444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia car loan market represents a dynamic and evolving segment of the country’s financial services landscape, characterized by significant growth potential despite economic challenges. Automotive financing in Russia has demonstrated remarkable resilience, adapting to changing economic conditions while maintaining steady expansion across various consumer segments. The market encompasses traditional bank lending, specialized automotive finance companies, and emerging digital lending platforms that serve diverse customer needs.

Market dynamics indicate substantial growth opportunities driven by increasing vehicle affordability programs, government incentives, and evolving consumer preferences toward personal mobility solutions. The sector has experienced a 12.5% annual growth rate in loan originations over recent years, reflecting strong underlying demand for automotive financing solutions. Digital transformation initiatives have revolutionized the application and approval processes, making car loans more accessible to a broader demographic of Russian consumers.

Regional distribution shows concentrated activity in major metropolitan areas, with Moscow and St. Petersburg accounting for approximately 35% of total market activity. However, emerging growth patterns indicate expanding opportunities in secondary cities and rural regions, supported by improved infrastructure and rising disposable incomes. The market structure includes both domestic and international financial institutions competing for market share through innovative product offerings and competitive interest rates.

The Russia car loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through installment financing arrangements. This market encompasses various lending mechanisms, including traditional bank loans, dealer financing programs, leasing arrangements, and specialized automotive credit products tailored to different consumer segments and vehicle categories.

Automotive financing in the Russian context involves multiple stakeholders, including commercial banks, credit unions, automotive manufacturers, dealership networks, and emerging fintech companies. The market facilitates access to personal transportation by enabling consumers to spread vehicle purchase costs over extended periods, typically ranging from 12 to 84 months, depending on loan terms and borrower qualifications.

Market participants include both secured and unsecured lending options, with most car loans requiring the vehicle itself as collateral. Interest rates, loan terms, and approval criteria vary significantly based on borrower creditworthiness, vehicle type, loan amount, and prevailing economic conditions. The market serves diverse customer segments, from first-time car buyers to commercial fleet operators seeking financing solutions.

Strategic analysis reveals the Russia car loan market as a resilient and expanding sector with significant growth potential across multiple dimensions. The market has successfully navigated economic uncertainties while maintaining steady expansion, supported by government initiatives promoting domestic automotive production and consumer financing accessibility. Digital innovation has emerged as a key differentiator, with online application processes reducing approval times by approximately 40% compared to traditional methods.

Competitive landscape features a mix of established banking institutions, specialized automotive finance companies, and emerging digital lenders competing for market share through product innovation and customer service excellence. The sector benefits from supportive regulatory frameworks that encourage responsible lending while protecting consumer interests. Interest rate trends have shown gradual stabilization, creating favorable conditions for both lenders and borrowers.

Market segmentation reveals diverse opportunities across new vehicle financing, used car loans, commercial vehicle financing, and specialized products for electric and hybrid vehicles. Consumer preferences increasingly favor flexible repayment terms, competitive interest rates, and streamlined application processes. The market demonstrates strong correlation with broader economic indicators, including employment rates, consumer confidence, and automotive industry performance.

Primary market drivers include expanding middle-class demographics, urbanization trends, and government incentives supporting domestic vehicle purchases. The following key insights shape market development:

Economic recovery serves as a fundamental driver for the Russia car loan market, with improving employment rates and wage growth supporting consumer confidence in making significant purchase commitments. Government initiatives promoting domestic automotive manufacturing have created favorable conditions for both vehicle production and financing accessibility, including subsidized interest rate programs for qualifying buyers.

Urbanization trends continue driving demand for personal transportation solutions, particularly in expanding metropolitan areas where public transportation may be insufficient. Rising disposable incomes among middle-class consumers create opportunities for vehicle ownership, supported by increasingly competitive financing options. Infrastructure development projects across Russia enhance the practical value of vehicle ownership, encouraging more consumers to consider car purchases.

