444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia quick service restaurants market represents one of the most dynamic and rapidly evolving segments within the Kingdom’s food service industry. This market encompasses a diverse range of fast-food establishments, including international chains, local brands, and emerging digital-first restaurant concepts that cater to the growing demand for convenient, affordable, and quality dining experiences. The sector has experienced remarkable transformation driven by changing consumer preferences, technological advancement, and the Kingdom’s Vision 2030 initiatives.

Market dynamics indicate substantial growth potential as urbanization accelerates and the young demographic increasingly embraces quick service dining options. The market benefits from a growing population of tech-savvy consumers who prioritize convenience and speed in their dining choices. With approximately 65% of the population under the age of 35, the Kingdom presents an ideal demographic profile for quick service restaurant expansion and innovation.

Digital transformation has become a cornerstone of market evolution, with delivery platforms and mobile ordering systems experiencing unprecedented adoption rates. The integration of technology in ordering, payment, and delivery processes has fundamentally reshaped how consumers interact with quick service restaurants, creating new opportunities for market participants to enhance customer experience and operational efficiency.

The Saudi Arabia quick service restaurants market refers to the comprehensive ecosystem of fast-food establishments operating within the Kingdom that provide quick meal preparation, limited table service, and emphasis on speed and convenience for customers seeking efficient dining solutions.

Quick service restaurants in Saudi Arabia encompass various formats including traditional fast-food chains, casual dining concepts with expedited service, food trucks, ghost kitchens, and digital-native restaurant brands. These establishments typically feature streamlined menus, standardized preparation processes, and multiple service channels including dine-in, takeaway, and delivery options to meet diverse consumer preferences.

The market structure includes international franchise operations, domestic restaurant chains, independent operators, and emerging cloud kitchen concepts. Each segment contributes to the overall market dynamics through different value propositions, target demographics, and operational models that collectively serve the Kingdom’s diverse consumer base across urban and suburban markets.

Strategic analysis reveals that the Saudi Arabia quick service restaurants market is experiencing robust expansion driven by demographic shifts, lifestyle changes, and technological innovation. The market demonstrates strong resilience and adaptability, particularly evident during recent global challenges that accelerated digital adoption and delivery service utilization.

Key performance indicators show impressive growth trajectories across multiple market segments, with delivery services experiencing particularly strong momentum. The market benefits from supportive government policies, infrastructure development, and increasing foreign investment in the food service sector. Consumer spending patterns indicate growing preference for convenient dining options that align with busy lifestyles and evolving social dynamics.

Competitive landscape features a balanced mix of established international brands and emerging local concepts, creating a dynamic environment that fosters innovation and market expansion. The sector’s growth is supported by favorable economic conditions, rising disposable incomes, and increasing urbanization rates that create sustained demand for quick service dining options.

Consumer behavior analysis reveals several critical insights that shape market development and strategic planning for industry participants:

Demographic transformation serves as a primary catalyst for market growth, with Saudi Arabia’s young population driving demand for modern dining experiences. The Kingdom’s demographic profile, characterized by a tech-savvy generation with disposable income and evolving lifestyle preferences, creates ideal conditions for quick service restaurant expansion and innovation.

Urbanization trends significantly impact market development as more Saudis migrate to urban centers where quick service restaurants thrive. Urban environments provide the population density, infrastructure, and lifestyle patterns that support successful quick service restaurant operations. The concentration of working professionals, students, and families in urban areas creates consistent demand for convenient dining solutions.

Economic diversification initiatives under Vision 2030 contribute to market growth by creating employment opportunities, attracting foreign investment, and fostering entrepreneurship in the food service sector. Government support for small and medium enterprises encourages local restaurant development while regulatory reforms facilitate international brand entry and expansion.

Technology advancement enables operational efficiency improvements and enhanced customer experiences through digital ordering systems, delivery platforms, and payment solutions. The widespread adoption of smartphones and high-speed internet connectivity creates an environment conducive to technology-enabled dining experiences that align with consumer expectations for convenience and efficiency.

Operational challenges present significant constraints for market participants, particularly in areas of labor management, supply chain optimization, and maintaining consistent service quality across multiple locations. The quick service restaurant industry requires efficient operations management to deliver on customer expectations while maintaining profitability in competitive market conditions.

