444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy continuous glucose monitoring devices market represents a rapidly evolving healthcare technology sector that has transformed diabetes management across the nation. Continuous glucose monitoring (CGM) devices provide real-time glucose readings, enabling patients and healthcare providers to make informed decisions about diabetes treatment and lifestyle modifications. The Italian market has experienced remarkable growth, driven by increasing diabetes prevalence, technological advancements, and growing awareness of the benefits of continuous monitoring over traditional fingerstick methods.

Market dynamics in Italy reflect a strong adoption rate of 15.2% annually among Type 1 diabetes patients, while Type 2 diabetes patients show increasing interest in CGM technology. The integration of digital health solutions with CGM devices has created new opportunities for remote patient monitoring and telemedicine applications. Italian healthcare institutions have increasingly recognized the value of continuous glucose monitoring in reducing long-term complications and improving patient outcomes.

Regional distribution shows concentrated adoption in northern Italian regions, with 42% market penetration in Lombardy and Veneto combined. The market encompasses various device types, from traditional CGM systems to advanced integrated insulin pump solutions, catering to diverse patient needs and preferences across Italy’s healthcare landscape.

The Italy continuous glucose monitoring devices market refers to the comprehensive ecosystem of medical devices, technologies, and services that enable real-time glucose level monitoring for diabetes patients throughout the Italian healthcare system. CGM devices utilize small sensors inserted under the skin to measure glucose levels in interstitial fluid, providing continuous data streams that help patients and healthcare providers optimize diabetes management strategies.

These sophisticated devices represent a significant advancement over traditional blood glucose meters, offering insights into glucose trends, patterns, and fluctuations throughout the day and night. The Italian market encompasses various stakeholders, including device manufacturers, healthcare providers, patients, and regulatory bodies working together to improve diabetes care outcomes.

Market participants include both international technology leaders and emerging Italian healthcare companies developing innovative solutions tailored to local patient needs and healthcare infrastructure requirements.

Italy’s continuous glucose monitoring devices market demonstrates robust growth potential driven by demographic trends, technological innovation, and evolving healthcare policies. The market benefits from Italy’s comprehensive healthcare system and increasing focus on preventive care and chronic disease management. Key growth drivers include rising diabetes prevalence, aging population demographics, and growing awareness of CGM benefits among patients and healthcare providers.

Technology advancement has been a primary catalyst, with next-generation CGM devices offering improved accuracy, longer wear times, and enhanced connectivity features. The integration of artificial intelligence and machine learning algorithms has enabled predictive glucose monitoring capabilities, representing a significant leap forward in diabetes management technology.

Market penetration rates show promising trends, with 28% adoption among eligible Type 1 diabetes patients and growing interest from Type 2 diabetes patients seeking better glucose control. The competitive landscape features established international players alongside innovative Italian companies developing specialized solutions for the domestic market.

Strategic market insights reveal several critical factors shaping Italy’s continuous glucose monitoring devices landscape:

Primary market drivers propelling Italy’s continuous glucose monitoring devices market include demographic, technological, and healthcare policy factors that create favorable conditions for sustained growth. The increasing prevalence of diabetes across Italy represents the most significant driver, with Type 2 diabetes affecting approximately 5.5% of the adult population and continuing to rise due to lifestyle factors and aging demographics.

Technological advancement serves as another crucial driver, with manufacturers developing increasingly sophisticated CGM devices that offer improved accuracy, extended wear times, and enhanced user experiences. The integration of digital health platforms enables seamless data sharing between patients and healthcare providers, supporting more effective diabetes management strategies.

Healthcare policy evolution supports market growth through expanded reimbursement coverage and clinical guidelines recommending CGM use for appropriate patient populations. Italian healthcare authorities increasingly recognize the long-term cost benefits of continuous glucose monitoring in preventing diabetes complications and reducing hospitalizations.

Patient awareness campaigns and educational initiatives have significantly increased understanding of CGM benefits, driving patient demand for these advanced monitoring solutions. Healthcare provider training programs ensure proper device utilization and maximize clinical benefits for diabetes patients across Italy.

Market restraints present challenges that may limit the full potential of Italy’s continuous glucose monitoring devices market. Cost considerations remain a primary constraint, as CGM devices and associated supplies represent significant ongoing expenses for patients and healthcare systems, particularly affecting lower-income populations and regions with limited healthcare resources.

