444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada chocolate market represents one of the most dynamic and evolving segments within the country’s food and beverage industry. Canadian consumers demonstrate a sophisticated palate for premium chocolate products, driving significant growth in artisanal and specialty chocolate categories. The market encompasses a diverse range of products from traditional milk chocolate bars to innovative dark chocolate varieties, organic options, and sugar-free alternatives.

Market dynamics indicate robust expansion driven by changing consumer preferences toward premium and ethically sourced chocolate products. The Canadian market shows particularly strong growth in the premium chocolate segment, with consumers increasingly willing to pay higher prices for quality ingredients and sustainable sourcing practices. Regional preferences vary significantly across provinces, with Quebec showing strong affinity for European-style chocolates while Western provinces demonstrate growing interest in craft chocolate makers.

Industry transformation continues as traditional chocolate manufacturers adapt to evolving consumer demands for healthier options, transparent supply chains, and innovative flavors. The market benefits from Canada’s strong retail infrastructure and growing e-commerce penetration, enabling both domestic and international brands to reach consumers effectively. Growth projections suggest the market will expand at a steady CAGR of 4.2% over the forecast period, driven by premium product adoption and increasing per capita consumption.

The Canada chocolate market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of chocolate products across Canadian provinces and territories. This market includes various chocolate formats such as bars, confectionery items, baking chocolate, cocoa powder, and specialty chocolate products manufactured by both domestic and international companies.

Market scope extends beyond traditional chocolate bars to include premium artisanal chocolates, organic varieties, sugar-free options, and functional chocolate products enhanced with additional nutrients or health benefits. The Canadian chocolate landscape reflects the country’s multicultural population, incorporating diverse flavor preferences and consumption patterns influenced by various ethnic communities and regional tastes.

Distribution channels within this market span traditional grocery retailers, specialty chocolate shops, online platforms, convenience stores, and foodservice establishments. The market also encompasses the supply chain from cocoa bean importation through processing, manufacturing, packaging, and final retail distribution across Canada’s vast geographical expanse.

Strategic analysis of the Canada chocolate market reveals a mature yet evolving industry characterized by premiumization trends and increasing consumer sophistication. The market demonstrates resilience through economic fluctuations while adapting to changing health consciousness and sustainability concerns among Canadian consumers.

Key market drivers include rising disposable income, growing awareness of premium chocolate benefits, and increasing demand for ethically sourced products. Consumer behavior shows a notable shift toward dark chocolate varieties, with dark chocolate segment growth reaching approximately 6.8% annually. The market benefits from strong brand loyalty while simultaneously witnessing emergence of innovative craft chocolate makers challenging established players.

Competitive landscape features a mix of multinational corporations and emerging local artisans, creating a diverse market ecosystem. Distribution evolution toward omnichannel approaches enables brands to reach consumers through multiple touchpoints, enhancing market accessibility and consumer engagement. The market’s future trajectory appears positive, supported by demographic trends and evolving consumption patterns favoring premium chocolate experiences.

Market intelligence reveals several critical insights shaping the Canada chocolate market landscape:

Consumer affluence serves as a primary driver for Canada chocolate market expansion, with rising disposable income enabling consumers to explore premium chocolate options. Economic stability in major Canadian markets supports consistent chocolate consumption patterns while encouraging experimentation with higher-priced specialty products.

Health consciousness trends paradoxically benefit the chocolate market as consumers increasingly recognize potential health benefits of dark chocolate consumption. Scientific research highlighting antioxidant properties and cardiovascular benefits of cocoa drives consumer interest in high-cocoa content products. This trend supports premium positioning and justifies higher price points for quality chocolate products.

Cultural diversity within Canada’s population creates demand for varied chocolate flavors and styles, encouraging manufacturers to develop products catering to different ethnic preferences. Immigration patterns introduce new consumption habits and flavor profiles, expanding market opportunities for innovative chocolate products.

