444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States white cement market represents a specialized segment within the broader construction materials industry, characterized by its distinctive aesthetic properties and premium positioning. White cement serves as a crucial component in architectural applications where visual appeal and design flexibility are paramount. The market has demonstrated consistent growth momentum, driven by increasing demand from residential, commercial, and infrastructure development projects across the nation.

Market dynamics indicate robust expansion potential, with the sector experiencing approximately 6.2% annual growth in recent years. This growth trajectory reflects the material’s increasing adoption in high-end construction projects, decorative applications, and specialized industrial uses. The construction industry’s evolution toward more aesthetically conscious building practices has positioned white cement as an essential material for modern architectural designs.

Regional distribution shows concentrated demand in major metropolitan areas, particularly in states with active construction markets such as California, Texas, Florida, and New York. The market’s expansion is closely tied to urbanization trends and the growing preference for premium building materials that offer both functional performance and visual enhancement capabilities.

The United States white cement market refers to the domestic production, distribution, and consumption of specialized cement products characterized by their white or off-white coloration, achieved through careful selection of raw materials and controlled manufacturing processes. White cement differs from ordinary Portland cement primarily in its mineral composition, featuring reduced iron oxide content and specific limestone and clay selections that result in its distinctive appearance.

Manufacturing processes for white cement involve stringent quality controls and specialized kiln operations that maintain the material’s color integrity while preserving its structural properties. The product serves multiple applications including architectural concrete, decorative mortars, terrazzo flooring, precast elements, and artistic installations where aesthetic considerations are crucial.

Market participants include both domestic manufacturers and international suppliers who cater to diverse customer segments ranging from large-scale construction contractors to specialized artisans and designers. The market encompasses various product grades and formulations tailored to specific application requirements and performance standards.

Strategic analysis of the United States white cement market reveals a dynamic sector positioned for sustained growth driven by evolving construction trends and increasing emphasis on architectural aesthetics. The market benefits from strong fundamentals including robust construction activity, growing disposable income, and heightened awareness of premium building materials among consumers and professionals.

Key performance indicators demonstrate the market’s resilience and expansion potential, with demand growth outpacing traditional cement segments by approximately 40% higher adoption rates in premium construction projects. The sector’s value proposition centers on its unique combination of structural integrity and aesthetic appeal, making it indispensable for high-end applications.

Competitive landscape features a mix of established cement manufacturers and specialized white cement producers, each leveraging distinct strategies to capture market share. Innovation in production techniques, quality enhancement, and customer service differentiation represent primary competitive factors driving market evolution.

Future prospects appear favorable, supported by continued urbanization, infrastructure modernization initiatives, and growing consumer preference for premium construction materials. The market’s trajectory suggests sustained expansion opportunities across multiple application segments and geographic regions.

Market intelligence reveals several critical insights that define the United States white cement sector’s current position and future direction:

Primary growth drivers propelling the United States white cement market forward encompass both macroeconomic factors and industry-specific trends that create favorable conditions for market expansion.

Construction industry growth represents the fundamental driver, with residential and commercial building activity generating consistent demand for premium construction materials. The sector benefits from population growth, urbanization trends, and economic expansion that fuel construction project development across diverse market segments.

Aesthetic consciousness among consumers and construction professionals has elevated the importance of visual appeal in building design. This trend drives demand for materials like white cement that enable creative architectural expressions and distinctive visual outcomes. Design flexibility offered by white cement allows architects and builders to achieve specific aesthetic goals while maintaining structural performance.

Infrastructure modernization initiatives at federal, state, and local levels create opportunities for white cement applications in public works projects where visual impact and durability are important considerations. Government investment in infrastructure renewal supports market growth through direct procurement and indirect demand stimulation.

Premium housing market expansion drives demand for high-quality construction materials, with white cement serving luxury residential projects that emphasize architectural distinction and visual appeal. Disposable income growth enables consumers to invest in premium building materials that enhance property value and aesthetic satisfaction.

Market constraints affecting the United States white cement sector include both structural challenges and external factors that may limit growth potential or create operational difficulties for market participants.

