444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico customs brokerage market represents a critical component of the country’s international trade infrastructure, facilitating the smooth flow of goods across borders while ensuring compliance with complex regulatory frameworks. As Mexico continues to strengthen its position as a major manufacturing hub and trading partner, particularly through agreements like the USMCA (United States-Mexico-Canada Agreement), the demand for professional customs brokerage services has experienced substantial growth.

Market dynamics indicate that the sector is experiencing robust expansion, driven by increasing trade volumes, evolving regulatory requirements, and the growing complexity of international commerce. The market encompasses a diverse range of service providers, from large multinational firms to specialized regional operators, all working to navigate the intricate landscape of Mexican customs regulations and international trade compliance.

Digital transformation has emerged as a key trend reshaping the customs brokerage landscape, with companies investing heavily in automated systems, artificial intelligence, and blockchain technologies to enhance efficiency and accuracy. This technological evolution is enabling customs brokers to process documentation faster, reduce errors, and provide real-time visibility to their clients. The market is currently experiencing a compound annual growth rate (CAGR) of approximately 6.8%, reflecting the strong underlying demand for professional customs services.

Geographic distribution of customs brokerage activities shows significant concentration along Mexico’s major trade corridors, particularly the northern border with the United States, key Pacific ports, and strategic inland manufacturing centers. The market serves diverse industries including automotive, electronics, textiles, agriculture, and energy, each with unique compliance requirements and operational challenges.

The Mexico customs brokerage market refers to the comprehensive ecosystem of licensed professionals and companies that provide specialized services to facilitate international trade through Mexican customs territories. These services encompass the preparation and submission of customs documentation, tariff classification, duty calculation, regulatory compliance verification, and coordination with government agencies to ensure smooth cargo clearance.

Customs brokers serve as intermediaries between importers, exporters, and Mexican customs authorities, leveraging their expertise in trade regulations, tariff schedules, and procedural requirements to minimize delays and ensure compliance. The market includes various service models, from traditional full-service brokerage to specialized consulting and technology-enabled solutions that cater to different client needs and transaction volumes.

Regulatory framework governing the market is established by Mexico’s Tax Administration Service (SAT) and other relevant authorities, requiring customs brokers to obtain specific licenses, maintain professional certifications, and adhere to strict operational standards. This regulatory structure ensures service quality while protecting the interests of both the government and trading parties.

Strategic positioning of Mexico as a key manufacturing and trade hub continues to drive substantial demand for professional customs brokerage services. The market benefits from the country’s extensive network of free trade agreements, robust manufacturing sector, and strategic geographic location connecting North and South American markets. Current market conditions reflect strong growth momentum, with trade facilitation initiatives and technological modernization creating new opportunities for service providers.

Key market drivers include increasing trade volumes, regulatory complexity, digital transformation requirements, and the growing emphasis on supply chain security and compliance. The market is characterized by intense competition among service providers, driving innovation in service delivery models and technology adoption. Nearshoring trends have particularly benefited the Mexican customs brokerage sector, as companies relocate manufacturing operations closer to North American markets.

Market segmentation reveals diverse service categories including import/export brokerage, customs consulting, trade compliance management, and specialized services for specific industries or cargo types. The competitive landscape features both established multinational firms and agile local operators, each leveraging different strategies to capture market share and serve client needs effectively.

Future outlook remains positive, with continued trade growth, technological advancement, and regulatory evolution expected to sustain market expansion. Industry participants are increasingly focusing on value-added services, digital capabilities, and strategic partnerships to differentiate their offerings and capture emerging opportunities in the evolving trade environment.

Market intelligence reveals several critical insights that define the current state and future trajectory of Mexico’s customs brokerage sector:

Trade volume expansion serves as the primary catalyst driving growth in Mexico’s customs brokerage market. The country’s strategic position in global supply chains, combined with favorable trade agreements and competitive manufacturing costs, continues to attract international businesses seeking efficient market access. This sustained trade growth creates consistent demand for professional customs services across all major industry sectors.

