444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada Courier, Express, and Parcel (CEP) market represents a dynamic and rapidly evolving sector that serves as the backbone of the nation’s logistics infrastructure. This comprehensive market encompasses traditional postal services, express delivery companies, and specialized parcel delivery providers that facilitate the movement of goods across Canada’s vast geographic landscape. The market has experienced unprecedented transformation driven by the explosive growth of e-commerce, changing consumer expectations, and technological innovations that have revolutionized last-mile delivery solutions.

Market dynamics indicate robust expansion with the sector demonstrating remarkable resilience and adaptability. The Canadian CEP market has witnessed substantial growth, with e-commerce penetration reaching 82% of Canadian consumers actively engaging in online shopping activities. This digital transformation has fundamentally altered delivery expectations, with consumers increasingly demanding faster, more flexible, and cost-effective shipping options that align with their lifestyle preferences.

Geographic challenges unique to Canada, including vast distances between urban centers, harsh weather conditions, and sparse population density in remote regions, have shaped the market’s operational strategies. Despite these challenges, the market continues to expand with innovative solutions addressing the complexities of serving both densely populated metropolitan areas and remote rural communities across Canada’s 9.98 million square kilometers of territory.

The Canada Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of logistics service providers specializing in the collection, transportation, and delivery of packages, documents, and parcels across Canadian territories. This market encompasses various service categories including same-day delivery, next-day express services, standard ground transportation, and specialized handling for sensitive or high-value items.

Service differentiation within the CEP market is characterized by delivery speed, geographic coverage, tracking capabilities, and specialized handling requirements. Express services typically guarantee delivery within 24-48 hours, while standard parcel services offer cost-effective solutions with longer transit times. The market also includes specialized segments such as temperature-controlled logistics, hazardous materials transportation, and white-glove delivery services for high-value or fragile items.

Market participants range from international logistics giants to regional carriers and emerging technology-driven startups. This diverse ecosystem creates a competitive landscape that drives innovation, service quality improvements, and pricing optimization across all market segments.

Strategic market positioning reveals the Canada CEP market as a critical component of the nation’s economic infrastructure, facilitating commerce, supporting business operations, and enabling consumer convenience. The market has demonstrated exceptional growth trajectory, particularly accelerated by the COVID-19 pandemic which fundamentally shifted consumer behavior toward online shopping and home delivery preferences.

Key performance indicators highlight the market’s robust health with parcel volumes increasing by 15.2% annually over the past three years. This growth has been primarily driven by e-commerce expansion, with online retail sales contributing to 68% of total parcel volume growth in the Canadian market. The shift toward omnichannel retail strategies has further amplified demand for flexible delivery solutions.

Technological integration has emerged as a primary differentiator, with companies investing heavily in automation, artificial intelligence, and data analytics to optimize routing, improve delivery accuracy, and enhance customer experience. The adoption of advanced tracking systems, predictive analytics, and mobile applications has transformed customer expectations and service standards across the industry.

Market consolidation trends indicate increasing competition among major players while creating opportunities for specialized service providers and innovative startups. The competitive landscape continues to evolve with traditional carriers adapting to new market realities and technology companies entering the logistics space with disruptive business models.

Consumer behavior analysis reveals fundamental shifts in delivery expectations and preferences that are reshaping the entire CEP landscape. Modern Canadian consumers prioritize convenience, speed, and transparency in their delivery experiences, with 73% of consumers willing to pay premium rates for same-day or next-day delivery options.

Market segmentation insights demonstrate diverse service requirements across different customer categories, from individual consumers seeking convenience to businesses requiring reliable supply chain solutions. The B2B segment continues to represent a substantial portion of market revenue, while B2C growth rates significantly exceed traditional business-to-business expansion patterns.

E-commerce proliferation stands as the primary catalyst driving unprecedented growth in the Canadian CEP market. The digital transformation of retail has fundamentally altered consumer shopping patterns, with online purchases becoming increasingly integrated into daily life. This shift has created sustained demand for reliable, efficient delivery services that can handle diverse package types and delivery requirements.

