444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan faucets market represents a sophisticated and technologically advanced segment within the country’s plumbing fixtures industry. Japanese consumers demonstrate exceptional preference for high-quality, innovative faucet solutions that combine traditional craftsmanship with cutting-edge technology. The market encompasses a diverse range of products including kitchen faucets, bathroom faucets, sensor-activated models, and smart water control systems that align with Japan’s emphasis on water conservation and technological innovation.

Market dynamics in Japan reflect the nation’s unique cultural values, emphasizing durability, precision engineering, and aesthetic appeal. The faucets market experiences steady growth driven by residential renovations, commercial construction projects, and increasing adoption of smart home technologies. Growth rates indicate a robust 4.2% CAGR across various product categories, with premium and technologically advanced faucets commanding significant market share.

Consumer preferences in Japan favor faucets that offer water-saving capabilities, antimicrobial properties, and seamless integration with modern interior designs. The market benefits from strong domestic manufacturing capabilities, with Japanese brands maintaining competitive advantages through superior quality control and innovative product development. Regional distribution shows concentrated demand in major metropolitan areas including Tokyo, Osaka, and Nagoya, where residential and commercial construction activities remain active.

The Japan faucets market refers to the comprehensive ecosystem of water control fixtures designed for residential, commercial, and industrial applications within Japan’s domestic market. This market encompasses traditional manual faucets, sensor-activated models, smart faucets with digital controls, and specialized fixtures designed for specific applications such as kitchen food preparation, bathroom hygiene, and commercial food service operations.

Market definition includes various product categories such as single-handle faucets, double-handle models, wall-mounted fixtures, deck-mounted systems, and innovative touchless technologies that respond to motion sensors or voice commands. The market serves diverse customer segments including homeowners, commercial property developers, hospitality businesses, healthcare facilities, and industrial manufacturers requiring specialized water control solutions.

Technological integration distinguishes Japan’s faucets market through incorporation of advanced features including temperature control systems, water flow regulation, filtration capabilities, and connectivity with smart home automation platforms. Japanese manufacturers emphasize precision engineering, corrosion resistance, and long-term reliability as core value propositions for domestic and international customers.

Japan’s faucets market demonstrates remarkable resilience and innovation, positioning itself as a global leader in premium water control technology. The market benefits from strong domestic demand driven by renovation activities, new construction projects, and increasing consumer awareness of water conservation benefits. Market penetration of smart and sensor-activated faucets reaches approximately 28% adoption rate in urban residential applications.

Key market drivers include Japan’s aging population requiring accessible bathroom fixtures, growing hospitality sector demanding premium amenities, and government initiatives promoting water conservation technologies. The market experiences consistent growth across multiple segments, with premium products capturing increasing market share as consumers prioritize quality and durability over price considerations.

Competitive landscape features strong domestic manufacturers alongside international brands, creating dynamic market conditions that foster continuous innovation. Japanese companies maintain competitive advantages through superior manufacturing processes, customer service excellence, and deep understanding of local consumer preferences. Export activities contribute significantly to market expansion, with Japanese faucet brands gaining recognition in international markets for quality and reliability.

Strategic insights reveal several critical trends shaping Japan’s faucets market landscape:

Primary market drivers propelling Japan’s faucets market growth encompass demographic, technological, and regulatory factors that create sustained demand across multiple customer segments. Residential renovation activities represent the largest driver, as Japanese homeowners increasingly invest in bathroom and kitchen upgrades to enhance property values and improve daily living experiences.

Technological advancement serves as a crucial growth catalyst, with consumers embracing smart faucets that offer convenience, water conservation, and integration with home automation systems. The proliferation of sensor-activated models in commercial applications drives significant market expansion, particularly in restaurants, hotels, and healthcare facilities where hygiene considerations remain paramount.

Government initiatives promoting water conservation create regulatory support for efficient faucet technologies. Japan’s commitment to environmental sustainability encourages adoption of water-saving fixtures through incentive programs and building code requirements. Commercial construction activities in major metropolitan areas generate consistent demand for premium faucet installations in office buildings, retail spaces, and hospitality venues.

Demographic trends including Japan’s aging population drive demand for accessible faucet designs with ergonomic features and easy operation mechanisms. Healthcare facility expansion and modernization projects create opportunities for specialized faucets with antimicrobial properties and hands-free operation capabilities that support infection control protocols.

