444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Austria data center networking market represents a rapidly evolving segment of the country’s digital infrastructure landscape, driven by increasing demand for cloud services, digital transformation initiatives, and the growing need for reliable data processing capabilities. Austria’s strategic position in Central Europe has positioned it as a critical hub for data center operations, serving both domestic enterprises and international organizations seeking robust networking solutions.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as organizations increasingly prioritize network modernization and capacity expansion. The Austrian market benefits from strong government support for digitalization initiatives, favorable regulatory frameworks, and significant investments in renewable energy infrastructure that appeals to environmentally conscious data center operators.

Key market characteristics include the dominance of Vienna and other major urban centers as primary locations for data center facilities, with approximately 65% of networking infrastructure concentrated in these metropolitan areas. The market encompasses various networking components including switches, routers, load balancers, and software-defined networking solutions that enable efficient data flow and management across modern data center environments.

The Austria data center networking market refers to the comprehensive ecosystem of networking hardware, software, and services that enable data centers within Austria to efficiently manage, route, and secure data traffic across their infrastructure. This market encompasses all networking components and solutions that facilitate connectivity between servers, storage systems, and external networks within Austrian data center facilities.

Data center networking involves the interconnection of computing resources through sophisticated network architectures that support high-speed data transmission, load balancing, and traffic management. In the Austrian context, this market includes both traditional networking approaches and modern software-defined networking (SDN) solutions that provide greater flexibility and scalability for data center operators.

Market scope extends beyond hardware components to include network management software, security solutions, and professional services that ensure optimal performance and reliability of data center operations. Austrian data centers serve diverse sectors including financial services, telecommunications, government agencies, and multinational corporations requiring robust networking infrastructure to support their digital operations.

Austria’s data center networking market demonstrates remarkable resilience and growth potential, driven by accelerating digital transformation across industries and increasing demand for cloud-based services. The market benefits from Austria’s stable political environment, advanced telecommunications infrastructure, and strategic geographic location that makes it an attractive destination for regional data center investments.

Technology adoption trends show significant momentum toward software-defined networking solutions, with approximately 42% of Austrian data centers implementing or planning SDN deployments within the next two years. This shift reflects the industry’s focus on achieving greater network agility, improved resource utilization, and enhanced operational efficiency through programmable network architectures.

Competitive landscape features a mix of international technology vendors and local system integrators who provide comprehensive networking solutions tailored to Austrian market requirements. The market exhibits strong growth in edge computing deployments, hybrid cloud connectivity solutions, and high-performance networking technologies that support emerging applications such as artificial intelligence and machine learning workloads.

Investment patterns indicate sustained capital allocation toward network infrastructure modernization, with data center operators prioritizing solutions that deliver improved performance, energy efficiency, and scalability. The market outlook remains positive, supported by continued digitalization initiatives and Austria’s commitment to becoming a leading digital economy within the European Union.

Strategic market insights reveal several critical trends shaping the Austrian data center networking landscape:

Market maturity indicators suggest that Austrian data center operators are increasingly sophisticated in their networking requirements, demanding solutions that provide comprehensive visibility, advanced analytics, and predictive maintenance capabilities to optimize network performance and minimize downtime.

Digital transformation initiatives across Austrian enterprises serve as the primary catalyst for data center networking market growth. Organizations are modernizing their IT infrastructure to support cloud-first strategies, requiring advanced networking solutions that can handle increased data volumes and provide reliable connectivity to distributed applications and services.

Government digitalization programs contribute significantly to market expansion, with Austrian authorities implementing comprehensive digital government initiatives that require robust data center infrastructure. These programs drive demand for secure, high-performance networking solutions capable of supporting citizen services, e-governance platforms, and inter-agency data sharing requirements.

Cloud adoption acceleration represents another major growth driver, as Austrian businesses increasingly migrate workloads to cloud platforms and implement hybrid cloud architectures. This trend necessitates sophisticated networking solutions that can provide seamless connectivity between on-premises infrastructure and multiple cloud service providers while maintaining security and performance standards.

