444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US mattress bases market represents a dynamic and evolving segment of the broader sleep products industry, experiencing significant transformation driven by changing consumer preferences and technological innovations. Market dynamics indicate substantial growth potential as consumers increasingly prioritize sleep quality and bedroom aesthetics. The market encompasses various foundation types including traditional box springs, platform beds, adjustable bases, and hybrid foundation systems designed to support modern mattress technologies.

Consumer behavior has shifted dramatically toward premium sleep solutions, with adjustable bases showing particularly strong adoption rates of 12.3% annually. The integration of smart technology features, including sleep tracking, massage functions, and connectivity options, has revolutionized the traditional mattress base concept. Regional distribution shows concentrated demand in metropolitan areas where space optimization and multi-functional furniture solutions drive purchasing decisions.

Manufacturing innovation continues to reshape product offerings, with companies investing heavily in materials research and ergonomic design improvements. The market benefits from strong residential construction activity and the growing replacement cycle for sleep products, as consumers recognize the importance of proper mattress support systems for sleep quality and mattress longevity.

The US mattress bases market refers to the comprehensive ecosystem of foundation products designed to support mattresses and enhance sleep experiences across residential and commercial applications. This market encompasses traditional box springs, platform beds, adjustable bases, bed frames, and innovative hybrid foundation systems that combine multiple support technologies.

Product categories within this market include fixed foundations that provide static support, adjustable bases offering customizable positioning, and smart bases incorporating technology features. The market serves diverse consumer segments from budget-conscious buyers seeking basic support solutions to premium customers demanding advanced features like zero-gravity positioning, massage functions, and smartphone connectivity.

Market participants range from established furniture manufacturers to specialized sleep technology companies, creating a competitive landscape that drives continuous innovation and product development. The definition extends beyond simple support structures to include comprehensive sleep systems that integrate with modern mattress technologies and smart home ecosystems.

Strategic analysis reveals the US mattress bases market is experiencing robust expansion driven by evolving consumer sleep preferences and technological advancement integration. The market demonstrates strong resilience with diversified product portfolios addressing multiple price points and functionality requirements. Growth trajectories indicate sustained momentum across all major product categories, with adjustable bases leading innovation adoption.

Key market drivers include increasing health consciousness, aging population demographics requiring enhanced sleep support, and growing awareness of sleep quality’s impact on overall wellness. Technology integration has become a primary differentiator, with 68% of premium purchases including smart features or connectivity options. The market benefits from strong replacement cycles and new household formation trends.

Competitive dynamics show established players expanding product lines while new entrants focus on niche segments and direct-to-consumer distribution models. MarkWide Research analysis indicates the market’s evolution toward comprehensive sleep ecosystems rather than standalone foundation products, creating opportunities for integrated solutions and cross-selling strategies.

Market intelligence reveals several critical insights shaping the US mattress bases landscape. Consumer preferences have evolved significantly, with functionality and health benefits taking precedence over traditional aesthetic considerations. The market demonstrates strong segmentation across price tiers, with premium segments showing the highest growth rates and innovation adoption.

Consumer research indicates growing sophistication in purchase decision-making, with buyers conducting extensive research and prioritizing long-term value over initial cost considerations. The market benefits from strong word-of-mouth marketing and increasing professional recommendations from sleep specialists and healthcare providers.

Primary growth drivers propelling the US mattress bases market include demographic shifts, health awareness trends, and technological innovation adoption. The aging population represents a significant driver, as older consumers increasingly seek adjustable positioning options for comfort and health management. Healthcare recommendations for proper sleep support systems contribute to market expansion across all age demographics.

Lifestyle changes following recent global events have elevated home comfort priorities, with consumers investing more heavily in bedroom upgrades and sleep quality improvements. Work-from-home trends have increased time spent in bedrooms, driving demand for multi-functional furniture solutions that serve both rest and productivity needs.

Technology advancement creates new market opportunities through smart home integration, sleep tracking capabilities, and personalized comfort settings. The growing awareness of sleep’s impact on physical and mental health drives consumer willingness to invest in premium foundation systems. Construction activity in residential markets provides steady demand for new installations, while replacement cycles ensure consistent market renewal.