Regulatory complexity represents another significant driver, as evolving customs regulations, security requirements, and compliance standards necessitate specialized expertise. The implementation of new trade facilitation measures, anti-dumping regulations, and security protocols requires customs brokers to continuously update their knowledge and capabilities, creating barriers to entry and supporting premium pricing for experienced providers.

Digital transformation initiatives are reshaping client expectations and service delivery models throughout the market. Companies are increasingly demanding real-time visibility, automated processing, and integrated technology solutions that can seamlessly connect with their existing systems. This technological evolution is driving investment in new platforms and capabilities while creating opportunities for innovative service providers.

Nearshoring trends have emerged as a powerful market driver, with companies relocating manufacturing operations from Asia to Mexico to reduce supply chain risks and transportation costs. This geographic shift is generating substantial new business for customs brokers, particularly those with expertise in manufacturing supply chains and cross-border logistics coordination.

Supply chain security requirements continue to intensify, driven by government initiatives and corporate risk management strategies. Programs such as the Authorized Economic Operator (AEO) certification and various security frameworks require specialized knowledge and ongoing compliance support, creating additional revenue opportunities for qualified customs brokers.

Regulatory barriers pose significant challenges for new market entrants, as obtaining customs broker licenses requires extensive training, examination, and ongoing compliance with strict professional standards. These requirements limit the number of qualified practitioners and create capacity constraints during periods of rapid trade growth, potentially impacting service availability and pricing.

Technology investment costs represent a substantial financial burden for smaller customs brokerage firms, as clients increasingly demand sophisticated digital capabilities and integration options. The need for continuous system upgrades, cybersecurity measures, and staff training creates ongoing operational expenses that can strain resources and limit competitive positioning.

Talent shortage challenges affect the entire industry, as the specialized knowledge required for customs brokerage takes years to develop and the pool of qualified professionals remains limited. This constraint affects service capacity, increases labor costs, and can impact service quality during periods of high demand or staff turnover.

Economic volatility and trade policy uncertainty can significantly impact market conditions, as changes in trade relationships, tariff structures, or economic conditions directly affect trade volumes and client demand for customs services. These external factors create planning challenges and can lead to sudden shifts in market dynamics.

Competitive pressure from both traditional competitors and new technology-enabled entrants is intensifying margin pressure throughout the market. The commoditization of basic customs clearance services is forcing brokers to invest in value-added capabilities while maintaining competitive pricing, creating operational and financial challenges for many firms.

Digital service expansion presents significant opportunities for customs brokers to differentiate their offerings and capture additional value. The development of comprehensive digital platforms that integrate customs clearance with broader supply chain management capabilities can create new revenue streams and strengthen client relationships through enhanced service value.

Industry specialization offers pathways for customs brokers to develop niche expertise and command premium pricing in specific sectors. Areas such as pharmaceutical imports, automotive manufacturing, renewable energy equipment, and e-commerce fulfillment each present unique regulatory challenges and service requirements that specialized brokers can address effectively.

Cross-border e-commerce growth is creating substantial new opportunities as online retailers and marketplace operators require efficient customs processing for small shipments and consumer goods. This segment demands different service models and technology capabilities compared to traditional commercial trade, offering innovative brokers the chance to capture emerging market share.

Trade compliance consulting represents a growing opportunity as companies seek to optimize their trade operations, reduce costs, and ensure regulatory compliance. Customs brokers with strong analytical capabilities and industry expertise can expand beyond transactional services to provide strategic consulting and ongoing compliance support.

Regional expansion opportunities exist for successful customs brokers to extend their geographic coverage and serve clients across multiple Mexican trade corridors. The development of integrated service networks can provide competitive advantages and support client growth strategies while diversifying revenue sources.

Competitive dynamics within Mexico’s customs brokerage market reflect a complex interplay of traditional service providers, technology-enabled disruptors, and multinational firms seeking to capture market share. The market structure includes several distinct segments, each with different competitive characteristics and client requirements, creating opportunities for various business models and strategic approaches.

