444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia refrigerated trailer market represents a rapidly expanding segment within the country’s transportation and logistics infrastructure. As Southeast Asia’s largest economy, Indonesia has witnessed remarkable growth in cold chain logistics driven by increasing consumer demand for fresh produce, pharmaceuticals, and processed foods. The market encompasses specialized trailers equipped with advanced refrigeration systems designed to maintain precise temperature control during transportation of temperature-sensitive goods.

Market dynamics indicate robust expansion fueled by urbanization, rising disposable incomes, and evolving consumer preferences toward fresh and frozen products. The archipelagic nature of Indonesia, comprising over 17,000 islands, creates unique logistical challenges that refrigerated trailers help address effectively. Current growth trajectories suggest the market is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting strong demand across multiple sectors including food and beverage, pharmaceuticals, and agricultural exports.

Infrastructure development initiatives by the Indonesian government, coupled with foreign investment in logistics capabilities, have significantly enhanced the market landscape. Major ports in Jakarta, Surabaya, and Medan serve as critical hubs for refrigerated transport, facilitating both domestic distribution and international trade. The market benefits from Indonesia’s strategic position as a gateway to ASEAN markets, with refrigerated trailers playing essential roles in maintaining product integrity during extended transportation routes.

The Indonesia refrigerated trailer market refers to the commercial sector encompassing the manufacturing, distribution, and utilization of temperature-controlled transportation units specifically designed for preserving perishable goods throughout the Indonesian archipelago. These specialized vehicles integrate advanced cooling technologies with robust trailer construction to ensure optimal temperature maintenance during transit.

Refrigerated trailers, commonly known as reefer trailers, serve as mobile cold storage solutions that bridge the gap between production facilities, distribution centers, and end consumers. In Indonesia’s context, these units must accommodate diverse climatic conditions, from tropical coastal regions to mountainous inland areas, while maintaining consistent internal temperatures ranging from frozen storage at negative temperatures to controlled ambient conditions for sensitive pharmaceuticals.

The market encompasses various stakeholder categories including trailer manufacturers, refrigeration system suppliers, logistics service providers, and end-user industries. Technology integration has evolved to include GPS tracking, remote temperature monitoring, and automated alert systems, transforming traditional refrigerated transport into sophisticated cold chain management solutions tailored to Indonesia’s unique geographical and economic requirements.

Indonesia’s refrigerated trailer market demonstrates exceptional growth potential driven by fundamental economic and demographic shifts. The market benefits from Indonesia’s position as the world’s fourth most populous country, with over 270 million consumers increasingly demanding fresh, frozen, and temperature-sensitive products. Urban population growth, currently representing 56% of total population, creates concentrated demand centers requiring efficient cold chain logistics.

Key market drivers include expanding retail modernization, growth in organized food retail, and increasing pharmaceutical distribution requirements. The market serves diverse applications from seafood exports, which constitute a significant portion of Indonesia’s agricultural exports, to vaccine distribution programs requiring precise temperature control. E-commerce growth has additionally created new demand patterns, with online grocery and food delivery services requiring reliable refrigerated transport capabilities.

Technological advancement represents a critical market differentiator, with modern refrigerated trailers incorporating IoT sensors, real-time monitoring systems, and energy-efficient cooling technologies. According to MarkWide Research analysis, the market shows strong correlation with Indonesia’s GDP growth and infrastructure development investments, positioning it for sustained expansion through the forecast period.

Regional distribution patterns reflect Indonesia’s economic geography, with Java accounting for approximately 58% of market demand due to its concentration of manufacturing, population, and port facilities. Sumatra and other major islands represent emerging growth opportunities as infrastructure development progresses and regional economic activity intensifies.

Market segmentation reveals distinct patterns across application categories, with food and beverage transportation representing the largest segment. The following key insights characterize current market dynamics:

Market maturation indicators suggest transition from basic refrigerated transport to comprehensive cold chain solutions. Service providers increasingly offer integrated logistics packages combining transportation, warehousing, and temperature monitoring services. This evolution reflects growing customer sophistication and demand for end-to-end cold chain reliability.

