444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand CRM market represents a rapidly evolving landscape driven by digital transformation initiatives and increasing customer-centric business strategies across various industries. Customer relationship management solutions have become essential tools for Thai businesses seeking to enhance customer engagement, streamline sales processes, and improve overall operational efficiency. The market demonstrates robust growth momentum, with organizations increasingly recognizing the strategic value of comprehensive CRM platforms in maintaining competitive advantages.

Digital adoption across Thailand’s business ecosystem has accelerated significantly, particularly following the global shift toward remote operations and digital-first customer interactions. Small and medium enterprises (SMEs) alongside large corporations are investing heavily in CRM technologies to better understand customer behaviors, personalize marketing campaigns, and optimize sales funnel management. The market exhibits strong growth potential with an estimated 12.5% CAGR projected over the forecast period.

Cloud-based CRM solutions dominate the Thai market landscape, accounting for approximately 68% market share due to their scalability, cost-effectiveness, and ease of implementation. Traditional on-premise deployments continue to serve specific enterprise requirements, particularly in sectors with stringent data security regulations. The market’s evolution reflects Thailand’s broader digital economy transformation and the government’s Thailand 4.0 initiative promoting technological innovation across industries.

The Thailand CRM market refers to the comprehensive ecosystem of customer relationship management software, services, and solutions specifically designed to serve Thai businesses across various sectors. This market encompasses cloud-based platforms, on-premise solutions, mobile CRM applications, and integrated business management systems that enable organizations to manage customer interactions, sales processes, marketing campaigns, and service delivery effectively.

CRM systems in the Thai context serve multiple functions including contact management, lead tracking, sales automation, customer service optimization, and analytics-driven insights. These platforms integrate with existing business infrastructure to provide unified customer views, enabling companies to deliver personalized experiences while improving operational efficiency. The market includes both international vendors adapting their solutions for Thai businesses and local providers developing region-specific functionalities.

Thailand’s CRM market demonstrates exceptional growth potential driven by increasing digitalization across industries and evolving customer expectations. The market benefits from strong government support for digital transformation initiatives and growing awareness among businesses regarding the importance of customer-centric strategies. Small and medium enterprises represent the fastest-growing segment, with adoption rates increasing by approximately 15.8% annually as these organizations seek competitive advantages through improved customer management.

Cloud deployment models continue to gain traction, offering Thai businesses flexible, scalable solutions without significant upfront infrastructure investments. The market landscape features a mix of international technology giants and emerging local providers, creating a competitive environment that drives innovation and competitive pricing. Mobile CRM capabilities have become increasingly important, with over 72% of implementations now including mobile-first features to support Thailand’s mobile-centric business culture.

Integration capabilities with existing enterprise systems, particularly ERP and e-commerce platforms, represent key differentiators in vendor selection processes. Thai businesses increasingly prioritize solutions that offer seamless connectivity with popular local payment systems, social media platforms, and communication tools commonly used in the region.

Market dynamics in Thailand’s CRM sector reveal several critical insights that shape strategic decision-making for both vendors and end-users. The following key insights provide comprehensive understanding of market trends and opportunities:

Digital transformation initiatives across Thailand’s business landscape serve as the primary catalyst driving CRM market expansion. Organizations increasingly recognize that effective customer relationship management directly correlates with revenue growth and competitive positioning. The government’s Thailand 4.0 strategy actively promotes technological adoption, creating favorable conditions for CRM solution deployment across various sectors.

Customer expectations have evolved significantly, with Thai consumers demanding personalized experiences and seamless interactions across multiple touchpoints. This shift compels businesses to invest in sophisticated CRM platforms capable of delivering unified customer views and enabling personalized engagement strategies. The rise of e-commerce and digital channels further amplifies the need for integrated customer management solutions.

Competitive pressures within Thailand’s dynamic business environment drive organizations to seek operational efficiencies and improved customer retention rates. CRM systems provide essential tools for sales process optimization, marketing automation, and customer service enhancement, enabling businesses to maintain competitive advantages in increasingly crowded markets.

Cost optimization requirements encourage businesses to adopt cloud-based CRM solutions that eliminate significant upfront infrastructure investments while providing scalable functionality. The subscription-based pricing models align with cash flow management preferences, particularly among SMEs seeking to minimize capital expenditures while accessing enterprise-grade capabilities.

