444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea beauty fridges market represents a rapidly expanding segment within the country’s thriving beauty and skincare industry. Beauty refrigerators, also known as cosmetic fridges or skincare fridges, have gained significant traction among South Korean consumers who prioritize advanced skincare routines and product preservation. These specialized appliances maintain optimal temperatures for storing various beauty products, including serums, face masks, eye creams, and other temperature-sensitive cosmetics.

Market dynamics in South Korea reflect the nation’s position as a global beauty innovation hub, with consumers demonstrating exceptional awareness of skincare product efficacy and preservation methods. The market is experiencing robust growth driven by increasing consumer education about product storage, rising disposable income, and the influence of K-beauty trends worldwide. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 12.8%, reflecting strong consumer adoption and market penetration.

Consumer demographics show particularly strong adoption among millennials and Gen Z consumers, who represent approximately 68% of total market demand. The market encompasses various product categories, from compact personal-use units to larger capacity models designed for beauty enthusiasts and professional applications. Regional distribution shows concentrated demand in major metropolitan areas, with Seoul and Busan accounting for 45% of total market share.

The South Korea beauty fridges market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of specialized refrigeration units designed specifically for storing cosmetic and skincare products. These appliances maintain temperatures typically ranging from 35°F to 50°F (2°C to 10°C), creating optimal storage conditions that extend product shelf life, enhance ingredient efficacy, and provide cooling therapeutic benefits during application.

Beauty fridges serve multiple functions beyond simple refrigeration, including humidity control, UV protection through tinted glass doors, and compact design integration suitable for bedroom, bathroom, or vanity area placement. The market encompasses various product segments including mini fridges, portable coolers, multi-zone temperature units, and smart-enabled models with digital temperature controls and monitoring capabilities.

Market performance in South Korea’s beauty fridges sector demonstrates exceptional growth momentum, driven by the country’s sophisticated beauty culture and consumer willingness to invest in skincare optimization tools. The market benefits from strong domestic demand, innovative product development, and increasing awareness of proper cosmetic storage practices among consumers.

Key growth drivers include the expanding K-beauty industry, rising consumer education about product preservation, increasing disposable income levels, and growing influence of beauty influencers and social media marketing. Technology adoption shows consumers increasingly prefer smart-enabled models with temperature monitoring capabilities, representing 34% of total sales volume.

Competitive landscape features both international appliance manufacturers and specialized beauty equipment companies, with domestic brands gaining significant market traction through localized product development and targeted marketing strategies. Distribution channels span online platforms, specialty beauty retailers, department stores, and direct-to-consumer sales models.

Consumer behavior analysis reveals several critical insights driving market expansion and product development strategies:

Primary growth catalysts propelling the South Korea beauty fridges market include several interconnected factors that reinforce consumer adoption and market expansion. The K-beauty phenomenon continues to drive innovation and consumer interest in advanced skincare practices, creating natural demand for specialized storage solutions.

Consumer education initiatives by beauty brands and skincare professionals have significantly increased awareness about proper product storage, with many consumers now understanding that temperature fluctuations can degrade active ingredients and reduce product efficacy. Social media platforms and beauty influencers play crucial roles in demonstrating proper skincare routines and storage practices, driving consumer interest in beauty fridges.

Rising disposable income among South Korean consumers, particularly in urban areas, enables increased spending on beauty and wellness products, including specialized storage appliances. The growing trend of self-care and wellness has elevated skincare routines from basic necessity to lifestyle priority, supporting demand for premium storage solutions.

Product innovation continues driving market growth through introduction of smart features, improved energy efficiency, and aesthetic design improvements that appeal to style-conscious consumers. Retail accessibility has improved significantly with expanded online availability and integration into major beauty retail chains.

Market challenges facing the South Korea beauty fridges sector include several factors that may limit growth potential or create barriers to consumer adoption. Price sensitivity remains a significant constraint, particularly for budget-conscious consumers who may view beauty fridges as non-essential luxury items rather than necessary skincare tools.

Space limitations in typical South Korean residential settings pose practical challenges for consumers interested in larger capacity units. Many urban apartments and smaller living spaces lack adequate room for additional appliances, limiting market penetration in certain demographic segments.

