444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia car insurance market represents a critical component of the nation’s financial services sector, providing essential protection for millions of vehicle owners across the vast Russian territory. Mandatory motor insurance regulations have established a robust foundation for market growth, with comprehensive coverage options expanding rapidly to meet evolving consumer demands. The market demonstrates steady growth momentum driven by increasing vehicle ownership, regulatory compliance requirements, and rising awareness of financial protection benefits.

Digital transformation initiatives are reshaping the traditional insurance landscape, with online platforms and mobile applications facilitating streamlined policy purchases and claims processing. The market exhibits strong regional variations reflecting diverse economic conditions, vehicle density, and consumer preferences across Russia’s federal districts. Premium pricing strategies continue to evolve in response to competitive pressures and regulatory framework adjustments, creating opportunities for both established insurers and emerging market entrants.

Market penetration rates indicate significant potential for expansion, particularly in underserved regions where insurance awareness and accessibility remain limited. The sector benefits from government support through regulatory frameworks that mandate basic coverage while encouraging voluntary comprehensive insurance adoption. Technology integration and data analytics capabilities are becoming increasingly important competitive differentiators, enabling insurers to optimize risk assessment and enhance customer experience delivery.

The Russia car insurance market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks designed to provide financial protection for vehicle owners against various risks including accidents, theft, and property damage. This market encompasses both mandatory motor third-party liability insurance (OSAGO) and voluntary comprehensive coverage options (CASCO) that protect against a broader range of potential losses and liabilities.

Insurance providers within this market offer diverse coverage solutions ranging from basic liability protection to comprehensive policies that include collision coverage, theft protection, and additional services such as roadside assistance. The market operates under strict regulatory oversight from the Central Bank of Russia, ensuring consumer protection and maintaining industry stability through standardized practices and financial requirements.

Market participants include domestic insurance companies, international insurers with local operations, and specialized automotive insurance providers that focus exclusively on vehicle-related coverage solutions. The ecosystem also encompasses distribution channels including traditional agents, online platforms, automotive dealerships, and direct-to-consumer sales models that facilitate policy acquisition and customer service delivery.

Russia’s car insurance market demonstrates resilient growth characteristics despite economic challenges and geopolitical considerations that have influenced the broader financial services sector. The market benefits from mandatory insurance requirements that ensure consistent demand while voluntary coverage segments present substantial expansion opportunities. Digital adoption rates have accelerated significantly, with approximately 42% of policies now purchased through online channels, reflecting changing consumer preferences and technological capabilities.

Competitive dynamics remain intense among major market participants, driving innovation in product offerings, pricing strategies, and customer service delivery. The market shows strong correlation with automotive sales trends and economic indicators, positioning it as both a defensive investment opportunity and a growth-oriented sector. Regulatory stability provides a supportive environment for long-term planning and investment in market development initiatives.

Premium growth rates have maintained positive momentum, supported by increasing vehicle values, enhanced coverage options, and improved risk assessment capabilities. The market demonstrates regional diversification benefits with varying growth patterns across different federal districts, creating opportunities for targeted expansion strategies and specialized product development approaches.

Market dynamics reveal several critical trends shaping the Russia car insurance landscape:

Vehicle ownership growth serves as the primary catalyst for market expansion, with increasing disposable income and improved financing options enabling broader access to personal transportation. Urbanization trends contribute significantly to market development as city dwellers require reliable insurance coverage for daily commuting and business activities. The growing complexity of modern vehicles and their higher replacement costs drive demand for comprehensive coverage options beyond basic liability requirements.

Regulatory compliance mandates ensure consistent market demand while encouraging responsible driving behaviors and financial protection awareness. Economic stability improvements in key regions support increased insurance spending and willingness to invest in premium coverage options. The expansion of automotive financing requires borrowers to maintain comprehensive insurance coverage, creating additional market demand drivers.

