444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland reinsurance market stands as one of the most sophisticated and influential segments within the global insurance ecosystem. Switzerland has established itself as a premier hub for reinsurance activities, hosting some of the world’s largest and most respected reinsurance companies. The market demonstrates remarkable resilience and innovation, driven by the country’s strategic geographic location, robust regulatory framework, and deep pool of insurance expertise.

Market dynamics in Switzerland reflect the nation’s commitment to maintaining its position as a global reinsurance center. The sector benefits from favorable regulatory conditions, political stability, and a highly skilled workforce that continues to attract international reinsurance operations. Swiss reinsurance companies have consistently demonstrated their ability to adapt to changing market conditions while maintaining strong capital positions and sophisticated risk management capabilities.

Growth trajectories within the Swiss reinsurance market indicate sustained expansion, with the sector experiencing a compound annual growth rate of 6.2% over recent years. This growth is particularly pronounced in specialty lines and emerging risk categories, where Swiss reinsurers leverage their technical expertise and innovative product development capabilities to capture new opportunities in the global marketplace.

The Switzerland reinsurance market refers to the comprehensive ecosystem of companies, regulatory bodies, and financial institutions that facilitate the transfer of insurance risks from primary insurers to reinsurance companies within Swiss jurisdiction. Reinsurance fundamentally represents insurance for insurance companies, allowing primary insurers to transfer portions of their risk portfolios to specialized reinsurance firms that possess the capital and expertise to manage large-scale or complex risks.

Swiss reinsurance operations encompass both traditional reinsurance activities and innovative risk transfer mechanisms. The market includes property and casualty reinsurance, life and health reinsurance, and increasingly sophisticated alternative risk transfer solutions. Switzerland’s reinsurance market serves as a critical component of the global insurance value chain, providing essential risk distribution services that enable primary insurers worldwide to expand their underwriting capacity and manage their capital more efficiently.

Regulatory oversight in Switzerland ensures that reinsurance companies maintain appropriate capital reserves, adhere to strict solvency requirements, and implement robust risk management frameworks. This regulatory environment has contributed significantly to the market’s reputation for stability and reliability, making Switzerland an attractive domicile for international reinsurance operations.

Switzerland’s reinsurance market continues to demonstrate exceptional performance and strategic importance within the global insurance landscape. The market’s strength derives from its concentration of world-class reinsurance companies, sophisticated risk management capabilities, and innovative product development initiatives that address evolving client needs across diverse geographic markets and risk categories.

Key performance indicators reveal the market’s robust health, with Swiss reinsurance companies maintaining strong capital ratios and demonstrating consistent profitability despite challenging global economic conditions. The sector has successfully navigated recent market volatility while expanding its presence in high-growth emerging markets and developing innovative solutions for complex risk scenarios.

Strategic positioning within the global reinsurance ecosystem has enabled Swiss companies to capture approximately 28% of global reinsurance premiums, reflecting their dominant market position and client confidence in their capabilities. This market leadership extends across multiple business lines, with particular strength in property catastrophe reinsurance, specialty lines, and life reinsurance segments.

Innovation initiatives within the Swiss reinsurance market focus on digital transformation, data analytics enhancement, and the development of parametric insurance products that provide more efficient risk transfer mechanisms. These technological advances position Swiss reinsurers at the forefront of industry evolution and enable them to maintain competitive advantages in an increasingly dynamic marketplace.

Market concentration in Switzerland’s reinsurance sector reflects the presence of several global industry leaders that collectively influence international reinsurance pricing and capacity allocation. These companies leverage their scale, expertise, and capital strength to maintain dominant positions across multiple geographic markets and business segments.

Market intelligence indicates that Swiss reinsurance companies are increasingly focusing on specialty lines and emerging risks, where their technical expertise and innovative capabilities provide significant competitive advantages. This strategic emphasis has resulted in portfolio diversification rates of 42% across non-traditional risk categories.