Technology adoption is fundamentally reshaping market dynamics, with leading firms leveraging automation, artificial intelligence, and data analytics to improve efficiency and service quality. According to MarkWide Research analysis, companies implementing advanced technology solutions are achieving operational efficiency improvements of 25-30% while reducing processing times and error rates.

Client expectations continue to evolve, with businesses demanding greater transparency, faster processing times, and integrated service offerings that extend beyond basic customs clearance. This shift is driving customs brokers to develop more sophisticated capabilities and forge strategic partnerships with logistics providers, technology companies, and other service providers.

Regulatory evolution creates both challenges and opportunities, as government agencies implement new trade facilitation measures, security requirements, and compliance frameworks. Customs brokers must continuously adapt their processes and capabilities to remain compliant while helping clients navigate changing requirements effectively.

Market consolidation trends are evident as larger firms acquire smaller competitors to expand geographic coverage, enhance capabilities, or achieve operational efficiencies. This consolidation is creating a more structured competitive landscape while potentially reducing the number of independent operators in certain market segments.

Comprehensive market analysis for Mexico’s customs brokerage sector employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and completeness. The methodology incorporates quantitative analysis of trade statistics, regulatory filings, and industry performance metrics alongside qualitative insights from industry participants and subject matter experts.

Primary research activities include structured interviews with customs brokers, industry associations, regulatory officials, and client companies across various sectors and geographic regions. These interviews provide valuable insights into market trends, competitive dynamics, operational challenges, and future outlook from multiple stakeholder perspectives.

Secondary research encompasses analysis of government trade statistics, regulatory publications, industry reports, and company financial disclosures to establish baseline market conditions and identify key trends. This research foundation supports quantitative analysis and provides context for primary research findings.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings and conclusions. The methodology emphasizes objectivity and reliability to support informed decision-making by market participants and stakeholders.

Market segmentation analysis employs both top-down and bottom-up approaches to accurately assess market size, growth rates, and competitive positioning across different service categories, geographic regions, and client segments. This comprehensive approach provides detailed insights into market structure and dynamics.

Northern border region dominates Mexico’s customs brokerage market, accounting for approximately 45% of total market activity due to the high volume of trade with the United States. Key border crossings including Tijuana-San Diego, Ciudad Juárez-El Paso, and Nuevo Laredo-Laredo serve as critical trade gateways requiring extensive customs brokerage support for manufacturing, automotive, and consumer goods sectors.

Pacific coast ports represent another significant market concentration, with Manzanillo, Lázaro Cárdenas, and Ensenada handling substantial container volumes from Asia-Pacific trading partners. These ports require specialized expertise in ocean freight customs clearance, container processing, and coordination with inland transportation networks, creating distinct service requirements and competitive dynamics.

Gulf coast region serves important energy and petrochemical trade flows, with Veracruz, Altamira, and Coatzacoalcos providing customs brokerage services for specialized cargo types including petroleum products, chemicals, and industrial equipment. This region demands specific technical expertise and regulatory knowledge related to hazardous materials and energy sector compliance.

Central Mexico manufacturing corridor, including Mexico City, Guadalajara, and surrounding industrial areas, generates substantial demand for customs brokerage services supporting inland manufacturing operations and distribution centers. This region requires integrated logistics solutions and coordination between multiple transportation modes and customs processing locations.

Southern border region with Guatemala and Belize represents a smaller but growing market segment, with increasing trade volumes and cross-border manufacturing operations creating new opportunities for customs brokers with expertise in Central American trade relationships and regulatory frameworks.

Market leadership in Mexico’s customs brokerage sector is distributed among several categories of service providers, each leveraging different competitive strategies and capabilities to serve distinct client segments and geographic markets.

Competitive differentiation strategies include technology innovation, industry specialization, geographic coverage, service integration, and pricing models tailored to specific client segments and operational requirements.

Service type segmentation reveals distinct market categories with different growth characteristics and competitive dynamics:

Client industry segmentation shows varying service requirements and growth patterns:

Import brokerage services continue to dominate market activity, driven by Mexico’s role as a major manufacturing destination and consumer market. This category benefits from consistent trade volumes and established client relationships, though competitive pressure is intensifying as technology enables more efficient processing and pricing transparency.

