444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France construction equipment market represents a cornerstone of the nation’s infrastructure development and industrial modernization efforts. This dynamic sector encompasses a comprehensive range of machinery including excavators, bulldozers, cranes, loaders, and specialized construction vehicles that power France’s ambitious construction projects. Market dynamics indicate robust growth driven by government infrastructure investments, urban renewal initiatives, and the ongoing transition toward sustainable construction practices.

Construction equipment demand in France has experienced significant momentum, particularly in response to the country’s commitment to green building standards and smart city development. The market demonstrates strong resilience with projected growth rates of 6.2% CAGR through the forecast period, reflecting sustained investment in both public and private construction sectors. Regional distribution shows concentrated activity in major metropolitan areas including Paris, Lyon, and Marseille, where large-scale infrastructure projects drive equipment utilization.

Technology integration has become a defining characteristic of the French construction equipment landscape, with 73% of major contractors adopting digital solutions for fleet management and project optimization. The market’s evolution toward electrification and autonomous operation aligns with France’s environmental regulations and sustainability goals, positioning the sector for long-term growth and innovation.

The France construction equipment market refers to the comprehensive ecosystem of heavy machinery, tools, and specialized vehicles utilized in construction, infrastructure development, and industrial projects across the French territory. This market encompasses the manufacturing, distribution, rental, and servicing of construction equipment ranging from compact utility machines to large-scale earthmoving and lifting equipment.

Market scope includes both new equipment sales and the thriving rental segment, which accounts for approximately 45% of total equipment utilization in France. The definition extends beyond traditional construction machinery to include emerging technologies such as autonomous construction vehicles, electric-powered equipment, and digitally connected machinery that enables real-time monitoring and predictive maintenance capabilities.

Industry classification within this market covers earthmoving equipment, material handling machinery, concrete equipment, road construction vehicles, and specialized construction tools. The market’s significance lies in its direct correlation with France’s economic development, urban planning initiatives, and infrastructure modernization programs that support the nation’s competitive positioning in the global economy.

Strategic analysis of the France construction equipment market reveals a sector characterized by steady growth, technological advancement, and increasing emphasis on sustainability. The market benefits from France’s robust construction industry, which encompasses residential development, commercial construction, and extensive infrastructure projects supported by both government and private investment.

Key performance indicators demonstrate the market’s resilience and growth potential, with equipment rental services experiencing particularly strong demand as contractors seek flexible, cost-effective solutions. The adoption of smart construction technologies has accelerated, with 68% of construction companies implementing IoT-enabled equipment monitoring systems to optimize operational efficiency and reduce downtime.

Market transformation is evident in the shift toward environmentally friendly equipment, driven by stringent European Union regulations and France’s commitment to carbon neutrality. Electric and hybrid construction equipment adoption rates have increased significantly, supported by government incentives and the construction industry’s sustainability initiatives. The competitive landscape features both established international manufacturers and innovative French companies developing specialized solutions for local market requirements.

Primary market drivers shaping the France construction equipment sector include sustained infrastructure investment, urban redevelopment projects, and the ongoing modernization of transportation networks. The market demonstrates particular strength in the following key areas:

Market segmentation reveals diverse applications across residential construction, commercial development, and public infrastructure projects. The equipment rental segment continues to expand, offering contractors access to the latest technology without significant capital investment requirements.

Government infrastructure investment serves as the primary catalyst for construction equipment demand in France. The national infrastructure modernization program, encompassing transportation networks, energy systems, and digital infrastructure, creates sustained demand for heavy machinery and specialized construction equipment. Public sector spending on infrastructure projects maintains consistent equipment utilization rates across multiple market segments.

Urban development initiatives throughout France’s major cities drive significant equipment demand as municipalities undertake comprehensive redevelopment projects. These initiatives include housing development, commercial construction, and public facility upgrades that require diverse construction machinery capabilities. The focus on sustainable urban planning has increased demand for precision equipment that minimizes environmental impact during construction activities.

Regulatory compliance requirements mandate the use of advanced construction equipment that meets stringent environmental and safety standards. France’s implementation of European Union construction regulations has accelerated the adoption of cleaner, more efficient machinery. Environmental regulations particularly influence equipment selection, with 82% of contractors prioritizing low-emission machinery in their fleet planning decisions.

Technological advancement in construction methodologies requires sophisticated equipment capable of supporting modern building techniques. The integration of Building Information Modeling (BIM) and digital construction processes demands machinery with advanced connectivity and precision control capabilities, driving equipment upgrade cycles and new technology adoption.

High capital investment requirements present significant barriers for smaller construction companies seeking to acquire advanced equipment. The substantial upfront costs associated with modern construction machinery, particularly specialized or technologically advanced units, limit market accessibility for emerging contractors and regional construction firms.

