444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom poultry meat market represents one of the most dynamic and essential segments within the nation’s agricultural and food production landscape. Market dynamics indicate sustained growth driven by evolving consumer preferences, technological advancements in farming practices, and increasing demand for protein-rich food sources. The UK poultry sector encompasses chicken, turkey, duck, and other fowl production, with chicken meat dominating market share at approximately 85% of total poultry consumption.

Consumer behavior patterns demonstrate a significant shift toward convenience foods, ready-to-cook products, and premium poultry offerings. The market benefits from robust domestic production capabilities, advanced processing facilities, and sophisticated distribution networks that serve both retail and foodservice channels. Production efficiency has improved by approximately 12% over the past five years, reflecting technological innovations and optimized breeding programs.

Regional distribution shows concentrated production in areas such as East Anglia, the West Midlands, and Yorkshire, where favorable agricultural conditions and established infrastructure support large-scale poultry operations. The market experiences steady growth with projected expansion at a CAGR of 3.2% through the forecast period, driven by population growth, urbanization trends, and increasing protein consumption per capita.

The United Kingdom poultry meat market refers to the comprehensive ecosystem encompassing the breeding, raising, processing, distribution, and retail sale of domesticated fowl meat products within the UK territory. This market includes all stages of the value chain from primary production on farms to final consumer purchase, covering various poultry species with chicken representing the dominant segment.

Market scope extends beyond traditional whole bird sales to include processed products such as cuts, fillets, ground meat, and value-added items like marinated, seasoned, and ready-to-cook offerings. The definition encompasses both conventional and organic production methods, free-range and intensive farming systems, and products destined for domestic consumption as well as export markets.

Industry classification includes integrated producers who control multiple stages of production, independent farmers, processing companies, distributors, retailers, and foodservice operators. The market operates within strict regulatory frameworks governing animal welfare, food safety, environmental standards, and trade policies that significantly influence production methods and market dynamics.

Market performance in the United Kingdom poultry meat sector demonstrates resilience and adaptability amid changing consumer preferences and external challenges. The industry has successfully navigated supply chain disruptions, regulatory changes, and shifting demand patterns while maintaining steady growth trajectories and market stability.

Key growth drivers include increasing health consciousness among consumers, rising demand for lean protein sources, and growing preference for convenient meal solutions. The market benefits from technological advancements in breeding, nutrition, and processing that enhance production efficiency and product quality. Consumer spending on poultry products has increased by approximately 8% annually, reflecting both volume growth and premiumization trends.

Strategic developments focus on sustainability initiatives, animal welfare improvements, and product innovation to meet evolving consumer expectations. The industry invests heavily in automation, digitalization, and sustainable farming practices that reduce environmental impact while improving operational efficiency. Export opportunities continue expanding, with international sales representing approximately 15% of total production volume.

Future prospects remain positive, supported by demographic trends, urbanization, and increasing protein consumption. The market anticipates continued growth in premium segments, organic products, and specialized offerings that cater to diverse consumer preferences and dietary requirements.

Consumer preferences increasingly favor fresh, locally-sourced poultry products with clear traceability and welfare credentials. The market experiences growing demand for premium offerings, including free-range, organic, and specialty breed products that command higher price points and margins.

Health and nutrition trends serve as primary market drivers, with consumers increasingly recognizing poultry meat as a lean, high-quality protein source essential for balanced diets. Growing awareness of nutritional benefits, including essential amino acids, vitamins, and minerals, supports sustained demand growth across demographic segments.

Convenience and lifestyle factors drive demand for ready-to-cook products, pre-marinated items, and portion-controlled offerings that align with busy modern lifestyles. The rise of meal kits, quick-service restaurants, and home delivery services creates additional demand channels for processed poultry products.

Economic accessibility positions poultry meat as an affordable protein option compared to beef and pork, making it attractive to price-conscious consumers. The favorable cost-to-protein ratio supports market penetration across income levels and demographic groups.

Technological advancements in production, processing, and packaging enhance product quality, extend shelf life, and improve food safety standards. Innovations in breeding, nutrition, and farm management systems increase productivity while reducing production costs and environmental impact.