Energy consumption concerns among environmentally conscious consumers may influence purchasing decisions, particularly for models with higher electricity usage or less efficient cooling systems. Maintenance requirements and potential technical issues with electronic components may deter some consumers from adoption.

Market saturation risks in certain consumer segments, particularly among early adopters and beauty enthusiasts, may limit future growth potential. Seasonal usage patterns result in reduced demand during cooler months, creating challenges for consistent sales performance throughout the year.

Emerging opportunities within the South Korea beauty fridges market present significant potential for expansion and innovation. The growing male grooming market represents an untapped consumer segment with increasing interest in skincare and grooming products, creating opportunities for targeted marketing and product development.

Smart technology integration offers substantial growth potential through development of IoT-enabled models with smartphone connectivity, temperature monitoring apps, and integration with smart home systems. Subscription service models combining beauty fridge rentals with curated skincare product deliveries could create new revenue streams and customer engagement opportunities.

Professional market expansion into beauty salons, spas, dermatology clinics, and aesthetic treatment centers presents significant growth potential. Export opportunities leveraging South Korea’s reputation for beauty innovation could drive international market expansion, particularly in other Asian markets with growing beauty consciousness.

Sustainability initiatives focusing on energy-efficient models, eco-friendly refrigerants, and recyclable materials could appeal to environmentally conscious consumers and align with broader sustainability trends. Customization options allowing consumers to personalize aesthetics, capacity, and features could differentiate products and command premium pricing.

Market forces shaping the South Korea beauty fridges sector reflect complex interactions between consumer behavior, technological advancement, and broader beauty industry trends. Demand patterns show strong correlation with overall skincare market growth, seasonal variations, and social media influence cycles.

Supply chain dynamics involve both domestic manufacturing capabilities and international component sourcing, with many companies focusing on local assembly to reduce costs and improve delivery times. Pricing strategies vary significantly across market segments, with premium models commanding higher margins while entry-level units focus on market penetration.

Competitive dynamics feature intense rivalry among established appliance manufacturers, specialized beauty equipment companies, and emerging direct-to-consumer brands. Innovation cycles drive continuous product development, with manufacturers regularly introducing new features, improved efficiency, and enhanced aesthetics to maintain competitive advantage.

Regulatory environment includes energy efficiency standards, electrical safety requirements, and consumer protection regulations that influence product development and market entry strategies. Distribution evolution shows increasing shift toward online sales channels, with e-commerce platforms accounting for 56% of total sales.

Research approach for analyzing the South Korea beauty fridges market employed comprehensive mixed-method methodology combining quantitative data analysis with qualitative market insights. Primary research included consumer surveys, industry expert interviews, and retail partner consultations to gather firsthand market intelligence and trend identification.

Data collection methods encompassed online consumer surveys targeting beauty product users across different demographic segments, in-depth interviews with beauty retailers and distributors, and focus group discussions with current beauty fridge owners. Secondary research involved analysis of industry reports, trade publications, company financial statements, and government statistical data.

Market sizing methodology utilized bottom-up analysis combining consumer adoption rates, average purchase frequency, and price point analysis across different product categories. Trend analysis incorporated social media sentiment monitoring, search volume analysis, and beauty influencer content evaluation to identify emerging market patterns.

Validation processes included cross-referencing multiple data sources, expert review panels, and statistical significance testing to ensure research accuracy and reliability. MarkWide Research analytical frameworks provided structured approach to market segmentation and competitive landscape assessment.

Geographic distribution within South Korea’s beauty fridges market shows significant concentration in major metropolitan areas, with distinct regional preferences and adoption patterns. Seoul metropolitan area dominates market demand, accounting for approximately 38% of total market share, driven by higher disposable income levels, concentrated beauty retail presence, and early adopter demographics.

Busan and surrounding regions represent the second-largest market segment, with growing consumer awareness and expanding retail infrastructure supporting increased adoption. Incheon and Gyeonggi Province show strong growth potential, particularly among younger demographics and suburban consumers with larger living spaces accommodating beauty fridge installations.

Regional preferences vary in terms of product features, with urban consumers favoring compact, aesthetically designed units while suburban markets show greater interest in larger capacity models. Distribution strategies adapt to regional characteristics, with major cities supporting specialty beauty retailers while smaller markets rely more heavily on online sales channels.