Technical limitations of current CGM technology include accuracy variations, calibration requirements, and occasional sensor failures that may impact user confidence and adoption rates. Some patients experience skin irritation or discomfort from sensor adhesives, leading to discontinuation of CGM use.

Healthcare provider training requirements create implementation challenges, as effective CGM utilization demands specialized knowledge and ongoing education for medical professionals. Limited availability of diabetes specialists in certain Italian regions may restrict optimal CGM implementation and patient support.

Regulatory complexity and varying reimbursement policies across different Italian regions create market fragmentation and may delay patient access to newer CGM technologies. Data privacy concerns and cybersecurity considerations also influence patient and provider adoption decisions.

Significant market opportunities exist within Italy’s continuous glucose monitoring devices sector, driven by technological innovation, expanding patient populations, and evolving healthcare delivery models. The integration of artificial intelligence and predictive analytics presents opportunities for next-generation CGM systems that can anticipate glucose fluctuations and provide proactive management recommendations.

Telemedicine expansion creates opportunities for remote diabetes management programs utilizing CGM data to support patients in rural or underserved areas. The growing focus on personalized medicine enables development of customized CGM solutions tailored to individual patient needs and preferences.

Pediatric diabetes management represents an underserved market segment with significant growth potential, as parents and healthcare providers seek better monitoring solutions for children with diabetes. The development of family-friendly CGM systems with enhanced safety features and simplified interfaces could capture this emerging market.

Integration opportunities with insulin delivery systems, fitness trackers, and other health monitoring devices create comprehensive diabetes management ecosystems. Pharmaceutical partnerships may lead to innovative combination therapies that leverage CGM data for optimized medication dosing and timing.

Market dynamics in Italy’s continuous glucose monitoring devices sector reflect complex interactions between technological innovation, healthcare policy, patient needs, and competitive forces. Supply chain considerations have become increasingly important, with manufacturers focusing on local production capabilities and distribution networks to ensure consistent product availability.

Competitive dynamics show intensifying rivalry between established international players and emerging Italian companies developing specialized solutions. This competition drives innovation while potentially creating pricing pressures that benefit patients and healthcare systems. Market consolidation trends may reshape the competitive landscape as companies seek to expand their technological capabilities and market reach.

Regulatory dynamics continue evolving as Italian health authorities adapt to rapid technological advancement and seek to balance innovation with patient safety. The harmonization of European Union regulations provides opportunities for streamlined market access while ensuring consistent quality standards.

Patient behavior dynamics show increasing sophistication in CGM utilization, with users demanding more advanced features, better integration with digital health platforms, and improved user experiences. This evolution drives manufacturers to continuously enhance their product offerings and support services.

Comprehensive research methodology employed in analyzing Italy’s continuous glucose monitoring devices market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare providers, diabetes specialists, patients, and industry stakeholders across various Italian regions to capture diverse perspectives and experiences.

Secondary research encompasses analysis of clinical studies, regulatory filings, company reports, and healthcare databases to establish market trends and quantitative insights. MarkWide Research utilizes proprietary analytical frameworks to synthesize data from multiple sources and identify key market patterns and opportunities.

Market modeling techniques incorporate demographic projections, healthcare utilization patterns, and technology adoption curves to forecast market development. Regional analysis considers variations in healthcare infrastructure, economic conditions, and patient populations across different Italian regions.

Validation processes include cross-referencing findings with industry experts and conducting sensitivity analyses to ensure research conclusions accurately reflect market realities. Continuous monitoring of market developments enables real-time updates to research findings and projections.

Regional analysis of Italy’s continuous glucose monitoring devices market reveals significant variations in adoption patterns, healthcare infrastructure, and market penetration across different geographic areas. Northern Italy leads in CGM adoption, with regions like Lombardy and Veneto showing 38% higher utilization rates compared to national averages, driven by advanced healthcare facilities and higher disposable incomes.

Central Italy demonstrates moderate growth patterns, with Rome and Florence serving as key adoption centers. The presence of major healthcare institutions and research facilities supports clinical innovation and physician education programs that drive CGM utilization. Tuscany and Lazio show particular strength in pediatric diabetes management applications.

Southern Italy presents both challenges and opportunities, with lower current adoption rates but significant growth potential. Healthcare infrastructure development and targeted education programs could unlock substantial market expansion in regions like Campania, Sicily, and Calabria. Telemedicine initiatives show particular promise for improving diabetes care access in these areas.

