444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States chemical logistics market represents a critical component of the nation’s industrial supply chain infrastructure, facilitating the safe and efficient transportation, storage, and distribution of chemical products across diverse industries. Chemical logistics encompasses specialized services designed to handle hazardous and non-hazardous chemical materials, ensuring compliance with stringent regulatory requirements while maintaining operational efficiency. The market has experienced robust growth driven by expanding chemical manufacturing activities, increasing demand for specialty chemicals, and growing emphasis on supply chain optimization.

Market dynamics indicate that the sector is witnessing significant transformation through technological advancement and regulatory evolution. The integration of digital technologies, enhanced safety protocols, and sustainable logistics practices has positioned the market for continued expansion. Industrial growth across pharmaceuticals, petrochemicals, agriculture, and manufacturing sectors continues to drive demand for specialized chemical logistics services, with companies seeking comprehensive solutions that address both operational efficiency and regulatory compliance requirements.

Regional distribution shows concentrated activity in key industrial corridors, particularly along the Gulf Coast, Great Lakes region, and major metropolitan areas where chemical manufacturing facilities are clustered. The market benefits from extensive transportation infrastructure, including specialized rail networks, pipeline systems, and port facilities designed for chemical handling. Growth projections suggest the market will maintain steady expansion at approximately 6.2% CAGR through the forecast period, supported by increasing chemical production and evolving logistics requirements.

The United States chemical logistics market refers to the comprehensive ecosystem of specialized transportation, warehousing, and distribution services designed to handle chemical products safely and efficiently throughout the supply chain. This market encompasses third-party logistics providers, transportation companies, storage facilities, and integrated service providers that offer end-to-end solutions for chemical manufacturers, distributors, and end-users across various industries.

Chemical logistics involves complex operations requiring specialized equipment, trained personnel, and strict adherence to safety and environmental regulations. The market includes services such as bulk chemical transportation, hazardous material handling, temperature-controlled storage, inventory management, and regulatory compliance support. Service providers must maintain certifications and capabilities to handle diverse chemical categories, from basic industrial chemicals to highly specialized pharmaceutical intermediates and agricultural formulations.

Market participants range from large multinational logistics companies with comprehensive chemical handling capabilities to specialized regional providers focusing on specific chemical categories or geographic areas. The market’s complexity stems from the need to balance operational efficiency with stringent safety requirements, environmental protection measures, and evolving regulatory frameworks that govern chemical transportation and storage activities.

Strategic analysis reveals that the United States chemical logistics market is positioned for sustained growth, driven by expanding chemical manufacturing activities and increasing demand for specialized logistics services. The market demonstrates strong fundamentals supported by robust industrial activity, technological advancement, and growing emphasis on supply chain optimization across chemical-dependent industries.

Key growth drivers include the resurgence of domestic chemical manufacturing, particularly in petrochemicals and specialty chemicals, which has increased demand for reliable logistics services. The market benefits from infrastructure investments in transportation networks, storage facilities, and digital technologies that enhance operational efficiency and safety compliance. Regulatory compliance requirements continue to drive demand for specialized service providers with expertise in hazardous material handling and environmental protection.

Market segmentation shows diverse service categories including bulk liquid transportation, packaged chemical distribution, hazardous material handling, and integrated supply chain solutions. Geographic distribution reflects concentration in major industrial regions, with approximately 35% market share concentrated in Gulf Coast states where petrochemical production is prominent. Competitive dynamics feature both large integrated logistics providers and specialized chemical handling companies, creating a diverse service landscape that addresses varied customer requirements.

Market intelligence indicates several critical insights shaping the United States chemical logistics landscape. Digital transformation is revolutionizing traditional logistics operations through implementation of advanced tracking systems, predictive analytics, and automated inventory management solutions that enhance visibility and operational efficiency.

According to MarkWide Research, the market is experiencing increased adoption of specialized equipment and facilities designed for specific chemical categories, reflecting the growing sophistication of chemical logistics operations and customer requirements for specialized handling capabilities.

