444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea MLCC market represents a critical segment of the global electronics component industry, driven by the nation’s position as a leading technology hub and manufacturing powerhouse. Multi-Layer Ceramic Capacitors (MLCCs) serve as essential components in virtually every electronic device, from smartphones and automotive systems to industrial equipment and consumer electronics. South Korea’s market demonstrates remarkable growth potential, with the industry experiencing a compound annual growth rate (CAGR) of 8.2% over recent years.

Market dynamics in South Korea are influenced by the country’s robust electronics manufacturing ecosystem, including major conglomerates like Samsung Electronics and LG Electronics. The domestic demand for MLCCs continues to surge, driven by the proliferation of 5G technology, electric vehicles, and Internet of Things (IoT) applications. Manufacturing capabilities in the region have expanded significantly, with local producers capturing approximately 35% of the domestic market share.

Technological advancement remains a key differentiator in the South Korean MLCC landscape, with companies investing heavily in research and development to produce smaller, more efficient capacitors. The market benefits from strong government support for the electronics industry and favorable policies promoting technological innovation. Supply chain integration between MLCC manufacturers and end-user industries has strengthened considerably, creating a more resilient and responsive market environment.

The South Korea MLCC market refers to the domestic industry encompassing the production, distribution, and consumption of Multi-Layer Ceramic Capacitors within South Korean borders. MLCCs are passive electronic components that store electrical energy temporarily and release it when needed, making them indispensable for circuit functionality across numerous applications.

These components consist of multiple layers of ceramic dielectric material alternated with metal electrodes, creating a compact yet highly effective capacitive element. The South Korean market specifically focuses on both domestic manufacturing capabilities and consumption patterns within the country’s extensive electronics ecosystem. Market participants include local manufacturers, international suppliers, distributors, and end-user industries ranging from consumer electronics to automotive and industrial sectors.

Strategic importance of the South Korean MLCC market extends beyond domestic boundaries, as the country serves as a crucial link in global electronics supply chains. The market encompasses various MLCC types, including high-capacitance, high-voltage, and specialized automotive-grade components, each serving distinct technological requirements and application areas.

South Korea’s MLCC market demonstrates exceptional growth momentum, positioning itself as a vital component of the global electronics supply chain. The market benefits from strong domestic demand driven by leading technology companies and a thriving consumer electronics industry. Key growth drivers include the rapid adoption of 5G technology, increasing electric vehicle production, and expanding IoT applications across various sectors.

Manufacturing excellence characterizes the South Korean MLCC landscape, with local producers achieving significant technological breakthroughs in miniaturization and performance enhancement. The market shows remarkable resilience, with domestic production capacity expanding by approximately 12% annually to meet growing demand. Investment flows into research and development have intensified, focusing on next-generation MLCC technologies and advanced manufacturing processes.

Competitive dynamics reveal a balanced market structure, combining established international players with emerging domestic manufacturers. The market benefits from strong government support through favorable policies and incentives for electronics manufacturing. Future prospects remain highly positive, with analysts projecting sustained growth driven by technological innovation and expanding application areas across multiple industries.

Strategic insights into the South Korean MLCC market reveal several critical success factors and emerging trends shaping industry development:

Market intelligence indicates that South Korean MLCC manufacturers are particularly well-positioned to capitalize on emerging technologies requiring high-performance capacitors. The integration of artificial intelligence and machine learning in manufacturing processes has improved production efficiency by approximately 18%, enhancing overall market competitiveness.

Primary market drivers propelling the South Korean MLCC market include technological advancement, expanding application areas, and robust domestic demand from leading electronics manufacturers. The proliferation of 5G technology represents a significant growth catalyst, with 5G-enabled devices requiring substantially more MLCCs than their 4G predecessors.

Automotive electrification serves as another major driver, with electric and hybrid vehicles incorporating hundreds of MLCCs for various functions including battery management, power conversion, and electronic control systems. The South Korean automotive industry’s transition toward electrification has increased MLCC demand by approximately 25% annually in recent years.

Consumer electronics innovation continues driving market growth, with smartphones, tablets, and wearable devices requiring increasingly sophisticated MLCC solutions. The Internet of Things expansion creates additional demand for specialized MLCCs designed for low-power, high-reliability applications. Industrial automation and smart manufacturing initiatives further contribute to market expansion, requiring robust MLCCs for control systems and sensor applications.

Government initiatives supporting the electronics industry through favorable policies, tax incentives, and research funding create a conducive environment for market growth. The emphasis on technological sovereignty and supply chain security has encouraged domestic MLCC production capabilities, reducing dependence on imports.