Island regions including Sicily and Sardinia face unique logistical challenges but benefit from specialized healthcare programs focused on chronic disease management. Regional healthcare policies increasingly support CGM adoption through targeted reimbursement programs and provider training initiatives.

The competitive landscape of Italy’s continuous glucose monitoring devices market features a dynamic mix of established international leaders and innovative emerging companies. Market leaders have established strong positions through comprehensive product portfolios, extensive clinical evidence, and robust distribution networks.

Emerging competitors include Italian healthcare technology companies developing specialized solutions for local market needs. Strategic partnerships between international companies and Italian healthcare providers create opportunities for market expansion and localized product development.

Market segmentation analysis reveals distinct categories within Italy’s continuous glucose monitoring devices market, each with unique characteristics and growth patterns. By Technology: Traditional CGM systems maintain significant market share while newer flash glucose monitoring and implantable systems show rapid adoption rates.

By Patient Type:

By End User:

By Component: Sensors represent the largest segment, while transmitters and receivers show steady demand patterns aligned with device replacement cycles.

Category-wise analysis provides detailed insights into specific segments of Italy’s continuous glucose monitoring devices market. Real-time CGM systems dominate the high-end market segment, offering continuous data streams and advanced alert capabilities that appeal to patients requiring intensive diabetes management.

Flash glucose monitoring systems have gained significant traction due to their accessibility and ease of use, particularly among patients transitioning from traditional blood glucose meters. These systems show 62% adoption rates among newly diagnosed Type 2 diabetes patients seeking improved monitoring solutions.

Integrated systems combining CGM with insulin delivery represent the premium market segment, offering comprehensive diabetes management solutions for patients with complex needs. Artificial intelligence integration in these systems provides predictive capabilities and automated insulin adjustment features.

Pediatric-specific CGM systems address unique requirements including smaller sensor sizes, enhanced adhesion properties, and family-friendly mobile applications. School integration programs support CGM use in educational settings, ensuring continuous monitoring during daily activities.

Professional CGM systems used by healthcare providers for diagnostic purposes show steady demand, particularly in diabetes specialty clinics and endocrinology practices across Italy.

Industry participants and stakeholders in Italy’s continuous glucose monitoring devices market realize substantial benefits across multiple dimensions. Healthcare providers benefit from enhanced patient monitoring capabilities, improved clinical outcomes, and more efficient diabetes management workflows that reduce consultation time while improving care quality.

Patients experience significant quality of life improvements through reduced fingerstick testing, better glucose control, and increased confidence in daily diabetes management. Real-time alerts help prevent dangerous glucose excursions, while trend data enables more informed lifestyle and treatment decisions.

Healthcare systems benefit from reduced long-term complications, decreased emergency department visits, and lower overall healthcare costs associated with better diabetes management. Preventive care capabilities enabled by CGM technology support Italy’s focus on chronic disease management and healthcare cost containment.

Technology companies gain access to valuable patient data (with appropriate consent) that drives product innovation and enables development of more effective diabetes management solutions. Market expansion opportunities exist through partnerships with healthcare providers and integration with digital health platforms.

Regulatory authorities benefit from improved patient safety monitoring and real-world evidence generation that supports evidence-based healthcare policy development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Italy’s continuous glucose monitoring devices landscape reflect technological advancement, changing patient expectations, and evolving healthcare delivery models. Artificial intelligence integration represents a transformative trend, with CGM systems increasingly incorporating machine learning algorithms for predictive glucose monitoring and personalized management recommendations.

Smartphone connectivity has become standard across CGM platforms, enabling seamless data sharing, remote monitoring capabilities, and integration with broader digital health ecosystems. Cloud-based analytics provide healthcare providers with comprehensive patient insights and population health management tools.

Miniaturization trends continue driving development of smaller, more comfortable CGM sensors with extended wear times and improved adhesion properties. Needle-free insertion technologies address patient comfort concerns and may expand adoption among needle-phobic individuals.

Personalization trends include customizable alert settings, individualized glucose targets, and tailored management recommendations based on patient lifestyle patterns and preferences. Integration with insulin delivery systems creates closed-loop diabetes management solutions that automatically adjust insulin dosing based on CGM readings.