Technological advancement in lending processes has significantly reduced application complexity and approval timeframes, making car loans more attractive to time-conscious consumers. Digital platforms enable lenders to reach previously underserved market segments while reducing operational costs. Partnership strategies between financial institutions and automotive dealers create seamless purchasing experiences that encourage loan utilization over cash transactions.

Economic volatility remains a significant constraint on market expansion, with currency fluctuations and inflation concerns affecting both lender risk appetite and consumer borrowing confidence. Interest rate sensitivity among consumers creates challenges for lenders in maintaining competitive pricing while managing profitability margins. Regulatory changes and compliance requirements add operational complexity and costs for market participants.

Credit risk management presents ongoing challenges, particularly in assessing borrower creditworthiness in regions with limited credit history data. Vehicle depreciation concerns affect loan-to-value ratios and collateral security, requiring careful risk assessment and pricing strategies. Economic sanctions and international trade restrictions create uncertainties that may impact automotive supply chains and financing availability.

Competition intensity from alternative financing sources, including personal loans and leasing arrangements, pressures traditional car loan products. Consumer debt levels in certain segments may limit additional borrowing capacity, restricting market expansion potential. Seasonal variations in automotive sales create cyclical challenges for consistent loan origination volumes throughout the year.

Digital innovation presents substantial opportunities for market expansion through enhanced customer experiences, streamlined processes, and improved risk assessment capabilities. Artificial intelligence and machine learning technologies enable more accurate credit scoring and personalized product offerings, potentially expanding the addressable customer base while maintaining prudent risk management standards.

Partnership development with automotive manufacturers, dealership networks, and technology companies creates opportunities for integrated financing solutions that enhance customer convenience and market penetration. Green financing initiatives supporting electric and hybrid vehicle purchases align with environmental sustainability trends while accessing government incentive programs.

Regional expansion into underserved markets offers significant growth potential, particularly in secondary cities and rural areas experiencing economic development. Product diversification through specialized financing options for commercial vehicles, motorcycles, and recreational vehicles can capture additional market segments. Cross-selling opportunities with insurance products, extended warranties, and maintenance services create additional revenue streams while enhancing customer relationships.

Supply and demand dynamics in the Russia car loan market reflect complex interactions between economic conditions, consumer preferences, regulatory frameworks, and competitive pressures. Demand drivers include population growth, urbanization, rising incomes, and changing lifestyle preferences favoring personal mobility solutions. Supply factors encompass lender capacity, funding availability, regulatory constraints, and risk management requirements.

Competitive dynamics involve traditional banks, specialized automotive finance companies, credit unions, and emerging fintech platforms competing through product innovation, pricing strategies, and customer service excellence. Market consolidation trends may create opportunities for strategic partnerships and acquisitions that enhance market position and operational efficiency.

Regulatory environment influences market dynamics through consumer protection requirements, lending standards, interest rate regulations, and capital adequacy rules. Technology adoption continues reshaping market dynamics by enabling new business models, improving operational efficiency, and enhancing customer experiences. Economic cycles create periodic fluctuations in market activity, requiring adaptive strategies from market participants.

Comprehensive analysis of the Russia car loan market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research includes structured interviews with industry executives, lending professionals, automotive dealers, and consumer focus groups to gather firsthand market intelligence and trend identification.

Secondary research encompasses analysis of regulatory filings, industry reports, economic data, and statistical databases from relevant government agencies and industry associations. Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation factors affecting market performance.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert verification, and consistency checks. Market modeling techniques project future scenarios based on historical trends, economic indicators, and identified market drivers. Competitive intelligence gathering provides insights into market participant strategies, product offerings, and positioning approaches.

Moscow region dominates the Russia car loan market, accounting for approximately 28% of total loan originations due to high population density, elevated income levels, and concentrated automotive dealership networks. The region benefits from advanced financial infrastructure, competitive lending environments, and strong consumer demand for both new and used vehicles.

St. Petersburg represents the second-largest regional market, contributing roughly 12% of national loan volume with similar characteristics to Moscow but slightly lower average loan amounts. Siberian regions show emerging growth potential, with cities like Novosibirsk and Yekaterinburg experiencing 15% annual growth rates in automotive financing activity.

