444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Dominican Republic construction market represents one of the most dynamic and rapidly evolving sectors in the Caribbean region, driven by robust economic growth, increasing urbanization, and substantial foreign investment. This comprehensive market encompasses residential, commercial, industrial, and infrastructure development projects that are transforming the nation’s landscape and economic prospects.

Market dynamics indicate that the construction sector has experienced remarkable expansion, with the industry contributing significantly to the country’s GDP growth. The market is characterized by a diverse range of projects, from luxury resort developments along the coastline to affordable housing initiatives in urban centers, reflecting the varied demands of both domestic and international stakeholders.

Key growth drivers include the government’s ambitious infrastructure modernization programs, increasing tourism investments, and the rising demand for residential properties driven by population growth and urbanization trends. The construction market has demonstrated resilience and adaptability, with industry participants leveraging modern construction technologies and sustainable building practices to meet evolving market demands.

Regional positioning places the Dominican Republic as a leading construction market in the Caribbean, attracting significant foreign direct investment from North American and European developers. The market benefits from strategic geographic location, favorable investment climate, and government policies that support construction and real estate development activities.

The Dominican Republic construction market refers to the comprehensive ecosystem of building and infrastructure development activities within the Dominican Republic, encompassing residential, commercial, industrial, and public infrastructure projects. This market includes all phases of construction from planning and design to completion and maintenance, involving various stakeholders including developers, contractors, suppliers, and government entities.

Market scope extends beyond traditional building construction to include specialized segments such as tourism infrastructure, renewable energy projects, transportation networks, and urban development initiatives. The construction market serves as a critical economic driver, creating employment opportunities, stimulating related industries, and contributing to the country’s overall economic development and modernization efforts.

Industry definition encompasses both private and public sector construction activities, including new construction, renovation, and infrastructure maintenance projects. The market operates within a regulatory framework established by Dominican authorities, ensuring compliance with building codes, environmental standards, and safety requirements while promoting sustainable development practices.

Market performance in the Dominican Republic construction sector has demonstrated exceptional growth momentum, supported by favorable economic conditions, strategic government investments, and increasing private sector participation. The industry has successfully navigated various challenges while maintaining steady expansion across multiple construction segments.

Strategic developments include significant infrastructure modernization projects, expansion of tourism-related construction, and growing emphasis on sustainable building practices. The market has attracted substantial international investment, particularly in luxury residential developments, resort properties, and commercial real estate projects that cater to both domestic and international markets.

Growth trajectory analysis reveals strong fundamentals supporting continued market expansion, with residential construction showing particularly robust demand driven by urbanization trends and rising disposable incomes. Commercial construction has benefited from increased business activity and foreign investment, while infrastructure development remains a government priority with substantial budget allocations.

Competitive landscape features a mix of domestic and international construction companies, with increasing collaboration between local firms and foreign developers. The market has witnessed consolidation trends as companies seek to enhance capabilities and expand market reach through strategic partnerships and acquisitions.

The Dominican Republic construction market demonstrates robust growth momentum driven by expanding tourism infrastructure, residential development demand, and government investment in transportation and energy projects across this Caribbean nation. Market analysis reveals that construction activity has become a cornerstone of economic development, with the sector contributing significantly to GDP growth, employment generation, and foreign direct investment attraction while transforming the country’s physical infrastructure and urban landscapes.

Tourism infrastructure dominance indicates sustained investment in hotel resorts, vacation properties, and entertainment facilities that capitalize on the Dominican Republic’s position as a leading Caribbean tourist destination. The market experiences particularly strong demand for luxury hospitality projects along coastal regions including Punta Cana, Puerto Plata, and Santo Domingo, with international hotel chains and resort developers driving substantial construction volume and introducing world-class building standards to local markets.

Key market insights include:

Project type diversification shows expanding activity beyond traditional tourism and residential construction to include commercial centers, industrial facilities, and specialized infrastructure such as logistics parks and renewable energy installations. The development of mixed-use projects combining residential, retail, and entertainment components has created integrated urban developments that address diverse market needs while optimizing land utilization.