Export services are experiencing accelerated growth as Mexican manufacturers expand their global market reach and agricultural producers increase international sales. This segment requires different expertise compared to import operations, particularly in destination country regulations and export documentation requirements.

Specialized industry services command premium pricing due to the technical expertise and regulatory knowledge required. Automotive, pharmaceutical, and aerospace sectors particularly value brokers with deep industry understanding and proven compliance track records, creating opportunities for differentiation and client loyalty.

Technology-enabled services are rapidly gaining market share as clients demand greater efficiency, transparency, and integration capabilities. Brokers offering advanced digital platforms, automated processing, and real-time tracking are capturing business from traditional operators, particularly in high-volume segments.

Consulting and advisory services represent a growing market category as companies seek to optimize their trade operations and ensure compliance with evolving regulations. This segment offers higher margins and stronger client relationships compared to transactional brokerage services.

Importers and exporters benefit significantly from professional customs brokerage services through reduced compliance risks, faster processing times, and access to specialized expertise that would be costly to develop internally. Professional brokers help companies navigate complex regulations, optimize duty payments, and avoid costly delays or penalties that can disrupt supply chain operations.

Manufacturing companies particularly value customs brokers who understand their specific industry requirements and can provide integrated solutions that support just-in-time production schedules and quality management systems. The ability to coordinate customs clearance with broader logistics operations creates substantial operational efficiencies and cost savings.

Government agencies benefit from working with professional customs brokers who ensure accurate documentation, proper classification, and regulatory compliance, reducing the administrative burden on customs officials while maintaining security and revenue collection objectives. Professional brokers serve as important partners in trade facilitation initiatives.

Logistics service providers can enhance their service offerings and client relationships by partnering with experienced customs brokers, creating integrated solutions that address the full spectrum of international trade requirements. These partnerships enable logistics companies to offer more comprehensive services while focusing on their core transportation and warehousing capabilities.

Economic development benefits from efficient customs brokerage services include increased trade volumes, improved competitiveness of Mexican businesses, and enhanced attractiveness as an investment destination for international companies seeking reliable trade infrastructure and professional service support.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend reshaping Mexico’s customs brokerage market, with companies investing heavily in automated processing systems, artificial intelligence, and blockchain technologies. These investments are enabling processing time reductions of 40-50% while improving accuracy and client satisfaction levels.

Service integration expansion is driving customs brokers to develop comprehensive trade solutions that extend beyond traditional clearance services. Leading firms are incorporating logistics coordination, trade finance, compliance consulting, and supply chain optimization into their service portfolios to create stronger client relationships and higher value propositions.

Sustainability focus is emerging as companies seek to reduce their environmental impact and meet corporate responsibility objectives. Customs brokers are developing green logistics solutions, carbon footprint reporting, and sustainable trade practices to support client sustainability initiatives while differentiating their service offerings.

Real-time visibility has become a standard client expectation, with customs brokers implementing tracking systems, automated notifications, and dashboard reporting to provide complete transparency throughout the customs clearance process. This trend is driving technology investment and changing client service models across the industry.

Regulatory technology adoption is helping customs brokers manage compliance requirements more effectively through automated rule engines, classification systems, and regulatory update mechanisms. These tools are reducing compliance risks while enabling brokers to handle higher transaction volumes with existing staff resources.

Government digitization initiatives have significantly impacted the customs brokerage market, with Mexican customs authorities implementing electronic processing systems, digital documentation requirements, and automated clearance procedures. These changes are requiring customs brokers to upgrade their technology capabilities while creating opportunities for more efficient service delivery.

USMCA implementation has created new opportunities and challenges for customs brokers, with updated rules of origin, labor compliance requirements, and trade facilitation measures affecting how brokers serve manufacturing clients. The agreement has particularly benefited brokers with expertise in automotive and textile sectors.