Consumer lifestyle changes have elevated convenience as a paramount consideration in purchasing decisions. Time-pressed consumers increasingly value delivery services that accommodate their schedules, offer flexible options, and provide transparent communication throughout the delivery process. The expectation for seamless, Amazon-like delivery experiences has become universal across all market segments.

Urbanization trends across major Canadian cities have created concentrated demand centers that enable efficient delivery operations while simultaneously presenting challenges related to traffic congestion, parking limitations, and building access restrictions. Urban density creates both opportunities for optimization and operational complexities that require innovative solutions.

Business digitalization has accelerated the adoption of e-commerce platforms among traditional retailers, creating new demand for integrated logistics solutions. Small and medium-sized businesses increasingly rely on professional delivery services to compete effectively with larger retailers and meet customer expectations for professional fulfillment services.

Cross-border trade expansion has increased demand for international shipping services, with Canadian businesses and consumers engaging more frequently in global commerce. This trend has created opportunities for CEP providers to develop specialized international service offerings and partnerships with global logistics networks.

Geographic challenges present significant operational constraints for CEP providers serving the Canadian market. The country’s vast territory, combined with uneven population distribution, creates cost pressures for maintaining comprehensive service coverage. Remote and rural areas often require subsidized service levels that impact overall profitability and operational efficiency.

Seasonal weather variations significantly impact delivery operations, particularly during harsh winter months when road conditions, flight delays, and extreme temperatures can disrupt normal service schedules. These seasonal challenges require substantial investment in contingency planning, alternative routing capabilities, and weather-resistant infrastructure.

Labor market constraints have emerged as a critical challenge, with the industry experiencing difficulty recruiting and retaining qualified drivers, warehouse workers, and customer service personnel. Competition for skilled labor has intensified wage pressures while potentially impacting service quality and operational consistency.

Regulatory compliance requirements across federal, provincial, and municipal jurisdictions create complex operational frameworks that require ongoing investment in compliance systems, training, and administrative overhead. Varying regulations across different provinces can complicate standardized service offerings and operational procedures.

Infrastructure limitations in certain regions, including inadequate road networks, limited airport capacity, and insufficient warehousing facilities, can constrain service expansion and operational efficiency. These infrastructure gaps require significant capital investment or creative workaround solutions that may impact service quality or cost-effectiveness.

Technology integration opportunities present substantial potential for market expansion and service differentiation. Advanced technologies including artificial intelligence, machine learning, and Internet of Things (IoT) applications can optimize routing efficiency, improve predictive capabilities, and enhance customer experience through personalized service offerings.

Sustainability initiatives are creating new market segments focused on environmentally conscious delivery solutions. The growing demand for carbon-neutral shipping options, electric vehicle fleets, and sustainable packaging materials presents opportunities for companies to differentiate their services while addressing environmental concerns.

Healthcare logistics expansion represents a high-growth opportunity segment, particularly following increased awareness of medical supply chain importance during the pandemic. Specialized services for pharmaceutical distribution, medical equipment delivery, and temperature-sensitive healthcare products offer premium pricing opportunities with stable demand characteristics.

Same-day delivery services continue to present expansion opportunities, particularly in major metropolitan areas where population density supports efficient route optimization. Consumer willingness to pay premium rates for ultra-fast delivery creates attractive revenue opportunities for companies capable of executing reliable same-day services.

B2B logistics solutions offer opportunities for companies to develop comprehensive supply chain partnerships with businesses seeking to outsource their logistics operations. These relationships often provide more predictable revenue streams and opportunities for value-added services beyond basic delivery functions.

Competitive intensity within the Canadian CEP market has reached unprecedented levels as traditional carriers, international logistics companies, and technology-driven startups compete for market share. This competition has accelerated innovation cycles, improved service quality, and created downward pressure on pricing across various service categories.