Economic growth serves as the primary driver for Indonesia’s refrigerated trailer market expansion. The country’s robust economic performance, supported by domestic consumption and export activities, creates favorable conditions for cold chain infrastructure development. Rising per capita income levels enable consumers to purchase higher-value fresh and frozen products, directly translating to increased refrigerated transport demand.

Urbanization trends significantly impact market dynamics, with urban populations requiring sophisticated food distribution networks. Cities like Jakarta, Surabaya, and Medan concentrate millions of consumers who depend on efficient cold chain systems for daily food supplies. Urban lifestyle changes, including increased consumption of processed foods, dairy products, and imported goods, necessitate reliable refrigerated transportation capabilities.

Government initiatives supporting food security and agricultural modernization create positive market conditions. Programs aimed at reducing food waste, improving agricultural productivity, and enhancing export competitiveness directly benefit refrigerated trailer demand. The government’s focus on developing eastern Indonesia regions through infrastructure investments opens new market territories for cold chain services.

Export market expansion drives sophisticated refrigerated transport requirements. Indonesia’s agricultural exports, including palm oil derivatives, seafood, and tropical fruits, require precise temperature control to maintain quality during international shipment. Growing export volumes to markets with stringent quality standards necessitate advanced refrigerated trailer capabilities.

Healthcare sector growth creates specialized demand for pharmaceutical-grade refrigerated transport. Indonesia’s expanding healthcare infrastructure, vaccination programs, and pharmaceutical manufacturing require reliable cold chain solutions. The COVID-19 pandemic highlighted critical importance of temperature-controlled logistics for vaccine distribution, accelerating market development in this segment.

High capital investment requirements represent a significant market restraint, particularly for small and medium-sized logistics providers. Refrigerated trailers involve substantial upfront costs compared to standard transportation units, including specialized refrigeration equipment, insulation systems, and ongoing maintenance requirements. This financial barrier limits market entry for smaller operators and constrains overall market expansion pace.

Infrastructure limitations in certain regions restrict refrigerated trailer operational efficiency. While major corridors benefit from improved road networks, remote areas and smaller islands often lack adequate infrastructure to support heavy refrigerated transport. Poor road conditions increase operational costs, reduce equipment lifespan, and limit service coverage to underserved markets.

Energy costs significantly impact operational economics, with fuel expenses representing a major component of refrigerated transport costs. Indonesia’s fuel pricing policies and energy infrastructure limitations create cost pressures for operators. Additionally, power requirements for refrigeration systems during loading, unloading, and stationary periods add complexity to operational planning and cost management.

Skilled workforce shortages constrain market growth, as refrigerated trailer operations require specialized technical knowledge. Operators must understand refrigeration systems, temperature monitoring protocols, and maintenance procedures. The shortage of qualified technicians and drivers trained in cold chain operations limits service quality and market expansion capabilities.

Regulatory complexity across Indonesia’s diverse regions creates operational challenges. Different provinces may have varying regulations regarding transportation, environmental standards, and safety requirements. Navigating this regulatory landscape requires significant compliance investments and operational flexibility, particularly for companies operating across multiple regions.

E-commerce expansion presents substantial opportunities for refrigerated trailer market growth. Indonesia’s rapidly growing online retail sector, particularly in food and grocery categories, requires sophisticated last-mile delivery capabilities. The rise of online fresh food delivery services creates demand for smaller, more flexible refrigerated transport solutions tailored to urban distribution networks.

Cold storage integration opportunities emerge as the market evolves toward comprehensive cold chain solutions. Companies can expand beyond transportation services to offer integrated logistics including warehousing, inventory management, and distribution services. This vertical integration approach provides higher value propositions and stronger customer relationships while improving overall supply chain efficiency.

