444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia automotive fuels market represents a pivotal segment within the Kingdom’s energy landscape, characterized by substantial domestic consumption and strategic importance to the national economy. Saudi Arabia stands as one of the world’s largest oil producers and consumers of automotive fuels, with the domestic market experiencing significant transformation driven by economic diversification initiatives and Vision 2030 objectives. The market encompasses various fuel types including gasoline, diesel, and emerging alternative fuels, serving a rapidly expanding vehicle fleet that has grown by approximately 8.5% annually over recent years.

Market dynamics in Saudi Arabia reflect unique characteristics influenced by government subsidies, domestic refining capacity, and evolving consumer preferences. The Kingdom’s automotive fuels sector benefits from abundant crude oil reserves and sophisticated refining infrastructure, positioning it as a self-sufficient market with export capabilities. Gasoline consumption dominates the market landscape, accounting for approximately 72% of total automotive fuel demand, while diesel represents a significant portion of commercial and industrial vehicle requirements.

Government initiatives aimed at fuel subsidy reforms and energy efficiency improvements have introduced new market dynamics, encouraging more sustainable consumption patterns while maintaining economic competitiveness. The market continues to evolve with technological advancements in fuel quality standards, distribution networks, and emerging alternative fuel technologies that align with global environmental trends and domestic sustainability goals.

The Saudi Arabia automotive fuels market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of liquid fuels specifically designed for automotive applications within the Kingdom’s borders. This market includes traditional petroleum-based fuels such as gasoline and diesel, as well as emerging alternative fuel options including biofuels and synthetic fuels that power the nation’s diverse vehicle fleet.

Automotive fuels in the Saudi context represent refined petroleum products processed from crude oil through sophisticated refining operations, meeting specific quality standards and octane requirements for optimal engine performance. The market encompasses the entire value chain from crude oil extraction and refining to retail distribution through service stations and commercial fuel suppliers serving individual consumers, fleet operators, and industrial users across various sectors.

Market significance extends beyond simple fuel supply, representing a critical component of Saudi Arabia’s energy security strategy and economic development framework. The automotive fuels sector supports transportation infrastructure, logistics networks, and mobility solutions that enable economic activity across industries while contributing to government revenues through various taxation and pricing mechanisms.

Saudi Arabia’s automotive fuels market demonstrates robust fundamentals supported by strong domestic demand, extensive refining capacity, and strategic government policies promoting energy sector development. The market benefits from the Kingdom’s position as a leading global oil producer, ensuring reliable supply chains and competitive pricing structures that support economic growth and consumer mobility needs.

Key market characteristics include substantial gasoline consumption driven by a growing vehicle population, significant diesel demand from commercial transportation and logistics sectors, and emerging interest in alternative fuel technologies. The market operates within a framework of government subsidies and pricing controls that maintain fuel affordability while gradually transitioning toward more market-oriented mechanisms aligned with economic diversification objectives.

Growth drivers encompass population expansion, urbanization trends, infrastructure development projects, and increasing vehicle ownership rates that continue to boost fuel demand across all segments. The market faces evolving dynamics related to fuel efficiency improvements, environmental regulations, and technological innovations that influence consumption patterns and fuel specifications.

Strategic developments include investments in refining capacity expansion, distribution network modernization, and research into alternative fuel technologies that position Saudi Arabia as a leader in regional energy markets while supporting long-term sustainability goals and economic diversification initiatives.

Market insights reveal several critical factors shaping the Saudi Arabia automotive fuels landscape:

Population growth serves as a fundamental driver of automotive fuels demand in Saudi Arabia, with expanding demographics creating increased transportation needs and vehicle ownership requirements. The Kingdom’s young population demonstrates strong preferences for personal mobility, driving consistent growth in gasoline consumption and supporting market expansion across all fuel categories.

Economic development initiatives under Vision 2030 stimulate automotive fuels demand through infrastructure projects, industrial expansion, and commercial activity growth. Mega-projects including NEOM, The Red Sea Project, and various industrial cities require substantial fuel supplies for construction equipment, transportation logistics, and operational support systems.

