444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada flexible plastic packaging market represents a dynamic and rapidly evolving sector within the country’s packaging industry, driven by increasing consumer demand for convenient, sustainable, and cost-effective packaging solutions. Flexible plastic packaging encompasses a wide range of products including pouches, bags, films, wraps, and sachets that are manufactured from various plastic materials such as polyethylene, polypropylene, and polyester. The market has experienced robust growth in recent years, with industry analysts projecting a compound annual growth rate (CAGR) of 4.2% through the forecast period.

Market dynamics in Canada are significantly influenced by the country’s diverse industrial landscape, including food and beverage processing, pharmaceuticals, personal care, and e-commerce sectors. The food and beverage segment dominates the market, accounting for approximately 65% of total market share, driven by consumer preferences for fresh, convenient, and portable food products. Sustainability initiatives have become increasingly important, with manufacturers investing heavily in recyclable and biodegradable flexible packaging solutions to meet evolving regulatory requirements and consumer expectations.

Regional distribution across Canada shows concentrated activity in Ontario and Quebec, which together represent nearly 70% of market activity, primarily due to their established manufacturing bases and proximity to major consumer markets. The market landscape is characterized by both large multinational corporations and specialized regional players, creating a competitive environment that fosters innovation and technological advancement in flexible packaging solutions.

The Canada flexible plastic packaging market refers to the comprehensive ecosystem of manufacturers, suppliers, distributors, and end-users involved in the production, distribution, and utilization of flexible plastic packaging materials and products across Canadian territories. Flexible plastic packaging is defined as packaging materials that can be readily shaped, bent, or folded without breaking, offering superior protection, convenience, and cost-effectiveness compared to rigid packaging alternatives.

Key characteristics of flexible plastic packaging include lightweight construction, barrier properties that protect contents from moisture, oxygen, and light, excellent printability for branding and marketing purposes, and the ability to conform to product shapes for optimal space utilization. The market encompasses various product categories including stand-up pouches, flat pouches, vacuum bags, shrink films, stretch films, and specialty packaging solutions designed for specific industry applications.

Market participants range from raw material suppliers providing plastic resins and additives to converting companies that transform these materials into finished packaging products, as well as equipment manufacturers supplying machinery for production processes. The market also includes recycling companies and waste management organizations that handle post-consumer packaging materials, reflecting the growing emphasis on circular economy principles within the Canadian packaging industry.

Canada’s flexible plastic packaging market demonstrates strong fundamentals and promising growth prospects, driven by evolving consumer preferences, technological innovations, and increasing adoption across diverse industry verticals. The market benefits from Canada’s stable economic environment, advanced manufacturing capabilities, and strategic geographic position providing access to both North American and international markets.

Key growth drivers include the expanding e-commerce sector, which has accelerated demand for protective and lightweight packaging solutions, and the food industry’s continued shift toward convenient, portion-controlled, and shelf-stable products. Sustainability trends are reshaping market dynamics, with approximately 78% of Canadian consumers expressing preference for environmentally responsible packaging options, prompting manufacturers to invest in recyclable and compostable alternatives.

Market challenges include regulatory pressures related to single-use plastics, volatile raw material costs, and increasing competition from alternative packaging materials such as paper-based and bio-based solutions. However, ongoing innovations in barrier technologies, smart packaging features, and recycling infrastructure development present significant opportunities for market expansion and differentiation.

Future outlook remains positive, with industry experts anticipating continued growth driven by urbanization trends, changing demographics, and the ongoing digital transformation of retail and distribution channels. The market is expected to benefit from increased investment in advanced manufacturing technologies and sustainable packaging solutions that align with Canada’s environmental commitments and consumer expectations.

Strategic market insights reveal several critical trends shaping the Canadian flexible plastic packaging landscape. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating challenges while capitalizing on emerging opportunities across various sectors.

Primary market drivers propelling the Canada flexible plastic packaging market include fundamental shifts in consumer behavior, technological advancements, and evolving industry requirements that collectively create sustained demand for innovative packaging solutions.

