444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China herbicide market represents one of the most dynamic and rapidly evolving agricultural chemical sectors in the Asia-Pacific region. China’s agricultural landscape has undergone significant transformation over the past decade, with increasing mechanization, modernization of farming practices, and growing emphasis on sustainable crop protection solutions driving substantial demand for advanced herbicide formulations.

Market dynamics indicate that China’s herbicide sector is experiencing robust growth, driven by the country’s vast agricultural land area covering approximately 165 million hectares of arable land and the need to enhance crop productivity to feed its massive population. The market encompasses a diverse range of herbicide types, including selective and non-selective formulations, pre-emergence and post-emergence applications, and both synthetic and bio-based solutions.

Agricultural modernization initiatives launched by the Chinese government have significantly influenced herbicide adoption patterns, with farmers increasingly shifting from traditional manual weeding methods to chemical weed control solutions. This transition has been particularly pronounced in major grain-producing regions, where labor shortages and rising agricultural wages have made herbicide applications more economically attractive.

Technology advancement in herbicide formulations has enabled Chinese manufacturers to develop more effective and environmentally sustainable products, contributing to market expansion. The integration of precision agriculture technologies and smart farming practices has further enhanced the efficiency of herbicide applications, reducing waste and improving crop protection outcomes.

The China herbicide market refers to the comprehensive ecosystem of chemical and biological weed control products manufactured, distributed, and utilized across China’s agricultural sectors. This market encompasses various herbicide categories designed to eliminate unwanted vegetation that competes with crops for nutrients, water, and sunlight, thereby maximizing agricultural productivity and crop yields.

Herbicide applications in China span multiple agricultural segments, including cereal crops such as rice, wheat, and corn, as well as cash crops like soybeans, cotton, and various fruits and vegetables. The market includes both domestic production capabilities and imported formulations, creating a complex supply chain that serves diverse regional agricultural needs.

Market participants range from large multinational agrochemical corporations to domestic Chinese manufacturers, research institutions, and distribution networks that collectively contribute to product development, manufacturing, marketing, and end-user support services throughout China’s vast agricultural landscape.

China’s herbicide market stands as a cornerstone of the country’s agricultural chemical industry, demonstrating remarkable resilience and growth potential despite global economic uncertainties. The market has evolved from primarily relying on basic herbicide formulations to embracing advanced, environmentally conscious solutions that align with China’s sustainable agriculture policies.

Key market drivers include increasing agricultural mechanization rates reaching approximately 72% adoption across major farming regions, growing labor costs that make chemical weed control more economical than manual methods, and government initiatives promoting modern farming techniques. The shift toward precision agriculture has created new opportunities for targeted herbicide applications and integrated pest management approaches.

Competitive landscape features both international players and domestic manufacturers competing across various market segments. Chinese companies have significantly strengthened their research and development capabilities, leading to innovative product launches and improved market positioning. The market benefits from robust domestic manufacturing infrastructure and established distribution networks reaching rural farming communities.

Regulatory environment continues to evolve, with stricter environmental standards and safety requirements driving innovation toward more sustainable herbicide formulations. This regulatory shift has accelerated the development of bio-based herbicides and reduced-risk chemical alternatives, creating new market opportunities for forward-thinking manufacturers.

Market segmentation analysis reveals distinct patterns in herbicide consumption across China’s diverse agricultural regions. The following key insights highlight critical market dynamics:

Agricultural modernization serves as the primary catalyst driving China’s herbicide market expansion. The government’s commitment to transforming traditional farming practices into mechanized, efficient agricultural systems has created substantial demand for chemical weed control solutions. This modernization effort includes infrastructure development, technology adoption incentives, and educational programs that promote best practices in crop protection.

Labor shortage challenges across rural China have significantly accelerated herbicide adoption rates. As younger populations migrate to urban areas for employment opportunities, remaining agricultural workers face increased workloads and time constraints. Herbicide applications offer efficient alternatives to labor-intensive manual weeding, enabling farmers to manage larger areas with reduced workforce requirements.

Crop yield optimization pressures continue to drive herbicide demand as China seeks to maintain food security for its growing population. Effective weed control directly correlates with improved crop yields, making herbicide investments economically attractive for farmers focused on maximizing productivity per hectare. Advanced herbicide formulations enable more precise weed management while minimizing crop damage risks.

Government policy support through agricultural subsidies and modernization programs has made herbicide technologies more accessible to smallholder farmers. These initiatives include financial assistance for purchasing agricultural inputs, training programs on proper herbicide application techniques, and research funding for developing locally adapted formulations that address specific regional weed challenges.

