444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The dry cleaning and laundry market represents a vital service industry that has evolved significantly over the past decade, driven by changing consumer lifestyles, urbanization trends, and technological advancements. This comprehensive market encompasses traditional dry cleaning services, commercial laundry operations, coin-operated laundromats, and emerging on-demand laundry solutions that cater to diverse customer segments across residential and commercial sectors.

Market dynamics indicate robust growth potential, with the industry experiencing a compound annual growth rate (CAGR) of 4.8% as consumers increasingly prioritize convenience and professional garment care. The sector has witnessed substantial transformation through digital integration, eco-friendly cleaning solutions, and innovative service delivery models that address modern consumer preferences for time-saving and sustainable options.

Geographic expansion patterns reveal significant opportunities in emerging markets, where rising disposable incomes and changing work cultures drive demand for professional cleaning services. Urban centers continue to dominate market share, accounting for approximately 72% of total service demand, while suburban markets show accelerating adoption rates for both traditional and technology-enabled laundry solutions.

Service diversification has become a key competitive strategy, with providers expanding beyond basic cleaning to offer specialized services including leather care, wedding dress preservation, household item cleaning, and corporate uniform management. This evolution reflects the industry’s adaptation to changing consumer needs and the pursuit of higher-margin service offerings.

The dry cleaning and laundry market refers to the comprehensive service industry that provides professional cleaning, washing, drying, and finishing services for clothing, textiles, and household items using various cleaning methods including water-based washing, solvent-based dry cleaning, and specialized treatment processes. This market encompasses both consumer-facing retail operations and business-to-business commercial services that serve hotels, restaurants, healthcare facilities, and other institutional clients.

Service categories within this market include traditional dry cleaning using chemical solvents, wet cleaning processes, self-service laundromats, full-service laundry operations, pickup and delivery services, and specialized cleaning for items such as carpets, curtains, and leather goods. The market also includes equipment manufacturing, cleaning chemical supply, and technology solutions that support service delivery and operational efficiency.

Modern market definition has expanded to include digital platforms, mobile applications, and on-demand services that connect consumers with cleaning providers, representing the industry’s evolution toward technology-integrated service delivery models that prioritize convenience and customer experience.

Market performance demonstrates resilience and adaptability, with the dry cleaning and laundry industry successfully navigating economic challenges while embracing technological innovation and sustainability initiatives. The sector benefits from essential service demand that remains relatively stable across economic cycles, supported by consistent consumer need for professional garment care and commercial cleaning services.

Key growth drivers include urbanization trends that increase demand for convenient services, rising female workforce participation that creates time constraints for household tasks, and growing awareness of professional garment care benefits. Additionally, the expansion of hospitality and healthcare sectors generates substantial commercial demand, with business-to-business services representing approximately 38% of market revenue.

Technology integration has emerged as a critical success factor, with leading providers implementing mobile applications, automated pickup scheduling, RFID tracking systems, and eco-friendly cleaning processes. These innovations address consumer preferences for convenience, transparency, and environmental responsibility while improving operational efficiency and service quality.

Competitive landscape features a mix of large chain operations, regional providers, and independent businesses, with market consolidation trends creating opportunities for technology-enabled service differentiation. The industry shows strong potential for continued growth, supported by demographic trends, lifestyle changes, and ongoing innovation in service delivery methods.

Consumer behavior analysis reveals significant shifts toward convenience-oriented services, with on-demand pickup and delivery options experiencing rapid adoption rates. The following insights highlight critical market dynamics:

Demographic trends serve as primary market drivers, with urbanization creating concentrated demand for professional cleaning services in metropolitan areas. Rising disposable incomes enable consumers to prioritize convenience and professional garment care, while changing household structures and dual-income families increase demand for time-saving services.

Lifestyle evolution significantly impacts market growth, as busy professionals and working families seek convenient solutions for household tasks. The expansion of formal work environments and professional dress codes maintains consistent demand for dry cleaning services, while growing fashion consciousness drives interest in proper garment care and maintenance.

Commercial sector expansion provides substantial growth opportunities, with hospitality industry growth, healthcare facility expansion, and corporate uniform programs generating steady business-to-business demand. According to MarkWide Research analysis, commercial clients typically offer higher volume contracts and more predictable revenue streams compared to individual consumers.

Technology adoption enables service innovation and operational efficiency improvements that attract new customers while retaining existing ones. Digital platforms, mobile applications, and automated systems reduce service friction and improve customer experience, creating competitive advantages for technology-forward providers.