Gifting culture remains strong in Canadian society, with chocolate products serving as popular gifts for various occasions. Seasonal celebrations and cultural holidays drive consistent demand spikes, providing predictable revenue opportunities for chocolate manufacturers and retailers. Corporate gifting and business relationship building further support premium chocolate segment growth.

Health concerns regarding sugar content and caloric density of chocolate products pose ongoing challenges for market growth. Rising obesity rates and diabetes prevalence in Canada create consumer hesitation around regular chocolate consumption, particularly affecting traditional milk chocolate and confectionery segments.

Raw material volatility significantly impacts chocolate manufacturers’ profitability and pricing strategies. Cocoa price fluctuations driven by climate change, political instability in producing regions, and supply chain disruptions create operational challenges for Canadian chocolate companies. These cost pressures often translate to higher consumer prices, potentially limiting market accessibility.

Regulatory compliance requirements around food safety, labeling, and nutritional information impose additional costs on chocolate manufacturers. Import regulations and trade policies affecting cocoa and chocolate ingredient sourcing can create supply chain complexities and cost implications for Canadian market participants.

Competitive intensity from both domestic and international brands creates margin pressure across all market segments. Private label growth in retail channels challenges branded chocolate manufacturers’ market share and pricing power, particularly in mainstream chocolate categories.

Premiumization trends present substantial opportunities for chocolate manufacturers to develop high-value products targeting affluent Canadian consumers. Artisanal chocolate segments show particular promise, with consumers seeking unique flavor experiences and craft production methods that justify premium pricing.

Functional chocolate development offers significant growth potential as manufacturers incorporate additional health benefits into chocolate products. Protein-enriched chocolates, probiotic varieties, and products enhanced with vitamins or minerals appeal to health-conscious consumers seeking indulgence without guilt.

Sustainability positioning creates competitive advantages for brands emphasizing ethical sourcing, environmental responsibility, and social impact. Fair trade certification and direct farmer relationships resonate strongly with Canadian consumers, particularly in urban markets where social consciousness drives purchasing decisions.

E-commerce expansion enables chocolate manufacturers to reach consumers directly, building brand relationships and capturing higher margins. Subscription models and personalized chocolate experiences offer recurring revenue opportunities while enhancing customer engagement and loyalty.

Supply chain evolution continues reshaping the Canada chocolate market as manufacturers seek greater control over ingredient sourcing and quality assurance. Vertical integration strategies enable companies to manage costs while ensuring consistent product quality and supply availability.

Consumer behavior shifts toward experiential consumption drive demand for unique chocolate experiences, including chocolate tastings, factory tours, and educational content about chocolate production processes. Social media influence amplifies these trends as consumers share chocolate experiences and discover new brands through digital platforms.

Retail landscape transformation affects chocolate distribution strategies as traditional grocery dominance faces challenges from specialty retailers, online platforms, and direct-to-consumer models. Channel diversification becomes essential for chocolate brands seeking to maintain market reach and consumer accessibility.

Innovation cycles accelerate as manufacturers respond to rapidly changing consumer preferences and competitive pressures. Product development timelines compress while investment in research and development increases to support continuous innovation and market differentiation.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Canada chocolate market. Primary research includes consumer surveys, industry expert interviews, and retail channel analysis to capture current market dynamics and future trends.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial information to build comprehensive market understanding. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights.

Market modeling techniques project future market scenarios based on historical trends, demographic changes, and economic indicators. Statistical analysis identifies significant correlations and patterns within market data to support strategic recommendations and growth projections.

Qualitative research through focus groups and in-depth interviews provides deeper understanding of consumer motivations, preferences, and decision-making processes related to chocolate purchases. This approach reveals insights that quantitative data alone cannot capture, enriching overall market understanding.

Ontario market represents the largest regional segment within Canada’s chocolate industry, driven by high population density and diverse consumer base. Toronto metropolitan area serves as a key market for premium and artisanal chocolate brands, with consumers demonstrating willingness to pay premium prices for quality products. The province shows approximately 38% of national chocolate consumption, reflecting its economic importance and consumer purchasing power.

