444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kuwait used car market represents a dynamic and rapidly evolving automotive sector that has experienced significant transformation in recent years. Market dynamics indicate substantial growth driven by economic diversification efforts, changing consumer preferences, and increasing awareness of value-oriented purchasing decisions. The market has demonstrated remarkable resilience, with annual growth rates reaching approximately 8.5% CAGR over the past five years.

Consumer behavior patterns in Kuwait’s used car market reflect a sophisticated understanding of automotive value retention and practical ownership considerations. The market encompasses various vehicle categories, from luxury sedans and SUVs to compact cars and commercial vehicles. Digital transformation has revolutionized how consumers research, evaluate, and purchase pre-owned vehicles, with online platforms capturing approximately 45% of market transactions.

Regional positioning within the Gulf Cooperation Council has strengthened Kuwait’s role as a significant hub for used car trading and distribution. The market benefits from strategic geographic location, robust infrastructure, and established automotive service networks that support the entire used vehicle ecosystem.

The Kuwait used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and servicing of pre-owned vehicles within Kuwait’s automotive sector. This market includes dealerships, private sellers, online platforms, auction houses, and supporting services such as vehicle inspection, financing, and warranty providers.

Market participants range from established automotive dealers and certified pre-owned programs to individual sellers and emerging digital platforms. The sector encompasses various vehicle categories, age ranges, and price segments, serving diverse consumer needs from budget-conscious buyers to luxury vehicle enthusiasts seeking value retention opportunities.

Economic significance extends beyond simple vehicle transactions, contributing to employment generation, tax revenue, and supporting ancillary industries including automotive finance, insurance, maintenance, and parts distribution throughout Kuwait’s economy.

Strategic analysis reveals the Kuwait used car market has emerged as a cornerstone of the nation’s automotive sector, driven by evolving consumer preferences and economic pragmatism. Market penetration has reached significant levels, with used car sales representing approximately 68% of total vehicle transactions in the domestic market.

Key growth drivers include increasing cost consciousness among consumers, improved vehicle quality and longevity, and enhanced transparency through digital platforms and standardized inspection processes. The market has benefited from technological integration, with digital platforms facilitating approximately 52% of initial vehicle research activities.

Competitive landscape features a mix of traditional dealerships, emerging online platforms, and hybrid business models that combine physical presence with digital capabilities. Consumer confidence has strengthened significantly, supported by improved warranty offerings, certified pre-owned programs, and transparent pricing mechanisms.

Future prospects indicate continued expansion, with projections suggesting sustained growth driven by demographic trends, urbanization, and increasing acceptance of pre-owned vehicles as a viable alternative to new car purchases.

Consumer preferences in Kuwait’s used car market reveal sophisticated decision-making processes that prioritize value retention, reliability, and total cost of ownership. Market research indicates several critical insights shaping industry dynamics:

Economic pragmatism serves as the primary catalyst driving Kuwait’s used car market expansion. Consumer awareness regarding vehicle depreciation patterns has increased significantly, leading to greater acceptance of pre-owned vehicles as financially prudent alternatives to new car purchases.

Digital transformation has revolutionized market accessibility and transparency. Online platforms provide comprehensive vehicle histories, pricing comparisons, and detailed specifications that empower informed decision-making. Mobile applications and digital tools have simplified the search, evaluation, and purchase processes, attracting tech-savvy consumers who value convenience and information accessibility.

Quality improvements in automotive manufacturing have extended vehicle lifespans and reliability, making older vehicles more attractive to cost-conscious buyers. Modern vehicles retain functionality and aesthetic appeal for longer periods, supporting robust demand for pre-owned options across various age categories.

Financing accessibility has expanded significantly, with banks and financial institutions developing specialized products for used car purchases. Competitive interest rates and flexible repayment terms have made vehicle ownership more accessible to broader demographic segments.

Environmental consciousness among younger consumers has contributed to market growth, as purchasing used vehicles represents a form of sustainable consumption that extends product lifecycles and reduces environmental impact associated with new vehicle production.

Quality concerns remain a significant challenge in Kuwait’s used car market, particularly regarding vehicle history transparency and hidden mechanical issues. Consumer skepticism about previous ownership conditions, accident history, and maintenance records can limit market participation among risk-averse buyers.

Financing limitations for older vehicles create barriers for certain consumer segments. Banks and financial institutions often impose restrictions on loan terms and interest rates for vehicles beyond specific age thresholds, limiting accessibility for budget-conscious buyers seeking older, more affordable options.