Environmental concerns represent significant challenges for China’s herbicide market, as increasing awareness of chemical residues and ecological impacts influences regulatory policies and consumer preferences. Stricter environmental standards require manufacturers to invest heavily in developing safer, more sustainable formulations while managing compliance costs that may affect product pricing and market accessibility.

Regulatory complexity creates barriers for both domestic and international herbicide manufacturers seeking to enter or expand within the Chinese market. Registration processes for new herbicide products involve extensive testing requirements, documentation standards, and approval timelines that can delay product launches and increase development costs significantly.

Price volatility in raw materials and active ingredients affects herbicide manufacturing costs and market stability. Fluctuations in petroleum-based chemical prices, supply chain disruptions, and currency exchange rate variations create uncertainty for manufacturers and distributors, potentially impacting product availability and pricing strategies.

Resistance development in target weed species poses ongoing challenges for herbicide effectiveness and market sustainability. As certain weed populations develop tolerance to commonly used herbicide modes of action, farmers require alternative solutions or combination products, increasing complexity and costs associated with effective weed management programs.

Precision agriculture integration presents substantial opportunities for herbicide market expansion through technology-enabled application systems. Smart farming technologies, including GPS-guided sprayers, drone applications, and sensor-based weed detection systems, enable more efficient herbicide use while reducing environmental impact and improving cost-effectiveness for farmers.

Bio-based herbicide development offers significant growth potential as environmental regulations tighten and consumer preferences shift toward sustainable agricultural practices. Natural and biological herbicide alternatives derived from plant extracts, microbial sources, and other organic materials represent emerging market segments with strong growth prospects and premium pricing opportunities.

Export market expansion provides Chinese herbicide manufacturers with opportunities to leverage domestic production capabilities and cost advantages in international markets. Growing demand for agricultural chemicals in developing countries, particularly in Southeast Asia and Africa, creates export opportunities for competitively priced Chinese herbicide products.

Specialty crop applications represent underserved market segments with potential for targeted herbicide solutions. High-value crops such as fruits, vegetables, and specialty grains require specific weed management approaches, creating opportunities for manufacturers to develop niche products with higher profit margins and reduced competition intensity.

Supply chain evolution continues to reshape China’s herbicide market structure, with manufacturers investing in vertical integration strategies to control costs and ensure product quality. Direct relationships between producers and large-scale farming operations are becoming more common, reducing distribution layers and improving profit margins for both parties while enabling better technical support services.

Technology convergence between herbicide formulations and application equipment is creating new market dynamics that favor integrated solutions providers. Companies offering combined herbicide products and precision application technologies gain competitive advantages through comprehensive weed management systems that deliver superior results and customer value.

Competitive intensity has increased significantly as both domestic and international players expand their presence in China’s herbicide market. This competition drives innovation, improves product quality, and creates pricing pressures that benefit end users while challenging manufacturers to differentiate their offerings through superior performance, service, or cost-effectiveness.

Market consolidation trends are emerging as larger companies acquire smaller manufacturers to expand product portfolios, distribution networks, and manufacturing capabilities. These consolidation activities create opportunities for improved operational efficiency and market coverage while potentially reducing competition in specific product segments.

Comprehensive market analysis for China’s herbicide sector employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include extensive surveys of herbicide manufacturers, distributors, agricultural cooperatives, and end-user farmers across major agricultural regions to gather firsthand market intelligence and trend information.

Secondary research components encompass analysis of government agricultural statistics, industry association reports, trade publications, and regulatory documentation to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics, regulatory influences, and competitive landscape factors affecting the herbicide industry.

Data validation processes involve cross-referencing information from multiple sources, conducting expert interviews with industry professionals, and applying statistical analysis techniques to ensure research accuracy and reliability. Regional market variations are carefully documented to provide nuanced understanding of local market conditions and opportunities.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, trend identification techniques, and forecasting models that account for various economic, regulatory, and technological factors influencing market development. These frameworks enable comprehensive assessment of market opportunities and challenges facing industry participants.

Northern China regions, including Heilongjiang, Jilin, and Inner Mongolia, represent the largest herbicide consumption areas, accounting for approximately 35% of national demand. These provinces feature extensive grain production systems with high mechanization rates and large-scale farming operations that drive substantial herbicide usage for corn, soybean, and wheat cultivation.

Central China provinces such as Henan, Hubei, and Hunan contribute significantly to herbicide demand through intensive rice and wheat production systems. The region’s diverse cropping patterns and multiple growing seasons create year-round herbicide demand, with rice cultivation representing the primary application segment requiring specialized aquatic herbicide formulations.

