444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US handheld vacuum cleaners market represents a dynamic and rapidly evolving segment within the broader home appliance industry. This market encompasses portable, lightweight cleaning devices designed for quick cleanup tasks, spot cleaning, and reaching areas where traditional vacuum cleaners cannot access effectively. Market dynamics indicate robust growth driven by changing consumer lifestyles, technological advancements, and increasing demand for convenient cleaning solutions.

Consumer preferences have shifted significantly toward cordless, battery-powered handheld vacuum cleaners that offer superior mobility and ease of use. The market demonstrates strong growth momentum with a projected CAGR of 8.2% through the forecast period, reflecting increasing adoption across residential and commercial applications. Technological innovations including improved battery life, enhanced suction power, and specialized attachments continue to drive market expansion.

Regional distribution shows concentrated demand in urban areas where space constraints and busy lifestyles create strong preference for compact, efficient cleaning solutions. The market benefits from rising disposable incomes, growing awareness of hygiene standards, and increasing penetration of dual-income households requiring time-saving appliances.

The US handheld vacuum cleaners market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sale of portable vacuum cleaning devices specifically designed for handheld operation within the United States territory. These devices typically feature compact designs, lightweight construction, and specialized functionality for targeted cleaning applications including automotive interiors, upholstery, stairs, and hard-to-reach spaces.

Market scope includes cordless battery-powered units, corded electric models, and specialized variants designed for wet-dry cleaning applications. The market encompasses various distribution channels including retail stores, e-commerce platforms, and direct-to-consumer sales, serving both residential consumers and commercial users across diverse industry segments.

Market performance demonstrates exceptional growth trajectory driven by evolving consumer preferences toward convenient, portable cleaning solutions. The handheld vacuum cleaners segment has experienced significant transformation with technological advancements in battery technology, motor efficiency, and filtration systems creating enhanced value propositions for consumers.

Key growth drivers include increasing urbanization, rising awareness of indoor air quality, and growing adoption of cordless cleaning appliances. Market penetration reaches approximately 42% of US households, indicating substantial room for continued expansion. Innovation trends focus on smart connectivity features, improved ergonomics, and specialized attachments for diverse cleaning applications.

Competitive landscape features established appliance manufacturers alongside emerging technology-focused brands, creating dynamic market conditions with continuous product innovation and competitive pricing strategies. The market benefits from strong distribution networks and increasing consumer acceptance of premium-priced, feature-rich handheld vacuum solutions.

Strategic insights reveal several critical factors shaping market development and future growth potential:

Primary growth drivers propelling market expansion include fundamental shifts in consumer lifestyle patterns and technological capabilities. Urbanization trends create increased demand for space-efficient cleaning solutions that can effectively address the unique challenges of apartment living and smaller residential spaces.

Technological advancement in battery technology represents a crucial driver, with modern lithium-ion systems providing significantly improved performance and reliability. Consumer expectations for cordless convenience have elevated handheld vacuum cleaners from supplementary cleaning tools to essential household appliances.

Demographic factors including aging population and increasing number of pet-owning households drive demand for lightweight, easy-to-use cleaning solutions. Time constraints associated with modern lifestyles create strong preference for quick-cleanup capabilities that handheld vacuum cleaners provide effectively.

Health consciousness and growing awareness of indoor air quality issues motivate consumers to invest in advanced filtration systems and regular cleaning practices. E-commerce growth facilitates easier product discovery, comparison shopping, and convenient purchasing experiences that support market expansion.

Market challenges include several factors that may limit growth potential and market penetration. Price sensitivity among certain consumer segments creates barriers to adoption of premium-featured handheld vacuum cleaners, particularly in price-conscious demographics.

Battery limitations continue to present challenges despite technological improvements, with runtime constraints and charging requirements affecting user experience and satisfaction levels. Performance expectations regarding suction power and debris capacity may not always align with the physical constraints of handheld form factors.

Market saturation in certain segments and regions may limit growth opportunities, particularly where traditional vacuum cleaner penetration remains high. Maintenance requirements including filter replacement and battery degradation over time create ongoing ownership costs that may deter some consumers.

Competition intensity from alternative cleaning solutions and established vacuum cleaner categories creates challenges for market share expansion and pricing power maintenance.

Emerging opportunities present significant potential for market expansion and innovation-driven growth. Smart home integration offers possibilities for connected cleaning solutions that can be controlled and monitored through smartphone applications and home automation systems.

