444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The decoys and dispensers market represents a critical segment within the global defense and aerospace industry, encompassing sophisticated countermeasure systems designed to protect military aircraft, naval vessels, and ground-based assets from incoming threats. This specialized market has experienced robust growth driven by escalating geopolitical tensions, modernization of defense forces worldwide, and the continuous evolution of threat landscapes requiring advanced protective measures.

Market dynamics indicate that the decoys and dispensers sector is witnessing unprecedented demand across multiple defense applications. The integration of advanced electronic warfare systems with traditional kinetic countermeasures has created new opportunities for market expansion. Current trends show a 12.5% annual growth rate in adoption of next-generation dispensing systems, particularly among NATO member countries and emerging defense markets.

Technological advancement remains the primary catalyst driving market evolution, with manufacturers focusing on developing more sophisticated, lightweight, and cost-effective solutions. The market encompasses various product categories including chaff dispensers, flare systems, electronic decoys, and integrated countermeasure suites that provide comprehensive protection against diverse threat vectors.

The decoys and dispensers market refers to the specialized defense industry segment focused on manufacturing, developing, and deploying countermeasure systems designed to protect military platforms from guided missiles, radar-guided weapons, and other precision-guided munitions. These systems work by creating false targets, jamming enemy sensors, or providing alternative heat and radar signatures to divert incoming threats away from protected assets.

Decoy systems encompass a wide range of technologies including expendable countermeasures such as chaff and flares, as well as more sophisticated electronic warfare devices that can simulate aircraft signatures or create false radar returns. Dispenser systems are the mechanical platforms responsible for deploying these countermeasures at precise moments, often integrated with threat warning systems and automated response protocols.

The market includes both expendable countermeasures that are consumed during use and reusable electronic systems that can operate multiple times. Modern applications extend beyond traditional military aircraft to include protection for unmanned aerial vehicles, naval vessels, ground vehicles, and critical infrastructure installations requiring sophisticated threat mitigation capabilities.

Strategic analysis reveals that the decoys and dispensers market is positioned for sustained expansion, driven by increasing defense budgets globally and the growing sophistication of modern warfare threats. The market demonstrates strong fundamentals with consistent demand patterns across established defense markets and emerging economies investing in military modernization programs.

Key market drivers include the proliferation of advanced missile systems, increased focus on force protection, and the integration of artificial intelligence in threat detection and countermeasure deployment. The sector benefits from 65% of global defense spending being allocated to force protection and survivability enhancement programs, creating substantial opportunities for market participants.

Innovation trends show significant investment in next-generation technologies including smart dispensers, networked countermeasure systems, and multi-spectral decoy capabilities. The market is experiencing a shift toward integrated solutions that combine multiple countermeasure types within single platforms, offering enhanced protection while reducing system complexity and maintenance requirements.

Regional distribution indicates strong market presence in North America and Europe, with rapid growth emerging in Asia-Pacific and Middle Eastern markets. The competitive landscape features established defense contractors alongside specialized countermeasure manufacturers, creating a dynamic environment for technological advancement and market expansion.

Market intelligence reveals several critical insights shaping the decoys and dispensers landscape. The sector demonstrates remarkable resilience and growth potential, supported by fundamental defense requirements and evolving threat environments that continuously drive demand for advanced countermeasure solutions.

Primary market drivers propelling the decoys and dispensers sector stem from fundamental changes in global security environments and the continuous evolution of military threats. These driving forces create sustained demand for advanced countermeasure technologies across multiple defense applications and geographic regions.

Geopolitical tensions represent the most significant driver, with increasing regional conflicts and military modernization programs creating substantial demand for protective systems. Nations worldwide are investing heavily in survivability enhancement for their military assets, recognizing that effective countermeasures are essential for maintaining operational effectiveness in contested environments.

Threat proliferation continues to drive market expansion as adversaries develop more sophisticated guided weapons systems. The widespread availability of precision-guided munitions and advanced radar systems necessitates corresponding improvements in countermeasure capabilities. This technological arms race ensures continuous demand for next-generation decoy and dispenser systems.

Military modernization programs across developed and emerging nations create substantial opportunities for market growth. Countries are upgrading aging defense systems and incorporating modern countermeasure capabilities into new platforms, driving both replacement demand and new system integration requirements.

Technological advancement in threat detection and response systems enables more sophisticated countermeasure deployment strategies. The integration of artificial intelligence and advanced sensors allows for more effective threat identification and automated response protocols, increasing the value proposition of modern dispensing systems.