Market constraints affecting Japan’s faucets industry include economic factors, regulatory challenges, and competitive pressures that may limit growth potential in certain segments. High manufacturing costs associated with precision engineering and quality materials create pricing pressures, particularly for premium product categories where Japanese brands compete with lower-cost international alternatives.

Economic uncertainty and deflationary pressures in Japan’s domestic market influence consumer spending patterns, potentially delaying discretionary purchases such as faucet upgrades and renovations. Regulatory compliance requirements for water efficiency standards and safety certifications increase development costs and time-to-market for new product introductions.

Supply chain disruptions affecting raw material availability and component sourcing create operational challenges for manufacturers. The complexity of smart faucet technologies requires specialized technical support and installation services, potentially limiting adoption among cost-conscious consumers or in regions with limited service infrastructure.

Market saturation in certain residential segments may constrain growth opportunities, as replacement cycles for high-quality faucets extend beyond typical consumer electronics refresh patterns. Competition from alternative water control technologies and changing consumer preferences toward minimalist designs may impact demand for traditional faucet categories.

Significant opportunities exist within Japan’s faucets market through technological innovation, market expansion, and strategic partnerships that leverage the country’s manufacturing expertise and consumer preferences. Smart home integration presents substantial growth potential as Japanese consumers increasingly adopt connected home technologies and seek seamless integration between various household systems.

Export market expansion offers Japanese faucet manufacturers opportunities to leverage their reputation for quality and innovation in international markets, particularly in Asia-Pacific regions where Japanese brands command premium positioning. Commercial sector growth in hospitality, healthcare, and food service industries creates demand for specialized faucet solutions with advanced features and durability requirements.

Sustainability initiatives create opportunities for manufacturers to develop eco-friendly faucets using recycled materials, energy-efficient manufacturing processes, and water conservation technologies that align with global environmental trends. Customization services and bespoke design offerings cater to high-end residential and commercial customers seeking unique aesthetic solutions.

Partnership opportunities with smart home platform providers, interior design firms, and construction companies enable market expansion through integrated solution offerings. Retrofit markets for older buildings and infrastructure modernization projects provide steady demand for replacement faucets with improved efficiency and functionality.

Market dynamics in Japan’s faucets industry reflect complex interactions between consumer preferences, technological advancement, and competitive forces that shape industry evolution. Consumer behavior patterns demonstrate increasing sophistication in product selection, with buyers conducting extensive research and prioritizing long-term value over initial purchase price considerations.

Technology adoption cycles influence market dynamics as early adopters drive initial demand for smart faucets, followed by mainstream acceptance as prices decrease and functionality improves. Seasonal fluctuations affect market activity, with peak demand occurring during spring renovation seasons and year-end construction completion periods.

Supply chain dynamics impact product availability and pricing, particularly for imported components and specialized materials required for advanced faucet technologies. Competitive dynamics intensify as domestic and international manufacturers vie for market share through product differentiation, pricing strategies, and distribution channel optimization.

Regulatory dynamics shape product development priorities as manufacturers adapt to evolving water efficiency standards, safety requirements, and environmental regulations. Distribution channel evolution toward online sales platforms and direct-to-consumer models creates new opportunities while challenging traditional retail relationships. Innovation cycles accelerate as manufacturers invest in research and development to maintain competitive advantages in technology-driven market segments.

Comprehensive research methodology employed for analyzing Japan’s faucets market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry executives, manufacturers, distributors, and end-users across residential and commercial segments to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary findings. Market surveys conducted among consumers and business buyers provide quantitative data on purchasing preferences, brand awareness, and satisfaction levels across different product categories.

Data triangulation methods ensure consistency and accuracy by comparing information from multiple sources and identifying potential discrepancies or biases in collected data. Statistical analysis techniques including regression modeling and trend analysis support market forecasting and growth projections based on historical performance and identified market drivers.

Expert validation processes involve consultation with industry specialists, academic researchers, and market analysts to review findings and provide additional context for market interpretations. Continuous monitoring of market developments, regulatory changes, and competitive activities ensures research findings remain current and relevant for strategic decision-making purposes.

Regional market distribution across Japan reveals distinct patterns influenced by urbanization levels, economic development, and demographic characteristics that shape faucet demand and preferences. Tokyo metropolitan area commands approximately 35% market share due to high population density, active construction markets, and consumer purchasing power that supports premium product adoption.