Regulatory compliance requirements in sectors such as financial services, healthcare, and telecommunications drive investments in advanced networking infrastructure. Austrian data centers must implement networking solutions that support strict data protection regulations, audit requirements, and industry-specific compliance standards while maintaining operational efficiency.

Edge computing emergence creates new opportunities for networking solution providers, as organizations deploy distributed computing resources closer to end users. This trend requires networking architectures that can support low-latency applications, real-time data processing, and seamless integration between edge locations and centralized data centers.

High implementation costs present significant challenges for data center operators considering network infrastructure upgrades. The substantial capital investment required for advanced networking equipment, software licenses, and professional services can strain budgets, particularly for smaller data center facilities and organizations with limited IT spending capacity.

Skills shortage in specialized networking technologies creates operational challenges for Austrian data center operators. The complexity of modern networking solutions, particularly software-defined networking and network automation platforms, requires highly skilled professionals who are in limited supply within the local market, leading to increased recruitment costs and project delays.

Legacy system integration complexities hinder rapid adoption of modern networking solutions. Many Austrian data centers operate with existing infrastructure investments that must be carefully integrated with new networking technologies, creating technical challenges and extending implementation timelines while increasing project risks.

Vendor lock-in concerns influence purchasing decisions, as data center operators seek to avoid dependence on single-vendor solutions that could limit future flexibility and increase long-term costs. This concern can slow adoption of innovative networking technologies and complicate vendor selection processes.

Cybersecurity threats create additional complexity and costs for networking implementations. Austrian data centers must invest in comprehensive security measures, regular updates, and continuous monitoring capabilities to protect against evolving cyber threats, adding layers of complexity to networking architectures and increasing operational expenses.

5G network deployment creates substantial opportunities for data center networking providers in Austria. The rollout of 5G infrastructure requires edge computing capabilities and ultra-low latency networking solutions, presenting new market segments for specialized networking equipment and services that can support next-generation mobile applications and IoT deployments.

Artificial intelligence integration represents a growing opportunity as Austrian organizations implement AI and machine learning applications that require high-performance networking infrastructure. Data centers need networking solutions optimized for AI workloads, including high-bandwidth interconnects, specialized accelerator networking, and intelligent traffic management capabilities.

Sustainability initiatives offer opportunities for energy-efficient networking solutions as Austrian data centers prioritize environmental responsibility. Vendors can capitalize on demand for green networking technologies, power-efficient equipment, and solutions that support renewable energy integration and carbon footprint reduction goals.

Industry 4.0 adoption in Austrian manufacturing sectors creates demand for industrial data center networking solutions that can support smart factory applications, predictive maintenance systems, and real-time production monitoring. This trend opens new market segments for ruggedized networking equipment and specialized industrial connectivity solutions.

Cross-border connectivity opportunities arise from Austria’s strategic location in Central Europe, with data centers serving as regional hubs for international organizations. This positioning creates demand for high-capacity international networking solutions, redundant connectivity options, and specialized services for multinational enterprises.

Technological evolution drives continuous change in the Austrian data center networking market, with emerging technologies such as intent-based networking, network slicing, and AI-driven network optimization reshaping how data centers design and operate their network infrastructure. These innovations enable more efficient resource utilization and improved service delivery capabilities.

Competitive pressures intensify as international networking vendors expand their presence in Austria while local system integrators develop specialized expertise in emerging technologies. This competition drives innovation, improves service quality, and creates more favorable pricing conditions for data center operators seeking networking solutions.

Customer expectations continue to evolve, with Austrian data center operators demanding greater network visibility, predictive analytics capabilities, and automated management tools. According to MarkWide Research analysis, approximately 73% of data center operators prioritize solutions that provide comprehensive network monitoring and automated troubleshooting capabilities.

