444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US daybeds market represents a dynamic segment within the broader furniture industry, characterized by innovative designs and evolving consumer preferences. Daybeds have emerged as versatile furniture pieces that seamlessly blend functionality with aesthetic appeal, serving dual purposes as both seating and sleeping solutions. The market demonstrates robust growth potential driven by changing lifestyle patterns, urbanization trends, and increasing demand for space-efficient furniture solutions.

Market dynamics indicate significant expansion opportunities as consumers increasingly prioritize multifunctional furniture that maximizes utility in compact living spaces. The sector experiences steady growth momentum with a projected compound annual growth rate of 6.2% through 2028, reflecting strong consumer adoption and market penetration across diverse demographic segments.

Regional distribution shows concentrated demand in metropolitan areas where space optimization remains a primary concern for homeowners and renters alike. The market encompasses various product categories, from traditional wooden daybeds to contemporary metal and upholstered designs, catering to diverse consumer preferences and interior design trends.

The US daybeds market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and retail of daybed furniture across the United States. Daybeds are specialized furniture pieces that function as both seating during daytime hours and sleeping accommodations when needed, typically featuring a twin-sized mattress platform with decorative backing or side rails.

Market scope includes various daybed styles ranging from traditional designs with ornate metalwork to modern minimalist platforms, upholstered options with storage capabilities, and convertible models that transform into full-sized beds. The market serves residential consumers, hospitality establishments, healthcare facilities, and commercial spaces requiring flexible furniture solutions.

Industry participants include furniture manufacturers, specialty retailers, e-commerce platforms, interior designers, and distribution networks that collectively contribute to market growth and consumer accessibility. The market encompasses both domestic production and imported products, creating a competitive landscape that drives innovation and price competitiveness.

Strategic analysis reveals the US daybeds market positioned for sustained growth driven by demographic shifts, housing trends, and evolving consumer lifestyle preferences. The market benefits from increasing urbanization rates, with 78% of Americans now living in urban areas where space-efficient furniture solutions command premium positioning.

Key growth drivers include the rising popularity of studio apartments, guest room optimization needs, and the growing trend of work-from-home arrangements that require flexible living spaces. Consumer behavior patterns show increased preference for multifunctional furniture, with 65% of millennials prioritizing versatility when making furniture purchases.

Market segmentation reveals diverse opportunities across material types, price points, and distribution channels. Online sales channels demonstrate particularly strong growth, capturing 42% market share as consumers increasingly embrace digital furniture shopping experiences. The market outlook remains positive with expanding product innovation, sustainable material adoption, and enhanced customization options driving future growth trajectories.

Consumer preferences reveal significant insights into daybed market dynamics and purchasing behavior patterns. MarkWide Research analysis indicates several critical market developments shaping industry growth and competitive positioning.

Urbanization trends serve as primary catalysts for daybed market expansion, with metropolitan areas experiencing continued population growth and housing density increases. Space constraints in urban environments create sustained demand for furniture solutions that maximize functionality while minimizing footprint requirements.

Demographic shifts contribute significantly to market growth, particularly among millennials and Generation Z consumers who prioritize flexibility and adaptability in their living arrangements. These demographic groups demonstrate strong preference for furniture that accommodates changing lifestyle needs and temporary living situations.

Housing market dynamics influence daybed adoption rates, with increasing numbers of studio apartments, micro-units, and compact living spaces driving demand for versatile furniture solutions. Rental market growth also supports market expansion as renters seek furniture that adapts to various living configurations.

Economic uncertainties present challenges for the daybed market, particularly regarding consumer discretionary spending on furniture items. Inflationary pressures on raw materials and manufacturing costs create pricing challenges that may impact market accessibility for price-sensitive consumer segments.

Supply chain disruptions continue to affect furniture manufacturing and distribution networks, leading to inventory shortages and extended delivery timeframes that may discourage potential buyers. Transportation costs and logistics complexities add additional layers of operational challenges for market participants.

