444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America fungicide market represents a dynamic and rapidly evolving agricultural sector that plays a crucial role in protecting crop yields across the continent. This market encompasses a comprehensive range of chemical and biological solutions designed to combat fungal diseases that threaten agricultural productivity. South American countries including Brazil, Argentina, Colombia, Chile, and Peru are experiencing significant growth in fungicide adoption, driven by expanding agricultural activities and increasing awareness of crop protection benefits.

Market dynamics in South America are characterized by diverse agricultural landscapes, varying climatic conditions, and evolving regulatory frameworks. The region’s tropical and subtropical climates create favorable conditions for fungal pathogens, making effective fungicide solutions essential for maintaining crop health. Agricultural expansion across key crops such as soybeans, corn, coffee, sugarcane, and fruits has intensified the demand for advanced fungicide technologies.

Growth trajectory in the South American fungicide market is supported by increasing agricultural mechanization, rising food security concerns, and growing export demands. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, reflecting the region’s commitment to sustainable agricultural practices and enhanced crop protection strategies.

The South America fungicide market refers to the comprehensive ecosystem of antifungal agricultural products, technologies, and services designed to prevent, control, and eliminate fungal diseases affecting crops throughout South American countries. This market encompasses synthetic chemical fungicides, biological fungicides, and integrated pest management solutions that protect agricultural investments and ensure food security across the region.

Fungicide applications in South America extend beyond traditional crop protection to include post-harvest treatments, seed treatments, and soil applications. The market includes various formulations such as liquid concentrates, wettable powders, granules, and ready-to-use solutions tailored to specific crop requirements and application methods. Modern fungicide technologies incorporate advanced active ingredients, precision application systems, and environmentally sustainable formulations that align with evolving agricultural practices.

Market scope encompasses both preventive and curative fungicide solutions, addressing diverse fungal pathogens including rusts, blights, mildews, and root rot diseases. The integration of digital agriculture technologies and precision farming techniques has expanded the market definition to include smart application systems and data-driven crop protection strategies.

Strategic positioning of the South America fungicide market reflects the region’s status as a global agricultural powerhouse with increasing emphasis on crop protection and yield optimization. The market demonstrates strong fundamentals driven by expanding cultivated areas, intensifying agricultural practices, and growing awareness of integrated pest management benefits. Key market drivers include climate change impacts, evolving pathogen resistance, and increasing demand for high-quality agricultural products.

Technological advancement represents a significant market trend, with biological fungicides gaining 23% market share as farmers seek sustainable alternatives to synthetic chemicals. The integration of precision agriculture technologies and digital farming solutions is transforming traditional fungicide application methods, enabling more targeted and efficient crop protection strategies.

Regional dynamics vary significantly across South American countries, with Brazil dominating market consumption due to its extensive agricultural sector, followed by Argentina and Colombia. Market segmentation reveals strong growth in specialty crops, organic farming applications, and export-oriented agricultural operations that require stringent quality standards.

Competitive landscape features both multinational corporations and regional players, with increasing focus on product innovation, sustainable formulations, and integrated crop protection solutions. The market outlook remains positive, supported by continued agricultural expansion, technological innovation, and growing emphasis on food security across the region.

Agricultural transformation across South America is driving fundamental changes in fungicide market dynamics, with farmers increasingly adopting integrated pest management approaches that combine chemical, biological, and cultural control methods. MarkWide Research analysis indicates that modern farming practices are reshaping product demand patterns and application methodologies throughout the region.

Agricultural expansion represents the primary driver of South America’s fungicide market growth, with increasing cultivated areas and crop intensification creating sustained demand for effective crop protection solutions. Food security concerns and growing population pressures are compelling governments and farmers to invest in technologies that maximize agricultural productivity and minimize crop losses.

Climate change impacts are significantly influencing market dynamics, as changing precipitation patterns, temperature fluctuations, and extreme weather events create more favorable conditions for fungal pathogens. Disease pressure intensification requires more frequent and targeted fungicide applications, driving market volume growth across key agricultural regions.

