444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The camping equipment and furniture market represents a dynamic and rapidly expanding sector within the broader outdoor recreation industry. Growing consumer interest in outdoor activities, adventure tourism, and nature-based experiences has significantly boosted demand for high-quality camping gear and portable furniture solutions. The market encompasses a comprehensive range of products including tents, sleeping bags, camping chairs, portable tables, cooking equipment, and specialized outdoor furniture designed for recreational camping, glamping, and outdoor events.

Market dynamics indicate robust growth driven by increasing participation in outdoor recreational activities, with camping participation rates showing consistent annual growth of 4.5% across key demographics. The sector benefits from technological innovations in lightweight materials, weather-resistant fabrics, and ergonomic designs that enhance user comfort and product durability. Seasonal demand patterns create opportunities for manufacturers to optimize production cycles and inventory management strategies.

Consumer preferences have evolved toward premium, multi-functional camping equipment that offers superior comfort and convenience. The market serves diverse customer segments including casual weekend campers, serious outdoor enthusiasts, glamping facilities, and commercial outdoor event organizers. E-commerce penetration has reached approximately 38% of total sales, reflecting changing shopping behaviors and the importance of digital marketing strategies for market participants.

The camping equipment and furniture market refers to the comprehensive industry segment encompassing the design, manufacturing, distribution, and retail of portable outdoor gear and furniture specifically designed for camping, recreational vehicle use, and outdoor leisure activities. This market includes essential camping gear such as shelters, sleeping systems, cooking equipment, lighting solutions, and portable furniture items that enable comfortable outdoor experiences.

Market scope extends beyond traditional camping to include glamping accessories, festival equipment, emergency preparedness gear, and outdoor event furniture. The industry serves both individual consumers seeking recreational camping solutions and commercial entities requiring bulk outdoor equipment for hospitality, events, and tourism applications. Product categories range from basic utility items to premium luxury camping furniture that rivals indoor comfort standards.

Market performance demonstrates strong momentum across all major product categories, with portable furniture and premium camping gear leading growth trends. The industry benefits from increasing outdoor recreation participation, rising disposable incomes, and growing awareness of mental health benefits associated with nature-based activities. Innovation drivers include sustainable materials, smart technology integration, and enhanced portability features that appeal to modern consumers.

Regional markets show varying growth patterns, with North America maintaining the largest market share at approximately 42% of global demand, followed by Europe and Asia-Pacific regions. Competitive landscape features a mix of established outdoor brands, specialized camping equipment manufacturers, and emerging direct-to-consumer companies leveraging digital marketing strategies.

Key market trends include the rise of glamping, increased female participation in outdoor activities, and growing demand for eco-friendly camping products. The market faces challenges from seasonal demand fluctuations and supply chain complexities, while opportunities emerge from expanding outdoor tourism and corporate team-building activities requiring camping equipment.

Consumer behavior analysis reveals significant shifts in camping equipment preferences and purchasing patterns. Modern campers prioritize comfort, convenience, and multi-functionality when selecting outdoor gear and furniture. MarkWide Research indicates that premium camping furniture sales have increased by 23% annually as consumers invest in higher-quality outdoor experiences.

Primary growth drivers propelling the camping equipment and furniture market include increasing outdoor recreation participation, rising awareness of nature’s mental health benefits, and growing popularity of alternative vacation experiences. Demographic trends show millennials and Gen Z consumers leading outdoor activity adoption, with camping participation among these groups growing at 6.2% annually.

Economic factors contribute significantly to market expansion, including rising disposable incomes, increased leisure spending, and growing investment in experiential activities over material possessions. The wellness tourism trend drives demand for comfortable camping solutions that enable extended outdoor stays without sacrificing comfort or convenience.

Technological advancements in materials science enable lighter, more durable camping equipment that appeals to weight-conscious backpackers and car campers alike. Social media influence amplifies outdoor lifestyle trends, inspiring more consumers to invest in quality camping gear for Instagram-worthy outdoor experiences. Corporate wellness programs increasingly incorporate outdoor team-building activities, creating additional demand for commercial-grade camping furniture and equipment.

Seasonal demand fluctuations present significant challenges for camping equipment manufacturers and retailers, with sales heavily concentrated in spring and summer months. This seasonality creates inventory management complexities and cash flow challenges for market participants. Weather dependency affects consumer purchasing decisions, with adverse weather conditions potentially dampening camping enthusiasm and equipment sales.

High-quality camping equipment often requires substantial initial investment, which may deter price-sensitive consumers from entering the camping market. Storage limitations in urban environments restrict consumer ability to purchase and maintain large camping furniture items, particularly affecting apartment dwellers and city residents.