Quebec chocolate market exhibits unique characteristics influenced by French cultural heritage and sophisticated culinary traditions. Montreal and Quebec City demonstrate particularly strong demand for European-style chocolates and artisanal products. The province maintains roughly 23% market share while showing above-average per capita consumption rates.

Western provinces including British Columbia, Alberta, Saskatchewan, and Manitoba collectively represent growing market opportunities. Vancouver and Calgary emerge as key urban markets with increasing preference for organic, fair-trade, and craft chocolate products. The region shows approximately 28% of total market share with strong growth potential.

Atlantic provinces maintain steady chocolate consumption patterns while showing gradual adoption of premium product categories. Halifax and St. John’s serve as primary distribution hubs for the region, with local retailers increasingly stocking specialty chocolate brands to meet evolving consumer preferences.

Market leadership in Canada’s chocolate industry reflects a combination of multinational corporations and emerging domestic players, creating a dynamic competitive environment:

Competitive strategies increasingly focus on product differentiation, sustainability initiatives, and direct consumer engagement through digital channels and experiential marketing approaches.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer appeal:

By Product Type:

By Distribution Channel:

By Price Range:

Dark chocolate category demonstrates exceptional growth momentum as Canadian consumers increasingly recognize health benefits associated with higher cocoa content. Premium dark chocolate varieties with cocoa percentages above 70% show particularly strong performance, appealing to sophisticated consumers seeking intense flavor experiences and perceived wellness benefits.

Organic chocolate segment gains significant traction among environmentally conscious consumers, with organic certification becoming an important differentiator in premium market categories. Canadian consumers show willingness to pay price premiums for organic chocolate products, particularly in urban markets where environmental awareness runs high.

Seasonal chocolate products maintain crucial importance for market participants, with holiday-themed chocolates generating substantial revenue during key periods. Easter chocolate represents the largest seasonal opportunity, followed by Christmas and Valentine’s Day products that drive significant sales volumes and brand visibility.

Functional chocolate innovations emerge as manufacturers incorporate additional health benefits into chocolate products. Protein-enriched chocolates target fitness-conscious consumers while probiotic chocolate varieties appeal to digestive health awareness trends. These innovations command premium pricing while addressing consumer desire for guilt-free indulgence.

Manufacturers benefit from Canada’s stable economic environment and sophisticated consumer base that appreciates quality chocolate products. Market maturity provides predictable demand patterns while premiumization trends enable margin expansion through value-added product development.

Retailers gain from chocolate’s role as a high-turnover category that drives foot traffic and impulse purchases. Cross-merchandising opportunities with complementary products enhance overall basket size while seasonal chocolate promotions generate significant revenue spikes during key periods.

Consumers enjoy unprecedented variety and quality in chocolate offerings, with options ranging from affordable everyday treats to luxury artisanal experiences. Health-conscious options enable guilt-free indulgence while sustainability initiatives align with environmental values.

Supply chain partners including distributors, logistics providers, and packaging companies benefit from steady market demand and growth opportunities in premium segments. Technology integration throughout the supply chain enhances efficiency and traceability, supporting quality assurance and consumer confidence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization acceleration continues reshaping the Canada chocolate market as consumers increasingly seek high-quality, artisanal chocolate experiences. Craft chocolate movement gains momentum with small-batch producers emphasizing bean-to-bar processes, unique flavor profiles, and transparent sourcing practices that resonate with discerning consumers.

Health-conscious formulations drive product innovation as manufacturers develop chocolate products with reduced sugar content, added functional ingredients, and organic certifications. Plant-based alternatives emerge to serve vegan consumers while maintaining indulgent chocolate experiences through innovative ingredient combinations.

Sustainability integration becomes essential for brand differentiation as consumers increasingly consider environmental and social impact in purchasing decisions. Fair trade certification and direct farmer relationships enhance brand credibility while supporting ethical sourcing practices throughout the supply chain.