Technology integration enables insurers to offer more competitive pricing through improved risk assessment and operational efficiency gains. Consumer awareness campaigns and educational initiatives increase understanding of insurance benefits and coverage options. The development of infrastructure projects and road networks creates new opportunities for vehicle usage and corresponding insurance needs across previously underserved regions.

Economic volatility and currency fluctuations create challenges for premium pricing stability and long-term financial planning among consumers. Regulatory complexity and frequent policy changes require significant compliance investments and operational adjustments that can impact profitability margins. Fraud concerns within the insurance sector necessitate enhanced verification processes and investigation capabilities, increasing operational costs.

Competition intensity among market participants leads to margin pressure and requires continuous investment in technology and service improvements. Consumer price sensitivity limits premium growth potential and requires careful balance between coverage quality and affordability. Claims inflation driven by increasing vehicle repair costs and parts availability challenges affects profitability calculations.

Geographic challenges in serving remote regions create distribution and service delivery complexities that require specialized solutions and higher operational costs. Technology adoption barriers among certain consumer segments limit the effectiveness of digital transformation initiatives. Seasonal demand variations create cash flow management challenges and require flexible operational capacity planning.

Digital innovation presents substantial opportunities for market expansion through improved customer experience, streamlined operations, and enhanced risk assessment capabilities. Telematics integration enables usage-based insurance models that appeal to cost-conscious consumers while providing valuable data for risk management. Partnership opportunities with automotive manufacturers, dealerships, and financial institutions create new distribution channels and customer acquisition strategies.

Product diversification beyond traditional coverage options includes value-added services such as roadside assistance, vehicle maintenance programs, and mobility solutions. Market penetration in underserved regions offers significant growth potential through targeted marketing and accessible distribution strategies. Cross-selling opportunities with other insurance products enable customer lifetime value optimization and relationship deepening.

Regulatory modernization initiatives may create opportunities for innovative product development and streamlined operational processes. Data analytics capabilities enable personalized pricing strategies and improved customer segmentation for targeted marketing efforts. Sustainability initiatives and electric vehicle adoption create new market segments requiring specialized coverage solutions and expertise development.

Supply and demand dynamics within the Russia car insurance market reflect the interplay between mandatory coverage requirements and voluntary insurance adoption patterns. Market equilibrium is influenced by competitive pricing strategies, regulatory framework adjustments, and consumer purchasing power fluctuations. Demand elasticity varies significantly between mandatory and voluntary coverage segments, with comprehensive insurance showing higher sensitivity to economic conditions.

Competitive forces drive continuous innovation in product offerings, distribution strategies, and customer service delivery methods. Market consolidation trends create opportunities for economies of scale while potentially reducing competitive intensity in certain segments. Technology disruption reshapes traditional business models and creates new competitive advantages for digitally-enabled insurers.

Regulatory influence remains a critical factor shaping market dynamics through policy requirements, pricing guidelines, and consumer protection measures. Economic cycles impact both insurance demand and claims frequency, requiring adaptive strategies and flexible operational capabilities. Consumer behavior evolution toward digital channels and personalized services drives market transformation and competitive differentiation strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Russia car insurance market landscape. Primary research includes structured interviews with industry executives, insurance professionals, and consumer focus groups to gather firsthand perspectives on market trends and challenges. Secondary research encompasses analysis of regulatory filings, industry reports, and statistical databases maintained by relevant government agencies.

Quantitative analysis utilizes statistical modeling techniques to identify market patterns, growth trajectories, and correlation factors affecting market performance. Qualitative assessment provides contextual understanding of market dynamics, competitive positioning, and strategic implications for industry participants. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification procedures.

Market segmentation analysis examines various dimensions including geographic regions, customer demographics, product categories, and distribution channels. Competitive intelligence gathering involves systematic monitoring of market participants, pricing strategies, and strategic initiatives. Trend analysis identifies emerging patterns and potential disruption factors that may influence future market development trajectories.