Market constraints affecting the decoys and dispensers sector primarily relate to budgetary limitations, regulatory challenges, and technical complexities associated with advanced countermeasure systems. These restraining factors require careful consideration by market participants when developing growth strategies and product offerings.

Budget constraints represent a significant challenge, particularly for smaller nations and defense organizations operating under fiscal limitations. The high cost of advanced countermeasure systems can limit adoption rates, especially when competing with other defense priorities for limited funding allocations.

Regulatory restrictions and export controls create barriers to market expansion, particularly for international sales of sensitive countermeasure technologies. Technology transfer limitations and classification requirements can restrict market access and complicate international business development efforts.

Technical complexity associated with integrating modern countermeasure systems into existing platforms presents challenges for both manufacturers and end users. The need for specialized training and maintenance capabilities can increase total ownership costs and limit adoption among resource-constrained organizations.

Obsolescence concerns arise from the rapid pace of technological advancement in both threat systems and countermeasure technologies. Organizations may delay procurement decisions due to concerns about system longevity and the potential for premature obsolescence of expensive countermeasure investments.

Emerging opportunities within the decoys and dispensers market present significant potential for growth and innovation. These opportunities span technological advancement, market expansion, and the development of new applications that extend beyond traditional military uses.

Unmanned systems protection represents a rapidly expanding opportunity as military organizations increasingly deploy unmanned aerial vehicles and autonomous platforms requiring sophisticated countermeasure capabilities. The growing UAV market creates demand for lightweight, cost-effective dispensing systems tailored to unmanned platform requirements.

Commercial applications are emerging as civilian aircraft and critical infrastructure face increasing threats from hostile actors. The development of commercial-grade countermeasure systems for protecting high-value civilian assets presents new market segments with substantial growth potential.

Artificial intelligence integration offers opportunities to develop next-generation systems capable of autonomous threat assessment and countermeasure selection. Smart dispensing systems that can learn from engagement patterns and optimize response strategies represent a significant technological advancement opportunity.

International market expansion provides growth opportunities as emerging nations invest in defense modernization. Countries in Asia-Pacific, Middle East, and Latin America regions present substantial opportunities for market participants willing to navigate complex regulatory and competitive environments.

Retrofit and upgrade programs create opportunities to enhance existing platforms with modern countermeasure capabilities. The large installed base of military aircraft and vehicles provides a substantial market for modernization solutions that can extend platform effectiveness without complete replacement.

Market dynamics within the decoys and dispensers sector reflect the complex interplay between technological advancement, geopolitical factors, and evolving threat landscapes. These dynamic forces create both challenges and opportunities that shape market development and competitive positioning.

Innovation cycles in the sector are driven by the continuous evolution of threats and corresponding countermeasure requirements. The market experiences rapid technological turnover as new threat systems emerge, requiring corresponding advances in countermeasure capabilities and deployment strategies.

Competitive intensity varies across different market segments, with established defense contractors dominating high-end military applications while specialized manufacturers focus on niche technologies and emerging applications. This competitive structure drives continuous innovation and creates opportunities for both large-scale integration and specialized solutions.

Supply chain considerations play an increasingly important role as manufacturers seek to balance cost optimization with security requirements. The need for secure supply chains and domestic production capabilities influences market structure and competitive dynamics, particularly for sensitive countermeasure technologies.

Customer requirements continue to evolve toward more integrated, intelligent, and cost-effective solutions. End users increasingly demand multi-threat protection capabilities within single systems, driving manufacturers to develop more sophisticated and versatile countermeasure platforms.

According to MarkWide Research analysis, the market demonstrates strong resilience to economic fluctuations due to the essential nature of defense applications and the critical importance of force protection in military operations.

Research approach for analyzing the decoys and dispensers market employs comprehensive methodologies combining primary research, secondary data analysis, and expert consultation to provide accurate market insights and forecasts. The methodology ensures reliable data collection and analysis across multiple market dimensions.

Primary research involves extensive interviews with industry stakeholders including manufacturers, defense contractors, military procurement officials, and technology developers. These interviews provide firsthand insights into market trends, technological developments, and future requirements that shape market evolution.

Secondary research encompasses analysis of industry reports, government publications, defense budget allocations, and technical literature to establish comprehensive market understanding. This research foundation supports quantitative analysis and trend identification across multiple market segments and geographic regions.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and statistical analysis. The methodology incorporates triangulation techniques to verify findings and eliminate potential biases or inaccuracies in market assessments.

Market modeling utilizes advanced analytical techniques to project future market development based on historical trends, current dynamics, and anticipated changes in technology and threat environments. These models account for multiple variables affecting market growth and competitive positioning.

