444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States industrial sensors market represents a critical component of the nation’s manufacturing and automation infrastructure, experiencing unprecedented growth driven by Industry 4.0 initiatives and smart manufacturing adoption. Industrial sensors serve as the foundational technology enabling real-time data collection, process monitoring, and automated decision-making across diverse manufacturing sectors. The market encompasses a comprehensive range of sensor technologies including temperature sensors, pressure sensors, proximity sensors, flow sensors, and advanced IoT-enabled sensing solutions.

Manufacturing digitization has accelerated sensor deployment across automotive, aerospace, pharmaceuticals, food and beverage, and chemical processing industries. The integration of artificial intelligence and machine learning capabilities with sensor networks has created sophisticated predictive maintenance systems, reducing operational costs by 25-30% while improving equipment reliability. Smart factory initiatives are driving demand for wireless sensor networks, edge computing-enabled sensors, and cloud-connected monitoring systems.

Regional manufacturing hubs across the Midwest, Southeast, and West Coast are witnessing substantial sensor technology investments, with automotive manufacturing centers leading adoption rates at 78% of facilities implementing advanced sensor networks. The market benefits from strong domestic manufacturing capabilities, established supply chains, and significant research and development investments from leading technology companies.

The United States industrial sensors market refers to the comprehensive ecosystem of sensing technologies, devices, and systems designed to monitor, measure, and control industrial processes across manufacturing, processing, and production environments. Industrial sensors convert physical parameters such as temperature, pressure, flow, level, proximity, and chemical composition into electrical signals for process control and data analysis purposes.

Modern industrial sensors incorporate advanced technologies including microelectromechanical systems (MEMS), wireless communication protocols, edge computing capabilities, and artificial intelligence algorithms. These sophisticated devices enable real-time monitoring, predictive analytics, and automated response systems that optimize production efficiency, ensure quality control, and maintain operational safety standards.

Market scope encompasses traditional analog sensors, digital smart sensors, wireless sensor networks, and integrated sensor systems that connect to industrial IoT platforms. The definition includes both hardware components and associated software solutions that enable data processing, visualization, and decision-making capabilities across diverse industrial applications.

Strategic market positioning reveals the United States industrial sensors market as a cornerstone of advanced manufacturing transformation, with robust growth trajectories supported by federal manufacturing initiatives and private sector automation investments. Technology convergence between traditional sensing technologies and emerging digital capabilities has created unprecedented opportunities for market expansion and innovation.

Key growth drivers include mandatory safety regulations, energy efficiency requirements, and competitive pressures for operational optimization. The automotive sector leads market adoption with 42% of total sensor deployments, followed by chemical processing at 18% and food and beverage manufacturing at 15%. Wireless sensor technologies are experiencing particularly strong growth, with adoption rates increasing by 35% annually as manufacturers prioritize flexible, scalable monitoring solutions.

Market dynamics indicate strong momentum toward integrated sensor ecosystems that combine multiple sensing modalities with advanced analytics capabilities. MarkWide Research analysis suggests that predictive maintenance applications are driving 60% of new sensor installations, reflecting the industry’s focus on reducing unplanned downtime and optimizing asset utilization.

Fundamental market insights reveal transformative trends shaping the industrial sensors landscape across the United States manufacturing sector:

Primary market drivers propelling the United States industrial sensors market include comprehensive digitization initiatives, regulatory compliance requirements, and competitive operational optimization demands. Industry 4.0 adoption represents the most significant driver, with manufacturers investing heavily in smart factory technologies that rely extensively on sensor networks for data collection and process control.

Regulatory compliance serves as a critical driver, particularly in pharmaceutical, food processing, and chemical manufacturing sectors where sensors ensure adherence to safety, quality, and environmental standards. FDA regulations for pharmaceutical manufacturing require continuous monitoring of critical process parameters, driving demand for validated sensor systems with comprehensive data logging capabilities.

Operational efficiency pressures are compelling manufacturers to implement sensor-based monitoring systems that identify inefficiencies, reduce waste, and optimize resource utilization. Energy management requirements are driving adoption of sensors that monitor power consumption, equipment performance, and environmental conditions to support sustainability initiatives and cost reduction objectives.