Market constraints affecting the South Korean MLCC industry include raw material price volatility, intense global competition, and technological complexity challenges. Raw material costs, particularly for high-purity ceramic materials and precious metals used in electrode formation, can significantly impact production economics and profit margins.

Global competition from established manufacturers in Japan, Taiwan, and China creates pricing pressures and market share challenges for South Korean producers. The industry faces ongoing pressure to reduce costs while maintaining quality standards and technological advancement. Supply chain disruptions, as experienced during recent global events, can affect raw material availability and production schedules.

Technical challenges associated with MLCC miniaturization and performance enhancement require substantial research and development investments, which may strain resources for smaller manufacturers. The complexity of manufacturing processes demands highly skilled workforce and sophisticated equipment, creating barriers to entry for new market participants.

Regulatory compliance requirements, including environmental standards and quality certifications, add operational complexity and costs. The need for continuous technological innovation to meet evolving customer requirements creates ongoing pressure on research and development capabilities and financial resources.

Emerging opportunities in the South Korean MLCC market span multiple high-growth sectors and technological applications. The expansion of electric vehicle production presents substantial growth potential, with automotive MLCCs requiring specialized characteristics including high temperature resistance and enhanced reliability.

5G infrastructure deployment creates significant opportunities for high-frequency, low-loss MLCCs designed specifically for telecommunications applications. The market opportunity in 5G-related applications is expected to grow by 40% annually over the next several years. Industrial IoT applications offer additional growth avenues, requiring specialized MLCCs for sensor networks, smart meters, and industrial automation systems.

Advanced automotive electronics, including autonomous driving systems and advanced driver assistance systems (ADAS), represent high-value market segments requiring premium MLCC solutions. The renewable energy sector, particularly solar and wind power systems, creates demand for specialized high-voltage MLCCs.

Export market expansion offers significant growth potential, with South Korean manufacturers leveraging technological capabilities to compete in international markets. Strategic partnerships with global electronics manufacturers can facilitate market entry and technology transfer opportunities. Customization services for specific applications provide opportunities for value-added solutions and premium pricing.

Market dynamics in the South Korean MLCC industry reflect the interplay between technological innovation, competitive pressures, and evolving customer requirements. Supply and demand balance has improved significantly, with domestic production capacity expansion helping meet growing local demand while reducing import dependence.

Competitive intensity remains high, with manufacturers competing on multiple dimensions including price, quality, technological capability, and customer service. The market has witnessed consolidation trends, with larger players acquiring smaller manufacturers to achieve economies of scale and expand technological capabilities. Innovation cycles have accelerated, with new product introductions occurring more frequently to meet rapidly evolving market requirements.

Customer relationships have evolved toward longer-term partnerships, with MLCC manufacturers working closely with end-users to develop customized solutions. According to MarkWide Research analysis, collaborative development projects have increased by 22% over recent years, indicating stronger industry integration.

Price dynamics reflect the balance between cost pressures and value-added capabilities, with premium products commanding higher margins while commodity products face intense price competition. The market demonstrates increasing differentiation between high-performance specialty MLCCs and standard commodity products.

Research approach for analyzing the South Korean MLCC market employed comprehensive primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research included extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the MLCC value chain.

Data collection encompassed multiple sources including manufacturer surveys, distributor interviews, end-user feedback, and expert consultations with industry professionals. Secondary research involved analysis of industry reports, company financial statements, government statistics, and trade association data to validate primary findings and provide comprehensive market context.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing production capacity, consumption patterns, and trade flows to develop accurate market assessments. Trend analysis incorporated historical data spanning multiple years to identify growth patterns and market evolution trajectories.

Quality assurance measures included data triangulation, expert validation, and cross-verification of findings across multiple sources. The research methodology ensured comprehensive coverage of market segments, geographic regions, and application areas within the South Korean MLCC market landscape.

Regional distribution within South Korea reveals concentrated MLCC manufacturing and consumption activities in key industrial zones. Seoul Metropolitan Area accounts for approximately 45% of market activity, benefiting from proximity to major electronics manufacturers and research institutions. The region hosts numerous MLCC producers and serves as the primary hub for technology development and innovation.

Gyeonggi Province represents another significant market concentration, with approximately 30% market share, driven by extensive electronics manufacturing facilities and supplier networks. The region benefits from well-developed infrastructure and skilled workforce availability, supporting both production and research activities.