Regulatory complexities surrounding vehicle transfers, registration processes, and compliance requirements can create administrative burdens that discourage some potential buyers. Documentation requirements and bureaucratic procedures may particularly impact expatriate residents unfamiliar with local processes.

Market fragmentation across multiple channels and platforms can create confusion and inefficiencies. Price inconsistencies between different sellers and lack of standardized valuation methods can complicate decision-making processes for consumers seeking fair market pricing.

Limited warranty coverage for older vehicles or private party sales creates risk perceptions that may deter quality-conscious consumers. Service availability and parts accessibility for certain vehicle models or brands can also influence purchase decisions, particularly for less common or discontinued models.

Digital platform expansion presents substantial opportunities for market growth and efficiency improvements. Technology integration through artificial intelligence, virtual reality showrooms, and enhanced mobile applications can further streamline the buying experience and attract digitally-native consumers.

Certified pre-owned programs represent significant growth potential, as consumers increasingly value quality assurance and warranty coverage. Manufacturer-backed programs and third-party certification services can differentiate market offerings and command premium pricing for qualified vehicles.

Export market development offers opportunities to leverage Kuwait’s strategic location for regional used car distribution. Cross-border trade with neighboring GCC countries and broader Middle Eastern markets could expand revenue streams and market reach for local dealers and platforms.

Financial services integration through partnerships between automotive dealers and financial institutions can create comprehensive solutions that simplify the purchase process. Insurance bundling and maintenance packages can generate additional revenue streams while enhancing customer value propositions.

Sustainability positioning can attract environmentally conscious consumers by emphasizing the environmental benefits of vehicle lifecycle extension. Green marketing initiatives and carbon footprint reduction messaging can differentiate brands and appeal to socially responsible buyers.

Supply and demand equilibrium in Kuwait’s used car market reflects complex interactions between economic conditions, consumer preferences, and vehicle availability. Market forces demonstrate cyclical patterns influenced by new car sales, economic cycles, and seasonal purchasing behaviors.

Price volatility responds to various factors including fuel prices, economic conditions, and new vehicle incentives. Depreciation curves vary significantly across vehicle categories, with luxury vehicles experiencing steeper initial depreciation while economy vehicles maintain more stable value retention patterns.

Competitive intensity has increased substantially with the emergence of digital platforms and new business models. Traditional dealerships face pressure to adapt their service offerings and customer experience approaches to compete effectively with online-first competitors.

Consumer behavior evolution continues to shape market dynamics, with increasing emphasis on transparency, convenience, and value-added services. Generational differences in purchasing preferences require diverse marketing approaches and service delivery models to address varying customer expectations.

Regulatory environment influences market operations through vehicle safety standards, emissions requirements, and consumer protection measures. Policy changes regarding vehicle imports, registration procedures, and taxation can significantly impact market dynamics and competitive positioning.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Kuwait’s used car market. Primary research included extensive surveys of consumers, dealers, and industry stakeholders to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporated analysis of industry reports, government statistics, automotive registration data, and economic indicators to establish market context and validate primary findings. Data triangulation techniques ensured consistency and reliability across multiple information sources.

Quantitative analysis utilized statistical modeling to identify trends, correlations, and predictive indicators within the market data. Qualitative research through in-depth interviews with industry experts provided nuanced insights into market dynamics and future prospects.

Market segmentation analysis examined various demographic, geographic, and behavioral factors to identify distinct consumer groups and their specific preferences. Competitive analysis evaluated market participants across traditional and digital channels to understand competitive positioning and strategic approaches.

Validation processes included expert reviews, stakeholder feedback, and cross-referencing with established industry benchmarks to ensure accuracy and relevance of research findings and conclusions.

Geographic distribution within Kuwait reveals distinct regional patterns in used car market activity and consumer preferences. Kuwait City and surrounding metropolitan areas account for approximately 65% of market transactions, reflecting population density and economic activity concentration.

Hawalli Governorate demonstrates strong market participation, particularly among expatriate communities who often prefer used vehicles due to temporary residence considerations. Consumer behavior in this region shows higher price sensitivity and preference for reliable, fuel-efficient vehicles.

Ahmadi Governorate exhibits unique characteristics due to its industrial base and oil sector employment. Vehicle preferences tend toward larger SUVs and pickup trucks, reflecting both lifestyle needs and higher disposable income levels among residents.

Farwaniya and Mubarak Al-Kabeer governorates show growing market activity, with approximately 28% combined market share. These regions demonstrate increasing adoption of digital platforms and online research tools for vehicle purchases.

