444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines data center cooling market represents a rapidly expanding sector driven by the country’s digital transformation initiatives and increasing demand for cloud computing services. Market dynamics indicate significant growth potential as enterprises across the archipelago embrace digitalization and require robust infrastructure to support their operations. The cooling systems market encompasses various technologies including precision air conditioning, liquid cooling solutions, and innovative hybrid systems designed to maintain optimal operating temperatures in data centers.

Regional expansion throughout the Philippines has accelerated dramatically, with major metropolitan areas like Manila, Cebu, and Davao experiencing substantial infrastructure development. The market benefits from the country’s strategic location as a gateway to Southeast Asian markets and its growing reputation as a business process outsourcing hub. Technology adoption rates have increased by approximately 42% annually as organizations recognize the critical importance of efficient cooling systems for maintaining server performance and reducing operational costs.

Industry stakeholders are witnessing unprecedented demand for energy-efficient cooling solutions that can operate effectively in the Philippines’ tropical climate. The market encompasses both traditional cooling methods and cutting-edge technologies such as free cooling systems, evaporative cooling, and advanced thermal management solutions. Investment patterns show growing interest from both domestic and international players seeking to capitalize on the expanding digital economy.

The Philippines data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal temperature and humidity levels within data center facilities across the Philippine archipelago. This market encompasses various cooling methodologies including computer room air conditioning units, chilled water systems, direct expansion cooling, and innovative liquid cooling solutions specifically engineered for high-density computing environments.

Core components of this market include precision cooling equipment, environmental monitoring systems, thermal management solutions, and energy-efficient technologies that ensure continuous operation of critical IT infrastructure. The market serves diverse sectors including telecommunications, banking, government, healthcare, and emerging cloud service providers who require reliable cooling systems to protect their valuable digital assets and maintain service availability.

Market scope extends beyond traditional cooling equipment to include comprehensive services such as system design, installation, maintenance, and optimization. The definition encompasses both greenfield data center projects and retrofit solutions for existing facilities seeking to improve their cooling efficiency and reduce environmental impact in the Philippines’ challenging tropical climate conditions.

Strategic analysis reveals that the Philippines data center cooling market is experiencing transformative growth driven by accelerating digital adoption and infrastructure modernization initiatives. The market demonstrates robust expansion potential with cooling system deployments increasing by approximately 38% year-over-year as organizations prioritize reliable thermal management solutions for their critical computing infrastructure.

Key market drivers include the rapid proliferation of cloud computing services, increasing data generation from mobile devices, and government initiatives promoting digital transformation across various sectors. The market benefits from favorable regulatory frameworks and growing foreign investment in Philippine data center infrastructure, creating substantial opportunities for cooling system providers and technology integrators.

Competitive landscape features a mix of established international players and emerging local companies offering specialized cooling solutions tailored to the Philippines’ unique environmental challenges. Market participants are focusing on energy-efficient technologies, sustainable cooling methods, and innovative approaches to address the country’s tropical climate conditions while maintaining optimal data center performance standards.

Future projections indicate continued market expansion with particular strength in precision cooling systems, liquid cooling technologies, and hybrid solutions that combine multiple cooling methodologies. The market is expected to benefit from increasing hyperscale data center deployments and growing demand for edge computing infrastructure throughout the Philippine islands.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Philippines data center cooling market:

Digital transformation initiatives across the Philippines are creating unprecedented demand for robust data center infrastructure, directly driving the need for sophisticated cooling systems. Government programs promoting digitalization in sectors such as healthcare, education, and public services are accelerating data center construction and modernization projects throughout the archipelago.

Cloud computing adoption represents a primary growth catalyst as Philippine enterprises migrate their operations to cloud-based platforms. This transition requires substantial data center capacity expansion, creating significant opportunities for cooling system providers. The growing popularity of Software-as-a-Service applications and Platform-as-a-Service solutions is driving continuous infrastructure investment.

Mobile connectivity expansion throughout the Philippines is generating massive amounts of data that require processing and storage in local data centers. The proliferation of smartphones and mobile internet services is creating sustained demand for cooling systems capable of supporting high-density computing environments and ensuring reliable service delivery.

Foreign investment influx in Philippine data center infrastructure is providing substantial capital for advanced cooling system deployments. International technology companies and hyperscale operators are establishing significant presences in the Philippines, bringing global best practices and demanding world-class cooling solutions that can operate effectively in tropical conditions.

