444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa e-commerce apparel market represents one of the fastest-growing digital retail segments in the region, driven by increasing internet penetration, smartphone adoption, and changing consumer preferences. This dynamic market encompasses online sales of clothing, footwear, accessories, and fashion items across diverse demographics and geographic locations. Regional growth has been particularly robust, with the market experiencing a compound annual growth rate (CAGR) of 12.5% over recent years, significantly outpacing traditional retail channels.

Digital transformation across the Middle East and Africa has created unprecedented opportunities for fashion retailers to reach consumers through online platforms. The market benefits from a young, tech-savvy population with approximately 65% of consumers under 35 years actively engaging in online shopping activities. Mobile commerce dominates the landscape, accounting for nearly 78% of all e-commerce transactions in the apparel sector, reflecting the region’s mobile-first approach to digital adoption.

Infrastructure development and improved logistics networks have facilitated market expansion, enabling retailers to overcome traditional barriers associated with last-mile delivery and payment processing. The integration of local and international brands has created a diverse marketplace that caters to varying consumer preferences, from traditional modest wear to contemporary fashion trends. Cross-border e-commerce has also gained significant traction, with international retailers increasingly targeting Middle Eastern and African consumers through localized online platforms.

The Middle East and Africa e-commerce apparel market refers to the digital marketplace encompassing online sales of clothing, footwear, accessories, and fashion-related products across countries in the Middle East and African regions. This market includes business-to-consumer (B2C) transactions conducted through dedicated e-commerce platforms, brand websites, mobile applications, and social commerce channels, facilitating the purchase and delivery of fashion items to end consumers.

Market scope extends beyond traditional retail boundaries, incorporating various business models including direct-to-consumer brands, marketplace platforms, subscription services, and omnichannel retail strategies. The definition encompasses both domestic and international retailers serving regional consumers, as well as local brands expanding their digital presence to compete in the evolving fashion landscape.

Geographic coverage includes major markets such as the United Arab Emirates, Saudi Arabia, Egypt, South Africa, Nigeria, and Kenya, among others, each contributing unique consumer behaviors, preferences, and purchasing patterns. The market definition also incorporates emerging technologies such as augmented reality fitting rooms, artificial intelligence-powered recommendations, and blockchain-based authentication systems that enhance the online shopping experience.

Market dynamics in the Middle East and Africa e-commerce apparel sector reflect a rapidly evolving landscape characterized by strong growth momentum, increasing consumer adoption, and significant investment in digital infrastructure. The market has demonstrated remarkable resilience and adaptability, particularly following global events that accelerated digital transformation across retail sectors.

Key performance indicators reveal substantial progress in market penetration, with online apparel sales representing approximately 18% of total fashion retail in major urban centers across the region. Consumer behavior has shifted dramatically, with 42% of shoppers now preferring online channels for fashion purchases, compared to traditional brick-and-mortar stores. This transformation has been supported by improved payment systems, enhanced logistics capabilities, and increased trust in online transactions.

Competitive landscape features a mix of international giants, regional players, and emerging local brands, creating a diverse ecosystem that serves various market segments. Innovation adoption has accelerated, with retailers implementing advanced technologies such as virtual try-on features, personalized styling services, and AI-driven inventory management systems to enhance customer experience and operational efficiency.

Future prospects remain highly positive, with continued investment in digital infrastructure, expanding internet connectivity, and growing consumer confidence in online shopping driving sustained market growth. The integration of social commerce, influencer marketing, and sustainable fashion initiatives represents key areas of opportunity for market participants.

Consumer demographics reveal distinct patterns that shape market development and strategic positioning. The following insights provide comprehensive understanding of market dynamics:

Digital infrastructure expansion serves as a fundamental driver of market growth, with governments and private sector entities investing heavily in broadband connectivity, 5G networks, and digital payment systems. These improvements have significantly enhanced the online shopping experience, reducing transaction friction and enabling seamless mobile commerce across urban and rural areas.

Demographic advantages position the region favorably for continued e-commerce growth, with a predominantly young population that embraces digital technologies and online shopping behaviors. Urbanization trends have concentrated consumer spending power in major cities, creating dense markets with sophisticated logistics infrastructure and delivery capabilities.