Digital engagement strategies transform how chocolate brands connect with consumers, utilizing social media platforms, influencer partnerships, and interactive content to build brand loyalty and drive purchase decisions. Personalization trends enable customized chocolate experiences through online platforms and subscription services.

Manufacturing investments by major chocolate companies demonstrate commitment to the Canadian market, with facility expansions and technology upgrades enhancing production capacity and efficiency. Automation integration improves quality consistency while reducing operational costs and supporting competitive positioning.

Strategic partnerships between chocolate manufacturers and Canadian retailers create exclusive product lines and enhanced market access. Co-branding initiatives with local businesses and cultural institutions strengthen brand connections with Canadian consumers while supporting community engagement.

Sustainability certifications gain prominence as chocolate companies pursue Rainforest Alliance, UTZ, and Fair Trade certifications to meet consumer expectations for responsible sourcing. These initiatives often require significant supply chain investments but provide important competitive differentiation.

Technology adoption throughout the chocolate industry includes blockchain implementation for supply chain transparency, artificial intelligence for demand forecasting, and advanced packaging solutions for product freshness and shelf life extension. MarkWide Research analysis indicates that technology integration drives operational efficiency improvements of approximately 15% across leading chocolate manufacturers.

Market positioning strategies should emphasize premium quality and unique value propositions to differentiate from commodity chocolate products. Brand storytelling around heritage, craftsmanship, and sourcing practices resonates strongly with Canadian consumers seeking authentic chocolate experiences.

Distribution diversification becomes critical as traditional retail channels face disruption from e-commerce and changing consumer shopping behaviors. Omnichannel approaches that seamlessly integrate online and offline touchpoints provide competitive advantages while enhancing consumer convenience and engagement.

Innovation investment in health-conscious formulations and functional chocolate products addresses evolving consumer preferences while commanding premium pricing. Research and development focus should balance indulgence with wellness benefits to capture growing health-conscious consumer segments.

Sustainability initiatives require long-term commitment and supply chain transformation but provide essential competitive differentiation in the Canadian market. Transparent communication about environmental and social impact initiatives builds consumer trust and brand loyalty among values-driven purchasers.

Market trajectory for Canada’s chocolate industry appears positive, supported by demographic trends, economic stability, and evolving consumer preferences toward premium products. Growth projections suggest continued expansion at a compound annual growth rate of 4.2% over the next five years, driven primarily by premium segment adoption and innovation in health-conscious formulations.

Consumer evolution toward experiential consumption and sustainability consciousness will continue shaping market dynamics, favoring brands that successfully balance indulgence with responsibility. Generational shifts as millennials and Gen Z consumers gain purchasing power will accelerate trends toward craft chocolate, ethical sourcing, and digital engagement.

Technology integration throughout the chocolate value chain will enhance efficiency, traceability, and consumer engagement while supporting personalization trends and direct-to-consumer relationships. MWR analysis indicates that companies investing in digital transformation achieve customer retention rates approximately 25% higher than traditional approaches.

Market consolidation may occur as smaller players seek partnerships with larger companies to achieve scale economies while maintaining artisanal positioning. International expansion by successful Canadian craft chocolate makers could create export opportunities, leveraging Canada’s reputation for quality food products in global markets.

Canada’s chocolate market demonstrates remarkable resilience and adaptability, successfully navigating health consciousness trends while maintaining strong consumer appeal through premiumization and innovation. The market’s evolution toward sustainability, quality, and experiential consumption creates opportunities for both established players and emerging artisanal producers to thrive in distinct market segments.

Strategic success in this market requires balancing traditional chocolate appeal with contemporary consumer values around health, sustainability, and authenticity. Companies that effectively communicate their value propositions while delivering consistent quality and innovation will capture the greatest share of market growth and consumer loyalty.

Future market dynamics will likely favor brands that successfully integrate digital engagement, sustainability practices, and health-conscious formulations while maintaining the indulgent experience that defines chocolate consumption. The Canadian market’s sophisticated consumer base and stable economic environment provide an excellent foundation for continued chocolate industry growth and innovation.