Southern regions including Rostov-on-Don and Krasnodar demonstrate strong market development supported by agricultural prosperity and industrial growth. Far Eastern territories present unique opportunities due to proximity to Asian automotive markets and special economic zone incentives. Central regions beyond Moscow show steady growth patterns with increasing penetration of digital lending platforms and dealer financing programs.

Market leadership in the Russia car loan sector features a diverse mix of financial institutions competing through differentiated strategies and specialized offerings. The competitive environment includes:

Competitive strategies emphasize digital transformation, customer experience enhancement, risk management optimization, and strategic partnerships with automotive industry participants. Market differentiation occurs through specialized products, pricing competitiveness, application convenience, and value-added services.

By Loan Type:

By Vehicle Category:

By Customer Segment:

New vehicle financing represents the largest market segment, benefiting from manufacturer incentive programs, warranty coverage, and predictable depreciation patterns. Interest rates for new car loans typically range 2-3 percentage points below used vehicle financing due to reduced risk profiles and stronger collateral values.

Used car loans demonstrate rapid growth driven by affordability considerations and expanding certified pre-owned programs from automotive manufacturers. Risk assessment for used vehicles requires enhanced due diligence regarding vehicle condition, maintenance history, and market value verification.

Commercial vehicle financing shows strong correlation with economic activity levels and business investment cycles. Loan structures often incorporate seasonal payment adjustments, balloon payments, and flexible terms aligned with business cash flow patterns. Fleet financing programs offer volume discounts and comprehensive service packages for large-scale vehicle acquisitions.

Luxury vehicle financing targets high-net-worth individuals with premium service levels, personalized terms, and exclusive partnership benefits. Credit requirements typically involve enhanced income verification and comprehensive financial analysis due to higher loan amounts and specialized vehicle categories.

Financial institutions benefit from diversified revenue streams, relatively low default rates compared to unsecured lending, and opportunities for cross-selling additional financial products. Automotive dealers gain competitive advantages through financing partnerships that facilitate sales completion and customer satisfaction.

Consumers access affordable vehicle ownership through manageable monthly payments, competitive interest rates, and flexible term options. Automotive manufacturers benefit from increased sales volumes, market share expansion, and enhanced customer loyalty through financing partnerships.

Economic benefits include job creation in financial services, automotive retail, and supporting industries. Government stakeholders benefit from increased tax revenues, economic activity stimulation, and achievement of transportation policy objectives. Insurance companies gain opportunities for product bundling and expanded customer relationships through automotive financing partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the Russia car loan market through mobile applications, online approval processes, and automated underwriting systems. Artificial intelligence implementation enables more sophisticated risk assessment, personalized product offerings, and fraud detection capabilities that enhance both customer experience and operational efficiency.

Sustainable financing trends include growing interest in electric vehicle loans, hybrid financing programs, and environmentally conscious lending practices. Government incentives supporting clean transportation technologies create new market opportunities while aligning with environmental policy objectives.

Partnership evolution involves deeper integration between lenders, automotive manufacturers, dealerships, and technology providers to create seamless customer experiences. Data analytics utilization improves customer segmentation, pricing optimization, and risk management strategies. Mobile-first approaches recognize changing consumer preferences for convenient, accessible financial services.

Regulatory enhancements have strengthened consumer protection measures while maintaining market competitiveness and innovation incentives. Technology investments by major lenders have resulted in significantly improved application processing times and customer satisfaction scores.

Strategic partnerships between financial institutions and automotive manufacturers have created integrated financing solutions that benefit both parties and enhance customer convenience. Market expansion initiatives have successfully penetrated previously underserved regional markets through targeted product offerings and localized service approaches.

Product innovation includes development of flexible repayment options, seasonal payment adjustments, and specialized financing for emerging vehicle categories. Risk management improvements through advanced analytics and machine learning have enabled more accurate credit assessment while expanding market accessibility. MarkWide Research analysis indicates these developments position the market for continued sustainable growth.