Regulatory support from the Philippine government through favorable policies and incentives for data center development is encouraging infrastructure investment. Special economic zones and technology parks offer attractive conditions for data center operators, creating a conducive environment for cooling system market expansion.

High initial investment requirements for advanced cooling systems present significant barriers for smaller organizations and emerging data center operators. The substantial capital expenditure needed for precision cooling equipment, installation, and supporting infrastructure can limit market participation and slow adoption rates among cost-sensitive customers.

Technical complexity associated with designing and implementing effective cooling solutions in the Philippines’ challenging tropical climate creates operational challenges. The high humidity levels, frequent temperature fluctuations, and seasonal weather patterns require specialized expertise and customized solutions that may not be readily available in all market segments.

Energy cost concerns related to cooling system operations impact total cost of ownership calculations for data center operators. The Philippines’ relatively high electricity costs make energy-efficient cooling solutions essential, but these advanced systems often require higher upfront investments that may deter some potential customers.

Skilled workforce limitations in specialized cooling system maintenance and optimization create operational challenges for data center operators. The shortage of qualified technicians familiar with advanced cooling technologies can lead to suboptimal system performance and increased operational risks.

Infrastructure constraints in certain regions of the Philippines, including limited power grid capacity and inadequate telecommunications connectivity, can restrict data center development and consequently limit cooling system market expansion in these areas.

Edge computing proliferation throughout the Philippines presents substantial opportunities for cooling system providers specializing in compact, efficient solutions. The growing need for distributed computing infrastructure to support low-latency applications creates demand for innovative cooling technologies designed for smaller facilities and remote locations.

Sustainability initiatives are driving demand for environmentally friendly cooling solutions that can reduce carbon footprints and operating costs. Organizations seeking to achieve green certifications and meet environmental compliance requirements represent a growing market segment for eco-friendly cooling technologies.

Retrofit market potential exists as older data centers throughout the Philippines require cooling system upgrades to improve efficiency and meet modern performance standards. This presents opportunities for system integrators and technology providers offering modernization solutions and energy-efficient replacements.

Hyperscale expansion by major cloud service providers creates opportunities for large-scale cooling system deployments. These projects typically require cutting-edge cooling technologies and comprehensive service packages, offering substantial revenue potential for qualified providers.

Industry-specific solutions represent emerging opportunities as sectors such as healthcare, financial services, and telecommunications develop specialized data center requirements. Cooling system providers can differentiate themselves by offering tailored solutions that address specific industry needs and regulatory requirements.

Supply chain evolution within the Philippines data center cooling market is characterized by increasing localization of manufacturing and assembly operations. International cooling system manufacturers are establishing regional partnerships and local assembly facilities to reduce costs and improve service delivery throughout the archipelago.

Technology convergence is reshaping market dynamics as traditional cooling system boundaries blur with the integration of artificial intelligence, IoT sensors, and predictive maintenance capabilities. These smart cooling solutions offer improved efficiency and reliability while providing valuable operational insights for data center operators.

Competitive intensity is increasing as both established players and new entrants compete for market share in the expanding Philippine market. This competition is driving innovation, improving service quality, and creating more favorable pricing conditions for customers seeking advanced cooling solutions.

Customer expectations are evolving toward comprehensive solutions that combine cooling equipment, monitoring systems, and managed services. Data center operators increasingly prefer integrated offerings that provide single-point accountability and optimized performance across all cooling system components.

Regulatory landscape continues to develop with new standards and requirements for data center energy efficiency and environmental impact. These evolving regulations are influencing technology selection and driving demand for compliant cooling solutions that meet or exceed government-mandated performance criteria.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability of findings. The methodology incorporated extensive stakeholder interviews, industry surveys, and detailed analysis of market trends and competitive dynamics within the Philippines data center cooling sector.

Primary research activities included structured interviews with key market participants including cooling system manufacturers, data center operators, system integrators, and technology consultants. These interviews provided valuable insights into current market conditions, emerging trends, and future growth prospects from industry experts with direct market experience.

Secondary research sources encompassed industry reports, government publications, trade association data, and company financial statements to validate primary research findings and provide comprehensive market context. This approach ensured thorough coverage of all relevant market segments and geographic regions within the Philippines.

Data validation processes included cross-referencing multiple sources, statistical analysis of market data, and expert review of research findings to ensure accuracy and reliability. The methodology incorporated both quantitative analysis of market metrics and qualitative assessment of industry trends and competitive dynamics.

Market segmentation analysis was performed using established industry classification systems and customized frameworks specific to the Philippine market context. This approach enabled detailed examination of market dynamics across different technology categories, application segments, and geographic regions throughout the archipelago.

