444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia contract packaging market represents a dynamic and rapidly evolving sector that serves as a critical backbone for numerous industries across the continent. This specialized market encompasses comprehensive packaging solutions provided by third-party service providers to manufacturers, retailers, and distributors who require professional packaging services without investing in their own packaging infrastructure. The market has experienced remarkable transformation driven by increasing demand for flexible packaging solutions, growing e-commerce activities, and rising consumer expectations for sustainable packaging alternatives.

Market dynamics indicate substantial growth potential, with the sector expanding at a robust CAGR of 6.2% over the forecast period. This growth trajectory reflects the increasing adoption of outsourced packaging services across diverse industries including food and beverages, pharmaceuticals, cosmetics, and consumer goods. The market’s expansion is particularly pronounced in metropolitan areas such as Sydney, Melbourne, and Brisbane, where manufacturing and distribution activities are concentrated.

Industry participants are witnessing significant shifts in packaging requirements, with companies increasingly seeking specialized services that combine efficiency, cost-effectiveness, and environmental sustainability. The integration of advanced technologies, including automated packaging systems and smart packaging solutions, has revolutionized traditional packaging processes and enhanced operational capabilities across the sector.

The Australia contract packaging market refers to the comprehensive ecosystem of third-party packaging service providers that offer specialized packaging solutions to manufacturers and brands across various industries. These services encompass primary packaging, secondary packaging, labeling, assembly, and distribution preparation activities performed by external contractors rather than in-house operations.

Contract packaging services include a wide range of activities from simple packaging and labeling to complex assembly operations, quality control, and regulatory compliance management. Service providers in this market typically operate sophisticated facilities equipped with advanced packaging machinery, quality assurance systems, and skilled workforce capable of handling diverse packaging requirements across multiple product categories.

The market structure encompasses various service models including co-packing, co-manufacturing, fulfillment services, and specialized packaging solutions. These services enable client companies to focus on their core competencies while leveraging the expertise and infrastructure of specialized packaging providers to achieve cost efficiencies and operational flexibility.

The Australia contract packaging market demonstrates exceptional resilience and growth potential, driven by evolving consumer preferences, regulatory requirements, and technological advancements. The market has established itself as an indispensable component of the broader supply chain ecosystem, providing essential services that enable manufacturers to respond quickly to market demands while maintaining cost competitiveness.

Key market characteristics include increasing demand for sustainable packaging solutions, with 78% of companies prioritizing environmentally friendly packaging options in their outsourcing decisions. The market benefits from Australia’s strategic geographic position, serving as a gateway for Asia-Pacific trade and distribution activities. This positioning has attracted significant investment in packaging infrastructure and technology upgrades across the sector.

Industry consolidation trends are evident as larger contract packaging companies acquire smaller regional players to expand their service capabilities and geographic reach. The market is characterized by a mix of large multinational service providers and specialized local companies that cater to specific industry segments or regional markets. Innovation in packaging technologies and sustainability initiatives continues to drive competitive differentiation among market participants.

Strategic market insights reveal several critical trends shaping the Australia contract packaging landscape:

Market intelligence indicates that companies utilizing contract packaging services achieve average cost savings of 25% compared to in-house packaging operations, while gaining access to specialized expertise and advanced packaging technologies.

Primary market drivers propelling the Australia contract packaging market include the accelerating shift toward outsourced manufacturing and packaging services. Companies across various industries are recognizing the strategic advantages of partnering with specialized packaging providers to achieve operational flexibility, cost efficiency, and access to advanced packaging technologies without significant capital investments.

E-commerce expansion serves as a fundamental growth driver, with online retail activities demanding sophisticated packaging solutions that ensure product protection during shipping while providing attractive unboxing experiences for consumers. The rise of direct-to-consumer business models has created new packaging requirements that traditional in-house operations struggle to accommodate efficiently.

Regulatory compliance requirements continue to drive demand for specialized packaging services, particularly in highly regulated industries such as pharmaceuticals, food and beverages, and cosmetics. Contract packaging providers offer expertise in navigating complex regulatory landscapes and ensuring compliance with evolving packaging standards and labeling requirements.