Predictive maintenance strategies are becoming standard practice across manufacturing industries, requiring sophisticated sensor networks that monitor equipment health, detect anomalies, and predict failure modes. Labor shortage challenges are accelerating automation adoption, with sensors enabling unmanned operations and remote monitoring capabilities that address workforce limitations.

Significant market restraints include high implementation costs, technical complexity, and cybersecurity concerns that can limit sensor adoption across certain industrial segments. Capital investment requirements for comprehensive sensor networks, including hardware, software, and integration services, can be substantial, particularly for smaller manufacturing operations with limited budgets.

Technical integration challenges arise when implementing sensor systems in legacy manufacturing environments that lack modern communication infrastructure or standardized protocols. Compatibility issues between different sensor technologies, communication standards, and existing control systems can create implementation barriers and increase project complexity.

Cybersecurity vulnerabilities associated with connected sensor networks present ongoing concerns for manufacturers handling sensitive data or operating critical infrastructure. Data privacy regulations and industrial espionage risks require robust security measures that can increase system costs and complexity.

Skilled workforce limitations constrain market growth as sensor system implementation, maintenance, and optimization require specialized technical expertise that may not be readily available in all geographic regions or industrial sectors.

Substantial market opportunities emerge from advancing sensor technologies, expanding application areas, and growing demand for intelligent manufacturing solutions. Artificial intelligence integration presents significant opportunities for developing smart sensors that provide autonomous decision-making capabilities and advanced predictive analytics.

Emerging applications in renewable energy, electric vehicle manufacturing, and advanced materials processing are creating new market segments with specific sensor requirements. Green manufacturing initiatives are driving demand for environmental monitoring sensors that track emissions, energy consumption, and waste generation.

5G network deployment enables new possibilities for ultra-low latency sensor communications, supporting real-time control applications and massive sensor network deployments. Edge computing advancement creates opportunities for intelligent sensors that process data locally and reduce cloud connectivity requirements.

International expansion opportunities exist for US sensor manufacturers to leverage advanced technologies and established expertise in global markets, particularly in developing economies undergoing industrial modernization.

Complex market dynamics shape the United States industrial sensors landscape through interconnected technological, economic, and regulatory factors. Technology evolution cycles drive continuous innovation in sensor capabilities, with new generations offering enhanced accuracy, reliability, and functionality that create replacement demand and new application opportunities.

Supply chain considerations influence market dynamics, particularly regarding semiconductor availability, raw material costs, and manufacturing capacity constraints. Global supply chain disruptions have highlighted the importance of domestic sensor manufacturing capabilities and supply chain resilience.

Competitive dynamics involve both established industrial automation companies and emerging technology startups developing innovative sensor solutions. Strategic partnerships between sensor manufacturers, software developers, and system integrators are creating comprehensive solutions that address complex industrial requirements.

Customer adoption patterns vary significantly across industrial sectors, with early adopters in automotive and aerospace leading implementation while traditional manufacturing industries follow more conservative adoption timelines. Return on investment considerations heavily influence purchasing decisions, with customers requiring clear demonstrations of operational benefits and cost savings.

Comprehensive research methodology employed for analyzing the United States industrial sensors market incorporates multiple data collection approaches, analytical frameworks, and validation processes to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, technical specialists, and end-user representatives across diverse manufacturing sectors.

Secondary research components encompass analysis of industry publications, technical documentation, regulatory filings, and company financial reports to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling techniques to project market trends, growth patterns, and segment performance based on historical data and identified market drivers.

Market segmentation analysis employs both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market segments, applications, and geographic regions. Technology assessment includes evaluation of emerging sensor technologies, patent analysis, and innovation pipeline assessment to identify future market opportunities.

Data validation processes include triangulation of multiple data sources, expert review panels, and sensitivity analysis to ensure research findings accurately reflect market realities and provide reliable insights for strategic decision-making.

Regional market distribution across the United States reveals distinct patterns of industrial sensor adoption, with the Midwest region leading market share at 35% due to concentrated automotive and heavy manufacturing industries. Great Lakes states including Michigan, Ohio, and Illinois demonstrate particularly strong sensor deployment rates driven by automotive manufacturing clusters and advanced manufacturing initiatives.