Competition intensity from alternative furniture categories and imported products creates pricing pressures that may limit profit margins for domestic manufacturers. Consumer preference volatility regarding design trends and style preferences requires continuous product development investments.

Sustainable furniture trends create substantial opportunities for daybed manufacturers to differentiate their products through eco-friendly materials and production processes. Environmental consciousness among consumers drives demand for furniture made from recycled, renewable, or responsibly sourced materials.

Technology integration presents innovative opportunities for smart daybed designs that incorporate charging stations, LED lighting, storage solutions, and connectivity features. IoT capabilities and smart home integration represent emerging market segments with significant growth potential.

Customization services offer premium market opportunities as consumers increasingly seek personalized furniture solutions that reflect individual style preferences and specific space requirements. Made-to-order business models can command higher margins while building customer loyalty.

Competitive dynamics within the US daybeds market reflect a complex interplay of established furniture manufacturers, emerging direct-to-consumer brands, and international suppliers competing across multiple market segments. Innovation cycles drive continuous product development as companies seek to differentiate their offerings through design, functionality, and value propositions.

Consumer behavior evolution significantly influences market dynamics, with shifting preferences toward online shopping, sustainable products, and customizable solutions reshaping traditional retail models. Digital transformation accelerates market changes as consumers increasingly research, compare, and purchase furniture through digital channels.

Supply chain optimization becomes increasingly critical as manufacturers seek to balance cost efficiency with quality standards and delivery performance. Vertical integration strategies enable some companies to achieve better cost control and quality assurance while maintaining competitive pricing.

Market consolidation trends may reshape competitive landscapes as larger players acquire specialized manufacturers or innovative brands to expand their product portfolios and market reach. Strategic partnerships between manufacturers, retailers, and technology providers create new value propositions and market opportunities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the US daybeds sector. Primary research includes direct surveys with consumers, interviews with industry executives, and focus groups with target demographic segments to understand purchasing behavior and preference patterns.

Secondary research encompasses analysis of industry reports, trade publications, government statistics, and company financial statements to establish market sizing, growth trends, and competitive positioning. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability.

Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Statistical analysis methods ensure data integrity and support evidence-based conclusions regarding market dynamics and future opportunities.

Geographic distribution of the US daybeds market reveals distinct regional patterns influenced by demographic characteristics, housing types, and lifestyle preferences. West Coast markets demonstrate strong demand driven by urban density, tech industry growth, and contemporary design preferences, capturing approximately 28% market share.

Northeast regions show consistent market performance supported by established metropolitan areas, higher disposable incomes, and traditional furniture appreciation. Urban centers like New York, Boston, and Philadelphia drive significant demand for space-efficient furniture solutions, representing 24% of national market volume.

Southern states experience growing market penetration as population migration patterns bring urban lifestyle preferences to traditionally suburban markets. Texas and Florida lead regional growth with expanding metropolitan areas and diverse demographic compositions supporting market expansion.

Midwest markets demonstrate steady demand patterns with emphasis on value-oriented products and traditional design preferences. Regional preferences vary significantly, with coastal areas favoring contemporary designs while interior regions show stronger demand for traditional and transitional styles.

Market leadership in the US daybeds sector encompasses both established furniture manufacturers and emerging direct-to-consumer brands that leverage innovative business models and digital marketing strategies. Competitive positioning varies across price segments, design categories, and distribution channels.

Competitive strategies focus on product differentiation, pricing optimization, and channel expansion to capture market share across diverse consumer segments. Innovation emphasis drives continuous product development in materials, functionality, and design aesthetics.