Sustainability initiatives represent another significant driver, as companies seek packaging partners capable of implementing environmentally responsible packaging solutions. The growing consumer awareness of environmental issues has prompted brands to prioritize sustainable packaging options, creating opportunities for contract packaging providers that specialize in eco-friendly materials and processes.

Market restraints affecting the Australia contract packaging sector include concerns about quality control and brand protection when outsourcing critical packaging operations. Some companies remain hesitant to entrust their packaging requirements to external providers due to fears about maintaining consistent quality standards and protecting proprietary information.

Supply chain vulnerabilities have become more apparent following recent global disruptions, with some companies questioning the wisdom of relying heavily on external packaging providers. These concerns have led to increased scrutiny of contract packaging partnerships and demands for enhanced supply chain resilience and contingency planning.

Cost pressures from raw material price fluctuations and labor shortages present ongoing challenges for contract packaging providers. These pressures can impact service pricing and profitability, potentially limiting market growth and investment in new technologies and capabilities.

Technological complexity and the need for continuous innovation create barriers for smaller contract packaging companies that lack resources to invest in advanced packaging systems and technologies. This technological gap can limit their ability to compete for larger contracts and serve sophisticated client requirements.

Significant market opportunities exist in the rapidly expanding pharmaceutical and healthcare packaging segment, where specialized requirements for sterile packaging, temperature control, and regulatory compliance create demand for expert contract packaging services. The aging population and increasing healthcare spending in Australia present substantial growth potential for providers with appropriate capabilities and certifications.

Sustainable packaging solutions represent a major opportunity area, with increasing consumer and regulatory pressure driving demand for environmentally responsible packaging alternatives. Contract packaging providers that invest in sustainable materials, processes, and technologies can capture premium market segments and establish competitive advantages.

Technology integration opportunities include the implementation of smart packaging solutions, IoT-enabled tracking systems, and advanced automation technologies that enhance operational efficiency and provide value-added services to clients. These technological capabilities can differentiate service providers and justify premium pricing structures.

Regional expansion opportunities exist for established contract packaging companies to extend their services to underserved regional markets and specialized industry segments. The development of regional packaging hubs can provide cost advantages and improved service delivery for local manufacturers and distributors.

Market dynamics in the Australia contract packaging sector reflect a complex interplay of supply and demand factors, technological innovation, and evolving customer expectations. The market exhibits strong cyclical characteristics tied to broader economic conditions and consumer spending patterns, with packaging demand closely correlated to manufacturing activity and retail sales performance.

Competitive dynamics are intensifying as market participants seek to differentiate their service offerings through technological innovation, specialized capabilities, and value-added services. The market has witnessed consolidation activity increase by 28% over recent years, as larger players acquire specialized providers to expand their service portfolios and geographic coverage.

Supply chain dynamics have evolved significantly, with contract packaging providers increasingly serving as strategic partners rather than simple service vendors. This evolution has led to deeper integration between packaging providers and their clients, including collaborative product development, supply chain optimization, and joint sustainability initiatives.

Innovation dynamics continue to reshape the market landscape, with emerging technologies such as artificial intelligence, machine learning, and advanced materials science creating new possibilities for packaging solutions and operational efficiency improvements.

Comprehensive research methodology employed in analyzing the Australia contract packaging market incorporates both primary and secondary research approaches to ensure accurate and reliable market intelligence. Primary research activities include extensive interviews with industry executives, contract packaging service providers, and end-user companies across various sectors.

Data collection methods encompass structured surveys, in-depth interviews, and focus group discussions with key market participants to gather insights on market trends, competitive dynamics, and future growth prospects. Secondary research involves analysis of industry reports, company financial statements, regulatory filings, and trade association publications.

Market sizing methodologies utilize multiple approaches including top-down and bottom-up analysis to validate market estimates and growth projections. The research incorporates analysis of packaging volumes, service pricing trends, and market share distribution among key players to develop comprehensive market assessments.