Urbanization trends concentrate population in major cities, creating dense transportation networks that rely heavily on automotive fuels for daily mobility needs. Urban expansion projects and smart city developments increase vehicle usage patterns and fuel consumption requirements while supporting market growth through improved distribution infrastructure.

Industrial growth across manufacturing, logistics, and service sectors drives diesel demand for commercial vehicles, freight transportation, and industrial equipment. The Kingdom’s efforts to develop non-oil industries create additional fuel requirements for supply chain operations and business transportation needs.

Tourism development initiatives increase automotive fuels demand through rental car services, tour operations, and hospitality sector transportation requirements. Religious tourism and emerging leisure tourism sectors contribute to seasonal demand fluctuations and overall market growth patterns.

Fuel efficiency improvements in modern vehicles reduce per-vehicle fuel consumption, potentially limiting demand growth despite increasing vehicle populations. Advanced engine technologies and hybrid vehicle adoption create challenges for traditional fuel demand projections and market growth expectations.

Subsidy reform initiatives aimed at reducing government expenditures may increase fuel prices and impact consumer behavior patterns. Gradual subsidy reductions could influence vehicle usage patterns and encourage more efficient transportation choices that affect overall fuel demand levels.

Environmental regulations and sustainability commitments may restrict certain fuel types and encourage alternative energy adoption in transportation sectors. Climate change considerations and international environmental agreements create pressure for cleaner fuel alternatives and reduced carbon emissions.

Economic diversification efforts may shift focus and resources away from traditional petroleum sectors toward renewable energy and alternative fuel technologies. Investment priorities in non-oil sectors could impact future automotive fuels market development and expansion strategies.

Regional competition from neighboring countries with competitive fuel pricing and advanced distribution networks may influence market dynamics and consumer preferences. Cross-border fuel trade and regional market integration create competitive pressures that affect domestic market conditions.

Alternative fuel development presents significant opportunities for market expansion and diversification, including biofuels, synthetic fuels, and hydrogen-based transportation solutions. Research and development investments in clean fuel technologies position Saudi Arabia as a regional leader in sustainable transportation energy solutions.

Export market expansion leverages Saudi Arabia’s refining capacity and strategic location to serve regional automotive fuels demand in neighboring countries. Regional integration initiatives create opportunities for fuel trade partnerships and cross-border distribution network development.

Technology integration in fuel distribution systems offers opportunities for enhanced customer service, operational efficiency, and market differentiation. Digital payment systems and smart fuel management technologies improve consumer convenience while reducing operational costs.

Premium fuel segments present growth opportunities through high-octane gasoline and specialty fuel products that command higher margins and serve performance-oriented consumers. Branded fuel offerings with additives and performance enhancements create market differentiation opportunities.

Industrial fuel services expansion into specialized commercial and industrial fuel supply contracts offers stable revenue streams and long-term customer relationships. Fleet management services and bulk fuel supply arrangements provide opportunities for market share growth and customer loyalty development.

Supply-demand balance in Saudi Arabia’s automotive fuels market reflects the Kingdom’s unique position as both a major producer and significant consumer of petroleum products. Domestic refining capacity exceeds local consumption requirements, creating opportunities for export while ensuring supply security and price stability for domestic consumers.

Pricing mechanisms operate within government-controlled frameworks that balance consumer affordability with economic efficiency objectives. Fuel pricing policies consider international oil prices, refining costs, and social welfare considerations while gradually transitioning toward more market-oriented pricing structures.

Seasonal variations influence automotive fuels demand patterns, with increased consumption during cooler months and holiday periods when travel activity peaks. Hajj and Umrah seasons create significant temporary demand increases that require flexible supply chain management and distribution capacity.

Competitive landscape features both government-owned and private sector participants in fuel distribution and retail operations. Market liberalization initiatives encourage private investment and competition while maintaining strategic government oversight of critical energy infrastructure.