Export market opportunities are motivating South American farmers to adopt advanced crop protection practices that ensure product quality and compliance with international standards. Premium pricing for high-quality agricultural exports provides economic incentives for comprehensive fungicide programs that protect crop value and market access.

Technological innovation in fungicide formulations and application methods is expanding market potential by offering more effective, convenient, and environmentally responsible solutions. Precision agriculture adoption enables optimized fungicide use that improves cost-effectiveness while maintaining crop protection efficacy.

Government support programs and agricultural subsidies in several South American countries are facilitating farmer access to modern crop protection technologies, including advanced fungicide solutions that support sustainable agricultural development goals.

Regulatory challenges pose significant constraints on the South America fungicide market, as evolving registration requirements, safety assessments, and environmental impact evaluations can delay product introductions and increase compliance costs. Harmonization differences between countries create complex regulatory landscapes that challenge market participants.

Economic volatility in several South American countries affects farmer purchasing power and investment capacity, potentially limiting adoption of premium fungicide products. Currency fluctuations and commodity price instability can impact the cost-benefit calculations that drive fungicide investment decisions.

Environmental concerns regarding synthetic chemical fungicides are driving regulatory restrictions and consumer preferences toward more sustainable alternatives. Resistance development in fungal pathogens reduces the effectiveness of existing products and necessitates continuous innovation in active ingredients and formulation technologies.

Infrastructure limitations in rural areas can restrict access to advanced fungicide products and application technologies, particularly in remote agricultural regions where distribution networks are underdeveloped. Technical knowledge gaps among smallholder farmers may limit optimal fungicide utilization and integrated pest management adoption.

Competition from alternative solutions including cultural practices, resistant crop varieties, and biological control methods can reduce reliance on chemical fungicides, particularly in organic and sustainable farming systems that prioritize non-chemical approaches.

Biological fungicide development presents substantial growth opportunities as South American farmers increasingly seek sustainable crop protection alternatives that align with environmental stewardship goals. Bio-based solutions are experiencing 18% annual growth as regulatory support and consumer preferences favor environmentally friendly agricultural practices.

Precision agriculture integration offers significant market expansion potential through smart application systems, drone technology, and sensor-based monitoring that optimize fungicide use efficiency. Digital farming platforms enable data-driven decision making that improves crop protection outcomes while reducing input costs.

Specialty crop markets including fruits, vegetables, coffee, and cocoa present high-value opportunities for targeted fungicide solutions that address specific pathogen challenges and quality requirements. Premium crop segments demonstrate willingness to invest in advanced protection technologies that preserve product value.

Export-oriented agriculture creates opportunities for fungicide products that ensure compliance with international residue standards and quality specifications. Traceability systems and integrated crop management programs support market access for South American agricultural exports.

Climate adaptation solutions represent emerging opportunities as changing environmental conditions require new approaches to fungal disease management. Resistance management programs and combination products address evolving pathogen challenges while extending product lifecycles.

Supply chain evolution in the South America fungicide market reflects increasing localization of manufacturing and distribution capabilities, reducing dependence on imports while improving product accessibility across diverse agricultural regions. Regional production facilities are enhancing supply security and enabling more responsive customer service.

Innovation cycles are accelerating as market participants invest in research and development to address emerging pathogen challenges, regulatory requirements, and sustainability demands. Product lifecycle management strategies focus on extending the utility of existing active ingredients while developing next-generation solutions.

Market consolidation trends are reshaping competitive dynamics as larger companies acquire regional players and specialized technology providers to expand their product portfolios and market reach. Strategic partnerships between multinational corporations and local distributors are strengthening market penetration capabilities.

Price dynamics reflect complex interactions between raw material costs, regulatory compliance expenses, and competitive pressures. Value-based pricing strategies emphasize product performance and integrated solutions rather than commodity-based competition.