Changing lifestyle preferences reflect increased time constraints, convenience-seeking behavior, and desire for diverse fashion choices that traditional retail channels cannot always provide. Social media influence has become particularly powerful, with fashion influencers and brand ambassadors driving product discovery and purchase decisions among target demographics.

Economic diversification initiatives across Gulf countries and emerging African markets have created new consumer segments with disposable income and appetite for fashion consumption. Government support for e-commerce development through regulatory frameworks, digital payment infrastructure, and logistics improvements has facilitated market expansion and reduced operational barriers for retailers.

International brand expansion has brought global fashion retailers to regional markets, increasing competition while simultaneously educating consumers about online shopping benefits and building trust in digital transactions. Technological innovation continues to enhance user experience through personalization, virtual styling, and augmented reality features that address traditional online shopping limitations.

Logistical challenges remain significant barriers to market expansion, particularly in remote areas where delivery infrastructure is underdeveloped. Last-mile delivery costs and complexity can significantly impact profitability and customer satisfaction, especially for lower-value fashion items that require cost-effective shipping solutions.

Cultural considerations influence product selection and marketing strategies, requiring retailers to navigate diverse religious, social, and traditional preferences across different markets. Modest fashion requirements in certain regions necessitate specialized product curation and marketing approaches that may limit standardized regional strategies.

Payment system limitations persist in some markets where banking penetration remains low and digital payment adoption is gradual. Trust and security concerns continue to influence consumer behavior, particularly regarding online payment processing and personal data protection, requiring ongoing investment in cybersecurity and consumer education.

Regulatory complexity across different countries creates compliance challenges for retailers operating in multiple markets, with varying import duties, tax structures, and consumer protection requirements. Currency fluctuations and economic instability in certain regions can impact consumer purchasing power and cross-border transaction costs.

Return and exchange processes present operational challenges due to the tactile nature of fashion products and consumer expectations for easy returns. Size standardization issues across international brands and regional preferences create additional complexity in inventory management and customer satisfaction.

Emerging market penetration presents substantial growth opportunities as internet connectivity expands and smartphone adoption increases across previously underserved regions. Rural market development offers significant potential as logistics networks improve and digital payment systems become more accessible to broader population segments.

Sustainable fashion trends create opportunities for brands that can effectively communicate environmental and social responsibility messages while delivering quality products. Circular economy initiatives including clothing rental, resale platforms, and upcycling services represent emerging market segments with strong growth potential.

Technology integration opportunities include artificial intelligence for personalized recommendations, blockchain for supply chain transparency, and virtual reality for enhanced shopping experiences. Voice commerce and conversational AI present new channels for customer engagement and transaction processing.

Local brand development offers opportunities for regional designers and manufacturers to leverage e-commerce platforms for market access and brand building. Cultural fashion segments including modest wear, traditional clothing, and region-specific styles represent underserved niches with dedicated consumer bases.

Cross-border expansion enables successful regional retailers to explore international markets while allowing global brands to deepen their regional presence through localized strategies. Partnership opportunities with logistics providers, payment processors, and technology companies can accelerate market entry and operational efficiency.

Supply chain evolution has transformed traditional fashion retail models, with e-commerce enabling direct-to-consumer relationships and reducing intermediary dependencies. Inventory management has become more sophisticated through data analytics and demand forecasting, allowing retailers to optimize stock levels and reduce waste while improving product availability.

Consumer expectations continue to evolve, demanding faster delivery times, seamless return processes, and personalized shopping experiences. Omnichannel integration has become essential, with successful retailers combining online and offline touchpoints to create cohesive brand experiences that meet diverse consumer preferences.

Competitive intensity has increased as market barriers lower and new entrants leverage digital platforms to challenge established players. Price transparency through online comparison shopping has intensified price competition while simultaneously rewarding retailers who can differentiate through service quality and brand experience.

Technology adoption cycles accelerate rapidly in the digital fashion space, requiring continuous investment in platform capabilities, mobile optimization, and emerging technologies. Data-driven decision making has become crucial for understanding consumer behavior, optimizing marketing spend, and improving operational efficiency across the value chain.