Technological evolution drives continuous improvements in fuel quality, distribution efficiency, and customer service capabilities. Innovation adoption in areas such as fuel additives, storage technologies, and retail automation enhances market competitiveness and operational performance.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Saudi Arabia’s automotive fuels market dynamics. Primary research includes extensive interviews with industry stakeholders, government officials, fuel distributors, and consumer surveys to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of government publications, industry reports, statistical databases, and regulatory documentation to establish market baselines and historical trend analysis. Data validation processes ensure accuracy and consistency across multiple information sources while identifying potential discrepancies or data gaps.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and identify growth opportunities. Market segmentation analysis examines consumption patterns across different fuel types, geographic regions, and consumer categories to provide detailed market insights.

Qualitative assessment incorporates expert opinions, industry best practices, and strategic analysis to interpret market data and identify underlying factors influencing market development. Stakeholder feedback provides valuable context for understanding market dynamics and future development scenarios.

Continuous monitoring ensures research findings remain current and relevant through ongoing data collection and analysis updates. Market intelligence systems track key performance indicators and emerging trends that may impact future market conditions and strategic planning requirements.

Central Region dominates Saudi Arabia’s automotive fuels consumption, anchored by Riyadh’s metropolitan area which accounts for approximately 35% of national fuel demand. Riyadh serves as the primary consumption center with extensive distribution networks, major fuel terminals, and high vehicle density supporting consistent demand growth across all fuel categories.

Eastern Province represents a significant market segment driven by industrial activities, port operations, and petrochemical complexes that require substantial diesel and gasoline supplies. Dammam-Khobar metropolitan area contributes approximately 28% of regional fuel consumption while supporting export operations through major fuel terminals and distribution facilities.

Western Region encompasses Jeddah, Mecca, and Medina, creating unique demand patterns influenced by religious tourism and commercial activities. Jeddah serves as a major consumption center while Mecca and Medina experience significant seasonal demand fluctuations related to Hajj and Umrah pilgrimages that can increase fuel consumption by up to 45% during peak periods.

Northern regions including Tabuk and Al-Jouf demonstrate growing fuel demand driven by agricultural development, mining activities, and cross-border trade with Jordan and Iraq. Infrastructure development projects in these regions create additional fuel requirements while expanding distribution network coverage.

Southern provinces encompassing Asir, Jazan, and Najran show steady fuel demand growth supported by industrial development, agricultural activities, and border trade operations. Regional development initiatives continue to drive fuel infrastructure expansion and consumption growth across these emerging markets.

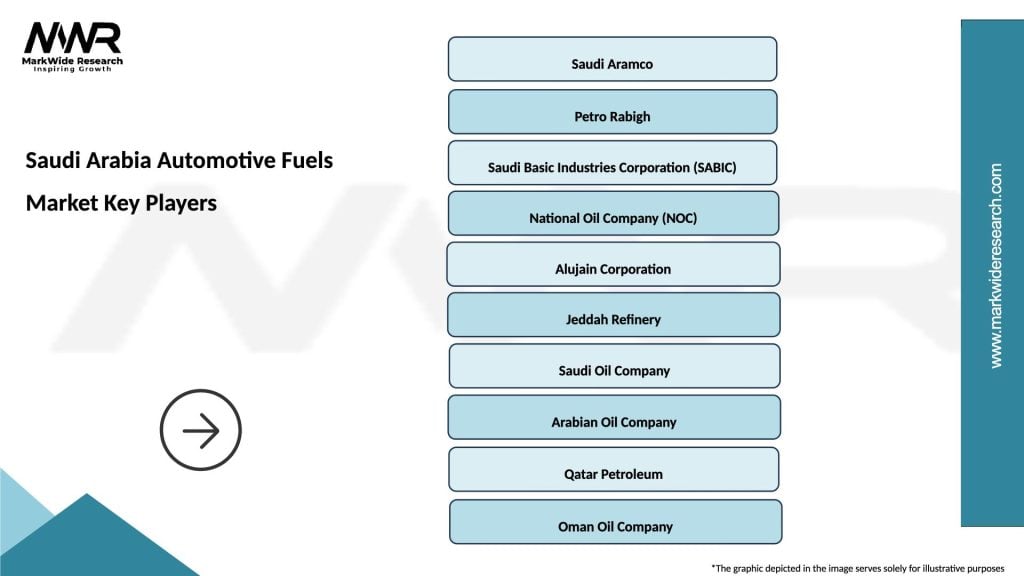

Major market participants in Saudi Arabia’s automotive fuels sector include both government-owned entities and private sector companies operating across the value chain:

Market competition focuses on distribution network expansion, customer service quality, and operational efficiency improvements. Strategic partnerships between major players and technology providers enhance competitive positioning through innovation and service differentiation.

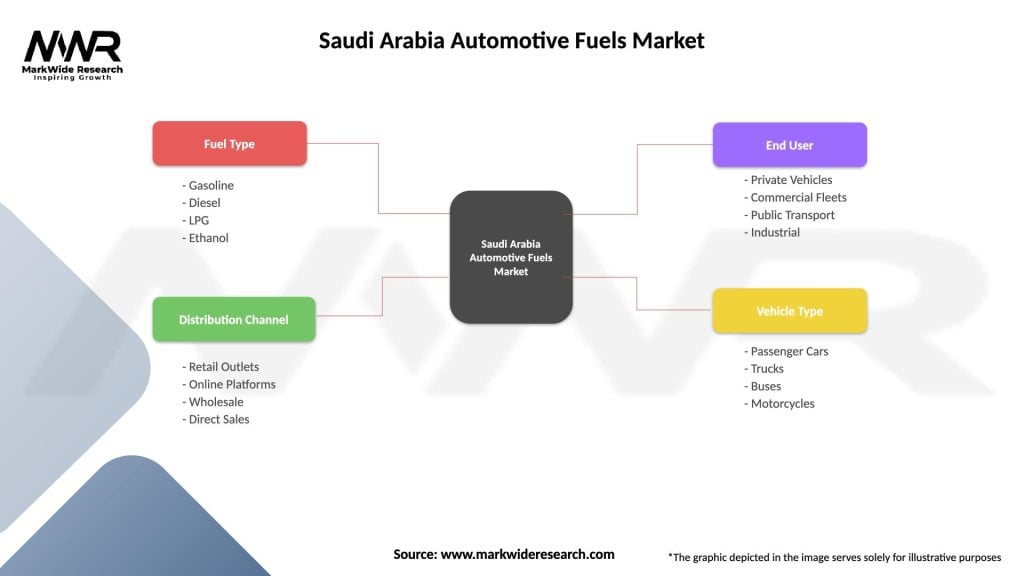

By Fuel Type:

By Application:

By Distribution Channel:

Gasoline segment maintains market dominance with consistent growth driven by expanding passenger vehicle ownership and urban mobility requirements. Premium gasoline shows particularly strong growth as consumers increasingly prefer higher-octane fuels for improved engine performance and fuel efficiency benefits.

Diesel category demonstrates steady demand from commercial transportation, logistics operations, and industrial applications. Commercial diesel consumption patterns reflect economic activity levels and freight transportation volumes, with seasonal variations related to construction and agricultural cycles.

Alternative fuels represent an emerging category with growing interest from environmentally conscious consumers and government sustainability initiatives. Biofuel blends and synthetic fuel options gain traction as technology advances and cost competitiveness improves.

Retail distribution channels continue to modernize with enhanced customer service features, digital payment options, and convenience store integration. Service station networks expand to serve growing suburban and rural markets while upgrading existing facilities with modern amenities.

Commercial fuel services grow in importance as businesses seek reliable fuel supply partnerships and fleet management solutions. Bulk fuel delivery and specialized commercial services provide stable revenue streams for fuel distributors while meeting specific customer requirements.

Fuel distributors benefit from stable demand patterns, government support for infrastructure development, and opportunities for market expansion through network growth and service diversification. Operational efficiency improvements through technology adoption and supply chain optimization create competitive advantages and margin improvements.