Population growth and urbanization create expanding consumer bases, particularly in metropolitan areas where convenience and quality are prioritized. Demographic shifts toward smaller household sizes favor portion-controlled and individual serving products.

Regulatory compliance costs present significant challenges for producers, particularly smaller operations struggling to meet evolving animal welfare, environmental, and food safety standards. Compliance requirements increase operational expenses and may limit market entry for new participants.

Disease outbreaks such as avian influenza pose ongoing threats to production stability and market confidence. Biosecurity measures, while necessary, add operational complexity and costs that impact profitability and supply chain reliability.

Feed cost volatility significantly affects production economics, as feed represents approximately 65% of total production costs. Fluctuations in grain prices, influenced by weather conditions and global commodity markets, create margin pressure for producers.

Environmental concerns regarding intensive farming practices generate consumer skepticism and regulatory scrutiny. Issues related to waste management, greenhouse gas emissions, and land use efficiency require ongoing investment in sustainable practices.

Competition from alternative proteins including plant-based and cultured meat products challenges traditional poultry market share. Growing consumer interest in meat alternatives, driven by environmental and ethical considerations, creates competitive pressure.

Labor shortages in processing facilities and farms affect production capacity and operational efficiency. Skilled worker availability remains challenging, particularly in rural areas where many production facilities operate.

Premium product segments offer substantial growth opportunities as consumers demonstrate willingness to pay higher prices for quality, welfare-friendly, and sustainable products. Free-range, organic, and heritage breed offerings command significant price premiums while meeting evolving consumer values.

Export market expansion presents opportunities for UK producers to access international markets, particularly in regions with growing protein demand and appreciation for British food quality standards. Trade agreements and market access negotiations create new revenue streams.

Value-added processing enables producers to capture additional margins through product innovation, convenience offerings, and specialized formulations. Ready-to-cook meals, marinated products, and ethnic cuisine adaptations address diverse consumer preferences.

Sustainability initiatives create competitive advantages and market differentiation opportunities. Producers implementing environmental improvements, carbon reduction programs, and circular economy principles attract environmentally conscious consumers and retail partners.

Technology integration offers opportunities to improve efficiency, reduce costs, and enhance product quality through precision farming, automated processing, and digital supply chain management. Data analytics and IoT applications optimize production parameters and resource utilization.

Foodservice partnerships with restaurants, catering companies, and institutional buyers provide stable demand channels and opportunities for customized product development. The growing foodservice sector creates consistent volume opportunities.

Supply chain integration characterizes the UK poultry market, with major players controlling multiple stages from breeding through retail distribution. This vertical integration provides cost advantages, quality control, and supply security while creating barriers for smaller competitors.

Seasonal demand patterns influence production planning and pricing strategies, with peak consumption during holiday periods and summer months. Producers adjust production schedules and inventory management to accommodate these cyclical variations.

Price sensitivity varies across market segments, with premium products showing lower elasticity while commodity products remain highly price-competitive. MarkWide Research analysis indicates that price remains the primary purchase decision factor for approximately 60% of consumers in standard product categories.

Innovation cycles drive product development and market differentiation, with successful innovations quickly adopted across the industry. New product launches, packaging improvements, and processing technologies create competitive advantages and market expansion opportunities.

Regulatory evolution continuously shapes market dynamics through changing animal welfare standards, environmental requirements, and food safety protocols. Industry adaptation to regulatory changes influences production costs, operational procedures, and market positioning strategies.

Primary research encompasses comprehensive surveys of industry participants including producers, processors, distributors, retailers, and consumers. Data collection methods include structured interviews, focus groups, and quantitative surveys designed to capture market trends, consumer preferences, and industry challenges.

Secondary research utilizes government statistics, industry reports, trade publications, and academic studies to establish market baselines and validate primary findings. Official data sources include DEFRA agricultural statistics, ONS economic data, and industry association reports.

Market analysis employs statistical modeling, trend analysis, and comparative studies to identify growth patterns, market drivers, and future opportunities. Analytical frameworks include Porter’s Five Forces, SWOT analysis, and value chain assessment methodologies.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources, expert review panels, and statistical verification procedures. Quality assurance protocols maintain research integrity and analytical rigor throughout the study process.