Regulatory evolution continues to shape market dynamics as governments develop e-commerce frameworks, consumer protection regulations, and tax policies that impact operational strategies and compliance requirements for market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East and Africa e-commerce apparel market. Primary research includes extensive surveys, interviews, and focus groups conducted with consumers, retailers, logistics providers, and industry experts across key markets in the region.

Secondary research incorporates analysis of industry reports, government statistics, company financial statements, and trade association data to validate primary findings and provide comprehensive market context. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators.

Qualitative research methods include in-depth interviews with industry leaders, case study analysis of successful market entrants, and ethnographic research to understand cultural factors influencing consumer behavior. Market segmentation analysis examines demographic, geographic, and psychographic factors that drive purchasing decisions and brand preferences.

Data validation processes ensure accuracy through triangulation of multiple sources, expert review panels, and statistical significance testing. Regional expertise is incorporated through partnerships with local research organizations and cultural consultants who provide market-specific insights and validation of findings across diverse geographic and cultural contexts.

Gulf Cooperation Council (GCC) markets lead regional e-commerce adoption, with the United Arab Emirates and Saudi Arabia representing the most mature markets characterized by high internet penetration, sophisticated logistics infrastructure, and strong consumer purchasing power. Market penetration rates in these countries exceed 25% of total apparel sales, driven by tech-savvy populations and government initiatives supporting digital economy development.

North African markets including Egypt, Morocco, and Tunisia demonstrate strong growth potential despite infrastructure challenges, with urban centers showing 15% annual growth in online fashion purchases. Cultural preferences for modest fashion create unique market opportunities, while improving payment systems and logistics networks support market expansion.

Sub-Saharan Africa presents emerging opportunities led by South Africa, Nigeria, and Kenya, where mobile commerce dominates due to widespread smartphone adoption and limited traditional banking infrastructure. Mobile payment solutions have enabled market development, with mobile transactions representing 85% of online purchases in key markets.

Levant region markets including Jordan, Lebanon, and Palestine show resilience despite economic challenges, with consumers increasingly turning to online platforms for access to international brands and competitive pricing. Cross-border shopping has become particularly important in these markets, accounting for significant portions of total e-commerce activity.

Regional disparities in infrastructure, regulations, and consumer behavior require tailored strategies for market entry and expansion, with successful retailers adapting their approaches to local conditions while maintaining operational efficiency across multiple markets.

Market leadership is distributed among several categories of players, each bringing distinct advantages and strategic approaches to the regional e-commerce apparel market:

Competitive strategies focus on differentiation through customer service, delivery speed, product curation, and localized shopping experiences. Technology investment has become crucial for maintaining competitive advantage, with leading players implementing advanced recommendation engines, mobile optimization, and social commerce integration.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand geographic coverage, enhance logistics capabilities, and achieve economies of scale in increasingly competitive markets.

By Product Category:

By Consumer Demographics:

By Geographic Markets:

Women’s Fashion dominates the regional e-commerce apparel market, accounting for approximately 58% of total online fashion sales. This category benefits from higher shopping frequency, diverse product needs, and strong social media influence on purchasing decisions. Modest wear represents a particularly important subcategory, with specialized retailers and international brands developing dedicated collections for regional consumers.

Men’s Apparel shows accelerating growth as male consumers increasingly embrace online shopping for convenience and product variety. Casual wear and athletic apparel lead category growth, while traditional garments maintain steady demand during cultural and religious seasons. Size consistency and fit concerns remain key challenges requiring enhanced product descriptions and return policies.

Children’s Clothing benefits from busy parent lifestyles and seasonal shopping patterns, with back-to-school and holiday seasons driving significant sales spikes. Safety considerations and quality concerns influence brand selection, while rapid size changes create frequent repurchase opportunities for retailers.

Footwear Category presents unique challenges related to fit and comfort assessment through online channels. Athletic footwear leads online adoption due to standardized sizing and brand familiarity, while formal shoes and traditional footwear require enhanced product visualization and flexible return policies.

Accessories Segment offers high-margin opportunities with lower shipping costs and reduced fit concerns. Jewelry and handbags show strong online performance, particularly during gift-giving seasons and special occasions that are culturally significant in regional markets.

