444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore data center storage market represents a critical component of the nation’s digital infrastructure ecosystem, serving as the backbone for the country’s ambitious Smart Nation initiative and regional digital transformation efforts. Singapore’s strategic position as a Southeast Asian technology hub has attracted significant investments in data center infrastructure, with storage solutions playing an increasingly vital role in supporting cloud computing, artificial intelligence, and big data analytics applications.

Market dynamics indicate robust growth driven by the proliferation of digital services, increasing data generation, and the government’s commitment to establishing Singapore as a leading digital economy. The market encompasses various storage technologies including solid-state drives, hard disk drives, hybrid storage systems, and emerging technologies such as storage-class memory and software-defined storage solutions.

Growth projections suggest the market is expanding at a compound annual growth rate of 12.8%, fueled by enterprise digital transformation initiatives, cloud adoption, and the increasing demand for edge computing capabilities. The market’s evolution reflects Singapore’s position as a preferred destination for multinational corporations seeking reliable, secure, and scalable data storage infrastructure in the Asia-Pacific region.

The Singapore data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services deployed within data center facilities across Singapore to store, manage, and retrieve digital information for various applications and end-users. This market encompasses traditional storage arrays, modern flash-based systems, cloud storage infrastructure, and emerging technologies designed to meet the evolving demands of digital businesses and government initiatives.

Storage infrastructure in Singapore’s data centers includes primary storage for active workloads, secondary storage for backup and archival purposes, and specialized storage solutions for high-performance computing applications. The market serves diverse sectors including financial services, healthcare, manufacturing, telecommunications, and government agencies, each with unique storage requirements and compliance considerations.

Singapore’s data center storage market demonstrates exceptional resilience and growth potential, driven by the nation’s strategic focus on digital innovation and its role as a regional technology hub. The market benefits from strong government support, robust telecommunications infrastructure, and favorable business policies that attract international investments in data center facilities.

Key market characteristics include the dominance of enterprise-grade storage solutions, increasing adoption of flash-based technologies, and growing demand for hybrid cloud storage architectures. The market serves both local enterprises and regional subsidiaries of multinational corporations, creating a diverse customer base with varying storage requirements and budget considerations.

Technology trends shaping the market include the transition from traditional spinning disk storage to solid-state drives, the integration of artificial intelligence in storage management, and the emergence of software-defined storage solutions that provide greater flexibility and cost efficiency. Market participants are increasingly focusing on sustainability initiatives, with energy-efficient storage systems gaining traction among environmentally conscious organizations.

Strategic insights reveal several critical factors driving market evolution and competitive dynamics within Singapore’s data center storage landscape:

Digital transformation initiatives across Singapore’s economy serve as the primary catalyst for data center storage market expansion. Organizations are modernizing their IT infrastructure to support digital services, requiring scalable and reliable storage solutions that can accommodate growing data volumes and performance requirements.

Government support through various initiatives including the Digital Economy Framework and Infocomm Media Development Authority programs creates favorable conditions for storage technology adoption. These initiatives provide funding, regulatory clarity, and strategic direction that encourage both local and international investments in advanced storage infrastructure.

Cloud computing adoption continues to accelerate across all sectors, with organizations seeking hybrid and multi-cloud storage architectures that provide flexibility, scalability, and cost optimization. This trend drives demand for storage solutions that can seamlessly integrate with public cloud services while maintaining on-premises capabilities for sensitive workloads.

Data generation growth from Internet of Things devices, mobile applications, and digital services creates unprecedented storage requirements. Organizations must invest in high-capacity, high-performance storage systems to manage the exponential increase in structured and unstructured data across their operations.

High implementation costs associated with enterprise-grade storage infrastructure present significant barriers for small and medium-sized enterprises. The substantial capital investment required for modern storage systems, including hardware, software licenses, and professional services, can strain organizational budgets and delay adoption decisions.

Skills shortage in storage administration and management creates operational challenges for organizations seeking to deploy and maintain advanced storage systems. The complexity of modern storage architectures requires specialized expertise that is often scarce and expensive in Singapore’s competitive technology job market.

