444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America confectionery market represents one of the most dynamic and rapidly evolving segments within the region’s food and beverage industry. This vibrant market encompasses a diverse range of sweet products including chocolates, candies, gums, jellies, and traditional confectionery items that reflect the rich cultural heritage of South American countries. Market dynamics indicate substantial growth potential driven by increasing disposable income, urbanization trends, and evolving consumer preferences toward premium and artisanal confectionery products.

Regional consumption patterns demonstrate significant variation across different South American countries, with Brazil and Argentina leading in terms of market penetration and consumer demand. The market exhibits a compound annual growth rate of 6.2%, reflecting robust expansion driven by demographic shifts and changing lifestyle patterns. Consumer behavior analysis reveals increasing preference for organic, sugar-free, and functional confectionery products, indicating a shift toward health-conscious consumption without compromising on taste and indulgence.

Manufacturing capabilities across the region have expanded significantly, with local producers increasingly competing with international brands through innovation and localized product offerings. The market benefits from abundant raw material availability, including cocoa, sugar, and tropical fruits, providing competitive advantages for regional manufacturers. Distribution channels have evolved to include modern retail formats, e-commerce platforms, and specialty confectionery stores, enhancing product accessibility and market reach.

The South America confectionery market refers to the comprehensive ecosystem of sweet food products manufactured, distributed, and consumed across South American countries, encompassing traditional candies, chocolates, chewing gums, and innovative confectionery items that cater to diverse consumer preferences and cultural tastes.

Market definition includes both mass-market and premium confectionery segments, covering products ranging from everyday affordable treats to luxury artisanal chocolates and specialty confections. The market encompasses various product categories including hard candies, soft candies, chocolate confectionery, sugar confectionery, and functional confectionery products designed to meet specific dietary requirements or health objectives.

Geographic scope covers major South American markets including Brazil, Argentina, Colombia, Chile, Peru, Venezuela, and other regional countries, each contributing unique cultural preferences and consumption patterns. The market includes both domestic production and imported products, creating a diverse competitive landscape that serves varied consumer segments across different price points and quality levels.

Market performance in the South American confectionery sector demonstrates resilient growth despite economic challenges, with increasing consumer demand for innovative and premium products driving market expansion. The region’s confectionery market benefits from strong cultural affinity for sweet products, growing middle-class population, and increasing exposure to international confectionery trends through globalization and digital connectivity.

Key growth drivers include urbanization trends affecting 78% of the regional population, rising disposable income levels, and evolving retail infrastructure that improves product accessibility. The market shows particular strength in chocolate confectionery and premium segments, with consumers increasingly willing to pay premium prices for quality, organic, and artisanal products that offer unique taste experiences and perceived health benefits.

Competitive dynamics feature a mix of international confectionery giants and strong regional players who leverage local market knowledge and cultural preferences. The market demonstrates increasing consolidation through strategic acquisitions and partnerships, while simultaneously supporting innovation and entrepreneurship in specialty confectionery segments. Digital transformation has emerged as a critical factor, with e-commerce sales representing 23% growth in online confectionery purchases.

Consumer preference analysis reveals significant shifts toward premium and artisanal confectionery products, with particular emphasis on products featuring local ingredients and traditional flavors adapted for modern tastes. The market demonstrates strong seasonal variations, with peak consumption periods during holidays, festivals, and celebration seasons that are culturally significant across different South American countries.

Economic development across South American countries has created favorable conditions for confectionery market expansion, with growing middle-class populations demonstrating increased purchasing power and willingness to spend on discretionary food items. Urbanization trends have significantly impacted consumption patterns, with urban consumers showing greater exposure to international confectionery brands and innovative product formats.

Cultural factors play a crucial role in driving market growth, as confectionery products hold significant cultural importance in South American societies for celebrations, gift-giving, and social interactions. The region’s strong tradition of sweet consumption, combined with increasing exposure to global confectionery trends, creates a dynamic market environment that supports both traditional and innovative products.

Demographic shifts including a growing young population with disposable income and changing lifestyle patterns contribute to sustained market demand. Tourism growth has also emerged as a significant driver, with international visitors seeking authentic local confectionery experiences and contributing to demand for premium and artisanal products that represent regional culinary heritage.