Environmental awareness drives demand for eco-friendly cleaning processes and sustainable business practices. Consumers increasingly prefer providers that offer green cleaning options, biodegradable packaging, and environmentally responsible operations, creating differentiation opportunities for forward-thinking businesses.

Economic sensitivity affects consumer spending on discretionary services during economic downturns, as dry cleaning and professional laundry services may be perceived as non-essential expenses. Price-conscious consumers may reduce service frequency or switch to lower-cost alternatives during challenging economic periods.

Environmental regulations impose compliance costs and operational constraints, particularly regarding chemical solvent use, waste disposal, and air quality standards. Regulatory changes require significant investment in equipment upgrades, staff training, and process modifications that can strain smaller operators’ resources.

Labor challenges include skilled worker shortages, wage inflation, and high employee turnover rates that impact service quality and operational efficiency. The industry faces difficulties attracting and retaining qualified staff, particularly in specialized roles requiring technical expertise in garment care and equipment operation.

Competition intensity from alternative solutions including home washing machines, at-home dry cleaning kits, and DIY care products reduces demand for professional services. Additionally, fast fashion trends may decrease consumer investment in high-quality garments that require professional care.

Real estate costs in prime urban locations create significant operational expenses, particularly for traditional storefront operations. Rising commercial rent and property costs pressure profit margins and may force relocations to less convenient locations that reduce customer accessibility.

Digital service expansion presents significant growth opportunities through mobile applications, online platforms, and technology-enabled service delivery models. Providers can capture market share by offering convenient booking, real-time tracking, and personalized service options that appeal to tech-savvy consumers.

Subscription models create recurring revenue streams and improve customer retention through monthly or annual service packages. These models provide predictable income while offering customers cost savings and convenience, particularly attractive for regular users of dry cleaning and laundry services.

Specialty services offer higher-margin opportunities through leather care, wedding dress preservation, vintage clothing restoration, and luxury item cleaning. These specialized services command premium pricing while serving niche market segments with specific needs and higher willingness to pay.

Geographic expansion into underserved suburban and rural markets provides growth potential as these areas experience population growth and economic development. Franchise models and mobile service units can effectively serve these markets without requiring significant fixed infrastructure investment.

Corporate partnerships with hotels, restaurants, healthcare facilities, and uniform rental companies create stable revenue streams through long-term contracts. These business-to-business relationships typically offer higher volume and more predictable demand compared to individual consumer services.

Sustainability initiatives attract environmentally conscious consumers and may qualify for government incentives or certifications. Green cleaning processes, energy-efficient equipment, and sustainable packaging create competitive differentiation while supporting corporate social responsibility objectives.

Supply chain evolution reflects changing consumer expectations and technological capabilities, with traditional storefront-based operations expanding to include pickup and delivery services, mobile units, and digital platforms. This transformation requires investment in logistics capabilities, technology infrastructure, and customer service systems.

Competitive dynamics feature increasing consolidation as larger operators acquire smaller businesses to achieve economies of scale and expand geographic coverage. This trend creates opportunities for technology integration, standardized service quality, and improved operational efficiency across multiple locations.

Customer expectations continue evolving toward greater convenience, transparency, and service customization. Modern consumers expect real-time service updates, flexible scheduling options, and personalized service preferences, driving providers to invest in customer relationship management systems and service innovation.

Regulatory environment influences operational practices through environmental standards, worker safety requirements, and chemical usage restrictions. Compliance with evolving regulations requires ongoing investment in equipment, training, and process improvements that impact operational costs and service delivery methods.

Technology integration accelerates across all market segments, with providers implementing point-of-sale systems, inventory management software, customer relationship management platforms, and automated equipment. These investments improve operational efficiency while enabling better customer service and business intelligence capabilities.

Data collection employs comprehensive primary and secondary research methodologies to ensure accurate market analysis and reliable insights. Primary research includes surveys of industry participants, consumer behavior studies, and interviews with key stakeholders across the dry cleaning and laundry value chain.

Market segmentation analysis examines service categories, customer demographics, geographic regions, and business models to identify growth opportunities and competitive dynamics. This segmentation approach enables detailed understanding of market drivers and constraints within specific industry segments.

Competitive analysis evaluates market participants across multiple dimensions including service offerings, pricing strategies, geographic coverage, technology adoption, and customer satisfaction metrics. This analysis provides insights into competitive positioning and strategic opportunities for market participants.