Eastern coastal regions including Shandong, Jiangsu, and Zhejiang demonstrate high herbicide adoption rates driven by advanced agricultural practices and proximity to major manufacturing centers. These areas feature intensive vegetable production, fruit cultivation, and cash crop farming that require specialized herbicide solutions and precision application technologies.

Southern China markets encompass Guangdong, Guangxi, and Fujian provinces with tropical and subtropical agricultural systems that present unique weed management challenges. The region’s year-round growing seasons and diverse crop portfolio create consistent herbicide demand, with particular emphasis on selective formulations for specialty crops and sustainable farming practices.

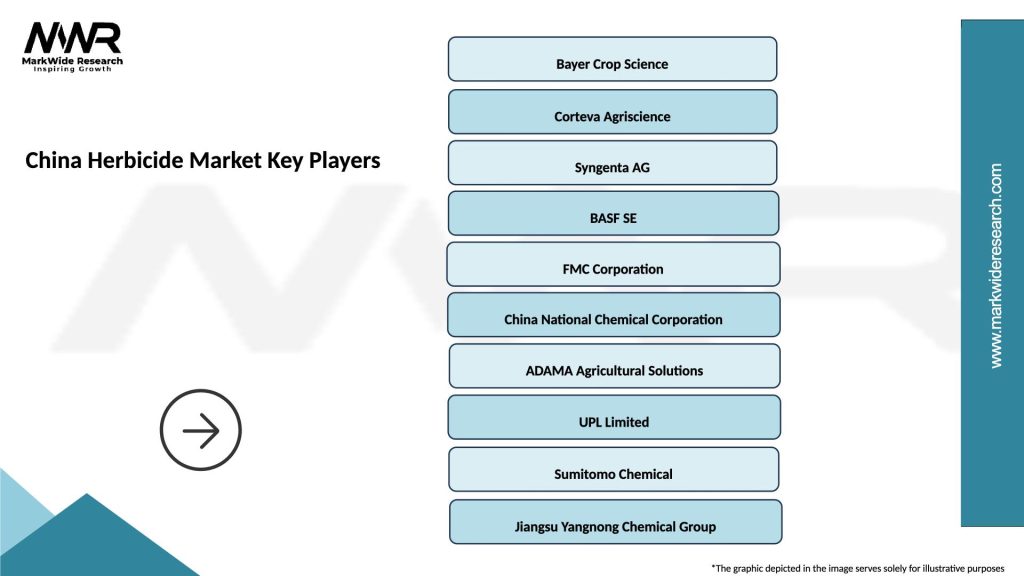

Market leadership in China’s herbicide sector is distributed among several key players, each contributing unique strengths and market positioning strategies:

Competitive strategies focus on product innovation, cost optimization, distribution network expansion, and customer service enhancement. Companies invest heavily in research and development to create differentiated herbicide formulations that address specific regional weed challenges while meeting environmental compliance requirements.

By Product Type:

By Application Method:

By Crop Type:

Glyphosate herbicides maintain market dominance due to their broad-spectrum effectiveness, cost advantages, and versatility across multiple crop systems. However, growing environmental concerns and resistance development issues are driving demand for alternative active ingredients and combination products that provide effective weed control while addressing sustainability requirements.

Selective herbicides represent a growing market segment as farmers seek more targeted weed control solutions that minimize crop damage risks. These products command premium pricing due to their specialized formulations and reduced environmental impact, making them attractive for high-value crop applications and environmentally sensitive farming operations.

Pre-emergence herbicides show strong growth potential as farmers recognize the economic benefits of preventing weed establishment rather than controlling established weed populations. These products offer superior cost-effectiveness and reduced application complexity, making them particularly attractive for large-scale farming operations with mechanized application capabilities.

Bio-based herbicide alternatives emerge as the fastest-growing category, driven by regulatory pressures, environmental concerns, and consumer preferences for sustainable agricultural practices. Although currently representing a small market share, these products demonstrate significant growth potential as formulation technologies improve and production costs decrease.

Farmers and agricultural producers benefit from improved crop yields, reduced labor requirements, and enhanced operational efficiency through effective herbicide applications. Modern herbicide formulations enable precise weed management that maximizes crop productivity while minimizing input costs and environmental impact, contributing to improved farm profitability and sustainability.

Herbicide manufacturers gain access to one of the world’s largest agricultural markets with diverse crop systems and growing demand for advanced weed control solutions. The market offers opportunities for product innovation, manufacturing scale advantages, and long-term growth potential driven by ongoing agricultural modernization and technology adoption trends.

