444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK pet nutraceuticals market represents a rapidly expanding segment within the broader animal health industry, driven by increasing pet ownership and growing awareness of preventive healthcare for companion animals. Pet nutraceuticals encompass a wide range of functional food products, dietary supplements, and therapeutic treats designed to support optimal health outcomes in dogs, cats, and other companion animals.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects changing consumer attitudes toward pet care, with UK pet owners increasingly viewing their animals as family members deserving premium healthcare solutions. Preventive care approaches have gained significant traction, with approximately 73% of pet owners now actively seeking nutritional supplements to support their pets’ long-term health and wellbeing.

Industry transformation has been particularly evident in the premium segment, where sophisticated formulations targeting specific health conditions have captured considerable market share. The integration of evidence-based nutrition with traditional pet food manufacturing has created new opportunities for specialized products addressing joint health, digestive wellness, cognitive function, and immune system support.

The UK pet nutraceuticals market refers to the commercial sector encompassing nutritional products that provide health benefits beyond basic nutrition for companion animals, combining pharmaceutical-grade ingredients with food-based delivery systems to support specific physiological functions and prevent health conditions in pets.

Nutraceutical products bridge the gap between conventional pet food and veterinary pharmaceuticals, offering pet owners accessible solutions for maintaining their animals’ health through targeted nutrition. These products typically contain bioactive compounds such as omega fatty acids, probiotics, antioxidants, glucosamine, chondroitin, and various vitamins and minerals formulated to address specific health concerns or support overall wellness.

Regulatory frameworks governing this sector ensure product safety and efficacy while allowing for innovation in formulation and delivery methods. The market encompasses various product categories including soft chews, tablets, powders, liquid supplements, and functional treats, each designed to meet different consumer preferences and pet compliance requirements.

Strategic analysis reveals the UK pet nutraceuticals market as a high-growth sector characterized by increasing consumer sophistication and demand for scientifically-backed pet health solutions. Market penetration has reached approximately 42% of UK pet-owning households, indicating substantial room for continued expansion across demographic segments.

Key growth drivers include the humanization of pets, aging pet populations requiring specialized care, and growing awareness of the connection between nutrition and long-term health outcomes. Premium positioning has become increasingly important, with consumers willing to invest in higher-quality products that demonstrate clear health benefits and contain transparent ingredient profiles.

Competitive landscape features a mix of established multinational corporations, specialized pet health companies, and emerging direct-to-consumer brands leveraging digital marketing strategies. Innovation focus centers on personalized nutrition solutions, sustainable ingredient sourcing, and enhanced bioavailability through advanced delivery technologies.

Distribution channels have diversified significantly, with online platforms capturing 38% of total sales while traditional veterinary clinics and specialty pet retailers maintain strong positions. The integration of professional recommendations with consumer education has proven crucial for market development and brand differentiation.

Consumer behavior analysis reveals several critical trends shaping the UK pet nutraceuticals landscape. Primary insights demonstrate the following key patterns:

Market maturation has led to increased product sophistication, with consumers demanding detailed ingredient information, clinical evidence, and transparent manufacturing processes. Quality assurance has become a key differentiator, with third-party testing and certification gaining importance among discerning pet owners.

Primary growth catalysts propelling the UK pet nutraceuticals market encompass demographic, social, and technological factors that collectively create favorable conditions for sustained expansion. Humanization trends represent the most significant driver, with pet owners increasingly treating their animals as family members deserving premium healthcare solutions.

Demographic shifts contribute substantially to market growth, particularly the aging pet population requiring specialized nutritional support. Veterinary advancements have extended pet lifespans, creating larger populations of senior animals with age-related health concerns such as arthritis, cognitive decline, and digestive sensitivities. This demographic transition drives demand for targeted nutraceutical solutions addressing specific geriatric health needs.

Consumer education has reached unprecedented levels, with pet owners actively seeking information about nutrition’s role in preventing disease and supporting optimal health. Digital platforms facilitate knowledge sharing, enabling consumers to make informed decisions about their pets’ nutritional needs. Social media influence and online communities have amplified awareness of nutraceutical benefits and success stories.

Veterinary integration has strengthened significantly, with more practitioners recommending nutraceutical products as part of comprehensive healthcare protocols. Professional endorsement provides credibility and drives adoption among pet owners who value expert guidance. The shift toward preventive care models aligns perfectly with nutraceutical positioning as proactive health solutions.