Primary growth drivers propelling the United States chemical logistics market include the expansion of domestic chemical manufacturing capacity and increasing complexity of chemical supply chains. The reshoring trend in chemical production has created new demand for logistics services as companies establish or expand manufacturing operations within the United States to reduce supply chain risks and improve market responsiveness.

Industrial growth across key end-use sectors continues to drive demand for chemical logistics services. The pharmaceutical industry’s expansion, particularly in biotechnology and specialty pharmaceuticals, requires sophisticated logistics capabilities for handling temperature-sensitive and high-value chemical intermediates. Agricultural sector growth drives demand for fertilizer and crop protection chemical distribution services, while expanding manufacturing activities across automotive, electronics, and consumer goods industries increase requirements for industrial chemical logistics.

Regulatory compliance requirements serve as a significant market driver, as companies seek specialized service providers with expertise in navigating complex regulatory frameworks. Environmental regulations governing chemical transportation and storage continue to evolve, creating demand for logistics providers with advanced compliance capabilities and environmental management systems. Safety standards improvements drive investment in specialized equipment and training programs, supporting market growth through enhanced service capabilities.

Technology advancement enables new service offerings and operational efficiencies that drive market expansion. Digital platforms improve supply chain visibility and enable predictive maintenance programs that reduce operational disruptions. Automation technologies in warehousing and transportation enhance operational efficiency while improving safety outcomes, making chemical logistics services more attractive to potential customers.

Significant challenges facing the United States chemical logistics market include stringent regulatory requirements that increase operational complexity and compliance costs. Regulatory burden associated with hazardous material transportation and storage requires substantial investments in specialized equipment, training, and certification programs, creating barriers to entry for new service providers and increasing operational costs for existing participants.

Infrastructure limitations in certain regions constrain market growth, particularly in areas where transportation networks lack adequate capacity for chemical transportation or where storage facilities require significant upgrades to meet current safety and environmental standards. Capital intensity of chemical logistics operations requires substantial investments in specialized equipment, facilities, and technology systems, limiting the ability of smaller companies to compete effectively in the market.

Safety concerns and potential liability exposure create ongoing challenges for market participants. Incident risks associated with chemical transportation and storage require comprehensive insurance coverage and risk management programs that increase operational costs. Public perception issues related to chemical transportation can create community resistance to facility development and route expansion, limiting growth opportunities in certain geographic areas.

Skilled workforce shortages present ongoing challenges as the industry requires specialized training and certification for personnel handling chemical materials. Labor costs continue to increase as companies compete for qualified drivers, warehouse operators, and technical specialists with chemical handling expertise. Economic volatility in chemical markets can create demand fluctuations that impact logistics service utilization and pricing stability.

Emerging opportunities in the United States chemical logistics market include the growing demand for specialized services supporting the expansion of domestic chemical manufacturing capacity. Nearshoring trends are creating opportunities for logistics providers to develop new service offerings and expand geographic coverage as chemical companies establish operations closer to end markets to improve supply chain resilience and reduce transportation costs.

Technology integration presents significant opportunities for service enhancement and operational efficiency improvements. Digital transformation initiatives enable development of advanced tracking and monitoring systems that provide real-time visibility into chemical shipments and inventory levels. Predictive analytics capabilities allow for proactive maintenance scheduling and route optimization that reduce costs and improve service reliability.

Sustainability initiatives create opportunities for logistics providers to differentiate their services through environmental responsibility programs. Green logistics solutions including alternative fuel vehicles, energy-efficient facilities, and waste reduction programs appeal to environmentally conscious customers and may qualify for regulatory incentives. Circular economy principles present opportunities for developing specialized services supporting chemical recycling and waste-to-energy initiatives.

Market expansion opportunities exist in underserved geographic regions and emerging chemical industry segments. Specialty chemicals growth creates demand for customized logistics solutions with enhanced handling capabilities and quality control measures. E-commerce growth in chemical distribution presents opportunities for developing last-mile delivery services and small-package handling capabilities tailored to chemical products.