Cross-regional mobility patterns indicate consumers frequently travel between governorates to find specific vehicles or better pricing, suggesting a unified market despite geographic distribution. Dealer networks have adapted to serve customers across multiple regions through expanded service coverage and delivery options.

Market competition in Kuwait’s used car sector features diverse participants ranging from established automotive dealerships to innovative digital platforms. Competitive dynamics have intensified significantly with the emergence of technology-driven business models and changing consumer expectations.

Competitive strategies increasingly emphasize customer experience, transparency, and value-added services. Digital transformation has become essential for maintaining market relevance, with traditional dealers investing heavily in online presence and digital customer engagement tools.

Service differentiation through warranty programs, inspection services, and financing partnerships has become crucial for competitive positioning. Brand reputation and customer trust remain fundamental competitive advantages in this relationship-driven market.

Market segmentation in Kuwait’s used car market reveals distinct categories based on vehicle characteristics, consumer demographics, and purchasing behaviors. Segmentation analysis provides insights into specific market opportunities and consumer preferences across different categories.

By Vehicle Type:

By Age Category:

By Price Range:

Sedan category maintains strong market position due to practical considerations including fuel efficiency, maintenance costs, and parking convenience in urban environments. Consumer preferences within this segment favor Japanese and Korean brands known for reliability and value retention.

SUV segment has experienced remarkable growth, driven by lifestyle trends and perceived safety advantages. Market dynamics show increasing demand for mid-size SUVs that balance capability with fuel economy, particularly among young families and outdoor enthusiasts.

Luxury vehicle category presents unique opportunities for value-conscious affluent consumers. Depreciation patterns in this segment create attractive entry points for buyers seeking premium features and brand prestige at significantly reduced prices compared to new alternatives.

Commercial vehicle segment serves business customers and entrepreneurs requiring reliable transportation for commercial applications. Durability and maintenance considerations drive purchasing decisions, with emphasis on total cost of ownership rather than initial purchase price.

Compact car category appeals primarily to young professionals and expatriate workers seeking affordable, efficient transportation. Market trends indicate growing interest in hybrid and fuel-efficient models within this segment as environmental consciousness increases.

Consumers benefit from expanded vehicle choices, competitive pricing, and improved transparency through digital platforms and standardized inspection processes. Cost savings compared to new vehicle purchases enable broader access to reliable transportation and premium features previously beyond budget constraints.

Dealers gain opportunities to expand inventory turnover, develop recurring customer relationships, and generate revenue through value-added services including financing, warranties, and maintenance packages. Digital integration enables broader market reach and operational efficiency improvements.

Financial institutions benefit from expanded lending opportunities and diversified automotive finance portfolios. Risk management improvements through better vehicle valuation and inspection standards enhance loan portfolio quality and profitability.

Government stakeholders realize increased tax revenue from vehicle transactions, registration fees, and economic activity generated throughout the automotive ecosystem. Employment generation across dealerships, service centers, and supporting industries contributes to economic diversification objectives.

Environmental benefits include extended vehicle lifecycles, reduced manufacturing demand, and improved resource utilization efficiency. Sustainability outcomes align with broader environmental objectives and responsible consumption patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first approaches are reshaping how consumers research, evaluate, and purchase used vehicles. Online platforms increasingly serve as primary touchpoints, with virtual showrooms, 360-degree vehicle photography, and detailed specification databases becoming standard features.

Transparency enhancement through blockchain technology and digital vehicle histories is gaining traction. Immutable records of maintenance, accidents, and ownership changes provide unprecedented transparency that builds consumer confidence and reduces information asymmetries.

Subscription and flexible ownership models are emerging as alternatives to traditional purchase arrangements. Short-term vehicle access solutions appeal to expatriate populations and consumers seeking flexibility without long-term ownership commitments.

Artificial intelligence integration in pricing algorithms and vehicle matching systems improves market efficiency. Machine learning applications help consumers find suitable vehicles based on preferences, budget, and usage patterns while optimizing dealer inventory management.

Sustainability messaging increasingly influences consumer decisions, with environmental impact considerations becoming important factors in vehicle selection. Carbon footprint awareness drives interest in fuel-efficient and hybrid vehicles within the used car market.

Platform consolidation has accelerated as successful digital marketplaces acquire smaller competitors and expand service offerings. Market concentration among leading platforms creates more comprehensive solutions while potentially reducing competition in certain segments.