Trend analysis incorporates historical data, current market conditions, and forward-looking indicators to identify emerging opportunities and potential challenges. This approach enables accurate forecasting and strategic planning for industry participants and investors.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert interviews, and statistical analysis techniques. Quality assurance measures include peer review, data triangulation, and sensitivity analysis to confirm research findings and conclusions.

North American markets demonstrate mature industry characteristics with steady demand growth driven by urbanization, lifestyle changes, and commercial sector expansion. The region shows strong adoption of technology-enabled services, with pickup and delivery options gaining significant market share in metropolitan areas.

European markets emphasize sustainability and environmental compliance, with stringent regulations driving adoption of eco-friendly cleaning processes and equipment. The region shows strong preference for premium services and specialized offerings, supporting higher-margin business models for quality-focused providers.

Asia-Pacific regions represent the fastest-growing markets, with rapid urbanization, rising disposable incomes, and changing lifestyle patterns driving substantial demand increases. Countries experiencing economic development show particularly strong growth in commercial and premium consumer segments.

Latin American markets show emerging opportunities as economic development and urban population growth create demand for professional cleaning services. The region demonstrates strong potential for franchise expansion and technology adoption as infrastructure development supports service delivery innovation.

Middle East and Africa present developing market opportunities with growing hospitality sectors, commercial development, and increasing consumer awareness of professional garment care benefits. These markets show potential for both traditional and technology-enabled service models.

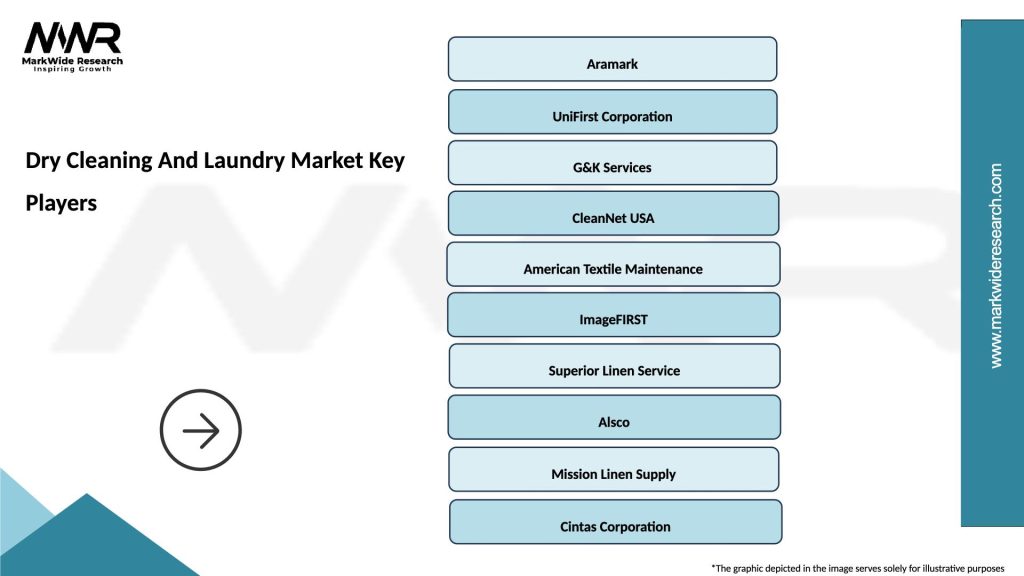

Market structure features diverse participants ranging from large national chains to independent local operators, creating a competitive environment that rewards service differentiation, operational efficiency, and customer relationship management. The following companies represent key market participants:

Competitive strategies focus on service differentiation through technology integration, convenience features, specialty services, and customer experience improvements. Leading providers invest in mobile applications, automated systems, and logistics capabilities to create competitive advantages.

By Service Type:

By Customer Segment:

By Service Delivery:

Dry Cleaning Category maintains steady demand despite challenges from casual dress trends, with premium garment care and specialty fabrics supporting service value. This category benefits from professional wardrobe maintenance needs and formal occasion garment care requirements.

Laundry Services Category shows strong growth potential through convenience-focused offerings and time-saving solutions for busy consumers. Pickup and delivery options within this category demonstrate particularly strong adoption rates among urban professionals and dual-income households.