Specialized applications including automotive detailing, workshop cleaning, and outdoor recreational use create niche market segments with specific performance requirements and premium pricing potential. Commercial market expansion represents substantial opportunity as businesses recognize the efficiency benefits of handheld vacuum solutions for maintenance and cleaning operations.

Sustainability initiatives create opportunities for eco-friendly product development, including recyclable materials, energy-efficient designs, and extended product lifecycles. International expansion potential exists for successful US market participants to leverage proven technologies and business models in global markets.

Subscription services for replacement parts, filters, and accessories offer recurring revenue opportunities while enhancing customer relationships and product performance maintenance.

Market dynamics reflect complex interactions between technological innovation, consumer behavior evolution, and competitive forces. Innovation cycles demonstrate accelerating pace with manufacturers introducing new features and capabilities at increasingly frequent intervals to maintain competitive differentiation.

Consumer adoption patterns show strong correlation between product performance improvements and market acceptance, with customer satisfaction rates exceeding 78% for leading handheld vacuum brands. Seasonal fluctuations create predictable demand patterns with peak sales occurring during spring cleaning periods and holiday shopping seasons.

Supply chain dynamics have evolved to support just-in-time inventory management and rapid product introduction cycles. Pricing strategies demonstrate increasing sophistication with value-based pricing models replacing traditional cost-plus approaches in premium market segments.

Regulatory environment influences product development through energy efficiency standards and safety requirements that drive innovation while ensuring consumer protection.

Research approach employs comprehensive methodology combining primary and secondary research techniques to ensure accuracy and reliability of market insights. Primary research includes consumer surveys, industry expert interviews, and manufacturer consultations to gather firsthand market intelligence and validate secondary research findings.

Data collection methods encompass quantitative analysis of sales data, market share information, and pricing trends alongside qualitative assessment of consumer preferences, technology adoption patterns, and competitive positioning strategies. Market segmentation analysis utilizes demographic, psychographic, and behavioral variables to identify distinct consumer groups and their specific requirements.

Validation processes ensure data accuracy through cross-referencing multiple sources, statistical analysis, and expert review procedures. Forecasting models incorporate historical trends, current market conditions, and projected future developments to provide reliable growth projections and market evolution scenarios.

Regional market distribution reveals distinct patterns reflecting demographic characteristics, economic conditions, and consumer preferences across different US geographic areas. Northeast region demonstrates strong demand for premium handheld vacuum cleaners, accounting for approximately 28% of total market share, driven by high population density and elevated disposable income levels.

West Coast markets show highest adoption rates for technologically advanced cordless models, with California representing 22% of national sales volume. Consumer preferences in these markets favor eco-friendly features and smart connectivity capabilities, supporting premium pricing strategies.

Southern states exhibit growing market penetration with increasing urbanization and rising household incomes driving demand expansion. Midwest region shows steady growth patterns with strong preference for value-oriented product offerings and multi-functional capabilities.

Urban versus rural market dynamics reveal significant differences in product preferences, with urban consumers favoring compact, cordless designs while rural markets show continued demand for corded models with extended reach capabilities.

Competitive environment features diverse participant categories including established appliance manufacturers, specialized vacuum cleaner companies, and emerging technology-focused brands. Market leadership positions are determined by factors including brand recognition, product innovation, distribution reach, and customer satisfaction levels.

Key market participants include:

Competitive strategies emphasize product differentiation through technological innovation, brand building, and strategic partnerships with retailers and e-commerce platforms.