Regulatory influences shape market dynamics through data protection requirements, cybersecurity mandates, and environmental regulations that impact networking solution selection and implementation approaches. These regulatory factors create both challenges and opportunities for networking vendors who can demonstrate compliance capabilities.

Economic factors including currency fluctuations, supply chain disruptions, and global semiconductor shortages affect equipment availability and pricing in the Austrian market. Data center operators must navigate these economic challenges while maintaining network performance and planning for future capacity requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Austrian data center networking market. Primary research involves direct engagement with key market participants including data center operators, networking vendors, system integrators, and end-user organizations across various industry sectors.

Data collection methods include structured interviews with industry executives, technical surveys of data center professionals, and detailed case studies of networking implementations in Austrian facilities. This primary research provides firsthand insights into market trends, technology adoption patterns, and customer requirements that drive purchasing decisions.

Secondary research incorporates analysis of industry publications, vendor announcements, regulatory filings, and market intelligence reports to validate primary findings and identify broader market trends. This approach ensures comprehensive coverage of market dynamics and competitive landscape developments.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and technology adoption timelines. Market sizing methodologies consider multiple data points including equipment shipments, service revenues, and installation activity to develop accurate market assessments.

Quality assurance processes include data triangulation, expert validation, and peer review to ensure research accuracy and reliability. All findings undergo rigorous verification procedures to maintain the highest standards of market intelligence and analytical integrity.

Vienna metropolitan area dominates the Austrian data center networking market, accounting for approximately 58% of total networking infrastructure deployments. The capital region benefits from excellent international connectivity, proximity to major European markets, and concentration of multinational corporations requiring sophisticated data center services.

Salzburg and Linz represent emerging regional hubs for data center development, driven by industrial digitalization initiatives and growing demand for edge computing capabilities. These regions show strong growth potential with networking infrastructure investments increasing by 12% annually as local enterprises modernize their IT capabilities.

Graz and Innsbruck serve specialized market segments including research institutions, healthcare organizations, and tourism-related businesses that require reliable data center networking solutions. These markets demonstrate steady growth in networking investments, particularly in solutions supporting hybrid cloud deployments and remote work capabilities.

Border regions with Germany, Switzerland, and other neighboring countries present unique opportunities for cross-border data center networking solutions. These areas benefit from international connectivity requirements and serve as strategic locations for data centers supporting regional business operations across multiple countries.

Rural areas increasingly require data center networking solutions to support agricultural technology, renewable energy management, and distributed manufacturing operations. While representing a smaller market segment, these regions show growing demand for edge computing and industrial networking solutions tailored to specific local requirements.