Complex market dynamics characterize the United States chemical logistics sector, with multiple factors influencing supply and demand patterns. Supply chain integration trends are driving chemical companies to seek comprehensive logistics partnerships that provide end-to-end visibility and control over product movement from manufacturing facilities to end customers.

Competitive pressures are intensifying as logistics providers expand service capabilities and geographic coverage to capture market share. Service differentiation has become increasingly important as customers seek specialized capabilities for handling specific chemical categories or meeting unique operational requirements. Price competition remains significant in commodity chemical transportation, while specialty chemical logistics commands premium pricing for specialized services.

Regulatory dynamics continue to evolve with new safety and environmental requirements that impact operational procedures and equipment specifications. Compliance costs represent approximately 12-15% of total operational expenses for major chemical logistics providers, reflecting the significant investment required to maintain regulatory compliance. Technology adoption is accelerating as companies seek to improve operational efficiency and reduce compliance burden through automated monitoring and reporting systems.

Customer relationship dynamics are shifting toward longer-term partnerships as chemical companies seek to reduce supply chain risks and improve operational predictability. Service level agreements are becoming more sophisticated, incorporating performance metrics related to safety, environmental compliance, and operational efficiency. Value-added services including inventory management, quality control, and regulatory support are becoming increasingly important differentiators in customer selection processes.

Comprehensive research methodology employed in analyzing the United States chemical logistics market incorporates multiple data sources and analytical approaches to ensure accuracy and completeness of market insights. Primary research activities include extensive interviews with industry executives, logistics service providers, chemical manufacturers, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, regulatory filings, company annual reports, and trade association data to validate primary research findings and identify additional market trends. Quantitative analysis includes examination of transportation statistics, facility capacity data, and economic indicators that influence chemical logistics demand patterns.

Market segmentation analysis employs multiple classification criteria including service type, chemical category, end-use industry, and geographic region to provide comprehensive market understanding. Competitive analysis incorporates evaluation of service capabilities, geographic coverage, customer base, and strategic positioning of major market participants.

Trend analysis utilizes historical data spanning multiple years to identify growth patterns and cyclical variations in market demand. Forecasting methodology combines statistical modeling with expert judgment to project future market developments under various economic and regulatory scenarios. Data validation processes ensure accuracy and consistency of research findings through cross-referencing multiple sources and expert review procedures.

Geographic distribution of the United States chemical logistics market reflects the concentration of chemical manufacturing activities and transportation infrastructure across key industrial regions. Gulf Coast region dominates market activity with approximately 40% market share, driven by extensive petrochemical manufacturing facilities and specialized port infrastructure for chemical imports and exports.

Great Lakes region represents the second-largest market segment with 22% market share, supported by diverse chemical manufacturing activities and excellent transportation connectivity through rail, water, and highway networks. Industrial concentration in states including Ohio, Michigan, and Illinois creates substantial demand for chemical logistics services across multiple industry sectors.

Northeast corridor accounts for 18% market share, characterized by high-value specialty chemical production and proximity to major population centers that drive demand for chemical products. Pharmaceutical manufacturing concentration in New Jersey and Pennsylvania creates specialized logistics requirements for temperature-controlled and high-security transportation services.

Western regions including California and the Pacific Northwest represent 12% market share, with growth driven by expanding agricultural chemical demand and emerging biotechnology industries. Regulatory environment in California creates demand for specialized compliance services and environmentally responsible logistics solutions. Remaining regions account for 8% market share but show potential for growth as chemical manufacturing activities expand into new geographic areas seeking cost advantages and improved market access.

Competitive structure of the United States chemical logistics market features a diverse mix of large integrated logistics providers, specialized chemical handling companies, and regional service providers. Market leadership is distributed among several major players with comprehensive service capabilities and national geographic coverage.

Competitive differentiation focuses on service specialization, safety performance, technology capabilities, and geographic coverage. Market consolidation continues through strategic acquisitions and partnerships as companies seek to expand service capabilities and achieve operational scale advantages.

Market segmentation of the United States chemical logistics market reveals diverse service categories and customer requirements across multiple dimensions. Service type segmentation includes transportation services, warehousing and storage, inventory management, and value-added services such as packaging and quality control.