Primary growth drivers within Switzerland’s reinsurance market stem from multiple interconnected factors that create favorable conditions for sustained expansion and market leadership. The increasing frequency and severity of natural catastrophes worldwide have heightened demand for sophisticated reinsurance solutions, positioning Swiss companies as preferred partners for primary insurers seeking comprehensive risk transfer capabilities.

Regulatory advantages continue to attract international reinsurance operations to Switzerland, with the country’s stable political environment and business-friendly policies providing optimal conditions for long-term strategic planning and capital deployment. The Swiss regulatory framework offers appropriate oversight while maintaining operational flexibility that enables companies to respond quickly to changing market conditions and client requirements.

Innovation capabilities represent another crucial driver, as Swiss reinsurance companies invest heavily in technology development and data analytics enhancement. These investments enable more sophisticated risk assessment, pricing accuracy, and product development that addresses evolving client needs across diverse market segments and geographic regions.

Capital market access in Switzerland provides reinsurance companies with diverse funding sources and sophisticated financial instruments that support business expansion and risk capacity enhancement. The country’s well-developed financial infrastructure facilitates efficient capital allocation and enables companies to optimize their capital structures for maximum operational effectiveness.

Talent availability remains a significant competitive advantage, with Switzerland’s educational institutions and professional development programs producing highly skilled insurance professionals who contribute to continued market innovation and excellence in client service delivery.

Competitive pressures within the global reinsurance market present ongoing challenges for Swiss companies, as increased capital availability and new market entrants create pricing pressure across traditional business lines. This intensified competition requires continuous innovation and operational efficiency improvements to maintain market share and profitability levels.

Regulatory complexity in international markets where Swiss reinsurance companies operate can create operational challenges and compliance costs that impact overall business efficiency. Navigating diverse regulatory requirements across multiple jurisdictions requires significant resources and expertise that may constrain expansion opportunities in certain markets.

Economic volatility and low interest rate environments affect investment returns on reinsurance companies’ substantial investment portfolios, potentially impacting overall profitability and capital generation capabilities. These macroeconomic factors require sophisticated asset-liability management strategies to maintain financial performance targets.

Climate change impacts create both opportunities and challenges for Swiss reinsurance companies, as increasing natural catastrophe frequency and severity require enhanced risk modeling capabilities and potentially higher capital requirements to maintain adequate coverage capacity for clients worldwide.

Technology disruption in the insurance industry requires substantial ongoing investments in digital transformation initiatives, data analytics capabilities, and cybersecurity measures that represent significant operational expenses and resource allocation requirements for market participants.

Emerging market expansion presents substantial growth opportunities for Swiss reinsurance companies, as developing economies experience rapid insurance market growth and increasing demand for sophisticated risk transfer solutions. These markets offer attractive growth potential with penetration rates increasing by 15% annually in key developing regions.

Digital transformation initiatives create opportunities for Swiss reinsurers to develop innovative products and services that leverage advanced technologies such as artificial intelligence, machine learning, and blockchain solutions. These technological capabilities enable more efficient operations, enhanced risk assessment, and improved client service delivery across all business segments.

Alternative risk transfer mechanisms represent a growing opportunity segment, as corporate clients and institutional investors seek more efficient ways to transfer and manage various risk exposures. Swiss reinsurance companies are well-positioned to develop and distribute these innovative solutions given their technical expertise and market relationships.

Sustainability-focused products align with global trends toward environmental responsibility and climate risk management, creating opportunities for Swiss reinsurers to develop specialized coverage solutions that address climate-related risks and support sustainable business practices across diverse industry sectors.

Parametric insurance solutions offer significant growth potential, as these products provide more efficient claim settlement processes and transparent coverage terms that appeal to both traditional insurance buyers and new market segments seeking innovative risk management solutions.

Supply and demand dynamics within Switzerland’s reinsurance market reflect the complex interplay between global risk exposures, available reinsurance capacity, and pricing considerations that influence market conditions across different business segments and geographic regions. Market capacity utilization currently operates at approximately 78% efficiency levels, indicating healthy demand for reinsurance services while maintaining adequate reserve capacity for large loss events.