Lifestyle factors including increased pet activity levels, urban living conditions, and environmental stressors create specific nutritional requirements that traditional pet foods may not fully address. Functional nutrition offers targeted solutions for these modern challenges, supporting pets’ adaptation to contemporary living conditions.

Significant challenges facing the UK pet nutraceuticals market include regulatory complexities, consumer skepticism, and economic pressures that may limit adoption rates across certain demographic segments. Regulatory uncertainty creates barriers for new product development and market entry, particularly for innovative formulations requiring extensive safety and efficacy documentation.

Cost considerations represent a substantial restraint, as premium nutraceutical products often carry higher price points compared to conventional pet foods. Economic sensitivity among certain consumer segments may limit market penetration, particularly during periods of financial uncertainty when discretionary spending on pet products faces scrutiny.

Scientific validation challenges persist, with some consumers questioning the efficacy of nutraceutical products due to limited clinical research or conflicting information. Evidence gaps in certain product categories may hinder adoption among skeptical pet owners who demand robust scientific support for health claims.

Market fragmentation creates confusion among consumers facing numerous product options with varying quality standards and ingredient profiles. Information overload can lead to decision paralysis, particularly among first-time nutraceutical users who lack experience evaluating product claims and formulations.

Veterinary hesitancy in some cases may limit professional recommendations, particularly among practitioners who prefer pharmaceutical interventions or lack familiarity with specific nutraceutical products. Professional education gaps can restrict the integration of nutraceuticals into standard veterinary practice protocols.

Emerging opportunities within the UK pet nutraceuticals market present significant potential for growth and innovation across multiple dimensions. Personalized nutrition represents a transformative opportunity, with advances in genetic testing and biomarker analysis enabling customized supplement regimens tailored to individual pets’ specific needs and health profiles.

Technology integration offers substantial potential through digital health monitoring, mobile applications, and data analytics that can optimize supplement protocols and track health outcomes. Smart packaging solutions incorporating QR codes, NFC technology, and blockchain verification can enhance consumer confidence and provide detailed product information.

Sustainable formulations present opportunities to capture environmentally conscious consumers through eco-friendly ingredients, sustainable sourcing practices, and recyclable packaging solutions. Plant-based alternatives and novel protein sources align with broader sustainability trends while addressing specific dietary requirements and sensitivities.

Therapeutic partnerships with veterinary practices create opportunities for professional-grade product lines and integrated healthcare protocols. Clinical collaboration can generate valuable research data supporting product efficacy claims while building professional credibility and trust.

Export potential exists for successful UK brands to expand into international markets, leveraging the country’s reputation for high-quality pet products and stringent regulatory standards. Global expansion can provide significant revenue growth opportunities for established domestic players.

Niche specialization offers opportunities to develop products for specific breeds, life stages, or health conditions that remain underserved by current market offerings. Targeted solutions can command premium pricing while building strong customer loyalty through demonstrated efficacy.

Complex interactions between supply chain factors, consumer behavior, and regulatory environments shape the UK pet nutraceuticals market dynamics. Supply chain resilience has become increasingly important following global disruptions, with companies investing in diversified sourcing strategies and local manufacturing capabilities to ensure consistent product availability.

Competitive intensity continues to escalate as new entrants challenge established players through innovative formulations, direct-to-consumer business models, and aggressive pricing strategies. Market consolidation trends indicate potential for strategic acquisitions and partnerships as companies seek to expand their product portfolios and distribution networks.

Consumer loyalty patterns reveal strong brand attachment once pet owners experience positive results, creating opportunities for subscription-based business models and lifetime customer value optimization. Retention strategies focusing on consistent product quality and customer education prove most effective in maintaining market share.

Seasonal fluctuations impact demand patterns, with certain products experiencing peak sales during specific periods related to pet activity levels, health concerns, or promotional campaigns. Inventory management strategies must account for these variations while maintaining adequate stock levels throughout the year.

Innovation cycles accelerate as companies invest in research and development to differentiate their offerings and capture emerging market segments. Product lifecycle management becomes crucial as formulations evolve and new ingredients gain regulatory approval for pet use.

Comprehensive analysis of the UK pet nutraceuticals market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves extensive surveys of pet owners, veterinary professionals, and industry stakeholders to capture current usage patterns, preferences, and future intentions regarding nutraceutical products.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade publications to establish market size, competitive positioning, and growth trends. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market assessments.

Quantitative methodologies include statistical analysis of sales data, consumer surveys, and market share calculations to establish baseline metrics and growth projections. Sample sizes of over 2,000 pet owners and 500 veterinary professionals provide statistically significant insights into market behavior and preferences.