Moscow and St. Petersburg represent the most mature and competitive segments of the Russia car insurance market, accounting for approximately 35% of total market activity. These metropolitan areas demonstrate higher premium values and sophisticated consumer preferences for comprehensive coverage options. Digital adoption rates in major cities exceed 65% for online policy purchases, reflecting advanced technological infrastructure and consumer comfort with digital transactions.

Central Federal District shows strong growth momentum driven by economic development and increasing vehicle ownership rates among middle-class consumers. Volga Federal District presents significant expansion opportunities with growing industrial activity and improving transportation infrastructure. Siberian regions demonstrate unique market characteristics requiring specialized products and distribution strategies adapted to harsh climate conditions and geographic challenges.

Southern regions benefit from agricultural prosperity and tourism development, creating diverse insurance needs and seasonal demand patterns. Far Eastern territories show emerging potential with infrastructure development projects and increasing cross-border trade activities. Regional premium variations reflect local economic conditions, risk profiles, and competitive dynamics, with differences of up to 40% between regions for similar coverage levels.

Market leadership is distributed among several major players with distinct competitive advantages and strategic positioning approaches:

Competitive strategies focus on digital transformation, customer experience enhancement, and operational efficiency improvements. Market differentiation occurs through specialized products, pricing innovation, and value-added services that address specific customer segments and needs.

By Coverage Type:

By Distribution Channel:

By Customer Segment:

Mandatory Insurance Segment demonstrates stable demand patterns with limited growth potential due to market saturation and regulatory price controls. Premium standardization reduces competitive differentiation opportunities while ensuring market accessibility for all vehicle owners. Claims processing efficiency becomes a key differentiator in this commoditized segment, with digital capabilities providing competitive advantages.

Comprehensive Coverage Segment shows strong growth potential driven by increasing vehicle values and consumer awareness of protection benefits. Product customization enables insurers to address specific customer needs and preferences while commanding premium pricing. Value-added services such as roadside assistance and rental car coverage enhance customer satisfaction and retention rates.

Commercial Insurance Segment presents opportunities for specialized expertise and relationship-based selling approaches. Fleet management solutions integrate insurance coverage with operational efficiency tools and risk management services. Industry-specific products address unique risks and requirements across different commercial sectors and business models.

Insurance Companies benefit from stable regulatory frameworks that provide predictable operating environments and clear compliance requirements. Revenue diversification opportunities exist through product expansion and cross-selling initiatives that leverage existing customer relationships. Technology investments enable operational efficiency gains and improved customer experience delivery, creating sustainable competitive advantages.

Consumers gain access to comprehensive financial protection against vehicle-related risks while benefiting from competitive pricing and improved service quality. Digital convenience simplifies policy management and claims processing through user-friendly online platforms and mobile applications. Product transparency enables informed decision-making through clear coverage comparisons and pricing information.

Automotive Industry participants benefit from insurance partnerships that facilitate vehicle sales financing and customer acquisition. Dealership revenue opportunities exist through insurance product sales and commission arrangements. Manufacturer partnerships enable integrated service offerings that enhance customer value propositions and brand loyalty.

Regulatory Authorities achieve consumer protection objectives while maintaining market stability through appropriate oversight and policy frameworks. Economic benefits include reduced financial burden on accident victims and improved road safety incentives through insurance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Strategies are transforming customer acquisition and service delivery models, with insurers investing heavily in mobile applications and online platforms. Artificial Intelligence integration enables automated underwriting, fraud detection, and personalized customer interactions that improve operational efficiency. Telematics adoption grows rapidly as consumers embrace usage-based insurance models that reward safe driving behaviors.

Sustainability Focus drives development of specialized coverage for electric and hybrid vehicles, reflecting environmental consciousness and regulatory support for clean transportation. Customer Experience becomes a primary competitive differentiator through streamlined claims processing, 24/7 support availability, and proactive communication strategies. Data Analytics capabilities enable precise risk assessment and personalized pricing strategies that optimize both customer satisfaction and profitability.