Quality assurance processes include data triangulation, expert validation, and cross-verification of findings to ensure research accuracy and reliability. The methodology incorporates continuous monitoring of market developments and regular updates to reflect changing market conditions and emerging trends.

Regional market distribution across Australia reveals significant concentration in major metropolitan areas, with New South Wales accounting for 38% of total contract packaging activity, followed by Victoria with 32% and Queensland representing 18% of market activity. These regions benefit from established manufacturing bases, transportation infrastructure, and proximity to major consumer markets.

Sydney and Melbourne serve as primary hubs for contract packaging services, hosting the largest concentration of service providers and most sophisticated packaging facilities. These metropolitan areas offer advantages including skilled workforce availability, advanced logistics infrastructure, and proximity to major ports for import and export activities.

Queensland’s market presence is strengthened by its strategic position for Asia-Pacific trade and growing food processing industry. The region has attracted significant investment in specialized packaging facilities serving agricultural products, processed foods, and export-oriented manufacturing sectors.

Western Australia and South Australia represent emerging opportunities for contract packaging expansion, driven by mining sector activities, wine industry growth, and increasing manufacturing diversification. These regions offer potential for specialized packaging services tailored to local industry requirements and export markets.

The competitive landscape of the Australia contract packaging market features a diverse mix of multinational corporations, regional specialists, and niche service providers. Market leadership is distributed among several key players that have established strong positions through strategic acquisitions, technological investments, and specialized service capabilities.

Leading market participants include:

Competitive strategies focus on technological innovation, service diversification, and strategic partnerships to enhance market position and capture emerging opportunities. Companies are investing heavily in automation, sustainability initiatives, and specialized capabilities to differentiate their service offerings.

Market segmentation analysis reveals distinct categories based on service type, end-use industry, and packaging format. Understanding these segments is crucial for identifying growth opportunities and developing targeted market strategies.

By Service Type:

By End-Use Industry:

Food and beverage packaging represents the largest category within the Australia contract packaging market, driven by the country’s significant agricultural production and food processing industry. This segment requires specialized expertise in food safety, shelf-life extension, and regulatory compliance, creating opportunities for providers with appropriate certifications and capabilities.

Pharmaceutical packaging demonstrates the highest growth potential, with market expansion of 8.5% annually driven by an aging population, increasing healthcare spending, and growing pharmaceutical manufacturing activities. This segment demands specialized facilities, sterile environments, and comprehensive quality assurance systems.

E-commerce packaging has emerged as a rapidly growing category, requiring innovative solutions for direct-to-consumer shipping, product protection, and enhanced unboxing experiences. This segment presents opportunities for providers that can offer flexible, scalable packaging solutions tailored to online retail requirements.

Sustainable packaging categories are experiencing accelerated growth as companies seek environmentally responsible alternatives to traditional packaging materials. Providers specializing in biodegradable, recyclable, and reduced-impact packaging solutions are capturing premium market segments and establishing competitive advantages.

Manufacturers and brands benefit significantly from contract packaging partnerships through reduced capital investment requirements, access to specialized expertise, and enhanced operational flexibility. These partnerships enable companies to scale packaging operations efficiently without the complexities of managing in-house packaging facilities and equipment.

Cost optimization benefits include reduced labor costs, improved material utilization, and economies of scale achieved through shared resources and specialized equipment. Contract packaging providers can often achieve packaging cost reductions of 20-30% compared to in-house operations while maintaining or improving quality standards.

Risk mitigation advantages encompass reduced regulatory compliance burdens, improved quality control systems, and enhanced supply chain resilience through diversified packaging capabilities. Contract packaging providers assume responsibility for maintaining compliance with evolving regulations and industry standards.

Innovation access enables client companies to leverage cutting-edge packaging technologies, materials, and processes without significant research and development investments. This access accelerates time-to-market for new products and enables rapid response to changing market requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Australia contract packaging market, with companies increasingly prioritizing environmentally responsible packaging solutions. This trend encompasses the adoption of biodegradable materials, recyclable packaging designs, and reduced packaging waste initiatives that align with consumer expectations and regulatory requirements.