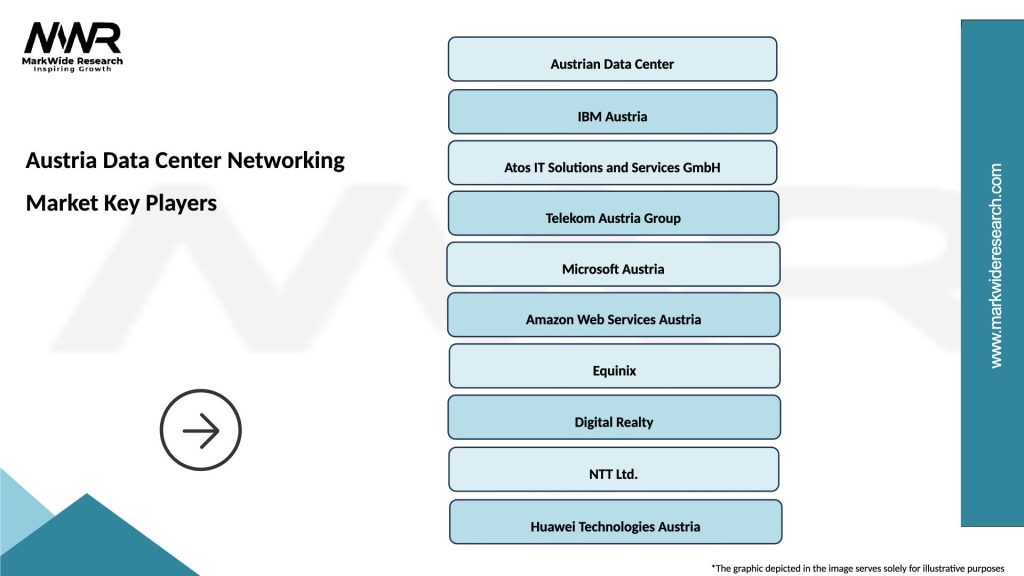

Market leadership in the Austrian data center networking sector features a combination of global technology vendors and specialized local providers who offer comprehensive solutions tailored to regional requirements:

Local system integrators play crucial roles in solution delivery, providing specialized expertise in Austrian market requirements, regulatory compliance, and customized implementation services. These partners often differentiate through industry-specific knowledge and long-term customer relationships.

Competitive strategies focus on innovation in software-defined networking, network automation, and integrated security capabilities. Vendors increasingly emphasize subscription-based service models, managed services offerings, and comprehensive support packages to differentiate their solutions in the competitive Austrian market.

By Technology:

By Application:

By End User:

Ethernet switching solutions represent the largest segment of the Austrian data center networking market, driven by continuous demand for higher port densities, increased bandwidth capabilities, and improved energy efficiency. Modern switching platforms incorporate advanced features such as programmable ASICs, telemetry capabilities, and integrated security functions that appeal to Austrian data center operators.

Software-defined networking demonstrates the highest growth rate among technology categories, with adoption accelerating as data centers seek greater operational flexibility and automated management capabilities. MWR data indicates that 38% of Austrian data centers have implemented or are piloting SDN solutions, with this percentage expected to increase significantly over the next three years.

Network security solutions show strong growth as cybersecurity concerns drive investments in integrated security architectures. Austrian data centers increasingly deploy network-based security solutions that provide micro-segmentation, threat detection, and automated response capabilities without compromising network performance.

Load balancing and application delivery solutions gain importance as data centers support increasingly complex application architectures including microservices, containers, and serverless computing platforms. These solutions provide essential traffic optimization and application performance management capabilities.

High-performance networking for specialized applications such as artificial intelligence, machine learning, and high-performance computing represents a growing niche segment with significant revenue potential for vendors offering specialized solutions tailored to these demanding workloads.

Data center operators benefit from advanced networking solutions that provide improved operational efficiency, reduced management complexity, and enhanced service delivery capabilities. Modern networking platforms enable operators to offer differentiated services, improve customer satisfaction, and optimize resource utilization across their facilities.

Enterprise customers gain access to more reliable and performant data center services through advanced networking infrastructure. These improvements translate to better application performance, reduced downtime, and enhanced user experiences for business-critical applications and services.

Technology vendors benefit from growing market opportunities driven by digital transformation initiatives and increasing demand for advanced networking capabilities. The Austrian market provides a stable environment for long-term investments and partnership development with local organizations.

System integrators capitalize on increasing complexity of networking solutions by providing specialized expertise in design, implementation, and ongoing management of data center networks. These partners play crucial roles in helping customers navigate technology choices and optimize their networking investments.

End users experience improved application performance, enhanced security, and greater service reliability through advanced data center networking infrastructure. These benefits support business productivity, enable new digital services, and provide competitive advantages in increasingly digital markets.

Economic stakeholders benefit from Austria’s strengthened position as a regional data center hub, attracting international investments and supporting the growth of the digital economy. Advanced networking infrastructure supports innovation, entrepreneurship, and economic development across multiple industry sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation and orchestration emerge as dominant trends in Austrian data center networking, with operators implementing intelligent network management platforms that reduce manual intervention and improve operational efficiency. These solutions provide automated provisioning, configuration management, and performance optimization capabilities that appeal to resource-constrained IT teams.