Manufacturer involvement in used car markets has increased significantly, with automotive brands launching certified pre-owned programs and direct-to-consumer used vehicle sales channels. Brand-backed warranties and quality assurance programs differentiate manufacturer offerings from independent dealers.

Financial services innovation includes development of specialized used car financing products, flexible payment terms, and integrated insurance offerings. Fintech partnerships enable faster approval processes and more accessible financing options for diverse consumer segments.

Inspection technology advancement through automated systems and AI-powered assessment tools improves accuracy and consistency in vehicle evaluation. Standardized inspection protocols enhance market transparency and consumer confidence across different sellers and platforms.

Cross-border trade facilitation through improved logistics and documentation processes expands market opportunities. Regional integration initiatives within the GCC create larger addressable markets for Kuwait-based used car businesses.

MarkWide Research analysis indicates that market participants should prioritize digital transformation initiatives to remain competitive in the evolving landscape. Investment in technology platforms and customer experience enhancement will be crucial for long-term success.

Quality standardization should be a primary focus for industry stakeholders. Standardized inspection protocols and transparent reporting mechanisms will build consumer confidence and support market growth across all participant categories.

Strategic partnerships between dealers, financial institutions, and technology providers can create comprehensive solutions that address consumer needs more effectively. Ecosystem approaches that integrate multiple services will likely outperform standalone offerings.

Market expansion opportunities in neighboring countries should be evaluated carefully, considering regulatory requirements and competitive dynamics. Regional growth strategies can leverage Kuwait’s strategic position and established automotive expertise.

Sustainability positioning will become increasingly important as environmental consciousness grows among consumers. Green marketing initiatives and carbon footprint reduction programs can differentiate brands and attract environmentally aware buyers.

Growth projections for Kuwait’s used car market remain positive, with MWR forecasting continued expansion driven by demographic trends, economic diversification, and technological advancement. Market maturation is expected to bring improved efficiency and enhanced consumer experiences.

Digital transformation will accelerate, with online platforms capturing an increasing share of market transactions. Mobile-first approaches and integrated service offerings will become standard expectations rather than competitive differentiators.

Regulatory evolution is anticipated to enhance consumer protection and market transparency. Policy developments may include standardized inspection requirements, enhanced warranty regulations, and improved cross-border trade facilitation.

Demographic shifts toward younger, tech-savvy consumers will drive continued innovation in customer experience and service delivery. Generational preferences for digital interactions and transparent processes will shape market development strategies.

Regional integration opportunities within the GCC will likely expand, creating larger addressable markets and economies of scale for successful operators. Cross-border expansion may become a key growth strategy for leading market participants.

The Kuwait used car market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance within the nation’s automotive ecosystem. Market fundamentals remain strong, supported by robust economic conditions, sophisticated consumer base, and strategic geographic positioning that facilitates regional commerce opportunities.

Digital transformation continues to reshape market dynamics, creating opportunities for enhanced efficiency, transparency, and customer experience while challenging traditional business models. Successful market participants will be those who effectively integrate technology solutions with established automotive expertise and customer relationship management capabilities.

Consumer preferences toward value-oriented purchasing decisions, combined with improving vehicle quality and longevity, support continued market expansion. Quality assurance and transparency initiatives will be crucial for maintaining consumer confidence and supporting sustainable growth across all market segments.

Future success in Kuwait’s used car market will depend on adaptability, technological integration, and commitment to customer-centric service delivery. Market participants who embrace these principles while maintaining focus on quality and transparency will be well-positioned to capitalize on the substantial opportunities ahead in this evolving automotive landscape.

What is Used Car?

The used car refers to any vehicle that has had one or more previous owners. In the context of the Kuwait Used Car Market, it encompasses a wide range of vehicles, including sedans, SUVs, and trucks, that are resold after their initial purchase.