Forecasting methodologies combine quantitative modeling with qualitative insights to project market trends and growth scenarios. Multiple forecasting approaches provide robust predictions while acknowledging inherent uncertainties in market evolution.

East Anglia dominates UK poultry production, accounting for approximately 35% of national output, benefiting from favorable agricultural conditions, established infrastructure, and proximity to feed sources. The region hosts major processing facilities and integrated production operations that serve national and international markets.

West Midlands represents another significant production center, contributing approximately 20% of total production with strong concentrations in Herefordshire, Worcestershire, and Shropshire. The region benefits from agricultural traditions, available land, and transportation links to major population centers.

Yorkshire and Humber accounts for approximately 15% of national production, with particular strength in turkey production and specialized poultry operations. The region’s agricultural heritage and rural infrastructure support diverse production systems and processing capabilities.

South West England contributes approximately 12% of production, with notable concentrations in Devon and Cornwall. The region emphasizes premium and specialty products, including free-range and organic offerings that capitalize on rural imagery and quality perceptions.

Scotland and Wales together represent approximately 10% of production, with growing emphasis on sustainable farming practices and premium product positioning. These regions benefit from strong agricultural traditions and increasing consumer recognition of regional quality.

Northern England accounts for the remaining 8% of production, with operations concentrated in areas with suitable agricultural infrastructure and market access. Regional production focuses on serving local markets and specialized product segments.

Market concentration characterizes the UK poultry industry, with leading companies controlling significant market shares through vertical integration and operational scale. The competitive environment features both multinational corporations and specialized regional producers serving different market segments.

Competitive strategies focus on operational efficiency, product differentiation, and supply chain optimization. Leading companies invest in technology, sustainability initiatives, and brand development to maintain market positions and capture growth opportunities.

By Product Type: The market segments into fresh whole birds, fresh cuts and portions, frozen products, and processed items. Fresh products dominate with approximately 70% market share, while frozen and processed segments show strong growth potential.

By Production Method: Conventional, free-range, and organic production systems serve different consumer segments with varying price points and value propositions.

By Distribution Channel: Retail and foodservice channels serve different customer needs with specialized product offerings and service requirements.

Chicken meat dominates the poultry market with approximately 85% market share, driven by versatility, affordability, and consumer familiarity. The segment benefits from efficient production systems, diverse product offerings, and strong consumer acceptance across demographic groups.

Turkey products represent approximately 12% of market volume, with seasonal demand peaks during holiday periods and growing year-round consumption. The segment emphasizes premium positioning, health benefits, and specialty product development.

Duck and specialty poultry account for the remaining 3% of market share, serving premium and ethnic cuisine segments. These categories command higher prices but serve niche markets with specific culinary applications and cultural preferences.

Value-added products across all categories show strong growth potential, with consumers willing to pay premiums for convenience, flavor enhancement, and cooking solutions. Innovation in marinades, seasonings, and preparation methods drives category expansion.

Organic and premium segments demonstrate robust growth across all poultry categories, reflecting consumer willingness to pay higher prices for perceived quality, welfare, and environmental benefits. MWR data indicates premium segments grow at approximately 15% annually despite higher price points.

Producers benefit from stable demand patterns, technological advancement opportunities, and premium market segments that offer improved margins. Vertical integration possibilities provide supply chain control and cost optimization advantages.

Retailers gain from high-velocity products that generate consistent traffic and margins. Poultry products serve as destination categories that drive store visits and basket building opportunities.

Consumers receive access to affordable, nutritious protein sources with increasing variety, quality, and convenience options. Market competition drives innovation and value improvement across product categories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus drives industry transformation toward environmentally responsible production methods, renewable energy adoption, and waste reduction initiatives. Producers implement circular economy principles and carbon footprint reduction programs to meet consumer and regulatory expectations.

Premium product growth reflects consumer willingness to pay higher prices for perceived quality, welfare standards, and environmental benefits. Free-range, organic, and heritage breed products experience strong demand growth despite premium pricing.

Technology integration accelerates across the value chain, from precision farming and automated processing to digital supply chain management and consumer engagement platforms. IoT sensors, data analytics, and artificial intelligence optimize production efficiency and quality control.

