444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK confectionery market represents one of Europe’s most dynamic and established sweet treats sectors, encompassing chocolate, sugar confectionery, gum, and seasonal specialties. British consumers demonstrate remarkable loyalty to both traditional and innovative confectionery products, driving consistent demand across multiple categories. The market benefits from a rich heritage of iconic brands, sophisticated manufacturing capabilities, and evolving consumer preferences toward premium and healthier alternatives.

Market dynamics indicate robust growth potential, with the sector experiencing a 4.2% annual growth rate driven by product innovation, seasonal demand fluctuations, and expanding retail distribution channels. Premium chocolate segments particularly show strong performance, capturing 38% market share as consumers increasingly seek quality over quantity. The integration of sustainable sourcing practices and ethical manufacturing processes has become increasingly important, with 72% of consumers expressing preference for responsibly sourced confectionery products.

Digital transformation and e-commerce expansion have revolutionized distribution strategies, enabling direct-to-consumer sales and personalized product offerings. Seasonal variations remain significant, with Easter and Christmas periods generating approximately 45% of annual sales volume, while everyday consumption patterns support steady baseline demand throughout the year.

The UK confectionery market refers to the comprehensive sector encompassing the production, distribution, and retail sale of sweet treats including chocolate products, sugar confectionery, chewing gum, and seasonal specialties across the United Kingdom. This market includes both traditional British confectionery brands and international products adapted for local tastes and preferences.

Confectionery products span multiple categories from everyday chocolate bars and sweets to premium artisanal chocolates and health-conscious alternatives. The market encompasses manufacturing operations, supply chain management, retail distribution through various channels, and emerging direct-to-consumer sales platforms. Seasonal confectionery represents a significant component, including Easter eggs, Christmas chocolates, and Valentine’s Day specialties that drive substantial revenue spikes during specific periods.

Market participants include multinational confectionery giants, established British heritage brands, emerging artisanal producers, and private label manufacturers serving major retail chains. The sector also encompasses ingredient suppliers, packaging specialists, and distribution networks that support the complex supply chain from cocoa bean to consumer purchase.

Strategic analysis reveals the UK confectionery market maintains strong fundamentals despite evolving consumer preferences toward healthier alternatives. Premium positioning strategies have proven successful, with consumers willing to pay higher prices for quality ingredients, ethical sourcing, and innovative flavors. The market demonstrates resilience through economic fluctuations, supported by confectionery’s role as affordable luxury and emotional comfort food.

Innovation trends focus on reduced sugar formulations, plant-based alternatives, and functional ingredients that provide additional health benefits. Sustainability initiatives have become competitive differentiators, with 68% of manufacturers implementing comprehensive environmental programs. Digital engagement strategies increasingly influence purchasing decisions, particularly among younger demographics who research products online before making purchases.

Market consolidation continues as larger players acquire specialized brands to expand portfolio diversity and market reach. Retail partnerships remain crucial for market access, with major supermarket chains controlling significant distribution channels. The emergence of specialty confectionery retailers and online platforms creates new opportunities for niche products and direct consumer relationships.

Consumer behavior analysis reveals several critical insights shaping market development and strategic planning across the UK confectionery sector:

Market segmentation reveals chocolate products dominate with the largest share, followed by sugar confectionery and specialty items. Regional preferences show variations in flavor profiles and brand preferences across England, Scotland, Wales, and Northern Ireland, requiring tailored marketing approaches.

Economic factors supporting market growth include stable disposable income levels and confectionery’s position as affordable luxury during economic uncertainty. Consumer lifestyle changes create new consumption occasions, with busy schedules driving demand for convenient, portable sweet treats that provide quick energy and emotional satisfaction.

Innovation acceleration drives market expansion through continuous product development addressing evolving consumer preferences. Manufacturers invest heavily in research and development to create novel flavors, textures, and formulations that capture consumer interest and command premium pricing. Seasonal marketing campaigns effectively stimulate demand during key periods, maximizing revenue potential through targeted promotional strategies.

Retail channel expansion increases product accessibility through diverse distribution networks including traditional supermarkets, convenience stores, specialty retailers, and online platforms. Digital commerce growth enables direct consumer relationships and personalized marketing approaches that drive repeat purchases and brand loyalty.

