444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The ASEAN Courier, Express, and Parcel (CEP) market represents one of the most dynamic and rapidly expanding logistics sectors in Southeast Asia. This comprehensive market encompasses the delivery of time-sensitive documents, packages, and parcels across the ten member nations of the Association of Southeast Asian Nations. The region’s strategic geographic position, combined with its burgeoning e-commerce ecosystem and increasing cross-border trade activities, has positioned the ASEAN CEP market as a critical component of the global supply chain infrastructure.

Market dynamics in the ASEAN region are characterized by unprecedented growth in digital commerce, urbanization trends, and evolving consumer expectations for faster delivery services. The market is experiencing robust expansion driven by the proliferation of online shopping platforms, increasing smartphone penetration rates of 78% across major ASEAN markets, and the growing preference for contactless delivery solutions. The integration of advanced technologies such as artificial intelligence, IoT-enabled tracking systems, and automated sorting facilities has revolutionized the traditional courier and express delivery landscape.

Regional integration initiatives and trade facilitation measures have significantly enhanced the operational efficiency of CEP services across ASEAN borders. The market demonstrates remarkable resilience and adaptability, with companies continuously innovating to meet the diverse needs of both business-to-business and business-to-consumer segments. The sector’s growth trajectory reflects the broader economic transformation occurring throughout Southeast Asia, with e-commerce penetration rates reaching 65% in key metropolitan areas.

The ASEAN Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of logistics and delivery services that facilitate the transportation of documents, packages, and parcels within and across the ten ASEAN member countries. This market encompasses traditional postal services, express delivery companies, last-mile delivery providers, and specialized courier services that cater to both domestic and international shipping requirements.

CEP services are distinguished by their emphasis on speed, reliability, and tracking capabilities, offering customers various delivery options ranging from same-day and next-day delivery to standard shipping services. The market includes both established international logistics giants and emerging regional players who leverage local market knowledge and innovative delivery solutions to capture market share. These services are essential for supporting the region’s growing e-commerce sector, facilitating international trade, and enabling businesses to maintain efficient supply chain operations.

Market participants in the ASEAN CEP sector include multinational express delivery companies, regional logistics providers, e-commerce platform-integrated delivery services, and technology-enabled startup companies that focus on last-mile delivery solutions. The market’s scope extends beyond traditional package delivery to include specialized services such as cold chain logistics, healthcare product delivery, and high-value item transportation.

The ASEAN CEP market stands at the forefront of the region’s digital transformation, driven by explosive e-commerce growth and changing consumer behavior patterns. The market has demonstrated exceptional resilience and adaptability, particularly during the global pandemic period, when demand for delivery services surged dramatically. Key market indicators show sustained growth momentum with annual growth rates exceeding 12% across major market segments.

Strategic developments in the market include significant investments in automation technology, expansion of delivery networks, and the integration of sustainable delivery practices. Major players are focusing on enhancing their last-mile delivery capabilities while exploring innovative solutions such as drone delivery, autonomous vehicles, and smart locker systems. The market’s competitive landscape is characterized by intense rivalry among established international players and agile local competitors.

Regional integration efforts have facilitated cross-border trade and created opportunities for market consolidation and expansion. The implementation of digital trade agreements and customs modernization initiatives has streamlined international shipping processes, reducing delivery times and costs. According to MarkWide Research analysis, the market is experiencing a fundamental shift toward technology-driven solutions that prioritize customer experience and operational efficiency.

Future prospects for the ASEAN CEP market remain highly optimistic, supported by continued economic growth, increasing internet penetration, and the ongoing digital transformation of traditional retail sectors. The market is expected to benefit from infrastructure development projects, regulatory harmonization efforts, and the growing adoption of sustainable logistics practices across the region.