Convenience innovation addresses busy lifestyles through ready-to-cook products, meal kits, and portion-controlled offerings. Product development focuses on reducing preparation time while maintaining nutritional value and taste quality.

Traceability enhancement meets consumer demands for transparency regarding product origin, production methods, and supply chain practices. Blockchain technology and digital tracking systems provide comprehensive product histories from farm to fork.

Health positioning emphasizes nutritional benefits, lean protein content, and functional food applications. Marketing strategies highlight health advantages while addressing consumer concerns about processed foods and additives.

Consolidation activities continue reshaping the competitive landscape through mergers, acquisitions, and strategic partnerships. Industry leaders pursue scale advantages and market position strengthening through strategic combinations and operational integration.

Sustainability investments accelerate as companies implement renewable energy systems, waste reduction programs, and environmental management initiatives. Major producers announce carbon neutrality targets and invest in sustainable farming practices.

Technology adoption expands across production and processing operations, with investments in automation, robotics, and digital monitoring systems. Smart farming technologies optimize feed efficiency, health management, and production performance.

Product innovation focuses on convenience, health benefits, and premium positioning. New product launches emphasize natural ingredients, functional benefits, and cooking convenience to meet evolving consumer preferences.

Export expansion efforts target new international markets and strengthen existing trade relationships. Industry organizations work with government agencies to secure market access and promote British poultry products globally.

Regulatory compliance initiatives address evolving animal welfare standards, environmental requirements, and food safety protocols. Industry investments in compliance systems and certification programs ensure market access and consumer confidence.

Strategic positioning should emphasize sustainability, quality, and innovation to differentiate from commodity competitors and capture premium market opportunities. MarkWide Research recommends focusing on value-added products and sustainable production methods to build competitive advantages.

Technology investment priorities should include automation, data analytics, and supply chain digitalization to improve efficiency and reduce operational costs. Companies should evaluate IoT applications, precision farming technologies, and processing automation opportunities.

Market diversification strategies should explore export opportunities, foodservice partnerships, and premium product segments to reduce dependence on traditional retail channels. Geographic and channel diversification provides risk mitigation and growth opportunities.

Sustainability initiatives require immediate attention as consumer and regulatory pressures intensify. Companies should develop comprehensive environmental strategies including carbon reduction, waste management, and renewable energy adoption.

Innovation focus should address convenience trends, health positioning, and premium product development. Investment in research and development capabilities enables competitive differentiation and market expansion.

Supply chain optimization should emphasize resilience, efficiency, and transparency to meet consumer expectations and manage operational risks. Vertical integration and strategic partnerships provide supply security and cost advantages.

Market growth prospects remain positive, supported by demographic trends, protein consumption increases, and product innovation. The industry anticipates continued expansion in premium segments, convenience products, and sustainable offerings that align with consumer values and preferences.

Technology transformation will accelerate, with artificial intelligence, robotics, and biotechnology revolutionizing production methods and product development. Digital integration across the value chain will optimize efficiency, quality, and consumer engagement.

Sustainability requirements will intensify, driving industry investment in environmental technologies, renewable energy, and circular economy principles. Companies that proactively address sustainability challenges will gain competitive advantages and market positioning benefits.

Consumer preferences will continue evolving toward premium, convenient, and transparent products. Health consciousness, environmental awareness, and ethical considerations will influence purchasing decisions and market dynamics.

International opportunities will expand as trade relationships develop and global protein demand increases. UK producers with quality credentials and sustainable practices will access growing export markets and premium international segments.

Innovation acceleration will focus on alternative production methods, novel products, and enhanced convenience offerings. Investment in research and development will drive competitive differentiation and market expansion opportunities.

The United Kingdom poultry meat market demonstrates remarkable resilience and growth potential amid evolving consumer preferences, technological advancement, and sustainability imperatives. Industry participants who embrace innovation, prioritize quality, and invest in sustainable practices will capture the most significant opportunities in this dynamic market environment.

Strategic success requires balancing operational efficiency with consumer value creation, emphasizing premium product development, and maintaining competitive cost structures. The market rewards companies that demonstrate environmental responsibility, animal welfare commitment, and product innovation while delivering consistent quality and value to consumers.