By Transportation Mode:

By Chemical Category:

By End-Use Industry:

Transportation services represent the largest segment of the chemical logistics market, with truck transportation accounting for approximately 55% of total transportation volume due to its flexibility and ability to provide door-to-door service for packaged chemicals. Rail transportation serves as the backbone for bulk chemical movements, particularly for petrochemicals and basic industrial chemicals where cost efficiency is paramount.

Warehousing and storage services have evolved to include sophisticated inventory management systems and specialized facilities designed for specific chemical categories. Temperature-controlled storage represents a growing segment driven by pharmaceutical and specialty chemical requirements. Hazardous material storage requires specialized facilities with enhanced safety systems and environmental protection measures.

Value-added services are becoming increasingly important as chemical companies seek to outsource non-core logistics activities. Packaging and repackaging services allow chemical manufacturers to serve diverse customer requirements without maintaining multiple packaging lines. Quality control services including sampling and testing provide assurance of product integrity throughout the supply chain.

Technology services including track-and-trace capabilities, inventory visibility, and automated reporting systems are becoming standard requirements for chemical logistics providers. Digital integration with customer systems enables real-time information sharing and improved supply chain coordination. Predictive analytics capabilities help optimize routing, scheduling, and maintenance activities to improve operational efficiency and reduce costs.

Chemical manufacturers benefit from specialized logistics services through improved supply chain efficiency, reduced operational complexity, and enhanced regulatory compliance. Cost optimization is achieved through economies of scale and specialized equipment utilization that would be difficult to achieve with internal logistics operations. Risk mitigation benefits include professional handling of hazardous materials and comprehensive insurance coverage provided by experienced logistics providers.

Logistics service providers benefit from stable demand patterns and premium pricing for specialized chemical handling services. Market differentiation opportunities exist through development of specialized capabilities and technology platforms that address unique customer requirements. Long-term partnerships with chemical companies provide revenue stability and opportunities for service expansion.

End-use industries benefit from reliable chemical supply chains that support production continuity and quality consistency. Just-in-time delivery capabilities reduce inventory carrying costs while ensuring material availability for production processes. Regulatory compliance support helps end-users navigate complex requirements for chemical handling and storage.

Economic stakeholders benefit from job creation in transportation, warehousing, and support services sectors. Infrastructure development associated with chemical logistics facilities creates construction and maintenance employment opportunities. Tax revenue generation from logistics operations and facility investments supports local and state government budgets. Trade facilitation through efficient chemical logistics supports export competitiveness and import efficiency for domestic industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the United States chemical logistics market, with companies investing heavily in advanced technology platforms that provide real-time visibility, predictive analytics, and automated reporting capabilities. Internet of Things sensors and tracking devices enable continuous monitoring of chemical shipments, providing unprecedented visibility into product location, condition, and handling history.

Sustainability initiatives are gaining momentum as chemical companies and logistics providers respond to environmental regulations and customer expectations for responsible supply chain practices. Alternative fuel vehicles including electric and hydrogen-powered trucks are being tested for chemical transportation applications. Carbon footprint reduction programs focus on route optimization, modal shift strategies, and energy-efficient facility operations.

Service integration trends show increasing demand for comprehensive supply chain solutions that combine transportation, warehousing, inventory management, and value-added services under single-provider arrangements. MWR analysis indicates that approximately 68% of chemical companies prefer integrated service providers over multiple specialized vendors to reduce complexity and improve coordination.

Safety technology advancement continues with implementation of advanced monitoring systems, automated safety protocols, and enhanced driver training programs. Predictive maintenance systems use sensor data and analytics to prevent equipment failures and reduce safety risks. Emergency response capabilities are being enhanced through improved communication systems and specialized response teams positioned at strategic locations.

Strategic acquisitions and partnerships are reshaping the competitive landscape as logistics providers seek to expand service capabilities and geographic coverage. Technology investments in digital platforms and automation systems are enabling new service offerings and operational efficiencies that differentiate market leaders from traditional providers.