Osaka region represents the second-largest market with 18% market share, benefiting from strong commercial activity, manufacturing presence, and renovation projects in both residential and commercial sectors. Nagoya area contributes 12% market share driven by automotive industry prosperity and associated commercial development that generates consistent demand for quality faucet installations.

Regional preferences vary significantly, with urban areas favoring compact, technologically advanced faucets suitable for smaller living spaces, while rural regions prefer traditional designs with proven reliability and easier maintenance requirements. Northern regions including Hokkaido demonstrate specific preferences for faucets with freeze-resistant features and robust construction suitable for harsh winter conditions.

Southern regions including Kyushu show growing adoption of water-saving technologies driven by environmental awareness and government conservation initiatives. Coastal areas require specialized faucets with enhanced corrosion resistance due to salt air exposure, creating niche market opportunities for manufacturers offering marine-grade materials and protective coatings.

Competitive landscape in Japan’s faucets market features a dynamic mix of established domestic manufacturers and international brands competing across multiple product segments and price points. Market leadership positions are held by companies that successfully combine traditional Japanese manufacturing excellence with innovative technology integration and strong distribution networks.

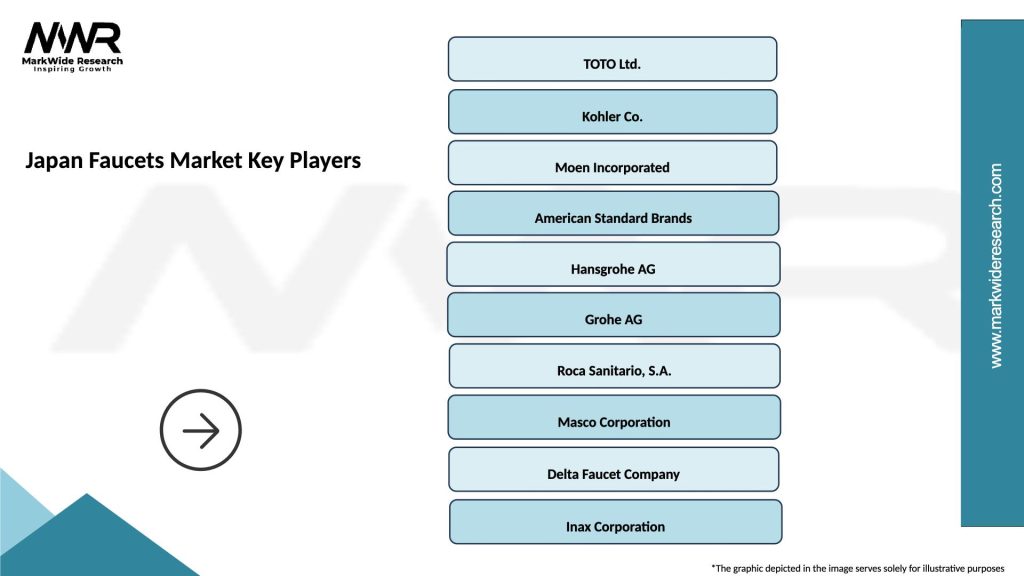

Leading market participants include:

Competitive strategies focus on product differentiation through technology innovation, design excellence, and superior customer service. Market positioning varies from value-oriented offerings targeting cost-conscious consumers to premium products emphasizing luxury features and advanced functionality for affluent market segments.

Market segmentation analysis reveals distinct categories based on product type, application, technology, and price positioning that serve different customer needs and preferences within Japan’s faucets market. Segmentation strategies enable manufacturers to target specific customer groups with tailored product offerings and marketing approaches.

By Product Type:

By Technology:

By Application:

Kitchen faucets category represents the largest segment within Japan’s faucets market, driven by frequent renovation activities and consumer preferences for multifunctional designs that enhance cooking and cleaning efficiency. Pull-out spray models gain popularity due to their versatility and space-saving benefits in compact Japanese kitchens. Water filtration integration becomes increasingly important as consumers seek convenient access to clean drinking water.

Bathroom faucets segment demonstrates steady growth with emphasis on water conservation and aesthetic appeal that complements modern bathroom designs. Thermostatic controls gain acceptance for their safety benefits and energy efficiency, particularly in households with elderly residents or young children. Wall-mounted models appeal to consumers seeking minimalist designs and easier cleaning maintenance.