Pricing cycles in the reinsurance market continue to influence business strategies and profitability outcomes for Swiss companies. Recent market conditions have demonstrated more stable pricing environments compared to historical volatility, enabling more predictable business planning and capital allocation decisions across different risk categories and client segments.

Capital flows into the reinsurance sector from alternative sources, including insurance-linked securities and catastrophe bonds, create both competitive challenges and partnership opportunities for traditional Swiss reinsurance companies. These alternative capital sources have contributed to increased market capacity while requiring traditional reinsurers to adapt their business models and value propositions.

Risk accumulation management remains a critical dynamic, as Swiss reinsurance companies must carefully balance portfolio diversification with concentration limits to optimize risk-adjusted returns while maintaining adequate capacity for client needs. Advanced modeling techniques and sophisticated risk management frameworks enable more effective portfolio optimization and capital efficiency.

Client relationship evolution reflects changing expectations and requirements from primary insurance companies, with increased emphasis on partnership approaches, technical expertise sharing, and collaborative risk management solutions that extend beyond traditional reinsurance coverage arrangements.

Comprehensive market analysis of Switzerland’s reinsurance sector employs multiple research methodologies to ensure accurate and reliable insights into market conditions, competitive dynamics, and future growth prospects. Primary research activities include extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand perspectives on market trends and strategic developments.

Secondary research components encompass detailed analysis of public company financial reports, regulatory filings, industry publications, and academic research studies that provide quantitative data and analytical insights into market performance and structural characteristics. This comprehensive approach ensures thorough coverage of all relevant market aspects and stakeholder perspectives.

Data validation processes involve cross-referencing information from multiple sources and conducting analytical consistency checks to ensure accuracy and reliability of research findings. MarkWide Research employs rigorous quality control measures throughout the research process to maintain the highest standards of analytical integrity and market intelligence accuracy.

Market modeling techniques utilize advanced statistical methods and forecasting algorithms to project future market trends and identify potential growth opportunities and risk factors that may influence market development. These analytical approaches provide robust foundations for strategic recommendations and market outlook assessments.

Industry expert consultation ensures that research findings reflect current market realities and incorporate professional insights from experienced practitioners who possess deep understanding of reinsurance market dynamics and operational considerations that influence business performance and strategic decision-making.

Switzerland’s domestic market serves as the foundation for the country’s global reinsurance leadership, with Zurich and Geneva functioning as primary centers for reinsurance operations and strategic decision-making. The domestic market benefits from favorable regulatory conditions, sophisticated financial infrastructure, and concentrated expertise that supports efficient business operations and strategic planning initiatives.

European market integration enables Swiss reinsurance companies to leverage their strategic location and regulatory advantages to serve clients throughout the European Union and broader European Economic Area. This regional positioning provides access to diverse risk portfolios and client relationships that support business diversification and growth opportunities across multiple market segments.

North American operations represent a crucial component of Swiss reinsurance companies’ global strategies, with significant market presence and local operational capabilities that enable effective service delivery to major insurance markets. Market share penetration in North America reaches approximately 35% of total premium volumes for leading Swiss reinsurance companies.

Asia-Pacific expansion continues to drive growth strategies for Swiss reinsurance companies, as the region’s rapid economic development and increasing insurance penetration create substantial opportunities for reinsurance services. Strategic investments in local capabilities and partnerships enable effective market entry and sustainable business development across diverse Asian markets.

Emerging market presence reflects Swiss reinsurance companies’ commitment to global diversification and growth in developing economies where insurance market expansion creates increasing demand for sophisticated risk transfer solutions and technical expertise that Swiss companies are uniquely positioned to provide.