Customer relationship evolution is transforming from transactional product sales to comprehensive crop protection partnerships that include technical support, application guidance, and integrated pest management consulting services.

Comprehensive market analysis for the South America fungicide market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with key stakeholders including farmers, distributors, manufacturers, and regulatory officials across major South American countries.

Secondary research incorporates analysis of government agricultural statistics, trade data, regulatory filings, and industry publications to establish market baselines and trend patterns. Data triangulation methods validate findings across multiple sources to ensure research accuracy and reliability.

Market segmentation analysis examines product categories, application methods, crop types, and geographic regions to identify growth opportunities and competitive dynamics. Quantitative modeling techniques project market trends and growth trajectories based on historical data and identified market drivers.

Expert consultation with agricultural scientists, crop protection specialists, and industry veterans provides qualitative insights into market dynamics, technological trends, and future opportunities. Field research in key agricultural regions offers direct observation of farming practices and product utilization patterns.

Regulatory analysis tracks policy developments, registration processes, and compliance requirements across South American countries to assess market access conditions and regulatory impact on product development and commercialization strategies.

Brazil dominates the South America fungicide market with approximately 58% market share, driven by its extensive agricultural sector, advanced farming practices, and significant export-oriented crop production. Brazilian agriculture encompasses large-scale soybean, corn, and sugarcane operations that require comprehensive fungicide programs to maintain productivity and quality standards.

Argentina represents the second-largest market with 22% regional share, characterized by sophisticated agricultural technologies and strong emphasis on crop protection in wheat, soybean, and corn production systems. Argentine farmers demonstrate high adoption rates for innovative fungicide solutions and integrated pest management approaches.

Colombia’s market accounts for 8% regional share, with significant growth potential driven by expanding coffee production, flower cultivation, and diversified agriculture. Colombian agriculture benefits from year-round growing seasons that create consistent demand for fungicide applications across multiple crop cycles.

Chile contributes approximately 6% market share, with focus on high-value fruit exports, wine grapes, and specialty crops that require premium fungicide solutions to meet international quality standards. Chilean producers emphasize sustainable agriculture practices and integrated crop management systems.

Peru and other countries collectively represent 6% market share, with growing opportunities in specialty crops, organic agriculture, and export-oriented production systems. Regional diversity in climate conditions, crop types, and farming practices creates varied demand patterns for fungicide solutions across different market segments.

Market leadership in the South America fungicide market is characterized by strong competition between multinational corporations and regional players, each leveraging distinct competitive advantages to capture market share and drive growth.

Competitive strategies emphasize product innovation, sustainable formulations, integrated pest management solutions, and comprehensive customer support services. Market differentiation occurs through technological advancement, regulatory compliance, and value-added services that enhance customer relationships and market positioning.