Economic uncertainty and fluctuating construction activity levels create challenges for equipment manufacturers and distributors. Market volatility affects equipment utilization rates and influences purchasing decisions, as contractors may defer equipment acquisitions during periods of economic uncertainty or reduced project activity.

Skilled operator shortage represents a critical constraint affecting equipment utilization efficiency. The complexity of modern construction equipment requires specialized training and certification, yet France faces a shortage of qualified operators capable of maximizing equipment performance and safety standards.

Maintenance complexity associated with advanced construction equipment increases operational costs and requires specialized service capabilities. The integration of digital systems and sophisticated hydraulic components demands expert maintenance services that may not be readily available in all regions, potentially limiting equipment adoption and performance optimization.

Green construction initiatives present substantial opportunities for equipment manufacturers and service providers focused on sustainable solutions. France’s commitment to environmental sustainability creates demand for electric, hybrid, and low-emission construction equipment that supports green building certifications and reduces project environmental impact.

Digital transformation in the construction industry opens new markets for connected equipment and data analytics services. The integration of IoT sensors, GPS tracking, and predictive maintenance capabilities creates opportunities for technology providers and equipment manufacturers to offer value-added services that enhance operational efficiency.

Equipment-as-a-Service models represent emerging opportunities that address capital constraints while providing contractors access to the latest technology. Flexible leasing arrangements and comprehensive service packages enable market expansion by making advanced equipment accessible to a broader range of construction companies.

Infrastructure modernization programs scheduled for the coming decade will drive sustained equipment demand across multiple sectors. The planned expansion of renewable energy infrastructure, transportation networks, and digital communication systems creates long-term market opportunities for specialized construction equipment providers.

Supply chain integration within the France construction equipment market has evolved to support just-in-time delivery and flexible equipment access models. Manufacturers and distributors have developed sophisticated logistics networks that ensure equipment availability while minimizing inventory costs and storage requirements.

Competitive dynamics reflect a market characterized by both global equipment manufacturers and specialized French companies serving niche applications. The competitive landscape emphasizes technological innovation, service quality, and local market expertise as key differentiating factors that influence customer selection and brand loyalty.

Market consolidation trends have resulted in strategic partnerships and acquisitions that strengthen distribution networks and expand service capabilities. These developments enhance market efficiency while providing customers with comprehensive equipment solutions and support services.

Customer behavior evolution shows increasing preference for flexible equipment access models over traditional ownership structures. According to MarkWide Research analysis, contractors increasingly value operational flexibility and cost predictability, driving growth in rental and leasing segments that now represent 52% of total equipment utilization in the French market.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the France construction equipment market. Primary research activities included extensive interviews with industry stakeholders, equipment manufacturers, construction contractors, and rental service providers to gather firsthand market intelligence and validate market trends.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and regulatory documentation to establish market context and historical performance patterns. This approach provided comprehensive coverage of market segments, competitive dynamics, and regulatory influences affecting the construction equipment sector.

Data validation processes included cross-referencing multiple information sources and conducting follow-up interviews to confirm key findings and market projections. Statistical analysis techniques were applied to identify significant trends and correlations within the market data.

Market modeling utilized advanced analytical frameworks to project future market development scenarios and assess the impact of various market drivers and constraints on sector growth. The methodology incorporated both quantitative analysis and qualitative insights to provide balanced market perspectives.

Île-de-France region dominates the construction equipment market, accounting for approximately 35% of national equipment demand due to concentrated construction activity in the Paris metropolitan area. Major infrastructure projects, urban redevelopment initiatives, and commercial construction drive sustained equipment utilization in this region.

Auvergne-Rhône-Alpes represents the second-largest regional market, benefiting from industrial development, transportation infrastructure projects, and Alpine construction activities. The region’s diverse construction requirements support demand for specialized equipment including mountain construction machinery and precision lifting equipment.

Provence-Alpes-Côte d’Azur demonstrates strong market activity driven by tourism infrastructure development, residential construction, and port facility modernization. The Mediterranean coastal region requires specialized equipment for marine construction and coastal protection projects.

Regional distribution patterns reflect France’s economic geography, with higher equipment concentration in industrialized regions and major urban centers. Rural regions show increasing equipment demand driven by renewable energy projects and agricultural infrastructure development, creating opportunities for mobile equipment services and regional distribution networks.

Market leadership in the France construction equipment sector is characterized by a diverse mix of international manufacturers and specialized French companies. The competitive environment emphasizes technological innovation, service quality, and local market expertise as primary differentiation factors.

Competitive strategies focus on technological advancement, sustainability initiatives, and comprehensive service offerings that address evolving customer requirements. Market leaders invest significantly in research and development to maintain technological leadership and respond to changing regulatory requirements.