Regulatory complexity surrounding data protection, privacy, and cross-border data transfer creates compliance challenges that can complicate storage architecture decisions. Organizations must navigate multiple regulatory frameworks while ensuring their storage solutions meet all applicable requirements without compromising performance or functionality.

Technology obsolescence risks associated with rapid innovation cycles in storage technology create concerns about investment longevity. Organizations must carefully balance the benefits of cutting-edge storage solutions with the risk of premature obsolescence and the need for frequent technology refreshes.

Artificial intelligence integration presents significant opportunities for storage vendors to differentiate their offerings through intelligent data management, predictive analytics, and automated optimization capabilities. AI-powered storage systems can provide superior performance, efficiency, and reliability compared to traditional solutions.

Edge computing expansion creates new market segments for distributed storage solutions that can support low-latency applications and local data processing requirements. This trend opens opportunities for specialized storage products designed for edge environments with unique constraints and requirements.

Sustainability initiatives drive demand for energy-efficient storage solutions that can help organizations meet environmental goals while reducing operational costs. Vendors focusing on green storage technologies can capture market share from environmentally conscious customers seeking to reduce their carbon footprint.

Industry 4.0 adoption in manufacturing and logistics sectors creates opportunities for storage solutions optimized for industrial IoT applications, real-time analytics, and automated decision-making systems. These specialized use cases require storage architectures with unique performance and reliability characteristics.

Competitive intensity within Singapore’s data center storage market continues to increase as both established vendors and emerging players compete for market share. This competition drives innovation, improves product offerings, and creates favorable pricing conditions for customers seeking advanced storage solutions.

Technology convergence between storage, compute, and networking infrastructure creates opportunities for integrated solutions that simplify deployment and management while improving overall system performance. Hyper-converged infrastructure and composable systems represent key trends in this convergence.

Customer expectations continue to evolve toward solutions that provide greater automation, intelligence, and self-service capabilities. Organizations seek storage systems that can adapt to changing requirements without extensive manual intervention or specialized expertise.

Partnership ecosystems between storage vendors, system integrators, and cloud service providers create new go-to-market strategies and solution architectures. These collaborations enable more comprehensive offerings that address complex customer requirements across multiple technology domains.

Primary research conducted for this analysis included comprehensive interviews with key stakeholders across Singapore’s data center storage ecosystem, including storage vendors, system integrators, end-user organizations, and industry experts. These interviews provided insights into market trends, competitive dynamics, and future growth prospects.

Secondary research encompassed analysis of industry reports, government publications, vendor announcements, and market data from multiple sources to validate primary findings and provide comprehensive market coverage. This research approach ensured accuracy and completeness of market insights and projections.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key respondents, and applying statistical analysis techniques to ensure data reliability and consistency. The methodology emphasized qualitative insights while incorporating quantitative metrics where appropriate.

Market segmentation analysis utilized both top-down and bottom-up approaches to accurately assess market size, growth rates, and competitive positioning across different storage technologies, deployment models, and end-user segments within Singapore’s data center storage market.

Singapore’s geographic position as a strategic hub between major Asian markets creates unique advantages for data center storage infrastructure. The country’s excellent connectivity, stable political environment, and advanced telecommunications infrastructure make it an ideal location for regional data center operations serving multiple markets.

Central Business District continues to host the majority of enterprise data centers, with approximately 45% of storage capacity concentrated in this area. However, new developments in suburban areas are gaining traction due to lower costs and greater expansion opportunities for large-scale storage deployments.

Jurong Innovation District emerges as a significant growth area for data center storage infrastructure, particularly for organizations focused on research and development activities. This region benefits from government incentives and proximity to academic institutions, creating a favorable environment for innovative storage technology deployments.

Cross-border connectivity through submarine cables and terrestrial networks positions Singapore as a critical data hub for the broader Southeast Asian region. This connectivity advantage drives demand for storage infrastructure that can support regional data distribution and backup operations across multiple countries.