Cross-border e-commerce facilitation programs have opened new market segments for customs brokers willing to adapt their service models for small shipments and consumer goods. Government initiatives to streamline e-commerce customs processing are creating opportunities for brokers with appropriate technology and operational capabilities.

Security program expansion including Authorized Economic Operator (AEO) certification and other trusted trader programs is creating additional service opportunities for customs brokers who can help clients achieve and maintain security certifications while providing ongoing compliance support.

Trade facilitation investments by government agencies are improving infrastructure and processing capabilities at major ports and border crossings, creating opportunities for customs brokers to handle increased trade volumes while reducing processing times and operational costs.

Technology investment prioritization should focus on client-facing platforms that provide real-time visibility, automated processing capabilities, and integration with client systems. MWR analysis indicates that brokers implementing comprehensive digital platforms are achieving client retention rates exceeding 90% while capturing premium pricing for enhanced services.

Strategic partnerships with logistics providers, technology companies, and industry specialists can help customs brokers expand their capabilities and market reach without requiring substantial internal investment. These partnerships are particularly valuable for smaller operators seeking to compete with larger full-service providers.

Industry specialization development offers significant opportunities for customs brokers to differentiate their services and command premium pricing. Sectors such as pharmaceuticals, renewable energy, and advanced manufacturing present complex regulatory requirements that specialized brokers can address effectively.

Geographic expansion strategies should consider both traditional trade corridors and emerging opportunities in underserved markets. The growth of manufacturing operations in central and southern Mexico is creating new demand for customs services outside traditional border and port locations.

Talent development programs are essential for addressing the industry’s skilled labor shortage while building capabilities for future growth. Investment in training, certification, and career development can help customs brokers attract and retain qualified professionals in a competitive labor market.

Market growth trajectory remains positive, with continued expansion expected across all major service categories and geographic regions. The combination of increasing trade volumes, regulatory complexity, and technology adoption is creating a favorable environment for professional customs brokerage services throughout the forecast period.

Technology evolution will continue to reshape service delivery models, with artificial intelligence, machine learning, and blockchain technologies enabling new levels of automation and efficiency. Customs brokers who successfully integrate these technologies while maintaining high service quality will capture disproportionate market share and profitability.

Industry consolidation is expected to accelerate as larger firms acquire smaller competitors to expand geographic coverage, enhance capabilities, and achieve operational efficiencies. This consolidation will create a more structured competitive landscape while potentially improving service standardization and quality.

Regulatory modernization initiatives by government agencies will continue to create both opportunities and challenges for customs brokers. Firms that can adapt quickly to regulatory changes while helping clients navigate new requirements will maintain competitive advantages in an evolving market environment.

Client expectations will continue to evolve toward greater integration, transparency, and value-added services beyond basic customs clearance. Successful customs brokers will need to develop comprehensive trade solutions that address the full spectrum of international commerce requirements while leveraging technology to enhance efficiency and service quality.

Mexico’s customs brokerage market represents a dynamic and essential component of the country’s international trade infrastructure, characterized by strong growth prospects, technological transformation, and evolving client requirements. The market benefits from Mexico’s strategic geographic position, extensive trade relationships, and growing role as a manufacturing and logistics hub connecting global supply chains.

Key success factors for customs brokers include technology investment, industry specialization, geographic coverage, and the ability to provide integrated solutions that extend beyond traditional clearance services. The market rewards firms that can combine regulatory expertise with operational efficiency and client service excellence while adapting to rapidly changing technology and regulatory environments.

Future opportunities are substantial, driven by nearshoring trends, e-commerce growth, digital transformation, and the continued expansion of international trade. However, success will require significant investment in technology, talent development, and service innovation to meet evolving client expectations and maintain competitive positioning in an increasingly sophisticated market environment.

The Mexico customs brokerage market is well-positioned for continued growth and evolution, offering attractive opportunities for both established operators and new entrants who can develop the capabilities and strategies necessary to serve the complex and dynamic requirements of international trade in the modern economy.

What is Customs Brokerage?

