444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany car insurance market represents one of Europe’s most sophisticated and competitive automotive insurance landscapes, characterized by stringent regulatory frameworks and evolving consumer preferences. Market dynamics indicate substantial growth driven by increasing vehicle registrations, technological advancements in telematics, and shifting consumer behavior toward digital insurance solutions. The German automotive insurance sector demonstrates remarkable resilience with consistent growth rates of approximately 4.2% annually, reflecting the country’s robust automotive industry and comprehensive insurance penetration.

Digital transformation has emerged as a pivotal force reshaping the German car insurance landscape, with insurers increasingly adopting artificial intelligence, machine learning, and IoT-enabled solutions to enhance risk assessment and customer experience. The market exhibits strong regional variations, with urban centers like Berlin, Munich, and Hamburg showing higher adoption rates of innovative insurance products compared to rural areas. Regulatory compliance remains paramount, with German insurance companies adhering to strict EU directives while maintaining competitive pricing strategies.

Consumer preferences have evolved significantly, with approximately 68% of German drivers now preferring comprehensive coverage options that include additional benefits such as roadside assistance, rental car coverage, and gap insurance. The integration of telematics-based insurance products has gained considerable traction, particularly among younger demographics who appreciate usage-based insurance models that reward safe driving behaviors.

The Germany car insurance market refers to the comprehensive ecosystem of automotive insurance products, services, and regulatory frameworks operating within German borders to provide financial protection for vehicle owners against various risks including accidents, theft, vandalism, and third-party liabilities. This market encompasses mandatory liability insurance, optional comprehensive coverage, and specialized insurance products tailored to meet diverse consumer needs across different vehicle categories and usage patterns.

Automotive insurance in Germany operates under a dual structure combining compulsory third-party liability insurance with voluntary comprehensive and collision coverage options. The market includes traditional insurance carriers, digital-first insurers, and hybrid models that leverage technology to deliver personalized insurance solutions. Risk assessment methodologies have evolved to incorporate advanced analytics, driving behavior monitoring, and predictive modeling to determine premium pricing and coverage terms.

Market participants include established insurance giants, emerging insurtech companies, and specialized automotive insurance providers who compete across various distribution channels including direct sales, broker networks, and digital platforms. The German car insurance market serves as a benchmark for European insurance practices, influencing regulatory standards and innovative product development across the continent.

Strategic analysis reveals that the Germany car insurance market continues to demonstrate robust growth momentum driven by technological innovation, regulatory evolution, and changing consumer expectations. The market landscape features intense competition among traditional insurers and emerging digital platforms, creating opportunities for differentiation through personalized products and enhanced customer experiences. Key growth drivers include increasing vehicle electrification, autonomous driving technology integration, and rising demand for flexible insurance solutions.

Market segmentation shows distinct preferences across demographic groups, with millennials and Gen Z consumers driving demand for digital-first insurance experiences and usage-based pricing models. Traditional insurance companies are investing heavily in digital transformation initiatives to compete with insurtech startups that offer streamlined onboarding processes and AI-powered claims handling. Premium pricing strategies have become increasingly sophisticated, incorporating real-time data analytics and behavioral insights to optimize risk assessment accuracy.

Competitive dynamics indicate consolidation trends among smaller players while market leaders expand their digital capabilities and product portfolios. The integration of telematics technology has enabled insurers to offer more precise risk pricing, with approximately 34% of new policies now incorporating some form of usage-based insurance elements. Regulatory compliance remains a critical success factor, with insurers adapting to evolving EU insurance directives and German-specific requirements.

Market intelligence reveals several transformative trends reshaping the German car insurance landscape, with digitalization leading the charge in product innovation and customer engagement strategies. The following insights highlight critical market developments:

Primary growth catalysts propelling the Germany car insurance market include technological advancement, regulatory modernization, and evolving consumer mobility patterns. The increasing penetration of connected vehicles and advanced driver assistance systems creates new opportunities for risk assessment and premium optimization. Digital transformation initiatives enable insurers to offer more responsive customer service while reducing operational costs through automation and artificial intelligence integration.