E-commerce growth has democratized access to premium products, enabling direct-to-consumer brands to compete effectively with traditional retailers. This distribution evolution has increased consumer awareness of product options and features, driving overall market sophistication and demand for advanced functionality.

Market challenges facing the US mattress bases industry include high initial investment costs for premium products, which can limit market penetration among price-sensitive consumers. The complexity of advanced adjustable bases may deter some buyers who prefer simple, reliable solutions without technological complications.

Economic sensitivity affects discretionary spending on home furnishings, with mattress bases often considered secondary purchases compared to mattresses themselves. Consumer education remains a significant challenge, as many buyers underestimate the importance of proper foundation systems for mattress performance and longevity.

Installation complexity for adjustable and smart bases can create barriers for some consumers, particularly older demographics who may be less comfortable with technology integration. The market faces competition from DIY solutions and lower-cost alternatives that may not provide optimal support but appeal to budget-conscious consumers.

Supply chain disruptions have impacted manufacturing costs and delivery timelines, affecting customer satisfaction and market growth. The industry also contends with space limitations in urban markets where smaller living spaces may not accommodate larger adjustable base systems, limiting market penetration in key demographic segments.

Emerging opportunities in the US mattress bases market center on technological innovation integration and expanding consumer awareness of sleep health benefits. The growing smart home market presents significant potential for connected sleep systems that integrate with broader home automation ecosystems. Health-conscious consumers represent an expanding target market for bases offering therapeutic benefits and customizable support options.

Commercial market expansion offers substantial growth potential, particularly in healthcare facilities, senior living communities, and premium hospitality establishments. These sectors prioritize functionality and durability, creating opportunities for specialized product development and long-term service contracts.

Sustainability initiatives create opportunities for eco-friendly product lines using recycled materials and sustainable manufacturing processes. Consumer interest in environmental responsibility continues growing, with 34% of buyers considering sustainability factors in purchasing decisions. The market can capitalize on this trend through innovative material sourcing and manufacturing approaches.

Customization services represent an untapped opportunity for premium positioning and increased customer loyalty. Personalized sizing, feature selection, and aesthetic customization can command premium pricing while enhancing customer satisfaction and reducing returns.

Market forces shaping the US mattress bases industry reflect complex interactions between consumer behavior evolution, technological advancement, and competitive pressures. The traditional product lifecycle has accelerated due to rapid innovation cycles, requiring companies to balance investment in new technologies with maintaining reliable core product offerings.

Competitive intensity has increased significantly as new entrants leverage direct-to-consumer models and innovative marketing approaches. Established players respond through product line extensions, strategic partnerships, and enhanced customer service offerings. Price competition remains moderate in premium segments where differentiation through features and quality maintains margin stability.

Consumer empowerment through online research and reviews has shifted market dynamics toward transparency and quality focus. Companies must maintain consistent product quality and customer service standards to succeed in this environment. Distribution channel evolution continues reshaping traditional retail relationships and customer acquisition strategies.

Regulatory considerations around product safety, materials standards, and environmental compliance influence product development and manufacturing processes. The market demonstrates resilience through diversified product portfolios and multiple distribution channels, enabling adaptation to changing market conditions and consumer preferences.

Comprehensive analysis of the US mattress bases market employs multi-faceted research approaches combining primary and secondary data sources. Primary research includes extensive consumer surveys, industry expert interviews, and manufacturer consultations to gather current market insights and future trend projections.

Data collection methods encompass retail sales analysis, online marketplace monitoring, and consumer behavior tracking across multiple touchpoints. Industry trade publications, manufacturer reports, and regulatory filings provide additional data sources for market size estimation and competitive landscape analysis.

Analytical frameworks include statistical modeling for growth projections, competitive positioning analysis, and consumer segmentation studies. Market validation occurs through cross-referencing multiple data sources and conducting follow-up research to confirm findings and projections.

Quality assurance measures ensure data accuracy through systematic verification processes and expert review panels. The methodology incorporates both quantitative metrics and qualitative insights to provide comprehensive market understanding and actionable intelligence for industry stakeholders.