Cost considerations represent a significant restraint, as white cement typically commands premium pricing compared to ordinary cement products. This price differential may limit adoption in cost-sensitive projects or applications where aesthetic considerations are secondary to functional requirements. Budget constraints in construction projects can influence material selection decisions.

Manufacturing complexity associated with white cement production requires specialized equipment, controlled processes, and careful raw material selection. These requirements create barriers to entry for potential new manufacturers and may limit production capacity expansion among existing participants.

Raw material availability poses challenges, as white cement production requires specific limestone and clay compositions with low iron content. Supply chain dependencies on suitable raw materials can create vulnerability to supply disruptions or quality variations that affect production consistency.

Technical expertise requirements for proper white cement application and handling may limit adoption among contractors and builders unfamiliar with the material’s specific characteristics. Training needs and application knowledge gaps can slow market penetration in certain segments or geographic regions.

Emerging opportunities within the United States white cement market present significant potential for growth and market expansion across multiple dimensions and application areas.

Green building initiatives create opportunities for white cement applications in sustainable construction projects where reflective properties and energy efficiency considerations are important. LEED certification requirements and environmental building standards may favor white cement use in specific applications.

Decorative concrete market expansion offers substantial growth potential, with white cement serving as a key component in stamped concrete, exposed aggregate, and architectural concrete applications. Landscape architecture and outdoor design trends support demand for aesthetically appealing concrete solutions.

Precast concrete industry growth presents opportunities for white cement applications in manufactured building components, architectural panels, and decorative elements. Modular construction trends may increase demand for high-quality precast products featuring white cement.

Restoration and renovation projects in historic buildings and landmark structures create specialized demand for white cement products that match original architectural aesthetics. Heritage preservation initiatives support niche market opportunities for specialized white cement applications.

Market dynamics in the United States white cement sector reflect the complex interplay of supply and demand factors, competitive forces, and external influences that shape market behavior and evolution.

Supply-side dynamics are influenced by production capacity constraints, raw material availability, and manufacturing cost structures. The specialized nature of white cement production creates capacity limitations that can affect market supply responsiveness to demand fluctuations. Production efficiency improvements and capacity expansion initiatives represent key supply-side considerations.

Demand-side factors include construction activity levels, architectural design trends, and consumer preferences for premium building materials. Seasonal variations in construction activity create cyclical demand patterns that influence market dynamics throughout the year. Project pipeline visibility helps market participants anticipate demand trends and adjust production accordingly.

Competitive dynamics involve pricing strategies, product differentiation, and customer service excellence among market participants. Brand recognition and technical support capabilities influence customer loyalty and market share distribution. Innovation initiatives in product development and application techniques create competitive advantages.

Regulatory environment affects market dynamics through building codes, environmental regulations, and quality standards that influence product specifications and manufacturing processes. Compliance requirements create both challenges and opportunities for market participants to demonstrate quality leadership.

Comprehensive research approach employed in analyzing the United States white cement market incorporates multiple data sources, analytical techniques, and validation methods to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with industry executives, construction professionals, and end-users to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data on usage patterns, preferences, and purchase decision factors across different market segments.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial disclosures to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Market modeling employs statistical analysis and forecasting techniques to project future market trends and quantify growth opportunities. Scenario analysis considers various economic and industry conditions to assess potential market outcomes under different circumstances.

Expert validation processes involve consultation with industry specialists and technical experts to verify research findings and ensure practical relevance of market insights. Peer review mechanisms maintain research quality standards and analytical rigor throughout the study process.

Geographic distribution of the United States white cement market reveals distinct regional patterns influenced by construction activity levels, economic conditions, and local market characteristics that create diverse opportunities and challenges across different areas.

West Coast markets, particularly California, demonstrate strong demand driven by active construction sectors and emphasis on architectural aesthetics in residential and commercial projects. The region accounts for approximately 28% of national consumption, supported by robust economic growth and population expansion. Seismic building requirements and environmental considerations influence product specifications and application methods.

Southeast region shows significant growth potential, with Florida, Georgia, and North Carolina leading demand expansion. The area represents roughly 22% of market share, benefiting from population migration, tourism-related construction, and infrastructure development initiatives. Hurricane-resistant construction requirements create opportunities for high-performance white cement applications.