Distribution partners including agricultural retailers, cooperatives, and service providers benefit from stable demand patterns, recurring revenue streams, and opportunities to provide value-added services such as application support, technical advice, and integrated crop management solutions that strengthen customer relationships and improve profit margins.

Research institutions and technology providers find opportunities to collaborate with industry participants in developing next-generation herbicide formulations, application technologies, and integrated pest management systems that address evolving market needs while meeting environmental and regulatory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture adoption represents a transformative trend reshaping herbicide application practices across China’s agricultural landscape. Farmers increasingly utilize GPS-guided equipment, variable rate application technologies, and sensor-based weed detection systems to optimize herbicide use efficiency while reducing environmental impact and input costs.

Sustainable farming practices drive growing demand for environmentally friendly herbicide alternatives and integrated weed management approaches. This trend includes increased interest in bio-based herbicides, reduced-risk chemical formulations, and combination strategies that minimize reliance on synthetic chemicals while maintaining effective weed control.

Digital agriculture platforms are emerging as important tools for herbicide selection, application timing, and performance monitoring. Mobile applications, weather-based advisory services, and data analytics platforms help farmers make informed decisions about herbicide use while improving application outcomes and cost-effectiveness.

Consolidation activities among herbicide manufacturers and distributors create larger, more efficient market participants with enhanced research capabilities, broader product portfolios, and improved market coverage. This consolidation trend influences competitive dynamics and market structure development across the industry.

Regulatory framework evolution continues to shape China’s herbicide market through updated registration requirements, environmental standards, and safety protocols. Recent developments include stricter residue limits, enhanced environmental impact assessments, and accelerated approval processes for reduced-risk herbicide formulations that meet sustainability criteria.

Technology partnerships between herbicide manufacturers and precision agriculture companies are creating integrated solutions that combine advanced formulations with smart application technologies. These collaborations result in comprehensive weed management systems that deliver superior performance while addressing environmental and economic concerns.

Research investments in next-generation herbicide technologies focus on developing products with novel modes of action, improved environmental profiles, and enhanced crop selectivity. MarkWide Research indicates that research and development spending in the sector has increased by approximately 18% annually as companies seek to address resistance challenges and regulatory requirements.

Manufacturing capacity expansion by both domestic and international companies reflects growing confidence in China’s herbicide market potential. New production facilities, technology upgrades, and capacity additions demonstrate industry commitment to serving expanding market demand while improving operational efficiency and product quality.

Market participants should prioritize investment in sustainable herbicide technologies and bio-based alternatives to align with evolving regulatory requirements and consumer preferences. Companies that proactively develop environmentally friendly solutions will gain competitive advantages as market dynamics shift toward sustainability-focused products and practices.

Distribution strategy optimization requires enhanced focus on reaching smallholder farmers through agricultural cooperatives, mobile service units, and digital platforms that provide education, technical support, and convenient access to herbicide products. Effective distribution strategies must address the unique challenges of China’s fragmented agricultural landscape.

Technology integration opportunities should be pursued through partnerships with precision agriculture providers, equipment manufacturers, and digital platform developers. Companies that successfully integrate herbicide products with smart farming technologies will create differentiated value propositions and strengthen customer relationships.

Regional market adaptation strategies must account for diverse crop systems, weed species, and farming practices across China’s various agricultural regions. Customized product formulations, application recommendations, and support services tailored to specific regional needs will improve market penetration and customer satisfaction.

Long-term growth prospects for China’s herbicide market remain positive, driven by continued agricultural modernization, increasing farm mechanization, and growing emphasis on crop productivity optimization. MarkWide Research projects that the market will experience sustained expansion over the next decade, with growth rates accelerating in segments focused on sustainable and technology-enabled solutions.

Innovation trajectories point toward development of more sophisticated herbicide formulations that combine multiple active ingredients, incorporate biological components, and integrate with precision application technologies. These advanced products will command premium pricing while addressing complex weed management challenges and environmental requirements.

Market structure evolution will likely feature increased consolidation among manufacturers and distributors, creating larger, more efficient market participants with enhanced capabilities in research, manufacturing, and market coverage. This consolidation will improve industry competitiveness while potentially reducing the number of active players in specific market segments.

Regulatory landscape development will continue influencing market dynamics through evolving environmental standards, safety requirements, and approval processes that favor sustainable herbicide alternatives. Companies that anticipate and adapt to regulatory changes will maintain competitive advantages in the evolving market environment.