Retail infrastructure development has improved product accessibility through modern shopping centers, convenience stores, and e-commerce platforms. Marketing innovation through digital channels and social media engagement has enhanced brand visibility and consumer connection, particularly among younger demographics who influence household purchasing decisions.

Economic volatility in several South American countries creates challenges for consistent market growth, with currency fluctuations and inflation affecting both production costs and consumer purchasing power. Raw material price volatility, particularly for key ingredients like cocoa, sugar, and imported components, impacts profit margins and pricing strategies for confectionery manufacturers.

Health concerns related to sugar consumption and obesity rates have led to increased scrutiny of confectionery products, with government regulations and consumer awareness campaigns potentially limiting market growth in traditional high-sugar product categories. Regulatory challenges including labeling requirements, taxation policies, and import restrictions create operational complexities for market participants.

Infrastructure limitations in certain regions affect distribution efficiency and product quality maintenance, particularly for temperature-sensitive chocolate products. Competition from alternative snacks and healthier food options presents ongoing challenges as consumers increasingly consider nutritional factors in purchasing decisions.

Supply chain disruptions can impact product availability and cost structures, while environmental concerns regarding packaging waste and sustainable sourcing practices require ongoing investment and adaptation from industry participants.

Innovation opportunities in functional confectionery present significant growth potential, with products incorporating vitamins, minerals, probiotics, and natural ingredients appealing to health-conscious consumers who seek indulgence without compromising wellness objectives. Artisanal and craft confectionery segments offer premium positioning opportunities for manufacturers who can deliver authentic, high-quality products with compelling brand stories.

E-commerce expansion creates new distribution channels and direct-to-consumer opportunities, enabling confectionery brands to reach previously inaccessible markets and build stronger customer relationships through personalized experiences. Export potential exists for South American confectionery products featuring unique regional flavors and ingredients that can appeal to international markets seeking authentic experiences.

Sustainable packaging solutions represent both environmental responsibility and marketing opportunities, as consumers increasingly prefer brands that demonstrate environmental consciousness. Private label opportunities with major retailers allow manufacturers to expand market reach while retailers can offer differentiated products at competitive price points.

Seasonal and limited-edition products create opportunities for premium pricing and increased consumer engagement, while cross-category innovation combining confectionery with other food categories can attract new consumer segments and usage occasions.

Supply chain dynamics in the South American confectionery market reflect both regional advantages and global dependencies, with local availability of key ingredients like sugar and tropical fruits providing cost advantages while specialized ingredients and packaging materials often require imports. Manufacturing efficiency improvements through technology adoption and process optimization have enhanced competitiveness and product quality consistency.

Consumer behavior patterns demonstrate increasing sophistication and willingness to experiment with new flavors and formats, while maintaining strong loyalty to traditional favorites and culturally significant products. Seasonal fluctuations create predictable demand patterns that require careful inventory management and production planning to optimize profitability and market service levels.

Competitive intensity varies across different product segments and geographic markets, with premium segments showing less price sensitivity and greater opportunity for differentiation through quality, innovation, and brand positioning. Technology integration in manufacturing, distribution, and marketing has become essential for maintaining competitiveness and operational efficiency.

Regulatory environment continues evolving with increased focus on health and nutrition labeling, sustainable practices, and consumer protection, requiring ongoing adaptation and compliance investment from market participants.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the South American confectionery market landscape. Primary research included extensive interviews with industry executives, manufacturers, distributors, retailers, and consumers across major South American markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporated analysis of industry reports, government statistics, trade association data, and company financial statements to establish quantitative market parameters and validate primary research findings. Market observation through retail audits, product sampling, and competitive analysis provided practical insights into market dynamics and consumer behavior patterns.

Data triangulation methods ensured research accuracy by cross-referencing multiple information sources and validating findings through different analytical approaches. Statistical analysis employed advanced modeling techniques to project market trends and identify significant correlations between market variables and performance indicators.

Expert consultation with industry specialists, academic researchers, and market analysts provided additional perspective and validation of research conclusions, ensuring comprehensive understanding of complex market dynamics and future development scenarios.