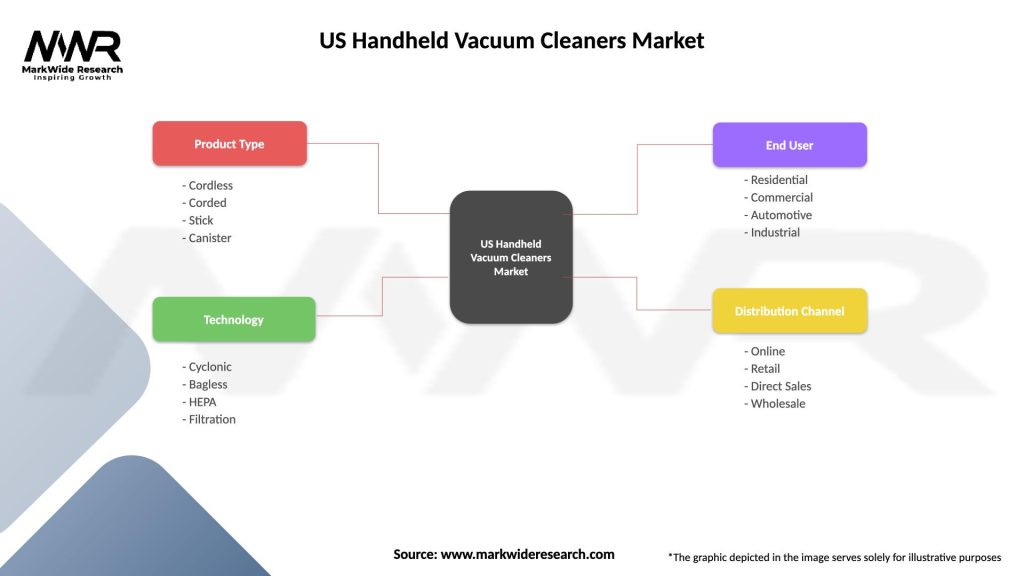

Market segmentation reveals distinct categories based on multiple classification criteria that help identify specific consumer needs and preferences.

By Power Source:

By Application:

By Price Range:

Cordless battery-powered category dominates market dynamics with continuous technological improvements in battery capacity, charging speed, and motor efficiency. Consumer preference strongly favors cordless models due to enhanced mobility and elimination of cord management challenges.

Wet-dry capability represents growing category importance as consumers seek versatile cleaning solutions capable of handling both dry debris and liquid spills. Performance improvements in this category include better sealing systems and more effective filtration for liquid applications.

Pet-specific models constitute rapidly expanding category segment driven by increasing pet ownership rates and specialized cleaning requirements. Feature innovations include specialized attachments, enhanced filtration for pet dander, and improved debris capacity for pet hair collection.

Smart-enabled category emerges as premium segment differentiator with connectivity features, mobile app integration, and automated maintenance reminders appealing to tech-savvy consumers seeking advanced functionality.

Manufacturers benefit from expanding market opportunities, technological innovation potential, and premium pricing possibilities in growing market segments. Product development advantages include relatively short development cycles and opportunities for continuous feature enhancement and differentiation.

Retailers gain from strong consumer demand, healthy profit margins, and opportunities for accessory and replacement part sales that enhance customer lifetime value. E-commerce platforms benefit from high search volume and comparison shopping behavior that drives traffic and conversion rates.

Consumers receive improved cleaning efficiency, time savings, and enhanced convenience through technological advancements and product innovation. Commercial users benefit from reduced labor costs, improved cleaning effectiveness, and enhanced operational flexibility.

Service providers including repair and maintenance companies benefit from growing installed base and ongoing maintenance requirements that create recurring revenue opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence drives integration of smart features including mobile app connectivity, usage tracking, and automated maintenance scheduling. Consumer behavior evolution shows increasing acceptance of premium pricing for advanced features and superior performance characteristics.

Sustainability trends influence product development with growing emphasis on recyclable materials, energy efficiency, and extended product lifecycles. Design innovation focuses on ergonomic improvements, noise reduction, and aesthetic appeal that enhances user experience and satisfaction.

Market consolidation trends show established manufacturers acquiring innovative startups to accelerate technology development and market expansion. Distribution evolution continues toward omnichannel strategies combining traditional retail with e-commerce and direct-to-consumer sales models.

Customization trends reflect growing consumer demand for specialized attachments and accessories that enhance versatility and application-specific performance. According to MarkWide Research analysis, customization features show 15% higher customer satisfaction rates compared to standard product offerings.

Recent developments demonstrate accelerating innovation pace and increasing market sophistication. Battery technology breakthroughs include introduction of fast-charging systems and extended runtime capabilities that address primary consumer concerns about cordless operation limitations.

Product launches increasingly feature smart connectivity options, advanced filtration systems, and specialized attachments designed for specific cleaning applications. Manufacturing innovations focus on cost reduction while maintaining quality standards and performance characteristics.

Partnership developments include collaborations between manufacturers and technology companies to integrate advanced features and connectivity capabilities. Retail partnerships expand distribution reach and enhance customer access to product demonstrations and expert advice.

Regulatory developments influence product design through updated safety standards and energy efficiency requirements that drive innovation while ensuring consumer protection and environmental responsibility.