Implementation complexity represents a significant barrier for many Thai organizations, particularly smaller businesses lacking dedicated IT resources. The process of migrating existing customer data, training staff, and integrating CRM systems with current business processes often proves more challenging and time-consuming than initially anticipated, leading to delayed deployments and reduced adoption rates.

Data security concerns continue to influence purchasing decisions, especially among organizations handling sensitive customer information or operating in regulated industries. Despite advances in cloud security technologies, some businesses remain hesitant to migrate customer data to external platforms, preferring on-premise solutions that offer perceived greater control over data protection.

Limited technical expertise within many Thai organizations constrains effective CRM utilization and optimization. The shortage of skilled professionals capable of configuring, customizing, and maintaining CRM systems often results in underutilized implementations that fail to deliver expected returns on investment.

Integration challenges with legacy systems pose ongoing obstacles for organizations with established IT infrastructure. The complexity and cost associated with connecting CRM platforms to existing ERP, accounting, and operational systems can deter adoption, particularly among businesses with limited IT budgets and resources.

Artificial intelligence integration presents substantial opportunities for CRM vendors targeting the Thai market. Organizations increasingly seek intelligent automation capabilities, predictive analytics, and machine learning-powered insights to enhance customer engagement and sales effectiveness. AI-powered CRM solutions can provide competitive differentiation while addressing the growing demand for data-driven decision-making tools.

Industry-specific solutions offer significant growth potential as Thai businesses seek CRM platforms tailored to their unique operational requirements. Sectors such as healthcare, education, hospitality, and agriculture present opportunities for specialized CRM offerings that address specific regulatory compliance, workflow management, and customer engagement needs.

Mobile-first development aligns with Thailand’s high smartphone adoption rates and mobile-centric business culture. CRM vendors can capitalize on this trend by developing native mobile applications and responsive web interfaces that enable field sales teams, customer service representatives, and management personnel to access critical customer information from any location.

Partnership opportunities with local system integrators, consulting firms, and technology distributors can accelerate market penetration and provide essential localization expertise. These collaborations enable international CRM vendors to better understand Thai business practices while offering local partners access to advanced technology platforms and global best practices.

Competitive dynamics within Thailand’s CRM market reflect a balance between established international vendors and emerging local providers. Global technology companies leverage their extensive feature sets and proven track records, while local vendors compete through specialized regional knowledge, competitive pricing, and personalized customer support. This dynamic creates opportunities for businesses to select solutions that best align with their specific requirements and budget constraints.

Technology evolution continues to reshape market expectations and vendor capabilities. The integration of artificial intelligence, machine learning, and advanced analytics transforms traditional CRM platforms into comprehensive customer intelligence systems. MarkWide Research indicates that organizations utilizing advanced CRM analytics experience 31% improved customer retention rates compared to basic implementations.

Customer behavior patterns increasingly influence CRM feature development and market positioning strategies. Thai consumers’ preference for social media engagement, mobile interactions, and personalized experiences drives demand for CRM solutions capable of managing omnichannel customer journeys effectively. This trend encourages vendors to develop integrated social CRM capabilities and mobile-optimized interfaces.

Regulatory considerations surrounding data protection and privacy compliance create both challenges and opportunities within the market. Organizations must ensure their CRM implementations align with Thailand’s Personal Data Protection Act and other relevant regulations, creating demand for solutions with built-in compliance features and data governance capabilities.

Primary research methodologies employed in analyzing Thailand’s CRM market include comprehensive surveys of business decision-makers across various industries, in-depth interviews with CRM vendors and system integrators, and focus group discussions with end-users representing different organizational sizes and sectors. These direct engagement approaches provide valuable insights into market trends, adoption patterns, and future requirements.

Secondary research sources encompass industry reports, government publications, vendor documentation, and academic studies related to customer relationship management technologies and digital transformation initiatives in Thailand. This comprehensive approach ensures balanced perspectives and validates primary research findings through multiple data sources.

Market analysis techniques include competitive landscape mapping, technology trend assessment, and adoption pattern analysis across different industry verticals. Quantitative analysis methods examine market size calculations, growth projections, and segmentation patterns, while qualitative assessments focus on strategic implications and emerging opportunities.

Data validation processes involve cross-referencing multiple sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis methods to ensure research accuracy and reliability. This rigorous approach supports confident market projections and strategic recommendations for industry participants.

Bangkok metropolitan area dominates Thailand’s CRM market, accounting for approximately 52% of total adoption due to its concentration of large enterprises, multinational corporations, and technology-forward businesses. The capital region benefits from advanced telecommunications infrastructure, skilled workforce availability, and proximity to vendor support services, creating favorable conditions for CRM implementation and optimization.