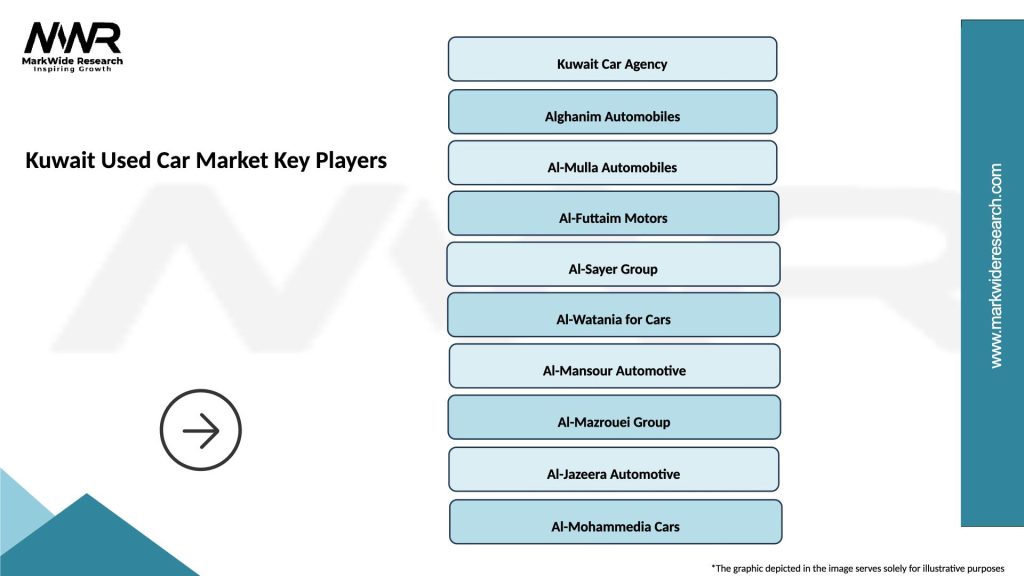

What are the key players in the Kuwait Used Car Market?

Key players in the Kuwait Used Car Market include Alghanim Automobiles, Al-Mulla Group, and Al-Futtaim Automotive, among others. These companies play significant roles in the distribution and sale of used vehicles across the country.

What are the growth factors driving the Kuwait Used Car Market?

The growth of the Kuwait Used Car Market is driven by factors such as increasing consumer demand for affordable transportation, the rising number of expatriates seeking budget-friendly options, and the availability of financing options for used vehicles.

What challenges does the Kuwait Used Car Market face?

The Kuwait Used Car Market faces challenges such as fluctuating vehicle prices, competition from new car sales, and regulatory hurdles related to vehicle inspections and emissions standards.

What opportunities exist in the Kuwait Used Car Market?

Opportunities in the Kuwait Used Car Market include the potential for online sales platforms, the growing interest in electric and hybrid used vehicles, and the expansion of financing options tailored for used car buyers.

What trends are shaping the Kuwait Used Car Market?

Trends in the Kuwait Used Car Market include an increasing preference for SUVs and crossovers, a rise in digital platforms for buying and selling vehicles, and a growing focus on vehicle history transparency and certification.

Kuwait Used Car Market

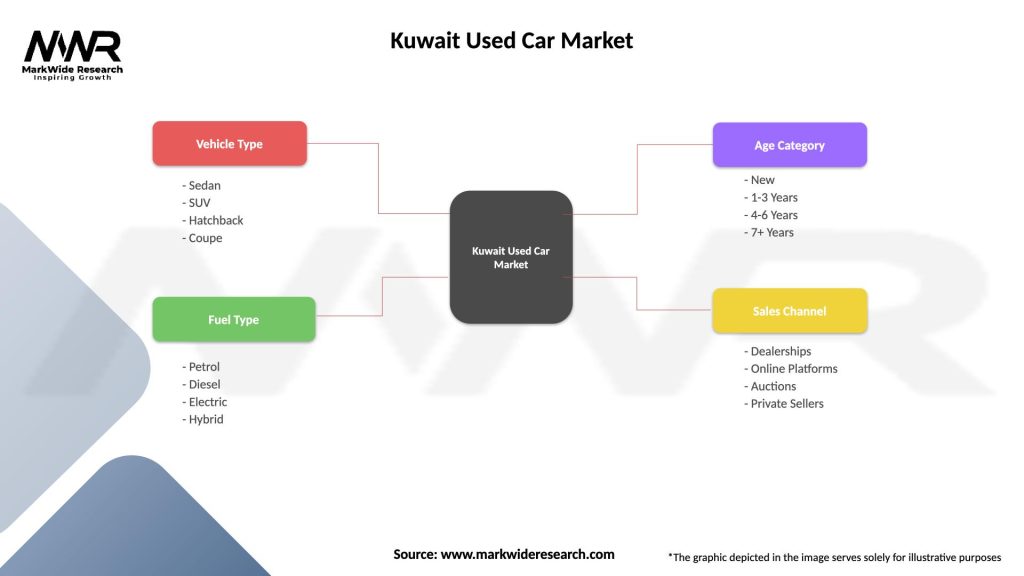

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kuwait Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at