Cultural traditions maintain steady baseline demand for confectionery products associated with British celebrations, holidays, and social customs. Tourism industry contributes additional demand as visitors seek authentic British confectionery experiences and souvenir purchases, supporting specialty and heritage brand segments.

Health concerns regarding sugar consumption and obesity rates create headwinds for traditional confectionery products, requiring significant reformulation efforts and marketing strategy adjustments. Regulatory pressures including sugar taxes and advertising restrictions limit promotional activities and increase operational costs across the industry.

Raw material volatility affects production costs and profit margins, particularly cocoa and sugar price fluctuations that impact manufacturing economics. Supply chain disruptions create operational challenges and inventory management difficulties, especially for imported ingredients and packaging materials essential for production continuity.

Competitive intensity from international brands and private label products pressures market share and pricing strategies. Consumer preference shifts toward healthier snacking alternatives reduce traditional confectionery consumption among health-conscious demographics, requiring strategic pivots toward better-for-you product lines.

Economic uncertainty influences discretionary spending patterns, with confectionery purchases potentially declining during periods of financial stress. Environmental regulations increase packaging and manufacturing compliance costs while demanding sustainable sourcing practices that may impact profitability.

Health-focused innovation presents substantial growth opportunities through development of reduced sugar, functional, and plant-based confectionery products that meet evolving consumer demands. Premium positioning strategies enable higher margins through artisanal products, unique flavor combinations, and luxury packaging that appeals to affluent consumer segments.

Digital transformation creates opportunities for direct-to-consumer sales, subscription services, and personalized product offerings that strengthen customer relationships and improve profitability. Export expansion leverages British confectionery heritage and quality reputation to access international markets seeking authentic UK products.

Sustainability leadership provides competitive advantages through comprehensive environmental and social responsibility programs that resonate with conscious consumers. Seasonal specialization offers opportunities for limited-edition products and premium seasonal collections that generate excitement and drive higher sales volumes during peak periods.

Partnership opportunities with retailers, foodservice operators, and complementary brands create new distribution channels and cross-promotional possibilities. Technology integration enables smart packaging, traceability systems, and enhanced consumer engagement through interactive experiences that differentiate products in competitive markets.

Supply chain evolution reflects increasing complexity as manufacturers balance cost efficiency with sustainability requirements and quality standards. Vertical integration strategies help companies control key inputs and ensure consistent product quality while managing cost pressures from volatile commodity markets.

Consumer engagement patterns show growing importance of brand storytelling, authenticity, and emotional connections that transcend traditional product attributes. Seasonal demand cycles require sophisticated forecasting and inventory management to optimize production schedules and minimize waste while meeting peak period requirements.

Regulatory compliance demands continuous adaptation to evolving food safety standards, labeling requirements, and health-focused legislation that impacts product formulations and marketing approaches. Technology adoption accelerates across manufacturing processes, quality control systems, and consumer interaction platforms that enhance operational efficiency and market responsiveness.

Competitive dynamics intensify as traditional boundaries blur between confectionery categories and adjacent food sectors, requiring broader strategic thinking and portfolio diversification. Market consolidation trends create opportunities for strategic acquisitions while increasing competitive pressure on independent manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into UK confectionery market dynamics. Primary research activities include structured interviews with industry executives, retail buyers, and consumer focus groups to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and trade publications to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling and trend analysis to identify growth patterns and forecast future market developments.

Consumer surveys capture purchasing behavior, brand preferences, and emerging trends across diverse demographic segments. Retail audits provide insights into product placement, pricing strategies, and promotional effectiveness across various distribution channels.

Expert consultations with industry specialists, regulatory authorities, and market analysts ensure comprehensive understanding of complex market dynamics. Data triangulation validates findings through multiple sources and methodologies to enhance research reliability and accuracy.

England dominates the UK confectionery market with approximately 78% market share, driven by large population centers, diverse retail infrastructure, and strong consumer spending power. London and Southeast regions show particular strength in premium and artisanal confectionery segments, reflecting higher disposable incomes and sophisticated consumer preferences.

Scotland represents a distinctive market segment with strong preferences for traditional Scottish confectionery products and seasonal specialties. Regional manufacturers maintain competitive advantages through local brand loyalty and specialized product offerings that resonate with Scottish cultural preferences and traditions.