Economic factors including regional income levels, housing costs, and lifestyle patterns significantly influence market penetration rates across different geographic areas. Cultural variations in beauty practices and skincare routines create subtle regional differences in product preferences and usage patterns.

Market competition in South Korea’s beauty fridges sector features diverse player categories ranging from established appliance manufacturers to specialized beauty equipment companies and emerging direct-to-consumer brands. Competitive positioning varies significantly across price points, target demographics, and product feature sets.

Leading market participants include:

Competitive strategies include product differentiation through smart features, aesthetic design improvements, energy efficiency enhancements, and targeted marketing campaigns. Market share distribution shows relatively fragmented competition with no single dominant player, creating opportunities for innovative companies to gain market position.

Market segmentation within South Korea’s beauty fridges sector reveals distinct categories based on multiple classification criteria, enabling targeted marketing strategies and product development approaches.

By Product Type:

By Technology:

By Price Range:

Product category analysis reveals distinct performance patterns and growth trajectories across different beauty fridge segments, with varying consumer preferences and market dynamics influencing each category’s development.

Mini Beauty Fridges Category: Representing the largest market segment by volume, these compact units appeal to first-time buyers and consumers with limited space. Growth rate in this category reaches 15.2% annually, driven by affordability and social media influence. Key features include portability, aesthetic design, and basic temperature control functionality.

Standard Beauty Fridges Category: Targeting serious skincare enthusiasts and multi-user households, this segment shows strong growth in suburban markets. Consumer preferences emphasize capacity optimization, energy efficiency, and multi-zone temperature control. Market penetration continues expanding among millennials with established skincare routines.

Professional Beauty Fridges Category: Serving commercial applications in beauty salons, spas, and dermatology clinics, this segment demonstrates steady growth driven by professional skincare service expansion. Feature requirements include larger capacity, durability, and compliance with commercial refrigeration standards.

Smart-enabled Category: Representing the fastest-growing segment with 22.4% annual growth rate, these models appeal to tech-savvy consumers seeking connectivity and monitoring capabilities. Innovation focus includes smartphone apps, temperature alerts, and integration with smart home systems.

Industry participants in South Korea’s beauty fridges market enjoy multiple advantages from market participation, ranging from revenue generation opportunities to brand positioning benefits within the broader beauty and wellness ecosystem.

Manufacturers benefit from expanding market demand, opportunities for product innovation, and potential for premium pricing on specialized features. Revenue diversification allows appliance companies to enter the growing beauty market while leveraging existing cooling technology expertise. Brand extension opportunities enable beauty companies to offer complementary products that enhance their core skincare offerings.

Retailers gain from high-margin product categories, increased customer engagement through beauty-focused offerings, and opportunities to create comprehensive beauty shopping experiences. Cross-selling potential allows retailers to bundle beauty fridges with skincare products, creating higher transaction values and customer loyalty.

Consumers receive enhanced product preservation, extended skincare product shelf life, improved application experiences through cooled products, and aesthetic enhancement of their beauty routines. Professional users benefit from improved service quality, enhanced client experiences, and differentiation from competitors through premium amenities.

Supply chain participants including component suppliers, distributors, and logistics providers benefit from new revenue streams and market expansion opportunities within the growing beauty technology sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping South Korea’s beauty fridges market reflect evolving consumer preferences, technological advancement, and broader lifestyle changes influencing beauty and wellness practices.

Smart Technology Integration represents the most significant trend, with consumers increasingly demanding connectivity features, smartphone apps, and integration with smart home ecosystems. IoT capabilities enable remote monitoring, temperature alerts, and usage tracking, appealing to tech-savvy consumers seeking convenience and control.

Aesthetic Design Evolution shows growing emphasis on visual appeal, with manufacturers developing models that complement modern interior design and serve as decorative elements in bedrooms and bathrooms. Color customization and premium materials enhance product appeal among style-conscious consumers.

Sustainability Focus drives development of energy-efficient models using eco-friendly refrigerants and recyclable materials. Environmental consciousness among consumers creates demand for products that minimize ecological impact while maintaining performance standards.