Supply chain complexities impact product availability and pricing, especially for specialized outdoor fabrics and lightweight materials sourced globally. Competition from alternative recreation activities and vacation options may limit camping participation growth in certain demographic segments. Environmental concerns about outdoor recreation impact on natural areas could potentially influence camping regulations and access restrictions.

Emerging market opportunities include the rapidly expanding glamping sector, which demands premium camping furniture and luxury outdoor amenities. Corporate market potential remains largely untapped, with businesses increasingly seeking unique team-building experiences and outdoor meeting solutions that require specialized camping equipment and furniture.

International expansion opportunities exist in developing markets where outdoor recreation is gaining popularity alongside economic growth. Product innovation opportunities include smart camping gear with IoT connectivity, solar-powered equipment, and modular furniture systems that adapt to various outdoor scenarios.

Rental market development presents opportunities for equipment sharing platforms and rental services that make premium camping gear accessible to occasional users. Sustainability initiatives create opportunities for companies developing eco-friendly camping products using recycled materials and sustainable manufacturing processes. Customization services appeal to consumers seeking personalized camping solutions tailored to specific outdoor activities and preferences.

Market dynamics reflect the interplay between consumer preferences, technological innovation, and industry competition. Seasonal patterns drive inventory cycles and marketing strategies, with manufacturers typically launching new products in early spring to capture peak camping season demand. Price sensitivity varies significantly across consumer segments, with budget-conscious families seeking value-oriented solutions while outdoor enthusiasts invest in premium equipment.

Distribution channel evolution shows continued growth in online sales, which now represent approximately 35% of total market transactions. Retail partnerships between camping equipment manufacturers and outdoor specialty stores remain crucial for product demonstration and customer education. Brand loyalty plays a significant role in repeat purchases, with established outdoor brands maintaining strong customer retention rates.

Innovation cycles typically span 2-3 years for major product updates, driven by material science advances and changing consumer preferences. Competitive pressure encourages continuous product improvement and feature enhancement, particularly in portable furniture design and multi-functional camping gear categories.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes consumer surveys, industry expert interviews, and retail partner feedback to understand current market conditions and future trends. Secondary research incorporates industry reports, trade association data, and government statistics on outdoor recreation participation.

Data collection methods encompass both quantitative and qualitative approaches, including online consumer surveys, focus groups with camping enthusiasts, and in-depth interviews with industry stakeholders. Market sizing utilizes bottom-up and top-down approaches to validate findings and ensure accuracy across different market segments and geographic regions.

Trend analysis incorporates social media sentiment analysis, search trend data, and retail sales patterns to identify emerging opportunities and potential market shifts. Competitive intelligence gathering includes product launches, pricing strategies, and distribution channel developments among key market participants.

North America dominates the global camping equipment and furniture market, accounting for approximately 42% of worldwide demand. The region benefits from established camping culture, extensive national park systems, and high consumer spending on outdoor recreation. United States leads regional growth with strong participation in car camping, RV camping, and glamping experiences driving equipment demand.

Europe represents the second-largest regional market, with 28% market share driven by growing outdoor tourism and camping popularity across Scandinavian and Central European countries. Germany, France, and the United Kingdom show particularly strong demand for premium camping furniture and innovative outdoor gear solutions.

Asia-Pacific emerges as the fastest-growing regional market, with camping participation increasing by 8.1% annually as urbanization drives interest in nature-based recreation. Japan, South Korea, and Australia lead regional adoption of camping activities and premium outdoor equipment. China represents significant future growth potential as outdoor recreation infrastructure develops and consumer awareness increases.

Latin America and Middle East & Africa show emerging market potential, with growing adventure tourism and increasing disposable incomes supporting camping equipment demand growth in select countries.

Market competition features a diverse mix of established outdoor brands, specialized camping equipment manufacturers, and emerging direct-to-consumer companies. Brand differentiation focuses on product innovation, quality, sustainability, and customer service excellence.

Competitive strategies include product innovation, strategic partnerships with outdoor retailers, direct-to-consumer sales channels, and sustainability initiatives that appeal to environmentally conscious consumers.

Product segmentation divides the camping equipment and furniture market into distinct categories based on functionality and consumer needs. Shelter solutions include tents, tarps, and portable structures that provide weather protection and privacy. Sleeping systems encompass sleeping bags, sleeping pads, and portable bedding designed for outdoor comfort.

By Product Type:

By End User:

By Distribution Channel:

Camping furniture represents the fastest-growing product category, with portable chairs and tables showing particularly strong demand growth of 15.3% annually. Consumer preferences favor lightweight, compact designs that don’t compromise on comfort or durability. Premium camping chairs with advanced ergonomic features and high-quality materials command significant price premiums and strong customer loyalty.

Shelter equipment maintains steady demand with innovation focused on weather resistance, setup ease, and space efficiency. Family-sized tents and multi-room camping shelters show strong growth as camping becomes more popular among families with children. Ultralight backpacking tents appeal to serious outdoor enthusiasts seeking weight reduction without performance compromise.