Market intelligence reveals several critical insights that define the current state and future trajectory of the ASEAN CEP market. The following key insights provide a comprehensive understanding of market dynamics:

E-commerce proliferation serves as the primary catalyst driving unprecedented growth in the ASEAN CEP market. The rapid adoption of online shopping platforms, accelerated by changing consumer preferences and digital payment solutions, has created sustained demand for reliable delivery services. Mobile commerce growth rates of 25% annually across key ASEAN markets have particularly contributed to increased parcel volumes and delivery frequency requirements.

Urbanization trends across Southeast Asia have concentrated population centers and created dense delivery networks that enhance operational efficiency for CEP providers. The growing middle class in major cities demonstrates increasing willingness to pay premium prices for faster and more convenient delivery services. Urban consumers’ busy lifestyles and preference for doorstep delivery have fundamentally altered traditional shopping patterns and created new market opportunities.

Cross-border trade expansion within the ASEAN Economic Community has facilitated increased international parcel flows and created demand for specialized cross-border delivery services. Trade facilitation measures, customs modernization, and digital documentation processes have reduced barriers to international shipping and enabled CEP companies to offer more competitive cross-border services.

Technology advancement in areas such as mobile applications, GPS tracking, and automated sorting systems has enhanced service quality while reducing operational costs. The integration of artificial intelligence and machine learning algorithms has enabled more efficient route planning, demand forecasting, and customer service automation, creating competitive advantages for technology-forward CEP providers.

Infrastructure limitations in certain ASEAN countries pose significant challenges for CEP market expansion, particularly in rural and remote areas where road networks and addressing systems may be inadequate. The varying levels of infrastructure development across different countries create operational complexities and cost disparities that affect service standardization and pricing strategies.

Regulatory complexity arising from different national regulations, customs procedures, and documentation requirements across ASEAN member countries creates operational challenges for cross-border CEP services. Compliance costs and administrative burdens can significantly impact profit margins, particularly for smaller regional players who lack the resources to navigate complex regulatory environments effectively.

Labor shortage issues in key markets have created challenges in scaling delivery operations, particularly for last-mile delivery services that require significant human resources. The gig economy model adopted by many CEP companies faces sustainability concerns related to worker welfare, training requirements, and service quality consistency.

Environmental concerns and increasing pressure for sustainable delivery practices have created additional operational costs and complexity. The need to balance rapid delivery expectations with environmental responsibility requires significant investments in electric vehicles, alternative fuel systems, and carbon offset programs that may impact short-term profitability.

Rural market expansion represents one of the most significant untapped opportunities in the ASEAN CEP market. As internet connectivity improves and e-commerce adoption spreads to rural areas, CEP companies can capture new customer segments while contributing to economic development in underserved regions. Innovative delivery models such as hub-and-spoke systems and partnerships with local retailers can make rural delivery economically viable.

Specialized service segments including healthcare logistics, cold chain delivery, and high-value item transportation offer premium pricing opportunities and reduced competition. The growing pharmaceutical and healthcare sectors across ASEAN countries create demand for temperature-controlled delivery services and specialized handling capabilities that command higher margins.

Technology integration opportunities include the implementation of autonomous delivery vehicles, drone delivery systems, and smart locker networks that can reduce operational costs while improving service quality. Early adoption of emerging technologies can create competitive advantages and establish market leadership positions in innovative delivery solutions.

Sustainability initiatives present opportunities to differentiate services while meeting growing environmental consciousness among consumers and businesses. Carbon-neutral delivery options, electric vehicle fleets, and eco-friendly packaging solutions can attract environmentally conscious customers and align with corporate sustainability goals.

Competitive intensity in the ASEAN CEP market has reached unprecedented levels as both international giants and local players compete for market share in this rapidly growing sector. The market dynamics are characterized by continuous innovation, aggressive pricing strategies, and strategic partnerships that reshape competitive positioning. Service differentiation through technology adoption, customer experience enhancement, and specialized service offerings has become crucial for maintaining competitive advantages.

Customer expectations continue to evolve toward faster delivery times, greater transparency, and more flexible delivery options. The success of same-day and next-day delivery services has raised the bar for all market participants, forcing companies to invest heavily in network optimization and technology infrastructure. Customer loyalty increasingly depends on consistent service quality and innovative features rather than traditional factors such as brand recognition alone.