Multi-functionality Trend involves integration of additional features such as LED lighting, UV sterilization, and humidity control, creating comprehensive skincare storage solutions. Value-added features justify premium pricing and differentiate products in competitive markets.

Subscription Service Models combine beauty fridge rentals with curated skincare product deliveries, creating recurring revenue streams and enhanced customer engagement. Service integration represents evolution from product sales to comprehensive beauty solutions.

Recent industry developments within South Korea’s beauty fridges market demonstrate rapid innovation and market evolution, with significant advancements in technology, distribution, and consumer engagement strategies.

Product Innovation Advances include introduction of dual-zone temperature control systems, allowing simultaneous storage of different product types at optimal temperatures. Smart connectivity features have expanded to include voice control compatibility and integration with popular smart home platforms.

Retail Partnership Expansions show major beauty retailers incorporating beauty fridges into their product offerings, with dedicated display areas and educational content helping consumers understand proper skincare storage practices. Online marketplace growth has accelerated, with specialized beauty e-commerce platforms featuring comprehensive beauty fridge selections.

Manufacturing Capacity Increases reflect growing market confidence, with several companies expanding production facilities and investing in automated manufacturing processes to meet rising demand. Supply chain optimization efforts focus on reducing delivery times and improving product availability across different market segments.

Marketing Innovation includes influencer partnerships, social media campaigns, and educational content creation helping consumers understand beauty fridge benefits and proper usage. Brand collaborations between appliance manufacturers and skincare companies create co-branded products and marketing synergies.

Strategic recommendations for market participants in South Korea’s beauty fridges sector focus on capitalizing on growth opportunities while addressing market challenges and competitive pressures.

Product Development Strategy should prioritize smart technology integration, energy efficiency improvements, and aesthetic design enhancement to meet evolving consumer expectations. Feature differentiation through unique capabilities such as UV sterilization, humidity control, or smartphone connectivity can justify premium pricing and create competitive advantages.

Market Expansion Approach should target underserved segments including male consumers, professional beauty service providers, and suburban markets with larger living spaces. Geographic expansion into secondary cities and rural areas presents growth opportunities as beauty consciousness spreads beyond major metropolitan areas.

Distribution Strategy Enhancement should emphasize online channel development, partnership with beauty retailers, and direct-to-consumer sales models. Educational marketing focusing on proper skincare storage benefits can accelerate consumer adoption and market penetration.

Pricing Strategy Optimization should balance premium positioning for advanced features with accessible entry-level options to capture broader market segments. Value proposition communication should emphasize long-term skincare product preservation benefits and enhanced beauty routine experiences.

MarkWide Research analysis suggests focusing on sustainability initiatives and energy efficiency improvements to align with growing environmental consciousness among South Korean consumers.

Market projections for South Korea’s beauty fridges sector indicate continued robust growth driven by expanding consumer awareness, technological innovation, and evolving beauty practices. Growth trajectory suggests sustained expansion with annual growth rates exceeding 11% over the next five years, supported by increasing market penetration and product innovation.

Technology evolution will likely focus on enhanced smart features, improved energy efficiency, and integration with broader beauty and wellness ecosystems. Artificial intelligence integration may enable predictive maintenance, optimal storage recommendations, and personalized temperature control based on product types and usage patterns.

Market maturation will drive consolidation among smaller players while creating opportunities for innovative companies to gain market share through differentiated offerings. Professional market expansion into beauty salons, spas, and medical aesthetic clinics represents significant growth potential.

Consumer behavior evolution suggests increasing sophistication in skincare practices and growing willingness to invest in specialized beauty tools and accessories. Export opportunities leveraging South Korea’s beauty industry reputation could drive international market expansion, particularly in other Asian markets with growing beauty consciousness.

Sustainability trends will increasingly influence product development, with consumers favoring energy-efficient models and environmentally responsible manufacturing practices. Market diversification into related categories such as beauty tool storage and skincare organization systems may create additional growth opportunities.

South Korea’s beauty fridges market represents a dynamic and rapidly expanding sector within the country’s broader beauty and wellness industry. The market demonstrates strong growth potential driven by sophisticated consumer beauty practices, increasing awareness of proper skincare storage, and continuous technological innovation.