Consumer lifestyle changes represent a significant driver, with increasing urbanization, busy lifestyles, and growing preference for convenient, portable food and beverage products. The rise of single-person households and aging demographics has intensified demand for portion-controlled packaging formats that offer extended shelf life and easy handling characteristics. E-commerce expansion has created substantial opportunities, as online retailers require lightweight, protective packaging that minimizes shipping costs while ensuring product integrity during transportation.

Food industry evolution continues to drive market growth, with manufacturers seeking packaging solutions that extend product freshness, reduce food waste, and enhance brand differentiation through attractive graphics and functional features. The growing popularity of ready-to-eat meals, snack foods, and specialty dietary products has created demand for specialized barrier films and multi-layer structures that provide optimal protection and presentation.

Technological innovations in materials science and manufacturing processes enable the development of high-performance packaging solutions with enhanced barrier properties, improved sustainability profiles, and smart packaging capabilities. These advances allow manufacturers to address specific customer requirements while maintaining cost-effectiveness and production efficiency.

Market restraints facing the Canada flexible plastic packaging industry include regulatory challenges, environmental concerns, and economic factors that create headwinds for traditional packaging approaches and require strategic adaptation by market participants.

Environmental regulations pose significant challenges, with federal and provincial governments implementing increasingly stringent policies regarding single-use plastics and packaging waste management. These regulations require substantial investment in alternative materials, recycling infrastructure, and product redesign initiatives that can impact short-term profitability and operational efficiency.

Raw material volatility creates ongoing challenges for manufacturers, with petroleum-based resin prices subject to fluctuations based on global oil markets, supply chain disruptions, and geopolitical factors. This volatility makes long-term planning difficult and can compress profit margins, particularly for smaller manufacturers with limited pricing flexibility.

Consumer perception challenges regarding plastic packaging sustainability continue to influence purchasing decisions and brand preferences. Despite technological advances in recyclability and biodegradability, negative perceptions of plastic packaging persist among environmentally conscious consumers, potentially limiting market growth in certain segments.

Competition from alternatives including paper-based packaging, glass containers, and emerging bio-based materials creates pressure on traditional flexible plastic packaging applications. While flexible plastics often provide superior performance characteristics, alternative materials may be preferred in applications where sustainability considerations outweigh functional benefits.

Significant market opportunities exist within the Canada flexible plastic packaging sector, driven by emerging technologies, evolving consumer preferences, and new application areas that present potential for substantial growth and market expansion.

Sustainable packaging innovation represents the most promising opportunity, with growing demand for recyclable, compostable, and bio-based flexible packaging solutions. Companies investing in advanced materials research and circular economy initiatives are positioned to capture market share as regulatory requirements and consumer preferences continue evolving toward environmental sustainability.

Smart packaging technologies offer substantial growth potential, with applications including freshness indicators, temperature monitoring, authentication features, and interactive consumer engagement capabilities. These technologies enable brands to differentiate their products while providing enhanced functionality and consumer value that justifies premium pricing.

Healthcare and pharmaceutical applications present expanding opportunities, particularly in areas such as medical device packaging, pharmaceutical pouches, and sterile barrier systems. The aging Canadian population and increasing healthcare spending create sustained demand for specialized packaging solutions that ensure product safety and regulatory compliance.

Export market development offers growth opportunities, with Canadian manufacturers leveraging advanced technology capabilities and quality standards to serve international markets. Trade agreements and geographic proximity to major markets create competitive advantages for Canadian flexible packaging producers seeking global expansion.

Market dynamics within the Canada flexible plastic packaging sector reflect complex interactions between supply and demand factors, technological developments, regulatory influences, and competitive pressures that collectively shape industry evolution and strategic decision-making.

Supply chain integration has become increasingly important, with manufacturers developing closer relationships with raw material suppliers, equipment providers, and end-user customers to ensure consistent quality, reliable delivery, and cost optimization. Vertical integration strategies are gaining popularity among larger players seeking to control critical aspects of the value chain and improve operational efficiency.

Innovation cycles are accelerating, driven by competitive pressures and customer demands for enhanced performance characteristics. Research and development investments focus on barrier technology improvements, sustainability enhancements, and smart packaging features that provide measurable value to end users. Collaboration initiatives between packaging manufacturers, brand owners, and technology providers are fostering rapid innovation adoption and market development.