China’s herbicide market represents a dynamic and rapidly evolving sector within the global agricultural chemicals industry, characterized by substantial growth potential, increasing technological sophistication, and evolving regulatory requirements. The market benefits from China’s vast agricultural base, ongoing modernization initiatives, and growing emphasis on crop productivity optimization that drives consistent demand for effective weed control solutions.

Market transformation toward more sustainable, technology-enabled herbicide applications creates opportunities for innovative companies while challenging traditional approaches to weed management. The integration of precision agriculture technologies, development of bio-based alternatives, and emphasis on environmental stewardship are reshaping competitive dynamics and market structure across the industry.

Future success in China’s herbicide market will depend on companies’ ability to balance performance, sustainability, and cost-effectiveness while navigating complex regulatory requirements and diverse regional market conditions. Organizations that invest in innovation, build strong distribution networks, and develop comprehensive customer support capabilities will be best positioned to capitalize on the market’s substantial growth potential and contribute to China’s agricultural modernization objectives.

What is Herbicide?

Herbicides are chemical substances used to control or eliminate unwanted plants, commonly known as weeds. They play a crucial role in agriculture by enhancing crop yields and managing vegetation in various settings.

What are the key players in the China Herbicide Market?

Key players in the China Herbicide Market include companies like Syngenta, BASF, and Bayer. These companies are involved in the development and distribution of various herbicide products, among others.

What are the growth factors driving the China Herbicide Market?

The China Herbicide Market is driven by factors such as the increasing demand for food production, the adoption of modern agricultural practices, and the need for effective weed management solutions in both large-scale and smallholder farming.

What challenges does the China Herbicide Market face?

The China Herbicide Market faces challenges such as regulatory scrutiny over chemical usage, the development of herbicide-resistant weed species, and environmental concerns related to pesticide application.

What opportunities exist in the China Herbicide Market?

Opportunities in the China Herbicide Market include the development of bio-based herbicides, advancements in precision agriculture technologies, and increasing investments in sustainable farming practices.

What trends are shaping the China Herbicide Market?

Trends in the China Herbicide Market include the rising popularity of integrated pest management, the shift towards organic farming, and the innovation of new herbicide formulations that are more effective and environmentally friendly.

China Herbicide Market

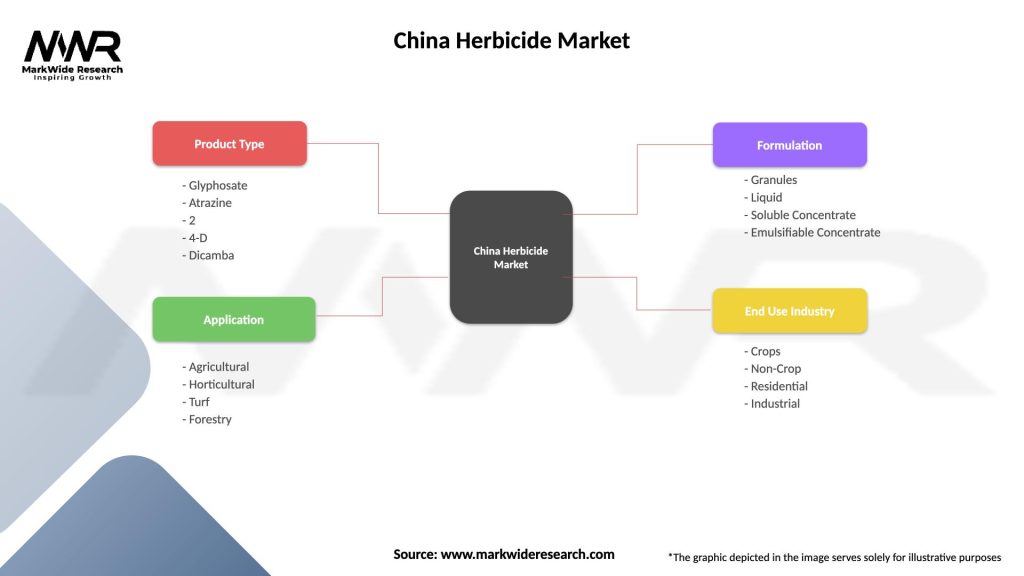

| Segmentation Details | Description |

|---|---|

| Product Type | Glyphosate, Atrazine, 2,4-D, Dicamba |

| Application | Agricultural, Horticultural, Turf, Forestry |

| Formulation | Granules, Liquid, Soluble Concentrate, Emulsifiable Concentrate |

| End Use Industry | Crops, Non-Crop, Residential, Industrial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Herbicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at