Technology advancement creates opportunities for service differentiation and operational optimization. IoT integration, predictive maintenance systems, and automated monitoring technologies enable superior service quality and cost efficiency. Companies investing in advanced technology platforms can capture premium market segments and establish competitive advantages in service reliability and transparency.

Regional expansion opportunities exist in Indonesia’s developing eastern regions. Government infrastructure investments and economic development programs in areas like Sulawesi, Kalimantan, and Papua create new market territories. Early market entrants in these regions can establish strong positions as local economies develop and cold chain requirements emerge.

Export market development offers significant growth potential as Indonesia strengthens its position in global agricultural and seafood markets. International quality standards and traceability requirements create demand for sophisticated refrigerated transport capabilities. Companies meeting international certification standards can access premium export logistics segments with higher profit margins.

Supply chain evolution fundamentally shapes Indonesia’s refrigerated trailer market dynamics. Traditional distribution models are transforming toward integrated cold chain networks that prioritize efficiency, transparency, and reliability. This transformation creates both challenges and opportunities as market participants adapt to changing customer expectations and technological capabilities.

Competitive intensity increases as both domestic and international players recognize market potential. Local logistics companies leverage their understanding of Indonesian market conditions, while international firms bring advanced technology and operational expertise. This competition drives innovation, service quality improvements, and cost optimization across the market.

Customer sophistication grows as end-users become more knowledgeable about cold chain requirements and service options. Pharmaceutical companies, food processors, and retail chains increasingly demand comprehensive service packages with performance guarantees, real-time monitoring, and compliance documentation. This evolution pushes service providers toward higher value-added offerings.

Technology integration accelerates across all market segments, with digital platforms becoming essential for operational management and customer service. GPS tracking, temperature monitoring, and predictive maintenance systems transition from premium features to standard requirements. Companies failing to adopt these technologies risk losing competitive position.

Regulatory evolution continues as government agencies develop more sophisticated frameworks for cold chain operations. Environmental regulations, food safety standards, and transportation safety requirements become more stringent, requiring ongoing compliance investments. However, these regulations also create barriers to entry that protect established operators with proper certifications and capabilities.

Primary research methodologies employed for analyzing Indonesia’s refrigerated trailer market include comprehensive stakeholder interviews, industry surveys, and direct market observation. Research teams conducted extensive interviews with logistics service providers, trailer manufacturers, refrigeration equipment suppliers, and end-user companies across major Indonesian markets to gather firsthand insights into market conditions, challenges, and growth opportunities.

Secondary research components encompass analysis of government statistics, industry publications, trade association reports, and regulatory documentation. This research foundation provides quantitative market data, regulatory framework understanding, and historical trend analysis essential for comprehensive market assessment. Import/export statistics, transportation industry data, and economic indicators contribute to market sizing and growth projections.

Market segmentation analysis utilizes both quantitative and qualitative research approaches to identify distinct market segments, customer requirements, and competitive dynamics. Research methodologies include customer surveys, focus group discussions, and detailed analysis of service provider offerings across different market segments and geographical regions.

Competitive landscape assessment employs systematic analysis of market participants, including service capabilities, geographical coverage, technology adoption, and strategic positioning. This analysis combines public information research with primary interviews to develop comprehensive competitive intelligence and market share estimations.

Technology trend analysis incorporates expert interviews, patent research, and technology adoption surveys to understand current and emerging technological developments impacting the refrigerated trailer market. This research component focuses on identifying disruptive technologies and their potential market impact over the forecast period.

Java region dominates Indonesia’s refrigerated trailer market, accounting for approximately 58% of total market demand. This concentration reflects Java’s economic significance, with major cities like Jakarta, Surabaya, and Bandung serving as primary consumption and distribution centers. The region benefits from well-developed infrastructure, including major ports, highway networks, and industrial facilities that support efficient refrigerated transport operations.