Brazil dominates the South American confectionery market with approximately 45% regional market share, driven by its large population, developed retail infrastructure, and strong domestic manufacturing capabilities. Brazilian consumers demonstrate sophisticated preferences for both traditional and innovative confectionery products, with particular strength in chocolate confectionery and premium segments.

Argentina represents the second-largest market with 22% regional share, characterized by strong cultural affinity for confectionery products and well-established local brands that compete effectively with international players. Argentine market dynamics reflect economic volatility challenges while maintaining consistent consumer demand for quality confectionery products.

Colombia and Chile together account for approximately 18% market share, showing rapid growth driven by economic development and increasing consumer sophistication. Colombian market benefits from growing tourism and cultural celebration traditions, while Chilean consumers demonstrate increasing preference for premium and imported confectionery products.

Peru, Venezuela, and other regional markets comprise the remaining 15% market share, presenting significant growth opportunities despite economic and political challenges. Market development in these countries focuses on improving distribution infrastructure and adapting products to local preferences and economic conditions.

Market leadership in the South American confectionery sector features a dynamic mix of international corporations and strong regional players who leverage different competitive advantages to serve diverse consumer segments and geographic markets.

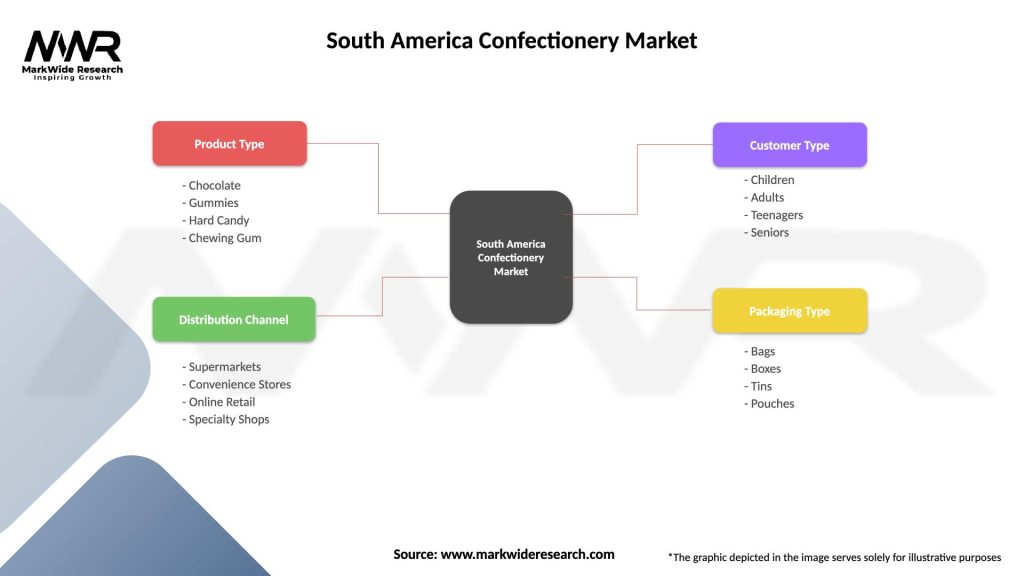

Product category segmentation reveals distinct market dynamics and growth opportunities across different confectionery types, with each segment demonstrating unique consumer preferences, competitive landscapes, and development trajectories that require specialized marketing and operational approaches.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Chocolate confectionery represents the most dynamic and profitable segment within the South American market, with consumers demonstrating increasing sophistication and willingness to pay premium prices for quality products. Dark chocolate products show particularly strong growth as health-conscious consumers seek products with perceived wellness benefits while maintaining indulgent experiences.

Traditional candy categories maintain strong cultural significance and consistent demand, with manufacturers successfully innovating through new flavors, formats, and packaging while preserving authentic taste profiles that resonate with local consumers. Functional confectionery emerges as a high-growth category, incorporating vitamins, minerals, and natural ingredients to appeal to health-conscious consumers.

Seasonal confectionery products generate significant revenue peaks during cultural celebrations and holidays, with manufacturers developing specialized products and limited-edition offerings that command premium pricing. Gift confectionery represents an important category for special occasions, driving demand for attractive packaging and premium product positioning.