Customer expectations evolution continues to reshape service standards and operational requirements. Modern consumers expect real-time tracking, flexible delivery options, proactive communication, and seamless problem resolution. These elevated expectations require continuous investment in technology infrastructure and customer service capabilities.

Supply chain integration has become increasingly important as businesses seek comprehensive logistics solutions rather than standalone delivery services. CEP providers are expanding their service offerings to include warehousing, inventory management, and fulfillment services to capture greater value from customer relationships.

Pricing dynamics reflect the tension between competitive pressures and rising operational costs. While competition drives pricing efficiency, factors such as fuel costs, labor expenses, and infrastructure investments create upward pressure on service rates. Companies must balance competitive positioning with sustainable profitability.

Regulatory environment changes continue to influence market dynamics, with evolving regulations related to data privacy, environmental standards, and labor practices requiring ongoing adaptation. Companies that proactively address regulatory changes can gain competitive advantages while those that lag may face compliance challenges.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Canadian CEP market landscape. Primary research activities included extensive interviews with industry executives, operational managers, and customer service representatives across major market participants to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research components incorporated analysis of publicly available financial reports, industry publications, government statistics, and regulatory filings to establish quantitative baselines and validate primary research findings. This approach ensured comprehensive coverage of market dynamics from multiple perspectives and data sources.

Data validation processes included cross-referencing information across multiple sources, conducting follow-up interviews to clarify inconsistencies, and applying statistical analysis techniques to identify trends and patterns within the collected data. This rigorous validation approach ensures the reliability and accuracy of presented market insights.

Market segmentation analysis utilized both geographic and service-based categorization approaches to provide detailed insights into different market components. This segmentation strategy enables more precise understanding of market dynamics within specific service categories and geographic regions.

Trend analysis methodology incorporated historical data review, current market assessment, and forward-looking projections based on identified market drivers and constraints. This temporal analysis approach provides comprehensive understanding of market evolution and future development potential.

Ontario market dominance reflects the province’s position as Canada’s economic center, with the Greater Toronto Area representing approximately 35% of national CEP market activity. The concentration of businesses, population density, and proximity to major transportation hubs creates optimal conditions for efficient delivery operations and service innovation.

Quebec market characteristics demonstrate unique linguistic and cultural considerations that influence service delivery approaches and customer communication strategies. The province’s 23% market share reflects its significant economic contribution while highlighting the importance of bilingual service capabilities and culturally sensitive customer service approaches.

Western Canada expansion has accelerated with Alberta and British Columbia representing rapidly growing market segments driven by resource industry activity and Pacific trade connections. British Columbia’s strategic position as a gateway for Asian trade has created specialized opportunities for international shipping services and cross-border logistics solutions.

Atlantic Canada challenges include lower population density, seasonal economic variations, and geographic isolation that require specialized service approaches. Despite representing a smaller market share of 7% nationally, the region offers opportunities for companies capable of developing cost-effective solutions for dispersed populations.

Northern territories present unique operational challenges including extreme weather conditions, limited infrastructure, and high operational costs. However, resource industry activity and government services create consistent demand for reliable delivery services, often at premium pricing levels that can support specialized service offerings.

Market leadership is characterized by intense competition among established international carriers, national postal services, and emerging technology-driven companies. The competitive landscape continues to evolve as traditional boundaries between different types of logistics providers become increasingly blurred.

Competitive strategies increasingly focus on technology differentiation, service quality enhancement, and specialized market segment development. Companies are investing heavily in automation, data analytics, and customer experience improvements to maintain competitive positioning in an increasingly crowded marketplace.

Market consolidation trends suggest ongoing merger and acquisition activity as companies seek to achieve scale economies, expand geographic coverage, and acquire specialized capabilities. This consolidation activity is reshaping competitive dynamics while creating opportunities for innovative service providers to establish market positions.