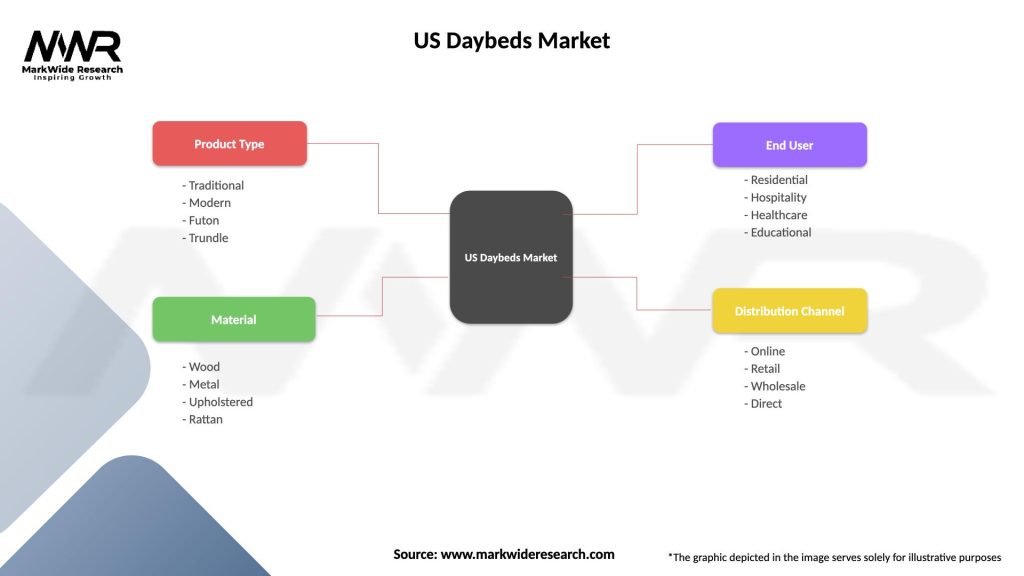

Market segmentation analysis reveals multiple classification approaches that provide insights into consumer preferences and market opportunities within the US daybeds sector. Product-based segmentation encompasses material types, design styles, and functional features that appeal to different consumer groups.

By Material Type:

By Price Range:

By Distribution Channel:

Traditional daybeds maintain steady market presence with classic designs that appeal to consumers seeking timeless furniture pieces. Wrought iron and wooden traditional daybeds demonstrate consistent demand in suburban markets and among consumers with traditional interior design preferences.

Contemporary daybeds experience the strongest growth trajectory, driven by millennial and Generation Z consumers who prioritize modern aesthetics and multifunctional design. Minimalist designs with clean lines and neutral colors capture significant market share in urban environments.

Storage daybeds represent a rapidly growing category as consumers increasingly value furniture that maximizes space efficiency. Built-in drawers and compartments add functional value that justifies premium pricing and drives customer satisfaction.

Manufacturers benefit from growing market demand that supports production scale economies and product line expansion opportunities. Diversification potential across multiple market segments reduces risk exposure while enabling targeted marketing strategies for different consumer groups.

Retailers gain from daybed category growth that drives store traffic and increases average transaction values through complementary product sales. Margin optimization opportunities exist through private label development and exclusive product partnerships with manufacturers.

Consumers benefit from increased product variety, competitive pricing, and innovative features that enhance living space functionality. Value proposition improvements include better quality materials, extended warranties, and enhanced customer service experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping the US daybeds market, with manufacturers increasingly adopting eco-friendly materials and production processes. Recycled materials and sustainably sourced wood gain consumer acceptance, driving product development toward environmentally responsible options.

Smart furniture evolution introduces technological features that enhance daybed functionality through integrated charging ports, LED lighting, and connectivity options. IoT capabilities enable remote control and monitoring features that appeal to tech-savvy consumers seeking connected home solutions.

Customization demand grows significantly as consumers seek personalized furniture solutions that reflect individual style preferences and specific space requirements. Made-to-order services and modular designs enable greater flexibility in meeting diverse consumer needs.

Product innovation accelerates across the daybed market with manufacturers introducing advanced materials, improved functionality, and enhanced design aesthetics. MWR analysis indicates significant investment in research and development activities focused on meeting evolving consumer expectations and market demands.

Strategic partnerships between furniture manufacturers and technology companies create opportunities for smart furniture development and market differentiation. Collaboration initiatives enable companies to leverage complementary expertise and accelerate innovation cycles.