Sugar-free and reduced-calorie products show increasing market acceptance as consumers seek to balance indulgence with health considerations, creating opportunities for innovation in sweetening technologies and formulation approaches that maintain taste satisfaction while addressing nutritional concerns.

Manufacturers benefit from growing market demand, opportunities for product innovation, and potential for premium positioning through quality and authenticity. Economies of scale in production and distribution create competitive advantages for established players while providing barriers to entry that protect market positions.

Retailers gain from high-margin confectionery categories that generate impulse purchases and increase average transaction values. Category management opportunities allow retailers to optimize product mix, pricing strategies, and promotional activities to maximize profitability while serving diverse consumer preferences.

Distributors capitalize on expanding market reach and product diversification opportunities, with confectionery products offering attractive margins and consistent demand patterns. Logistics efficiency improvements through technology and network optimization enhance service levels and profitability.

Consumers enjoy increasing product variety, quality improvements, and accessibility through multiple distribution channels. Innovation benefits include healthier product options, sustainable packaging, and authentic cultural flavors that enhance consumption experiences while addressing evolving lifestyle needs.

Economic stakeholders benefit from job creation, tax revenue generation, and export potential that contributes to regional economic development. Supply chain participants including ingredient suppliers, packaging manufacturers, and logistics providers gain from market growth and increasing sophistication requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends dominate the South American confectionery market as consumers increasingly seek high-quality, artisanal products that offer unique taste experiences and perceived value beyond basic sweetness. Craft chocolate movement gains momentum with local producers creating bean-to-bar products that showcase regional cocoa varieties and traditional processing techniques.

Health and wellness integration drives innovation in functional confectionery products that incorporate beneficial ingredients like antioxidants, vitamins, and natural sweeteners while maintaining indulgent taste profiles. Sugar reduction initiatives lead to development of alternative sweetening solutions and portion control formats that address health concerns without eliminating consumption pleasure.

Sustainability focus influences packaging choices, ingredient sourcing, and manufacturing processes as consumers and regulators increasingly prioritize environmental responsibility. Digital engagement strategies transform marketing approaches through social media campaigns, influencer partnerships, and interactive brand experiences that resonate with younger demographics.

Flavor innovation incorporates traditional South American ingredients and taste profiles into modern confectionery formats, creating authentic products that celebrate regional culinary heritage while appealing to contemporary preferences. Personalization trends enable customized products and packaging that enhance gift-giving experiences and consumer emotional connection to brands.

Strategic acquisitions reshape the competitive landscape as international confectionery companies seek to strengthen regional presence through partnerships with established local brands that possess market knowledge and distribution networks. Technology investments in manufacturing automation and quality control systems enhance production efficiency and product consistency while reducing operational costs.

Sustainable sourcing initiatives gain prominence as major confectionery companies implement responsible procurement practices for cocoa, sugar, and other key ingredients, responding to consumer demands for ethical production methods. MarkWide Research analysis indicates that sustainability commitments influence 67% of premium segment purchasing decisions.

Product line extensions into functional and health-focused categories demonstrate industry adaptation to evolving consumer preferences, with traditional confectionery companies diversifying portfolios to include protein-enriched, vitamin-fortified, and probiotic products. Packaging innovations focus on sustainability, convenience, and visual appeal to enhance shelf presence and consumer experience.

Distribution channel evolution includes expanded e-commerce capabilities, direct-to-consumer programs, and specialized retail partnerships that improve market access and customer engagement. Regulatory compliance improvements address labeling requirements, nutritional standards, and marketing restrictions while maintaining product appeal and market competitiveness.

Market participants should prioritize innovation in health-conscious product development while maintaining the indulgent characteristics that define confectionery appeal. Investment recommendations focus on manufacturing technology upgrades, sustainable packaging solutions, and digital marketing capabilities that enhance competitive positioning and operational efficiency.

Strategic partnerships with local distributors, retailers, and ingredient suppliers can provide market access advantages and cost optimization opportunities while ensuring cultural authenticity and consumer relevance. Brand positioning strategies should emphasize quality, authenticity, and cultural connection while incorporating modern health and sustainability values.