Service-based segmentation reveals distinct market categories with unique characteristics, customer requirements, and competitive dynamics. Each segment presents different growth opportunities and operational challenges that require specialized approaches and service capabilities.

By Service Type:

By Customer Type:

By Package Size:

Express delivery services continue to demonstrate the strongest growth rates within the Canadian CEP market, driven by consumer expectations for rapid fulfillment and business requirements for time-sensitive deliveries. This segment commands premium pricing while requiring significant investment in transportation infrastructure and operational capabilities.

E-commerce fulfillment has emerged as the fastest-growing category, with online retail integration becoming essential for market success. Companies specializing in e-commerce logistics have developed sophisticated capabilities including inventory management, order processing, and returns handling that extend beyond traditional delivery services.

Healthcare logistics represents a specialized high-value segment with stringent regulatory requirements and temperature-control needs. The COVID-19 pandemic highlighted the critical importance of reliable healthcare supply chains, creating sustained demand for specialized medical logistics services with 12% annual growth rates.

International shipping continues to expand as Canadian businesses increase their global trade activities and consumers access international e-commerce platforms. This segment requires specialized expertise in customs procedures, international regulations, and global logistics networks.

Same-day delivery services have gained significant traction in major metropolitan areas, with consumer adoption rates reaching 28% in urban markets. This category requires dense urban networks and sophisticated routing optimization to achieve profitability while meeting customer expectations for ultra-fast delivery.

Revenue diversification opportunities enable CEP providers to expand beyond traditional delivery services into value-added logistics solutions. Companies can develop comprehensive supply chain partnerships that provide more stable revenue streams and higher profit margins through integrated service offerings.

Technology leverage advantages allow forward-thinking companies to differentiate their services through superior customer experience, operational efficiency, and predictive capabilities. Investment in advanced technologies creates sustainable competitive advantages while improving service quality and cost-effectiveness.

Market expansion potential exists across multiple dimensions including geographic coverage, service categories, and customer segments. Companies can achieve growth through strategic expansion into underserved markets or development of specialized service capabilities that address unmet customer needs.

Partnership opportunities with e-commerce platforms, retailers, and technology companies create synergistic relationships that benefit all participants. These partnerships can provide access to new customer bases, shared technology investments, and operational efficiencies that improve competitive positioning.

Sustainability leadership positions companies favorably with environmentally conscious consumers and businesses while potentially reducing operational costs through efficiency improvements. Early adoption of sustainable practices can create competitive advantages as environmental regulations become more stringent.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration is transforming operational capabilities across the Canadian CEP market, with companies investing heavily in robotic sorting systems, automated warehouses, and artificial intelligence applications. These technologies improve processing speed, reduce labor dependencies, and enhance accuracy while creating opportunities for 24/7 operations.

Sustainability integration has evolved from optional consideration to essential business requirement, with companies developing comprehensive environmental strategies including electric vehicle fleets, carbon-neutral shipping options, and sustainable packaging solutions. Consumer and corporate customers increasingly factor environmental impact into their logistics decisions.

Last-mile innovation continues to drive experimentation with alternative delivery methods including drone delivery, autonomous vehicles, smart locker systems, and crowdsourced delivery networks. While many of these technologies remain in pilot phases, successful implementations could fundamentally alter urban delivery economics.

Data analytics sophistication is enabling predictive capabilities that improve route optimization, demand forecasting, and customer service quality. Companies leveraging advanced analytics can achieve significant operational efficiencies while providing superior customer experiences through proactive communication and problem resolution.

Omnichannel integration reflects the blending of online and offline retail channels, requiring CEP providers to support complex fulfillment strategies including buy-online-pickup-in-store, ship-from-store, and flexible return options. This trend requires sophisticated technology integration and operational flexibility.

Technology partnerships between traditional CEP providers and technology companies are accelerating innovation adoption and service enhancement capabilities. These collaborations combine logistics expertise with technological innovation to create superior customer experiences and operational efficiencies.