Edge computing integration drives demand for distributed networking architectures that can support low-latency applications and real-time data processing requirements. Austrian data centers are deploying edge networking solutions that provide seamless connectivity between centralized facilities and distributed edge locations.

Hybrid cloud connectivity represents a critical trend as organizations implement multi-cloud strategies requiring sophisticated networking solutions. Data centers must provide reliable, high-performance connections to multiple cloud service providers while maintaining security and performance standards across hybrid environments.

Network as a Service (NaaS) models gain traction as data center operators seek to reduce capital expenditures and improve operational flexibility. These service-based approaches allow customers to consume networking capabilities on-demand while vendors maintain ownership and management of underlying infrastructure.

Sustainability focus influences networking solution selection, with Austrian data centers prioritizing energy-efficient equipment and solutions that support renewable energy integration. Vendors respond with power-optimized networking platforms and comprehensive sustainability reporting capabilities.

AI-driven network optimization becomes increasingly important as networks grow in complexity and scale. Machine learning algorithms provide predictive analytics, automated troubleshooting, and intelligent traffic management capabilities that improve network performance and reduce operational costs.

Major infrastructure investments by international data center operators have expanded Austrian networking market opportunities, with several hyperscale facilities announcing significant capacity expansions requiring advanced networking infrastructure. These investments demonstrate confidence in Austria’s data center market potential and drive demand for high-performance networking solutions.

Government digitalization initiatives including the implementation of digital government services and smart city projects create new requirements for secure, high-performance data center networking infrastructure. These programs drive public sector investments in advanced networking technologies and create opportunities for specialized solution providers.

5G network rollout by Austrian telecommunications operators creates new requirements for edge computing infrastructure and ultra-low latency networking solutions. Data centers must prepare for 5G-enabled applications that demand specialized networking capabilities and distributed computing architectures.

Cybersecurity regulation enhancements including updated data protection requirements and critical infrastructure protection mandates influence networking solution selection and implementation approaches. These regulatory developments drive investments in network security solutions and compliance-focused networking architectures.

Industry partnerships between international technology vendors and local system integrators strengthen the Austrian market ecosystem, providing customers with access to global innovations while maintaining local expertise and support capabilities. These partnerships facilitate technology transfer and market development.

Research and development initiatives at Austrian universities and research institutions contribute to networking innovation and talent development. These programs support the growth of local expertise and create opportunities for collaboration between academia and industry participants.

Investment prioritization should focus on software-defined networking solutions that provide operational flexibility and automated management capabilities. Austrian data center operators should evaluate SDN platforms that offer comprehensive visibility, centralized control, and integration with existing infrastructure investments.

Skills development represents a critical success factor, with organizations needing to invest in training programs and certification initiatives that build internal expertise in emerging networking technologies. Partnerships with educational institutions and vendor training programs can help address skills gaps and improve implementation success rates.

Vendor selection should emphasize partners who demonstrate long-term commitment to the Austrian market, provide local support capabilities, and offer comprehensive service portfolios. Organizations should evaluate vendors based on technology roadmaps, financial stability, and ability to support evolving requirements over multi-year deployment cycles.

Security integration must be considered from the initial stages of networking infrastructure planning, with organizations implementing comprehensive security architectures that provide defense-in-depth capabilities. Network security should be integrated rather than added as an afterthought to ensure optimal performance and protection.

Sustainability planning should incorporate energy efficiency considerations and renewable energy integration capabilities when selecting networking solutions. Organizations should evaluate total cost of ownership including energy consumption and environmental impact to align with corporate sustainability goals.

Future-proofing strategies should consider emerging technologies such as quantum networking, advanced AI applications, and next-generation wireless standards that may impact networking requirements. Infrastructure investments should provide flexibility to accommodate future technology evolution and changing business requirements.