Telemedicine integration enables remote diabetes care delivery, particularly valuable for patients in rural areas or those with mobility limitations. MWR analysis indicates that 45% of healthcare providers plan to expand telemedicine-supported CGM programs within the next two years.

Recent industry developments highlight the dynamic nature of Italy’s continuous glucose monitoring devices market and emerging opportunities for growth and innovation. Regulatory approvals for next-generation CGM systems have accelerated, with Italian health authorities streamlining approval processes for devices demonstrating clear clinical benefits.

Strategic partnerships between international CGM manufacturers and Italian healthcare providers have expanded, creating localized support networks and specialized training programs. Clinical evidence generation continues through multi-center Italian studies demonstrating CGM effectiveness in diverse patient populations.

Technology advancement includes development of implantable CGM systems with extended wear times, reducing the burden of frequent sensor replacements. Biosensor innovation focuses on improved accuracy and reduced calibration requirements, addressing key user concerns.

Digital health integration has accelerated through partnerships with mobile health platforms, electronic health record systems, and telemedicine providers. Artificial intelligence applications continue expanding, with predictive algorithms showing promise for preventing dangerous glucose excursions.

Market access improvements include expanded reimbursement coverage and patient assistance programs that increase CGM accessibility across different socioeconomic groups. Educational initiatives targeting both healthcare providers and patients support optimal CGM utilization and clinical outcomes.

Strategic recommendations for stakeholders in Italy’s continuous glucose monitoring devices market focus on maximizing growth opportunities while addressing current market challenges. Healthcare providers should invest in comprehensive staff training programs and establish standardized CGM protocols to ensure optimal patient outcomes and maximize technology benefits.

Technology companies should prioritize user experience improvements, focusing on device comfort, ease of use, and seamless integration with patients’ daily routines. Localization strategies including Italian language support and culturally appropriate patient education materials can enhance market penetration.

Healthcare policymakers should consider expanding reimbursement coverage for appropriate patient populations while establishing evidence-based guidelines for CGM utilization. Regional coordination efforts can help address disparities in access and adoption across different Italian regions.

Investment opportunities exist in companies developing innovative CGM technologies, digital health integration platforms, and specialized diabetes management solutions. Partnership strategies between international companies and Italian healthcare organizations can accelerate market development and improve patient access.

Patient advocacy organizations should continue educational efforts highlighting CGM benefits while supporting policy initiatives that improve technology accessibility and affordability for all diabetes patients across Italy.

The future outlook for Italy’s continuous glucose monitoring devices market appears highly promising, with multiple factors converging to support sustained growth and innovation. Demographic trends including population aging and increasing diabetes prevalence create a expanding patient base requiring advanced monitoring solutions.

Technological evolution will likely focus on further miniaturization, improved accuracy, and enhanced connectivity features that seamlessly integrate with patients’ digital lives. Artificial intelligence advancement promises more sophisticated predictive capabilities and personalized management recommendations that could revolutionize diabetes care.

Market expansion is expected to accelerate with projected growth rates of 12.8% annually over the next five years, driven by increasing adoption among Type 2 diabetes patients and expanding pediatric applications. Geographic expansion into underserved Italian regions presents significant opportunities for market development.

Integration trends will likely continue with comprehensive diabetes management platforms combining CGM data with insulin delivery, nutrition tracking, and lifestyle management tools. Telemedicine expansion will enable broader access to specialized diabetes care, particularly benefiting patients in rural or remote areas.

MarkWide Research projects that next-generation CGM systems will capture increasing market share through superior performance characteristics and enhanced patient experiences, while traditional systems maintain presence in cost-sensitive segments.

Italy’s continuous glucose monitoring devices market represents a dynamic and rapidly evolving healthcare technology sector with substantial growth potential and significant opportunities for stakeholders across the diabetes care ecosystem. The convergence of demographic trends, technological advancement, and supportive healthcare policies creates favorable conditions for sustained market expansion and innovation.

Key success factors include continued focus on user experience improvements, expanded healthcare provider education, and strategic partnerships that enhance market access and patient support. The integration of artificial intelligence and digital health platforms will likely drive the next wave of innovation, creating more comprehensive and effective diabetes management solutions.