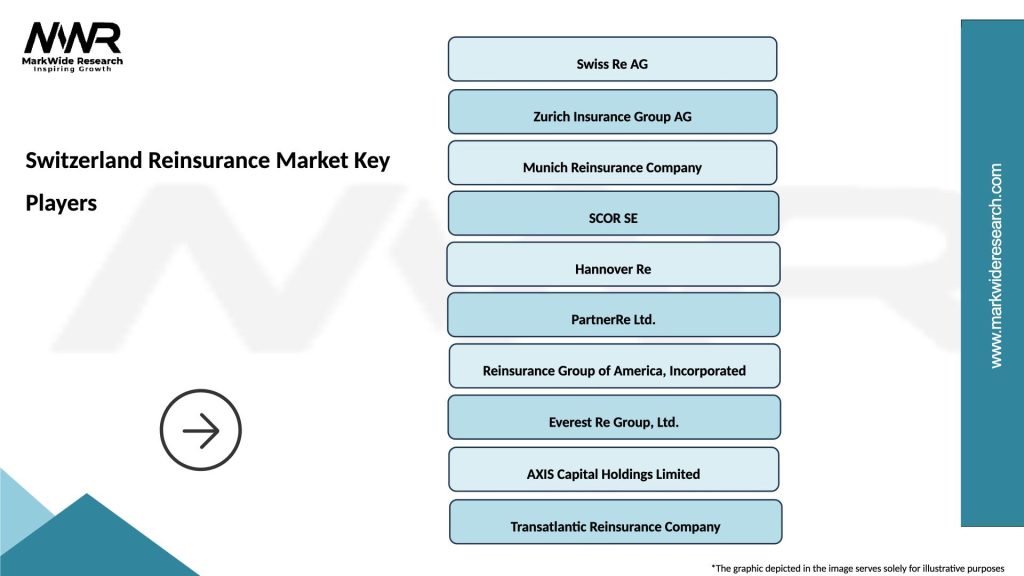

Market leadership in Switzerland’s reinsurance sector is characterized by the presence of several globally dominant companies that collectively influence international market conditions and set industry standards for technical excellence and innovation. These market leaders maintain competitive advantages through scale, expertise, and strategic positioning across multiple business segments.

Competitive strategies among market participants focus on differentiation through technical expertise, innovative product development, and superior client service delivery. Companies invest heavily in advanced analytics, risk modeling capabilities, and digital transformation initiatives to maintain competitive advantages and capture market share in attractive business segments.

Market consolidation trends reflect ongoing industry evolution, with larger companies acquiring specialized capabilities and smaller players seeking strategic partnerships to enhance their competitive positioning and operational efficiency in an increasingly complex global marketplace.

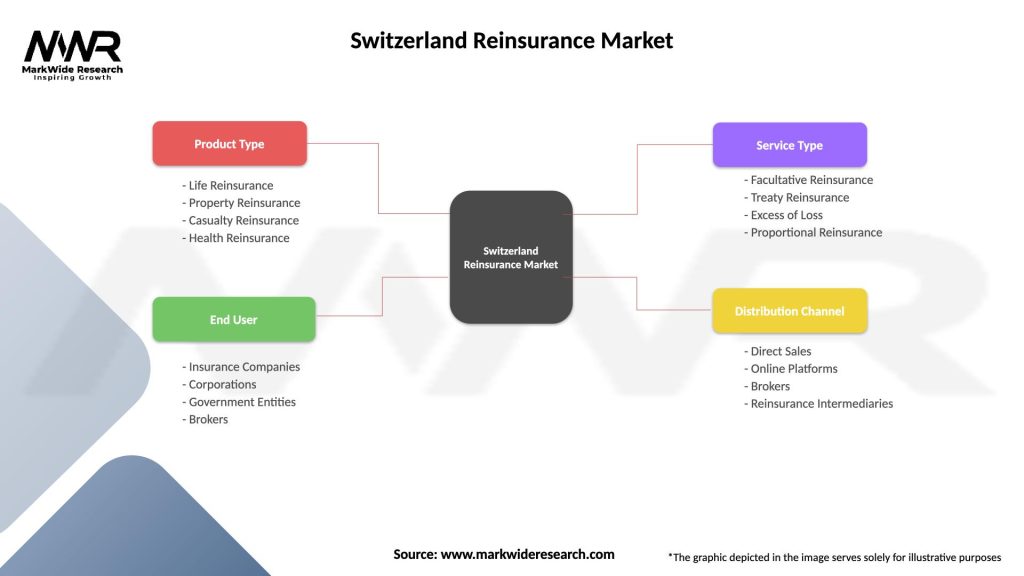

Business line segmentation within Switzerland’s reinsurance market reflects the diverse risk categories and client needs that drive market demand and competitive positioning. Property and casualty reinsurance represents the largest segment, encompassing natural catastrophe coverage, liability reinsurance, and specialty lines that require sophisticated risk assessment and pricing capabilities.

