444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia satellite imagery services market represents a rapidly evolving sector driven by increasing demand for geospatial intelligence across multiple industries. This market encompasses comprehensive satellite-based imaging solutions that provide critical data for government agencies, commercial enterprises, and research institutions throughout the Russian Federation. Satellite imagery services in Russia have experienced remarkable growth, with adoption rates increasing by 12.5% annually as organizations recognize the strategic value of earth observation data.

Government initiatives and national security requirements have significantly influenced market development, positioning Russia as a key player in the global satellite imagery landscape. The market serves diverse applications including defense and intelligence, agriculture monitoring, urban planning, environmental assessment, and disaster management. Commercial applications are expanding rapidly, with private sector adoption growing at 15.2% CAGR as businesses leverage satellite data for competitive advantage.

Technological advancements in satellite resolution, data processing capabilities, and analytics platforms have enhanced service quality while reducing costs. The integration of artificial intelligence and machine learning technologies has revolutionized data interpretation, enabling real-time analysis and automated pattern recognition. Regional coverage spans across Russia’s vast territory, with specialized focus on economically strategic regions including Siberia, the Far East, and Arctic territories.

The Russia satellite imagery services market refers to the comprehensive ecosystem of earth observation data collection, processing, and distribution services operating within the Russian Federation. This market encompasses satellite-based imaging solutions that capture, analyze, and deliver geospatial intelligence to support decision-making across government, commercial, and academic sectors.

Satellite imagery services involve the systematic collection of visual and spectral data from space-based platforms, followed by sophisticated processing to create actionable intelligence products. These services include high-resolution optical imaging, synthetic aperture radar (SAR) data, multispectral analysis, and temporal monitoring capabilities that enable comprehensive earth observation.

Market participants include satellite operators, data processing companies, analytics providers, and value-added resellers who collectively deliver integrated solutions. The market facilitates access to both domestic Russian satellite assets and international satellite constellations, ensuring comprehensive coverage and data availability for diverse user requirements.

Market dynamics in the Russia satellite imagery services sector reflect strong growth momentum driven by increasing digitalization and geospatial data adoption across multiple industries. The market demonstrates robust expansion with government sector demand accounting for 58% of total market share, while commercial applications continue gaining traction through enhanced accessibility and cost-effectiveness.

Key growth drivers include national security requirements, agricultural modernization initiatives, infrastructure development projects, and environmental monitoring mandates. The integration of advanced analytics and artificial intelligence capabilities has transformed traditional satellite imagery into comprehensive intelligence platforms, enabling predictive analysis and automated decision support systems.

Competitive landscape features a mix of domestic Russian providers and international partnerships, creating a diverse ecosystem that serves varied customer requirements. Market consolidation trends indicate increasing collaboration between satellite operators and analytics companies to deliver integrated end-to-end solutions.

Future prospects remain highly positive, with emerging applications in smart city development, precision agriculture, and climate monitoring driving sustained demand growth. The market benefits from supportive government policies and increasing private sector investment in geospatial technologies.

Strategic insights reveal several critical factors shaping the Russia satellite imagery services market landscape:

National security requirements serve as the primary driver for Russia’s satellite imagery services market, with government agencies requiring comprehensive surveillance and intelligence capabilities. Defense applications demand high-resolution imaging for border monitoring, military asset tracking, and strategic planning purposes. Intelligence gathering operations rely heavily on satellite data for geopolitical analysis and threat assessment.

Agricultural modernization initiatives represent a significant growth driver as Russia seeks to optimize its vast agricultural resources. Precision farming techniques utilizing satellite imagery enable crop yield optimization, pest management, and resource allocation efficiency. Food security concerns drive government investment in agricultural monitoring systems that can predict harvest outcomes and identify potential issues.

Infrastructure development projects across Russia’s extensive territory create substantial demand for satellite monitoring services. Large-scale construction projects, pipeline monitoring, and transportation network development require continuous satellite surveillance. Urban planning initiatives in major cities increasingly rely on satellite data for development planning and infrastructure optimization.