Qualitative research incorporates in-depth interviews with industry experts, focus groups with pet owners, and case studies of successful product launches to understand underlying market dynamics and consumer motivations. Expert panels provide insights into regulatory trends, technological developments, and future market evolution.

Market modeling techniques utilize historical data, demographic trends, and economic indicators to project future market development and identify potential growth scenarios. Sensitivity analysis evaluates the impact of various factors on market outcomes to provide robust forecasting capabilities.

Geographic distribution across the UK reveals distinct regional patterns in pet nutraceuticals adoption and market development. London and Southeast England demonstrate the highest market penetration rates at approximately 52% of pet-owning households, driven by higher disposable incomes, greater health consciousness, and access to specialized veterinary services.

Northern England shows strong growth potential with increasing adoption rates, particularly in urban centers like Manchester, Leeds, and Newcastle. Regional preferences tend toward value-oriented products with proven efficacy, reflecting more conservative purchasing patterns compared to southern markets.

Scotland and Wales present unique opportunities with distinct cultural attitudes toward pet care and strong preferences for locally-sourced or natural products. Rural markets in these regions often rely heavily on veterinary recommendations and word-of-mouth referrals for product selection.

Distribution network analysis reveals significant variations in channel preferences across regions. Urban areas show higher online purchasing rates at 45% of total sales, while rural regions maintain stronger reliance on traditional veterinary clinics and farm supply stores for nutraceutical products.

Regional demographics influence product preferences, with areas having older pet populations showing higher demand for senior-specific formulations and joint health supplements. Breed concentrations in certain regions create opportunities for targeted marketing of breed-specific nutraceutical solutions.

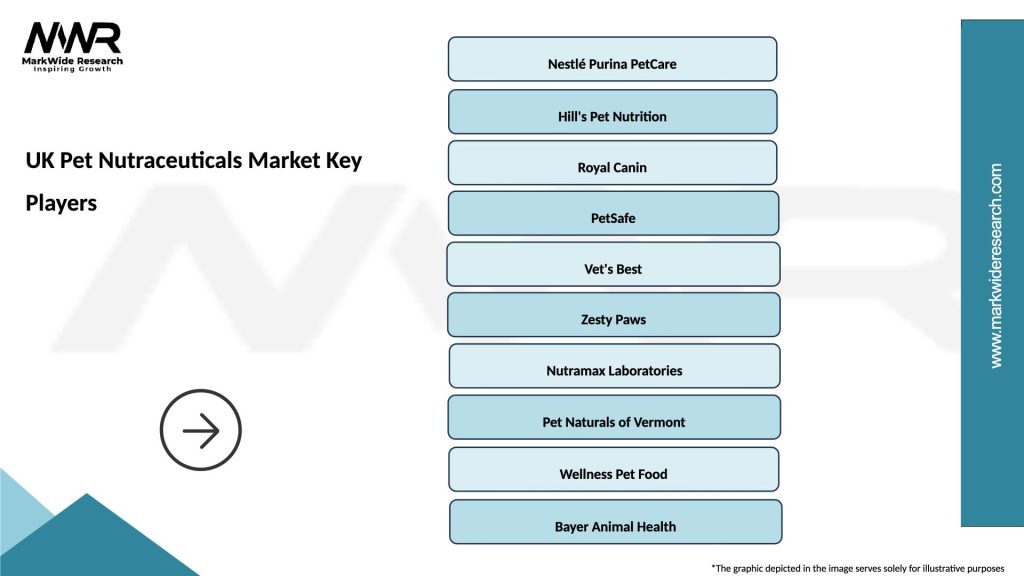

Market leadership in the UK pet nutraceuticals sector features a diverse array of companies ranging from multinational corporations to specialized boutique brands. Key players have established strong positions through different strategic approaches:

Competitive strategies vary significantly across market participants, with established players leveraging brand recognition and distribution advantages while newer entrants focus on innovation, digital marketing, and direct customer relationships. Product differentiation occurs through ingredient quality, formulation sophistication, and targeted health benefits.

Strategic partnerships between manufacturers and veterinary practices have become increasingly important for market access and credibility building. Professional endorsements provide significant competitive advantages in a market where trust and efficacy are paramount concerns for consumers.