Sleeping systems benefit from material science advances that improve insulation, comfort, and packability. Self-inflating sleeping pads and premium sleeping bags with advanced synthetic insulation gain market share from traditional down-filled products. Modular sleeping systems that adapt to different weather conditions appeal to year-round campers.

Cooking equipment shows innovation in fuel efficiency, compact design, and multi-functionality. Integrated cooking systems that combine stoves, cookware, and fuel storage gain popularity among backpackers and car campers seeking convenience and space savings.

Manufacturers benefit from growing market demand, opportunities for product innovation, and expanding distribution channels. Brand building opportunities exist through social media marketing, outdoor event sponsorships, and partnerships with outdoor influencers and content creators.

Retailers gain from increased consumer interest in outdoor activities and growing acceptance of premium-priced camping equipment. E-commerce growth provides opportunities for expanded market reach and direct customer relationships. Seasonal sales patterns enable inventory optimization and promotional planning.

Consumers benefit from continuous product improvements, increased variety, and competitive pricing across different market segments. Quality enhancements in durability, comfort, and functionality improve outdoor experiences and equipment longevity. Sustainability initiatives provide environmentally conscious options for eco-minded consumers.

Tourism operators and glamping facilities benefit from growing consumer demand for comfortable outdoor experiences. Equipment rental services create new business opportunities and make premium camping gear accessible to occasional users.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends dominate current market developments, with manufacturers increasingly adopting recycled materials, sustainable production processes, and circular economy principles. MWR analysis indicates that eco-friendly camping products show 19% higher growth rates compared to conventional alternatives, reflecting strong consumer preference for environmentally responsible options.

Technology integration emerges as a significant trend, with smart camping gear incorporating GPS tracking, weather monitoring, and mobile app connectivity. Solar-powered equipment gains popularity as campers seek energy independence and sustainable power solutions for extended outdoor stays.

Comfort enhancement drives product development across all categories, with camping furniture approaching indoor comfort levels through advanced materials and ergonomic design. Modular systems that allow customization and adaptation to different camping scenarios appeal to versatility-seeking consumers.

Gender-inclusive design addresses the growing female participation in outdoor activities, with products specifically designed for women’s needs and preferences. Family-oriented solutions accommodate multi-generational camping groups with larger capacity and enhanced safety features.

Recent industry developments include major brand acquisitions, strategic partnerships, and significant product launches that reshape competitive dynamics. Sustainability initiatives by leading manufacturers include carbon-neutral production goals, recycled material adoption, and take-back programs for end-of-life products.

Technology partnerships between camping equipment manufacturers and tech companies enable smart product development and connected outdoor experiences. Direct-to-consumer strategies gain momentum as brands seek closer customer relationships and higher profit margins through online sales channels.

International expansion activities include market entry strategies in Asia-Pacific regions and partnerships with local distributors in emerging markets. Product innovation focuses on multi-functional designs, weight reduction, and enhanced durability to meet evolving consumer expectations.

Retail channel evolution includes omnichannel strategies that integrate online and offline shopping experiences, virtual product demonstrations, and augmented reality applications for camping gear selection.

Market participants should prioritize sustainability initiatives and eco-friendly product development to align with growing consumer environmental consciousness. Investment in technology integration will differentiate products and create new value propositions for tech-savvy outdoor enthusiasts.

Distribution strategy optimization should balance online growth opportunities with maintaining strong retail partnerships for product demonstration and customer education. International expansion requires careful market research and local partnership development to understand regional preferences and regulations.

Product portfolio diversification into adjacent categories such as outdoor furniture for patios and gardens can reduce seasonal dependency and expand market opportunities. Brand building through authentic outdoor lifestyle marketing and influencer partnerships will strengthen customer relationships and brand loyalty.

Supply chain resilience development should include supplier diversification and nearshoring strategies to reduce disruption risks. Customer data analytics can improve demand forecasting and enable personalized marketing approaches that increase conversion rates and customer lifetime value.

Market projections indicate continued strong growth driven by increasing outdoor recreation participation and evolving consumer preferences for experiential activities. MarkWide Research forecasts that premium camping equipment segments will maintain growth rates of 12-15% annually as consumers prioritize comfort and quality in outdoor experiences.

Technology integration will accelerate with smart camping gear becoming mainstream, offering features such as weather monitoring, GPS tracking, and mobile app connectivity. Sustainability requirements will intensify, with circular economy principles and carbon-neutral production becoming competitive necessities rather than differentiators.

Market consolidation may occur as larger brands acquire innovative smaller companies to expand product portfolios and technological capabilities. International markets will drive significant growth, particularly in Asia-Pacific regions where outdoor recreation infrastructure continues developing.