Northeast corridor maintains steady demand levels, with New York, New Jersey, and Pennsylvania contributing approximately 20% of market volume. The region’s mature construction market emphasizes renovation and restoration projects where white cement’s aesthetic properties are particularly valued. Historic preservation activities support specialized market segments.

Texas and Southwest markets demonstrate rapid growth, driven by population expansion and commercial development. This region accounts for about 18% of national demand, with strong growth prospects supported by energy sector investments and urban development projects. Climate considerations influence product performance requirements and application techniques.

Market competition in the United States white cement sector involves established cement manufacturers, specialized white cement producers, and international suppliers competing across multiple dimensions including product quality, pricing, and customer service.

Competitive strategies focus on product differentiation, technical support, and customer relationship management to build market share and customer loyalty. Innovation initiatives in manufacturing processes and product development create competitive advantages and support premium positioning strategies.

Market segmentation analysis reveals distinct customer groups and application areas that define the United States white cement market structure and provide insights into growth opportunities and competitive dynamics.

By Application:

By End-Use Industry:

By Product Type:

Architectural concrete applications represent the dominant market category, driven by increasing emphasis on building aesthetics and design flexibility in construction projects. This segment benefits from growing architectural sophistication and demand for distinctive visual elements in both residential and commercial construction. Design trends favoring exposed concrete and architectural concrete features support continued growth in this category.

Decorative mortars segment shows strong growth potential, particularly in renovation and restoration projects where aesthetic matching and visual appeal are crucial. Historic preservation activities and luxury residential projects drive demand for high-quality decorative mortar applications. Color consistency and workability characteristics make white cement ideal for these specialized applications.

Terrazzo and flooring applications benefit from renewed interest in terrazzo as a premium flooring option in commercial and institutional buildings. Sustainability considerations and durability requirements support white cement use in these applications. Design flexibility offered by white cement enables creative terrazzo designs and color combinations.

Artistic and sculptural applications represent a specialized but growing market segment, driven by public art initiatives and architectural sculpture integration in building design. Creative possibilities offered by white cement attract artists and designers seeking materials that combine structural integrity with aesthetic appeal.

Market participants in the United States white cement sector realize multiple benefits from engagement in this specialized market segment, ranging from financial returns to strategic positioning advantages.

Manufacturers benefit from premium pricing opportunities and differentiated market positioning that white cement provides compared to commodity cement products. Profit margins typically exceed those of ordinary cement, supporting business sustainability and growth investment capabilities. Brand differentiation through white cement expertise creates competitive advantages and customer loyalty.

Distributors and suppliers gain access to high-value product lines that enhance their market positioning and customer relationships. Technical expertise in white cement applications creates consulting opportunities and value-added services that strengthen customer partnerships. Market specialization reduces direct competition and supports sustainable business models.

Contractors and builders benefit from access to premium materials that enable distinctive architectural achievements and customer satisfaction. Project differentiation through white cement use supports premium pricing and competitive positioning in the construction market. Technical support from suppliers enhances project success and professional reputation.

End-users and property owners realize aesthetic and functional benefits from white cement applications, including enhanced property values and visual appeal. Durability characteristics provide long-term performance and maintenance advantages. Design flexibility enables creative architectural expressions and personalized building aesthetics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the United States white cement market reflect broader construction industry evolution and changing customer preferences that create new opportunities and challenges for market participants.

Sustainability integration represents a major trend, with manufacturers and customers increasingly focused on environmental responsibility and sustainable construction practices. Carbon footprint reduction initiatives and green building certifications influence product development and marketing strategies. Recycled content incorporation and energy-efficient production methods gain importance in competitive positioning.

Digital transformation affects market operations through online ordering systems, digital marketing channels, and virtual technical support services. E-commerce platforms enable broader market reach and improved customer convenience. Digital tools for project visualization and specification support enhance customer experience and decision-making processes.

Customization demand grows as customers seek tailored solutions for specific project requirements and aesthetic goals. Color matching services and specialized formulations create differentiation opportunities and customer loyalty. Technical consulting services become increasingly important in supporting complex applications and ensuring project success.