By Coverage Type:

Life and Health Reinsurance:

Alternative Risk Transfer:

Property catastrophe reinsurance continues to represent the most significant category within Switzerland’s reinsurance market, driven by increasing natural disaster frequency and severity that creates substantial demand for sophisticated risk transfer solutions. Swiss reinsurance companies maintain leadership positions in this segment through advanced catastrophe modeling capabilities and substantial capital resources that enable large-scale risk assumption.

Specialty lines reinsurance demonstrates strong growth potential, as primary insurers seek expert partners for complex and emerging risk categories that require specialized technical knowledge and innovative coverage solutions. Market penetration rates in specialty lines have increased by 22% over recent years, reflecting growing demand for sophisticated risk management solutions.

Life reinsurance operations benefit from demographic trends and regulatory changes that create opportunities for risk transfer solutions addressing longevity risk, mortality fluctuations, and capital optimization requirements for primary life insurance companies. Swiss companies leverage their actuarial expertise and global reach to capture attractive opportunities in this growing segment.

Cyber reinsurance represents an emerging high-growth category, as increasing digitalization and cyber threat sophistication create substantial demand for specialized coverage solutions. Swiss reinsurance companies are developing innovative products and risk assessment capabilities to address this rapidly evolving risk landscape and capture market share in this attractive segment.

Climate risk solutions encompass both traditional property catastrophe coverage and innovative products addressing transition risks, physical climate impacts, and sustainability-focused risk management requirements that align with global environmental responsibility trends and regulatory developments.

Primary insurance companies benefit significantly from Switzerland’s sophisticated reinsurance market through access to substantial risk transfer capacity, technical expertise, and innovative solutions that enable business expansion and capital optimization. Swiss reinsurance partnerships provide primary insurers with enhanced underwriting capabilities and risk management support that improve their competitive positioning and financial performance.

Capital efficiency improvements result from effective reinsurance utilization, enabling primary insurers to optimize their capital allocation and achieve higher returns on equity while maintaining appropriate risk profiles. These benefits support business growth initiatives and enhance shareholder value creation across diverse market segments and geographic regions.

Risk management enhancement through Swiss reinsurance partnerships provides primary insurers with access to sophisticated modeling capabilities, technical expertise, and global market intelligence that improve their risk assessment and pricing accuracy. This collaboration enables more effective portfolio management and strategic decision-making processes.

Market access facilitation enables primary insurers to enter new geographic markets and business segments with confidence, leveraging Swiss reinsurance companies’ global presence and local market expertise to support successful expansion initiatives and sustainable business development strategies.

Innovation acceleration occurs through collaboration with Swiss reinsurance companies that invest heavily in technology development and product innovation, providing primary insurers with access to cutting-edge solutions and market-leading capabilities that enhance their competitive positioning and client service delivery.

Regulatory compliance support from Swiss reinsurance partners helps primary insurers navigate complex regulatory requirements across multiple jurisdictions, ensuring adherence to solvency standards and risk management requirements while optimizing operational efficiency and strategic flexibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend reshaping Switzerland’s reinsurance market, as companies invest heavily in advanced analytics, artificial intelligence, and automated underwriting systems that enhance operational efficiency and risk assessment capabilities. Technology adoption rates have increased by 38% across major market participants, reflecting the industry’s commitment to innovation and competitive advantage maintenance.

Sustainability integration has become a central focus for Swiss reinsurance companies, with increasing emphasis on environmental, social, and governance considerations in underwriting decisions and investment strategies. This trend aligns with global regulatory developments and client expectations for responsible business practices and climate risk management solutions.