Geographic distribution across the US mattress bases market reveals distinct regional preferences and growth patterns. The West Coast demonstrates the highest adoption rates for premium and smart base technologies, with 42% market share in the adjustable base segment. This region’s tech-savvy consumer base and higher disposable income levels drive innovation adoption and premium product penetration.

Northeast markets show strong demand for space-efficient solutions and multi-functional designs, reflecting urban living constraints and lifestyle preferences. The region maintains 28% of total market volume with particular strength in platform bed and hybrid foundation categories.

Southern regions exhibit growing market potential with increasing construction activity and population growth driving new household formation. Traditional preferences for box springs remain strong, though adjustable base adoption is accelerating among older demographics. The Midwest represents stable demand with emphasis on value-oriented products and established retail relationships.

Urban versus rural market dynamics show distinct patterns, with metropolitan areas driving premium product adoption while rural markets maintain preference for traditional foundation types. Climate considerations influence material preferences and durability requirements across different regions, affecting product specification and marketing strategies.

Market leadership in the US mattress bases industry is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment demonstrates healthy rivalry driving innovation and customer value creation.

Competitive strategies vary significantly across market participants, with some focusing on technological innovation while others emphasize manufacturing efficiency and cost leadership. Strategic partnerships between base manufacturers and mattress companies create integrated marketing opportunities and customer value propositions.

Market consolidation trends indicate potential for strategic acquisitions as companies seek to expand product portfolios and distribution capabilities. New entrants continue challenging established players through innovative designs and disruptive pricing strategies.

Market segmentation analysis reveals distinct categories based on product type, price range, distribution channel, and end-user applications. Each segment demonstrates unique growth characteristics and competitive dynamics.

By Product Type:

By Price Range:

By Distribution Channel:

Adjustable bases represent the most dynamic market category, experiencing rapid growth driven by aging demographics and health consciousness trends. This segment benefits from technological advancement integration, including massage functions, USB charging ports, and smartphone connectivity. Consumer adoption accelerates as awareness of health benefits increases and pricing becomes more accessible.

Platform beds appeal primarily to younger demographics seeking modern aesthetics and space efficiency. This category demonstrates strong growth in urban markets where minimalist design preferences and smaller living spaces drive purchasing decisions. Material innovation in platform construction enables lighter weight and easier assembly, addressing key consumer concerns.

Traditional box springs maintain market presence through replacement demand and consumer familiarity, though growth rates lag other categories. This segment focuses on value positioning and compatibility with existing bedroom furniture. Manufacturing efficiency improvements help maintain competitive pricing against alternative foundation types.

Smart bases emerge as a distinct category combining adjustable functionality with connected technology features. Early adoption shows promising growth potential with 78% customer satisfaction rates driving positive word-of-mouth marketing and repeat purchases within household networks.

Manufacturers benefit from expanding market opportunities across multiple product categories and price points. The industry’s evolution toward premium products and technology integration enables improved profit margins and brand differentiation. Innovation investment creates competitive advantages and customer loyalty while opening new market segments.

Retailers gain from increased consumer interest in sleep quality and bedroom upgrades, driving higher transaction values and customer engagement. The market’s complexity creates opportunities for consultative selling and value-added services. Online integration enables expanded market reach while maintaining local service capabilities.

Consumers receive enhanced sleep quality through improved support systems and personalized comfort options. Technology integration provides additional value through health monitoring and convenience features. Product longevity improvements deliver better long-term value and reduced replacement frequency.

Healthcare providers benefit from improved patient outcomes through better sleep support systems and positioning options. The market’s focus on health benefits aligns with medical recommendations for proper spinal alignment and circulation support. Commercial applications in healthcare facilities improve patient comfort and care quality.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration dominates current market trends, with smart features becoming standard expectations rather than premium options. Sleep tracking capabilities integrated into base systems provide valuable health insights and personalization opportunities. The trend toward comprehensive sleep ecosystems connects bases with mattresses, pillows, and environmental controls.