Quality assurance emphasis intensifies as customers demand consistent product performance and reliable supply chain support. Certification programs and quality management systems demonstrate commitment to excellence and build customer confidence. Traceability systems enable quality control and customer assurance throughout the supply chain.

Recent industry developments in the United States white cement market demonstrate ongoing innovation and strategic initiatives that shape competitive dynamics and market evolution.

Manufacturing investments by major cement companies include facility upgrades and capacity expansion projects designed to meet growing demand and improve production efficiency. Technology adoption in manufacturing processes enhances quality control and reduces environmental impact. Automation initiatives improve operational efficiency and product consistency.

Product innovations focus on enhanced performance characteristics, improved workability, and specialized formulations for emerging applications. Research and development activities target sustainability improvements and cost optimization while maintaining quality standards. Collaborative development with customers creates customized solutions for specific project requirements.

Market expansion strategies include geographic expansion, new customer segment development, and strategic partnerships with distributors and contractors. Acquisition activities consolidate market positions and expand product portfolios. International partnerships provide access to global expertise and technology transfer opportunities.

Sustainability initiatives encompass carbon reduction programs, alternative fuel usage, and circular economy principles in manufacturing operations. Environmental certifications demonstrate commitment to sustainable practices and support green building market participation. Community engagement programs build stakeholder relationships and social license to operate.

Strategic recommendations for United States white cement market participants focus on leveraging growth opportunities while addressing market challenges and competitive pressures through targeted initiatives and strategic positioning.

Market education initiatives should prioritize contractor and architect awareness programs that demonstrate white cement benefits and application techniques. Technical training programs and certification courses can expand the qualified contractor base and improve application quality. Design professional outreach through architectural firms and engineering consultants builds specification influence and project pipeline development.

Product development focus should emphasize sustainability characteristics, performance enhancements, and application-specific formulations that address evolving customer needs. Innovation partnerships with research institutions and technology companies can accelerate development timelines and improve competitive positioning. Customer feedback integration ensures product development aligns with market requirements and user preferences.

Distribution strategy optimization should leverage both traditional and digital channels to maximize market reach and customer convenience. Regional distribution partnerships can improve market penetration in underserved geographic areas. Supply chain resilience investments reduce vulnerability to disruptions and ensure reliable customer service.

MarkWide Research analysis suggests that companies should prioritize differentiation strategies that emphasize technical expertise, customer service excellence, and sustainable practices to maintain competitive advantages in an evolving market landscape.

Future prospects for the United States white cement market appear favorable, supported by multiple growth drivers and evolving market conditions that create sustained expansion opportunities across diverse application segments and geographic regions.

Growth projections indicate continued market expansion at approximately 5.8% annual growth rate over the next five years, driven by construction industry recovery, infrastructure investment, and increasing emphasis on architectural aesthetics. Demand fundamentals remain strong across residential, commercial, and infrastructure market segments.

Technology advancement will likely enhance manufacturing efficiency, product quality, and environmental performance, creating competitive advantages for innovative market participants. Digitalization trends will improve customer experience and operational efficiency throughout the value chain. Automation integration will optimize production processes and quality control systems.

Market evolution toward sustainability and environmental responsibility will create opportunities for companies that demonstrate leadership in green manufacturing and sustainable product development. Circular economy principles will influence raw material sourcing and waste management practices. Carbon neutrality goals will drive innovation in production methods and energy usage.

Regulatory environment changes may create both challenges and opportunities, with building code updates potentially favoring high-performance materials like white cement. Infrastructure legislation and government investment programs will support demand growth in public construction projects. Trade policies will influence competitive dynamics and market access considerations.

The United States white cement market represents a dynamic and growing segment within the broader construction materials industry, characterized by premium positioning, aesthetic differentiation, and diverse application opportunities. Market fundamentals remain strong, supported by construction industry growth, architectural design trends, and increasing consumer preference for high-quality building materials.

Strategic positioning in this market requires emphasis on product quality, technical expertise, and customer service excellence to capture growth opportunities and maintain competitive advantages. Innovation initiatives in manufacturing processes, product development, and sustainability practices will determine long-term success in an evolving market landscape.