Infrastructure investments across the industry include new distribution centers, automated sorting facilities, and transportation fleet expansions designed to handle growing parcel volumes while improving service quality. According to MarkWide Research analysis, infrastructure spending has increased by 18% annually over the past two years.

Service expansion initiatives demonstrate companies’ efforts to capture greater value from customer relationships through comprehensive logistics solutions. Many providers are expanding beyond traditional delivery services to offer warehousing, inventory management, and fulfillment services.

Sustainability commitments have become standard across major market participants, with companies setting ambitious targets for carbon neutrality, electric vehicle adoption, and sustainable packaging implementation. These commitments reflect both regulatory pressures and customer expectations for environmental responsibility.

International expansion activities include partnerships with global logistics networks, cross-border service enhancements, and specialized international shipping capabilities designed to support Canadian businesses’ global trade activities and consumers’ international shopping preferences.

Strategic focus recommendations emphasize the importance of technology investment, customer experience enhancement, and operational efficiency improvement as key priorities for market success. Companies should prioritize initiatives that address multiple objectives simultaneously while building sustainable competitive advantages.

Market positioning strategies should leverage unique strengths while addressing identified weaknesses through targeted investments and partnerships. Companies must differentiate their services through superior customer experience, specialized capabilities, or cost advantages that create sustainable competitive positioning.

Investment priorities should focus on technology infrastructure, automation capabilities, and sustainability initiatives that align with long-term market trends. MWR recommends balanced investment approaches that address immediate operational needs while building capabilities for future market requirements.

Partnership development opportunities exist across multiple dimensions including technology integration, geographic expansion, and service enhancement. Strategic partnerships can accelerate capability development while sharing investment costs and risks associated with market expansion initiatives.

Risk management strategies should address identified market constraints including geographic challenges, seasonal variations, and competitive pressures. Companies should develop comprehensive contingency plans and diversification strategies that reduce vulnerability to market disruptions.

Growth trajectory projections indicate continued expansion of the Canadian CEP market driven by sustained e-commerce growth, technological innovation, and evolving consumer expectations. The market is expected to maintain robust growth rates with parcel volumes increasing by 8-12% annually over the next five years.

Technology transformation will fundamentally alter operational capabilities and service offerings, with automation, artificial intelligence, and data analytics becoming standard components of competitive service delivery. Companies that successfully integrate these technologies will achieve significant advantages in efficiency, accuracy, and customer satisfaction.

Service evolution will continue toward more personalized, flexible, and sustainable delivery options that address diverse customer preferences and environmental concerns. The market will likely see increased segmentation with specialized services targeting specific customer needs and geographic markets.

Competitive landscape changes will include continued consolidation among traditional providers while creating opportunities for innovative companies with differentiated service offerings. Technology companies may play increasingly important roles as logistics service providers or technology partners.

Regulatory environment development will likely include enhanced environmental standards, data privacy requirements, and labor protection regulations that influence operational practices and cost structures. Companies must proactively address regulatory trends to maintain compliance and competitive positioning.

Market assessment reveals the Canada Courier, Express, and Parcel market as a dynamic, rapidly evolving sector with substantial growth potential driven by e-commerce expansion, technological innovation, and changing consumer expectations. The market demonstrates remarkable resilience and adaptability while facing unique challenges related to Canada’s geographic characteristics and seasonal variations.

Strategic opportunities exist for companies capable of leveraging technology, developing specialized capabilities, and creating superior customer experiences. Success in this market requires balanced investment in operational efficiency, service quality, and innovation while maintaining cost-effectiveness and regulatory compliance.

Future success factors will increasingly center on technology integration, sustainability leadership, and customer experience excellence. Companies that proactively address these trends while building flexible, scalable operations will be best positioned to capitalize on continued market growth and evolving customer requirements in Canada’s dynamic CEP marketplace.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the rapid delivery of packages and documents. These services are essential for businesses and individuals needing timely shipping solutions across various sectors, including e-commerce, retail, and logistics.