Sustainability focus influences material selection and manufacturing processes, with consumers increasingly considering environmental impact in purchasing decisions. Circular economy principles drive product design for recyclability and extended lifecycles, creating competitive advantages for environmentally conscious brands.

Customization demand grows across all market segments, with consumers seeking personalized solutions for specific health needs and aesthetic preferences. Modular design approaches enable feature selection and upgrade paths, extending product lifecycles and customer relationships.

Health and wellness positioning strengthens as consumers recognize sleep’s impact on overall health outcomes. Medical professional endorsements and clinical research support drive credibility and purchase justification for premium products. The trend toward preventive healthcare creates opportunities for therapeutic positioning and insurance coverage consideration.

Recent developments in the US mattress bases market reflect rapid innovation and strategic positioning changes among key players. MarkWide Research tracking indicates significant investment in research and development across the industry, with particular focus on smart technology integration and sustainable manufacturing processes.

Strategic partnerships between base manufacturers and mattress companies create integrated product offerings and enhanced customer value propositions. These collaborations enable optimized compatibility and performance while expanding market reach through shared distribution channels.

Manufacturing automation improvements reduce production costs while improving quality consistency and customization capabilities. Advanced materials research produces lighter, stronger, and more durable foundation systems that meet evolving consumer expectations for performance and longevity.

Regulatory developments around product safety and environmental standards influence design specifications and manufacturing processes. Industry adaptation to these requirements creates opportunities for competitive differentiation through superior compliance and performance standards.

Market consolidation activities include strategic acquisitions and partnerships aimed at expanding product portfolios and distribution capabilities. These developments reshape competitive dynamics and create new market leaders with enhanced resources and market reach.

Strategic recommendations for US mattress bases market participants emphasize innovation investment and customer experience enhancement. Companies should prioritize technology integration while maintaining product reliability and ease of use. Market positioning should emphasize health benefits and long-term value rather than competing solely on price.

Distribution strategy optimization requires balancing online growth with traditional retail relationships. Companies should invest in omnichannel capabilities that provide consistent customer experiences across all touchpoints. Customer education initiatives can drive market expansion by increasing awareness of foundation importance for sleep quality.

Product development focus should address sustainability concerns while advancing technological capabilities. Modular design approaches enable customization and upgrade paths that extend customer relationships and product lifecycles. Companies should consider subscription or service models that provide ongoing value and customer engagement.

Market expansion opportunities exist in commercial segments and underserved demographic groups. Partnership strategies with healthcare providers and hospitality companies can create new distribution channels and credibility enhancement. International expansion consideration may provide growth opportunities as global markets develop similar consumer preferences.

Long-term projections for the US mattress bases market indicate sustained growth driven by demographic trends, health awareness, and technological advancement. The market is expected to maintain robust expansion with compound annual growth rates of 8.7% across premium segments, while traditional categories stabilize at moderate growth levels.

Technology evolution will continue reshaping product offerings, with artificial intelligence and machine learning enabling personalized sleep optimization and predictive maintenance capabilities. Integration trends suggest bases will become central components of comprehensive smart bedroom ecosystems connected to broader home automation systems.

Demographic shifts toward an aging population will drive sustained demand for adjustable and therapeutic base options. Millennial and Gen Z consumers entering peak household formation years will prioritize technology features and sustainability considerations, influencing product development priorities.

Market maturation will likely lead to increased consolidation and specialization, with companies focusing on specific segments or geographic regions. MWR analysis suggests successful companies will be those that balance innovation with reliability while building strong customer relationships through superior service and support.

The US mattress bases market represents a dynamic and evolving industry positioned for sustained growth through technological innovation, demographic trends, and increasing consumer awareness of sleep quality importance. Market participants who successfully balance innovation with reliability while addressing diverse consumer needs across multiple price points will capture the greatest opportunities in this expanding market.

Strategic success requires understanding the complex interplay between consumer preferences, technological capabilities, and market dynamics. Companies must invest in research and development while maintaining focus on customer experience and value delivery. The market’s evolution toward comprehensive sleep ecosystems creates opportunities for integrated solutions and long-term customer relationships.