Regulatory dynamics continue evolving, with government policies increasingly focused on environmental impact reduction and circular economy principles. These regulatory changes create both challenges and opportunities, requiring industry adaptation while potentially creating competitive advantages for companies that proactively address sustainability requirements.

Market consolidation trends are evident, with larger companies acquiring specialized manufacturers and technology providers to expand capabilities and market reach. This consolidation creates economies of scale while potentially reducing competitive intensity in certain market segments.

Comprehensive research methodology employed in analyzing the Canada flexible plastic packaging market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for industry stakeholders and decision-makers.

Primary research activities include extensive interviews with industry executives, manufacturing specialists, technology providers, and end-user customers across various sectors. These interviews provide qualitative insights into market trends, competitive dynamics, technological developments, and future growth prospects that complement quantitative data analysis.

Secondary research sources encompass industry publications, government statistics, trade association reports, company financial statements, and patent databases that provide comprehensive market intelligence and historical trend analysis. MarkWide Research analysts utilize proprietary databases and analytical tools to process and synthesize information from diverse sources into coherent market insights.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews to verify key findings, and applying statistical analysis techniques to ensure data integrity and reliability. Market sizing and forecasting models incorporate both bottom-up and top-down approaches to provide robust projections and scenario analysis.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, value chain analysis, and competitive positioning studies that provide strategic context for market developments and investment decisions. These frameworks enable comprehensive understanding of market structure, competitive dynamics, and growth opportunities.

Regional market analysis reveals distinct patterns of demand, supply, and competitive dynamics across Canadian provinces and territories, reflecting local economic conditions, industrial concentrations, and consumer preferences that influence flexible plastic packaging market development.

Ontario market leadership is driven by the province’s diverse manufacturing base, large population centers, and proximity to major North American markets. The region accounts for approximately 45% of national market activity, with strong presence in food processing, automotive, and consumer goods sectors that drive packaging demand. Toronto and surrounding areas serve as major distribution hubs and manufacturing centers for flexible packaging products.

Quebec’s market position reflects the province’s significant food and beverage industry, pulp and paper heritage, and growing technology sector. The region represents roughly 25% of market share, with particular strength in dairy packaging, bakery products, and specialty food applications. Montreal’s strategic location provides access to both domestic and international markets, supporting export-oriented packaging manufacturers.

Western provinces demonstrate growing market importance, driven by agricultural processing, energy sector activities, and expanding population centers. Alberta and British Columbia together account for approximately 20% of market activity, with particular strength in agricultural packaging, industrial applications, and consumer goods distribution.

Atlantic provinces represent emerging opportunities, particularly in seafood packaging, agricultural products, and tourism-related applications. While representing a smaller market share, these regions show potential for specialized packaging solutions and niche market development.

Competitive landscape within the Canada flexible plastic packaging market features a diverse mix of multinational corporations, regional specialists, and emerging technology companies that compete across various market segments and application areas.