Market leadership in Singapore’s data center storage sector is characterized by a mix of global technology giants and specialized storage vendors, each offering distinct value propositions and targeting different market segments:

Technology segmentation reveals distinct market dynamics across different storage architectures and deployment models within Singapore’s data center storage market:

By Storage Type:

By Deployment Model:

Enterprise storage systems represent the largest market category, driven by large organizations requiring high-performance, reliable storage infrastructure for mission-critical applications. This segment emphasizes features such as data protection, disaster recovery, and compliance capabilities that support business continuity requirements.

Cloud storage infrastructure experiences the highest growth rates as organizations adopt cloud-first strategies and seek to leverage the scalability and cost benefits of cloud-based storage services. This category includes both public cloud storage and private cloud infrastructure deployed within enterprise data centers.

Backup and archival storage maintains steady demand as organizations implement comprehensive data protection strategies to safeguard against cyber threats, natural disasters, and human errors. Modern backup solutions increasingly incorporate cloud integration and intelligent data management capabilities.

High-performance storage serves specialized applications requiring ultra-low latency and high throughput, including financial trading systems, scientific computing, and real-time analytics platforms. This category commands premium pricing due to its specialized nature and performance requirements.

Storage vendors benefit from Singapore’s position as a regional technology hub, providing access to diverse customer segments and opportunities for innovation partnerships with local and international organizations. The market’s sophistication enables vendors to showcase advanced technologies and develop reference implementations for broader regional deployment.

System integrators gain opportunities to provide comprehensive storage solutions that combine multiple technologies and vendors into cohesive architectures. Singapore’s complex regulatory environment and diverse industry requirements create demand for specialized integration expertise and ongoing support services.

End-user organizations benefit from access to cutting-edge storage technologies, competitive pricing due to market competition, and comprehensive support ecosystems. Singapore’s advanced infrastructure and skilled workforce enable organizations to implement sophisticated storage architectures that support their digital transformation objectives.

Government agencies leverage advanced storage infrastructure to support Smart Nation initiatives, improve citizen services, and enhance operational efficiency. The availability of secure, compliant storage solutions enables government organizations to modernize their IT infrastructure while meeting strict security and privacy requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flash storage adoption continues to accelerate across all market segments, with organizations recognizing the performance, reliability, and total cost of ownership benefits of solid-state storage technologies. This trend is particularly pronounced in applications requiring high IOPS and low latency performance characteristics.

Software-defined storage gains momentum as organizations seek greater flexibility, vendor independence, and cost optimization in their storage architectures. This approach enables organizations to leverage commodity hardware while maintaining enterprise-grade features and capabilities through software innovation.

Artificial intelligence integration transforms storage management through predictive analytics, automated optimization, and intelligent data placement. AI-powered storage systems can anticipate performance bottlenecks, optimize resource utilization, and reduce administrative overhead while improving overall system reliability.

Sustainability initiatives drive adoption of energy-efficient storage technologies and practices, with organizations seeking to reduce their environmental impact while controlling operational costs. Green storage solutions that minimize power consumption and cooling requirements gain competitive advantages in environmentally conscious market segments.

Strategic partnerships between storage vendors and cloud service providers create new hybrid storage offerings that combine on-premises performance with cloud scalability. These collaborations enable seamless data mobility and provide customers with flexible deployment options that adapt to changing business requirements.

Technology innovations in storage-class memory and persistent memory technologies promise to bridge the gap between traditional storage and system memory, enabling new application architectures and performance capabilities. Early adopters in Singapore are exploring these technologies for high-performance computing and real-time analytics applications.

Regulatory developments including updated data protection laws and cross-border data transfer regulations influence storage architecture decisions and vendor selection criteria. Organizations must ensure their storage solutions comply with evolving regulatory requirements while maintaining operational flexibility and performance.

Investment announcements from major technology companies indicate continued confidence in Singapore’s data center storage market, with several vendors establishing regional headquarters and research facilities to better serve the growing market demand and develop localized solutions.

MarkWide Research analysis suggests that organizations should prioritize storage solutions that provide flexibility, scalability, and integration capabilities to support evolving business requirements. The rapid pace of digital transformation requires storage architectures that can adapt to changing workloads and performance demands without requiring complete infrastructure replacement.