Regional market distribution reveals significant variations in demand patterns, technological preferences, and growth trajectories across different geographic markets. Understanding these regional dynamics is essential for developing effective market strategies and identifying growth opportunities.

North America maintains the largest market share, accounting for approximately 45% of global demand, driven by substantial defense spending and advanced military modernization programs. The region benefits from established defense industrial base and continuous investment in next-generation countermeasure technologies.

Europe represents a significant market with strong demand for sophisticated countermeasure systems, particularly among NATO member countries investing in collective defense capabilities. The region shows 8.5% annual growth in countermeasure system procurement, driven by increased security concerns and military modernization initiatives.

Asia-Pacific demonstrates the highest growth potential with rapidly expanding defense budgets and increasing regional tensions driving demand for advanced protective systems. Countries in this region are investing heavily in indigenous defense capabilities and technology transfer programs to develop domestic countermeasure manufacturing capacity.

Middle East markets show strong demand for proven countermeasure technologies, with regional conflicts and security concerns driving immediate procurement requirements. The region represents approximately 15% of global market share with particular emphasis on aircraft and ground vehicle protection systems.

Latin America and Africa represent emerging opportunities with growing defense modernization programs and increasing recognition of countermeasure system importance. These regions show potential for cost-effective solutions tailored to specific regional requirements and budget constraints.

Competitive structure within the decoys and dispensers market features a mix of large defense contractors, specialized countermeasure manufacturers, and emerging technology companies developing innovative solutions. This diverse competitive environment drives continuous innovation and market development.

Market positioning varies among competitors, with some focusing on high-end military applications while others target cost-sensitive markets or specialized niche applications. This competitive diversity creates opportunities for both large-scale integration and specialized solution development.

Market segmentation analysis reveals distinct categories within the decoys and dispensers market, each with unique characteristics, growth patterns, and competitive dynamics. Understanding these segments is crucial for identifying opportunities and developing targeted market strategies.

By Product Type:

By Platform:

By Technology:

Expendable countermeasures represent the largest market segment by volume, driven by continuous consumption requirements and the need for regular replenishment. This category shows steady demand growth of approximately 6% annually, supported by increased military operations and training activities worldwide.

Electronic warfare systems demonstrate the highest growth rates within the market, benefiting from technological advancement and increasing sophistication of threat environments. These systems command premium pricing due to their advanced capabilities and reusable nature, making them attractive for manufacturers seeking higher profit margins.

Aircraft applications dominate market demand, accounting for the majority of countermeasure system deployments. The aviation segment benefits from large installed base of military aircraft and continuous modernization programs that drive both new installations and retrofit opportunities.

Integrated countermeasure suites represent the fastest-growing category, with military organizations increasingly preferring comprehensive solutions that provide multi-threat protection within single platforms. These systems offer operational efficiency and reduced training requirements compared to multiple standalone systems.

Unmanned platform applications emerge as a high-growth category, driven by expanding UAV operations and the need for protecting valuable autonomous assets. This segment requires specialized solutions that balance protection effectiveness with weight and cost constraints typical of unmanned systems.

Industry participants in the decoys and dispensers market benefit from multiple value propositions that support sustainable business growth and competitive positioning. These benefits extend across the entire value chain from manufacturers to end users.

Manufacturers benefit from strong demand fundamentals driven by essential defense requirements and continuous technology evolution. The market offers opportunities for recurring revenue through expendable countermeasure sales and long-term service contracts for complex electronic systems.

Defense contractors gain competitive advantages by incorporating advanced countermeasure capabilities into their platform offerings. Integration of sophisticated dispensing systems enhances overall platform value and provides differentiation in competitive procurement processes.

Military organizations achieve enhanced force protection and operational effectiveness through deployment of modern countermeasure systems. These capabilities provide asymmetric advantages by reducing vulnerability to precision-guided threats and enabling operations in contested environments.

Technology developers find opportunities to commercialize innovative solutions addressing evolving threat landscapes. The market rewards technological innovation and provides pathways for emerging companies to establish market presence through specialized capabilities.

Supply chain partners benefit from stable demand patterns and long-term procurement cycles typical of defense markets. Component suppliers and service providers enjoy predictable revenue streams and opportunities for long-term partnership development with prime contractors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological trends shaping the decoys and dispensers market reflect the continuous evolution of both threat systems and countermeasure capabilities. These trends drive innovation and create new opportunities for market participants willing to invest in advanced technologies.