Eastern Economic Corridor regions, including Chonburi, Rayong, and Chachoengsao provinces, represent rapidly growing CRM adoption areas driven by industrial development and manufacturing expansion. These regions show increasing demand for CRM solutions that integrate with production planning and supply chain management systems, reflecting the area’s focus on advanced manufacturing and export-oriented industries.

Northern Thailand, particularly around Chiang Mai and Chiang Rai, demonstrates growing CRM adoption among tourism, agriculture, and handicraft businesses. The region’s focus on sustainable tourism and agricultural innovation creates opportunities for specialized CRM solutions that address unique customer engagement requirements in these sectors.

Southern provinces show increasing CRM adoption within tourism, hospitality, and marine industries. The region’s economic dependence on tourism drives demand for customer experience management solutions capable of handling seasonal fluctuations and international customer requirements. Regional distribution patterns indicate that coastal provinces lead adoption rates within the southern region, reflecting their tourism industry concentration.

Market leadership in Thailand’s CRM sector features a diverse mix of international technology giants and specialized regional providers. The competitive environment encourages innovation while maintaining competitive pricing structures that benefit end-users across various organizational sizes and industries.

Competitive strategies focus on localization capabilities, pricing flexibility, and industry-specific functionality. International vendors increasingly partner with local system integrators to provide enhanced support and customization services, while regional providers leverage their understanding of Thai business culture and regulatory requirements to compete effectively against global alternatives.

Deployment model segmentation reveals distinct preferences across different organizational types and industries. Cloud-based solutions maintain dominant market position due to their scalability and cost-effectiveness, while on-premise deployments serve specific enterprise requirements related to data security and regulatory compliance.

By Deployment Type:

By Organization Size:

By Industry Vertical:

Sales automation category represents the most mature segment within Thailand’s CRM market, with organizations prioritizing lead management, opportunity tracking, and sales pipeline optimization. Thai businesses increasingly recognize that automated sales processes improve efficiency while reducing manual errors and administrative overhead. This category shows consistent growth with approximately 89% of CRM implementations including sales automation features.

Marketing automation capabilities gain increasing importance as Thai businesses seek to improve campaign effectiveness and customer engagement rates. Email marketing integration, social media management, and lead nurturing workflows become standard requirements for organizations looking to optimize their marketing investments and improve conversion rates.

Customer service management emerges as a critical differentiator, with Thai consumers expecting responsive, personalized support across multiple channels. CRM solutions incorporating ticketing systems, knowledge bases, and service level agreement tracking help organizations deliver superior customer experiences while managing support costs effectively.

Analytics and reporting functionality becomes increasingly sophisticated, with 56% of users actively utilizing advanced analytics features to gain customer insights and optimize business strategies. Thai organizations particularly value dashboards and reporting tools that provide real-time visibility into sales performance, customer satisfaction metrics, and marketing campaign effectiveness.

Operational efficiency improvements represent primary benefits for Thai businesses implementing CRM solutions. Organizations typically experience streamlined sales processes, reduced administrative overhead, and improved customer data management that enables more effective resource allocation and strategic decision-making. These efficiency gains translate directly into cost savings and improved profitability.

Enhanced customer relationships result from improved visibility into customer interactions, preferences, and purchase history. Thai businesses can deliver more personalized experiences, anticipate customer needs, and proactively address service issues, leading to increased customer satisfaction and loyalty. Customer retention rates typically improve by 23% following effective CRM implementation.

Sales performance optimization enables organizations to identify high-value opportunities, track sales team productivity, and implement data-driven sales strategies. CRM platforms provide valuable insights into sales cycle patterns, conversion rates, and customer acquisition costs that support more effective sales management and forecasting accuracy.

Scalability advantages allow growing Thai businesses to expand their customer management capabilities without proportional increases in administrative overhead. Cloud-based CRM solutions particularly benefit SMEs by providing enterprise-grade functionality at affordable subscription rates, enabling competitive positioning against larger organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the dominant trend shaping Thailand’s CRM market evolution. Organizations increasingly seek intelligent automation capabilities, predictive analytics, and machine learning-powered customer insights to enhance engagement effectiveness and sales performance. AI-enabled features such as chatbots, lead scoring, and automated customer segmentation become standard expectations rather than premium add-ons.