Operational efficiency improvements through automation, route optimization, and network consolidation have become essential for maintaining profitability in an increasingly competitive environment. Companies are leveraging data analytics and artificial intelligence to optimize their operations, with efficiency gains of 30% reported by leading technology-adopting CEP providers across the region.

Market consolidation trends are evident as larger players acquire smaller competitors or form strategic alliances to expand their geographic coverage and service capabilities. This consolidation is creating more comprehensive service networks while potentially reducing competition in certain market segments.

Primary research methodologies employed in analyzing the ASEAN CEP market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and direct observation of market trends across multiple countries. The research approach encompasses both quantitative data collection through structured questionnaires and qualitative insights gathered through expert interviews and focus group discussions.

Secondary research components involve extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. Cross-referencing multiple data sources ensures accuracy and reliability of market insights and projections.

Market segmentation analysis utilizes both geographic and demographic criteria to identify distinct market segments and their unique characteristics. The research methodology incorporates regional variations in market development, regulatory environments, and consumer behavior patterns to provide nuanced market understanding.

Trend analysis employs longitudinal data collection and statistical modeling to identify emerging patterns and forecast future market developments. The methodology includes scenario planning and sensitivity analysis to account for various market variables and potential disruption factors.

Indonesia represents the largest single market within the ASEAN CEP sector, driven by its massive population, growing e-commerce adoption, and expanding middle class. The Indonesian market demonstrates unique characteristics including archipelago geography challenges, diverse urban-rural development levels, and strong domestic e-commerce platform growth. Market penetration rates of 45% in urban areas indicate significant room for continued expansion.

Thailand serves as a regional logistics hub with well-developed infrastructure and strategic geographic positioning. The Thai CEP market benefits from advanced transportation networks, established international trade relationships, and strong government support for digital economy initiatives. The market shows particular strength in cross-border services and specialized logistics solutions.

Vietnam exhibits the fastest growth rates in the region, driven by rapid economic development, increasing foreign investment, and young, tech-savvy population demographics. The Vietnamese market demonstrates strong potential for innovative delivery solutions and technology adoption, with e-commerce growth rates exceeding 20% annually.

Singapore functions as the regional headquarters and innovation center for many international CEP companies, despite its smaller domestic market size. The Singaporean market leads in technology adoption, service quality standards, and serves as a testing ground for new delivery innovations that later expand throughout the region.

Malaysia and Philippines represent significant growth markets with unique geographic challenges and opportunities. Both countries demonstrate strong e-commerce adoption rates and increasing consumer sophistication regarding delivery service expectations.

International players dominate the premium express delivery segment, leveraging their global networks, advanced technology platforms, and established brand recognition. These companies continue to invest heavily in regional expansion and service enhancement to maintain their market leadership positions.

Regional champions have emerged as significant competitors by leveraging local market knowledge, competitive pricing, and innovative service models tailored to ASEAN consumer preferences.

By Service Type: The ASEAN CEP market demonstrates clear segmentation based on service categories, each with distinct characteristics and growth patterns.

By End-user: Market segmentation reveals distinct customer categories with varying service requirements and price sensitivities.

By Geography: Regional market segmentation reflects varying development levels and market maturity across ASEAN countries.

Express Delivery Services continue to command premium pricing and maintain strong profit margins despite increasing competitive pressure. This category benefits from business customer loyalty and the critical nature of time-sensitive shipments. Market share concentration remains high among established international players, though regional competitors are gaining ground through competitive pricing and localized service offerings.

E-commerce Integrated Delivery represents the fastest-growing category, with specialized services designed specifically for online retail fulfillment. This segment demonstrates the highest innovation rates, with companies developing proprietary technology platforms, automated sorting systems, and customer communication tools. Integration with e-commerce platforms has created new revenue models and partnership opportunities.