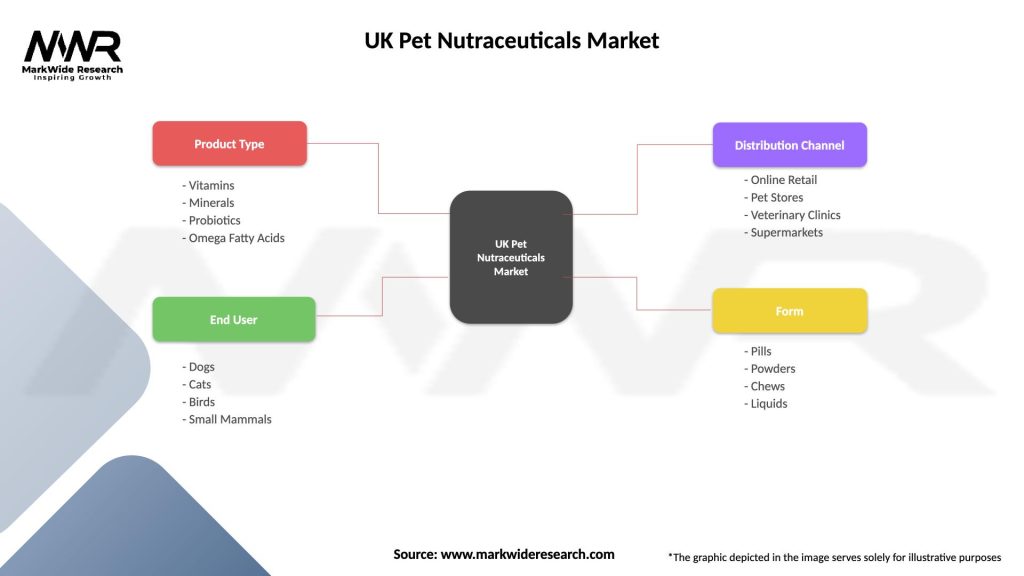

Market segmentation analysis reveals multiple dimensions for categorizing the UK pet nutraceuticals market, enabling targeted strategies and specialized product development. Primary segmentation approaches include:

By Pet Type:

By Product Form:

By Health Application:

By Distribution Channel:

Joint health supplements dominate the UK pet nutraceuticals market, driven by widespread recognition of arthritis and mobility issues in aging pets. Glucosamine and chondroitin formulations remain popular, while newer ingredients like green-lipped mussel and turmeric gain traction among health-conscious pet owners seeking natural alternatives.

Digestive health products experience rapid growth as understanding of the gut-health connection expands. Probiotic supplements show particular strength, with multi-strain formulations and specialized delivery systems improving efficacy and consumer satisfaction. Prebiotic ingredients and digestive enzymes complement probiotic offerings in comprehensive gut health solutions.

Skin and coat supplements benefit from visible results that reinforce consumer confidence in nutraceutical efficacy. Omega fatty acid formulations dominate this category, with fish oil and plant-based alternatives addressing different consumer preferences and pet sensitivities. Biotin, zinc, and specialized amino acids support comprehensive skin health approaches.

Immune support products gained significant momentum following increased health awareness, with formulations featuring antioxidants, vitamins, and immune-modulating ingredients. Seasonal demand patterns influence sales cycles, with peak periods coinciding with traditional illness seasons and stress-inducing events.

Cognitive health supplements represent an emerging category with substantial growth potential as pet owners become aware of age-related cognitive decline. Omega-3 fatty acids, antioxidants, and specialized nootropic ingredients target brain health and cognitive function maintenance in senior pets.

Manufacturers benefit from the UK pet nutraceuticals market through multiple value creation opportunities. Premium pricing potential allows for higher profit margins compared to conventional pet food products, while brand loyalty development creates sustainable competitive advantages and predictable revenue streams.

Veterinary professionals gain additional revenue opportunities through product recommendations and retail sales, while enhancing their ability to provide comprehensive healthcare solutions. Professional credibility increases when recommending evidence-based nutraceutical products that demonstrate clear health benefits for their patients.

Pet owners receive significant value through improved pet health outcomes, potentially reduced veterinary costs, and enhanced quality of life for their companions. Preventive care approaches may help avoid costly medical interventions while supporting long-term pet wellness and longevity.

Retailers benefit from higher-margin product categories that drive customer loyalty and repeat purchases. Cross-selling opportunities with related pet products create additional revenue potential while positioning stores as comprehensive pet health destinations.

Distributors capitalize on growing market demand and expanding product portfolios that require specialized knowledge and relationships. Value-added services including education, training, and marketing support create differentiation opportunities in competitive distribution markets.