Southeast region accounts for 28% of market activity, with significant growth in aerospace, chemical processing, and food manufacturing sectors. Texas, North Carolina, and Georgia lead regional adoption through diverse industrial bases and favorable business environments that attract manufacturing investments and technology deployments.

West Coast markets represent 22% of total sensor deployments, with California leading in high-technology manufacturing applications and innovative sensor implementations. Silicon Valley influence drives advanced sensor technology development and early adoption of cutting-edge sensing solutions across various industrial applications.

Northeast region maintains 15% market share, with established pharmaceutical, aerospace, and precision manufacturing industries driving demand for specialized sensor technologies. Regional characteristics include emphasis on high-precision applications, regulatory compliance requirements, and integration with existing industrial infrastructure.

Competitive landscape analysis reveals a diverse ecosystem of established industrial automation companies, specialized sensor manufacturers, and emerging technology providers competing across multiple market segments. Market leadership is distributed among several key players with distinct competitive advantages and market positioning strategies.

Competitive strategies include technology innovation, strategic acquisitions, partnership development, and vertical market specialization to differentiate offerings and capture market share.

Market segmentation analysis provides comprehensive understanding of the United States industrial sensors market structure across multiple dimensions including technology type, application sector, and deployment characteristics.

By Technology Type:

By Application Sector:

Temperature sensors represent the largest market category, accounting for significant market share due to universal requirements for thermal monitoring across industrial processes. Advanced temperature sensing technologies including wireless thermocouples and smart RTDs are experiencing strong growth driven by Industry 4.0 initiatives and predictive maintenance applications.

Pressure sensors demonstrate robust demand across process industries, with smart pressure transmitters incorporating digital communication protocols and advanced diagnostics capabilities. MEMS pressure sensors are gaining traction in applications requiring miniaturization and high-volume deployment.

Flow sensors benefit from increasing emphasis on process optimization and energy efficiency, with ultrasonic and electromagnetic technologies leading adoption in water treatment, chemical processing, and HVAC applications. Smart flow meters with integrated analytics capabilities are enabling advanced process control and optimization strategies.

Proximity sensors are experiencing growth driven by automation expansion and safety system requirements, with photoelectric and inductive technologies dominating industrial applications. IO-Link enabled proximity sensors are providing enhanced diagnostics and configuration capabilities that support predictive maintenance initiatives.

Manufacturers benefit from industrial sensor implementation through enhanced operational efficiency, reduced maintenance costs, and improved product quality. Predictive maintenance capabilities enabled by sensor networks can reduce unplanned downtime by 40-50% while extending equipment life and optimizing maintenance schedules.

System integrators gain opportunities to provide comprehensive automation solutions that combine sensor technologies with control systems, data analytics, and visualization platforms. Value-added services including sensor network design, implementation, and ongoing support create recurring revenue streams and strengthen customer relationships.

Technology providers benefit from expanding market opportunities driven by digital transformation initiatives and increasing demand for intelligent sensing solutions. Innovation investments in AI-enabled sensors, wireless technologies, and edge computing capabilities position companies for long-term market leadership.

End users realize substantial benefits including improved process control, enhanced safety, regulatory compliance, and operational cost reduction. Data-driven insights from sensor networks enable informed decision-making and continuous process improvement initiatives that drive competitive advantage.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless sensor networks represent a dominant trend transforming industrial monitoring applications through enhanced deployment flexibility and reduced installation costs. Industrial IoT integration is enabling comprehensive sensor ecosystems that provide real-time data streaming, cloud analytics, and remote monitoring capabilities across distributed manufacturing operations.

Artificial intelligence integration is revolutionizing sensor capabilities through embedded machine learning algorithms that enable autonomous decision-making, anomaly detection, and predictive analytics at the sensor level. Edge computing implementation reduces latency and bandwidth requirements while providing local data processing capabilities that support real-time control applications.

Miniaturization trends are enabling sensor deployment in previously inaccessible locations within industrial equipment, providing more comprehensive monitoring coverage and detailed process insights. Energy harvesting technologies are supporting wireless sensor deployment in remote locations without requiring external power sources or battery maintenance.