Demographic shifts significantly influence market dynamics, with younger consumers demanding more flexible and transparent insurance products that align with their digital-first lifestyle preferences. The growing popularity of electric vehicles drives demand for specialized coverage options that address unique risks associated with battery technology, charging infrastructure, and higher vehicle replacement costs. Urbanization trends contribute to changing mobility patterns, with city dwellers increasingly adopting car-sharing services and alternative transportation modes.

Regulatory support for innovation in insurance products encourages market participants to develop creative solutions that better serve consumer needs while maintaining adequate protection standards. The integration of European Union insurance directives with German national regulations creates a stable framework for market expansion and cross-border insurance operations. Economic stability in Germany provides a favorable environment for insurance market growth, with consistent employment levels supporting sustained demand for automotive insurance products.

Significant challenges facing the Germany car insurance market include intense price competition, regulatory complexity, and changing consumer expectations that pressure profit margins. The commoditization of basic insurance products makes differentiation increasingly difficult, forcing insurers to compete primarily on price rather than value-added services. Regulatory compliance costs continue to rise as insurers must adapt to evolving data protection requirements, consumer rights legislation, and solvency regulations.

Market saturation in certain segments limits growth opportunities, particularly in traditional liability insurance where penetration rates approach maximum levels. The increasing sophistication of consumers who actively compare insurance options online puts downward pressure on premium pricing and reduces customer loyalty. Claims inflation driven by rising vehicle repair costs, particularly for luxury and electric vehicles, challenges insurers’ ability to maintain profitable underwriting results.

Technology implementation costs represent substantial investments for traditional insurers seeking to modernize their operations and compete with digital-native competitors. The complexity of integrating legacy systems with new technologies creates operational challenges and potential service disruptions. Cybersecurity risks associated with increased digitalization require ongoing investments in security infrastructure and compliance measures, adding to operational expenses.

Emerging opportunities in the Germany car insurance market center around technological innovation, market expansion, and product diversification strategies that address evolving consumer needs. The rapid adoption of electric vehicles creates substantial opportunities for insurers to develop specialized products that address unique coverage requirements and risk profiles. Telematics-based insurance products offer significant potential for market differentiation and improved risk selection through real-time driving behavior monitoring.

Digital ecosystem expansion enables insurers to offer integrated mobility solutions that extend beyond traditional insurance coverage to include roadside assistance, vehicle maintenance services, and mobility-as-a-service platforms. The growing market for autonomous and semi-autonomous vehicles presents opportunities to develop innovative insurance products that address liability questions and coverage gaps in emerging transportation technologies. Cross-selling opportunities through digital platforms allow insurers to expand their product portfolios and increase customer lifetime value.

Partnership strategies with automotive manufacturers, technology companies, and mobility service providers create new distribution channels and product development opportunities. The increasing focus on sustainability and environmental responsibility opens markets for green insurance products that reward eco-friendly driving behaviors and support carbon reduction initiatives. Data monetization opportunities through anonymized driving data analysis can generate additional revenue streams while improving risk assessment capabilities.

Complex interactions between technological advancement, regulatory evolution, and consumer behavior changes drive the dynamic nature of the Germany car insurance market. The competitive landscape continues to evolve as traditional insurers adapt their business models to compete with agile insurtech startups that leverage advanced technologies and streamlined operations. Market consolidation trends reflect the need for scale economies in technology investments and regulatory compliance costs.

Consumer empowerment through digital comparison platforms and transparent pricing information has shifted market power toward buyers, forcing insurers to focus on value proposition differentiation rather than information asymmetries. The integration of artificial intelligence and machine learning technologies enables more sophisticated risk assessment and personalized pricing strategies. Real-time data processing capabilities allow insurers to adjust coverage and pricing dynamically based on changing risk profiles and market conditions.