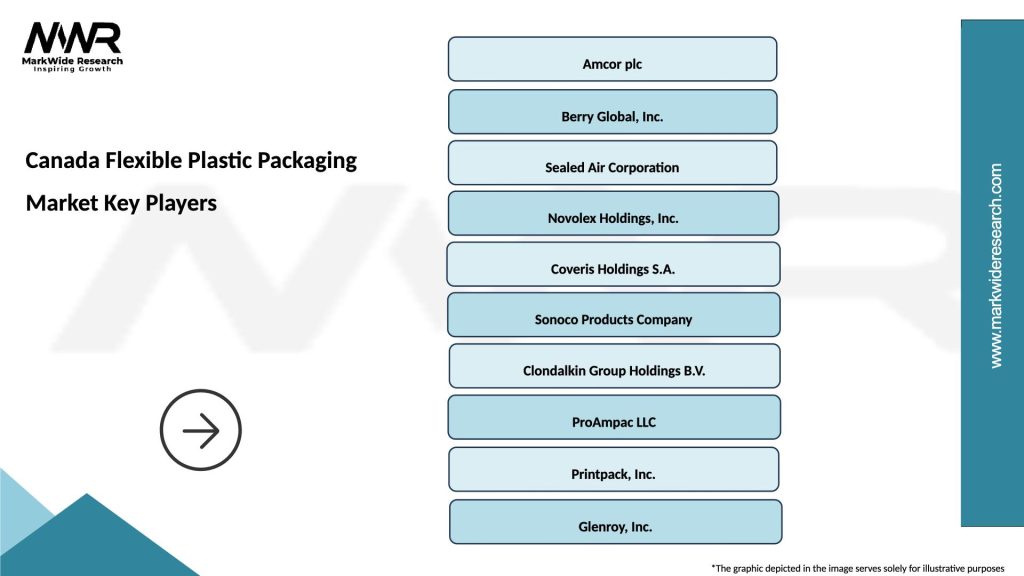

Market leaders include established companies with comprehensive product portfolios, advanced manufacturing capabilities, and strong customer relationships across multiple industries:

Regional competitors and specialized manufacturers play important roles in serving niche markets and providing customized solutions for specific customer requirements. These companies often compete based on technical expertise, customer service, and flexibility rather than scale advantages.

Competitive strategies focus on innovation, sustainability, operational efficiency, and customer relationship development. Leading companies invest heavily in research and development, manufacturing technology upgrades, and strategic acquisitions to maintain market position and drive growth.

Market segmentation analysis reveals distinct categories within the Canada flexible plastic packaging market, each characterized by specific performance requirements, customer needs, and growth dynamics that influence strategic positioning and investment decisions.

By Material Type:

By Product Type:

By End-Use Industry:

Category-wise analysis provides detailed understanding of specific market segments within the Canada flexible plastic packaging industry, revealing unique characteristics, growth drivers, and competitive dynamics that influence strategic decision-making and investment priorities.

Food Packaging Category represents the largest and most dynamic segment, driven by evolving consumer preferences for convenient, fresh, and sustainable food products. Stand-up pouches have gained significant popularity in snack foods, pet food, and beverage applications, offering superior shelf appeal and functional benefits compared to traditional packaging formats. Barrier films for meat, dairy, and processed foods continue growing as manufacturers seek to extend shelf life and reduce food waste.

Healthcare Packaging Category demonstrates strong growth potential, with increasing demand for sterile barrier systems, pharmaceutical pouches, and medical device packaging. Regulatory compliance requirements drive demand for specialized materials and manufacturing processes that ensure product safety and efficacy. The aging Canadian population and expanding healthcare sector create sustained growth opportunities in this premium market segment.

Industrial Packaging Category serves diverse applications including agricultural products, chemicals, and construction materials. Heavy-duty films and bulk packaging solutions address specific performance requirements for protection, handling, and storage of industrial products. This segment benefits from Canada’s resource-based economy and manufacturing activities.

E-commerce Packaging Category represents an emerging high-growth area, with specialized solutions designed for online retail applications. Protective mailers, tamper-evident pouches, and lightweight shipping films address specific requirements for product protection, cost optimization, and customer experience enhancement in digital commerce applications.

Industry participants and stakeholders in the Canada flexible plastic packaging market realize numerous strategic and operational benefits that contribute to business growth, competitive advantage, and long-term sustainability in an evolving marketplace.

Manufacturers benefit from growing market demand, technological innovation opportunities, and expanding application areas that drive revenue growth and profitability. Operational efficiency improvements through automation and process optimization enable cost reduction and quality enhancement. Product differentiation through advanced materials and smart packaging features creates competitive advantages and premium pricing opportunities.

Brand owners and retailers gain access to packaging solutions that enhance product protection, extend shelf life, and improve consumer appeal. Sustainability initiatives supported by recyclable and compostable packaging options help companies meet environmental commitments and consumer expectations. Supply chain optimization through lightweight packaging reduces transportation costs and carbon footprint.

Consumers benefit from improved product freshness, convenience features, and sustainable packaging options that align with environmental values. Portion control and resealable packaging formats support healthy lifestyle choices and reduce food waste. Product information and interactive features enhance user experience and brand engagement.