Metro Manila dominates the Philippines data center cooling market, accounting for approximately 68% of total system deployments due to its concentration of major enterprises, government agencies, and telecommunications infrastructure. The region benefits from established power grid infrastructure, skilled workforce availability, and proximity to international connectivity hubs that make it attractive for large-scale data center development.

Cebu region represents the second-largest market segment with growing importance as a secondary data center hub. The area’s strategic location, lower operational costs compared to Manila, and government support for technology development are attracting increased investment in data center infrastructure and associated cooling systems.

Davao and Mindanao are emerging as significant growth markets driven by regional economic development and increasing digitalization initiatives. These areas offer opportunities for cooling system providers seeking to establish early market presence in developing regions with substantial long-term growth potential.

Clark and Subic special economic zones are experiencing increased data center activity due to their strategic locations, favorable regulatory environments, and existing infrastructure. These areas represent important growth opportunities for cooling system providers targeting government and enterprise customers.

Regional distribution strategies are evolving as cooling system providers recognize the need for local presence and support capabilities throughout the Philippines. Companies are establishing regional service centers and partnerships to better serve customers across the diverse geographic and climatic conditions of the archipelago.

Market leadership in the Philippines data center cooling sector is characterized by a diverse mix of international technology companies and specialized regional providers. The competitive environment features both established global players and emerging local companies offering innovative solutions tailored to the Philippine market’s unique requirements.

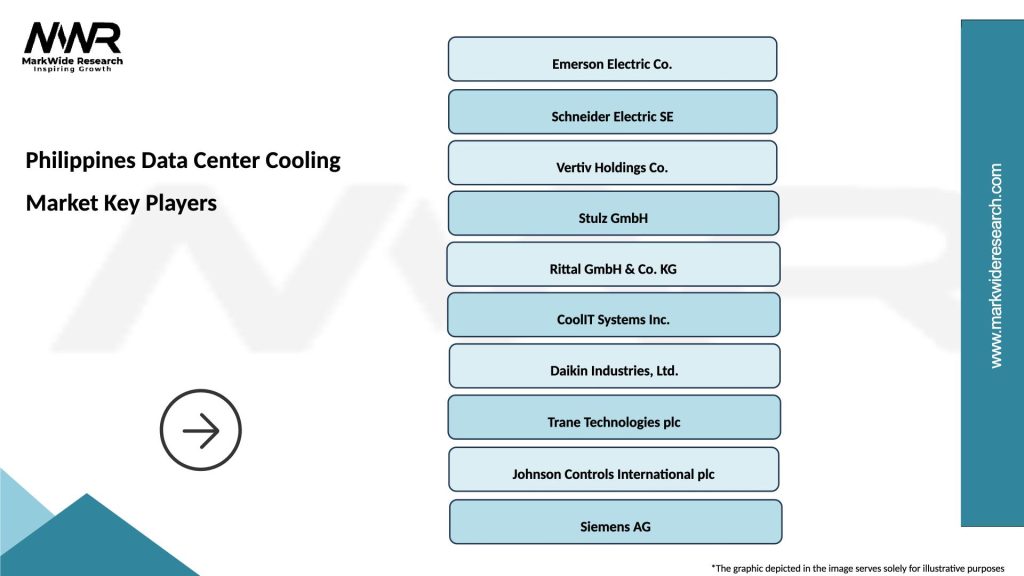

Key market participants include:

Competitive strategies focus on technology innovation, local service capabilities, and partnerships with data center operators and system integrators. Companies are investing in research and development to create solutions specifically designed for the Philippines’ tropical climate while maintaining global technology standards and reliability requirements.

Technology-based segmentation reveals distinct market categories within the Philippines data center cooling sector:

By Cooling Type:

By Application Segment:

By Organization Size:

Precision air conditioning systems continue to dominate the Philippine market due to their proven reliability in tropical conditions and extensive service support infrastructure. These systems offer predictable performance characteristics and are well-understood by local technical teams, making them preferred choices for many data center operators seeking dependable cooling solutions.

Liquid cooling technologies are experiencing rapid adoption growth, particularly among high-performance computing facilities and hyperscale data centers. These systems offer superior cooling efficiency and can handle higher heat densities, making them attractive for organizations seeking to maximize computing power while minimizing space requirements.

Hybrid cooling approaches are gaining popularity as organizations seek to optimize both performance and energy efficiency. These systems combine multiple cooling technologies to provide redundancy, improve efficiency, and adapt to varying load conditions throughout the year in the Philippines’ changing climate patterns.