Partnership Ecosystems expand beyond traditional distribution channels to include automotive manufacturers, technology companies, and mobility service providers. Regulatory Technology solutions help insurers maintain compliance while reducing administrative burdens and operational costs. Micro-Insurance Products address specific customer needs and budget constraints through flexible coverage options and payment structures.

Regulatory modernization initiatives by the Central Bank of Russia aim to enhance consumer protection while promoting market competition and innovation. Digital infrastructure investments by major insurers focus on improving customer experience and operational efficiency through advanced technology platforms. Strategic partnerships between insurance companies and automotive manufacturers create integrated service offerings and new customer acquisition channels.

Product innovation includes development of usage-based insurance models, parametric coverage options, and specialized products for emerging vehicle technologies. Market consolidation activities involve mergers and acquisitions that create larger, more competitive market participants with enhanced capabilities. International expansion by domestic insurers explores opportunities in neighboring markets and regions with similar regulatory frameworks.

Technology adoption accelerates across the industry with implementations of artificial intelligence, blockchain, and Internet of Things solutions for improved operations. Customer service enhancements include 24/7 digital support, mobile claims processing, and proactive communication systems. Sustainability initiatives address environmental concerns through green insurance products and carbon-neutral operational practices.

MarkWide Research analysis indicates that successful market participants should prioritize digital transformation initiatives to remain competitive in the evolving landscape. Investment priorities should focus on customer experience enhancement, operational efficiency improvements, and data analytics capabilities that enable personalized service delivery. Geographic expansion strategies should target underserved regions with tailored products and distribution approaches that address local market characteristics.

Product development efforts should emphasize innovation in coverage options, pricing models, and value-added services that differentiate offerings in competitive markets. Partnership strategies should explore opportunities with automotive industry participants, technology companies, and financial services providers to create comprehensive customer solutions. Regulatory compliance capabilities must be strengthened to adapt quickly to policy changes and maintain operational flexibility.

Technology investments should prioritize mobile-first platforms, artificial intelligence integration, and data security measures that protect customer information and enable advanced analytics. Human capital development requires focus on digital skills, customer service excellence, and technical expertise in emerging insurance technologies. Risk management practices should incorporate climate change considerations, cyber security threats, and evolving fraud patterns that affect industry operations.

Market growth prospects remain positive despite economic challenges, with digital transformation and product innovation driving expansion opportunities. Technology integration will continue reshaping industry operations, customer interactions, and competitive dynamics over the next decade. Regulatory evolution is expected to support market development while maintaining consumer protection standards and industry stability.

Consumer preferences will increasingly favor digital-first insurers that offer convenient, transparent, and personalized service experiences. Market consolidation may accelerate as smaller players seek scale advantages and larger insurers pursue growth through acquisition strategies. Product sophistication will advance through data analytics, artificial intelligence, and IoT integration that enables precise risk assessment and pricing.

MWR projections suggest that the market will experience sustained growth momentum driven by vehicle ownership expansion, coverage awareness improvements, and technological advancement adoption. Regional development will create new opportunities for market penetration and customer acquisition in previously underserved areas. International competitiveness of Russian insurers may improve through technology adoption and operational excellence initiatives that enhance market positioning.

Russia’s car insurance market demonstrates resilient growth characteristics and substantial development potential despite economic and geopolitical challenges affecting the broader financial services sector. Digital transformation initiatives are reshaping traditional business models while creating new opportunities for customer engagement, operational efficiency, and competitive differentiation. The market benefits from stable regulatory frameworks that ensure consistent demand while encouraging innovation and consumer protection.

Strategic opportunities exist for market participants willing to invest in technology capabilities, customer experience enhancement, and geographic expansion initiatives. Competitive dynamics will continue evolving as digital-native insurers challenge traditional market leaders through innovative products and service delivery models. Consumer expectations for convenience, transparency, and personalized service will drive continued industry transformation and investment priorities.