Sumatra region represents the second-largest market segment, contributing approximately 22% of national demand. The island’s significant agricultural production, including palm oil, rubber, and various food crops, creates substantial refrigerated transport requirements. Major cities like Medan and Palembang serve as regional logistics hubs, while the region’s export-oriented economy drives demand for sophisticated cold chain capabilities.

Kalimantan region shows emerging growth potential, currently representing about 12% of market share. The region’s natural resource extraction industries and growing urban centers create increasing demand for refrigerated transport services. Infrastructure development programs and economic diversification efforts position Kalimantan for accelerated market growth in coming years.

Eastern Indonesia regions, including Sulawesi, Maluku, and Papua, collectively account for the remaining 8% of market demand. While currently smaller markets, these regions demonstrate significant growth potential as government infrastructure investments and economic development programs progress. The regions’ unique agricultural products and growing urban populations create opportunities for specialized refrigerated transport services.

Regional connectivity patterns influence market dynamics, with inter-island transportation creating unique operational requirements. Ferry connections, port facilities, and specialized loading equipment become critical factors for refrigerated trailer operations across Indonesia’s archipelagic geography. According to MWR analysis, regional integration initiatives will likely reshape market dynamics as connectivity improves.

Market leadership in Indonesia’s refrigerated trailer sector involves both domestic and international companies offering diverse service capabilities and geographical coverage. The competitive landscape reflects market maturation with established players expanding service offerings while new entrants focus on specialized segments or regional markets.

Competitive strategies increasingly focus on technology integration, service quality differentiation, and comprehensive cold chain solutions rather than price competition alone. Leading companies invest in advanced monitoring systems, fleet modernization, and staff training to maintain competitive advantages in service reliability and customer satisfaction.

Market consolidation trends emerge as larger companies acquire smaller regional operators to expand geographical coverage and service capabilities. This consolidation process creates opportunities for companies with strong financial resources and operational expertise to build dominant market positions across multiple regions.

By Application: The Indonesia refrigerated trailer market demonstrates clear segmentation patterns across application categories, with distinct requirements and growth characteristics for each segment.

By Temperature Range: Market segmentation based on temperature requirements reflects diverse customer needs and operational complexity levels.

By Trailer Size: Equipment segmentation reflects operational requirements and route characteristics across Indonesia’s diverse geographical landscape.

Food and Beverage Category represents the most significant market segment, driven by Indonesia’s large population and evolving dietary preferences. This category encompasses diverse sub-segments including fresh produce distribution, dairy product transport, meat and seafood logistics, and processed food distribution. Growth drivers include retail modernization, urban population expansion, and increasing consumer demand for fresh and frozen products.

Pharmaceutical Category demonstrates the highest growth potential with stringent quality requirements and expanding healthcare infrastructure. This segment requires specialized equipment, trained personnel, and comprehensive documentation systems to ensure compliance with regulatory standards. The COVID-19 pandemic highlighted critical importance of pharmaceutical cold chain capabilities, accelerating investment and development in this category.

Agricultural Export Category focuses on maintaining product quality during international shipment, requiring sophisticated temperature control and monitoring systems. Indonesia’s position as a major agricultural exporter creates substantial demand for refrigerated transport capabilities meeting international quality standards. This category benefits from government export promotion programs and growing global demand for Indonesian agricultural products.

Industrial Chemical Category represents a specialized segment requiring customized temperature control solutions for sensitive chemical products. While smaller than food and pharmaceutical segments, this category offers higher profit margins and long-term customer relationships. Growth correlates with Indonesia’s industrial development and chemical manufacturing expansion.

Technology integration across all categories drives market evolution toward comprehensive cold chain solutions. Advanced monitoring systems, predictive maintenance capabilities, and real-time tracking become standard requirements rather than premium features. Companies successfully integrating technology across multiple categories achieve competitive advantages in service quality and operational efficiency.

Logistics Service Providers benefit from refrigerated trailer market expansion through revenue diversification, higher profit margins, and enhanced customer relationships. Cold chain services command premium pricing compared to standard transportation, while integrated service offerings create opportunities for long-term customer contracts and stable revenue streams.