Research institutions find opportunities for collaboration with industry partners on clinical studies and product development projects. Academic partnerships can provide funding for pet health research while contributing to evidence-based product development and validation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends are reshaping the UK pet nutraceuticals landscape, with companies developing customized supplement protocols based on individual pet characteristics, health history, and genetic profiles. DNA testing integration enables breed-specific formulations and personalized nutrition recommendations that address unique genetic predispositions and health risks.

Sustainability focus drives innovation in ingredient sourcing, packaging materials, and manufacturing processes. Eco-conscious consumers increasingly seek products with minimal environmental impact, creating opportunities for plant-based formulations, recyclable packaging, and carbon-neutral manufacturing approaches.

Digital transformation accelerates across the industry, with mobile applications, subscription services, and online consultation platforms enhancing customer engagement and product delivery. Telemedicine integration allows veterinary professionals to monitor pet health remotely and adjust supplement protocols based on real-time data.

Functional treat formats gain popularity as pet owners seek convenient administration methods that pets enjoy. Palatability improvements through natural flavoring and texture innovations increase compliance rates while maintaining therapeutic efficacy.

Transparency demands from consumers drive companies to provide detailed ingredient information, sourcing details, and manufacturing processes. Clean labeling with recognizable ingredients and third-party certifications becomes increasingly important for brand differentiation and consumer trust.

Preventive healthcare emphasis shifts focus from treatment to prevention, with nutraceuticals positioned as proactive health solutions rather than reactive treatments. Wellness protocols incorporating regular supplementation gain acceptance among health-conscious pet owners and progressive veterinary practices.

Recent innovations in the UK pet nutraceuticals market demonstrate the industry’s commitment to advancing pet health through scientific research and technological development. Nanotechnology applications improve ingredient bioavailability and absorption rates, enhancing product efficacy while reducing required dosages.

Clinical research partnerships between manufacturers and veterinary schools generate valuable efficacy data supporting product claims and professional recommendations. MarkWide Research analysis indicates that companies investing in clinical studies achieve 23% higher market penetration rates compared to those relying solely on anecdotal evidence.

Regulatory developments include updated guidelines for health claims, ingredient approvals, and manufacturing standards that enhance consumer protection while supporting industry growth. Harmonization efforts with European Union standards facilitate trade and product development across broader markets.

Acquisition activity accelerates as larger corporations seek to expand their nutraceutical portfolios through strategic purchases of specialized companies and innovative brands. Consolidation trends may reshape competitive dynamics while providing resources for enhanced research and development capabilities.

Sustainability initiatives include commitments to renewable energy use, sustainable ingredient sourcing, and packaging waste reduction. Corporate responsibility programs address environmental concerns while appealing to socially conscious consumers and stakeholders.

Technology partnerships with digital health companies create integrated solutions combining physical products with monitoring applications and data analytics capabilities. Internet of Things (IoT) integration enables smart feeding systems and automated supplement dispensing based on pet activity and health metrics.

Strategic recommendations for UK pet nutraceuticals market participants emphasize the importance of differentiation through scientific validation, consumer education, and innovative product development. Investment priorities should focus on clinical research, digital marketing capabilities, and supply chain resilience to support sustainable growth.

Product development strategies should prioritize evidence-based formulations with clear health benefits and measurable outcomes. Collaboration opportunities with veterinary professionals, research institutions, and technology companies can accelerate innovation while building credibility and market acceptance.

Market entry approaches for new participants should consider niche specialization initially, building expertise and brand recognition in specific health categories before expanding into broader market segments. Direct-to-consumer models offer opportunities to build customer relationships and gather valuable feedback for product improvement.

Distribution strategy optimization requires multi-channel approaches that balance professional recommendations with consumer convenience and competitive pricing. Online presence development becomes essential for reaching younger pet owners and providing educational content that supports purchasing decisions.

Regulatory compliance should be viewed as a competitive advantage rather than a burden, with companies investing in quality systems and documentation that exceed minimum requirements. Proactive engagement with regulatory authorities can help shape future guidelines while ensuring continued market access.

International expansion opportunities should be evaluated based on regulatory compatibility, market maturity, and competitive landscapes. Export strategies can leverage the UK’s reputation for quality pet products while diversifying revenue sources and reducing domestic market dependence.