Infrastructure development projects include construction of new chemical storage facilities, expansion of rail terminal capacity, and upgrades to port facilities handling chemical imports and exports. Pipeline infrastructure investments are expanding capacity for liquid chemical transportation, particularly in regions with growing petrochemical production.

Regulatory developments include updated safety standards for chemical transportation equipment and enhanced environmental protection requirements for storage facilities. Compliance technology solutions are being developed to automate regulatory reporting and ensure consistent adherence to evolving requirements.

Workforce development initiatives address skilled labor shortages through enhanced training programs, apprenticeship opportunities, and partnerships with educational institutions. Safety training programs are being expanded to address new chemical categories and emerging transportation technologies. Diversity and inclusion programs aim to expand the talent pool and improve workforce representation in chemical logistics operations.

Strategic recommendations for chemical logistics market participants emphasize the importance of technology investment and service differentiation to maintain competitive advantage. Digital transformation initiatives should focus on customer-facing platforms that provide real-time visibility and automated reporting capabilities that reduce administrative burden for chemical companies.

Capacity expansion strategies should prioritize high-growth segments including specialty chemicals and pharmaceutical logistics where premium pricing is sustainable. Geographic expansion into emerging chemical manufacturing regions presents opportunities for early market entry and customer relationship development. Service integration capabilities should be developed to provide comprehensive supply chain solutions that address multiple customer requirements.

Safety and compliance investments should exceed minimum regulatory requirements to establish market leadership and reduce liability risks. Environmental responsibility programs should be implemented proactively to address customer expectations and potential regulatory changes. Workforce development initiatives should focus on attracting and retaining skilled personnel through competitive compensation and career advancement opportunities.

Partnership strategies should include collaboration with technology providers, equipment manufacturers, and chemical companies to develop innovative solutions and expand market reach. Acquisition opportunities should be evaluated based on strategic fit, geographic coverage, and specialized capabilities that complement existing service offerings. Financial management should focus on maintaining adequate capital reserves for equipment replacement and facility upgrades while optimizing operational efficiency.

Long-term prospects for the United States chemical logistics market remain positive, supported by continued growth in domestic chemical manufacturing and increasing complexity of supply chain requirements. Technology advancement will continue to drive operational improvements and enable new service offerings that enhance customer value and competitive differentiation.

Market expansion is expected to continue at a steady pace with projected growth of approximately 6.5% CAGR over the next five years, driven by increasing chemical production, expanding end-use applications, and growing demand for specialized logistics services. Regional growth patterns will likely favor areas with new chemical manufacturing investments and improved transportation infrastructure.

Regulatory evolution will continue to shape market dynamics through enhanced safety requirements, environmental protection measures, and technology standards that influence operational procedures and equipment specifications. Compliance costs are expected to increase but will be offset by operational efficiencies and premium pricing for specialized services.

Competitive dynamics will likely favor companies with strong technology capabilities, comprehensive service offerings, and proven safety performance. Market consolidation may accelerate as companies seek scale advantages and expanded geographic coverage. Innovation opportunities in automation, sustainability, and digital services will create new avenues for growth and differentiation in the evolving chemical logistics landscape.

The United States chemical logistics market represents a dynamic and essential component of the nation’s industrial infrastructure, providing specialized services that enable safe and efficient movement of chemical products across diverse industries. Market fundamentals remain strong, supported by expanding domestic chemical manufacturing, technological advancement, and growing emphasis on supply chain optimization and regulatory compliance.

Growth prospects are favorable with multiple drivers including manufacturing reshoring trends, specialty chemical expansion, and increasing demand for integrated logistics solutions. Technology integration and sustainability initiatives present significant opportunities for service enhancement and competitive differentiation. Regulatory compliance requirements, while challenging, create barriers to entry that protect established market participants with proven capabilities.

Strategic success in this market requires substantial investments in specialized equipment, technology platforms, and skilled personnel, along with unwavering commitment to safety and environmental responsibility. Market participants that can effectively balance operational efficiency with regulatory compliance while providing superior customer service are positioned to capture the substantial opportunities available in this growing and evolving market segment.