Wales demonstrates steady market growth with increasing penetration of premium products and health-conscious alternatives. Rural distribution challenges create opportunities for online retailers and specialty brands that can effectively reach dispersed consumer populations through digital channels.

Northern Ireland shows unique market characteristics influenced by cross-border trade dynamics and distinct consumer preferences. Regional analysis conducted by MarkWide Research indicates growing demand for locally-produced confectionery products that reflect regional identity and cultural heritage.

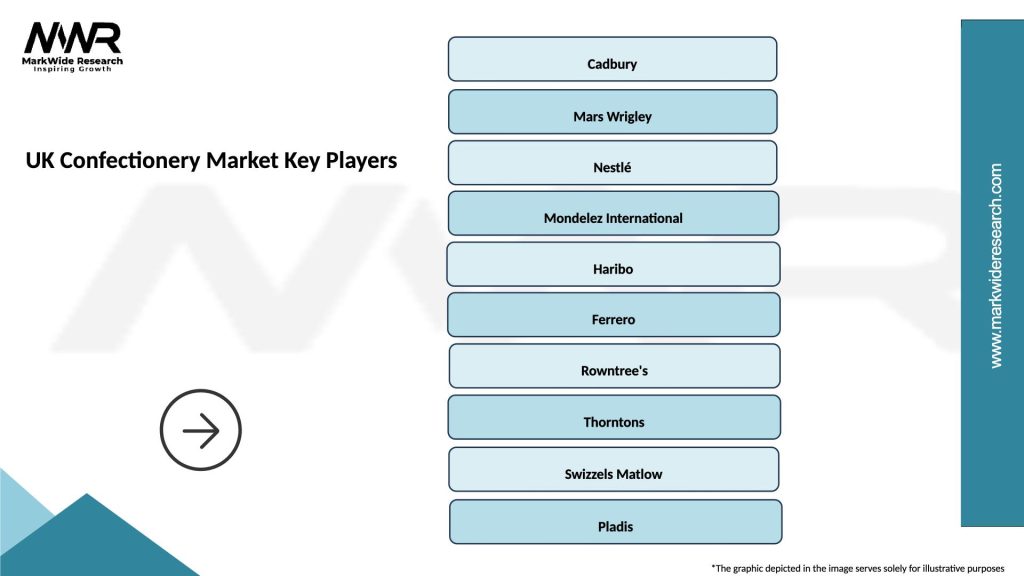

Market leadership remains concentrated among several key players who dominate through extensive distribution networks, strong brand portfolios, and significant marketing investments:

Competitive strategies emphasize brand differentiation, product innovation, and strategic retail partnerships to maintain market position and drive growth in increasingly competitive environment.

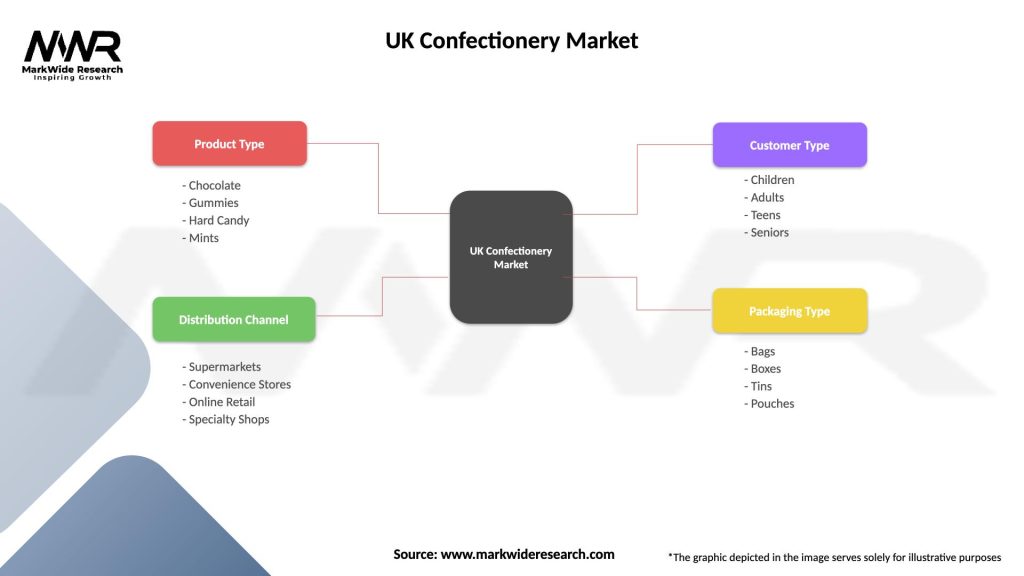

Product category segmentation reveals distinct market dynamics and growth opportunities across different confectionery types:

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Chocolate category maintains market dominance through continuous innovation in flavors, formats, and premium positioning strategies. Dark chocolate segments show particularly strong growth as consumers seek products with perceived health benefits and sophisticated taste profiles. Seasonal chocolate products generate substantial revenue spikes during Easter and Christmas periods, requiring strategic inventory management and marketing coordination.

Sugar confectionery adapts to health trends through reduced sugar formulations and functional ingredients while maintaining appeal through nostalgic flavors and innovative textures. Gummy products demonstrate resilience and growth potential through format innovation and flavor diversification that appeals to broad consumer demographics.

Premium segments across all categories show consistent growth as consumers prioritize quality over quantity and seek unique experiences through artisanal products. Health-conscious alternatives gain traction through plant-based formulations, organic ingredients, and functional benefits that address wellness trends without compromising taste satisfaction.

Gifting categories maintain importance through sophisticated packaging, personalization options, and seasonal specialties that serve emotional and social functions beyond basic consumption needs.

Manufacturers benefit from diverse revenue streams through multiple product categories, seasonal demand patterns, and expanding distribution channels that provide stability and growth opportunities. Innovation capabilities enable premium positioning and margin improvement through differentiated products that command higher prices and stronger consumer loyalty.

Retailers gain from confectionery’s role as high-margin impulse purchases and traffic drivers that complement other product categories. Seasonal promotions create opportunities for increased sales volumes and enhanced customer engagement through themed marketing campaigns and special displays.

Consumers enjoy expanding product choices including healthier alternatives, premium options, and innovative flavors that meet evolving preferences and dietary requirements. Convenience improvements through online ordering, subscription services, and improved packaging enhance accessibility and consumption experiences.

Supply chain partners benefit from stable demand patterns and long-term relationships with established manufacturers. Sustainability initiatives create opportunities for suppliers who can provide ethically sourced ingredients and environmentally friendly packaging solutions that meet industry requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends drive consumer preference toward higher-quality products with superior ingredients, ethical sourcing credentials, and sophisticated packaging. Artisanal positioning enables manufacturers to command premium prices while building stronger emotional connections with consumers who value craftsmanship and authenticity.

Health consciousness influences product development toward reduced sugar formulations, plant-based alternatives, and functional ingredients that provide additional wellness benefits. Clean label trends emphasize natural ingredients and transparent sourcing practices that resonate with informed consumers seeking healthier indulgence options.

Sustainability focus becomes increasingly important as consumers demand environmentally responsible packaging and ethically sourced ingredients. Circular economy principles influence packaging design and manufacturing processes to minimize environmental impact while maintaining product quality and shelf life.

Digital engagement transforms marketing strategies through social media campaigns, influencer partnerships, and interactive experiences that build brand awareness and consumer loyalty. Personalization trends enable customized products and targeted marketing approaches that enhance consumer satisfaction and repeat purchases.

Product innovation accelerates across categories with manufacturers introducing novel flavors, textures, and formats that capture consumer interest and differentiate brands in competitive markets. Functional confectionery emerges as significant trend with products incorporating vitamins, probiotics, and other health-beneficial ingredients.

Sustainability initiatives expand throughout the industry with comprehensive programs addressing packaging waste, carbon footprint reduction, and ethical sourcing practices. Certification programs gain importance as consumers increasingly seek verified sustainable and fair-trade products.

Digital transformation accelerates with manufacturers investing in e-commerce platforms, data analytics, and customer relationship management systems that enhance market responsiveness and operational efficiency. Supply chain digitization improves traceability and quality control while reducing operational costs.

Strategic partnerships increase between manufacturers and retailers to develop exclusive products, optimize shelf space allocation, and coordinate promotional activities. Acquisition activity continues as larger companies seek to expand product portfolios and market reach through targeted acquisitions of specialty brands.