Geographic expansion within South America should consider market-specific preferences, economic conditions, and regulatory requirements while leveraging successful product formulations and marketing approaches from established markets. Portfolio diversification across price points and health positioning can capture broader consumer segments and reduce market risk.

Supply chain optimization through vertical integration, strategic sourcing, and logistics efficiency improvements can enhance profitability and market responsiveness while ensuring product quality and availability. Consumer engagement through digital channels, experiential marketing, and community involvement can build brand loyalty and market share in competitive environments.

Market projections indicate continued growth in the South American confectionery market driven by demographic trends, economic development, and evolving consumer preferences toward premium and functional products. Growth trajectory suggests sustained expansion at 6.8% CAGR over the next five years, with premium segments outperforming traditional categories.

Innovation acceleration will focus on health-functional confectionery products that address wellness trends while maintaining taste satisfaction and emotional connection that consumers seek from confectionery experiences. Technology integration in manufacturing, distribution, and marketing will become essential for maintaining competitiveness and operational efficiency.

Sustainability requirements will increasingly influence product development, packaging choices, and supply chain practices as environmental consciousness becomes a key purchasing factor. MWR analysis projects that sustainable products will represent 42% of premium segment sales within three years.

Market consolidation through strategic acquisitions and partnerships will continue as companies seek scale advantages and market access while preserving local brand authenticity and consumer connection. Digital transformation will reshape distribution channels and consumer engagement strategies, with e-commerce expected to reach 35% of total confectionery sales in major urban markets.

Regulatory evolution will require ongoing adaptation in product formulation, labeling, and marketing practices while creating opportunities for companies that proactively address health and sustainability concerns through innovation and transparency.

The South America confectionery market presents a compelling growth opportunity characterized by strong cultural foundations, evolving consumer preferences, and increasing economic prosperity across the region. Market dynamics favor companies that can successfully balance traditional appeal with modern innovation, particularly in health-conscious and premium product segments that command higher margins and consumer loyalty.

Strategic success in this market requires understanding of local cultural preferences, investment in quality and innovation, and development of efficient distribution networks that can serve diverse geographic and demographic segments. Sustainability and health consciousness emerge as critical factors that will increasingly influence consumer choices and regulatory requirements, creating both challenges and opportunities for market participants.

Future market leaders will be those companies that can effectively combine authentic cultural connection with modern consumer values, leveraging technology and innovation to create products that satisfy both emotional and functional consumer needs. The South America confectionery market offers substantial potential for companies prepared to invest in understanding and serving this dynamic and evolving consumer base while adapting to changing market conditions and requirements.

What is Confectionery?

Confectionery refers to a category of food items that are primarily made of sugar and are often sweet in taste. This includes candies, chocolates, and other sweet treats that are popular across various cultures, including those in South America.

What are the key players in the South America Confectionery Market?

Key players in the South America Confectionery Market include companies like Mondelez International, Nestlé, and Ferrero, which are known for their wide range of confectionery products. These companies compete in various segments such as chocolate, gummies, and hard candies, among others.

What are the growth factors driving the South America Confectionery Market?

The South America Confectionery Market is driven by factors such as increasing disposable incomes, changing consumer preferences towards premium and innovative products, and the growing trend of gifting confectionery items during festivals and celebrations.

What challenges does the South America Confectionery Market face?

Challenges in the South America Confectionery Market include fluctuating raw material prices, health concerns related to sugar consumption, and increasing competition from healthier snack alternatives that may deter traditional confectionery sales.

What opportunities exist in the South America Confectionery Market?

Opportunities in the South America Confectionery Market include the rising demand for organic and sugar-free products, the expansion of e-commerce platforms for better distribution, and the potential for product innovation to cater to local tastes and preferences.

What trends are shaping the South America Confectionery Market?

Trends in the South America Confectionery Market include a growing focus on sustainability in packaging, the introduction of unique flavor combinations, and the increasing popularity of artisanal and handcrafted confectionery products that appeal to niche markets.

South America Confectionery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chocolate, Gummies, Hard Candy, Chewing Gum |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Shops |

| Customer Type | Children, Adults, Teenagers, Seniors |

| Packaging Type | Bags, Boxes, Tins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Confectionery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at