Alternative capital growth continues to influence market dynamics, as institutional investors seek direct access to insurance risks through sophisticated financial instruments and partnership arrangements with traditional reinsurance companies. This trend creates both competitive challenges and collaboration opportunities for Swiss market participants.

Parametric product development gains momentum as clients seek more efficient and transparent coverage solutions that provide rapid claim settlement and reduced basis risk. Swiss reinsurance companies are leveraging their technical expertise to develop innovative parametric solutions across multiple risk categories and geographic markets.

Cyber risk specialization emerges as a critical trend, with Swiss reinsurance companies developing dedicated capabilities and expertise to address the rapidly evolving cyber threat landscape and growing demand for sophisticated cyber risk transfer solutions from primary insurers and corporate clients.

Regional market expansion continues as Swiss reinsurance companies pursue growth opportunities in emerging markets through strategic partnerships, local presence establishment, and product adaptation initiatives that address specific regional risk characteristics and regulatory requirements.

Strategic acquisitions and partnerships have characterized recent industry developments, as Swiss reinsurance companies seek to enhance their capabilities and market presence through targeted transactions that provide access to specialized expertise, new technologies, or attractive market segments. These strategic initiatives support long-term growth objectives and competitive positioning enhancement.

Regulatory framework evolution in Switzerland continues to support market development while maintaining appropriate oversight standards that ensure financial stability and consumer protection. Recent regulatory updates have focused on solvency requirements, risk management standards, and digital innovation facilitation that benefit market participants and stakeholders.

Technology platform investments by major Swiss reinsurance companies have accelerated, with substantial resources allocated to advanced analytics, cloud computing infrastructure, and digital client interface development that enhance operational efficiency and service delivery capabilities across all business segments.

Product innovation initiatives have resulted in the launch of several groundbreaking coverage solutions addressing emerging risks and client needs, including parametric catastrophe products, cyber risk solutions, and climate transition risk coverage that demonstrate Swiss companies’ commitment to market leadership and innovation.

Capital market activities have increased, with Swiss reinsurance companies utilizing sophisticated financial instruments and alternative capital sources to optimize their capital structures and enhance their risk-bearing capacity while maintaining strong credit ratings and financial flexibility for strategic initiatives.

Sustainability commitments from major market participants include comprehensive environmental, social, and governance strategies that align with global sustainability goals and client expectations for responsible business practices and climate risk management leadership.

Strategic diversification represents a critical recommendation for Swiss reinsurance companies seeking to maintain competitive advantages and capture growth opportunities in an evolving market environment. MWR analysis suggests that companies should focus on expanding their presence in high-growth specialty lines and emerging risk categories that leverage their technical expertise and innovation capabilities.

Technology investment acceleration should remain a priority for market participants, with particular emphasis on advanced analytics, artificial intelligence, and digital platform development that enhance underwriting accuracy, operational efficiency, and client service delivery. These investments are essential for maintaining competitive positioning and capturing market share in attractive segments.

Partnership development with alternative capital providers and technology companies can create synergistic opportunities that enhance market access, risk capacity, and innovation capabilities while maintaining core competitive advantages and client relationships that drive long-term business success.

Geographic expansion strategies should focus on emerging markets with attractive growth prospects and regulatory environments that support sustainable business development. Careful market selection and local partnership development are essential for successful expansion initiatives and risk management in diverse operating environments.

Talent development programs require continued investment to ensure adequate skilled workforce availability for supporting business growth and innovation initiatives. Companies should focus on attracting and retaining top talent while developing internal capabilities that support strategic objectives and operational excellence.

Risk management enhancement through advanced modeling capabilities and sophisticated portfolio management techniques will be essential for maintaining appropriate risk-return profiles while supporting business growth and client service objectives in an increasingly complex global risk environment.