Investment strategies should focus on technologies that demonstrate clear return on investment through improved performance, reduced operational costs, or enhanced business capabilities. Organizations should evaluate storage solutions based on total cost of ownership rather than initial acquisition costs, considering factors such as energy consumption, management overhead, and scalability requirements.

Vendor selection criteria should emphasize long-term viability, innovation capabilities, and local support presence to ensure successful storage deployments and ongoing optimization. Organizations should seek vendors that demonstrate commitment to the Singapore market through local partnerships, support infrastructure, and technology development initiatives.

Risk mitigation strategies should include comprehensive data protection, disaster recovery planning, and cybersecurity measures to protect against various threats and ensure business continuity. Storage architectures should incorporate multiple layers of protection and provide rapid recovery capabilities to minimize the impact of potential disruptions.

Market evolution over the next five years will be characterized by continued growth in flash storage adoption, increasing integration of artificial intelligence capabilities, and greater emphasis on sustainability and energy efficiency. MWR projections indicate that the market will maintain robust growth rates while evolving toward more intelligent, automated storage solutions.

Technology advancement will focus on improving storage density, reducing latency, and enhancing data management capabilities through software innovation. Emerging technologies such as computational storage and DNA-based storage may begin to find practical applications in specialized use cases, though traditional storage technologies will continue to dominate mainstream deployments.

Market consolidation may occur as smaller vendors struggle to compete with the scale and resources of larger players, while successful niche vendors may become acquisition targets for companies seeking to expand their technology portfolios. This consolidation could lead to more comprehensive storage solutions but may reduce customer choice in some market segments.

Regional expansion opportunities will continue to drive growth as Singapore-based storage infrastructure serves broader Southeast Asian markets. The development of submarine cable networks and regional data center partnerships will enhance Singapore’s position as a critical storage hub for the Asia-Pacific region.

Singapore’s data center storage market demonstrates exceptional growth potential driven by digital transformation initiatives, government support, and the country’s strategic position as a regional technology hub. The market benefits from strong fundamentals including advanced infrastructure, skilled workforce, and favorable business environment that attract both local and international investments in storage technology.

Market dynamics indicate continued evolution toward more intelligent, efficient, and sustainable storage solutions that can support the growing demands of digital businesses and government initiatives. Organizations that invest in modern storage architectures will be better positioned to capitalize on emerging opportunities in artificial intelligence, edge computing, and data analytics applications.

Success factors for market participants include focusing on customer value creation, maintaining technology leadership, and building strong local partnerships that enable effective market penetration and customer support. The market rewards vendors that can demonstrate clear business benefits and provide comprehensive solutions that address complex customer requirements across multiple technology domains.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store and manage data in data centers. This includes various storage solutions such as cloud storage, on-premises storage, and hybrid models that cater to the needs of businesses and organizations.