Retailers and Brands benefit from expanded market reach, reduced operational costs compared to physical retail, and enhanced customer data collection capabilities. Direct-to-consumer relationships enable better margin control, brand experience management, and customer lifetime value optimization through personalized marketing and service delivery.

Consumers gain access to broader product selection, competitive pricing, convenient shopping experiences, and time-saving benefits that traditional retail cannot match. Product comparison capabilities and customer reviews enhance purchase confidence, while flexible delivery options accommodate diverse lifestyle needs and preferences.

Logistics Providers experience increased business volume and opportunities for service differentiation through specialized fashion fulfillment capabilities. Last-mile delivery innovations and return processing services create additional revenue streams while supporting overall market growth and customer satisfaction.

Payment Service Providers benefit from transaction volume growth and opportunities to develop specialized e-commerce payment solutions. Digital wallet adoption and buy-now-pay-later services create new product opportunities while supporting financial inclusion across diverse consumer segments.

Technology Companies find growing demand for e-commerce platforms, mobile applications, artificial intelligence solutions, and cybersecurity services. Innovation partnerships with retailers create opportunities for technology validation and market expansion across regional markets.

Government Stakeholders benefit from increased tax revenue, job creation in digital economy sectors, and enhanced consumer choice and competition. Economic diversification goals are supported through e-commerce growth, while digital infrastructure investments generate broader economic benefits beyond retail sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Social Commerce Revolution has transformed fashion discovery and purchasing processes, with platforms like Instagram, TikTok, and Snapchat becoming primary channels for brand engagement and product promotion. Influencer partnerships and user-generated content drive authentic brand connections while shoppable posts reduce friction between discovery and purchase.

Personalization Technology advancement enables retailers to deliver customized shopping experiences through AI-powered recommendations, dynamic pricing, and targeted marketing campaigns. Machine learning algorithms analyze consumer behavior patterns to predict preferences and optimize inventory management while enhancing customer satisfaction.

Sustainable Fashion Movement gains momentum as environmentally conscious consumers seek eco-friendly alternatives and transparent supply chain practices. Circular economy initiatives including clothing rental, resale platforms, and recycling programs create new business models while addressing sustainability concerns.

Augmented Reality Integration addresses traditional online shopping limitations through virtual try-on experiences, 3D product visualization, and interactive fitting rooms. AR technology reduces return rates while increasing consumer confidence in online fashion purchases, particularly for categories where fit and appearance are crucial.

Voice Commerce Emergence introduces new interaction models through smart speakers and voice assistants, enabling hands-free shopping experiences and reorder capabilities. Conversational AI enhances customer service while voice search optimization becomes increasingly important for product discovery.

Same-Day Delivery Expectations drive logistics innovation and urban fulfillment center development as consumers demand faster gratification. Micro-fulfillment strategies and crowdsourced delivery models enable cost-effective rapid delivery while maintaining service quality standards.

Platform Consolidation continues as major e-commerce players acquire specialized fashion retailers and technology companies to enhance capabilities and market coverage. Strategic partnerships between international brands and regional platforms facilitate market entry while leveraging local expertise and infrastructure.

Logistics Infrastructure Investment accelerates across the region, with major players establishing distribution centers, automated fulfillment facilities, and last-mile delivery networks. Cross-border logistics improvements enable seamless international shopping experiences while reducing delivery times and costs.

Payment Innovation introduces new financial products including buy-now-pay-later services, digital wallets, and cryptocurrency payment options. Financial inclusion initiatives expand access to online shopping through alternative payment methods and credit solutions tailored to regional consumer needs.

Regulatory Framework Development establishes clearer guidelines for e-commerce operations, consumer protection, and data privacy across regional markets. Tax harmonization efforts and trade facilitation measures support cross-border commerce while ensuring fair competition and consumer rights protection.

Technology Partnerships between fashion retailers and tech companies accelerate innovation adoption, with collaborations focusing on artificial intelligence, blockchain authentication, and immersive shopping experiences. Startup ecosystem growth introduces disruptive technologies and business models that challenge traditional retail approaches.