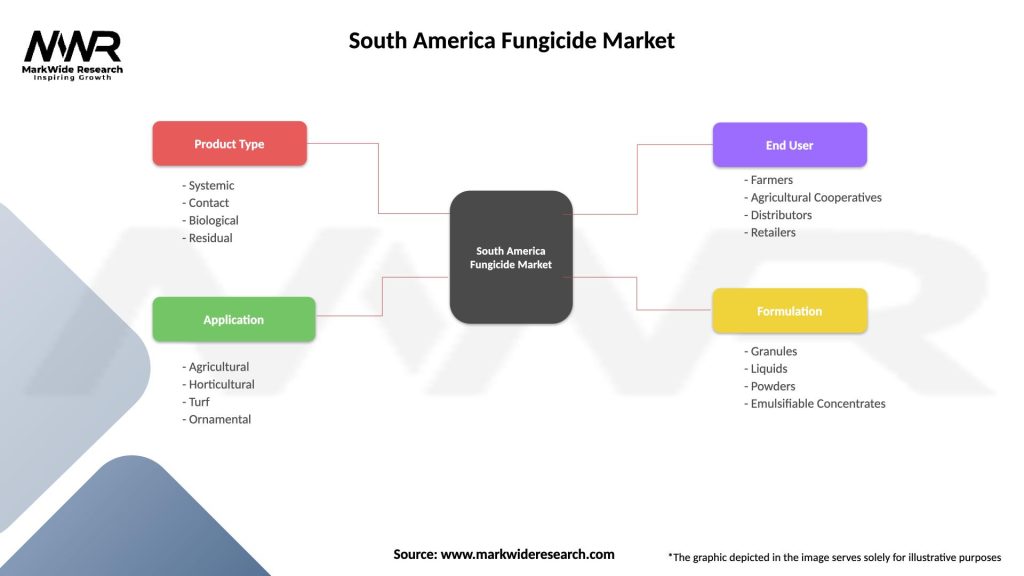

Product type segmentation reveals diverse market categories addressing specific crop protection needs and application requirements across South American agriculture.

By Chemistry Type:

By Application Method:

By Crop Type:

Synthetic fungicides continue to dominate market volume with 72% market share, driven by proven efficacy, broad-spectrum activity, and cost-effectiveness for large-scale agricultural operations. Triazole fungicides represent the largest synthetic category, offering systemic protection against diverse fungal pathogens affecting major crops throughout South America.

Biological fungicides are experiencing rapid growth with 15% annual expansion, reflecting increasing farmer interest in sustainable crop protection alternatives and regulatory support for bio-based solutions. Microbial fungicides using beneficial bacteria and fungi are gaining acceptance for integrated pest management programs.

Foliar applications account for 68% of total usage, providing flexible and responsive disease management capabilities that align with precision agriculture practices. Spray technologies continue to evolve with improved coverage, reduced drift, and enhanced application efficiency.

Field crop applications represent 78% of market volume, with soybeans and corn driving the majority of fungicide consumption across South American agriculture. Specialty crop segments demonstrate higher value per hectare and growing adoption of premium fungicide solutions.

Combination products are gaining market traction with 12% annual growth as farmers seek simplified application programs and enhanced disease control efficacy through multiple modes of action.

Farmers benefit from comprehensive fungicide solutions that protect crop investments, optimize yields, and ensure product quality for domestic and export markets. Crop protection programs provide economic security through reduced disease losses and improved harvest predictability.

Manufacturers gain from expanding market opportunities, technological innovation drivers, and increasing demand for sustainable crop protection solutions. Product development initiatives address evolving market needs while supporting long-term growth strategies.

Distributors advantage from growing market demand, diverse product portfolios, and opportunities to provide value-added services including technical support and integrated pest management consulting. Market expansion creates new revenue streams and customer relationship opportunities.

Regulatory authorities benefit from improved agricultural productivity, enhanced food security, and environmental protection through advanced fungicide technologies that support sustainable agriculture development goals.

Consumers receive higher quality agricultural products, improved food security, and reduced food prices through enhanced agricultural productivity and reduced crop losses from fungal diseases.

Research institutions gain from collaboration opportunities, technology development partnerships, and funding for agricultural innovation projects that advance crop protection science and sustainable agriculture practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the dominant trend shaping the South America fungicide market, with MWR research indicating that 34% of farmers are actively seeking environmentally friendly crop protection alternatives. Biological fungicide adoption is accelerating as regulatory frameworks support bio-based solutions and consumer preferences favor sustainable agriculture practices.

Precision agriculture adoption is transforming fungicide application methodologies through sensor technologies, drone applications, and data-driven decision making systems. Smart farming platforms enable optimized timing, targeted applications, and reduced environmental impact while maintaining crop protection efficacy.

Resistance management has become a critical focus area as fungal pathogens develop resistance to existing active ingredients. Rotation strategies and combination products are gaining acceptance as essential tools for preserving fungicide effectiveness and extending product lifecycles.

Digital integration is revolutionizing crop protection through mobile applications, weather monitoring systems, and predictive disease modeling that enable proactive fungicide applications. Data analytics support evidence-based decision making and improved return on investment for crop protection programs.