Regulatory compliance requirements create operational complexity and cost implications for restaurant operators. Food safety regulations, labor laws, licensing requirements, and health standards necessitate ongoing investment in compliance systems and staff training. These regulatory obligations, while essential for consumer protection, can impact operational efficiency and profitability.

Market saturation concerns emerge in prime urban locations where competition intensifies among established brands and new market entrants. High real estate costs in desirable locations create barriers to entry and pressure profit margins, particularly for smaller operators competing against well-capitalized international chains.

Cultural considerations require careful navigation as international brands adapt to local preferences and social norms. Menu customization, service protocols, and marketing approaches must align with cultural expectations while maintaining brand identity and operational efficiency. Misalignment with local preferences can result in reduced market acceptance and performance challenges.

Digital innovation presents substantial opportunities for market expansion and customer engagement enhancement. The development of advanced mobile applications, artificial intelligence-powered recommendation systems, and integrated loyalty programs can create competitive advantages and improve customer retention rates. Technology-enabled solutions offer pathways to operational efficiency and enhanced customer experiences.

Health-conscious dining trends create opportunities for menu innovation and market differentiation. Restaurants that successfully incorporate healthy options, transparent nutritional information, and sustainable practices can capture growing consumer segments prioritizing wellness and environmental responsibility. This trend aligns with government health initiatives and changing consumer awareness.

Delivery market expansion offers significant growth potential as consumer adoption of food delivery services continues increasing. The development of efficient delivery networks, ghost kitchen concepts, and partnership strategies with delivery platforms can unlock new revenue streams and market reach. According to MarkWide Research analysis, delivery services represent one of the fastest-growing segments within the quick service restaurant market.

Regional expansion opportunities exist in secondary cities and emerging urban centers where quick service restaurant penetration remains limited. These markets offer lower competition levels, reduced operational costs, and growing consumer bases that present attractive expansion opportunities for established brands and new market entrants.

Supply and demand dynamics in the Saudi Arabia quick service restaurants market reflect the interplay between growing consumer demand and expanding supply capacity. Demand drivers include population growth, urbanization, lifestyle changes, and increasing disposable incomes that support frequent dining out behaviors. Supply expansion occurs through new restaurant openings, menu diversification, and service channel development.

Competitive intensity shapes market dynamics as established international brands compete with local concepts and emerging digital-native restaurants. This competition drives innovation in menu offerings, service delivery, pricing strategies, and customer experience enhancement. Market participants must continuously adapt to maintain competitive positioning and market share.

Technology integration fundamentally alters market dynamics by enabling new business models, improving operational efficiency, and creating enhanced customer touchpoints. Digital platforms facilitate market entry for new concepts while providing established brands with tools to optimize operations and expand market reach. The pace of technological adoption influences competitive dynamics and market evolution.

Economic factors including oil prices, government spending, and employment levels impact consumer spending patterns and market growth trajectories. Economic stability supports sustained market expansion while economic volatility can influence consumer behavior and restaurant performance. Market participants must navigate these economic dynamics while maintaining operational resilience.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes consumer surveys, industry interviews, and direct observation of market trends and consumer behaviors. This approach provides firsthand insights into consumer preferences, purchasing patterns, and satisfaction levels across different market segments.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial data to establish market context and validate primary research findings. This methodology ensures comprehensive coverage of market dynamics, competitive landscape, and regulatory environment factors that influence market development.

Data validation processes include cross-referencing multiple data sources, statistical analysis, and expert review to ensure accuracy and reliability of market insights. Quantitative analysis focuses on market trends, growth patterns, and performance metrics while qualitative analysis explores consumer motivations, brand perceptions, and market opportunities.

Market segmentation analysis examines different customer demographics, geographic regions, restaurant formats, and service channels to provide detailed insights into market structure and growth opportunities. This segmentation approach enables targeted analysis and strategic recommendations for different market participants and stakeholder groups.

Riyadh region dominates the Saudi Arabia quick service restaurants market, accounting for approximately 35% of total market activity. The capital city’s large population, high concentration of business districts, and strong economic activity create ideal conditions for quick service restaurant operations. The region benefits from excellent infrastructure, diverse consumer demographics, and high levels of disposable income that support market growth.

Eastern Province represents a significant market segment, particularly in cities like Dammam, Khobar, and Dhahran where oil industry employment creates substantial consumer spending power. The region’s industrial economy and expatriate population contribute to demand for diverse dining options and international cuisine concepts. Market penetration in this region shows strong growth potential with 28% market share.