Free cooling systems represent an emerging category with significant potential in certain Philippine regions where ambient conditions can be leveraged to reduce energy consumption. These systems require careful design consideration due to the country’s tropical climate but can offer substantial operational cost savings when properly implemented.

Smart cooling solutions incorporating IoT sensors, artificial intelligence, and predictive analytics are becoming increasingly important as data center operators seek to optimize performance and reduce operational costs. These advanced systems provide real-time monitoring and automated optimization capabilities that improve overall cooling system efficiency.

Data center operators benefit from advanced cooling solutions that ensure reliable infrastructure performance while reducing operational costs and environmental impact. Modern cooling systems provide improved energy efficiency, reduced maintenance requirements, and enhanced monitoring capabilities that enable proactive management of critical infrastructure.

Technology providers gain access to a rapidly expanding market with substantial growth potential and opportunities for innovation. The Philippine market offers favorable conditions for companies offering specialized cooling solutions designed for tropical climates and emerging technology applications such as edge computing and artificial intelligence.

System integrators benefit from increasing demand for comprehensive cooling solutions that combine equipment, installation, and ongoing services. The market provides opportunities for companies with local expertise and service capabilities to differentiate themselves through customized solutions and superior customer support.

End-user organizations gain access to more reliable, efficient, and cost-effective cooling solutions that enable their digital transformation initiatives. Advanced cooling systems support improved application performance, reduced downtime, and lower total cost of ownership for critical IT infrastructure.

Government stakeholders benefit from improved digital infrastructure that supports economic development, government services digitization, and enhanced connectivity throughout the Philippines. Efficient cooling systems contribute to reduced energy consumption and environmental impact while supporting the country’s technology sector growth objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming data center cooling systems through predictive maintenance capabilities, automated optimization, and real-time performance monitoring. These AI-powered solutions enable proactive system management and can reduce energy consumption while improving reliability and extending equipment lifespan.

Sustainability initiatives are driving adoption of environmentally friendly cooling technologies that reduce carbon footprints and support corporate environmental goals. Organizations are increasingly prioritizing green cooling solutions that minimize environmental impact while maintaining optimal performance standards.

Modular cooling architectures are gaining popularity as organizations seek scalable solutions that can adapt to changing capacity requirements. These flexible systems enable incremental expansion and provide improved deployment efficiency compared to traditional monolithic cooling approaches.

Edge computing proliferation is creating demand for compact, efficient cooling solutions designed for distributed computing environments. These specialized systems must operate reliably in diverse locations while maintaining energy efficiency and requiring minimal local technical support.

Liquid cooling advancement is accelerating as high-performance computing applications require more efficient thermal management solutions. Advanced liquid cooling technologies offer superior heat removal capabilities and enable higher computing densities while reducing overall energy consumption.

Service-oriented models are emerging as organizations prefer comprehensive cooling-as-a-service offerings that include equipment, maintenance, and optimization services. These models provide predictable costs and ensure optimal system performance through professional management and proactive maintenance.

Technology partnerships between international cooling system manufacturers and local Philippine companies are expanding market reach and improving service capabilities. These collaborations combine global technology expertise with local market knowledge to deliver optimized solutions for Philippine data center operators.

Research and development investments in tropical climate cooling solutions are increasing as manufacturers recognize the unique requirements of the Philippine market. These initiatives focus on developing systems that can operate efficiently in high humidity, high temperature conditions while maintaining reliability and performance standards.

Government infrastructure programs supporting digital transformation are creating substantial opportunities for cooling system providers. Public sector digitalization initiatives require robust data center infrastructure with reliable cooling systems to support critical government services and applications.

Hyperscale facility announcements by major cloud service providers are driving demand for large-scale, high-efficiency cooling solutions. These projects typically require cutting-edge cooling technologies and represent significant revenue opportunities for qualified system providers.

Sustainability certifications are becoming increasingly important as data center operators seek to demonstrate environmental responsibility. Cooling system providers are responding by developing solutions that support green building certifications and meet stringent environmental performance criteria.

MarkWide Research analysis indicates that cooling system providers should prioritize development of solutions specifically designed for tropical climate conditions while maintaining global technology standards. Companies entering the Philippine market should establish local partnerships and service capabilities to effectively compete in this growing sector.

Investment strategies should focus on energy-efficient technologies that can demonstrate clear return on investment through reduced operational costs. Organizations considering cooling system upgrades should evaluate comprehensive solutions that combine equipment, monitoring, and services to maximize value and performance.