Sensor-activated faucets experience rapid adoption in commercial applications where hygiene considerations drive purchasing decisions. Healthcare facilities prioritize touchless operation to reduce infection risks, while restaurant applications value the convenience and water conservation benefits. Battery life improvements and solar charging options address maintenance concerns in commercial installations.

Smart faucets category represents the fastest-growing segment with technology adoption rates reaching 15% annually among early adopters. Voice control integration with popular smart home platforms creates convenience benefits that justify premium pricing. Water usage monitoring features appeal to environmentally conscious consumers seeking to reduce consumption and utility costs.

Industry participants in Japan’s faucets market benefit from multiple value creation opportunities through strategic positioning, innovation investment, and market expansion initiatives. Manufacturers gain competitive advantages through product differentiation, brand building, and operational efficiency improvements that enhance profitability and market share growth.

Key benefits for manufacturers include:

Distributors and retailers benefit from strong consumer demand, healthy profit margins, and opportunities for value-added services including installation and maintenance support. Construction companies and contractors gain access to reliable suppliers offering comprehensive product ranges and technical support services that enhance project execution capabilities.

End-user benefits encompass improved functionality, water conservation, aesthetic enhancement, and long-term reliability that justify investment in quality faucet solutions. Commercial customers achieve operational efficiency gains, reduced maintenance costs, and enhanced customer satisfaction through premium faucet installations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping Japan’s faucets market reflect broader societal changes, technological advancement, and evolving consumer expectations that drive industry innovation and strategic adaptation. Smart technology integration emerges as the dominant trend, with manufacturers incorporating IoT connectivity, app-based controls, and voice activation features that align with Japan’s digital transformation initiatives.

Sustainability focus intensifies as consumers and businesses prioritize water conservation, energy efficiency, and environmentally responsible manufacturing practices. Water-saving technologies including flow restrictors, aerators, and intelligent usage monitoring systems gain widespread adoption across residential and commercial applications.

Design minimalism continues influencing product development as Japanese consumers favor clean lines, compact profiles, and seamless integration with modern interior aesthetics. Antimicrobial materials and surfaces gain importance following increased hygiene awareness, particularly in commercial and healthcare applications where infection control remains critical.

Customization services expand as manufacturers offer personalized design options, finish selections, and bespoke solutions for high-end residential and commercial projects. Aging-in-place design principles drive development of accessible faucets with ergonomic features, lever handles, and sensor activation that accommodate users with mobility limitations. According to MarkWide Research, these trends collectively influence 62% of purchasing decisions in premium market segments.

Recent industry developments demonstrate accelerating innovation and strategic initiatives that reshape Japan’s faucets market landscape. Technology partnerships between faucet manufacturers and smart home platform providers create integrated solutions that enhance user experience and market appeal. Manufacturing automation investments improve production efficiency and quality consistency while reducing labor costs.

Product launches featuring advanced sensor technology, improved water conservation capabilities, and enhanced connectivity options reflect industry commitment to innovation and market leadership. Sustainability initiatives including recycled material usage, carbon-neutral manufacturing processes, and packaging reduction programs address environmental concerns and regulatory requirements.

Market consolidation activities through mergers and acquisitions enable companies to expand product portfolios, distribution networks, and technological capabilities. International expansion strategies focus on Asia-Pacific markets where Japanese quality reputation provides competitive advantages and growth opportunities.

Regulatory compliance investments ensure products meet evolving water efficiency standards, safety requirements, and environmental regulations. Digital transformation initiatives including e-commerce platforms, virtual showrooms, and augmented reality design tools enhance customer engagement and sales effectiveness. Research collaborations with universities and technology institutes accelerate innovation in materials science, sensor technology, and smart home integration capabilities.

Strategic recommendations for Japan’s faucets market participants emphasize innovation investment, market diversification, and operational excellence as key success factors in an increasingly competitive environment. Technology development should prioritize smart home integration, water conservation features, and user experience enhancements that differentiate products and justify premium pricing.

Market expansion strategies should focus on underserved segments including healthcare facilities, senior living communities, and sustainable construction projects where specialized faucet solutions command higher margins. Export development presents significant opportunities for Japanese manufacturers to leverage quality reputation and technological leadership in international markets.