Western region including Jeddah and Mecca presents unique market dynamics driven by religious tourism, commercial activity, and cultural diversity. The region’s position as a gateway for international visitors creates demand for familiar international brands while local preferences influence menu adaptation strategies. Tourism seasonality impacts market performance with significant variations throughout the year.

Secondary cities across Saudi Arabia represent emerging opportunities for market expansion as urbanization accelerates and consumer preferences evolve. Cities like Tabuk, Abha, and Buraidah show increasing receptivity to quick service restaurant concepts, though market development requires adaptation to local preferences and economic conditions. These markets collectively represent approximately 22% growth potential for strategic expansion initiatives.

Market leadership is distributed among several key players representing different strategic approaches and market positioning. The competitive environment features both international franchise operations and domestic restaurant chains that compete across multiple dimensions including menu variety, service quality, pricing, and customer experience.

Competitive strategies focus on differentiation through menu innovation, service excellence, technology integration, and strategic location selection. Market participants invest heavily in brand building, customer loyalty programs, and operational efficiency improvements to maintain competitive advantages in the dynamic market environment.

By Restaurant Format:

By Cuisine Type:

By Service Channel:

Burger segment maintains market leadership with strong consumer preference and brand loyalty. International chains dominate this category through established brand recognition, consistent quality, and extensive marketing investments. The segment benefits from universal appeal across age groups and cultural backgrounds, making it a cornerstone of the quick service restaurant market.

Chicken category demonstrates robust growth driven by health consciousness and cultural preferences. Fried chicken concepts perform particularly well, while grilled options gain traction among health-focused consumers. The segment’s success reflects alignment with local dietary preferences and the versatility of chicken-based menu offerings.

Pizza segment shows strong performance in delivery channels with technology-enabled ordering systems driving growth. The category benefits from social dining occasions and family meal solutions. Innovation in crust varieties, toppings, and delivery efficiency creates competitive differentiation opportunities within this segment.

Coffee and beverages represent a rapidly growing category as coffee culture expands in Saudi Arabia. International coffee chains and local concepts compete for market share through premium positioning, convenience locations, and loyalty programs. The segment shows particular strength in urban markets and commercial districts.

Healthy dining emerges as a significant growth category responding to increasing health awareness and lifestyle changes. Salad bars, wrap concepts, and nutrition-focused brands gain market acceptance, particularly among younger consumers and health-conscious demographics. This category represents substantial future growth potential.

Restaurant operators benefit from growing market demand, supportive regulatory environment, and technological infrastructure that enables efficient operations and customer engagement. The market provides opportunities for revenue growth, brand building, and operational scale development through multiple expansion strategies and service channels.

Franchise partners gain access to established business models, proven operational systems, and brand recognition that reduce market entry risks and accelerate business development. International franchise concepts provide training, marketing support, and ongoing operational guidance that enhance success probability for local partners.

Technology providers find substantial opportunities in point-of-sale systems, delivery platforms, mobile applications, and operational management solutions. The industry’s digital transformation creates sustained demand for technology solutions that improve efficiency, customer experience, and business intelligence capabilities.

Suppliers and vendors benefit from consistent demand for food ingredients, packaging materials, equipment, and services. The market’s growth creates opportunities for local suppliers to develop relationships with restaurant chains while international suppliers can expand their market presence through established distribution networks.

Real estate developers capitalize on demand for restaurant locations in shopping centers, commercial districts, and residential areas. The quick service restaurant industry’s expansion drives demand for suitable retail spaces with appropriate infrastructure and customer accessibility.

Employment opportunities expand across multiple skill levels from entry-level service positions to management roles and specialized functions. The industry provides career development pathways and contributes to economic development through job creation and skills development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across all market segments with mobile ordering, contactless payments, and artificial intelligence integration becoming standard operational features. Restaurants invest heavily in technology infrastructure to meet consumer expectations for seamless digital experiences and operational efficiency improvements.

Health and wellness consciousness drives menu innovation with increased focus on nutritional transparency, fresh ingredients, and dietary accommodation options. Restaurants respond to consumer demand for healthier choices while maintaining taste and convenience that define quick service dining experiences.

Sustainability initiatives gain prominence as environmental awareness increases among consumers and regulatory requirements evolve. Restaurants implement eco-friendly packaging, waste reduction programs, and sustainable sourcing practices to align with environmental responsibility expectations.