Market challenges including regional disparities, cost considerations, and technical limitations require coordinated efforts from industry participants, healthcare providers, and policymakers to ensure optimal outcomes for all diabetes patients across Italy. Collaborative approaches that leverage the strengths of different stakeholders will be essential for maximizing the potential of CGM technology in improving diabetes care and patient quality of life throughout Italy.

What is Continuous Glucose Monitoring Devices?

Continuous Glucose Monitoring Devices are medical devices that provide real-time measurements of glucose levels in the body, helping individuals manage diabetes more effectively. These devices typically include a sensor placed under the skin, a transmitter, and a display device that shows glucose readings.

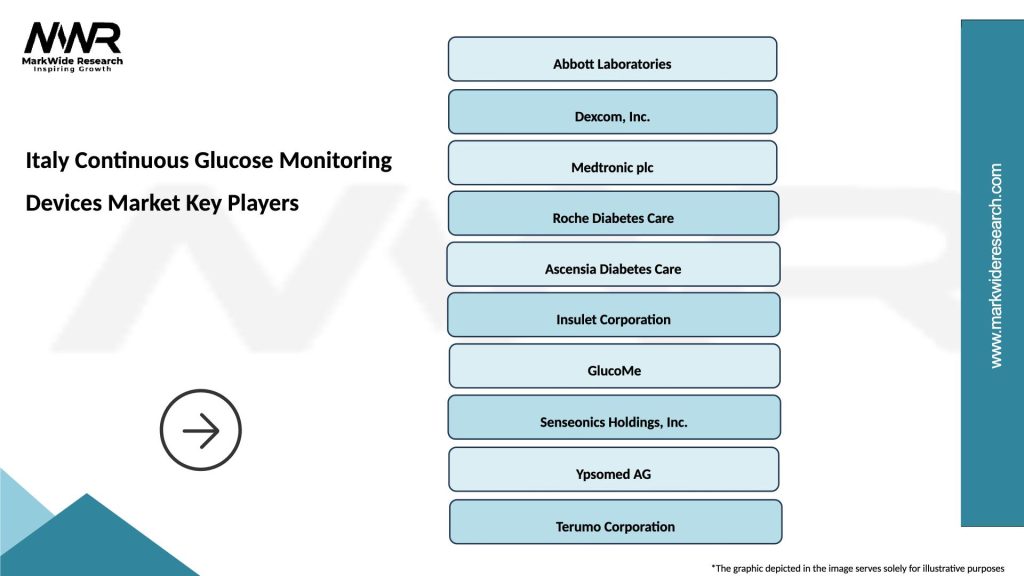

What are the key players in the Italy Continuous Glucose Monitoring Devices Market?

Key players in the Italy Continuous Glucose Monitoring Devices Market include Abbott Laboratories, Dexcom, and Medtronic, which are known for their innovative glucose monitoring solutions. These companies focus on enhancing device accuracy and user experience, among others.

What are the growth factors driving the Italy Continuous Glucose Monitoring Devices Market?

The growth of the Italy Continuous Glucose Monitoring Devices Market is driven by the increasing prevalence of diabetes, rising awareness about glucose monitoring, and advancements in technology that improve device functionality. Additionally, the demand for personalized healthcare solutions is contributing to market expansion.

What challenges does the Italy Continuous Glucose Monitoring Devices Market face?

The Italy Continuous Glucose Monitoring Devices Market faces challenges such as high costs of devices, regulatory hurdles, and the need for continuous calibration. These factors can limit accessibility and adoption among patients.

What opportunities exist in the Italy Continuous Glucose Monitoring Devices Market?

Opportunities in the Italy Continuous Glucose Monitoring Devices Market include the development of advanced sensors, integration with mobile health applications, and increasing partnerships between technology companies and healthcare providers. These trends can enhance patient engagement and improve diabetes management.

What trends are shaping the Italy Continuous Glucose Monitoring Devices Market?

Trends shaping the Italy Continuous Glucose Monitoring Devices Market include the rise of wearable technology, the shift towards remote patient monitoring, and the growing emphasis on data analytics for personalized treatment. These innovations are transforming how diabetes care is delivered.

Italy Continuous Glucose Monitoring Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Handheld Monitors, Continuous Glucose Sensors, Transmitters |

| Technology | Flash Glucose Monitoring, Real-Time Monitoring, Enzyme-Based Sensors, Non-Invasive Sensors |

| End User | Hospitals, Homecare Settings, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Medical Supply Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Continuous Glucose Monitoring Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at