Geographic expansion patterns reveal construction activity spreading from established coastal tourist zones to secondary cities and inland regions benefiting from improved transportation connectivity and economic development initiatives. The emergence of regional growth centers including Santiago, La Romana, and Samaná has diversified market opportunities while reducing concentration risks associated with single-market dependence.

Technology adoption trends indicate gradual integration of modern construction methods including prefabrication, building information modeling, and project management software among larger contractors and international developers. The implementation of quality control systems and international building standards has improved construction quality while addressing concerns about structural integrity and disaster resilience.

Sustainability considerations show increasing emphasis on energy-efficient designs, green building certifications, and climate-resilient construction techniques particularly in high-value tourism and commercial projects. The growing awareness of environmental standards and sustainable development practices has created opportunities for specialized contractors and material suppliers offering eco-friendly construction solutions.

Financing landscape evolution demonstrates improving access to construction financing through both domestic banking systems and international development institutions supporting infrastructure modernization. The availability of project financing options including public-private partnerships and foreign direct investment has enabled larger-scale developments while stimulating market professionalization and transparency.

Regulatory environment challenges include inconsistent enforcement of building codes, complex permitting processes, and bureaucratic delays that impact project timelines and costs. The ongoing efforts toward regulatory modernization and streamlined approval processes aim to improve business climate while ensuring adequate safety and quality standards.

Market competition dynamics reveal a fragmented landscape with numerous small local contractors coexisting with established regional firms and international construction companies. The emphasis on technical capability differentiation and proven track records has become essential for securing major projects as clients increasingly prioritize quality, reliability, and timely delivery over lowest-cost bidding across the Dominican Republic’s dynamic construction market landscape.

Economic growth serves as the fundamental driver of construction market expansion, with sustained GDP growth creating favorable conditions for both private and public construction investments. Rising disposable incomes and improved living standards have increased demand for quality housing and commercial facilities across urban and suburban areas.

Tourism industry expansion continues to drive significant construction activity, with new resort developments, hotel projects, and tourism infrastructure creating substantial demand for construction services. The government’s tourism promotion strategies have attracted international hotel chains and resort developers, generating large-scale construction projects along the coastline.

Urbanization trends represent a major market driver, with increasing rural-to-urban migration creating demand for residential housing, commercial facilities, and urban infrastructure. Cities are expanding rapidly, requiring new construction to accommodate growing populations and support economic activities in urban centers.

Government infrastructure initiatives provide substantial market opportunities through public works projects, transportation infrastructure development, and utility system improvements. Major infrastructure programs include highway construction, port modernization, airport expansion, and renewable energy projects that require significant construction resources and expertise.

Foreign investment flows have accelerated construction market growth, with international developers and investors recognizing the Dominican Republic’s potential for real estate development and infrastructure projects. Investment incentives and favorable regulatory conditions have attracted substantial foreign capital to the construction sector.

Material cost volatility presents ongoing challenges for construction companies, with fluctuating prices for steel, cement, and other essential building materials affecting project profitability and planning. Global supply chain disruptions and commodity price variations create uncertainty in project cost estimation and budget management.

Skilled labor shortages constrain market growth potential, with increasing demand for qualified construction workers, engineers, and project managers exceeding available supply. The industry faces challenges in workforce development and training programs needed to support expanding construction activities across various market segments.

Regulatory complexity can slow project development and increase costs, with multiple approval processes, environmental assessments, and compliance requirements creating delays in construction project initiation. Bureaucratic procedures and permitting challenges sometimes discourage investment and delay project timelines.

Environmental concerns and sustainability requirements add complexity and costs to construction projects, requiring companies to implement environmental management systems and sustainable building practices. Climate change considerations and natural disaster risks influence construction standards and increase project costs.

Financing constraints affect some market segments, particularly smaller developers and contractors who may face difficulties accessing capital for project development. Interest rate fluctuations and credit availability can impact construction project feasibility and market participation levels.