Localization strategies become increasingly sophisticated as international brands adapt to Saudi preferences through menu customization, cultural sensitivity, and local partnership development. Successful brands balance global consistency with local relevance to maximize market acceptance and performance.

Ghost kitchen expansion represents a significant trend as delivery-focused operations optimize for digital channels without traditional dine-in infrastructure. This model enables rapid market entry, reduced operational costs, and flexibility in testing new concepts and menu offerings.

Loyalty program evolution incorporates advanced data analytics, personalized offers, and integrated mobile experiences to enhance customer retention and lifetime value. Programs become more sophisticated in reward structures and customer engagement strategies.

Technology partnerships between restaurants and digital platforms create integrated ecosystems for ordering, payment, and delivery services. Major chains develop proprietary mobile applications while partnering with third-party delivery services to maximize market reach and customer convenience.

Franchise expansion accelerates as international brands seek growth opportunities in the Saudi market through local partnerships and master franchise agreements. These developments bring proven business models, operational expertise, and brand recognition to support market development initiatives.

Local brand development gains momentum as Saudi entrepreneurs create restaurant concepts that blend international quick service models with local flavors and cultural preferences. These brands compete effectively by understanding local market nuances and consumer preferences.

Investment activity increases as private equity firms, venture capital, and strategic investors recognize growth potential in the Saudi quick service restaurant market. Investment supports expansion plans, technology development, and operational improvements across market participants.

Regulatory modernization streamlines business licensing, food safety protocols, and operational requirements to support industry growth while maintaining consumer protection standards. Government initiatives facilitate market entry and expansion for both domestic and international restaurant operators.

Supply chain development improves through local sourcing initiatives, distribution network expansion, and logistics optimization. These developments reduce operational costs, improve supply reliability, and support the growth of local agricultural and food processing industries.

Market entry strategies should prioritize understanding local consumer preferences, cultural sensitivities, and regulatory requirements before launching operations. MWR recommends comprehensive market research and local partnership development to ensure successful market penetration and sustainable growth.

Technology investment represents a critical success factor for competitive positioning and operational efficiency. Restaurants should prioritize mobile application development, integrated point-of-sale systems, and data analytics capabilities to enhance customer experience and business intelligence.

Location strategy requires careful analysis of demographic patterns, traffic flows, and competitive density to optimize market positioning. Prime locations command premium rents but offer higher customer volumes, while secondary locations provide cost advantages with potentially lower traffic.

Menu development should balance international appeal with local preferences through careful ingredient selection, flavor profiles, and cultural considerations. Successful brands adapt core offerings while maintaining brand identity and operational efficiency.

Delivery optimization becomes essential for market success as consumer expectations for fast, reliable delivery service continue rising. Restaurants should develop efficient delivery operations or establish strategic partnerships with established delivery platforms.

Staff development programs should address Saudization requirements while ensuring service quality and operational efficiency. Investment in training, career development, and retention strategies creates competitive advantages in labor-intensive operations.

Market expansion is projected to continue at robust pace driven by demographic trends, economic development, and evolving consumer preferences. The combination of young population growth, urbanization, and lifestyle changes creates sustained demand for quick service restaurant concepts across multiple market segments.

Digital integration will deepen as artificial intelligence, machine learning, and automation technologies enhance operational efficiency and customer personalization. Restaurants that successfully integrate these technologies will gain competitive advantages in cost management, customer satisfaction, and market positioning.

Health-focused concepts are expected to gain significant market share as consumer awareness of nutrition and wellness continues growing. Restaurants that successfully balance health benefits with taste and convenience will capture expanding market segments and premium pricing opportunities.

Regional expansion into secondary cities presents substantial growth opportunities as infrastructure development and economic diversification create favorable market conditions. Early market entrants in these regions may establish competitive advantages through brand recognition and operational scale.

Sustainability requirements will likely become more stringent as environmental regulations evolve and consumer expectations increase. Restaurants that proactively implement sustainable practices will be better positioned for long-term success and regulatory compliance.

Innovation acceleration in menu development, service delivery, and customer engagement will characterize successful market participants. The pace of change requires continuous adaptation and investment in new concepts, technologies, and operational approaches to maintain competitive positioning.

The Saudi Arabia quick service restaurants market presents exceptional growth opportunities driven by favorable demographics, economic development, and evolving consumer preferences. The market’s dynamic nature requires strategic planning, operational excellence, and continuous adaptation to changing market conditions and consumer expectations.