Sustainability initiatives gain momentum as companies adopt environmentally responsible practices throughout their operations, from material sourcing to manufacturing processes and packaging solutions. Certification programs help consumers identify eco-friendly products and support purchasing decisions.

Strategic recommendations for market participants emphasize the importance of balancing innovation with cost efficiency while maintaining competitive positioning across diverse market segments. Product portfolio diversification enables companies to capture opportunities across multiple price points and consumer preferences.

Digital channel investment becomes increasingly critical as online sales continue growing and consumer shopping behaviors shift toward digital platforms. Omnichannel strategies that integrate online and offline experiences provide competitive advantages in customer acquisition and retention.

Sustainability focus should guide long-term strategic planning as environmental consciousness influences consumer purchasing decisions and regulatory requirements evolve. Supply chain transparency and responsible sourcing practices build brand credibility and customer loyalty.

Market projections indicate sustained growth momentum for the US daybeds market driven by demographic trends, urbanization patterns, and evolving consumer lifestyle preferences. Growth trajectory remains positive with projected expansion at 6.2% CAGR through the forecast period, supported by multiple growth drivers and market opportunities.

Technology integration will likely accelerate as smart home adoption increases and consumers seek furniture that complements connected living environments. Innovation cycles may shorten as companies compete to introduce cutting-edge features and maintain market relevance.

Sustainability requirements will probably intensify as environmental regulations evolve and consumer awareness increases regarding furniture industry environmental impacts. Circular economy principles may reshape business models toward product lifecycle management and recycling programs.

Market consolidation possibilities exist as larger companies seek to acquire innovative brands or specialized manufacturers to expand their market presence and technological capabilities. Competitive dynamics will likely intensify as market maturity increases and differentiation becomes more challenging.

The US daybeds market demonstrates strong growth potential supported by favorable demographic trends, urbanization patterns, and evolving consumer preferences for multifunctional furniture solutions. Market dynamics reflect a healthy balance of established players and innovative newcomers competing across diverse segments and price points.

Strategic opportunities abound for companies that successfully navigate challenges related to supply chain management, cost optimization, and product differentiation while capitalizing on trends toward sustainability, technology integration, and customization services. Consumer demand for space-efficient, versatile furniture continues driving market expansion across multiple geographic regions and demographic segments.

Future success in the US daybeds market will likely depend on companies’ abilities to balance innovation with affordability, maintain quality standards while optimizing costs, and develop distribution strategies that meet evolving consumer shopping preferences. The market outlook remains positive with sustained growth expected across multiple product categories and market segments.

What is a daybed?

A daybed is a versatile piece of furniture that can function as both a bed and a sofa. It typically features a back and sides, allowing it to be used for lounging during the day and sleeping at night.

What are the key players in the US Daybeds Market?

Key players in the US Daybeds Market include companies like IKEA, Wayfair, and Ashley Furniture, which offer a variety of styles and designs to cater to different consumer preferences and needs, among others.

What are the growth factors driving the US Daybeds Market?

The US Daybeds Market is driven by factors such as the increasing demand for multifunctional furniture in small living spaces, the rise in home decor trends, and the growing popularity of daybeds in guest rooms and home offices.

What challenges does the US Daybeds Market face?

Challenges in the US Daybeds Market include competition from alternative furniture options, fluctuating material costs, and changing consumer preferences towards more minimalist designs.

What opportunities exist in the US Daybeds Market?

Opportunities in the US Daybeds Market include the potential for customization and personalization of designs, the growth of e-commerce platforms for furniture sales, and the increasing interest in sustainable materials among consumers.

What trends are shaping the US Daybeds Market?

Trends in the US Daybeds Market include the rise of modern and minimalist designs, the integration of smart technology in furniture, and a focus on eco-friendly materials and production processes.

US Daybeds Market

| Segmentation Details | Description |

|---|---|

| Product Type | Traditional, Modern, Futon, Trundle |

| Material | Wood, Metal, Upholstered, Rattan |

| End User | Residential, Hospitality, Healthcare, Educational |

| Distribution Channel | Online, Retail, Wholesale, Direct |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Daybeds Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at