Cybersecurity enhancement has become a critical trend with manufacturers implementing advanced encryption, authentication, and intrusion detection capabilities to protect sensor networks from cyber threats. Standardization efforts are progressing toward universal communication protocols that improve interoperability and reduce integration complexity.

Recent industry developments highlight significant technological advances and strategic initiatives shaping the United States industrial sensors market. 5G network deployment is enabling ultra-low latency sensor communications that support real-time control applications and massive sensor network implementations across manufacturing facilities.

Semiconductor innovations are producing more powerful, energy-efficient sensor components that enable advanced functionality while reducing power consumption and physical footprint. MEMS technology advancement is creating new possibilities for miniaturized sensors with enhanced performance characteristics and cost-effectiveness.

Strategic partnerships between sensor manufacturers, software developers, and cloud service providers are creating integrated solutions that combine hardware, analytics, and visualization capabilities. Acquisition activities are consolidating market capabilities and creating comprehensive technology portfolios that address diverse industrial requirements.

Regulatory developments including updated safety standards and environmental regulations are driving demand for advanced sensor technologies that ensure compliance and support sustainable manufacturing practices. Government initiatives supporting domestic manufacturing and technology development are providing favorable conditions for sensor market growth and innovation.

Strategic recommendations for market participants include focusing on technology differentiation through AI integration, wireless capabilities, and advanced analytics functionality. MarkWide Research analysis suggests that companies should prioritize development of comprehensive sensor ecosystems that combine multiple sensing modalities with integrated data processing and visualization capabilities.

Market positioning strategies should emphasize vertical market specialization, developing deep expertise in specific industrial sectors to provide tailored solutions that address unique application requirements. Partnership development with system integrators, software providers, and cloud platforms can create comprehensive value propositions that differentiate offerings in competitive markets.

Investment priorities should include cybersecurity capabilities, edge computing integration, and wireless communication technologies that align with Industry 4.0 trends and customer digitization initiatives. Geographic expansion strategies should consider regional manufacturing concentrations and emerging industrial clusters that present growth opportunities.

Innovation focus areas should include energy-efficient sensor designs, self-calibrating technologies, and predictive maintenance capabilities that provide clear value propositions for industrial customers seeking operational optimization and cost reduction.

Future market trajectory indicates sustained growth driven by accelerating digital transformation initiatives, expanding automation adoption, and increasing emphasis on data-driven manufacturing optimization. Technology convergence between sensors, artificial intelligence, and cloud computing will create sophisticated industrial monitoring ecosystems that provide unprecedented visibility into manufacturing processes.

Emerging applications in renewable energy systems, electric vehicle manufacturing, and advanced materials processing will create new market segments with specialized sensor requirements. Sustainability initiatives will drive demand for environmental monitoring sensors that support carbon footprint reduction and resource optimization objectives.

Market evolution will favor intelligent sensor systems that provide autonomous operation, self-diagnostics, and predictive capabilities that reduce maintenance requirements and operational complexity. Wireless sensor networks are projected to achieve 65% market penetration within the next five years as manufacturers prioritize deployment flexibility and scalability.

Long-term prospects remain highly favorable with continued industrial modernization, regulatory compliance requirements, and competitive pressures driving sustained sensor adoption across diverse manufacturing sectors. MWR projections indicate that predictive maintenance applications will represent the fastest-growing market segment, with adoption rates increasing by 45% annually as manufacturers recognize the value of proactive equipment management strategies.

The United States industrial sensors market represents a dynamic and rapidly evolving sector that serves as a fundamental enabler of modern manufacturing transformation and Industry 4.0 implementation. Market fundamentals remain strong with diverse growth drivers including regulatory compliance, operational optimization, and digital transformation initiatives creating sustained demand for advanced sensor technologies.

Technology advancement continues to expand sensor capabilities through AI integration, wireless communication, and edge computing functionality that provides unprecedented monitoring and control capabilities. Market opportunities are substantial across multiple industrial sectors, with automotive, chemical processing, and pharmaceutical industries leading adoption of sophisticated sensor networks that enable predictive maintenance and process optimization.