Sustainable construction presents significant growth opportunities as environmental awareness increases and green building standards become more prevalent. Companies specializing in eco-friendly construction materials, energy-efficient building systems, and sustainable development practices can capture growing market demand for environmentally responsible construction.

Affordable housing development offers substantial market potential, with government programs and private initiatives addressing housing shortages in urban areas. Public-private partnerships and innovative financing mechanisms create opportunities for developers to participate in affordable housing projects while generating reasonable returns.

Infrastructure modernization provides extensive opportunities for construction companies with expertise in transportation, utilities, and public facilities development. Government infrastructure investment programs and international development funding create substantial project pipelines for qualified contractors and engineering firms.

Tourism infrastructure expansion continues to offer lucrative opportunities, with new destination development, resort expansion, and hospitality facility construction driven by growing international tourism. Specialized construction companies can benefit from the premium pricing and scale of tourism-related projects.

Technology integration creates opportunities for companies that adopt advanced construction technologies, including Building Information Modeling (BIM), prefabrication techniques, and smart building systems. Early adopters of construction technology can gain competitive advantages and access higher-value project opportunities.

Supply and demand balance in the Dominican Republic construction market reflects strong underlying demand across multiple segments, with supply capacity gradually expanding to meet growing market requirements. Construction companies have increased capacity through equipment investments, workforce expansion, and strategic partnerships to capture market opportunities.

Competitive intensity has increased as more companies enter the market, leading to innovation in construction methods, project delivery approaches, and customer service standards. Market participants are differentiating through specialization, quality improvements, and value-added services to maintain competitive positioning.

Price dynamics reflect material cost pressures, labor market conditions, and competitive factors that influence construction pricing across different market segments. Premium segments command higher prices due to quality requirements and specialized expertise, while commodity construction faces price pressure from competition.

Market consolidation trends are emerging as larger companies acquire smaller firms to expand capabilities, geographic coverage, and market share. Strategic alliances and joint ventures have become common as companies seek to combine resources and expertise for large-scale projects.

Innovation drivers include customer demands for higher quality, faster delivery, and sustainable construction practices that encourage companies to adopt new technologies and improve operational efficiency. Market leaders are investing in research and development to maintain competitive advantages and meet evolving market requirements.

Data collection approach for analyzing the Dominican Republic construction market involved comprehensive primary and secondary research methodologies, including industry surveys, stakeholder interviews, and analysis of government statistics and industry reports. MarkWide Research employed rigorous data validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities included structured interviews with construction company executives, government officials, real estate developers, and industry experts to gather firsthand insights into market conditions, trends, and future prospects. Survey methodologies captured quantitative data on market size, growth rates, and competitive dynamics across different construction segments.

Secondary research sources encompassed government construction statistics, industry association reports, academic studies, and international development organization publications that provide comprehensive market context and historical trend analysis. Data triangulation techniques ensured consistency and accuracy across multiple information sources.

Analytical framework utilized advanced statistical methods and market modeling techniques to analyze construction market dynamics, forecast future growth trends, and identify key success factors for market participants. Scenario analysis and sensitivity testing validated research findings and projections under different market conditions.

Quality assurance measures included peer review processes, expert validation, and cross-referencing of data sources to maintain research integrity and provide reliable market intelligence for industry stakeholders and decision-makers.

Santo Domingo metropolitan area represents the largest construction market segment, accounting for approximately 45% of total construction activity due to its role as the economic and political center of the Dominican Republic. The capital region attracts substantial commercial development, residential projects, and infrastructure investments that drive market growth and development.

Northern coast regions, including Puerto Plata and Santiago, contribute significantly to construction market activity with approximately 25% market share, driven primarily by tourism development and agricultural processing facilities. These areas benefit from coastal location advantages and government development incentives that encourage construction investment.

Eastern provinces, particularly Punta Cana and La Romana, represent high-growth construction markets focused on luxury tourism development and resort construction. This region has experienced rapid expansion in hospitality infrastructure and residential developments catering to international buyers and tourists.

Southern regions show emerging construction opportunities, with increasing industrial development and infrastructure projects supporting economic diversification efforts. Government initiatives to promote balanced regional development have increased construction activity in previously underserved areas.