Commercial Services Category provides stable revenue streams through long-term contracts and recurring service agreements. This category benefits from hospitality industry growth, healthcare facility expansion, and corporate uniform program development.

Specialty Services Category offers highest profit margins through expert care for valuable items, seasonal services, and niche market segments. Wedding dress preservation, leather care, and luxury item cleaning command premium pricing while serving specific customer needs.

Technology-Enabled Services represent the fastest-growing category, with mobile applications, online platforms, and automated systems attracting tech-savvy consumers. MWR data indicates this category shows annual growth rates exceeding 12% in major metropolitan markets.

Service Providers benefit from recurring revenue opportunities, customer loyalty development, and operational efficiency improvements through technology adoption. Successful providers can achieve sustainable competitive advantages through service differentiation and customer relationship management.

Consumers gain access to convenient, professional garment care that extends clothing lifespan, maintains appearance quality, and saves time on household tasks. Premium services offer specialized expertise for valuable items and delicate fabrics requiring professional handling.

Commercial Clients achieve cost savings through outsourced cleaning services, improved operational efficiency, and consistent service quality. Long-term partnerships provide predictable costs and reliable service delivery that supports business operations.

Equipment Manufacturers benefit from ongoing demand for cleaning equipment, technology systems, and facility infrastructure. Innovation opportunities exist in eco-friendly equipment, automation systems, and energy-efficient technologies.

Technology Providers find opportunities in mobile applications, point-of-sale systems, customer relationship management platforms, and logistics optimization software. The industry’s digital transformation creates demand for integrated technology solutions.

Real Estate Stakeholders benefit from stable tenant demand for commercial spaces, particularly in high-traffic urban locations. Dry cleaning and laundry operations typically maintain long-term leases and provide consistent rental income.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across the industry as providers implement mobile applications, online booking systems, and customer communication platforms. This trend enables improved customer experience, operational efficiency, and competitive differentiation through technology-enabled service delivery.

Sustainability Focus drives adoption of eco-friendly cleaning processes, biodegradable packaging, and energy-efficient equipment. Environmentally conscious consumers increasingly prefer providers that demonstrate commitment to sustainable business practices and environmental responsibility.

Convenience Services expand through pickup and delivery options, extended operating hours, and flexible scheduling systems. Busy consumers prioritize time-saving solutions that fit their lifestyle preferences and work schedules.

Service Specialization creates differentiation opportunities through expert care for luxury items, vintage clothing, leather goods, and specialty fabrics. These niche services command premium pricing while serving specific customer needs and preferences.

Subscription Models gain popularity as providers offer monthly or annual service packages that provide cost savings for regular customers while creating predictable revenue streams for businesses.

Quality Assurance becomes increasingly important as customers expect consistent service quality, damage protection, and satisfaction guarantees. Providers invest in staff training, quality control systems, and customer service improvements.

Technology Adoption accelerates with providers implementing RFID tracking systems, automated sorting equipment, and customer relationship management platforms. These investments improve operational efficiency while enabling better customer service and business intelligence capabilities.

Franchise Expansion continues as successful business models scale through franchising arrangements that provide operational support, brand recognition, and standardized service delivery. This trend enables rapid geographic expansion while maintaining service quality standards.

Partnership Development creates strategic alliances between cleaning providers and complementary businesses such as tailoring services, shoe repair, and clothing retailers. These partnerships expand service offerings while providing customer convenience and cross-selling opportunities.

Regulatory Compliance drives investment in environmentally friendly equipment and processes as regulations become more stringent regarding chemical usage, waste disposal, and air quality standards. Providers must balance compliance costs with operational efficiency and service quality.

Market Consolidation occurs as larger operators acquire smaller businesses to achieve economies of scale, expand geographic coverage, and integrate technology systems. This trend creates opportunities for improved operational efficiency and standardized service delivery.

Technology Investment should prioritize customer-facing applications and operational efficiency systems that improve service delivery and reduce costs. Providers should focus on mobile platforms, automated equipment, and customer communication systems that create competitive advantages.

Service Differentiation through specialty offerings, convenience features, and quality guarantees can justify premium pricing while building customer loyalty. Providers should identify niche market opportunities and develop expertise in high-value service categories.

Geographic Strategy should balance market penetration in existing areas with expansion into underserved markets that offer growth potential. Franchise models and strategic partnerships can enable cost-effective expansion while maintaining service quality standards.