Consumers enjoy reliable fuel supply, competitive pricing supported by government policies, and improving service quality through modernized distribution networks. Fuel quality standards ensure optimal vehicle performance while expanding alternative fuel options provide environmental benefits and choice diversity.

Government stakeholders realize significant economic benefits through fuel sector revenues, employment creation, and energy security enhancement. Strategic control over fuel supply chains supports national security objectives while gradual market liberalization encourages private sector investment and innovation.

Vehicle manufacturers benefit from reliable fuel supply chains that support vehicle sales and customer satisfaction. Fuel quality consistency enables optimal vehicle performance and warranty compliance while alternative fuel development creates opportunities for new vehicle technologies.

Commercial fleet operators access reliable fuel supply networks, competitive pricing structures, and specialized services that support operational efficiency and cost management. Fleet fuel management solutions provide operational insights and cost control capabilities that enhance business performance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Fuel quality enhancement represents a major trend with increasing adoption of advanced fuel formulations that improve engine performance and reduce emissions. Premium fuel segments show accelerated growth as consumers recognize benefits of higher-octane gasoline and advanced diesel formulations with performance additives.

Digital transformation revolutionizes fuel retail operations through mobile payment systems, loyalty programs, and customer relationship management technologies. Smart fuel stations integrate IoT sensors, automated systems, and data analytics to optimize operations and enhance customer experiences.

Sustainability initiatives drive development of cleaner fuel alternatives and carbon reduction programs across the automotive fuels value chain. Biofuel integration and renewable fuel blending gain momentum as environmental awareness increases and technology costs decline.

Fleet management solutions emerge as significant growth areas with integrated fuel cards, telematics systems, and comprehensive fleet services. Commercial customers increasingly demand sophisticated fuel management tools that provide operational insights and cost optimization capabilities.

Regional integration trends promote cross-border fuel trade and standardization of fuel specifications across Gulf Cooperation Council countries. Market harmonization initiatives facilitate regional supply chain optimization and competitive market development.

Infrastructure expansion projects include major investments in fuel terminal capacity, pipeline networks, and retail station development across emerging regions. Strategic infrastructure developments support growing fuel demand while improving distribution efficiency and market coverage.

Technology partnerships between fuel companies and technology providers accelerate adoption of digital solutions, automation systems, and customer service innovations. Collaborative initiatives focus on operational efficiency improvements and enhanced customer experiences through technological integration.

Regulatory developments include updated fuel quality standards, environmental compliance requirements, and market liberalization measures that reshape competitive dynamics. Policy changes promote private sector participation while maintaining strategic government oversight of critical energy infrastructure.

Alternative fuel investments encompass research and development programs, pilot projects, and commercial-scale alternative fuel production facilities. Innovation initiatives position Saudi Arabia as a regional leader in clean fuel technologies and sustainable transportation solutions.

Market consolidation activities include strategic acquisitions, joint ventures, and partnership agreements that strengthen market positions and expand service capabilities. Industry restructuring creates more efficient market structures while maintaining competitive dynamics and consumer choice.

MarkWide Research recommends that industry participants focus on diversification strategies that balance traditional fuel operations with emerging alternative fuel technologies. Strategic positioning in both conventional and clean fuel segments ensures long-term competitiveness while meeting evolving customer preferences and regulatory requirements.

Investment priorities should emphasize technology integration, operational efficiency improvements, and customer service enhancement initiatives that differentiate market offerings. Digital transformation investments in fuel retail operations and fleet management services provide sustainable competitive advantages and revenue growth opportunities.

Market expansion strategies should target underserved geographic regions and specialized customer segments with tailored fuel solutions and service offerings. Regional growth opportunities in developing areas provide attractive returns while supporting national economic development objectives.

Partnership development with technology providers, automotive manufacturers, and international fuel companies enhances capabilities and market reach. Strategic alliances facilitate knowledge transfer, technology adoption, and access to global best practices in fuel operations and customer service.

Sustainability integration across all business operations positions companies for long-term success while meeting environmental responsibilities and stakeholder expectations. Environmental stewardship initiatives create positive brand differentiation and support regulatory compliance objectives.