Long-term growth prospects for Switzerland’s reinsurance market remain highly favorable, supported by increasing global risk exposures, growing insurance penetration in emerging markets, and continued demand for sophisticated risk transfer solutions that Swiss companies are uniquely positioned to provide. Market expansion projections indicate sustained growth at compound annual rates of 5.8% over the next decade.

Innovation acceleration will continue to drive market evolution, with Swiss reinsurance companies investing heavily in technology development, product innovation, and operational enhancement initiatives that maintain their competitive advantages and market leadership positions across diverse business segments and geographic markets.

Regulatory developments are expected to support continued market growth while maintaining appropriate oversight standards that ensure financial stability and consumer protection. Swiss regulatory authorities are likely to continue their balanced approach that facilitates innovation while maintaining prudential standards and market confidence.

Climate risk management will become increasingly important as global climate change impacts intensify and create both challenges and opportunities for Swiss reinsurance companies. Market leaders are well-positioned to develop innovative solutions that address climate-related risks while supporting global sustainability objectives and client needs.

Digital transformation will accelerate across all market segments, with Swiss reinsurance companies leveraging advanced technologies to enhance their operational efficiency, risk assessment capabilities, and client service delivery while maintaining their technical expertise and market leadership positions.

Global market integration will continue as Swiss reinsurance companies expand their international presence and develop strategic partnerships that enhance their market access and service capabilities while maintaining their Swiss operational advantages and regulatory benefits.

Switzerland’s reinsurance market maintains its position as a global leader through exceptional technical expertise, substantial capital resources, and continuous innovation that addresses evolving client needs and market opportunities. The market’s strength derives from its concentration of world-class companies, favorable regulatory environment, and strategic positioning that enables effective service delivery across diverse geographic markets and risk categories.

Future success will depend on continued investment in technology development, talent acquisition, and strategic expansion initiatives that maintain competitive advantages while adapting to changing market conditions and client expectations. Swiss reinsurance companies are well-positioned to capitalize on emerging opportunities while managing evolving risks and regulatory requirements.

Market leadership sustainability requires ongoing commitment to innovation, operational excellence, and strategic partnership development that enhances market access and service capabilities while maintaining the technical expertise and financial strength that differentiate Swiss companies in the global reinsurance marketplace. The outlook remains highly favorable for continued growth and market leadership in this critical sector.

What is Reinsurance?

Reinsurance is a financial arrangement where one insurance company transfers a portion of its risk to another insurance company. This process helps insurers manage risk exposure and stabilize their financial performance.

What are the key players in the Switzerland Reinsurance Market?

The Switzerland Reinsurance Market features several prominent companies, including Swiss Re, Zurich Insurance Group, and PartnerRe, among others. These firms play a crucial role in providing reinsurance solutions across various sectors.

What are the main drivers of growth in the Switzerland Reinsurance Market?

Key drivers of growth in the Switzerland Reinsurance Market include increasing demand for risk management solutions, the rise of natural disasters necessitating coverage, and advancements in data analytics for better risk assessment.

What challenges does the Switzerland Reinsurance Market face?

The Switzerland Reinsurance Market faces challenges such as regulatory changes, increasing competition, and the impact of climate change on risk profiles. These factors can complicate underwriting processes and affect profitability.

What opportunities exist in the Switzerland Reinsurance Market?

Opportunities in the Switzerland Reinsurance Market include the expansion of cyber risk coverage, innovative insurance products tailored to emerging risks, and the potential for growth in the health reinsurance sector.

What trends are shaping the Switzerland Reinsurance Market?

Trends in the Switzerland Reinsurance Market include the integration of technology in underwriting processes, a focus on sustainability and ESG factors, and the increasing use of alternative capital sources to support reinsurance capacity.

Switzerland Reinsurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Reinsurance, Property Reinsurance, Casualty Reinsurance, Health Reinsurance |

| End User | Insurance Companies, Corporations, Government Entities, Brokers |

| Service Type | Facultative Reinsurance, Treaty Reinsurance, Excess of Loss, Proportional Reinsurance |

| Distribution Channel | Direct Sales, Online Platforms, Brokers, Reinsurance Intermediaries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Reinsurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at