Market entry approaches for international companies should emphasize local partnerships and service infrastructure development. Success in the Philippine market requires understanding of local conditions, regulatory requirements, and customer preferences that may differ from other regional markets.

Technology selection should prioritize solutions that offer scalability, reliability, and energy efficiency while providing comprehensive monitoring and management capabilities. Organizations should consider future growth requirements and emerging technology trends when making cooling system investment decisions.

Service differentiation opportunities exist for companies offering specialized expertise in tropical climate cooling solutions, predictive maintenance services, and comprehensive system optimization. Providers should focus on building local technical capabilities and customer relationships to establish competitive advantages.

Market expansion is expected to continue at robust rates driven by accelerating digital transformation initiatives and increasing data center infrastructure investment throughout the Philippines. The cooling systems market will benefit from growing demand for cloud computing services, edge computing infrastructure, and industry-specific digital solutions.

Technology evolution will favor advanced cooling solutions incorporating artificial intelligence, IoT connectivity, and predictive maintenance capabilities. These smart systems will become increasingly important as data center operators seek to optimize performance, reduce costs, and minimize environmental impact.

Regional development beyond Metro Manila will create new opportunities for cooling system providers as data center infrastructure expands to secondary cities and emerging economic zones. This geographic diversification will require flexible solutions and distributed service capabilities.

Sustainability requirements will continue to influence technology selection and market dynamics as environmental regulations become more stringent and organizations prioritize carbon footprint reduction. Cooling system providers must develop solutions that meet evolving environmental standards while maintaining performance requirements.

MWR projections indicate that liquid cooling technologies will experience particularly strong growth as high-performance computing applications become more prevalent. The market will also benefit from increasing adoption of hybrid cooling approaches that optimize both performance and energy efficiency for Philippine conditions.

The Philippines data center cooling market represents a dynamic and rapidly expanding sector with substantial growth potential driven by digital transformation initiatives, cloud computing adoption, and infrastructure modernization throughout the archipelago. Market participants benefit from favorable government policies, increasing foreign investment, and growing demand for reliable cooling solutions that can operate effectively in tropical climate conditions.

Strategic opportunities exist across multiple market segments including enterprise data centers, colocation facilities, cloud service providers, and emerging edge computing applications. The market demonstrates strong fundamentals with sustained growth drivers and increasing sophistication in cooling technology requirements as organizations prioritize energy efficiency and environmental sustainability.

Success factors for market participants include developing specialized expertise in tropical climate cooling solutions, establishing comprehensive local service capabilities, and offering integrated solutions that combine equipment, monitoring, and managed services. Companies that can demonstrate clear value through improved efficiency, reliability, and total cost of ownership will be well-positioned for long-term success in this expanding market.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data center operations.

What are the key players in the Philippines Data Center Cooling Market?

Key players in the Philippines Data Center Cooling Market include companies like Schneider Electric, Vertiv, and STULZ, which provide innovative cooling solutions and technologies. These companies focus on energy efficiency and reliability in their cooling systems, among others.

What are the main drivers of the Philippines Data Center Cooling Market?

The main drivers of the Philippines Data Center Cooling Market include the rapid growth of data centers due to increased digitalization, the rising demand for cloud services, and the need for energy-efficient cooling solutions. Additionally, the expansion of IT infrastructure contributes to market growth.

What challenges does the Philippines Data Center Cooling Market face?

Challenges in the Philippines Data Center Cooling Market include high energy consumption associated with cooling systems and the need for skilled personnel to manage advanced cooling technologies. Additionally, fluctuating energy prices can impact operational costs.

What opportunities exist in the Philippines Data Center Cooling Market?

Opportunities in the Philippines Data Center Cooling Market include the adoption of innovative cooling technologies such as liquid cooling and the integration of renewable energy sources. Furthermore, the increasing focus on sustainability and energy efficiency presents significant growth potential.

What trends are shaping the Philippines Data Center Cooling Market?

Trends shaping the Philippines Data Center Cooling Market include the shift towards modular cooling solutions and the use of artificial intelligence for optimizing cooling efficiency. Additionally, there is a growing emphasis on sustainability and reducing the carbon footprint of data centers.

Philippines Data Center Cooling Market

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Liquid Cooling, Evaporative Cooling, Hybrid Cooling |

| Technology | Chilled Water Systems, Direct Expansion Systems, In-Row Cooling, Overhead Cooling |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Installation | New Construction, Retrofit, Modular Solutions, On-Site Assembly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at