Future success will depend on market participants’ ability to adapt to changing customer needs, regulatory requirements, and competitive pressures while maintaining the quality standards and aesthetic properties that define white cement’s value proposition. MarkWide Research projects continued market expansion driven by favorable industry trends and growing recognition of white cement’s unique benefits in construction and architectural applications.

What is White Cement?

White cement is a type of cement that is characterized by its white color, which is achieved through the use of raw materials with low iron content. It is commonly used in architectural applications, decorative concrete, and precast products due to its aesthetic appeal and ability to reflect light.

What are the key players in the United States White Cement Market?

Key players in the United States White Cement Market include LafargeHolcim, CEMEX, and Boral, among others. These companies are involved in the production and distribution of white cement for various construction and architectural applications.

What are the growth factors driving the United States White Cement Market?

The growth of the United States White Cement Market is driven by increasing demand for aesthetically pleasing construction materials, the rise in infrastructure projects, and the growing popularity of sustainable building practices. Additionally, the use of white cement in decorative applications is contributing to market expansion.

What challenges does the United States White Cement Market face?

The United States White Cement Market faces challenges such as high production costs and competition from alternative materials. Additionally, fluctuations in raw material prices and environmental regulations can impact the market dynamics.

What opportunities exist in the United States White Cement Market?

Opportunities in the United States White Cement Market include the increasing trend towards green building practices and the growing demand for innovative architectural designs. Furthermore, advancements in technology and production methods may enhance the efficiency and sustainability of white cement.

What trends are shaping the United States White Cement Market?

Trends shaping the United States White Cement Market include a shift towards eco-friendly construction materials, the use of white cement in artistic and decorative applications, and the integration of smart technologies in construction processes. These trends reflect a broader movement towards sustainability and innovation in the construction industry.

United States White Cement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Type I, Type II, Type III, Type IV |

| Application | Residential Construction, Commercial Construction, Infrastructure, Precast Concrete |

| End User | Contractors, Builders, Architects, Engineers |

| Packaging Type | Bags, Bulk, Pallets, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

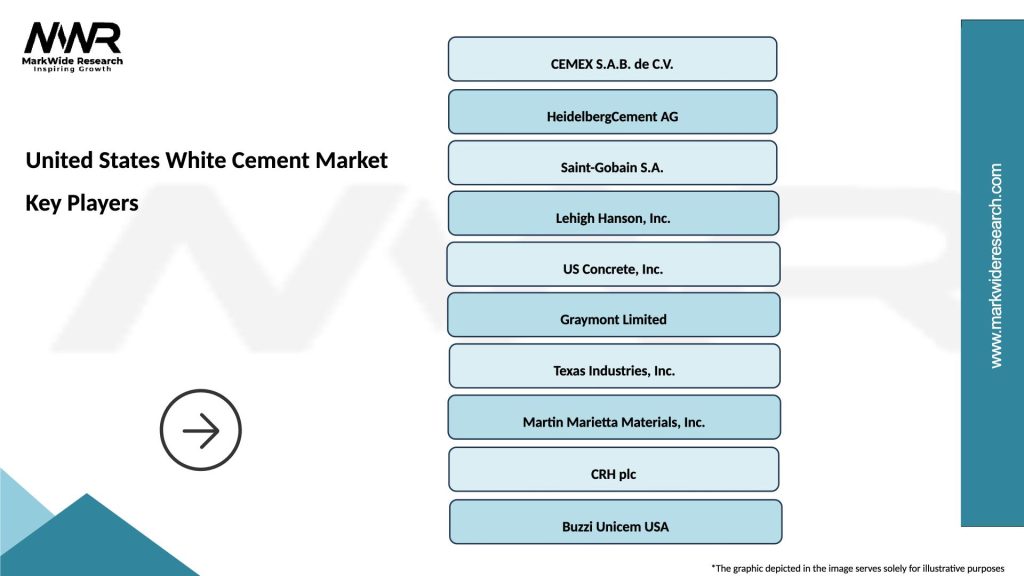

Leading companies in the United States White Cement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at