Western border areas present unique construction challenges and opportunities related to cross-border trade infrastructure and agricultural processing facilities. These regions require specialized construction approaches due to geographic and logistical considerations.

Market leadership in the Dominican Republic construction sector is shared among several major domestic and international companies that have established strong market positions through project excellence, financial capacity, and strategic partnerships. The competitive environment encourages innovation and quality improvements across the industry.

Key market participants include:

Competitive strategies focus on project quality, delivery speed, cost competitiveness, and specialized expertise in particular construction segments. Companies are investing in technology adoption, workforce development, and strategic partnerships to enhance competitive positioning and market share.

Market entry barriers include capital requirements, regulatory compliance, local market knowledge, and established relationships with suppliers and subcontractors. New entrants often partner with established local companies to overcome these barriers and access market opportunities.

By Construction Type:

By End User:

By Project Size:

Residential Construction Segment: This category dominates market activity with approximately 40% of total construction volume, driven by urbanization trends, population growth, and rising disposable incomes. The segment includes luxury developments for international buyers, middle-income housing for the growing middle class, and affordable housing initiatives supported by government programs.

Commercial Construction Segment: Representing significant market share, commercial construction benefits from economic growth, business expansion, and foreign investment in retail and office facilities. Shopping centers, office complexes, and mixed-use developments are particularly active, supported by increasing consumer spending and business activity.

Tourism Infrastructure Segment: This specialized category commands premium pricing and attracts substantial international investment, with resort developments, hotel construction, and tourism support facilities driving significant construction activity. The segment benefits from government tourism promotion policies and increasing international visitor arrivals.

Infrastructure Construction Segment: Government-funded infrastructure projects provide stable demand for construction services, including transportation networks, utility systems, and public facilities. This segment offers long-term contracts and steady revenue streams for qualified contractors with appropriate capabilities and experience.

Industrial Construction Segment: Growing industrial diversification efforts create opportunities for specialized construction companies with expertise in manufacturing facilities, processing plants, and logistics infrastructure. This segment requires technical expertise and compliance with industrial standards and regulations.

Construction Companies benefit from diverse market opportunities, stable demand growth, and favorable business environment that supports profitable operations and business expansion. The market offers opportunities for specialization, technology adoption, and strategic partnerships that enhance competitive positioning and financial performance.

Real Estate Developers gain access to growing market demand, favorable investment climate, and government support for development projects. The market provides opportunities for both domestic and international developers to participate in various construction segments with attractive return potential.

Material Suppliers benefit from sustained construction activity that creates steady demand for building materials, equipment, and supplies. Local suppliers can develop long-term relationships with construction companies while international suppliers can access growing market opportunities.

Financial Institutions find opportunities to provide construction financing, project loans, and real estate mortgages in a growing market with improving economic fundamentals. The construction sector offers diversified lending opportunities across different project types and customer segments.

Government Entities benefit from construction sector growth through tax revenues, employment creation, and economic development that supports broader policy objectives. Infrastructure development improves public services and supports long-term economic competitiveness.

Local Communities gain from construction activity through job creation, improved infrastructure, and enhanced living standards that result from residential, commercial, and public construction projects. Construction development contributes to community growth and modernization efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Construction Practices are gaining momentum as environmental awareness increases and green building standards become more prevalent. Construction companies are adopting eco-friendly materials, energy-efficient building systems, and sustainable development practices to meet growing market demand for environmentally responsible construction projects.

Technology Integration is transforming construction processes through Building Information Modeling (BIM), project management software, and digital collaboration tools that improve efficiency and quality. Advanced construction technologies are enabling better project planning, cost control, and delivery timelines across various construction segments.

Prefabrication and Modular Construction techniques are becoming more popular as companies seek to reduce construction time, improve quality control, and manage labor shortages. These methods offer cost advantages and faster project delivery while maintaining construction quality and safety standards.

Mixed-Use Development projects are increasingly common as developers seek to maximize land value and create integrated communities that combine residential, commercial, and recreational facilities. These developments appeal to modern lifestyle preferences and optimize infrastructure utilization.