Food Industry Stakeholders gain access to expanded market reach, reduced product losses, and improved quality control through reliable refrigerated transport services. Manufacturers can access distant markets while maintaining product integrity, while retailers benefit from consistent product quality and extended shelf life enabling better inventory management.

Pharmaceutical Companies achieve regulatory compliance, product integrity assurance, and market expansion capabilities through specialized refrigerated transport services. Temperature-controlled logistics enable pharmaceutical companies to distribute products safely across Indonesia’s diverse geographical regions while meeting strict regulatory requirements.

Agricultural Exporters benefit from enhanced product quality maintenance, international market access, and competitive positioning through sophisticated cold chain capabilities. Reliable refrigerated transport enables Indonesian agricultural exporters to meet international quality standards and access premium market segments globally.

Technology Providers find expanding market opportunities for monitoring systems, refrigeration equipment, and integrated logistics platforms. The market’s evolution toward technology-intensive solutions creates demand for advanced equipment, software systems, and technical services supporting cold chain operations.

Government Stakeholders achieve food security objectives, export promotion goals, and economic development targets through improved cold chain infrastructure. Enhanced refrigerated transport capabilities reduce food waste, support agricultural development, and strengthen Indonesia’s position in global markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across Indonesia’s refrigerated trailer market, with companies implementing comprehensive technology platforms for fleet management, customer service, and operational optimization. IoT sensors, GPS tracking, and automated monitoring systems become standard equipment rather than premium features. This digital evolution enables real-time visibility, predictive maintenance, and enhanced customer service capabilities.

Sustainability Focus drives adoption of environmentally friendly refrigeration technologies and energy-efficient operational practices. Companies invest in alternative refrigerants, solar-powered systems, and fuel-efficient vehicles to reduce environmental impact while meeting increasingly strict regulatory requirements. This trend creates competitive advantages for companies demonstrating environmental responsibility.

Service Integration trends toward comprehensive cold chain solutions combining transportation, warehousing, and value-added services. Customers increasingly prefer single-source providers capable of managing entire cold chain requirements rather than coordinating multiple service providers. This integration trend creates opportunities for companies with comprehensive capabilities while challenging single-service providers.

Regional Expansion accelerates as infrastructure improvements and economic development create new market opportunities beyond traditional Java-Sumatra corridors. Companies establish operations in eastern Indonesia regions to capture emerging demand and establish early market positions. This geographic expansion requires significant investment but offers substantial growth potential.

Quality Standardization increases as customers demand consistent service quality and regulatory compliance across all operations. International certification standards, quality management systems, and performance monitoring become essential for maintaining competitive position. This trend favors companies with strong operational capabilities and quality management systems.

Infrastructure Investment programs by the Indonesian government significantly impact refrigerated trailer market development. Major highway projects, port facility upgrades, and logistics park development create improved operational environments for cold chain services. These infrastructure improvements reduce operational costs, improve service reliability, and enable market expansion into previously underserved regions.

Technology Partnerships between logistics companies and technology providers accelerate innovation adoption across the market. Collaborations focus on developing integrated platforms combining fleet management, temperature monitoring, and customer service capabilities. These partnerships enable smaller companies to access advanced technologies while providing technology companies with market access and application expertise.

Regulatory Framework development continues as government agencies establish more comprehensive standards for cold chain operations. New regulations address food safety, pharmaceutical distribution, and environmental protection while creating clearer operational guidelines for industry participants. These regulatory developments provide operational clarity while requiring compliance investments.

Foreign Investment increases as international logistics companies recognize Indonesia’s market potential and establish local operations. Foreign investment brings advanced technology, operational expertise, and capital resources while intensifying competitive dynamics. This investment trend accelerates market development while creating challenges for domestic companies.