Regulatory harmonization efforts across South American countries are creating opportunities for streamlined product registration and market access, while maintaining safety and environmental protection standards.

Product innovation continues to drive market evolution with new active ingredients, improved formulations, and enhanced application technologies addressing emerging crop protection challenges. Biological fungicide development has accelerated with multiple companies investing in microbial solutions and natural product derivatives.

Manufacturing expansion across South America includes new production facilities, capacity increases, and technology upgrades that improve supply chain efficiency and reduce dependence on imports. Local production initiatives support regional economic development while enhancing market responsiveness.

Strategic partnerships between multinational corporations and regional distributors are strengthening market penetration capabilities and customer service quality. Technology licensing agreements facilitate knowledge transfer and accelerate innovation adoption across the region.

Regulatory approvals for new fungicide products and formulations are expanding available options for farmers while maintaining safety and environmental protection standards. Fast-track registration processes in some countries are reducing time-to-market for innovative solutions.

Sustainability initiatives include development of biodegradable formulations, reduced-risk active ingredients, and integrated pest management programs that align with environmental stewardship goals and consumer preferences.

Market participants should prioritize investment in biological fungicide development and sustainable crop protection solutions to align with evolving regulatory requirements and farmer preferences. Innovation focus on bio-based alternatives will create competitive advantages and support long-term market growth.

Distribution network expansion in rural areas represents a critical success factor for capturing market share and serving underserved agricultural regions. Local partnerships and direct-to-farmer programs can improve market penetration while providing valuable technical support services.

Digital agriculture integration should be prioritized to enhance product value propositions and support precision farming adoption. Technology platforms that combine fungicide recommendations with weather data and disease forecasting will differentiate market offerings.

Regulatory compliance capabilities must be strengthened to navigate complex registration requirements across South American countries. Proactive engagement with regulatory authorities and investment in data generation will facilitate market access for new products.

Customer education programs focusing on integrated pest management, resistance management, and optimal application practices will support market development while improving crop protection outcomes for farmers throughout the region.

Market growth prospects for the South America fungicide market remain positive, with projected expansion driven by agricultural modernization, climate adaptation needs, and increasing emphasis on crop protection technologies. Sustainable agriculture trends will continue to reshape product demand patterns and innovation priorities.

Biological fungicides are expected to achieve 28% market share by 2030, reflecting accelerating adoption of bio-based solutions and regulatory support for sustainable crop protection alternatives. Technology advancement in microbial formulations and natural product derivatives will expand biological solution capabilities.

Precision agriculture integration will transform fungicide application methodologies, with digital farming adoption reaching 45% of commercial operations within the next five years. Smart application systems will optimize product use efficiency while reducing environmental impact.

Climate change adaptation will drive demand for innovative fungicide solutions that address evolving pathogen challenges and changing environmental conditions. Resistance management will become increasingly important as fungal populations adapt to existing control measures.

Regional market integration through improved regulatory harmonization and trade facilitation will create opportunities for expanded product availability and enhanced competition that benefits farmers across South America.

The South America fungicide market represents a dynamic and essential component of the region’s agricultural ecosystem, providing critical crop protection solutions that support food security, economic development, and sustainable farming practices. Market evolution reflects the complex interplay of agricultural expansion, technological innovation, regulatory development, and environmental stewardship that characterizes modern agriculture across the continent.

Growth opportunities in biological fungicides, precision agriculture integration, and specialty crop applications offer significant potential for market participants willing to invest in innovation and sustainable solutions. Regional diversity in climate conditions, crop types, and farming practices creates varied market segments that require tailored approaches and localized strategies.

Sustainability trends are fundamentally reshaping market dynamics, with increasing emphasis on environmentally responsible crop protection solutions that align with consumer preferences and regulatory requirements. Technology advancement in biological formulations, digital agriculture, and precision application systems will continue to drive market evolution and competitive differentiation.