Artificial intelligence integration represents a transformative trend enabling autonomous threat detection, countermeasure selection, and deployment optimization. Smart dispensing systems can analyze threat patterns and adapt response strategies in real-time, significantly enhancing protection effectiveness.

Multi-spectral countermeasures are gaining prominence as threats become more sophisticated and operate across multiple electromagnetic spectrum bands. Modern systems provide comprehensive protection against infrared, radar, and other guided weapon systems within integrated platforms.

Miniaturization and weight reduction trends address the growing demand for countermeasure systems suitable for smaller platforms including unmanned vehicles and space-constrained applications. Advanced materials and compact designs enable effective protection without compromising platform performance.

Network-centric operations enable coordinated countermeasure deployment across multiple platforms and integration with broader defense networks. This trend supports collaborative defense strategies and enhanced situational awareness for improved protection effectiveness.

Environmental sustainability considerations drive development of eco-friendly countermeasures that reduce environmental impact while maintaining operational effectiveness. This trend reflects growing awareness of environmental responsibility within defense operations.

Recent industry developments highlight the dynamic nature of the decoys and dispensers market and the continuous innovation driving sector evolution. These developments reflect both technological advancement and changing market requirements.

Advanced material integration has enabled development of more effective and lightweight countermeasure systems. New composite materials and nanotechnology applications improve system performance while reducing weight and cost constraints that previously limited deployment options.

Software-defined countermeasures represent a significant technological advancement allowing systems to be updated and reconfigured through software modifications rather than hardware replacement. This capability provides enhanced flexibility and reduces lifecycle costs for military organizations.

International collaboration programs have increased, with allied nations developing joint countermeasure technologies and sharing development costs. These partnerships enable technology advancement while distributing financial risks among participating countries.

Commercial sector expansion has accelerated as civilian aircraft and critical infrastructure face increasing security threats. Development of commercial-grade systems adapted from military technologies creates new market opportunities and revenue streams.

Regulatory framework evolution continues to adapt to changing technology and threat landscapes. Updated export controls and technology transfer policies affect international market access and competitive dynamics within the sector.

Strategic recommendations for market participants focus on positioning for long-term growth while addressing current market challenges and opportunities. These suggestions reflect comprehensive analysis of market dynamics and future trends.

Technology investment should prioritize artificial intelligence integration and multi-spectral capabilities that address evolving threat landscapes. Companies investing in next-generation technologies will be better positioned to capture market share as military organizations modernize their countermeasure capabilities.

Market diversification strategies should explore commercial applications and emerging geographic markets to reduce dependence on traditional military customers. Developing dual-use technologies that serve both military and civilian markets can provide additional growth opportunities and revenue stability.

Partnership development with international allies and technology companies can accelerate innovation while sharing development costs and risks. Strategic alliances enable access to new markets and technologies that might otherwise require substantial independent investment.

Supply chain optimization should focus on developing secure, resilient supplier networks that can support both domestic and international operations. Companies should invest in supply chain diversification to reduce risks and ensure reliable component availability.

According to MWR analysis, companies should also focus on developing modular, upgradeable systems that can adapt to changing requirements and extend product lifecycles, providing better value propositions for cost-conscious customers.

Future market prospects for the decoys and dispensers sector remain positive, supported by fundamental defense requirements and continuous technological advancement. The market is expected to experience sustained growth driven by evolving threat landscapes and increasing emphasis on force protection across military organizations worldwide.

Technology evolution will continue to drive market development, with artificial intelligence, advanced materials, and network-centric capabilities becoming standard features in next-generation countermeasure systems. These technological advances will enable more effective, efficient, and cost-effective protection solutions.

Market expansion into commercial applications and emerging geographic regions provides significant growth potential beyond traditional military markets. The development of civilian protection systems and expansion into developing nations will create new revenue opportunities for market participants.

Integration trends will favor comprehensive countermeasure suites that provide multi-threat protection within unified platforms. Military organizations will increasingly prefer integrated solutions that simplify operations, reduce training requirements, and provide better overall protection effectiveness.

Competitive dynamics will continue to evolve as new technologies emerge and market requirements change. Companies that successfully balance innovation with cost-effectiveness will be best positioned to capture market share in an increasingly competitive environment.

The market is projected to maintain robust growth momentum with particularly strong performance expected in unmanned systems protection, commercial applications, and emerging market regions where defense modernization programs are accelerating.

The decoys and dispensers market represents a critical and dynamic segment within the global defense industry, characterized by strong fundamentals, continuous innovation, and expanding applications. Market analysis reveals sustained growth potential driven by essential defense requirements, evolving threat landscapes, and technological advancement that creates new capabilities and market opportunities.