Ecosystem partnerships between insurers, automotive manufacturers, and technology providers create new value chains and business models that extend beyond traditional insurance boundaries. According to MarkWide Research analysis, the convergence of insurance and mobility services represents a fundamental shift in how consumers perceive and purchase automotive protection. Regulatory adaptation continues to shape market dynamics as authorities balance innovation encouragement with consumer protection requirements.

Comprehensive research approach employed in analyzing the Germany car insurance market combines quantitative data analysis with qualitative insights gathered from industry stakeholders, regulatory bodies, and consumer surveys. Primary research methodologies include structured interviews with insurance executives, distribution partners, and technology providers to understand market trends and strategic priorities. Secondary research encompasses analysis of regulatory filings, industry reports, and market data from authoritative sources to validate findings and identify emerging patterns.

Data collection processes utilize multiple sources including insurance company annual reports, regulatory databases, consumer behavior studies, and technology adoption surveys to ensure comprehensive market coverage. Statistical analysis techniques applied to historical data enable identification of growth trends, market share evolution, and competitive positioning changes over time. Market segmentation analysis examines demographic, geographic, and behavioral factors that influence insurance purchasing decisions and product preferences.

Validation procedures include cross-referencing data from multiple sources, conducting expert interviews to verify findings, and applying statistical significance tests to ensure research reliability. The methodology incorporates both top-down market analysis and bottom-up demand assessment to provide balanced perspectives on market dynamics. Forecasting models integrate historical trends with forward-looking indicators to project market evolution and identify potential disruption scenarios.

Geographic distribution of the Germany car insurance market reveals significant regional variations in product preferences, pricing strategies, and competitive dynamics across different states and metropolitan areas. North Rhine-Westphalia represents the largest regional market, accounting for approximately 22% of total market activity, driven by high population density and industrial concentration. Bavaria follows as the second-largest market with strong demand for premium insurance products reflecting higher average income levels and luxury vehicle ownership rates.

Urban markets including Berlin, Hamburg, and Munich demonstrate higher adoption rates of digital insurance products and innovative coverage options such as usage-based insurance and telematics-enabled policies. These metropolitan areas show increased demand for flexible insurance solutions that accommodate car-sharing, ride-sharing, and alternative mobility services. Rural regions maintain preference for traditional insurance products and face-to-face distribution channels, though digital adoption is gradually increasing.

Eastern German states exhibit distinct market characteristics with price sensitivity driving purchasing decisions and lower penetration of comprehensive coverage options compared to western regions. The regional analysis indicates growing convergence in insurance preferences as economic development continues and digital infrastructure improves. Border regions show unique dynamics influenced by cross-border commuting patterns and international insurance requirements, creating opportunities for specialized product development.

Market leadership in the Germany car insurance sector is characterized by intense competition among established players and emerging digital challengers who leverage technology to disrupt traditional business models. The competitive environment features both large multinational insurance groups and specialized automotive insurers competing across multiple distribution channels and customer segments.

Competitive strategies increasingly focus on digital transformation, customer experience optimization, and data-driven product development to maintain market position and attract new customers in an evolving marketplace.

Market segmentation in the Germany car insurance sector reflects diverse consumer needs, vehicle types, and coverage preferences that drive product development and marketing strategies. Segmentation analysis reveals distinct patterns in purchasing behavior and risk profiles across different demographic and geographic categories.

By Coverage Type:

By Vehicle Type:

By Distribution Channel:

Detailed analysis of market categories reveals distinct trends and opportunities across different insurance product segments and customer demographics. Each category demonstrates unique characteristics in terms of growth potential, competitive dynamics, and consumer preferences that influence strategic planning and resource allocation decisions.

Liability Insurance Category maintains stable demand driven by legal requirements, with innovation focusing on enhanced customer service and claims processing efficiency. Digital transformation initiatives in this category emphasize automated underwriting and streamlined policy administration. Pricing competition remains intense as insurers seek to attract customers through competitive liability coverage rates while maintaining profitability through cross-selling opportunities.