Environmental monitoring mandates drive consistent demand from both government agencies and private companies. Climate change assessment, pollution monitoring, and natural resource management require comprehensive satellite-based observation systems. Regulatory compliance requirements in industries such as mining, oil and gas, and forestry necessitate regular satellite monitoring and reporting.

High initial investment costs present significant barriers for smaller organizations seeking to implement satellite imagery services. The expense of acquiring high-resolution satellite data and specialized analytics software can be prohibitive for budget-constrained entities. Technical complexity in data interpretation requires specialized expertise that may not be readily available in all market segments.

Regulatory restrictions on satellite imagery access and distribution create operational challenges for service providers. Government controls on high-resolution imagery for sensitive areas limit commercial applications and international collaboration opportunities. Data security requirements impose additional compliance costs and operational constraints on market participants.

Weather dependency affects optical satellite imagery quality, particularly in regions with frequent cloud cover. This limitation can impact service reliability and customer satisfaction, especially for time-sensitive applications. Seasonal variations in data quality and availability create challenges for consistent service delivery.

Competition from alternative technologies such as drone-based imaging and ground-based sensors provides lower-cost options for certain applications. These alternatives may offer higher resolution or more frequent data collection for localized monitoring requirements. Technology obsolescence risks require continuous investment in system upgrades and capability enhancement.

Smart city development initiatives across major Russian cities create substantial opportunities for satellite imagery service providers. Urban planning, traffic management, and infrastructure optimization require comprehensive geospatial data integration. Digital transformation in municipal services drives demand for real-time monitoring and predictive analytics capabilities.

Climate change monitoring presents emerging opportunities as environmental awareness increases and regulatory requirements expand. Satellite services can provide critical data for carbon footprint assessment, deforestation monitoring, and climate impact analysis. Sustainability initiatives in corporate sectors drive demand for environmental monitoring and reporting services.

Arctic region development offers unique market opportunities as Russia expands economic activities in northern territories. Ice monitoring, shipping route optimization, and resource exploration require specialized satellite imaging capabilities. Northern Sea Route development creates demand for continuous maritime monitoring and navigation support services.

International market expansion provides growth opportunities through partnerships with global satellite operators and service providers. Cross-border collaboration can enhance data availability and service capabilities while accessing new customer segments. Technology export potential exists for Russian satellite imagery expertise and specialized applications.

Supply-demand dynamics in the Russia satellite imagery services market reflect strong demand growth outpacing supply capacity in certain specialized segments. Government sector requirements continue expanding while commercial applications diversify across multiple industries. Capacity constraints in high-resolution imaging and real-time processing create opportunities for service expansion and technology investment.

Technological evolution drives market transformation through enhanced satellite capabilities, improved data processing algorithms, and advanced analytics platforms. Artificial intelligence integration enables automated pattern recognition and predictive analysis capabilities. Innovation cycles in satellite technology create opportunities for service differentiation and competitive advantage.

Pricing dynamics show downward pressure as satellite technology costs decrease and competition intensifies. Service providers must balance cost reduction with quality maintenance and capability enhancement. Value-added services become increasingly important for maintaining profit margins and customer differentiation.

Partnership dynamics emphasize collaboration between satellite operators, data processors, and end-user applications. Integrated service delivery models provide comprehensive solutions while optimizing resource utilization. Ecosystem development creates synergies between different market participants and enhances overall service capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research includes extensive interviews with industry executives, government officials, and end-user organizations across various sectors. Secondary research encompasses analysis of government publications, industry reports, and academic studies related to satellite imagery applications.

Data collection processes utilize both quantitative and qualitative research approaches to capture market dynamics and trends. Quantitative analysis includes market sizing, growth rate calculations, and statistical trend analysis. Qualitative insights provide context for market developments and identify emerging opportunities and challenges.