Digital integration trends are revolutionizing packaging operations through the implementation of IoT sensors, blockchain tracking systems, and artificial intelligence-powered quality control systems. These technologies enable real-time monitoring, predictive maintenance, and enhanced traceability throughout the packaging process.

Personalization and customization trends are driving demand for flexible packaging solutions capable of handling small batch sizes and variable packaging requirements. Contract packaging providers are investing in digital printing technologies and modular packaging systems to accommodate these evolving client needs.

Supply chain integration trends reflect the evolution of contract packaging providers from simple service vendors to strategic supply chain partners. This integration includes collaborative forecasting, inventory management, and distribution planning that optimize overall supply chain efficiency and cost-effectiveness.

Recent industry developments highlight the dynamic nature of the Australia contract packaging market and the continuous evolution of service capabilities and market structure. Major developments include significant investments in automation technologies, strategic acquisitions, and expansion of specialized service offerings.

Technology advancement initiatives have seen leading contract packaging providers implementing robotic packaging systems, automated quality inspection technologies, and integrated warehouse management systems. These investments have resulted in productivity improvements of up to 40% while enhancing service quality and consistency.

Sustainability initiatives include the development of innovative packaging materials, implementation of circular economy principles, and achievement of carbon neutrality goals by several major market participants. According to MarkWide Research analysis, these initiatives are driving competitive differentiation and attracting environmentally conscious clients.

Strategic partnerships between contract packaging providers and technology companies are creating new service capabilities and market opportunities. These collaborations focus on developing smart packaging solutions, enhancing supply chain visibility, and improving operational efficiency through advanced analytics and automation.

Strategic recommendations for contract packaging companies include prioritizing investments in sustainable packaging technologies and materials to capture growing market demand for environmentally responsible solutions. Companies should develop comprehensive sustainability strategies that encompass material selection, process optimization, and waste reduction initiatives.

Technology investment priorities should focus on automation systems, digital integration capabilities, and advanced quality control technologies that enhance operational efficiency and service quality. These investments are essential for maintaining competitiveness and meeting evolving client expectations for speed, accuracy, and reliability.

Market expansion strategies should consider geographic diversification, industry segment specialization, and value-added service development to reduce client dependency and capture new growth opportunities. Companies should evaluate opportunities in emerging segments such as pharmaceutical packaging and e-commerce fulfillment services.

Partnership development recommendations include establishing strategic alliances with technology providers, material suppliers, and complementary service companies to enhance service capabilities and market reach. These partnerships can provide access to specialized expertise and resources while sharing investment risks and costs.

The future outlook for the Australia contract packaging market remains highly positive, with continued growth expected across all major segments and geographic regions. MWR projections indicate sustained market expansion driven by ongoing outsourcing trends, technological innovation, and evolving consumer preferences for sustainable packaging solutions.

Growth projections suggest the market will maintain its robust expansion trajectory of 6.2% CAGR through the forecast period, supported by increasing adoption of contract packaging services across diverse industries and continued investment in advanced packaging technologies and capabilities.

Technology evolution will continue to reshape the market landscape, with artificial intelligence, machine learning, and advanced automation systems becoming standard components of modern contract packaging operations. These technologies will enable enhanced efficiency, quality control, and customization capabilities that meet evolving client requirements.

Sustainability imperatives will drive continued innovation in packaging materials, processes, and design approaches, creating opportunities for providers that can deliver environmentally responsible solutions without compromising performance or cost-effectiveness. The integration of circular economy principles will become increasingly important for long-term market success.

The Australia contract packaging market represents a dynamic and essential component of the broader manufacturing and retail ecosystem, providing critical services that enable companies to achieve operational efficiency, cost optimization, and market responsiveness. The market’s continued evolution reflects changing consumer preferences, technological advancement, and sustainability imperatives that are reshaping packaging requirements across all industry segments.