Strategic recommendations for market participants include continued investment in digital transformation initiatives, expansion into underserved regional markets, and development of specialized products for emerging customer segments. Risk management enhancement through advanced analytics and diversified portfolio strategies will support sustainable growth while maintaining prudent lending standards.

Partnership development with automotive industry participants, technology providers, and complementary service companies can create competitive advantages and enhanced customer value propositions. Customer experience improvements through streamlined processes, personalized service, and value-added offerings will differentiate successful market participants.

Market expansion strategies should focus on geographic diversification, product innovation, and customer segment development to reduce concentration risk and capture growth opportunities. Technology adoption must balance innovation with security, compliance, and customer trust requirements. MWR recommends maintaining flexible strategies that can adapt to changing economic conditions and regulatory environments.

Long-term prospects for the Russia car loan market remain positive, supported by demographic trends, urbanization, and economic development patterns. Growth projections indicate continued expansion at approximately 8-10% annual rates over the next five years, driven by digital innovation, regional expansion, and product diversification initiatives.

Technology integration will continue transforming market dynamics through enhanced customer experiences, improved risk management, and operational efficiency gains. Regulatory evolution is expected to support market development while maintaining appropriate consumer protection and financial stability measures.

Market maturation will likely result in increased specialization, niche product development, and enhanced service differentiation among competitors. Economic recovery trends support optimistic growth scenarios, while adaptive strategies will help market participants navigate potential challenges. MarkWide Research projects the market will achieve significant expansion while maintaining stability and sustainable lending practices.

The Russia car loan market represents a dynamic and resilient sector with substantial growth potential across multiple dimensions. Market fundamentals remain strong, supported by favorable demographics, government initiatives, technological advancement, and competitive innovation that collectively create an attractive environment for both lenders and consumers.

Strategic opportunities abound for market participants willing to invest in digital transformation, regional expansion, and customer-centric product development. The successful navigation of economic challenges while maintaining growth momentum demonstrates the market’s underlying strength and adaptability to changing conditions.

Future success will depend on continued innovation, prudent risk management, strategic partnerships, and responsive adaptation to evolving customer needs and regulatory requirements. The Russia car loan market is well-positioned to capitalize on emerging opportunities while contributing to broader economic development and consumer mobility objectives throughout the country.

What is Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which is then secured by the car itself. This type of loan typically involves monthly payments over a set period until the loan is paid off.

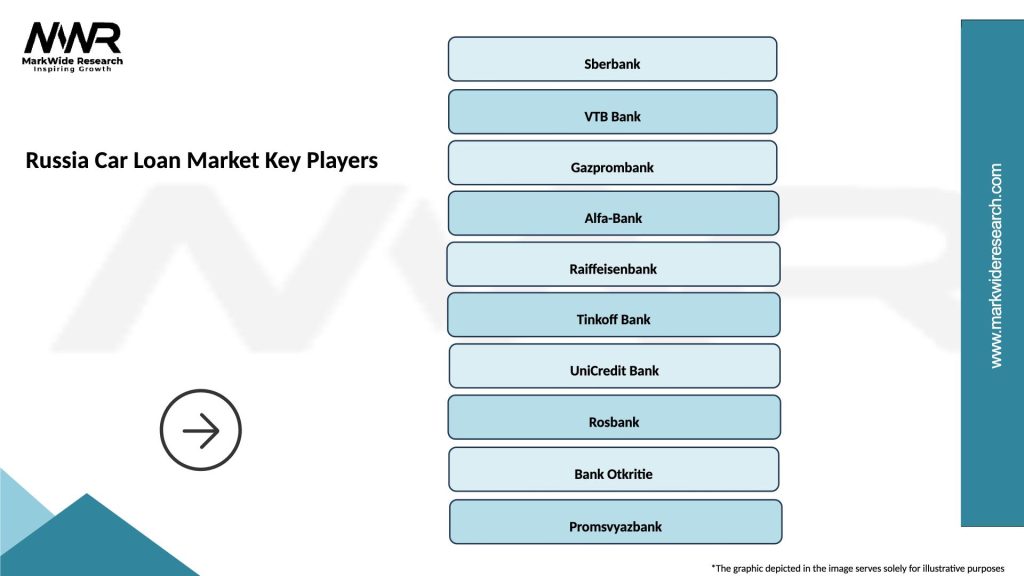

What are the key players in the Russia Car Loan Market?