What are the key players in the Canada Courier, Express, and Parcel (CEP) Market?

Key players in the Canada Courier, Express, and Parcel (CEP) Market include Canada Post, FedEx, and UPS. These companies dominate the market by offering a range of delivery options and services tailored to meet diverse customer needs, among others.

What are the growth factors driving the Canada Courier, Express, and Parcel (CEP) Market?

The growth of the Canada Courier, Express, and Parcel (CEP) Market is driven by the increasing demand for e-commerce, the rise in online shopping, and the need for faster delivery services. Additionally, advancements in logistics technology and customer expectations for quick shipping are significant contributors.

What challenges does the Canada Courier, Express, and Parcel (CEP) Market face?

The Canada Courier, Express, and Parcel (CEP) Market faces challenges such as rising operational costs, regulatory compliance issues, and competition from alternative delivery methods. These factors can impact service efficiency and profitability.

What opportunities exist in the Canada Courier, Express, and Parcel (CEP) Market?

Opportunities in the Canada Courier, Express, and Parcel (CEP) Market include the expansion of same-day delivery services, the integration of technology for improved tracking, and the growth of cross-border e-commerce. These trends can enhance service offerings and customer satisfaction.

What trends are shaping the Canada Courier, Express, and Parcel (CEP) Market?

Trends shaping the Canada Courier, Express, and Parcel (CEP) Market include the increasing use of automation in sorting and delivery processes, the rise of green logistics initiatives, and the growing importance of last-mile delivery solutions. These trends are influencing how companies operate and meet customer demands.

Canada Courier, Express, and Parcel (CEP) Market

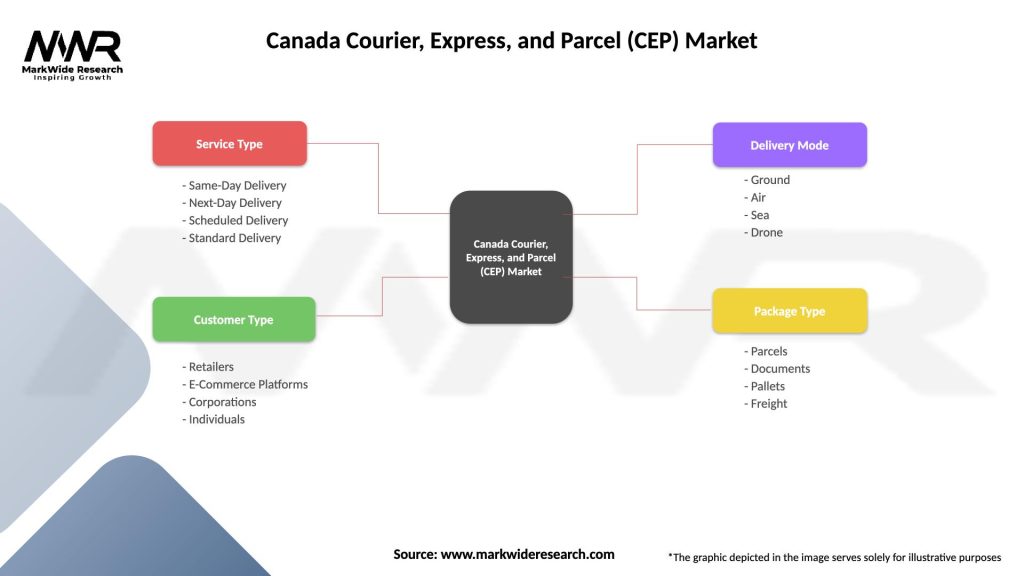

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, Standard Delivery |

| Customer Type | Retailers, E-Commerce Platforms, Corporations, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Package Type | Parcels, Documents, Pallets, Freight |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at