Last-mile Delivery Solutions have emerged as a critical competitive battleground, with companies investing heavily in network density and delivery speed. This category shows the greatest variation in service models, from traditional courier services to crowd-sourced delivery networks and automated locker systems. Success in last-mile delivery increasingly determines overall market positioning.

Cross-border Services benefit from ASEAN economic integration but face ongoing challenges related to customs procedures and regulatory compliance. This category offers higher margins but requires significant expertise and infrastructure investments. Market leaders in cross-border services typically leverage their global networks and established trade relationships.

Revenue Growth Opportunities in the ASEAN CEP market provide substantial benefits for both established players and new entrants. The market’s rapid expansion creates multiple avenues for revenue generation, from traditional delivery services to value-added logistics solutions. Companies can leverage the growing e-commerce ecosystem to develop integrated service offerings that capture higher customer lifetime values.

Operational Efficiency Gains through technology adoption and network optimization enable CEP companies to improve their cost structures while enhancing service quality. Advanced routing algorithms, automated sorting systems, and real-time tracking capabilities reduce operational costs while improving customer satisfaction scores by 40% on average.

Market Expansion Benefits allow companies to diversify their geographic risk while accessing new customer segments. The ASEAN market’s diversity provides opportunities to test different service models and pricing strategies, creating valuable learning experiences that can be applied to other emerging markets globally.

Strategic Partnership Opportunities with e-commerce platforms, retailers, and technology companies create synergistic relationships that benefit all stakeholders. These partnerships often result in exclusive service agreements, shared technology development costs, and access to customer data that enables better service customization.

Innovation Leadership positions in the ASEAN market can establish companies as regional technology leaders and create competitive advantages that extend beyond the immediate market. Early adoption of emerging technologies such as autonomous delivery vehicles and AI-powered logistics optimization can create sustainable competitive moats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has emerged as a defining trend in the ASEAN CEP market, with companies increasingly adopting electric vehicles, carbon-neutral delivery options, and eco-friendly packaging solutions. This trend reflects growing environmental consciousness among consumers and regulatory pressure for sustainable business practices. Leading companies report 25% reduction in carbon emissions through green delivery initiatives.

Technology Convergence is transforming traditional delivery models through the integration of artificial intelligence, Internet of Things sensors, and blockchain technology. These technologies enable predictive analytics, real-time tracking, and automated customer communications that enhance service quality while reducing operational costs. The convergence trend is creating new service categories and business models.

Hyperlocal Delivery services are gaining traction in major urban centers, with companies offering ultra-fast delivery times for food, groceries, and essential items. This trend reflects changing consumer expectations and the willingness to pay premium prices for convenience. Hyperlocal services often achieve delivery times under 60 minutes in dense urban areas.

Cross-border Simplification initiatives are reducing barriers to international shipping through digital documentation, automated customs clearance, and harmonized procedures. This trend facilitates regional trade integration and creates opportunities for smaller companies to offer international services previously available only to large logistics providers.

Customer Experience Focus has become a primary differentiator, with companies investing heavily in user-friendly mobile applications, flexible delivery options, and proactive customer communication. The trend toward experience-centric service design is reshaping competitive dynamics and creating new customer loyalty factors.

Strategic Acquisitions have reshaped the competitive landscape, with major players acquiring regional competitors to expand their geographic coverage and service capabilities. Recent acquisition activity has focused on last-mile delivery specialists and technology companies that offer innovative logistics solutions. These transactions often result in service integration and network optimization benefits.

Infrastructure Investments by both private companies and governments have significantly enhanced the region’s logistics capabilities. New sorting facilities, automated warehouses, and transportation hubs are improving operational efficiency and service quality across the market. MWR analysis indicates that infrastructure investments have contributed to 35% improvement in average delivery times.

Technology Partnerships between CEP companies and technology providers are accelerating innovation adoption and creating competitive advantages. These partnerships often focus on developing proprietary logistics software, implementing IoT tracking systems, and exploring emerging technologies such as autonomous delivery vehicles.