Sustainability Initiatives should align with customer preferences and regulatory requirements while supporting long-term operational efficiency. Investment in eco-friendly processes and equipment can create competitive differentiation while reducing environmental impact.

Customer Retention programs should focus on convenience, quality, and value proposition development that encourages repeat business and referrals. Subscription models, loyalty programs, and personalized service options can improve customer lifetime value.

Partnership Opportunities with complementary businesses, technology providers, and commercial clients can expand service offerings and create new revenue streams. Strategic alliances should focus on mutual value creation and customer benefit enhancement.

Market evolution indicates continued growth driven by urbanization trends, lifestyle changes, and technology adoption that support service innovation and operational efficiency improvements. The industry shows strong potential for sustainable expansion through service differentiation and customer experience enhancement.

Technology integration will accelerate as providers implement artificial intelligence, Internet of Things sensors, and automated systems that improve service quality while reducing operational costs. MarkWide Research projects that technology-enabled services will capture increasing market share as consumer preferences shift toward convenience and transparency.

Sustainability trends will drive continued investment in eco-friendly cleaning processes, energy-efficient equipment, and sustainable business practices. Regulatory requirements and consumer preferences will favor providers that demonstrate environmental responsibility and innovation in green cleaning solutions.

Service expansion opportunities exist in specialty cleaning, subscription models, and commercial partnerships that provide higher-margin revenue streams. Providers that successfully diversify service offerings while maintaining quality standards will achieve competitive advantages in evolving market conditions.

Geographic growth potential remains strong in emerging markets and underserved areas where economic development and lifestyle changes create demand for professional cleaning services. Franchise models and technology-enabled service delivery will facilitate market expansion while maintaining operational efficiency.

The dry cleaning and laundry market demonstrates resilient growth potential supported by essential service demand, evolving consumer preferences, and ongoing technology innovation. Industry participants that successfully adapt to changing market conditions through service differentiation, operational efficiency, and customer experience improvements will achieve sustainable competitive advantages.

Strategic success factors include technology adoption, sustainability initiatives, service specialization, and customer relationship management that create value for both consumers and commercial clients. The industry’s evolution toward convenience-focused, environmentally responsible service delivery models positions well-managed providers for continued growth and profitability.

Future opportunities exist in digital service expansion, specialty offerings, geographic growth, and strategic partnerships that leverage industry expertise while addressing evolving customer needs. Providers that invest in innovation, quality, and customer satisfaction will benefit from the market’s positive long-term outlook and growth trajectory.

What is Dry Cleaning And Laundry?

Dry cleaning and laundry refer to the processes used to clean clothing and textiles. Dry cleaning uses chemical solvents to remove stains and dirt, while laundry typically involves washing with water and detergent.

What are the key players in the Dry Cleaning And Laundry Market?

Key players in the dry cleaning and laundry market include companies like Tide Cleaners, Cleanly, and ZIPS Dry Cleaners, among others. These companies offer various services ranging from traditional dry cleaning to eco-friendly laundry solutions.

What are the growth factors driving the Dry Cleaning And Laundry Market?

The growth of the dry cleaning and laundry market is driven by increasing urbanization, busy lifestyles leading to higher demand for convenience, and a growing awareness of fabric care. Additionally, the rise in e-commerce and on-demand services is contributing to market expansion.

What challenges does the Dry Cleaning And Laundry Market face?

The dry cleaning and laundry market faces challenges such as environmental regulations regarding chemical use, competition from home laundry appliances, and fluctuating costs of cleaning agents. These factors can impact operational efficiency and profitability.

What opportunities exist in the Dry Cleaning And Laundry Market?

Opportunities in the dry cleaning and laundry market include the adoption of sustainable practices, such as using biodegradable detergents and energy-efficient machines. Additionally, expanding service offerings like pickup and delivery can attract more customers.

What trends are shaping the Dry Cleaning And Laundry Market?

Trends in the dry cleaning and laundry market include the increasing use of technology for online booking and tracking, the rise of eco-friendly cleaning methods, and the growth of subscription-based services. These trends reflect changing consumer preferences towards convenience and sustainability.

Dry Cleaning And Laundry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Wash & Fold, Dry Cleaning, Stain Removal, Ironing |

| End User | Residential, Commercial, Hospitality, Healthcare |

| Distribution Channel | Online, Retail Stores, Franchise, Direct Sales |

| Technology | Eco-Friendly, Automated, Traditional, Steam Cleaning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Dry Cleaning And Laundry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at