Market growth trajectory remains positive for the Austrian data center networking sector, supported by continued digital transformation initiatives, government digitalization programs, and increasing demand for cloud-based services. MarkWide Research projects sustained growth with networking infrastructure investments expected to increase by 9.1% annually over the next five years.

Technology evolution will continue to drive market dynamics, with software-defined networking, artificial intelligence integration, and edge computing capabilities becoming standard requirements for Austrian data centers. Organizations that invest in these emerging technologies will gain competitive advantages and improved operational efficiency.

Regulatory developments including enhanced cybersecurity requirements and environmental regulations will influence solution selection and implementation approaches. Data center operators must prepare for evolving compliance requirements while maintaining operational efficiency and service quality standards.

International expansion opportunities may emerge as Austrian data centers leverage their strategic location to serve broader Central and Eastern European markets. This expansion potential could drive additional networking infrastructure investments and create new market opportunities for solution providers.

Sustainability initiatives will become increasingly important, with data center operators prioritizing energy-efficient networking solutions and renewable energy integration. Vendors who can demonstrate environmental benefits and support sustainability goals will gain competitive advantages in the Austrian market.

Innovation acceleration in areas such as quantum networking, advanced AI applications, and immersive technologies will create new requirements for high-performance networking infrastructure. Austrian data centers must prepare for these emerging technologies while maintaining current service levels and operational efficiency.

Austria’s data center networking market presents significant opportunities for growth and innovation, driven by strong digital transformation momentum, government support for digitalization, and the country’s strategic position in Central Europe. The market demonstrates resilience and adaptability, with operators increasingly adopting advanced technologies such as software-defined networking, edge computing, and AI-driven network optimization.

Key success factors for market participants include investment in emerging technologies, development of local expertise, and implementation of comprehensive security and sustainability strategies. Organizations that can effectively navigate the evolving technology landscape while addressing regulatory requirements and customer expectations will achieve competitive advantages and sustainable growth.

Future prospects remain favorable, with continued investment in digital infrastructure, expanding cloud adoption, and emerging applications creating sustained demand for advanced networking solutions. The Austrian market’s stability, skilled workforce, and commitment to innovation position it well for continued growth and development in the global data center networking ecosystem.

What is Data Center Networking?

Data Center Networking refers to the technologies and processes that enable communication and data transfer within and between data centers. This includes hardware like switches and routers, as well as software solutions that manage network traffic and security.

What are the key players in the Austria Data Center Networking Market?

Key players in the Austria Data Center Networking Market include companies like Cisco Systems, Arista Networks, and Juniper Networks, which provide essential networking equipment and solutions for data centers, among others.

What are the main drivers of growth in the Austria Data Center Networking Market?

The main drivers of growth in the Austria Data Center Networking Market include the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced network security solutions to protect sensitive information.

What challenges does the Austria Data Center Networking Market face?

Challenges in the Austria Data Center Networking Market include the high costs associated with advanced networking technologies, the complexity of integrating new systems with existing infrastructure, and the ongoing need for skilled professionals to manage these networks.

What opportunities exist in the Austria Data Center Networking Market?

Opportunities in the Austria Data Center Networking Market include the growing adoption of edge computing, advancements in network automation technologies, and the increasing focus on energy-efficient networking solutions to reduce operational costs.

What trends are shaping the Austria Data Center Networking Market?

Trends shaping the Austria Data Center Networking Market include the shift towards software-defined networking (SDN), the integration of artificial intelligence for network management, and the expansion of hybrid cloud environments that require robust networking solutions.

Austria Data Center Networking Market

| Segmentation Details | Description |

|---|---|

| Product Type | Switches, Routers, Firewalls, Load Balancers |

| Technology | Ethernet, Fiber Channel, InfiniBand, MPLS |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Government |

| Deployment | On-Premises, Hybrid, Colocation, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Austria Data Center Networking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at