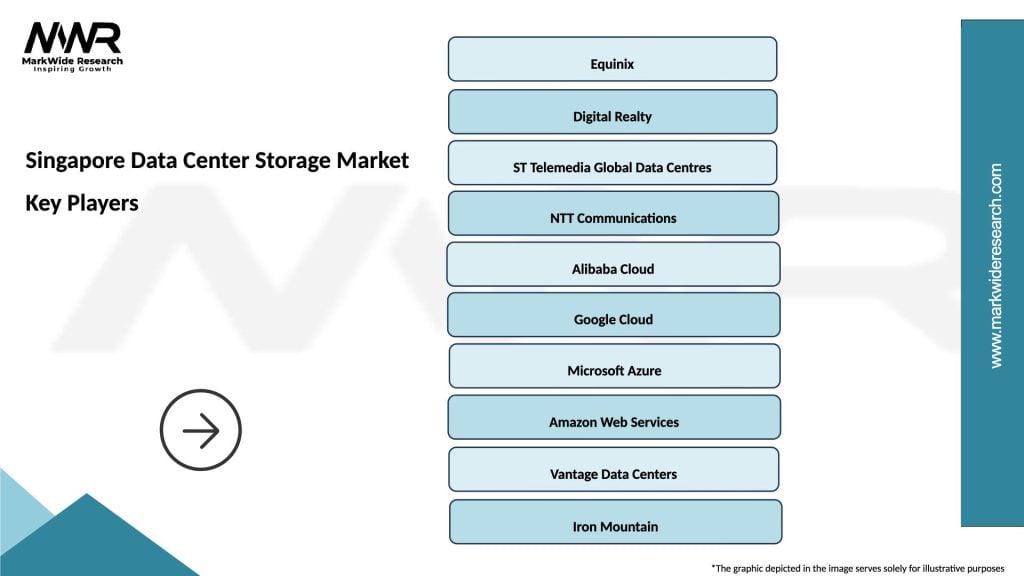

What are the key players in the Singapore Data Center Storage Market?

Key players in the Singapore Data Center Storage Market include companies like ST Telemedia, Digital Realty, and Equinix, which provide a range of storage solutions and services to meet the growing demand for data management and storage infrastructure, among others.

What are the growth factors driving the Singapore Data Center Storage Market?

The growth of the Singapore Data Center Storage Market is driven by the increasing demand for cloud computing, the rise of big data analytics, and the need for enhanced data security and compliance. Additionally, the expansion of digital services and e-commerce is contributing to this growth.

What challenges does the Singapore Data Center Storage Market face?

The Singapore Data Center Storage Market faces challenges such as high operational costs, the complexity of data management, and the need for continuous technological upgrades. Additionally, regulatory compliance and data privacy concerns pose significant challenges for service providers.

What opportunities exist in the Singapore Data Center Storage Market?

Opportunities in the Singapore Data Center Storage Market include the growing adoption of artificial intelligence and machine learning for data management, the expansion of edge computing, and the increasing demand for sustainable storage solutions. These trends are likely to shape the future landscape of data storage.

What trends are shaping the Singapore Data Center Storage Market?

Trends shaping the Singapore Data Center Storage Market include the shift towards hybrid cloud solutions, the integration of advanced technologies like NVMe and SSDs, and a focus on energy-efficient storage systems. These trends reflect the evolving needs of businesses for faster and more reliable data access.

Singapore Data Center Storage Market

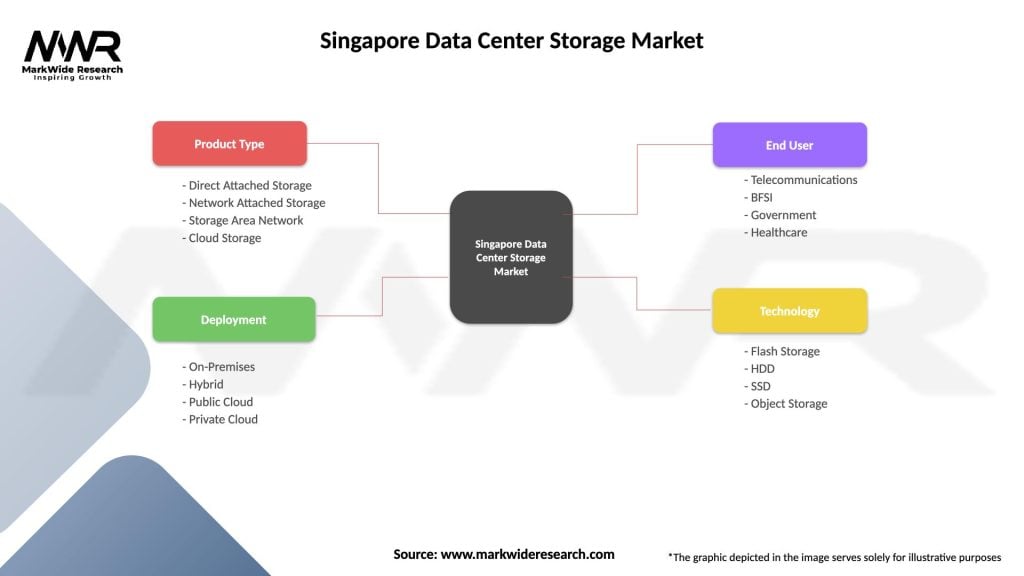

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Deployment | On-Premises, Hybrid, Public Cloud, Private Cloud |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Technology | Flash Storage, HDD, SSD, Object Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at