Customs brokerage refers to the services provided by licensed professionals who assist importers and exporters in complying with customs regulations and facilitating the clearance of goods across borders. This includes preparing and submitting necessary documentation, calculating duties and taxes, and ensuring compliance with local laws.

What are the key players in the Mexico Customs Brokerage Market?

Key players in the Mexico Customs Brokerage Market include companies like DHL, Kuehne + Nagel, and Agility Logistics, which provide comprehensive customs brokerage services. These companies help businesses navigate the complexities of customs regulations and streamline their import and export processes, among others.

What are the growth factors driving the Mexico Customs Brokerage Market?

The Mexico Customs Brokerage Market is driven by factors such as the increasing volume of international trade, the growth of e-commerce, and the need for efficient supply chain management. Additionally, the implementation of trade agreements and regulatory changes also contribute to market expansion.

What challenges does the Mexico Customs Brokerage Market face?

Challenges in the Mexico Customs Brokerage Market include complex regulatory requirements, potential delays in customs clearance, and the need for continuous updates on changing trade laws. These factors can complicate the logistics process for businesses operating in the region.

What opportunities exist in the Mexico Customs Brokerage Market?

Opportunities in the Mexico Customs Brokerage Market include the expansion of digital customs solutions, increased demand for specialized brokerage services, and the potential for growth in emerging markets. Companies that can adapt to technological advancements and changing consumer behaviors may find significant advantages.

What trends are shaping the Mexico Customs Brokerage Market?

Trends in the Mexico Customs Brokerage Market include the rise of automation in customs processes, the integration of artificial intelligence for compliance checks, and a growing emphasis on sustainability in logistics practices. These trends are transforming how customs brokerage services are delivered and enhancing operational efficiency.

Mexico Customs Brokerage Market

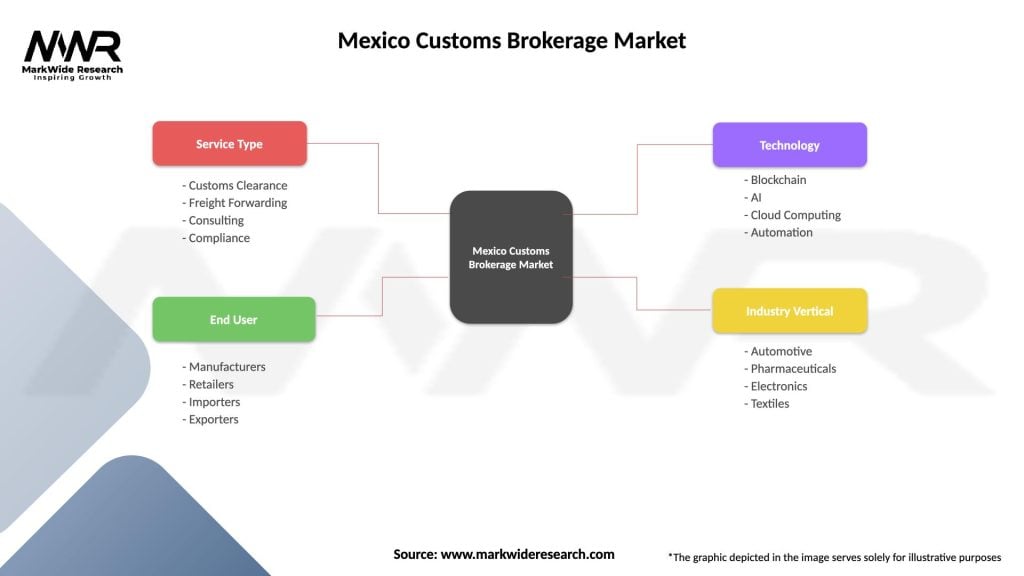

| Segmentation Details | Description |

|---|---|

| Service Type | Customs Clearance, Freight Forwarding, Consulting, Compliance |

| End User | Manufacturers, Retailers, Importers, Exporters |

| Technology | Blockchain, AI, Cloud Computing, Automation |

| Industry Vertical | Automotive, Pharmaceuticals, Electronics, Textiles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Customs Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at