Industry Consolidation accelerates as larger companies acquire smaller regional operators to expand geographical coverage and service capabilities. This consolidation trend creates opportunities for companies with strong financial resources while challenging smaller operators to find strategic positioning or partnership opportunities.

Technology Investment represents the highest priority for companies seeking competitive advantage in Indonesia’s refrigerated trailer market. Organizations should prioritize comprehensive technology platforms integrating fleet management, temperature monitoring, and customer service capabilities. Early technology adoption provides service differentiation opportunities and operational efficiency improvements essential for long-term success.

Regional Expansion Strategy should focus on emerging markets in eastern Indonesia where infrastructure development and economic growth create new opportunities. Companies should establish strategic positions in developing regions while maintaining strong operations in established markets. This balanced approach enables growth capture while maintaining revenue stability.

Service Integration development enables companies to provide comprehensive cold chain solutions rather than single-service offerings. Organizations should consider expanding capabilities to include warehousing, inventory management, and value-added services. This integration strategy creates stronger customer relationships and higher profit margins while reducing competitive pressure.

Sustainability Initiatives become increasingly important for regulatory compliance and customer preference alignment. Companies should invest in environmentally friendly refrigeration technologies, fuel-efficient vehicles, and sustainable operational practices. These investments create competitive advantages while ensuring long-term regulatory compliance.

Workforce Development programs address critical skill shortages constraining market growth. Companies should invest in training programs for technicians, drivers, and operational staff while developing partnerships with educational institutions. Skilled workforce development creates operational advantages and supports service quality improvements essential for market leadership.

Market expansion prospects for Indonesia’s refrigerated trailer sector remain exceptionally positive, driven by fundamental economic and demographic trends supporting cold chain development. The market is projected to maintain robust growth rates exceeding 8% CAGR through the forecast period, reflecting strong demand across multiple application segments and geographical regions.

Technology evolution will fundamentally transform market dynamics, with artificial intelligence, predictive analytics, and automated systems becoming standard operational components. Companies successfully integrating advanced technologies will achieve significant competitive advantages in service quality, operational efficiency, and customer satisfaction. According to MarkWide Research projections, technology-intensive service providers will capture disproportionate market share growth.

Geographic expansion into eastern Indonesia regions represents the most significant growth opportunity, with infrastructure development and economic growth creating substantial new market potential. Companies establishing early positions in these emerging markets will benefit from first-mover advantages and strong growth trajectories as regional economies develop.

Service sophistication will continue evolving toward comprehensive cold chain solutions integrating transportation, warehousing, and value-added services. Customer preferences increasingly favor single-source providers capable of managing entire cold chain requirements with consistent quality and reliability standards.

Regulatory environment development will create both opportunities and challenges, with stricter standards requiring compliance investments while providing competitive protection for certified operators. Companies maintaining high operational standards and regulatory compliance will benefit from market consolidation as substandard operators face elimination.

Indonesia’s refrigerated trailer market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by fundamental economic, demographic, and technological trends. The market benefits from Indonesia’s large population, growing economy, and strategic geographical position while facing challenges related to infrastructure limitations, operational costs, and regulatory complexity.

Market dynamics favor companies with comprehensive service capabilities, advanced technology integration, and strong operational standards. The evolution toward integrated cold chain solutions creates opportunities for service differentiation and premium pricing while challenging traditional single-service providers to adapt or face competitive displacement.

Future success in this market requires strategic focus on technology investment, regional expansion, service integration, and workforce development. Companies successfully addressing these priorities will achieve competitive advantages and capture disproportionate growth as the market continues expanding. The Indonesia refrigerated trailer market offers substantial opportunities for well-positioned companies prepared to invest in capabilities required for long-term market leadership.

What is Refrigerated Trailer?

Refrigerated trailers, also known as reefer trailers, are specialized vehicles designed to transport temperature-sensitive goods, such as food and pharmaceuticals, while maintaining a controlled environment. They are essential in the logistics and supply chain sectors for preserving the quality and safety of perishable items.