Comprehensive Coverage Category shows strong growth potential as consumers increasingly recognize the value of protection against non-collision risks. This category benefits from rising vehicle values and increased awareness of climate-related risks such as flooding and hail damage. Product innovation includes flexible deductible options, usage-based adjustments, and integrated roadside assistance services that enhance value propositions.

Electric Vehicle Insurance Category represents the fastest-growing segment with specialized products addressing unique risks and coverage requirements. Insurers develop expertise in battery technology, charging infrastructure, and specialized repair networks to serve this expanding market. Premium pricing models for electric vehicles incorporate factors such as vehicle range, charging patterns, and environmental benefits to create competitive advantages.

Strategic advantages available to Germany car insurance market participants include opportunities for revenue diversification, customer relationship enhancement, and operational efficiency improvements through technology adoption and market expansion initiatives. Industry stakeholders benefit from comprehensive market intelligence that enables informed decision-making and competitive positioning strategies.

Insurance Companies gain access to expanding market opportunities through digital transformation, product innovation, and strategic partnerships that enhance customer acquisition and retention capabilities. Technology investments enable improved risk assessment accuracy, reduced operational costs, and enhanced customer experience delivery. Data analytics capabilities provide insights for personalized product development and targeted marketing strategies that increase conversion rates and customer satisfaction.

Technology Providers benefit from increasing demand for insurance technology solutions including artificial intelligence, machine learning, and IoT integration that enable innovative product development and operational optimization. Partnership opportunities with established insurers provide market access and validation for emerging technologies. Market expansion potential exists for companies offering specialized solutions for electric vehicles, autonomous driving, and connected car technologies.

Consumers experience improved product choices, competitive pricing, and enhanced service quality through market competition and technological advancement. Digital platforms provide greater transparency in product comparison and purchasing processes while telematics-based products offer personalized pricing based on individual driving behavior. Value-added services including roadside assistance, rental car coverage, and mobile claims processing enhance the overall insurance experience and provide additional protection benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Germany car insurance market reflect broader technological, social, and economic changes that influence consumer behavior and industry dynamics. These trends create both opportunities and challenges for market participants seeking to maintain competitive advantages and capture emerging growth segments.

Digital-First Customer Experience has become a critical differentiator as consumers expect seamless online interactions from initial quotes through claims resolution. Mobile applications with AI-powered chatbots, instant policy modifications, and digital claims filing capabilities represent standard expectations rather than premium features. Omnichannel integration ensures consistent customer experiences across digital and traditional touchpoints while providing flexibility in communication preferences.

Usage-Based Insurance Expansion continues gaining momentum with approximately 28% of new policies incorporating some form of telematics or behavioral monitoring. These products appeal to safety-conscious drivers who benefit from personalized pricing based on actual driving patterns rather than demographic generalizations. Privacy concerns are being addressed through transparent data usage policies and consumer control over information sharing preferences.

Sustainability Integration reflects growing environmental consciousness among German consumers who increasingly prefer insurance products that align with their values. Green insurance initiatives include carbon offset programs, discounts for electric vehicle owners, and partnerships with environmental organizations. ESG compliance becomes increasingly important for insurers seeking to attract environmentally conscious consumers and meet regulatory expectations.

Recent developments in the Germany car insurance market demonstrate the rapid pace of innovation and adaptation as industry participants respond to technological advancement, regulatory changes, and evolving consumer expectations. These developments shape competitive dynamics and influence strategic planning across the sector.

Artificial Intelligence Integration has accelerated significantly with major insurers implementing AI-powered underwriting systems that process applications in minutes rather than days. Machine learning algorithms analyze vast datasets to identify risk patterns and optimize pricing strategies while reducing human bias in decision-making processes. Claims automation through AI-enabled damage assessment and fraud detection improves processing efficiency and customer satisfaction while reducing operational costs.