Environmental stakeholders benefit from industry investments in sustainable packaging technologies, recycling infrastructure development, and circular economy initiatives. Waste reduction through optimized packaging design and material efficiency contributes to environmental protection goals. Innovation in biodegradable materials supports transition toward more sustainable packaging systems.

SWOT analysis provides comprehensive assessment of internal strengths and weaknesses alongside external opportunities and threats facing the Canada flexible plastic packaging market, enabling strategic planning and risk management for industry participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Canada flexible plastic packaging industry reflect evolving consumer preferences, technological innovations, and regulatory developments that create both challenges and opportunities for market participants.

Sustainability Revolution represents the most significant trend, with companies investing heavily in recyclable, compostable, and bio-based packaging materials. Circular economy principles are driving design changes that prioritize end-of-life considerations and material recovery. MWR analysis indicates that sustainability-focused packaging solutions are experiencing growth rates significantly above market averages.

Smart Packaging Integration is gaining momentum, with applications including freshness indicators, temperature monitoring, and interactive consumer engagement features. Internet of Things (IoT) connectivity enables real-time tracking and data collection throughout the supply chain. These technologies provide measurable value to both manufacturers and consumers while creating opportunities for premium positioning.

Convenience and Portability continue driving packaging format evolution, with increasing demand for resealable pouches, portion-controlled packaging, and on-the-go consumption formats. Demographic changes including aging population and smaller household sizes influence packaging size and functionality requirements.

Customization and Personalization trends are enabled by digital printing technologies and flexible manufacturing systems that allow smaller production runs and rapid product variations. Brand differentiation through unique packaging designs and interactive features becomes increasingly important in competitive markets.

Recent industry developments highlight the dynamic nature of the Canada flexible plastic packaging market, with significant investments in technology, sustainability initiatives, and strategic partnerships that shape competitive positioning and future growth prospects.

Technology Investments include major facility upgrades and equipment installations that enhance manufacturing capabilities and product quality. Leading companies have announced substantial capital expenditures for advanced extrusion lines, printing systems, and automation technologies that improve operational efficiency and enable new product development.

Sustainability Initiatives encompass comprehensive programs addressing recyclability, material reduction, and circular economy principles. Several manufacturers have committed to achieving specific sustainability targets including increased recycled content usage and reduced carbon footprint across operations. Collaboration with recycling companies and waste management organizations supports infrastructure development for post-consumer packaging recovery.

Strategic Partnerships between packaging manufacturers, technology providers, and end-user customers are fostering innovation and market development. These partnerships enable knowledge sharing, risk mitigation, and accelerated commercialization of new packaging solutions that address specific market needs.

Regulatory Developments include new policies addressing single-use plastics, extended producer responsibility, and packaging waste management. Industry organizations are actively engaging with government agencies to ensure practical implementation of environmental regulations while maintaining packaging functionality and safety requirements.

Strategic recommendations for Canada flexible plastic packaging market participants emphasize the importance of proactive adaptation to evolving market conditions while capitalizing on emerging growth opportunities and addressing competitive challenges.

Sustainability Leadership should be prioritized through comprehensive programs that address material selection, manufacturing processes, and end-of-life considerations. Companies should invest in recyclable and compostable packaging technologies while developing partnerships with recycling infrastructure providers. Transparent communication about sustainability efforts helps address consumer concerns and regulatory requirements.

Innovation Investment in smart packaging technologies, advanced materials, and manufacturing processes creates competitive differentiation and enables premium positioning. Research and development partnerships with universities and technology companies can accelerate innovation while sharing development costs and risks.

Market Diversification across industry segments and geographic regions reduces dependence on specific markets and provides growth opportunities. Export market development leverages Canadian quality advantages and trade agreements to access international opportunities.

Operational Excellence through automation, digitalization, and lean manufacturing principles improves efficiency and cost competitiveness. Supply chain optimization including strategic supplier relationships and inventory management enhances resilience and responsiveness to market changes.

Customer Partnership Development through collaborative innovation, technical support, and value-added services strengthens relationships and creates switching barriers. Understanding customer needs and market trends enables proactive product development and market positioning.