Long-term growth prospects for Saudi Arabia’s automotive fuels market remain positive, supported by continued economic development, population growth, and infrastructure expansion initiatives. Market evolution toward more diverse fuel offerings and advanced distribution systems creates opportunities for sustained growth and innovation.

Alternative fuel adoption is expected to accelerate gradually, with biofuels and synthetic fuels gaining market share while traditional petroleum products maintain dominance. Technology advancement and cost reductions in alternative fuel production support growing market acceptance and commercial viability.

Digital transformation will continue reshaping fuel retail operations with enhanced customer experiences, operational efficiency improvements, and data-driven business insights. Smart fuel systems and IoT integration become standard features across modern fuel distribution networks.

Regional market integration strengthens through harmonized standards, cross-border trade facilitation, and collaborative infrastructure development. Export opportunities expand as regional demand growth outpaces local production capacity in neighboring countries.

Government policy evolution toward market-oriented mechanisms while maintaining strategic oversight supports healthy competition and private sector investment. Regulatory frameworks balance consumer protection, environmental objectives, and economic efficiency goals through adaptive policy approaches.

Saudi Arabia’s automotive fuels market demonstrates strong fundamentals and promising growth prospects supported by abundant resources, advanced infrastructure, and strategic government policies. The market benefits from unique advantages including domestic production capabilities, comprehensive distribution networks, and growing consumer demand across all fuel categories.

Market transformation toward greater diversification, technological integration, and sustainability focus creates opportunities for innovation and competitive differentiation. Industry participants who successfully balance traditional fuel operations with emerging alternative technologies position themselves for long-term success in an evolving market landscape.

Strategic priorities including infrastructure modernization, customer service enhancement, and alternative fuel development support sustainable market growth while meeting evolving consumer preferences and regulatory requirements. The combination of strong domestic demand, export potential, and technological advancement creates a favorable environment for continued market expansion and industry development in Saudi Arabia’s automotive fuels sector.

What is Automotive Fuels?

Automotive fuels refer to the various types of fuels used to power vehicles, including gasoline, diesel, and alternative fuels such as biofuels and electricity. These fuels are essential for the transportation sector, impacting both efficiency and environmental considerations.

What are the key players in the Saudi Arabia Automotive Fuels Market?

Key players in the Saudi Arabia Automotive Fuels Market include Saudi Aramco, SABIC, and TotalEnergies, among others. These companies are involved in the production, distribution, and innovation of automotive fuels in the region.

What are the growth factors driving the Saudi Arabia Automotive Fuels Market?

The growth of the Saudi Arabia Automotive Fuels Market is driven by increasing vehicle ownership, urbanization, and government initiatives to enhance fuel efficiency. Additionally, the demand for cleaner fuels is pushing innovation in the sector.

What challenges does the Saudi Arabia Automotive Fuels Market face?

The Saudi Arabia Automotive Fuels Market faces challenges such as fluctuating oil prices, regulatory pressures for emissions reductions, and competition from alternative energy sources. These factors can impact profitability and market stability.

What opportunities exist in the Saudi Arabia Automotive Fuels Market?

Opportunities in the Saudi Arabia Automotive Fuels Market include the development of sustainable fuels, investment in electric vehicle infrastructure, and advancements in fuel technology. These trends can lead to new market segments and consumer adoption.

What trends are shaping the Saudi Arabia Automotive Fuels Market?

Trends shaping the Saudi Arabia Automotive Fuels Market include the shift towards renewable energy sources, the rise of electric vehicles, and innovations in fuel efficiency technologies. These trends are influencing consumer preferences and regulatory frameworks.

Saudi Arabia Automotive Fuels Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | Gasoline, Diesel, LPG, Ethanol |

| Distribution Channel | Retail Outlets, Online Platforms, Wholesale, Direct Sales |

| End User | Private Vehicles, Commercial Fleets, Public Transport, Industrial |

| Vehicle Type | Passenger Cars, Trucks, Buses, Motorcycles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Automotive Fuels Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at