Sustainability Initiatives gain prominence as brands implement circular economy practices, carbon-neutral shipping options, and transparent supply chain reporting. Consumer education programs promote sustainable fashion choices while industry collaboration addresses environmental challenges collectively.

MarkWide Research analysis indicates that successful market participants should prioritize mobile-first strategies, given the dominance of smartphone-based shopping in regional markets. Investment in mobile app development and mobile payment integration will be crucial for capturing and retaining the growing base of mobile-native consumers.

Localization strategies should extend beyond language translation to include cultural sensitivity in product curation, marketing messaging, and customer service approaches. Regional partnerships with local influencers, cultural consultants, and logistics providers can accelerate market penetration while avoiding cultural missteps that could damage brand reputation.

Technology adoption should focus on practical applications that directly address consumer pain points such as sizing concerns, product authenticity, and delivery reliability. Augmented reality fitting tools and blockchain authentication systems represent high-impact investments that can differentiate brands while building consumer trust.

Omnichannel integration becomes increasingly important as consumers expect seamless experiences across online and offline touchpoints. Click-and-collect services, in-store returns for online purchases, and unified loyalty programs can enhance customer satisfaction while optimizing operational efficiency.

Sustainability positioning should be authentic and measurable, with clear communication of environmental and social impact initiatives. Transparency in supply chain practices and concrete sustainability metrics will resonate with increasingly conscious consumers while supporting long-term brand value.

Data analytics capabilities must be developed to understand regional consumer behavior patterns, optimize inventory management, and personalize marketing efforts. Customer lifetime value optimization through data-driven insights will be crucial for maintaining profitability in competitive markets.

Market trajectory remains strongly positive, with MWR projecting continued robust growth driven by expanding internet infrastructure, increasing consumer confidence, and ongoing digital transformation across the region. Penetration rates are expected to reach 30% of total apparel sales in mature markets within the next five years, while emerging markets show potential for even higher growth rates.

Technology integration will accelerate, with artificial intelligence, augmented reality, and blockchain technologies becoming standard features rather than competitive differentiators. Voice commerce and conversational AI are projected to account for 15% of fashion e-commerce interactions by 2028, requiring retailers to adapt their customer engagement strategies accordingly.

Sustainability focus will intensify as regulatory requirements and consumer expectations align around environmental responsibility. Circular economy business models including rental, resale, and recycling services are expected to represent significant market segments, creating new revenue opportunities while addressing sustainability concerns.

Cross-border commerce will expand as logistics networks improve and regulatory barriers decrease, enabling smaller brands to access regional markets while allowing consumers greater access to international fashion options. Regional trade agreements and digital economy initiatives will support this trend through reduced friction and enhanced consumer protection.

Market consolidation may continue as successful platforms acquire specialized players and technology companies to enhance their capabilities and market coverage. However, niche opportunities will persist for brands that can effectively serve specific cultural, demographic, or product segments with specialized expertise and authentic positioning.

The Middle East and Africa e-commerce apparel market represents a dynamic and rapidly evolving landscape with substantial growth potential driven by favorable demographics, improving infrastructure, and changing consumer behaviors. Market fundamentals remain strong, supported by increasing internet penetration, smartphone adoption, and digital payment system development across diverse regional markets.

Success factors for market participants include mobile-first strategies, cultural sensitivity, technology innovation, and authentic sustainability positioning. Consumer expectations continue to evolve toward more personalized, convenient, and socially responsible shopping experiences, requiring retailers to invest in advanced capabilities while maintaining operational efficiency.

Competitive dynamics will intensify as market barriers continue to lower and new entrants leverage digital platforms to challenge established players. However, market size and growth momentum provide opportunities for multiple players to succeed through differentiated positioning and specialized market focus.

Future development will be shaped by technology advancement, regulatory evolution, and sustainability imperatives that create both challenges and opportunities for market participants. Regional integration and cross-border commerce will expand market opportunities while requiring sophisticated operational capabilities and cultural expertise. The Middle East and Africa e-commerce apparel market is positioned for continued robust growth, offering significant opportunities for retailers, technology providers, and supporting service companies that can effectively navigate its unique characteristics and requirements.