Regulatory Harmonization efforts across ASEAN countries are reducing barriers to cross-border trade and creating more standardized operating environments. These developments facilitate market expansion and reduce compliance costs for companies operating across multiple countries.

Sustainability Initiatives have gained momentum with companies launching comprehensive environmental programs including electric vehicle adoption, carbon offset programs, and sustainable packaging solutions. These initiatives often receive government support and create positive brand differentiation in increasingly environmentally conscious markets.

Technology Investment should be prioritized by CEP companies seeking to maintain competitive positioning in the rapidly evolving market. Investment focus should include customer-facing applications, operational optimization systems, and emerging technologies that can create sustainable competitive advantages. Companies should allocate significant resources to technology development while ensuring proper integration with existing operations.

Geographic Expansion strategies should balance market opportunity with operational complexity, focusing on markets where companies can achieve sustainable competitive positions. Rural market expansion requires careful consideration of infrastructure limitations and service model adaptations. Companies should develop phased expansion plans that allow for learning and adjustment.

Partnership Development with e-commerce platforms, retailers, and technology companies can create synergistic relationships that benefit all stakeholders. Strategic partnerships should focus on long-term value creation rather than short-term cost reduction. Companies should seek partnerships that provide access to new customer segments or enhance service capabilities.

Sustainability Integration should be viewed as a strategic imperative rather than a compliance requirement. Early adoption of sustainable practices can create competitive advantages and align with evolving customer preferences. Companies should develop comprehensive sustainability strategies that address environmental impact while maintaining operational efficiency.

Customer Experience Enhancement should be a continuous focus area, with companies regularly updating their service offerings based on customer feedback and market trends. Investment in customer experience typically generates positive returns through increased customer loyalty and premium pricing opportunities.

Market trajectory for the ASEAN CEP sector remains highly positive, supported by continued economic growth, increasing digitalization, and evolving consumer preferences. The market is expected to maintain robust growth rates driven by e-commerce expansion, cross-border trade facilitation, and infrastructure development across the region. Technological advancement will continue to reshape service delivery models and create new competitive dynamics.

Innovation acceleration will likely focus on autonomous delivery systems, artificial intelligence applications, and sustainable logistics solutions. Companies that successfully integrate these technologies while maintaining cost-effective operations will establish market leadership positions. The pace of innovation is expected to increase as competition intensifies and customer expectations continue to evolve.

Market consolidation trends are expected to continue as larger players seek to achieve economies of scale and comprehensive service coverage. This consolidation may create opportunities for specialized service providers while potentially reducing competition in certain market segments. Regulatory oversight of consolidation activities may influence market structure development.

Sustainability requirements will become increasingly important as environmental regulations tighten and customer awareness grows. Companies that proactively address sustainability concerns will be better positioned for long-term success. According to MarkWide Research projections, sustainable delivery options could capture 50% market share within the next decade.

Regional integration will continue to facilitate cross-border trade and create opportunities for market expansion. Harmonized regulations and improved infrastructure will reduce operational complexity and enable smaller companies to compete more effectively in international markets. The ASEAN Economic Community’s continued development will likely create additional growth opportunities for the CEP sector.

The ASEAN CEP market represents one of the most dynamic and promising logistics sectors globally, characterized by rapid growth, technological innovation, and evolving customer expectations. The market’s strong fundamentals, including robust e-commerce growth, improving infrastructure, and supportive regulatory environments, create a favorable outlook for continued expansion and development.

Success factors in this competitive market include technology adoption, operational efficiency, customer experience excellence, and strategic partnership development. Companies that can effectively balance these elements while maintaining cost competitiveness will be best positioned to capture market opportunities and achieve sustainable growth.

Future developments will likely focus on sustainability integration, technology advancement, and service innovation that addresses evolving customer needs. The market’s continued evolution will create both challenges and opportunities for existing players while potentially opening doors for new entrants with innovative service models.