Mobile-first design reflects Thailand’s mobile-centric business culture and high smartphone penetration rates. CRM vendors prioritize responsive web interfaces and native mobile applications that enable field sales teams, customer service representatives, and management personnel to access critical customer information from any location. This trend drives development of offline synchronization capabilities and touch-optimized user interfaces.

Social CRM capabilities gain prominence as Thai businesses recognize the importance of social media engagement in customer relationship management. Integration with popular platforms such as Facebook, LINE, and Instagram enables organizations to monitor social conversations, engage customers directly, and incorporate social insights into customer profiles and marketing strategies.

Industry-specific solutions become increasingly important as Thai businesses seek CRM platforms tailored to their unique operational requirements. Healthcare providers need patient relationship management features, educational institutions require student lifecycle management, and hospitality businesses demand reservation and guest experience management capabilities integrated within their CRM systems.

Strategic partnerships between international CRM vendors and Thai system integrators accelerate market penetration while providing essential localization expertise. These collaborations enable global technology companies to better understand local business practices while offering partners access to advanced platforms and implementation methodologies. Recent partnerships focus on industry-specific solutions and vertical market expansion.

Product localization initiatives address the growing demand for Thai language support and local business practice integration. Major CRM vendors invest in translation services, local currency support, and integration with popular Thai payment systems and communication platforms. These developments reduce adoption barriers and improve user experience for Thai organizations.

Cloud infrastructure expansion by major technology providers enhances service delivery and data sovereignty options for Thai businesses. Local data center establishments improve performance, reduce latency, and address data residency requirements that influence purchasing decisions among security-conscious organizations and regulated industries.

Regulatory compliance enhancements respond to Thailand’s Personal Data Protection Act and other privacy regulations affecting customer data management. CRM vendors develop built-in compliance features, data governance tools, and audit capabilities that help organizations maintain regulatory compliance while maximizing customer data utilization for business insights.

Vendor recommendations emphasize the importance of localization strategies that go beyond simple language translation to encompass Thai business practices, cultural preferences, and regulatory requirements. MarkWide Research analysis suggests that CRM providers investing in comprehensive localization experience 34% higher adoption rates compared to those offering generic international solutions.

Implementation strategies should prioritize phased deployment approaches that allow organizations to gradually expand CRM functionality while building internal expertise and user confidence. Starting with core sales automation features before adding marketing automation and customer service capabilities reduces implementation complexity and improves success rates.

Training and support programs require special attention to address Thailand’s limited technical expertise in CRM systems. Vendors should invest in local training resources, user documentation in Thai language, and ongoing support services that help organizations maximize their CRM investments and achieve desired business outcomes.

Integration planning must account for the diverse technology landscape within Thai businesses, including legacy systems, local software applications, and popular communication platforms. CRM solutions offering flexible integration capabilities and pre-built connectors for common Thai business applications will achieve higher market acceptance and customer satisfaction.

Market evolution in Thailand’s CRM sector points toward continued robust growth driven by ongoing digital transformation initiatives and increasing customer experience focus across industries. The market is expected to maintain strong momentum with projected growth rates of 12.5% CAGR over the next five years, supported by expanding SME adoption and advanced feature development.

Technology advancement will continue reshaping market expectations and vendor capabilities. Artificial intelligence, machine learning, and advanced analytics will become standard features rather than premium add-ons, while emerging technologies such as voice interfaces and augmented reality begin appearing in specialized CRM applications. These developments will create new opportunities for differentiation and competitive positioning.

Market consolidation may occur as smaller vendors struggle to compete with the comprehensive feature sets and global resources of major CRM providers. However, opportunities remain for specialized regional vendors that can offer superior localization, industry-specific functionality, or innovative approaches to customer relationship management in the Thai context.

Regional expansion potential exists for successful CRM implementations in Thailand to serve as models for broader ASEAN market penetration. Thai businesses’ experience with CRM technologies and vendors’ understanding of regional requirements can facilitate expansion into neighboring markets with similar business cultures and development patterns. Cross-border opportunities may drive additional investment and innovation within Thailand’s CRM ecosystem.

Thailand’s CRM market represents a dynamic and rapidly evolving landscape characterized by strong growth potential, increasing digital adoption, and evolving customer expectations. The market benefits from favorable government policies, robust digital infrastructure, and a growing recognition among Thai businesses of the strategic importance of effective customer relationship management. Cloud-based solutions dominate the market with 68% adoption rates, while mobile-first capabilities and AI integration emerge as key differentiators.