Long-term projections for the UK pet nutraceuticals market indicate sustained growth driven by demographic trends, technological advancement, and evolving consumer attitudes toward pet healthcare. Market expansion is expected to continue at a compound annual growth rate of 7.5% over the next five years, supported by increasing pet ownership and growing health consciousness among pet owners.

Innovation trajectories point toward more sophisticated formulations incorporating cutting-edge ingredients, delivery technologies, and personalization capabilities. Precision nutrition approaches utilizing genetic testing, biomarker analysis, and artificial intelligence will enable truly customized supplement protocols tailored to individual pets’ specific needs and health profiles.

Regulatory evolution is likely to bring enhanced standards for efficacy claims, ingredient safety, and manufacturing quality, potentially creating barriers for smaller players while strengthening consumer confidence in the category. Harmonization efforts with international standards may facilitate global trade and product development.

Technology integration will accelerate, with smart packaging, mobile applications, and IoT devices becoming standard features that enhance product value and customer engagement. Data analytics capabilities will enable companies to optimize formulations, predict health trends, and provide personalized recommendations based on large-scale pet health databases.

Sustainability requirements will intensify, driving innovation in eco-friendly ingredients, packaging materials, and manufacturing processes. Circular economy principles may reshape supply chains and product design approaches, creating new opportunities for companies that embrace environmental responsibility.

Market consolidation is expected to continue as larger corporations acquire specialized companies and innovative brands to expand their nutraceutical capabilities. MWR analysis suggests that successful companies will balance scale advantages with innovation agility and customer intimacy to maintain competitive positions in an evolving marketplace.

The UK pet nutraceuticals market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental shifts in pet ownership attitudes and healthcare approaches. Market fundamentals remain strong, supported by demographic trends, increasing disposable income allocation to pet care, and growing awareness of nutrition’s role in preventive healthcare.

Success factors in this competitive landscape include scientific validation of product claims, effective consumer education, strategic distribution partnerships, and continuous innovation in formulation and delivery technologies. Companies that invest in clinical research, build strong veterinary relationships, and develop compelling brand narratives around pet health benefits are best positioned for sustained growth.

Future opportunities lie in personalized nutrition solutions, technology integration, sustainability initiatives, and international expansion strategies that leverage the UK’s reputation for quality pet products. Market participants must balance innovation with regulatory compliance while building consumer trust through transparency and demonstrated efficacy.

The trajectory toward premium, science-based pet healthcare solutions appears irreversible, creating a favorable environment for continued market expansion and innovation. Strategic positioning around preventive care, quality ingredients, and measurable health outcomes will determine long-term success in this evolving marketplace where pet health increasingly mirrors human health priorities and investment patterns.

What is Pet Nutraceuticals?

Pet nutraceuticals refer to products derived from food sources that provide health benefits beyond basic nutrition for pets. These products can include supplements, functional foods, and herbal remedies aimed at improving pet health and wellness.

What are the key players in the UK Pet Nutraceuticals Market?

Key players in the UK Pet Nutraceuticals Market include companies like Nestlé Purina, Hill’s Pet Nutrition, and PetLife among others. These companies focus on developing innovative products that cater to the health needs of pets.

What are the growth factors driving the UK Pet Nutraceuticals Market?

The UK Pet Nutraceuticals Market is driven by increasing pet ownership, rising awareness of pet health, and a growing demand for natural and organic pet products. Additionally, the trend towards preventive healthcare for pets is contributing to market growth.

What challenges does the UK Pet Nutraceuticals Market face?

Challenges in the UK Pet Nutraceuticals Market include regulatory hurdles, the need for scientific validation of product claims, and competition from traditional pet food products. These factors can hinder market entry for new players.

What opportunities exist in the UK Pet Nutraceuticals Market?

Opportunities in the UK Pet Nutraceuticals Market include the development of personalized nutrition products, expansion into online retail channels, and increasing demand for supplements targeting specific health issues in pets. These trends present avenues for innovation and growth.

What trends are shaping the UK Pet Nutraceuticals Market?

Trends in the UK Pet Nutraceuticals Market include a shift towards plant-based ingredients, the rise of functional treats, and an emphasis on sustainability in product sourcing. These trends reflect changing consumer preferences and a focus on holistic pet care.

UK Pet Nutraceuticals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Probiotics, Omega Fatty Acids |

| End User | Dogs, Cats, Birds, Small Mammals |

| Distribution Channel | Online Retail, Pet Stores, Veterinary Clinics, Supermarkets |

| Form | Pills, Powders, Chews, Liquids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Pet Nutraceuticals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at