Strategic positioning in the ASEAN CEP market requires a long-term perspective that accounts for regional diversity, technological change, and evolving competitive dynamics. Companies that can successfully navigate these complexities while delivering consistent value to customers will establish strong market positions and achieve sustainable competitive advantages in this rapidly growing sector.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the rapid delivery of packages and documents. This includes various delivery options such as same-day, next-day, and scheduled deliveries, catering to both businesses and individual consumers.

What are the key players in the ASEAN Courier, Express, and Parcel (CEP) Market?

Key players in the ASEAN Courier, Express, and Parcel (CEP) Market include companies like DHL, FedEx, and J&T Express. These companies compete on service speed, reliability, and coverage, among others.

What are the growth factors driving the ASEAN Courier, Express, and Parcel (CEP) Market?

The ASEAN Courier, Express, and Parcel (CEP) Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and the expansion of logistics infrastructure. Additionally, the growing trend of online shopping significantly boosts parcel volumes.

What challenges does the ASEAN Courier, Express, and Parcel (CEP) Market face?

The ASEAN Courier, Express, and Parcel (CEP) Market faces challenges such as regulatory hurdles, high operational costs, and competition from local delivery services. These factors can impact service efficiency and profitability.

What opportunities exist in the ASEAN Courier, Express, and Parcel (CEP) Market?

Opportunities in the ASEAN Courier, Express, and Parcel (CEP) Market include the potential for technological advancements in logistics, the growth of cross-border e-commerce, and the increasing demand for sustainable delivery solutions. Companies can leverage these trends to enhance their service offerings.

What trends are shaping the ASEAN Courier, Express, and Parcel (CEP) Market?

Trends shaping the ASEAN Courier, Express, and Parcel (CEP) Market include the adoption of automation and AI in logistics, the rise of same-day delivery services, and a focus on sustainability. These trends are influencing how companies operate and meet customer expectations.

ASEAN Courier, Express, and Parcel (CEP) Market

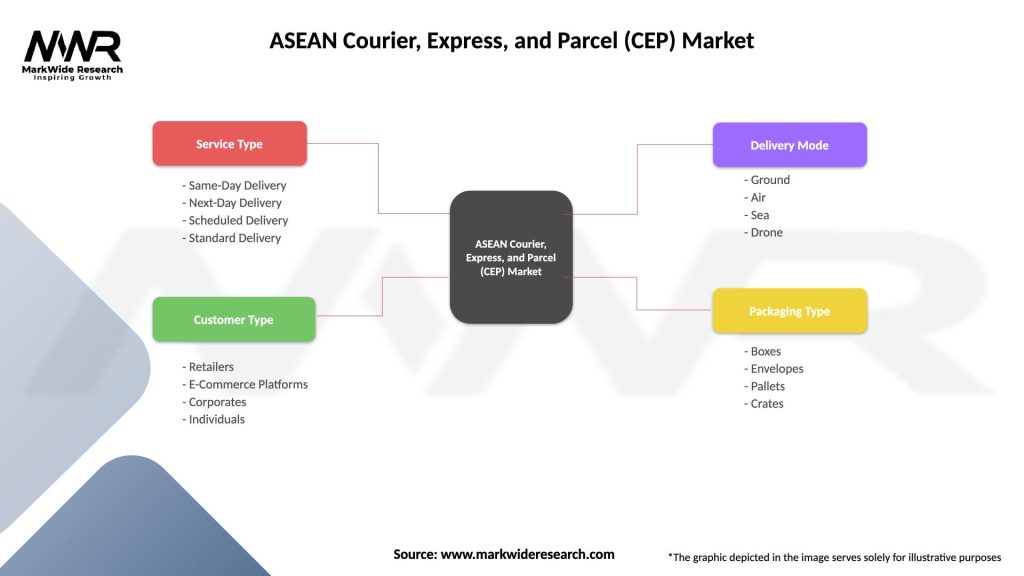

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, Standard Delivery |

| Customer Type | Retailers, E-Commerce Platforms, Corporates, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxes, Envelopes, Pallets, Crates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the ASEAN Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at