Future market outlook for the Canada flexible plastic packaging industry remains positive, with sustained growth expected across multiple segments driven by technological innovation, sustainability initiatives, and evolving consumer preferences that create new opportunities for market expansion.

Growth projections indicate continued market expansion, with particular strength in sustainable packaging solutions, smart packaging technologies, and specialized applications serving healthcare, e-commerce, and premium food segments. MarkWide Research forecasts suggest that companies investing in innovation and sustainability will capture disproportionate market share growth over the forecast period.

Technology evolution will continue driving market development, with advances in barrier materials, biodegradable polymers, and smart packaging features creating new application opportunities and competitive advantages. Digital integration throughout the value chain will enhance operational efficiency and enable new business models based on data analytics and customer insights.

Regulatory landscape evolution toward stricter environmental requirements will create both challenges and opportunities, favoring companies that proactively address sustainability concerns while maintaining packaging functionality. Extended producer responsibility programs may reshape industry economics and competitive dynamics.

Market consolidation trends are expected to continue, with larger companies acquiring specialized manufacturers and technology providers to expand capabilities and market reach. This consolidation may create opportunities for remaining independent companies to serve niche markets and provide specialized solutions.

International expansion opportunities will grow as Canadian manufacturers leverage quality advantages, technological capabilities, and trade agreements to serve global markets. Export growth potential exists in both developed and emerging markets seeking high-quality packaging solutions.

The Canada flexible plastic packaging market represents a dynamic and evolving industry characterized by strong fundamentals, innovative capabilities, and promising growth prospects across diverse application segments. Market participants benefit from Canada’s stable economic environment, advanced manufacturing infrastructure, and strategic geographic position that provides access to major North American markets.

Key success factors include proactive adaptation to sustainability requirements, investment in innovative technologies, and development of strategic partnerships that enhance competitive positioning and market access. Companies that effectively balance performance, cost, and environmental considerations while addressing evolving customer needs are positioned to capture significant growth opportunities in this expanding market.

Future market development will be shaped by continued innovation in materials science, manufacturing technologies, and smart packaging features that provide measurable value to end users. The industry’s commitment to sustainability and circular economy principles creates opportunities for differentiation while addressing regulatory requirements and consumer expectations. Strategic investments in technology, talent, and market development will determine competitive success in this dynamic and promising market segment.

What is Flexible Plastic Packaging?

Flexible Plastic Packaging refers to packaging made from flexible materials that can be easily shaped and molded. This type of packaging is commonly used in food, beverages, and consumer goods due to its lightweight and versatile nature.

What are the key players in the Canada Flexible Plastic Packaging Market?

Key players in the Canada Flexible Plastic Packaging Market include Amcor, Berry Global, and Sealed Air, among others. These companies are known for their innovative packaging solutions and commitment to sustainability.

What are the main drivers of the Canada Flexible Plastic Packaging Market?

The main drivers of the Canada Flexible Plastic Packaging Market include the growing demand for convenient packaging solutions, increased focus on sustainability, and the rise in e-commerce. These factors are pushing companies to adopt flexible packaging to meet consumer preferences.

What challenges does the Canada Flexible Plastic Packaging Market face?

The Canada Flexible Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste and recycling, as well as competition from alternative packaging materials. These challenges require companies to innovate and adapt their packaging strategies.

What opportunities exist in the Canada Flexible Plastic Packaging Market?

Opportunities in the Canada Flexible Plastic Packaging Market include the development of biodegradable and recyclable materials, as well as advancements in printing technology for customized packaging. These innovations can help companies meet consumer demands for sustainable options.

What trends are shaping the Canada Flexible Plastic Packaging Market?

Trends shaping the Canada Flexible Plastic Packaging Market include the increasing use of smart packaging technologies, the shift towards minimalistic designs, and the growing emphasis on reducing carbon footprints. These trends reflect changing consumer preferences and environmental concerns.

Canada Flexible Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Shrink Films, Rigid Containers, Flexible Bags |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Single-Use, Reusable, Compostable, Multi-Layer |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Flexible Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at