The future success of the South America fungicide market depends on continued innovation, regulatory adaptation, and collaborative efforts between industry stakeholders to address emerging challenges while supporting sustainable agricultural development goals across the region.

What is Fungicide?

Fungicide refers to a type of pesticide specifically designed to kill or inhibit the growth of fungi that can harm crops and plants. These chemicals are crucial in agriculture for protecting yields and ensuring food security.

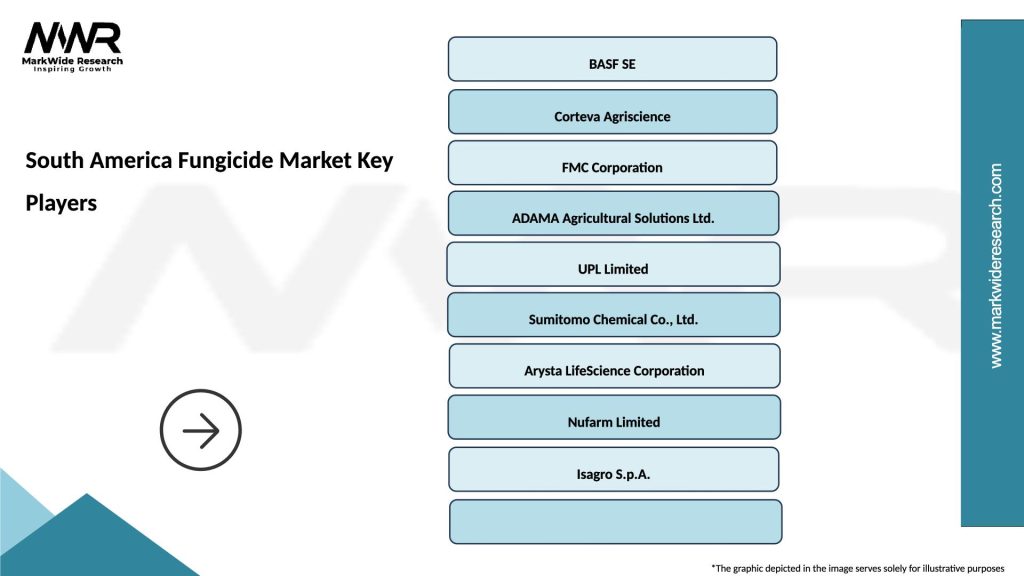

What are the key players in the South America Fungicide Market?

Key players in the South America Fungicide Market include BASF, Syngenta, and Bayer, which are known for their extensive portfolios of fungicide products. These companies focus on developing innovative solutions to combat fungal diseases in various crops, among others.

What are the growth factors driving the South America Fungicide Market?

The South America Fungicide Market is driven by increasing agricultural production, the rising prevalence of fungal diseases, and the growing demand for high-quality crops. Additionally, advancements in fungicide formulations and application techniques contribute to market growth.

What challenges does the South America Fungicide Market face?

The South America Fungicide Market faces challenges such as regulatory hurdles, resistance development in fungi, and environmental concerns regarding chemical usage. These factors can hinder the effectiveness and acceptance of fungicides in agricultural practices.

What opportunities exist in the South America Fungicide Market?

Opportunities in the South America Fungicide Market include the development of bio-based fungicides and integrated pest management strategies. There is also potential for growth in organic farming, which may drive demand for environmentally friendly fungicide options.

What trends are shaping the South America Fungicide Market?

Trends in the South America Fungicide Market include the increasing adoption of precision agriculture and the use of digital tools for crop management. Additionally, there is a growing focus on sustainability and reducing chemical residues in food production.

South America Fungicide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Systemic, Contact, Biological, Residual |

| Application | Agricultural, Horticultural, Turf, Ornamental |

| End User | Farmers, Agricultural Cooperatives, Distributors, Retailers |

| Formulation | Granules, Liquids, Powders, Emulsifiable Concentrates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Fungicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at