Strategic Partnerships between traditional insurers and technology companies have proliferated as market participants seek to accelerate digital transformation and access specialized capabilities. Collaborations with automotive manufacturers enable embedded insurance offerings that integrate seamlessly with vehicle purchase and financing processes. Insurtech acquisitions provide established companies with innovative technologies and digital-native talent to compete effectively in evolving market conditions.

Regulatory Evolution includes updated data protection requirements, consumer rights enhancements, and sustainability reporting mandates that influence product development and operational procedures. The implementation of new EU insurance distribution directives affects sales processes and customer communication requirements. MWR analysis indicates that regulatory adaptation costs represent significant investments for market participants while creating opportunities for compliance technology providers.

Strategic recommendations for Germany car insurance market participants emphasize the importance of digital transformation, customer-centric innovation, and strategic partnerships to maintain competitive positioning in an evolving marketplace. Success requires balancing traditional insurance expertise with emerging technology capabilities and changing consumer expectations.

Technology Investment Priorities should focus on customer-facing applications, automated underwriting systems, and data analytics capabilities that enable personalized product offerings and improved operational efficiency. Cloud-based infrastructure investments provide scalability and flexibility for future growth while reducing maintenance costs for legacy systems. Cybersecurity measures require ongoing attention and investment to protect customer data and maintain regulatory compliance in an increasingly digital environment.

Product Development Strategies should emphasize flexibility, personalization, and value-added services that differentiate offerings beyond price competition. Electric vehicle insurance products represent significant growth opportunities requiring specialized expertise and partnerships with automotive manufacturers and charging infrastructure providers. Usage-based insurance expansion should balance consumer privacy concerns with the benefits of personalized pricing and risk assessment accuracy.

Distribution Channel Optimization requires omnichannel strategies that provide consistent customer experiences across digital and traditional touchpoints while optimizing cost efficiency and customer acquisition effectiveness. Direct digital channels offer cost advantages and customer convenience while broker relationships provide personalized advice and complex risk assessment capabilities. Partnership strategies with automotive dealers, banks, and mobility service providers create new customer acquisition opportunities and cross-selling potential.

Long-term projections for the Germany car insurance market indicate continued evolution driven by technological advancement, changing mobility patterns, and regulatory development that will reshape industry dynamics over the next decade. Market participants must prepare for fundamental changes in risk profiles, customer expectations, and competitive landscapes while maintaining focus on profitability and customer satisfaction.

Autonomous Vehicle Integration will gradually transform insurance requirements as liability shifts from individual drivers to vehicle manufacturers and technology providers. This transition creates opportunities for new insurance products while potentially reducing demand for traditional coverage types. Timeline projections suggest significant market impact beginning in the late 2020s with full transformation occurring over multiple decades as autonomous technology adoption accelerates.

Electric Vehicle Dominance is expected to reach approximately 75% market penetration by 2035, requiring insurers to develop comprehensive expertise in electric vehicle technologies, charging infrastructure, and specialized repair networks. Battery technology evolution and cost reduction will influence insurance pricing models and coverage requirements. Charging infrastructure expansion creates new risk categories and coverage opportunities that forward-thinking insurers can capitalize on through early market entry.

Digital Ecosystem Evolution will continue integrating insurance with broader mobility services, creating comprehensive platforms that address all aspects of vehicle ownership and usage. According to MarkWide Research projections, integrated mobility platforms will become the preferred customer interface for insurance purchases and management. Data monetization opportunities through anonymized driving behavior analysis will create additional revenue streams while improving risk assessment capabilities and product development insights.

The Germany car insurance market stands at a pivotal transformation point where traditional insurance principles meet cutting-edge technology and evolving consumer expectations. Market participants who successfully navigate this transition through strategic investments in digital capabilities, innovative product development, and customer-centric service delivery will capture the greatest opportunities for sustainable growth and competitive advantage.

Key success factors include embracing technological innovation while maintaining insurance fundamentals, developing specialized expertise in emerging vehicle technologies, and creating flexible business models that adapt to changing market conditions. The integration of artificial intelligence, telematics, and data analytics capabilities enables more accurate risk assessment and personalized customer experiences that differentiate market leaders from followers.