Key success factors for market participants include maintaining technological leadership, developing cost-effective solutions, and expanding into emerging applications and geographic markets. The sector benefits from stable demand patterns while offering opportunities for innovation and market expansion beyond traditional military applications.

Strategic positioning requires balancing investment in advanced technologies with practical considerations of cost, reliability, and operational effectiveness. Companies that successfully navigate these requirements while developing comprehensive countermeasure solutions will be best positioned for long-term success in this evolving market landscape.

The future outlook remains positive, with MarkWide Research projecting continued market growth supported by increasing defense investments, technological advancement, and expanding applications across military and civilian sectors. The decoys and dispensers market will continue to play a vital role in protecting valuable assets and personnel in an increasingly complex threat environment.

What is Decoys And Dispensers?

Decoys and dispensers refer to devices used in various applications, including military operations and wildlife management, to mislead or distract targets or predators. They play a crucial role in enhancing safety and effectiveness in these fields.

What are the key players in the Decoys And Dispensers Market?

Key players in the Decoys And Dispensers Market include companies like Northrop Grumman, BAE Systems, and Leonardo S.p.A. These companies are known for their innovative solutions and technologies in defense and wildlife management, among others.

What are the growth factors driving the Decoys And Dispensers Market?

The growth of the Decoys And Dispensers Market is driven by increasing defense budgets, advancements in technology, and the rising need for effective wildlife management solutions. Additionally, the growing focus on safety and security in military operations contributes to market expansion.

What challenges does the Decoys And Dispensers Market face?

The Decoys And Dispensers Market faces challenges such as high development costs, regulatory hurdles, and the need for continuous innovation to keep up with evolving threats. These factors can hinder market growth and product adoption.

What opportunities exist in the Decoys And Dispensers Market?

Opportunities in the Decoys And Dispensers Market include the development of advanced technologies like smart decoys and the expansion into emerging markets. Additionally, increasing collaborations between defense contractors and wildlife organizations present new avenues for growth.

What trends are shaping the Decoys And Dispensers Market?

Trends in the Decoys And Dispensers Market include the integration of artificial intelligence for enhanced targeting and the use of eco-friendly materials in product design. These innovations aim to improve effectiveness while addressing environmental concerns.

Decoys And Dispensers Market

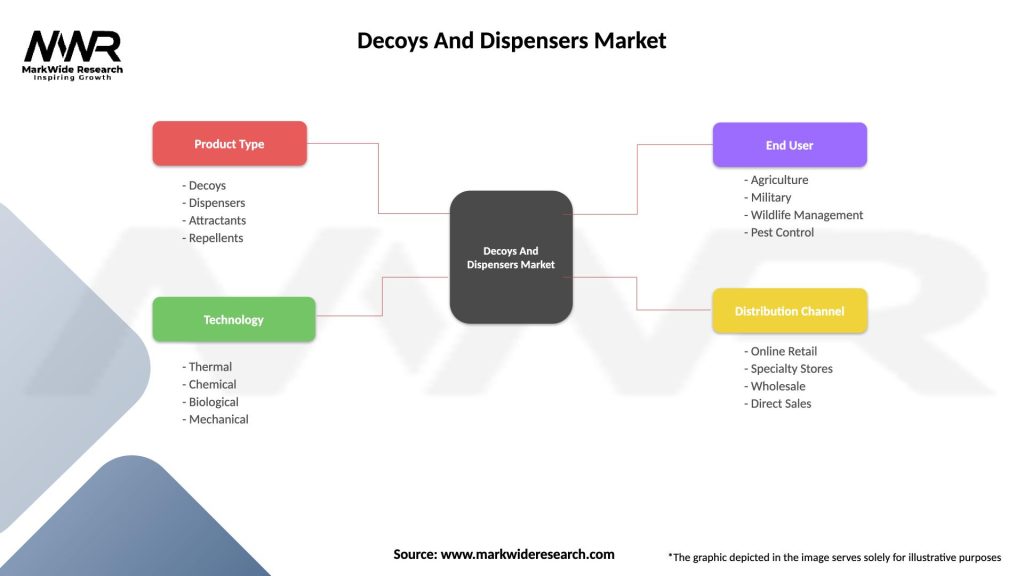

| Segmentation Details | Description |

|---|---|

| Product Type | Decoys, Dispensers, Attractants, Repellents |

| Technology | Thermal, Chemical, Biological, Mechanical |

| End User | Agriculture, Military, Wildlife Management, Pest Control |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Decoys And Dispensers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at