Smart Building Systems are being incorporated into new construction projects, featuring automated building management, energy optimization, and connectivity features that appeal to modern tenants and buyers. Smart building technology enhances property value and operational efficiency.

Government Infrastructure Investment programs have launched major transportation and utility projects that create substantial opportunities for construction companies. Recent infrastructure initiatives include highway expansion, port modernization, and renewable energy projects that require significant construction resources and expertise.

International Hotel Chain Expansions have brought major resort and hotel construction projects to the Dominican Republic, with several global hospitality companies announcing new developments along the coastline. These projects represent substantial construction contracts and demonstrate international confidence in the market.

Affordable Housing Initiatives have been launched by government and private sector partnerships to address housing shortages in urban areas. These programs create opportunities for construction companies while supporting social development objectives and market growth.

Construction Technology Adoption has accelerated among leading construction companies, with investments in digital project management systems, advanced equipment, and sustainable construction practices. Technology adoption is improving project efficiency and competitive positioning for early adopters.

Foreign Investment Increases have been reported across multiple construction segments, with international developers and investors recognizing market opportunities in residential, commercial, and tourism-related construction projects. Foreign investment brings capital, expertise, and international standards to the market.

Strategic Focus Areas for construction companies should include technology adoption, workforce development, and sustainable construction practices that position companies for long-term success in evolving market conditions. MWR analysis indicates that companies investing in these areas are achieving superior performance and market positioning.

Market Entry Strategies for new participants should emphasize partnerships with established local companies, understanding of regulatory requirements, and focus on specific market segments where competitive advantages can be developed. Successful market entry requires careful planning and local market expertise.

Investment Priorities should include equipment modernization, workforce training programs, and technology systems that improve operational efficiency and project delivery capabilities. Companies that invest in operational improvements are better positioned to capture market opportunities and maintain profitability.

Risk Management strategies should address material cost volatility, natural disaster risks, and regulatory compliance requirements that can impact project success and profitability. Comprehensive risk management enables companies to navigate market challenges while pursuing growth opportunities.

Growth Opportunities exist in sustainable construction, affordable housing development, and specialized construction segments that serve growing market demands. Companies that identify and pursue these opportunities can achieve above-average growth and market positioning.

Market growth prospects for the Dominican Republic construction sector remain highly favorable, with sustained economic expansion, continued urbanization, and government infrastructure investments supporting long-term market development. Industry projections indicate continued growth across multiple construction segments with particularly strong performance expected in residential and tourism-related construction.

Technology transformation will continue reshaping the construction industry, with increased adoption of digital tools, sustainable building practices, and advanced construction methods that improve efficiency and quality. Companies that embrace technological innovation will gain competitive advantages and access to higher-value project opportunities.

Infrastructure development will remain a key market driver, with government commitments to transportation, utility, and public facility improvements creating substantial construction opportunities. International development funding and public-private partnerships will support major infrastructure projects over the coming years.

Sustainable development requirements will become increasingly important, with environmental regulations, green building standards, and climate change considerations influencing construction practices and project requirements. Companies that develop sustainable construction capabilities will be well-positioned for future market opportunities.

Regional expansion opportunities will emerge as economic development spreads beyond traditional construction centers, creating new markets for construction services and development projects. Balanced regional development policies will support construction activity in previously underserved areas.

The Dominican Republic construction market presents exceptional opportunities for growth and development, supported by strong economic fundamentals, favorable investment climate, and diverse market segments that offer multiple paths to success. Market participants who understand local conditions, embrace technological innovation, and focus on quality and sustainability will be well-positioned to capitalize on the substantial opportunities available in this dynamic market.

Strategic positioning in key market segments, combined with operational excellence and strong stakeholder relationships, will enable construction companies to achieve sustainable growth and profitability in the expanding Dominican Republic market. The construction sector’s continued evolution toward higher standards, greater efficiency, and environmental responsibility creates opportunities for companies that can adapt and innovate in response to changing market requirements.