Future competitiveness depends on technology adoption, sustainability leadership, and market diversification strategies that reduce risk while capturing growth opportunities. The UK poultry market offers substantial potential for companies positioned to meet evolving consumer demands and navigate industry transformation successfully.

What is Poultry Meat?

Poultry meat refers to the flesh of domesticated birds, primarily chickens, turkeys, ducks, and geese, raised for human consumption. In the context of the United Kingdom Poultry Meat Market, it encompasses various products such as whole birds, cuts, and processed items.

What are the key companies in the United Kingdom Poultry Meat Market?

Key companies in the United Kingdom Poultry Meat Market include Pilgrim’s Pride Corporation, Moy Park, and Cranswick plc, which are significant players in poultry production and processing, among others.

What are the growth factors driving the United Kingdom Poultry Meat Market?

The growth of the United Kingdom Poultry Meat Market is driven by increasing consumer demand for protein-rich diets, the popularity of convenience foods, and the rise in health-conscious eating habits. Additionally, innovations in poultry farming and processing techniques contribute to market expansion.

What challenges does the United Kingdom Poultry Meat Market face?

The United Kingdom Poultry Meat Market faces challenges such as fluctuating feed prices, stringent regulations regarding animal welfare, and competition from alternative protein sources. These factors can impact production costs and market dynamics.

What opportunities exist in the United Kingdom Poultry Meat Market?

Opportunities in the United Kingdom Poultry Meat Market include the growing trend of organic and free-range poultry products, increasing exports to international markets, and the potential for value-added products such as ready-to-cook meals. These trends can enhance market growth and diversification.

What trends are shaping the United Kingdom Poultry Meat Market?

Trends shaping the United Kingdom Poultry Meat Market include a shift towards sustainable farming practices, the rise of plant-based alternatives, and increased consumer interest in traceability and sourcing. These trends reflect changing consumer preferences and environmental concerns.

United Kingdom Poultry Meat Market

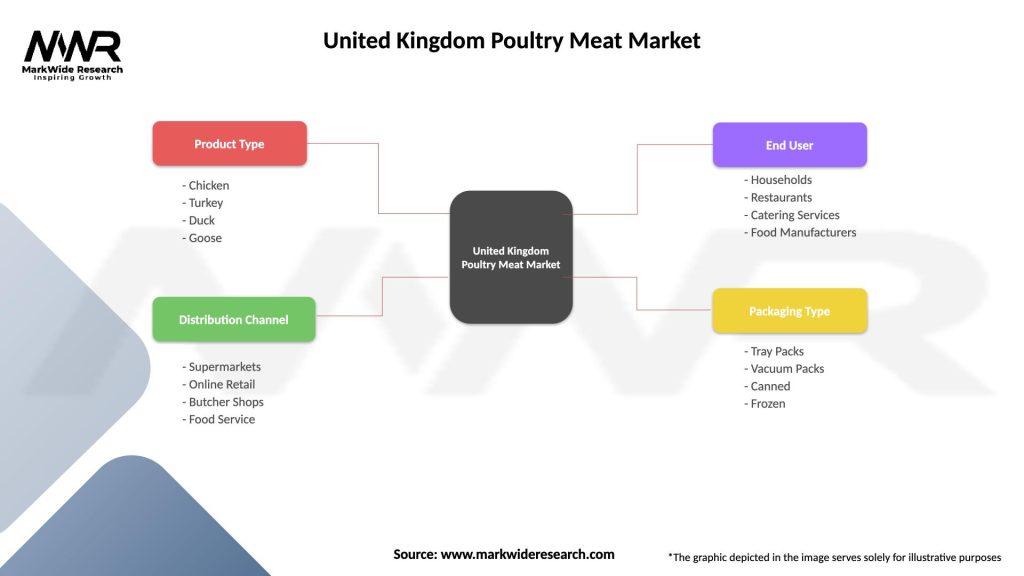

| Segmentation Details | Description |

|---|---|

| Product Type | Chicken, Turkey, Duck, Goose |

| Distribution Channel | Supermarkets, Online Retail, Butcher Shops, Food Service |

| End User | Households, Restaurants, Catering Services, Food Manufacturers |

| Packaging Type | Tray Packs, Vacuum Packs, Canned, Frozen |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Poultry Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at