What is Chocolate?

Chocolate is a food product made from roasted and ground cacao seeds, often sweetened and flavored. It is available in various forms, including bars, chips, and beverages, and is widely consumed as a treat or ingredient in desserts.

What are the key players in the Canada Chocolate Market?

Key players in the Canada Chocolate Market include companies like Cadbury, Lindt & Sprüngli, and Nestlé, which offer a range of chocolate products from bars to gourmet selections. These companies compete on quality, flavor variety, and brand loyalty among others.

What are the growth factors driving the Canada Chocolate Market?

The Canada Chocolate Market is driven by factors such as increasing consumer demand for premium and artisanal chocolates, the rise of health-conscious options like dark chocolate, and the growing popularity of chocolate in gifting and celebrations.

What challenges does the Canada Chocolate Market face?

Challenges in the Canada Chocolate Market include fluctuating cocoa prices, which can impact production costs, and increasing competition from alternative snacks that may appeal to health-conscious consumers. Additionally, sustainability concerns regarding cocoa sourcing are becoming more prominent.

What opportunities exist in the Canada Chocolate Market?

Opportunities in the Canada Chocolate Market include the expansion of online retail channels, the introduction of innovative flavors and product lines, and the growing trend of organic and fair-trade chocolates, which cater to environmentally conscious consumers.

What trends are shaping the Canada Chocolate Market?

Trends in the Canada Chocolate Market include the rise of plant-based chocolates, increased interest in ethical sourcing practices, and the popularity of experiential chocolate products, such as chocolate-making workshops and tasting events.

Canada Chocolate Market

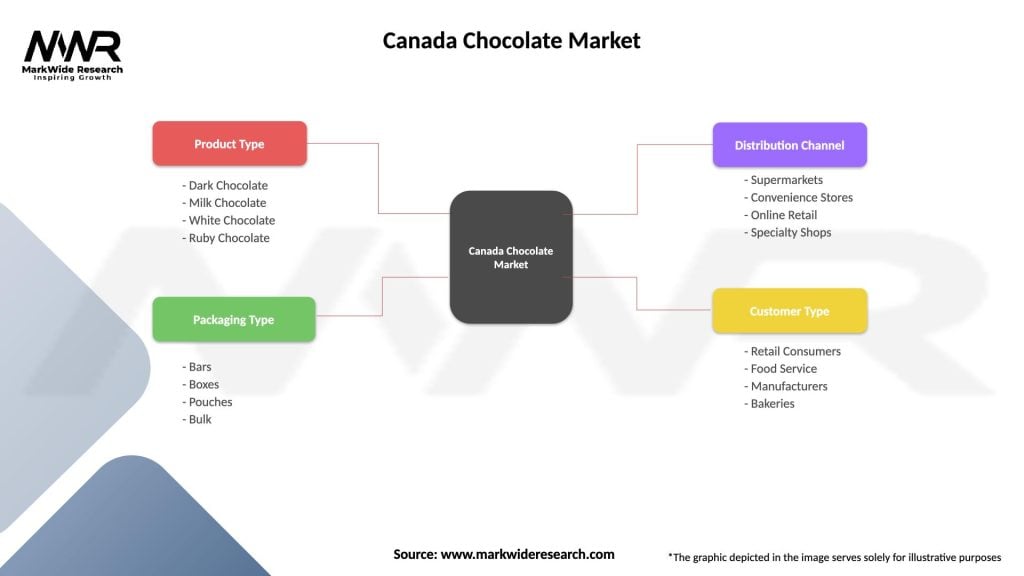

| Segmentation Details | Description |

|---|---|

| Product Type | Dark Chocolate, Milk Chocolate, White Chocolate, Ruby Chocolate |

| Packaging Type | Bars, Boxes, Pouches, Bulk |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Shops |

| Customer Type | Retail Consumers, Food Service, Manufacturers, Bakeries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Chocolate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at