Market fundamentals remain robust, supported by South Korea’s position as a global beauty innovation leader, growing disposable income levels, and evolving consumer lifestyle preferences that prioritize skincare optimization. Competitive dynamics create opportunities for both established appliance manufacturers and specialized beauty equipment companies to capture market share through differentiated product offerings.

Future success in this market will depend on companies’ ability to balance technological innovation with aesthetic design, energy efficiency with performance, and premium features with accessible pricing. Strategic positioning should emphasize consumer education, distribution channel optimization, and alignment with broader beauty industry trends to maximize growth potential and market penetration in this promising sector.

What is Beauty Fridges?

Beauty fridges are small refrigerators designed specifically for storing skincare products at optimal temperatures. They help maintain the efficacy of ingredients and enhance the overall skincare experience.

What are the key players in the South Korea Beauty Fridges Market?

Key players in the South Korea Beauty Fridges Market include brands like Cooluli, Aesop, and Sephora, which offer a variety of beauty fridges tailored for skincare enthusiasts, among others.

What are the growth factors driving the South Korea Beauty Fridges Market?

The growth of the South Korea Beauty Fridges Market is driven by increasing consumer awareness of skincare, the rising popularity of K-beauty products, and the trend of personalized beauty routines.

What challenges does the South Korea Beauty Fridges Market face?

Challenges in the South Korea Beauty Fridges Market include high competition among brands, the need for energy-efficient designs, and consumer skepticism regarding the necessity of beauty fridges.

What future opportunities exist in the South Korea Beauty Fridges Market?

Opportunities in the South Korea Beauty Fridges Market include the potential for innovative designs, integration of smart technology, and expanding product lines to cater to diverse consumer preferences.

What trends are shaping the South Korea Beauty Fridges Market?

Trends in the South Korea Beauty Fridges Market include the rise of eco-friendly materials, the popularity of compact and portable designs, and the increasing influence of social media on consumer purchasing decisions.

South Korea Beauty Fridges Market

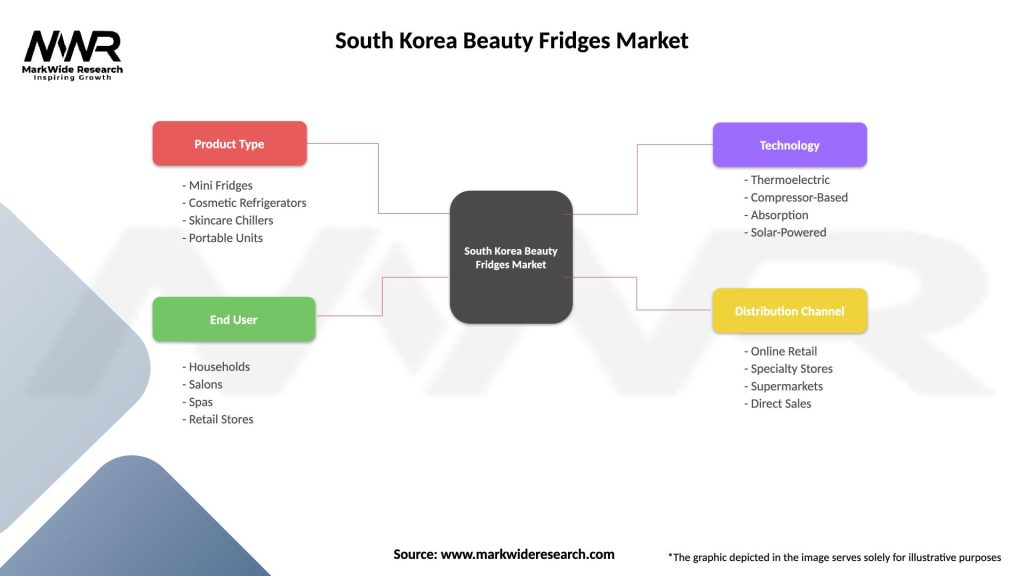

| Segmentation Details | Description |

|---|---|

| Product Type | Mini Fridges, Cosmetic Refrigerators, Skincare Chillers, Portable Units |

| End User | Households, Salons, Spas, Retail Stores |

| Technology | Thermoelectric, Compressor-Based, Absorption, Solar-Powered |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Beauty Fridges Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at