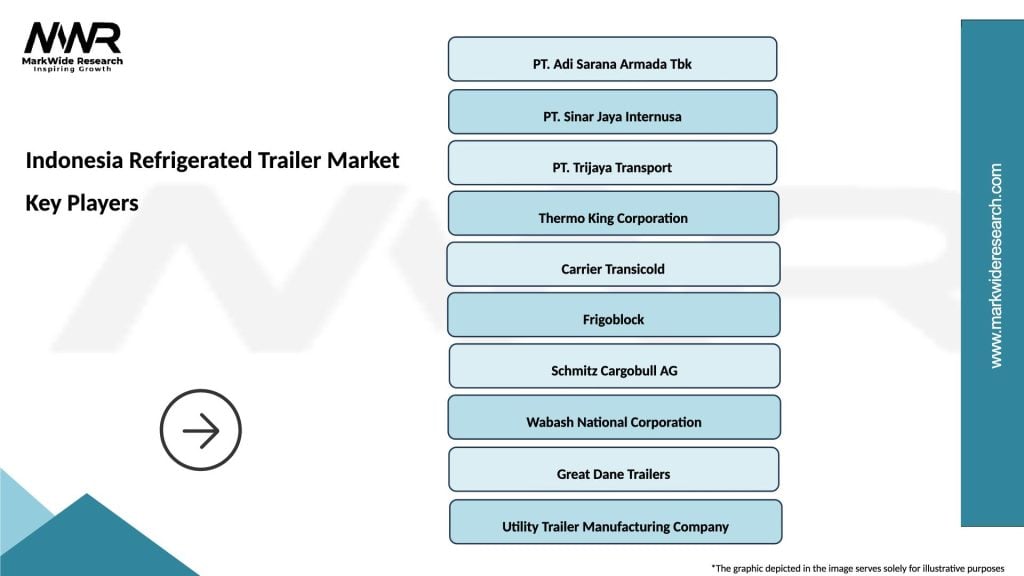

What are the key players in the Indonesia Refrigerated Trailer Market?

Key players in the Indonesia Refrigerated Trailer Market include companies like PT. Adi Sarana Armada Tbk, PT. Sumber Alfaria Trijaya Tbk, and PT. Indomobil Sukses Internasional Tbk, among others. These companies are involved in manufacturing and distributing refrigerated trailers to meet the growing demand in various sectors.

What are the growth factors driving the Indonesia Refrigerated Trailer Market?

The growth of the Indonesia Refrigerated Trailer Market is driven by the increasing demand for perishable goods, the expansion of the food and beverage industry, and the rise in e-commerce activities. Additionally, improvements in cold chain logistics are enhancing the efficiency of refrigerated transport.

What challenges does the Indonesia Refrigerated Trailer Market face?

The Indonesia Refrigerated Trailer Market faces challenges such as high operational costs, maintenance issues, and the need for skilled personnel to manage refrigerated logistics. Additionally, fluctuating fuel prices can impact the overall cost of transportation.

What opportunities exist in the Indonesia Refrigerated Trailer Market?

Opportunities in the Indonesia Refrigerated Trailer Market include the potential for technological advancements in refrigeration systems, the growth of online grocery shopping, and the increasing focus on food safety regulations. These factors can lead to enhanced demand for modern refrigerated trailers.

What trends are shaping the Indonesia Refrigerated Trailer Market?

Trends in the Indonesia Refrigerated Trailer Market include the adoption of energy-efficient refrigeration technologies, the integration of IoT for real-time monitoring, and the shift towards sustainable practices in logistics. These trends are influencing how refrigerated transport is managed and optimized.

Indonesia Refrigerated Trailer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Axle, Double-Axle, Multi-Axle, Refrigerated Vans |

| End User | Food & Beverage, Pharmaceuticals, Logistics, Retail |

| Technology | Direct Expansion, Vapor Compression, Thermoelectric, Hybrid Systems |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Refrigerated Trailer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at