By Equipment Type:

By Application:

By End User:

Earthmoving equipment maintains market dominance due to fundamental requirements across all construction project types. Excavators represent the largest sub-segment, with 42% market share driven by versatility and essential functionality in excavation, demolition, and material handling applications. Advanced hydraulic systems and precision control capabilities enhance productivity and operational efficiency.

Material handling equipment demonstrates strong growth potential as construction projects become more complex and require sophisticated logistics solutions. Wheel loaders and telehandlers show particular strength in the French market, supporting both construction activities and material management requirements across diverse project types.

Concrete equipment benefits from France’s emphasis on durable construction and infrastructure development. Concrete pumps and mixing equipment incorporate advanced technology for precise material delivery and quality control, supporting the construction industry’s focus on structural integrity and longevity.

Lifting equipment experiences growing demand driven by high-rise construction and complex infrastructure projects. Tower cranes and mobile cranes equipped with advanced safety systems and precision control capabilities address the requirements of modern construction methodologies and safety regulations.

Construction contractors benefit from access to advanced equipment that enhances project efficiency, reduces labor requirements, and improves safety performance. Modern construction equipment enables contractors to undertake more complex projects while maintaining competitive pricing and delivery schedules.

Equipment manufacturers gain opportunities for market expansion through technological innovation and sustainable product development. The French market’s emphasis on environmental compliance and advanced technology creates demand for premium equipment solutions that command higher margins and customer loyalty.

Rental service providers experience growing demand as contractors seek flexible, cost-effective equipment access solutions. The rental model enables service providers to maintain high equipment utilization rates while offering customers access to the latest technology without significant capital investment.

Technology providers find expanding opportunities in the integration of digital solutions, IoT connectivity, and data analytics services that enhance equipment performance and project management capabilities. These value-added services create recurring revenue streams and strengthen customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification trend represents a fundamental shift in construction equipment design and application. Electric and hybrid equipment adoption accelerates as manufacturers develop solutions that meet performance requirements while reducing environmental impact. Battery technology advancement enables longer operating periods and faster charging capabilities that support practical construction applications.

Autonomous operation emerges as a significant trend with equipment manufacturers developing self-operating machinery for specific construction tasks. These systems enhance safety by removing operators from hazardous environments while improving precision and consistency in repetitive operations.

Connectivity integration transforms equipment into data-generating assets that provide insights into performance, maintenance requirements, and operational efficiency. IoT-enabled equipment supports predictive maintenance strategies and real-time performance optimization that reduces operational costs and extends equipment lifecycles.

Modular equipment design enables flexible configuration for diverse construction applications. This trend supports equipment versatility and reduces the need for multiple specialized machines, providing cost-effective solutions for contractors managing diverse project requirements.

Strategic partnerships between equipment manufacturers and technology companies accelerate innovation in connected construction solutions. These collaborations combine mechanical engineering expertise with advanced software capabilities to create integrated systems that enhance construction productivity and project management.

Manufacturing localization initiatives by international equipment companies establish production facilities in France to serve European markets more effectively. These investments strengthen supply chains, reduce delivery times, and support local employment while enhancing customer service capabilities.

Service expansion programs by equipment manufacturers include comprehensive maintenance services, operator training, and technical support that enhance customer value and strengthen competitive positioning. These initiatives create recurring revenue streams while improving equipment performance and customer satisfaction.

Sustainability certifications become increasingly important as construction companies seek equipment that supports green building standards and environmental compliance requirements. Manufacturers invest in developing certified sustainable equipment solutions that meet evolving regulatory and market demands.

Market participants should prioritize investment in sustainable equipment technologies that align with France’s environmental regulations and construction industry sustainability goals. MWR analysis indicates that companies focusing on electric and hybrid solutions will capture significant market share as environmental compliance becomes mandatory across construction projects.

Service differentiation represents a critical success factor in the competitive construction equipment market. Companies should develop comprehensive service offerings that include maintenance, training, and technical support to create customer loyalty and recurring revenue streams that enhance business stability.

Digital transformation initiatives should focus on practical applications that deliver measurable value to construction contractors. Equipment connectivity and data analytics services that improve operational efficiency and reduce costs will drive adoption and market success.

Regional expansion strategies should consider the diverse requirements of different French regions and construction market segments. Tailored approaches that address local construction practices and project requirements will enhance market penetration and customer satisfaction.

Long-term market prospects for the France construction equipment sector remain positive, supported by sustained infrastructure investment and technological advancement. The market is projected to maintain steady growth with increasing emphasis on sustainable solutions and digital integration that enhance operational efficiency and environmental performance.

Technology evolution will continue to reshape the construction equipment landscape, with autonomous operation, electrification, and connectivity becoming standard features rather than premium options. These developments will create new market opportunities while requiring adaptation by manufacturers, service providers, and equipment users.