Future market leaders will be those organizations that balance innovation with reliability, offering cutting-edge products and services while maintaining the trust and financial stability that consumers expect from insurance providers. The convergence of insurance, technology, and mobility services creates unprecedented opportunities for market expansion and customer value creation, positioning the Germany car insurance market as a model for global insurance industry evolution.

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise therefrom. It typically covers various aspects such as property damage, medical expenses, and theft.

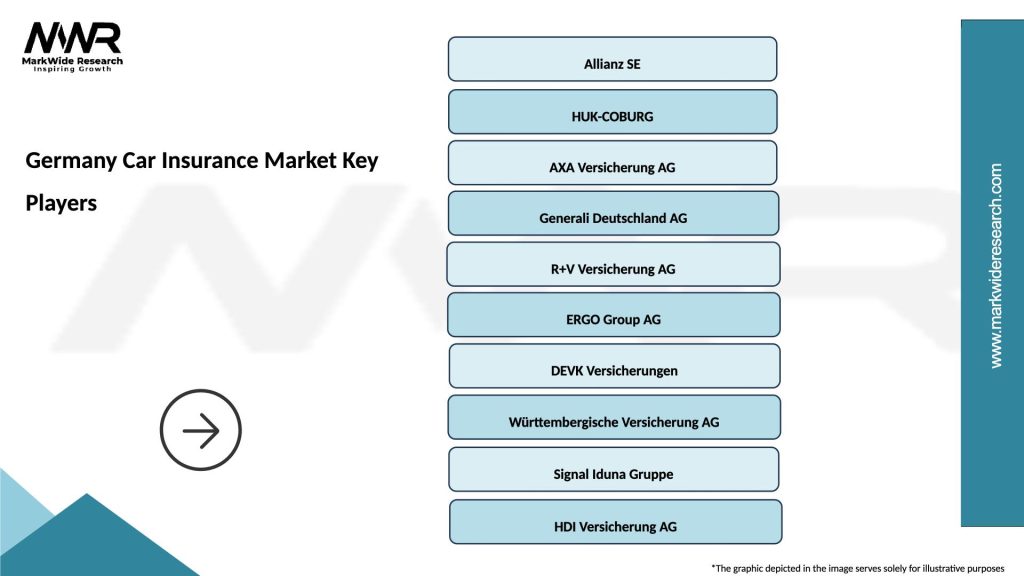

What are the key players in the Germany Car Insurance Market?

Key players in the Germany Car Insurance Market include Allianz, HUK-Coburg, and AXA, which offer a range of car insurance products tailored to different consumer needs and preferences, among others.

What are the main drivers of growth in the Germany Car Insurance Market?

The main drivers of growth in the Germany Car Insurance Market include the increasing number of vehicles on the road, rising awareness of the importance of insurance coverage, and advancements in technology that facilitate easier policy management and claims processing.

What challenges does the Germany Car Insurance Market face?

The Germany Car Insurance Market faces challenges such as regulatory changes that can impact pricing and coverage options, increased competition among insurers, and the growing prevalence of fraudulent claims that can affect profitability.

What opportunities exist in the Germany Car Insurance Market?

Opportunities in the Germany Car Insurance Market include the potential for innovative insurance products that cater to electric and autonomous vehicles, as well as the integration of telematics to offer personalized premiums based on driving behavior.

What trends are shaping the Germany Car Insurance Market?

Trends shaping the Germany Car Insurance Market include the rise of digital platforms for policy purchase and management, an increasing focus on sustainability and eco-friendly practices, and the growing use of artificial intelligence in underwriting and claims processing.

Germany Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Customer Type | Individual, Fleet, Commercial, Corporate |

| Coverage Type | Liability, Comprehensive, Collision, Third-Party |

| Vehicle Type | Passenger Cars, SUVs, Motorcycles, Vans |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at