Strategic recommendations for market participants emphasize the importance of continuous innovation and customer-centric product development. Investment priorities should focus on battery technology advancement, smart feature integration, and manufacturing efficiency improvements that support competitive positioning.

Market entry strategies for new participants should emphasize differentiation through specialized applications or unique technology approaches rather than direct competition with established brands. Distribution strategy optimization requires balanced approach combining traditional retail presence with strong e-commerce capabilities.

Product development focus should address identified consumer pain points including battery life, suction power, and ease of maintenance while incorporating emerging trends such as smart connectivity and sustainability features. MWR analysis suggests that companies investing in user experience improvements show 23% higher customer retention rates.

Pricing strategies should reflect value proposition differentiation while remaining competitive within target market segments. Brand building investments remain crucial for long-term market success and premium pricing sustainability.

Market trajectory indicates continued robust growth driven by technological advancement and expanding consumer adoption. Innovation acceleration will likely focus on artificial intelligence integration, improved battery chemistry, and enhanced user interface design that further simplifies operation and maintenance.

Market evolution suggests increasing segmentation with specialized products targeting specific applications and user requirements. Premium segment expansion appears likely as consumers become more willing to invest in advanced features and superior performance characteristics.

Technology integration trends point toward greater connectivity and smart home compatibility becoming standard features rather than premium options. Sustainability requirements will likely drive development of more environmentally friendly materials and energy-efficient designs.

Global market opportunities present potential for successful US market participants to expand internationally, leveraging proven technologies and business models. MarkWide Research projects that companies with strong US market positions show 65% success rates in international expansion initiatives.

The US handheld vacuum cleaners market represents a dynamic and rapidly evolving segment with substantial growth potential driven by technological innovation and changing consumer preferences. Market fundamentals remain strong with increasing adoption rates, expanding application areas, and continuous product improvement creating favorable conditions for sustained expansion.

Success factors for market participants include commitment to innovation, understanding of consumer needs, and ability to balance performance improvements with cost considerations. Future opportunities appear particularly promising in smart technology integration, commercial applications, and specialized cleaning solutions that address specific consumer requirements.

Market challenges including competition intensity and technology limitations require strategic responses focused on differentiation and continuous improvement. Overall market outlook remains positive with strong growth prospects supported by favorable demographic trends, technological advancement, and increasing consumer acceptance of premium-priced, feature-rich cleaning solutions that enhance convenience and effectiveness.

What is Handheld Vacuum Cleaners?

Handheld vacuum cleaners are compact, portable cleaning devices designed for quick and efficient cleaning of small areas. They are ideal for tasks such as cleaning cars, stairs, and tight spaces where traditional vacuums may be cumbersome.

What are the key players in the US Handheld Vacuum Cleaners Market?

Key players in the US Handheld Vacuum Cleaners Market include Dyson, Shark, Bissell, and Black+Decker, among others. These companies are known for their innovative designs and technology in the handheld vacuum segment.

What are the growth factors driving the US Handheld Vacuum Cleaners Market?

The growth of the US Handheld Vacuum Cleaners Market is driven by increasing consumer demand for convenience and portability in cleaning solutions. Additionally, the rise in pet ownership and the need for quick clean-ups in urban living spaces contribute to market expansion.

What challenges does the US Handheld Vacuum Cleaners Market face?

The US Handheld Vacuum Cleaners Market faces challenges such as intense competition among brands and the need for continuous innovation. Additionally, consumer preferences for multifunctional devices can impact sales of standalone handheld models.

What opportunities exist in the US Handheld Vacuum Cleaners Market?

Opportunities in the US Handheld Vacuum Cleaners Market include the development of advanced battery technologies and smart features that enhance user experience. There is also potential for growth in eco-friendly models that appeal to environmentally conscious consumers.

What trends are shaping the US Handheld Vacuum Cleaners Market?

Trends in the US Handheld Vacuum Cleaners Market include the increasing popularity of cordless models and the integration of smart technology for improved functionality. Additionally, lightweight designs and ergonomic features are becoming more prevalent to enhance user comfort.

US Handheld Vacuum Cleaners Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cordless, Corded, Stick, Canister |

| Technology | Cyclonic, Bagless, HEPA, Filtration |

| End User | Residential, Commercial, Automotive, Industrial |

| Distribution Channel | Online, Retail, Direct Sales, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Handheld Vacuum Cleaners Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at