What is Chemical Logistics?

Chemical logistics refers to the specialized transportation, storage, and distribution of chemical products. This includes managing hazardous materials, ensuring compliance with safety regulations, and optimizing supply chain processes for various chemical industries.

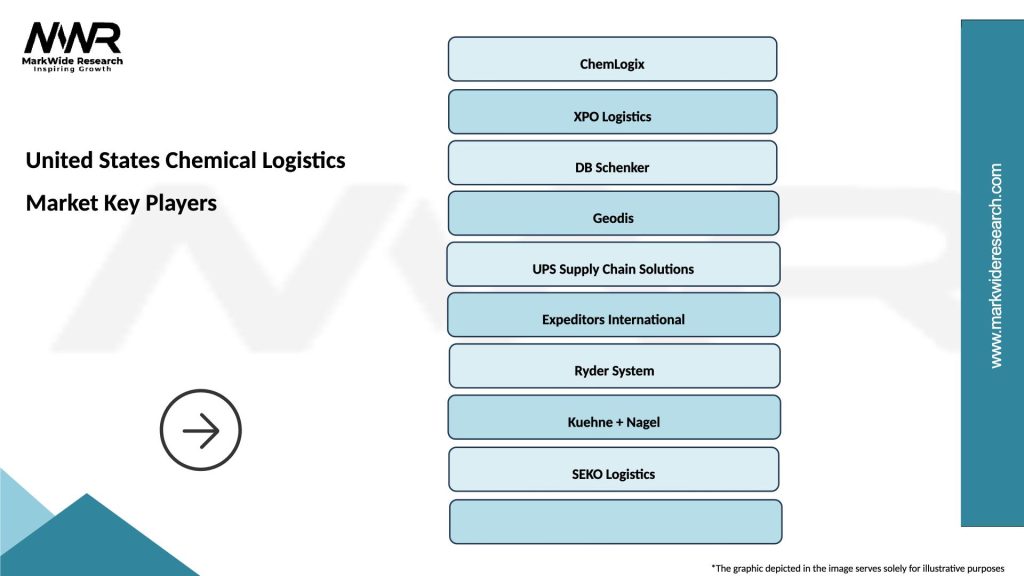

What are the key players in the United States Chemical Logistics Market?

Key players in the United States Chemical Logistics Market include companies like DHL Supply Chain, XPO Logistics, and C.H. Robinson. These companies provide a range of services including transportation, warehousing, and supply chain management for chemical products, among others.

What are the main drivers of growth in the United States Chemical Logistics Market?

The main drivers of growth in the United States Chemical Logistics Market include the increasing demand for chemical products in various industries, advancements in logistics technology, and the need for efficient supply chain solutions. Additionally, regulatory compliance and safety standards are pushing companies to invest in specialized logistics services.

What challenges does the United States Chemical Logistics Market face?

The United States Chemical Logistics Market faces challenges such as stringent regulatory requirements, the complexity of transporting hazardous materials, and fluctuating fuel prices. These factors can impact operational efficiency and increase costs for logistics providers.

What opportunities exist in the United States Chemical Logistics Market?

Opportunities in the United States Chemical Logistics Market include the growth of e-commerce in the chemical sector, the expansion of green logistics practices, and the integration of advanced technologies like IoT and AI for better supply chain management. These trends can enhance efficiency and sustainability in logistics operations.

What trends are shaping the United States Chemical Logistics Market?

Trends shaping the United States Chemical Logistics Market include the increasing focus on sustainability, the adoption of digital logistics solutions, and the rise of automation in warehousing and transportation. These trends are driving innovation and improving the overall efficiency of chemical logistics.

United States Chemical Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bulk Chemicals, Specialty Chemicals, Petrochemicals, Agrochemicals |

| Packaging Type | Drums, IBCs, Tank Containers, Flexitanks |

| End Use Industry | Pharmaceuticals, Agriculture, Food & Beverage, Personal Care |

| Service Type | Transportation, Warehousing, Distribution, Inventory Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Chemical Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at