Future growth will be driven by continued innovation in smart technology integration, sustainability initiatives, and health-focused product development. The industry’s ability to adapt to changing consumer preferences while maintaining product quality and reliability will determine long-term success in this competitive and rapidly evolving market landscape.

What is Mattress Bases?

Mattress bases are supportive structures designed to hold and elevate mattresses, enhancing comfort and durability. They come in various forms, including box springs, platform beds, and adjustable bases, catering to different sleeping preferences and styles.

What are the key players in the US Mattress Bases Market?

Key players in the US Mattress Bases Market include Tempur-Pedic, Sealy, Serta Simmons Bedding, and Leggett & Platt, among others. These companies are known for their innovative designs and commitment to quality in mattress support solutions.

What are the growth factors driving the US Mattress Bases Market?

The US Mattress Bases Market is driven by increasing consumer awareness of sleep health, the rising demand for adjustable bases, and the growth of online retail channels. Additionally, innovations in materials and designs are attracting more consumers.

What challenges does the US Mattress Bases Market face?

The US Mattress Bases Market faces challenges such as intense competition among manufacturers and fluctuating raw material costs. Additionally, consumer preferences for sustainable products are pushing companies to adapt their offerings.

What opportunities exist in the US Mattress Bases Market?

Opportunities in the US Mattress Bases Market include the growing trend of smart mattresses and bases that integrate technology for enhanced user experience. Furthermore, the increasing focus on eco-friendly materials presents a chance for innovation.

What trends are shaping the US Mattress Bases Market?

Trends in the US Mattress Bases Market include the rise of customizable and modular bases, as well as the popularity of hybrid models that combine traditional and modern features. Additionally, the shift towards online shopping is transforming how consumers purchase mattress bases.

US Mattress Bases Market

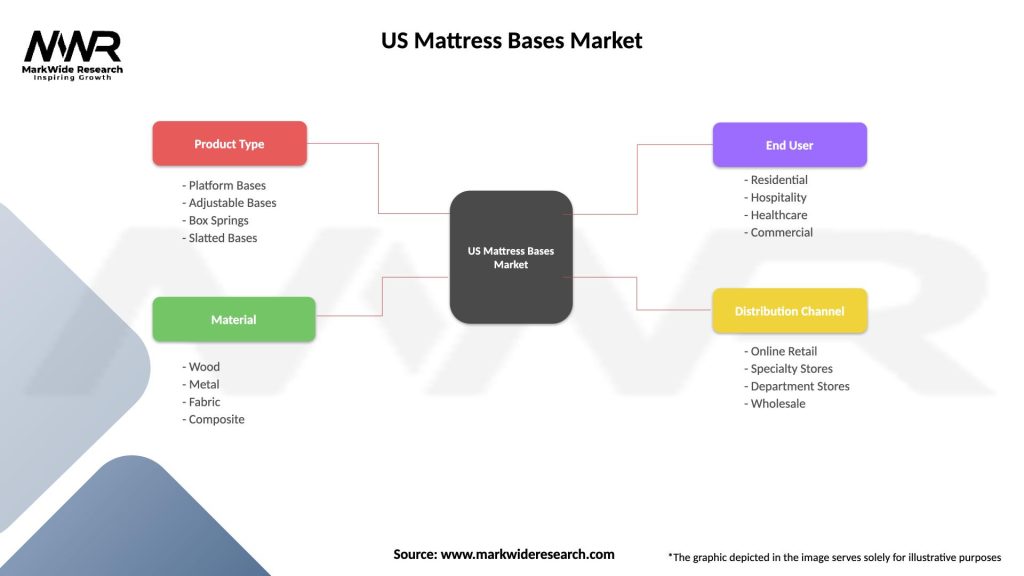

| Segmentation Details | Description |

|---|---|

| Product Type | Platform Bases, Adjustable Bases, Box Springs, Slatted Bases |

| Material | Wood, Metal, Fabric, Composite |

| End User | Residential, Hospitality, Healthcare, Commercial |

| Distribution Channel | Online Retail, Specialty Stores, Department Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Mattress Bases Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at