Long-term success in the Dominican Republic construction market will depend on companies’ ability to navigate regulatory requirements, manage operational challenges, and deliver high-quality projects that meet evolving customer expectations. The market’s growth trajectory and development potential make it an attractive destination for both domestic and international construction companies seeking expansion opportunities in the Caribbean region.

What is Dominican Republic Construction?

Dominican Republic Construction refers to the processes, activities, and industries involved in building infrastructure, residential, and commercial properties within the Dominican Republic. This sector encompasses various segments such as residential construction, commercial development, and civil engineering projects.

What are the key players in the Dominican Republic Construction Market?

Key players in the Dominican Republic Construction Market include Grupo Estrella, Constructora Moya, and CEMEX Dominicana. These companies are involved in various construction projects ranging from residential buildings to large-scale infrastructure developments, among others.

What are the main drivers of growth in the Dominican Republic Construction Market?

The main drivers of growth in the Dominican Republic Construction Market include increasing urbanization, government investment in infrastructure, and a growing tourism sector. These factors contribute to a rising demand for residential and commercial properties.

What challenges does the Dominican Republic Construction Market face?

The Dominican Republic Construction Market faces challenges such as regulatory hurdles, fluctuating material costs, and labor shortages. These issues can impact project timelines and overall market stability.

What opportunities exist in the Dominican Republic Construction Market?

Opportunities in the Dominican Republic Construction Market include the potential for sustainable building practices, investment in green technologies, and the development of smart cities. These trends can lead to innovative construction methods and improved energy efficiency.

What trends are shaping the Dominican Republic Construction Market?

Trends shaping the Dominican Republic Construction Market include the adoption of modern construction technologies, increased focus on sustainability, and the rise of prefabricated building methods. These trends are influencing how projects are designed and executed.

Dominican Republic Construction Market

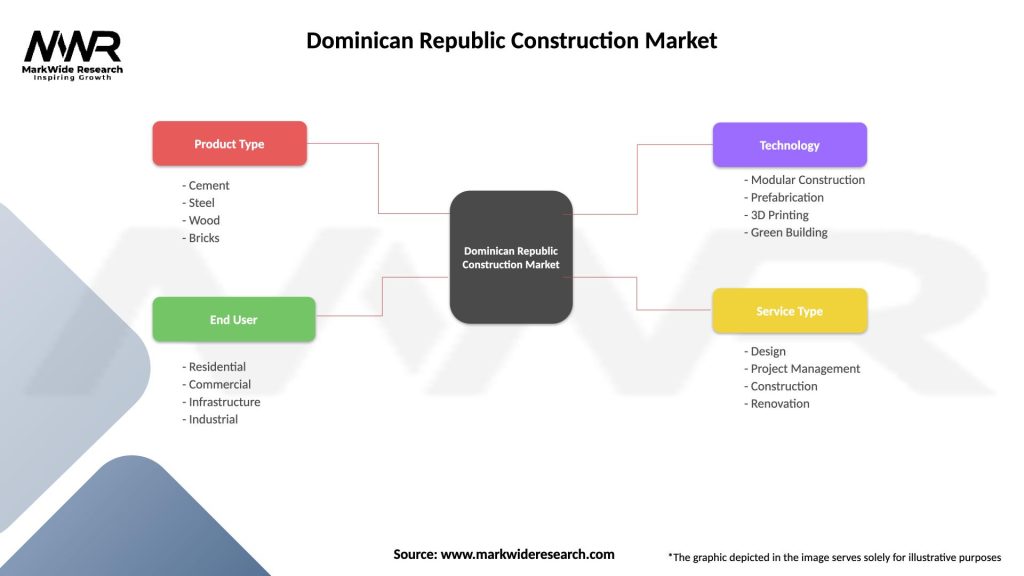

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Wood, Bricks |

| End User | Residential, Commercial, Infrastructure, Industrial |

| Technology | Modular Construction, Prefabrication, 3D Printing, Green Building |

| Service Type | Design, Project Management, Construction, Renovation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Dominican Republic Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at