Success factors include understanding local market nuances, investing in technology infrastructure, developing efficient operations, and building strong brand recognition among target consumer segments. Market participants that effectively balance international best practices with local market requirements will achieve sustainable competitive advantages and long-term growth.

Future market development will be characterized by continued digital transformation, health-conscious menu innovation, and expansion into emerging market segments and geographic regions. The industry’s evolution creates opportunities for established brands and new market entrants that can effectively navigate the complex market dynamics and deliver superior customer value propositions.

What is Quick Service Restaurants?

Quick Service Restaurants (QSR) are dining establishments that offer fast food and quick meal options, typically with limited table service. They focus on speed, convenience, and affordability, catering to a wide range of consumers seeking quick dining solutions.

What are the key players in the Saudi Arabia Quick Service Restaurants Market?

Key players in the Saudi Arabia Quick Service Restaurants Market include Al Baik, McDonald’s, KFC, and Domino’s Pizza, among others. These companies dominate the market with their extensive menus and widespread locations.

What are the growth factors driving the Saudi Arabia Quick Service Restaurants Market?

The growth of the Saudi Arabia Quick Service Restaurants Market is driven by factors such as increasing urbanization, a young population with changing dietary preferences, and the rising demand for convenience in dining options.

What challenges does the Saudi Arabia Quick Service Restaurants Market face?

The Saudi Arabia Quick Service Restaurants Market faces challenges such as intense competition, fluctuating food prices, and changing consumer preferences towards healthier eating options. These factors can impact profitability and market share.

What opportunities exist in the Saudi Arabia Quick Service Restaurants Market?

Opportunities in the Saudi Arabia Quick Service Restaurants Market include the expansion of delivery services, the introduction of healthier menu options, and the potential for technological innovations in ordering and payment systems.

What trends are shaping the Saudi Arabia Quick Service Restaurants Market?

Trends shaping the Saudi Arabia Quick Service Restaurants Market include the growing popularity of online ordering and delivery, the incorporation of local flavors into menus, and an increasing focus on sustainability practices within the industry.

Saudi Arabia Quick Service Restaurants Market

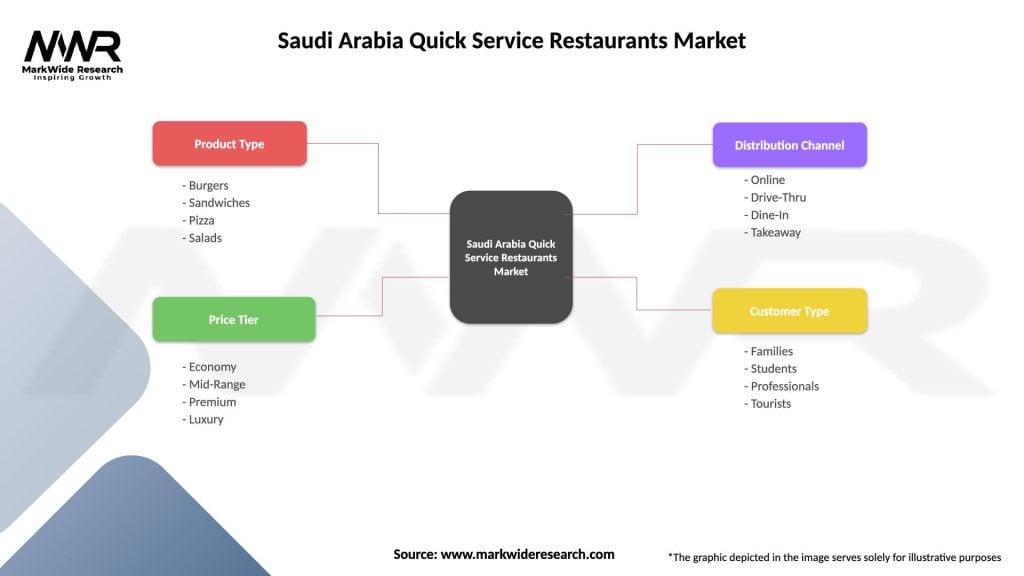

| Segmentation Details | Description |

|---|---|

| Product Type | Burgers, Sandwiches, Pizza, Salads |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

| Distribution Channel | Online, Drive-Thru, Dine-In, Takeaway |

| Customer Type | Families, Students, Professionals, Tourists |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Quick Service Restaurants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at