Market structure evolution toward service-based models will accelerate as contractors seek flexible, cost-effective equipment access solutions. Equipment-as-a-Service offerings will expand, supported by digital platforms that enable efficient fleet management and utilization optimization.

Regulatory influence will intensify as France implements stricter environmental standards and safety requirements for construction activities. These regulations will drive equipment modernization and create opportunities for manufacturers offering compliant, advanced solutions that exceed regulatory requirements while delivering superior performance.

The France construction equipment market demonstrates robust fundamentals and promising growth prospects driven by infrastructure investment, technological innovation, and sustainability initiatives. Market dynamics favor companies that combine advanced technology with comprehensive service offerings to address evolving customer requirements and regulatory compliance needs.

Strategic positioning in this market requires focus on sustainable solutions, digital integration, and flexible service models that provide value to construction contractors across diverse project types. The successful market participants will be those who adapt to changing customer preferences while maintaining operational excellence and technological leadership.

Future success in the France construction equipment market will depend on the ability to balance innovation with practical application, ensuring that advanced technology delivers measurable benefits to construction projects while supporting France’s broader economic and environmental objectives.

What is Construction Equipment?

Construction equipment refers to heavy machinery and tools used for construction activities, including excavation, lifting, and material handling. Common types include bulldozers, cranes, and excavators, which are essential for various construction projects.

What are the key players in the France Construction Equipment Market?

Key players in the France Construction Equipment Market include companies like Caterpillar, Komatsu, and Volvo Construction Equipment. These companies are known for their innovative machinery and extensive product lines, catering to various construction needs, among others.

What are the growth factors driving the France Construction Equipment Market?

The France Construction Equipment Market is driven by factors such as increasing infrastructure development, urbanization, and advancements in construction technology. Additionally, government investments in public works projects contribute to market growth.

What challenges does the France Construction Equipment Market face?

The France Construction Equipment Market faces challenges such as high operational costs, regulatory compliance, and the need for skilled labor. These factors can hinder the growth and efficiency of construction projects.

What opportunities exist in the France Construction Equipment Market?

Opportunities in the France Construction Equipment Market include the adoption of eco-friendly machinery and automation technologies. The growing demand for sustainable construction practices also presents avenues for innovation and market expansion.

What trends are shaping the France Construction Equipment Market?

Trends in the France Construction Equipment Market include the increasing use of telematics and IoT for equipment management, as well as a shift towards electric and hybrid machinery. These innovations aim to enhance efficiency and reduce environmental impact.

France Construction Equipment Market

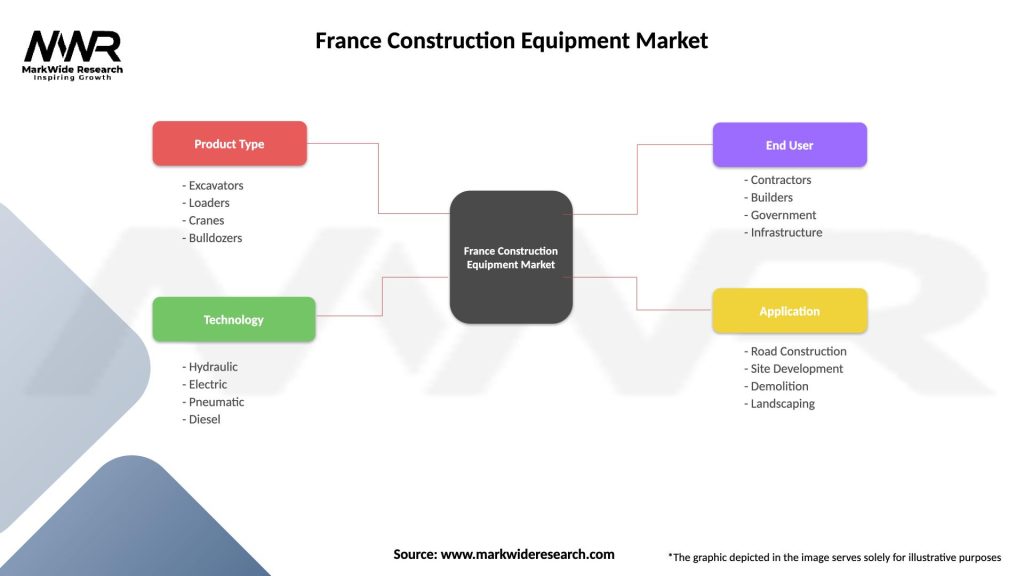

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Loaders, Cranes, Bulldozers |

| Technology | Hydraulic, Electric, Pneumatic, Diesel |

| End User | Contractors, Builders, Government, Infrastructure |

| Application | Road Construction, Site Development, Demolition, Landscaping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at