The long-term outlook remains positive for the Russia car insurance market, supported by fundamental drivers including vehicle ownership growth, regulatory compliance requirements, and increasing awareness of financial protection benefits. Success factors for industry participants include digital capability development, customer-centric service delivery, and adaptive strategies that respond effectively to changing market conditions and consumer preferences in this dynamic and evolving marketplace.

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents involving vehicles. It typically covers liability, collision, and comprehensive damages.

What are the key players in the Russia Car Insurance Market?

Key players in the Russia Car Insurance Market include SOGAZ, Ingosstrakh, and Rosgosstrakh, which offer a range of car insurance products tailored to different consumer needs. These companies compete on pricing, coverage options, and customer service, among others.

What are the growth factors driving the Russia Car Insurance Market?

The growth of the Russia Car Insurance Market is driven by increasing vehicle ownership, rising awareness of insurance benefits, and regulatory changes mandating insurance coverage. Additionally, the expansion of digital platforms for policy purchase and management is enhancing market accessibility.

What challenges does the Russia Car Insurance Market face?

The Russia Car Insurance Market faces challenges such as high competition leading to price wars, fraudulent claims affecting profitability, and economic fluctuations impacting consumer spending on insurance. These factors can hinder market stability and growth.

What opportunities exist in the Russia Car Insurance Market?

Opportunities in the Russia Car Insurance Market include the potential for innovative insurance products, such as usage-based insurance, and the integration of technology for better customer engagement. Additionally, the growing trend of electric vehicles presents new coverage needs.

What trends are shaping the Russia Car Insurance Market?

Trends in the Russia Car Insurance Market include the increasing adoption of telematics for personalized insurance premiums, a shift towards online policy management, and a focus on customer-centric services. These trends are transforming how insurers interact with clients and assess risk.

Russia Car Insurance Market

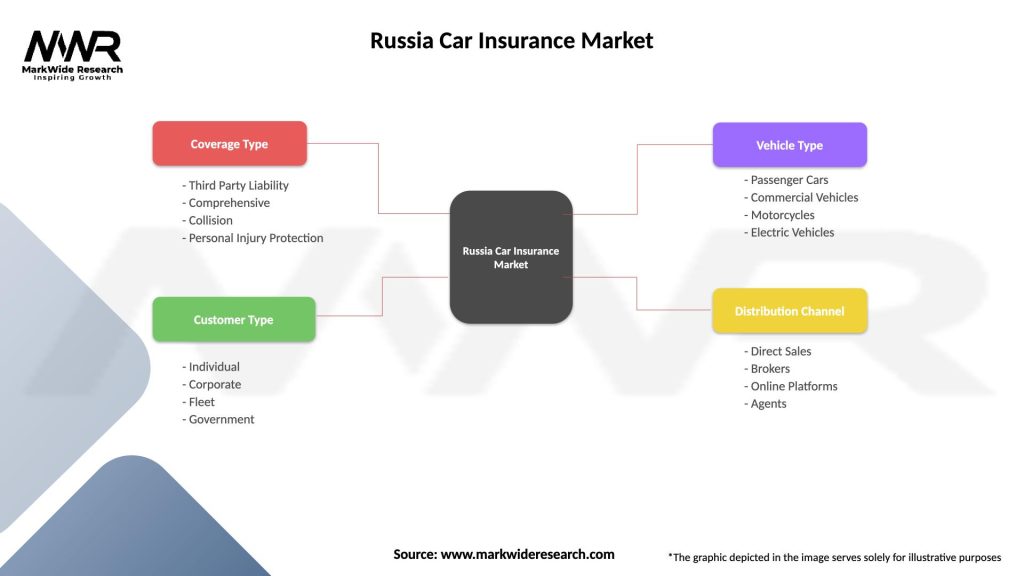

| Segmentation Details | Description |

|---|---|

| Coverage Type | Third Party Liability, Comprehensive, Collision, Personal Injury Protection |

| Customer Type | Individual, Corporate, Fleet, Government |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Motorcycles, Electric Vehicles |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at