Key players in the Russia Car Loan Market include Sberbank, VTB Bank, and Gazprombank, which offer various financing options for consumers. These institutions compete by providing different interest rates, loan terms, and customer service experiences, among others.

What are the growth factors driving the Russia Car Loan Market?

The growth of the Russia Car Loan Market is driven by increasing consumer demand for personal vehicles, favorable financing options, and the expansion of dealership financing programs. Additionally, economic recovery and rising disposable incomes contribute to this growth.

What challenges does the Russia Car Loan Market face?

The Russia Car Loan Market faces challenges such as fluctuating interest rates, economic instability, and regulatory changes that can impact lending practices. Additionally, consumer creditworthiness and default risks are significant concerns for lenders.

What opportunities exist in the Russia Car Loan Market?

Opportunities in the Russia Car Loan Market include the potential for digital transformation in loan applications and approvals, as well as the growth of electric vehicle financing. There is also an increasing trend towards flexible payment options that cater to diverse consumer needs.

What trends are shaping the Russia Car Loan Market?

Trends in the Russia Car Loan Market include the rise of online lending platforms, increased competition among banks, and a shift towards eco-friendly vehicle financing. Additionally, consumer preferences are evolving towards more personalized loan products and services.

Russia Car Loan Market

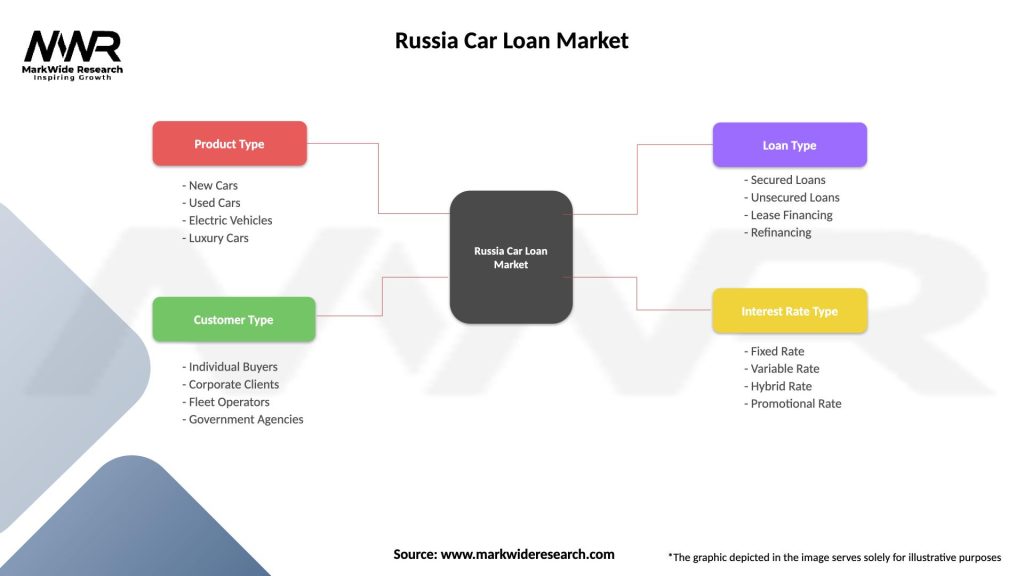

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, Luxury Cars |

| Customer Type | Individual Buyers, Corporate Clients, Fleet Operators, Government Agencies |

| Loan Type | Secured Loans, Unsecured Loans, Lease Financing, Refinancing |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Promotional Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at