Competitive landscape dynamics favor companies that can provide comprehensive sensor ecosystems combining hardware, software, and analytics capabilities that address complex industrial requirements. Future growth prospects remain highly favorable with expanding applications, technological innovation, and increasing emphasis on data-driven manufacturing creating sustained market expansion opportunities for industry participants and stakeholders throughout the United States industrial sensors market.

What is Industrial Sensors?

Industrial sensors are devices used to detect and measure physical properties such as temperature, pressure, and humidity in various industrial applications. They play a crucial role in automation, monitoring, and control processes across multiple sectors.

What are the key players in the United States (US) Industrial Sensors Market?

Key players in the United States (US) Industrial Sensors Market include Honeywell International Inc., Siemens AG, and Rockwell Automation, among others. These companies are known for their innovative sensor technologies and extensive product portfolios.

What are the main drivers of growth in the United States (US) Industrial Sensors Market?

The growth of the United States (US) Industrial Sensors Market is driven by the increasing demand for automation in manufacturing, the rise of the Internet of Things (IoT), and the need for real-time monitoring in various industries such as automotive and aerospace.

What challenges does the United States (US) Industrial Sensors Market face?

The United States (US) Industrial Sensors Market faces challenges such as the high cost of advanced sensor technologies and the complexity of integrating these sensors into existing systems. Additionally, concerns regarding data security and privacy can hinder market growth.

What opportunities exist in the United States (US) Industrial Sensors Market?

Opportunities in the United States (US) Industrial Sensors Market include the growing adoption of smart manufacturing practices and advancements in sensor technologies, such as wireless and smart sensors. These trends are expected to enhance operational efficiency and reduce costs.

What are the current trends in the United States (US) Industrial Sensors Market?

Current trends in the United States (US) Industrial Sensors Market include the increasing use of IoT-enabled sensors, the development of miniaturized sensors for various applications, and a focus on sustainability through energy-efficient sensor solutions.

United States (US) Industrial Sensors Market

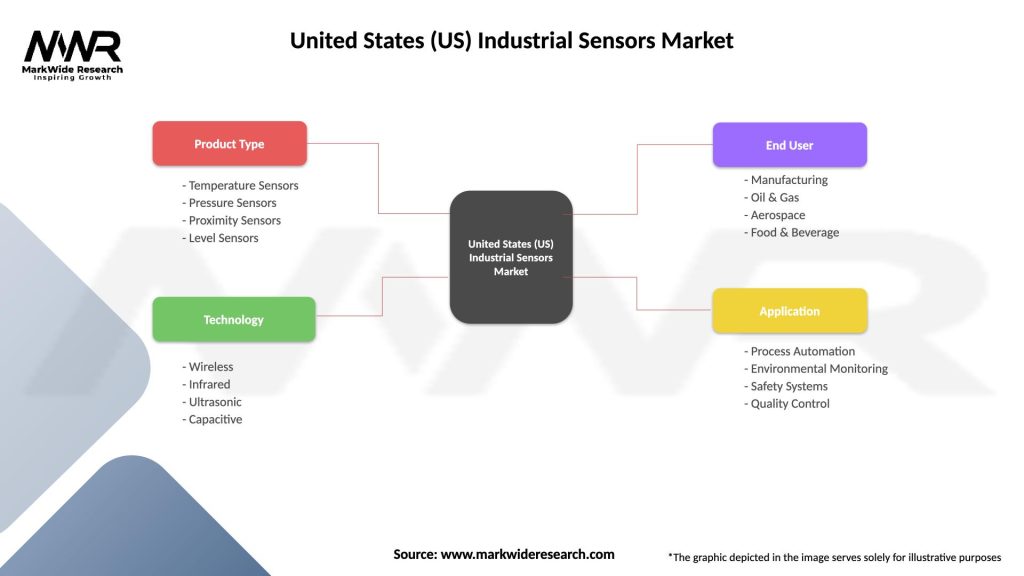

| Segmentation Details | Description |

|---|---|

| Product Type | Temperature Sensors, Pressure Sensors, Proximity Sensors, Level Sensors |

| Technology | Wireless, Infrared, Ultrasonic, Capacitive |

| End User | Manufacturing, Oil & Gas, Aerospace, Food & Beverage |

| Application | Process Automation, Environmental Monitoring, Safety Systems, Quality Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States (US) Industrial Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at