofing technologies, recycled materials, and lifecycle performance optimization become standard market expectations rather than premium options.

Market consolidation trends continue as larger companies acquire specialized manufacturers and regional contractors to expand capabilities and geographic coverage. This consolidation creates more comprehensive service providers while maintaining opportunities for specialized contractors serving niche market segments.

The United States roofing market demonstrates remarkable resilience and growth potential, supported by fundamental market drivers including population growth, infrastructure modernization, and evolving building performance requirements. Market dynamics favor companies that embrace technology innovation, sustainability initiatives, and comprehensive customer service strategies while addressing critical challenges including labor shortages and material cost volatility.

Strategic opportunities emerge through smart roofing integration, solar technology adoption, and extreme weather resilience solutions that address contemporary building protection and performance requirements. The market’s geographic diversity provides risk mitigation advantages while creating specialized opportunities for companies with regional expertise and technical capabilities.

Future success requires balanced approaches combining traditional roofing expertise with emerging technologies, sustainable practices, and comprehensive customer solutions. Companies that invest in workforce development, technology adoption, and strategic partnerships position themselves advantageously for long-term market participation and growth in this essential and evolving industry sector.

What is Roofing?

Roofing refers to the materials and methods used to construct and maintain roofs on buildings. It encompasses various types of materials such as asphalt shingles, metal, tile, and flat roofing systems, each serving different architectural and functional needs.

Who are the key players in the United States Roofing Market?

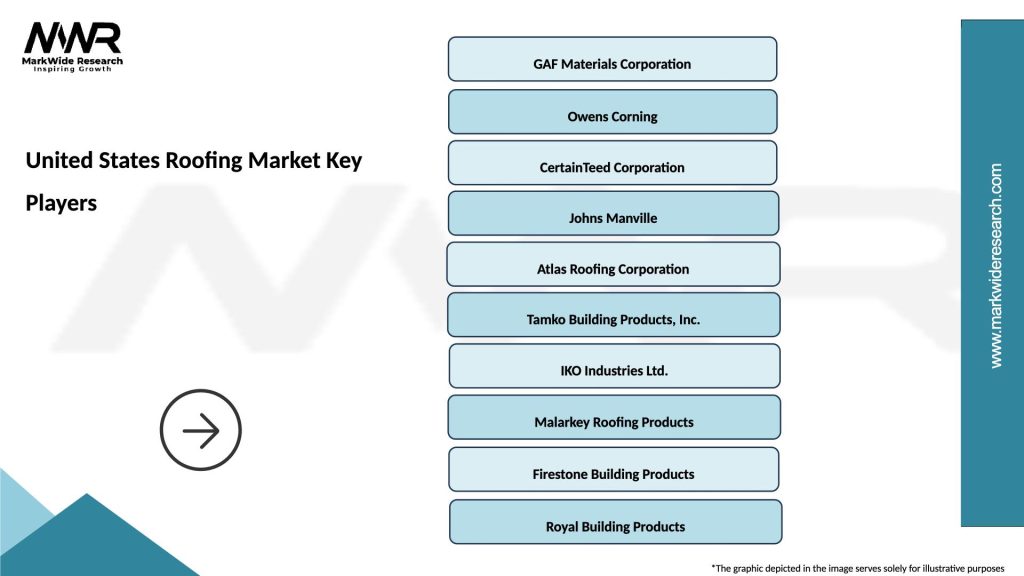

Key players in the United States Roofing Market include GAF Materials Corporation, Owens Corning, CertainTeed, and Tamko Building Products, among others. These companies are known for their diverse product offerings and significant market presence.

What are the main drivers of the United States Roofing Market?

The main drivers of the United States Roofing Market include the increasing demand for residential and commercial construction, the need for roof replacements due to aging infrastructure, and advancements in roofing technologies that enhance energy efficiency.

What challenges does the United States Roofing Market face?

The United States Roofing Market faces challenges such as fluctuating raw material prices, labor shortages, and stringent building regulations. These factors can impact production costs and project timelines.

What opportunities exist in the United States Roofing Market?

Opportunities in the United States Roofing Market include the growing trend towards sustainable roofing solutions, such as green roofs and solar roofing systems, as well as the increasing focus on energy-efficient building practices.

What trends are shaping the United States Roofing Market?

Trends shaping the United States Roofing Market include the rise of smart roofing technologies, the adoption of eco-friendly materials, and the increasing popularity of roofing systems that offer better insulation and energy efficiency.

United States Roofing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Asphalt Shingles, Metal Roofing, Tile Roofing, Flat Roofing |

| Installation Type | New Construction, Replacement, Renovation, Repair |

| End User | Residential, Commercial, Industrial, Institutional |

| Material | Fiberglass, Wood, PVC, EPDM |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Roofing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at