Busan and surrounding areas contribute approximately 15% of market activity, primarily focused on port-related logistics and export operations. The region serves as a crucial gateway for international trade and supply chain operations. Other regions including Daegu, Gwangju, and Daejeon collectively account for the remaining market share, with each area specializing in specific aspects of the MLCC value chain.

Regional specialization has emerged, with certain areas focusing on research and development while others emphasize manufacturing or logistics operations. This geographic distribution creates synergies and efficiency gains across the South Korean MLCC ecosystem.

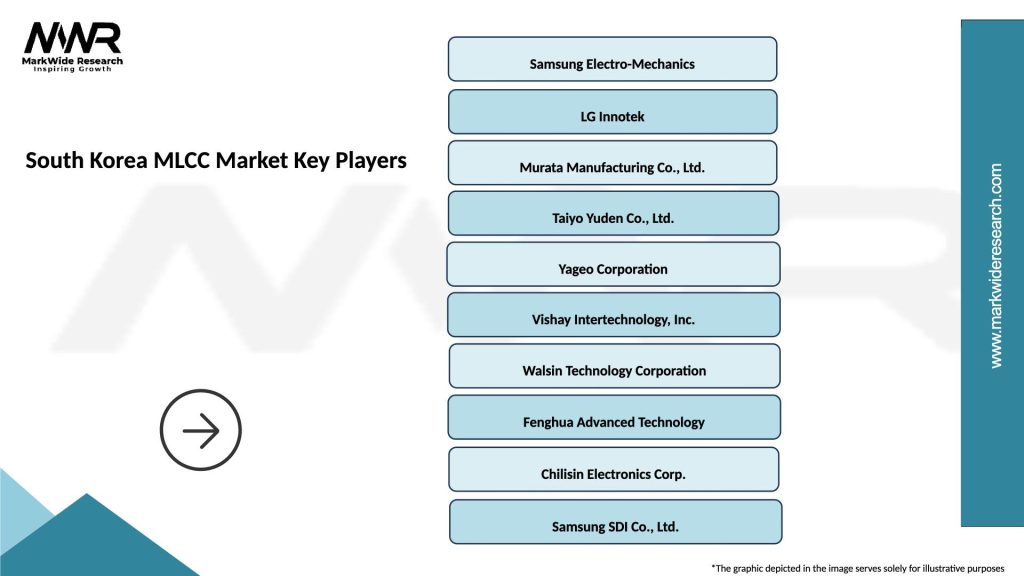

Competitive structure in the South Korean MLCC market features a mix of domestic manufacturers and international players, creating a dynamic and competitive environment. Key market participants include:

Competitive strategies focus on technological differentiation, cost optimization, and customer relationship development. Market leaders invest heavily in research and development to maintain technological advantages and develop next-generation MLCC solutions. Strategic partnerships between manufacturers and end-users have become increasingly important for market success.

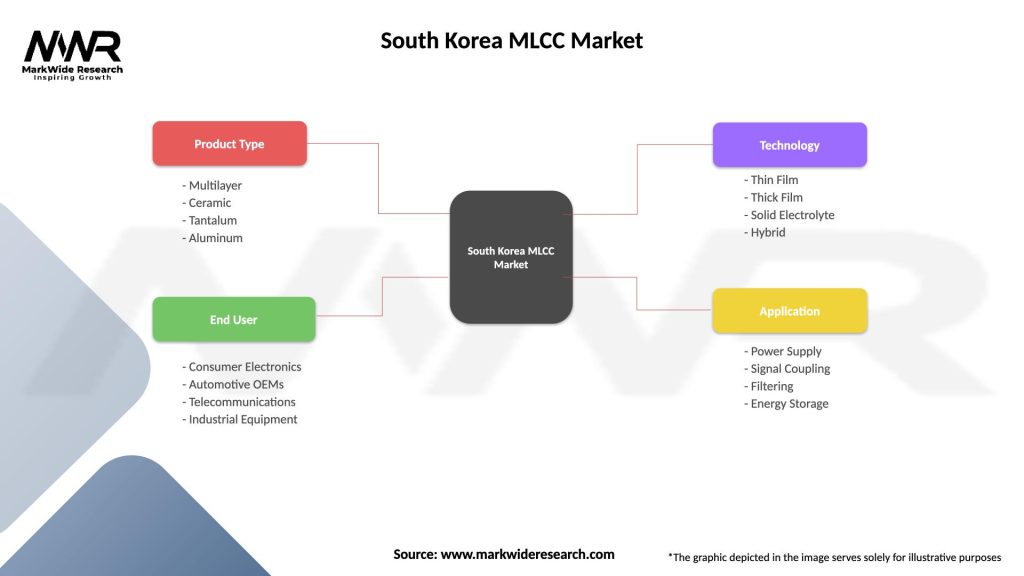

Market segmentation of the South Korean MLCC market reveals diverse categories based on various characteristics and applications:

By Capacitance Range:

By Voltage Rating:

By Application:

Consumer electronics category dominates the South Korean MLCC market, accounting for the largest share of demand driven by smartphone and tablet production. This segment requires high-volume, cost-effective MLCCs with reliable performance characteristics. Miniaturization trends in consumer devices drive demand for smaller, higher-capacity MLCCs with enhanced performance specifications.

Automotive segment represents the fastest-growing category, with electric vehicle adoption driving substantial demand increases. Automotive MLCCs require enhanced reliability, temperature resistance, and longevity compared to consumer applications. The segment commands premium pricing due to stringent quality requirements and specialized testing procedures.

Industrial applications focus on reliability and long-term performance, with customers prioritizing quality over cost considerations. This segment offers stable demand patterns and longer product lifecycles, providing predictable revenue streams for manufacturers. Telecommunications category experiences rapid growth driven by 5G infrastructure deployment, requiring specialized high-frequency MLCCs with low loss characteristics.

Emerging categories including renewable energy systems and medical devices present new growth opportunities, requiring specialized MLCC solutions with unique performance characteristics and regulatory compliance requirements.

Manufacturers benefit from the South Korean MLCC market through access to advanced technology, skilled workforce, and proximity to major end-user industries. The market provides opportunities for technological leadership, premium pricing for innovative products, and strong customer relationships with leading electronics companies.

End-users gain advantages through reliable supply chains, high-quality products, and collaborative development opportunities with MLCC manufacturers. The local market presence enables faster response times, customized solutions, and reduced supply chain risks. Technology companies benefit from access to cutting-edge MLCC technologies that enable product differentiation and performance enhancement.

Distributors and suppliers capitalize on the growing market through expanded business opportunities, diverse product portfolios, and strong customer relationships. The market provides stable demand patterns and growth opportunities across multiple application segments.

Government and economic stakeholders benefit from job creation, technology development, export revenue generation, and strengthened industrial competitiveness. The MLCC industry contributes to South Korea’s position as a global technology leader and supports the broader electronics ecosystem development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trend continues driving MLCC development, with manufacturers achieving smaller form factors while maintaining or improving electrical performance. This trend aligns with consumer electronics evolution toward thinner, lighter devices with enhanced functionality. High-capacitance MLCCs are gaining prominence as alternatives to traditional electrolytic capacitors in various applications.

Automotive-grade MLCCs represent a significant trend, with specialized products designed to meet stringent automotive requirements including extended temperature ranges, enhanced reliability, and longer operational life. The trend toward electric vehicles accelerates demand for high-voltage, high-temperature MLCCs.

5G-optimized MLCCs emerge as a key trend, with manufacturers developing products specifically designed for high-frequency applications with minimal signal loss. These specialized components enable 5G infrastructure deployment and next-generation mobile devices. MWR data indicates that 5G-related MLCC demand has grown by 55% annually.

Sustainability initiatives influence MLCC development, with manufacturers focusing on environmentally friendly materials and production processes. The trend toward circular economy principles drives development of recyclable and sustainable MLCC solutions.

Recent industry developments highlight the dynamic nature of the South Korean MLCC market and ongoing technological advancement. Samsung Electro-Mechanics announced significant capacity expansion plans, investing in advanced manufacturing equipment to meet growing demand from automotive and 5G applications.

Technology partnerships between MLCC manufacturers and research institutions have intensified, focusing on next-generation materials and manufacturing processes. Several collaborative projects aim to develop MLCCs with enhanced performance characteristics for emerging applications.

Manufacturing automation initiatives have gained momentum, with companies implementing artificial intelligence and machine learning technologies to improve production efficiency and quality control. These developments have resulted in approximately 20% improvement in manufacturing yield rates across the industry.

International expansion activities by South Korean manufacturers include establishing overseas production facilities and forming strategic partnerships with global electronics companies. These developments position South Korean companies for enhanced global market participation and reduced supply chain risks.