Partnership strategies with smart home platform providers, interior design firms, and construction companies enable integrated solution offerings and expanded market reach. Sustainability initiatives including eco-friendly materials, energy-efficient manufacturing, and circular economy principles align with consumer preferences and regulatory trends.

Digital transformation investments in e-commerce capabilities, virtual showrooms, and customer relationship management systems enhance market competitiveness and operational efficiency. MWR analysis suggests that companies implementing comprehensive digital strategies achieve 23% higher customer satisfaction rates compared to traditional approaches. Workforce development in advanced manufacturing techniques, digital technologies, and customer service excellence supports long-term competitive advantages.

Future market prospects for Japan’s faucets industry indicate continued growth driven by technological innovation, demographic trends, and evolving consumer preferences that create opportunities for forward-thinking manufacturers. Smart faucet adoption is projected to reach 45% market penetration within the next five years as prices decrease and functionality improves through technological advancement.

Market evolution toward integrated water management systems will create opportunities for manufacturers offering comprehensive solutions including faucets, filtration, heating, and monitoring capabilities. Sustainability requirements will intensify, driving demand for water-efficient products and environmentally responsible manufacturing practices that align with Japan’s carbon neutrality goals.

Demographic changes including population aging and urbanization will influence product development priorities toward accessible designs, compact solutions, and automated features that enhance convenience and safety. Commercial market expansion in healthcare, hospitality, and food service sectors will generate consistent demand for specialized faucet solutions with advanced functionality.

International market opportunities will expand as Japanese manufacturers leverage quality reputation and technological expertise to capture market share in developing economies. Innovation cycles will accelerate as manufacturers invest in research and development to maintain competitive advantages in technology-driven market segments. MarkWide Research forecasts that companies embracing these trends will achieve sustained growth rates exceeding industry averages through strategic positioning and operational excellence.

Japan’s faucets market represents a dynamic and sophisticated industry characterized by technological innovation, quality excellence, and evolving consumer preferences that create both opportunities and challenges for market participants. The market benefits from strong domestic demand, premium positioning capabilities, and export potential that leverage Japan’s reputation for manufacturing excellence and product reliability.

Key success factors include continuous innovation investment, strategic market positioning, and operational efficiency improvements that enable companies to compete effectively in both domestic and international markets. The integration of smart technologies, sustainability initiatives, and customer-centric design principles will determine long-term market leadership and profitability.

Future growth prospects remain positive despite demographic challenges and competitive pressures, as technological advancement and market diversification create new opportunities for value creation and market expansion. Companies that successfully balance innovation investment with operational excellence while maintaining focus on customer needs and market trends will achieve sustainable competitive advantages in Japan’s evolving faucets market landscape.

What is a faucet?

A faucet is a device for controlling the flow of liquid, typically water, from a pipe. In the context of the Japan Faucets Market, faucets are essential fixtures used in kitchens, bathrooms, and other areas requiring water access.

What are the key players in the Japan Faucets Market?

Key players in the Japan Faucets Market include TOTO Ltd., LIXIL Corporation, and Kohler Co., which are known for their innovative designs and technology in faucet manufacturing, among others.

What are the growth factors driving the Japan Faucets Market?

The Japan Faucets Market is driven by factors such as increasing urbanization, rising consumer demand for modern bathroom and kitchen designs, and a growing focus on water conservation technologies.

What challenges does the Japan Faucets Market face?

Challenges in the Japan Faucets Market include intense competition among manufacturers, fluctuating raw material prices, and the need to comply with stringent environmental regulations.

What opportunities exist in the Japan Faucets Market?

Opportunities in the Japan Faucets Market include the growing trend of smart home technologies, increasing investments in home renovation, and the rising popularity of eco-friendly products.

What trends are shaping the Japan Faucets Market?

Trends in the Japan Faucets Market include the adoption of touchless faucet technology, the integration of water-saving features, and a shift towards minimalist designs that enhance aesthetic appeal.

Japan Faucets Market

| Segmentation Details | Description |

|---|---|

| Product Type | Kitchen Faucets, Bathroom Faucets, Shower Faucets, Bidet Faucets |

| Material | Stainless Steel, Brass, Plastic, Chrome |

| Technology | Touchless, Thermostatic, Sensor-Activated, Manual |

| End User | Residential, Commercial, Industrial, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Faucets Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at