Innovation investment should prioritize health-conscious product development while maintaining taste satisfaction and emotional appeal that drives confectionery consumption. Portfolio diversification across price points and health positioning enables manufacturers to capture broader consumer segments and reduce market risk.

Digital capabilities require significant investment to compete effectively in evolving retail landscape and capture growing online sales opportunities. Data analytics should inform product development, marketing strategies, and inventory management to optimize performance across multiple channels.

Sustainability programs need comprehensive implementation to meet consumer expectations and regulatory requirements while creating competitive differentiation. Supply chain transparency becomes increasingly important for brand credibility and consumer trust.

Strategic partnerships with retailers, ingredient suppliers, and technology providers can enhance market position and operational efficiency. Market research insights from MarkWide Research suggest focusing on emerging consumer trends and regional preferences to guide strategic decision-making and resource allocation.

Market projections indicate continued growth driven by innovation in healthier formulations and premium positioning strategies that address evolving consumer preferences. Digital commerce expansion is expected to accelerate, with online sales potentially reaching 25% market share within the next five years as consumer shopping habits continue evolving.

Sustainability requirements will intensify, requiring comprehensive environmental and social responsibility programs that may increase operational costs but provide competitive advantages with conscious consumers. Regulatory evolution may introduce additional restrictions on sugar content and marketing practices, necessitating proactive adaptation strategies.

Innovation focus will shift toward functional confectionery products that provide health benefits while maintaining indulgent characteristics. Personalization trends are expected to grow, with customized products and targeted marketing becoming standard industry practices.

Market consolidation may continue as larger companies acquire specialized brands to expand capabilities and market reach. Export opportunities present significant growth potential as British confectionery brands leverage quality reputation and heritage appeal in international markets seeking authentic premium products.

The UK confectionery market demonstrates remarkable resilience and adaptability in addressing evolving consumer preferences while maintaining its position as a significant economic sector. Strategic opportunities exist for companies that successfully balance traditional appeal with innovative health-conscious formulations and sustainable practices that resonate with modern consumers.

Market dynamics favor organizations with strong innovation capabilities, comprehensive distribution networks, and authentic brand positioning that creates emotional connections with consumers. Digital transformation and sustainability initiatives represent critical success factors for long-term competitiveness and market leadership.

Future success will depend on manufacturers’ ability to navigate health trends, regulatory requirements, and competitive pressures while maintaining the fundamental appeal that makes confectionery products beloved by consumers across all demographics. The market’s evolution toward premium, sustainable, and health-conscious alternatives presents both challenges and opportunities for industry participants willing to invest in transformation and innovation.

What is Confectionery?

Confectionery refers to a category of food items that are primarily made of sugar and are often sweet in taste. This includes candies, chocolates, and other sweet treats that are popular among consumers in various settings, such as celebrations and everyday snacks.

What are the key players in the UK Confectionery Market?

Key players in the UK Confectionery Market include companies like Cadbury, Mars, and Nestlé, which dominate the chocolate segment, as well as Haribo and Mondelez in the candy sector. These companies are known for their diverse product offerings and strong brand recognition among consumers.

What are the growth factors driving the UK Confectionery Market?

The UK Confectionery Market is driven by factors such as increasing consumer demand for premium and artisanal products, the rise of e-commerce for confectionery sales, and innovative product launches that cater to health-conscious consumers, including sugar-free and organic options.

What challenges does the UK Confectionery Market face?

Challenges in the UK Confectionery Market include rising health concerns related to sugar consumption, regulatory pressures on food labeling and advertising, and intense competition among brands that can lead to price wars and reduced profit margins.

What opportunities exist in the UK Confectionery Market?

Opportunities in the UK Confectionery Market include the growing trend of vegan and plant-based confectionery products, the expansion of online retail channels, and the potential for international market expansion for local brands seeking to reach new consumers.

What trends are shaping the UK Confectionery Market?

Trends in the UK Confectionery Market include a shift towards healthier snacking options, the incorporation of unique flavors and ingredients, and an increasing focus on sustainable packaging solutions to meet consumer demand for environmentally friendly products.

UK Confectionery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chocolate, Gummies, Hard Candy, Mints |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Shops |

| Customer Type | Children, Adults, Teens, Seniors |

| Packaging Type | Bags, Boxes, Tins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Confectionery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at