What is E-Commerce Apparel?

E-Commerce Apparel refers to the online retailing of clothing and fashion items. This sector encompasses various segments including casual wear, formal wear, and activewear, catering to diverse consumer preferences and shopping behaviors.

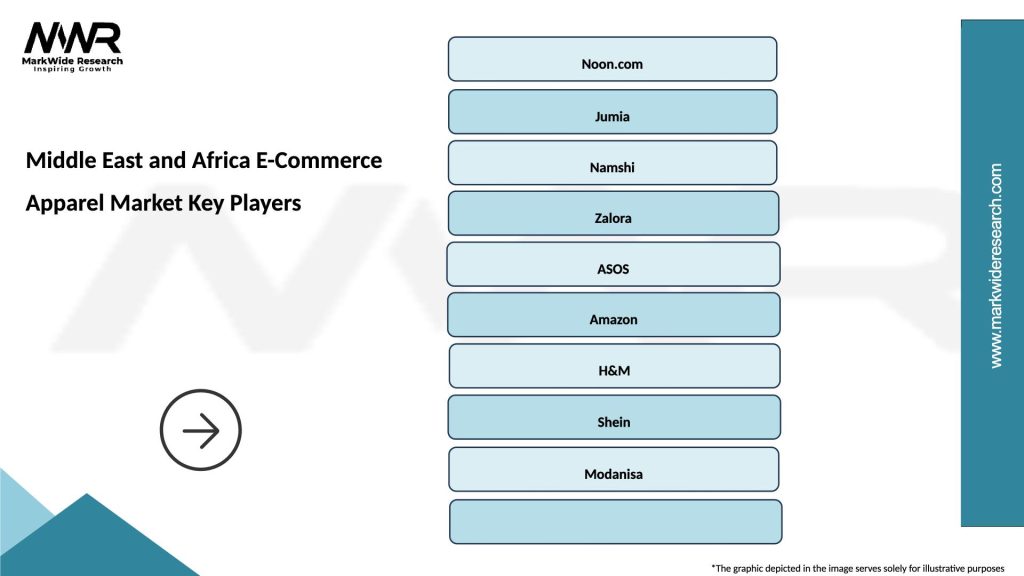

What are the key players in the Middle East and Africa E-Commerce Apparel Market?

Key players in the Middle East and Africa E-Commerce Apparel Market include Jumia, Namshi, and Souq, which offer a wide range of apparel products online. These companies are known for their extensive product catalogs and customer-centric services, among others.

What are the growth factors driving the Middle East and Africa E-Commerce Apparel Market?

The growth of the Middle East and Africa E-Commerce Apparel Market is driven by increasing internet penetration, the rise of mobile shopping, and changing consumer preferences towards online purchasing. Additionally, the expansion of logistics and payment solutions enhances accessibility for consumers.

What challenges does the Middle East and Africa E-Commerce Apparel Market face?

Challenges in the Middle East and Africa E-Commerce Apparel Market include logistical issues, such as delivery delays and high shipping costs, as well as competition from traditional retail. Additionally, concerns regarding product quality and return policies can deter online shoppers.

What opportunities exist in the Middle East and Africa E-Commerce Apparel Market?

The Middle East and Africa E-Commerce Apparel Market presents opportunities for growth through the introduction of sustainable fashion lines and personalized shopping experiences. Furthermore, leveraging social media for marketing can enhance brand visibility and consumer engagement.

What trends are shaping the Middle East and Africa E-Commerce Apparel Market?

Trends in the Middle East and Africa E-Commerce Apparel Market include the increasing popularity of fast fashion, the rise of influencer marketing, and the integration of augmented reality in online shopping experiences. These trends are reshaping how consumers interact with apparel brands.

Middle East and Africa E-Commerce Apparel Market

| Segmentation Details | Description |

|---|---|

| Product Type | T-Shirts, Dresses, Jeans, Activewear |

| Customer Type | Men, Women, Children, Unisex |

| Distribution Channel | Online Retail, Brand Websites, Marketplaces, Social Media |

| Price Tier | Luxury, Mid-Range, Budget, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa E-Commerce Apparel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at