Consumer expectations will continue evolving toward premium, multi-functional products that deliver indoor-level comfort in outdoor settings. Rental and sharing economy models may gain traction, making premium camping equipment accessible to broader consumer segments while creating new business opportunities for market participants.

The camping equipment and furniture market demonstrates robust growth potential driven by increasing outdoor recreation participation, evolving consumer preferences, and continuous product innovation. Market dynamics favor companies that prioritize sustainability, technology integration, and customer-centric design approaches while maintaining strong distribution partnerships and brand authenticity.

Success factors include adaptability to seasonal demand patterns, investment in sustainable materials and production processes, and development of multi-functional products that enhance outdoor comfort and convenience. Strategic opportunities exist in international expansion, premium product segments, and emerging categories such as glamping equipment and smart camping gear.

Industry participants who focus on innovation, sustainability, and authentic outdoor lifestyle marketing will be best positioned to capitalize on growing market opportunities and build lasting competitive advantages in this dynamic and expanding sector.

What is Camping Equipment And Furniture?

Camping Equipment And Furniture refers to the various tools, gear, and furnishings designed for outdoor camping activities. This includes tents, sleeping bags, portable chairs, and cooking equipment that enhance the camping experience.

What are the key players in the Camping Equipment And Furniture Market?

Key players in the Camping Equipment And Furniture Market include companies like Coleman, REI, and The North Face, which offer a wide range of camping gear and furniture. These companies are known for their innovative products and commitment to quality, among others.

What are the growth factors driving the Camping Equipment And Furniture Market?

The Camping Equipment And Furniture Market is driven by increasing outdoor recreational activities, a growing interest in sustainable living, and the rise of adventure tourism. Additionally, innovations in lightweight and durable materials are enhancing product appeal.

What challenges does the Camping Equipment And Furniture Market face?

Challenges in the Camping Equipment And Furniture Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards more sustainable options. These factors can impact profitability and market stability.

What opportunities exist in the Camping Equipment And Furniture Market?

Opportunities in the Camping Equipment And Furniture Market include the expansion of e-commerce platforms, increasing demand for eco-friendly products, and the potential for product innovation in smart camping gear. These trends can attract new consumers and enhance market growth.

What trends are shaping the Camping Equipment And Furniture Market?

Trends in the Camping Equipment And Furniture Market include the rise of glamping, which combines luxury with outdoor experiences, and the growing popularity of multifunctional gear. Additionally, advancements in technology are leading to smarter camping solutions, enhancing user convenience.

Camping Equipment And Furniture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tents, Sleeping Bags, Camping Chairs, Portable Stoves |

| Material | Aluminum, Polyester, Nylon, Wood |

| End User | Outdoor Enthusiasts, Families, Backpackers, Campgrounds |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

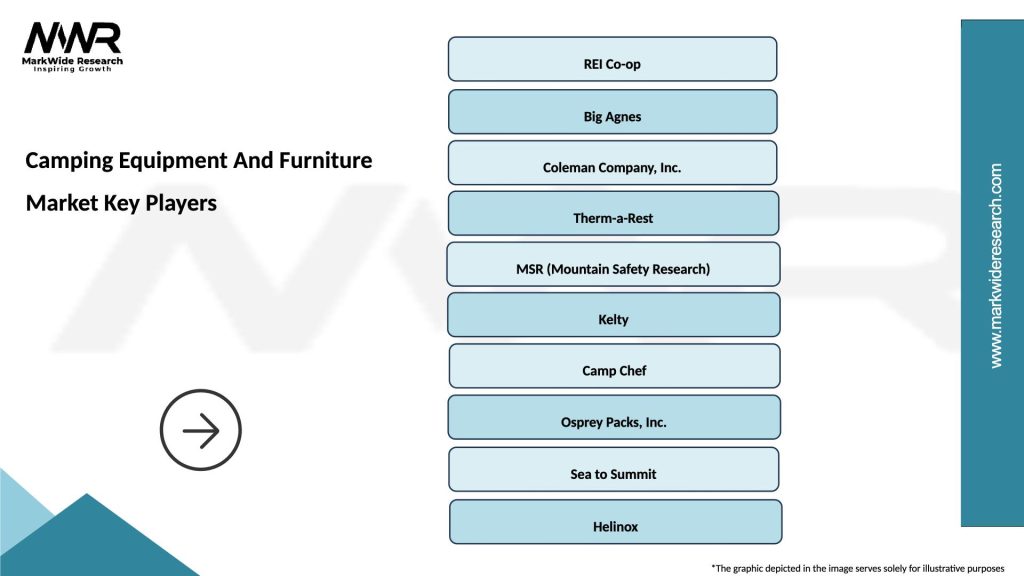

Leading companies in the Camping Equipment And Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at