Strategic recommendations for South Korean MLCC market participants emphasize diversification, innovation, and international expansion. Market diversification beyond consumer electronics into automotive, industrial, and telecommunications segments can reduce dependency risks and capture higher-value opportunities.

Technology investment remains crucial for maintaining competitive advantages, with focus areas including advanced materials, manufacturing processes, and product miniaturization. Companies should prioritize research and development spending to stay ahead of technological curves and customer requirements.

Supply chain optimization through vertical integration or strategic partnerships can enhance cost competitiveness and supply security. MarkWide Research analysis suggests that companies with integrated supply chains demonstrate 15% better profitability compared to those relying heavily on external suppliers.

International market development offers significant growth potential, particularly in emerging markets with expanding electronics industries. Companies should consider establishing local presence in key markets to better serve international customers and reduce logistics costs.

Sustainability initiatives should be integrated into business strategies to meet evolving customer requirements and regulatory standards. Environmental considerations are becoming increasingly important in customer selection criteria and long-term business viability.

Future prospects for the South Korean MLCC market remain highly positive, with multiple growth drivers supporting sustained expansion. The market is projected to maintain strong growth momentum, driven by technological advancement and expanding application areas. Electric vehicle adoption will continue serving as a major growth catalyst, with automotive MLCC demand expected to grow at 30% CAGR over the next five years.

5G technology deployment will create substantial opportunities for specialized MLCC solutions, with infrastructure development and device proliferation driving sustained demand growth. The Internet of Things expansion will generate additional demand for low-power, high-reliability MLCCs across various applications.

Technological evolution will focus on further miniaturization, enhanced performance characteristics, and specialized solutions for emerging applications. Advanced materials and manufacturing processes will enable new product categories and performance levels previously unattainable.

Market consolidation trends may continue, with larger players acquiring smaller manufacturers to achieve economies of scale and expand technological capabilities. International expansion by South Korean manufacturers will enhance global market presence and reduce domestic market dependence.

The South Korea MLCC market demonstrates exceptional growth potential and strategic importance within the global electronics component industry. Strong domestic demand, technological excellence, and favorable market conditions position South Korean manufacturers for continued success and expansion. The market benefits from robust growth drivers including 5G deployment, electric vehicle adoption, and expanding IoT applications.

Competitive advantages including advanced manufacturing capabilities, skilled workforce, and strong customer relationships provide solid foundations for future growth. While challenges exist in the form of global competition and cost pressures, the market’s fundamental strengths and growth opportunities outweigh potential constraints.

Strategic focus on innovation, diversification, and international expansion will be crucial for maximizing market opportunities and maintaining competitive positions. The South Korean MLCC market is well-positioned to capitalize on emerging technologies and expanding application areas, ensuring sustained growth and industry leadership in the years ahead.

What is MLCC?

MLCC stands for Multi-Layer Ceramic Capacitor, which is a type of capacitor that consists of multiple layers of ceramic dielectric material. These components are widely used in electronic devices for energy storage and filtering applications.

What are the key players in the South Korea MLCC Market?

Key players in the South Korea MLCC Market include Samsung Electro-Mechanics, Murata Manufacturing, and Yageo Corporation, among others. These companies are known for their advanced manufacturing capabilities and extensive product portfolios.

What are the growth factors driving the South Korea MLCC Market?

The South Korea MLCC Market is driven by the increasing demand for electronic devices, the growth of the automotive sector, and advancements in telecommunications technology. The rise of IoT and smart devices also contributes to the market’s expansion.

What challenges does the South Korea MLCC Market face?

The South Korea MLCC Market faces challenges such as supply chain disruptions, fluctuating raw material prices, and intense competition among manufacturers. Additionally, the need for miniaturization in electronic components can complicate production processes.

What opportunities exist in the South Korea MLCC Market?

Opportunities in the South Korea MLCC Market include the growing demand for electric vehicles, advancements in renewable energy technologies, and the increasing adoption of smart home devices. These trends are expected to create new avenues for growth.

What trends are shaping the South Korea MLCC Market?

Trends shaping the South Korea MLCC Market include the shift towards higher capacitance values, the development of environmentally friendly manufacturing processes, and the integration of MLCCs in emerging technologies like 5G and AI applications.

South Korea MLCC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Multilayer, Ceramic, Tantalum, Aluminum |

| End User | Consumer Electronics, Automotive OEMs, Telecommunications, Industrial Equipment |

| Technology | Thin Film, Thick Film, Solid Electrolyte, Hybrid |

| Application | Power Supply, Signal Coupling, Filtering, Energy Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea MLCC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at