Market fundamentals remain strong, supported by ongoing outsourcing trends, e-commerce growth, and increasing demand for specialized packaging expertise. The sector’s ability to adapt to changing requirements while maintaining cost competitiveness positions it well for continued expansion and market opportunity capture.

Future success in the Australia contract packaging market will depend on companies’ ability to embrace technological innovation, sustainability initiatives, and strategic partnerships that enhance service capabilities and market differentiation. Organizations that can effectively balance operational efficiency with environmental responsibility while delivering superior client value will be best positioned to capitalize on emerging growth opportunities and maintain competitive advantages in this evolving market landscape.

What is Contract Packaging?

Contract packaging refers to the outsourcing of packaging services to specialized companies that handle the packaging of products for various industries, including food, pharmaceuticals, and consumer goods.

What are the key players in the Australia Contract Packaging Market?

Key players in the Australia Contract Packaging Market include Amcor, Pact Group, and Visy Industries, among others.

What are the main drivers of growth in the Australia Contract Packaging Market?

The main drivers of growth in the Australia Contract Packaging Market include the increasing demand for sustainable packaging solutions, the rise of e-commerce, and the need for cost-effective packaging options across various industries.

What challenges does the Australia Contract Packaging Market face?

Challenges in the Australia Contract Packaging Market include regulatory compliance issues, fluctuating raw material costs, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Australia Contract Packaging Market?

Opportunities in the Australia Contract Packaging Market include the growing trend towards eco-friendly packaging, advancements in automation technology, and the expansion of the food and beverage sector requiring innovative packaging solutions.

What trends are shaping the Australia Contract Packaging Market?

Trends shaping the Australia Contract Packaging Market include the increasing adoption of smart packaging technologies, the shift towards minimalistic designs, and the focus on enhancing supply chain efficiency.

Australia Contract Packaging Market

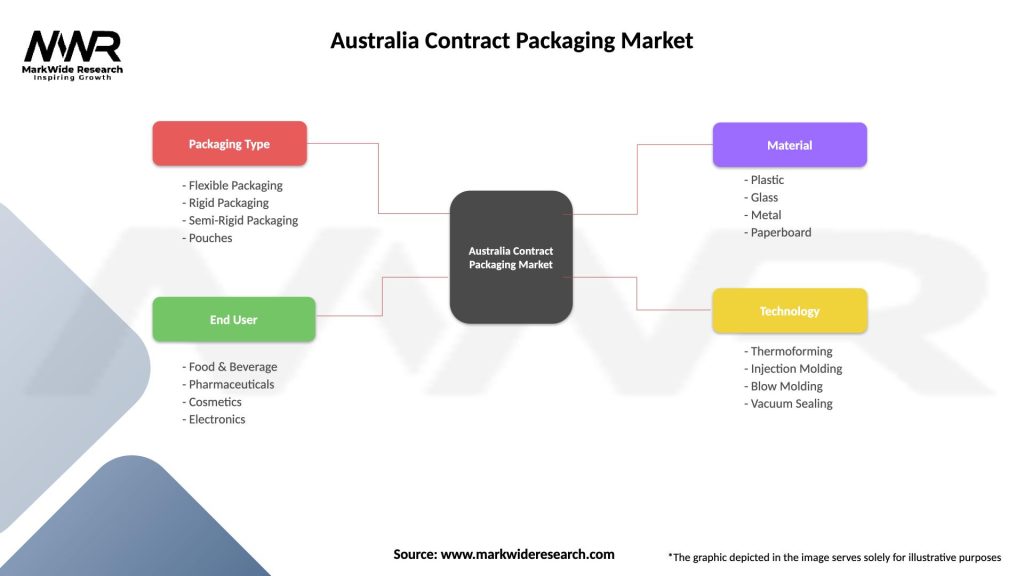

| Segmentation Details | Description |

|---|---|

| Packaging Type | Flexible Packaging, Rigid Packaging, Semi-Rigid Packaging, Pouches |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Material | Plastic, Glass, Metal, Paperboard |

| Technology | Thermoforming, Injection Molding, Blow Molding, Vacuum Sealing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Contract Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at