Market opportunities remain substantial, particularly among small and medium enterprises that represent the fastest-growing segment with 15.8% annual adoption increases. The combination of affordable cloud solutions, simplified implementation processes, and growing competitive pressures creates favorable conditions for continued CRM market expansion across various industry sectors.

Success factors for vendors and organizations include comprehensive localization strategies, effective integration capabilities, and ongoing investment in user training and support. The market rewards solutions that address specific Thai business requirements while providing scalable functionality that supports organizational growth and evolution. As Thailand continues its digital transformation journey, the CRM market will play an increasingly critical role in enabling businesses to build stronger customer relationships and achieve sustainable competitive advantages in an evolving economic landscape.

What is CRM?

CRM, or Customer Relationship Management, refers to strategies and technologies that companies use to manage interactions with customers and potential customers. It encompasses various tools and practices aimed at improving business relationships, enhancing customer satisfaction, and driving sales growth.

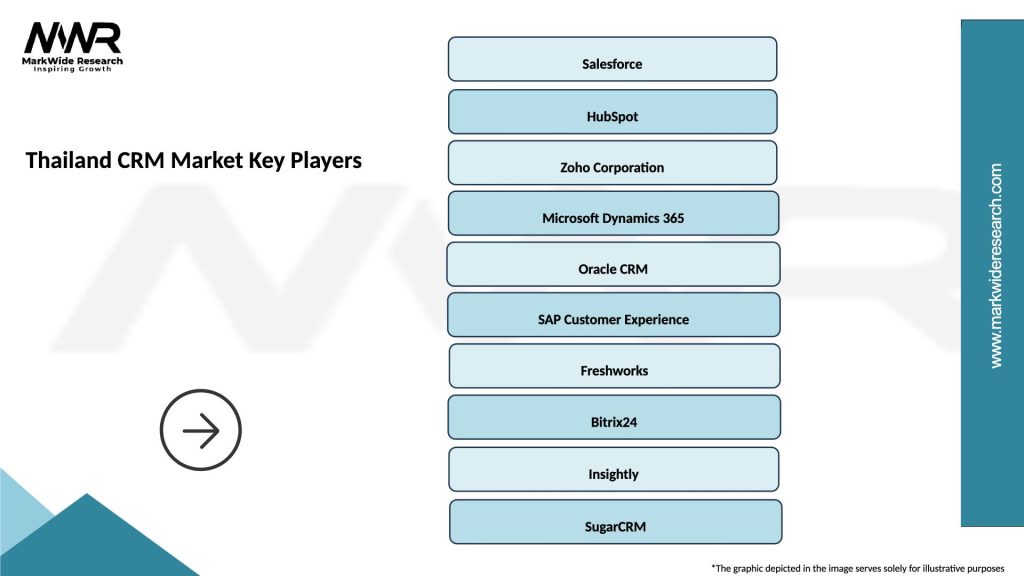

What are the key players in the Thailand CRM Market?

Key players in the Thailand CRM Market include Salesforce, HubSpot, and Zoho, which offer a range of CRM solutions tailored to different business needs. These companies provide tools for sales automation, customer service, and marketing, among others.

What are the growth factors driving the Thailand CRM Market?

The Thailand CRM Market is driven by increasing digital transformation among businesses, the growing need for personalized customer experiences, and the rise of e-commerce. Additionally, the demand for data analytics and customer insights is propelling market growth.

What challenges does the Thailand CRM Market face?

Challenges in the Thailand CRM Market include data privacy concerns, the complexity of integrating CRM systems with existing technologies, and the need for continuous training and support for users. These factors can hinder the effective implementation of CRM solutions.

What opportunities exist in the Thailand CRM Market?

Opportunities in the Thailand CRM Market include the expansion of cloud-based CRM solutions, the integration of artificial intelligence for enhanced customer insights, and the growing trend of mobile CRM applications. These developments can help businesses improve customer engagement and operational efficiency.

What trends are shaping the Thailand CRM Market?

Trends shaping the Thailand CRM Market include the increasing adoption of omnichannel strategies, the use of automation in customer interactions, and the focus on customer experience management. Companies are also leveraging social media and analytics to enhance their CRM efforts.

Thailand CRM Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Retail, Hospitality, Education, Healthcare |

| Solution | Sales Automation, Marketing Automation, Customer Support, Analytics |

| Customer Type | Small Businesses, Medium Enterprises, Large Corporations, Nonprofits |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand CRM Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at