Market segmentation analysis examines different application areas, customer segments, and geographic regions to provide detailed market understanding. Technology assessment evaluates current capabilities and future development trends in satellite imagery services. Competitive analysis includes detailed profiling of key market participants and their strategic positioning.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review. Market projections utilize econometric modeling and scenario analysis to provide reliable forecasts. Continuous monitoring tracks market developments and updates analysis to reflect changing conditions.

Moscow and Central Federal District dominate the Russia satellite imagery services market, accounting for 42% of total demand due to concentration of government agencies and major commercial enterprises. The region serves as the primary hub for satellite data processing and analytics services. Government sector applications in the capital region drive significant demand for high-resolution imaging and intelligence services.

Siberian Federal District represents substantial growth potential with 28% market share, driven by extensive natural resource extraction activities and infrastructure development projects. Mining, oil and gas, and forestry industries require comprehensive satellite monitoring services. Environmental monitoring applications in Siberia address regulatory compliance and sustainability requirements.

Far Eastern Federal District shows strong growth momentum with 18% market presence, supported by strategic economic development initiatives and proximity to Asia-Pacific markets. Maritime monitoring, border security, and international trade applications drive demand in this region. Arctic territories within the Far East require specialized imaging services for resource exploration and shipping route monitoring.

Northwestern Federal District maintains steady demand with 12% market share, focusing on industrial monitoring, urban planning, and environmental assessment applications. The region’s proximity to European markets creates opportunities for international collaboration and service expansion. Agricultural applications in the northwest support regional food production optimization efforts.

Market leadership in the Russia satellite imagery services sector features a diverse mix of domestic and international players providing comprehensive solutions across multiple application areas:

Competitive strategies focus on technology innovation, service integration, and customer relationship development. Market participants invest heavily in advanced analytics capabilities and artificial intelligence integration to differentiate their offerings. Partnership development enables access to complementary technologies and expanded market reach.

By Application:

By Technology:

By End User:

Defense and Intelligence Applications represent the largest market category, driven by national security requirements and government investment in surveillance capabilities. This segment demands highest resolution imagery and specialized analytics for threat assessment and strategic planning. Government contracts provide stable revenue streams with long-term service agreements and recurring monitoring requirements.

Agricultural Applications show the fastest growth trajectory with 18.3% annual expansion as precision farming techniques gain adoption across Russia’s vast agricultural regions. Satellite imagery enables crop health monitoring, yield prediction, and resource optimization for improved agricultural productivity. Seasonal demand patterns create opportunities for service providers to optimize capacity utilization throughout the year.

Infrastructure Monitoring applications benefit from extensive development projects across Russia’s territory, including transportation networks, energy infrastructure, and urban development initiatives. Continuous monitoring requirements create steady demand for satellite services with emphasis on change detection and progress tracking. Project-based contracts provide significant revenue opportunities for specialized monitoring services.

Environmental Monitoring applications address regulatory compliance requirements and sustainability initiatives across multiple industries. Climate change assessment, pollution monitoring, and natural resource management drive consistent demand for satellite-based observation services. Regulatory mandates ensure stable market demand with potential for expansion as environmental requirements increase.

Government agencies benefit from enhanced situational awareness and decision-making capabilities through comprehensive satellite imagery services. Real-time monitoring enables rapid response to security threats, natural disasters, and emergency situations. Cost efficiency in surveillance operations reduces the need for expensive ground-based monitoring systems while providing broader coverage.

Commercial enterprises gain competitive advantages through access to geospatial intelligence that supports strategic planning and operational optimization. Satellite imagery enables better resource allocation, risk assessment, and market analysis capabilities. Operational efficiency improvements through satellite-based monitoring can reduce costs and improve productivity across various business functions.

Agricultural producers achieve improved crop yields and resource utilization through precision farming techniques enabled by satellite imagery. Early detection of crop stress, pest infestations, and weather impacts allows for timely intervention and loss prevention. Sustainability benefits include optimized fertilizer and water usage, reducing environmental impact while maintaining productivity.

Research institutions access comprehensive earth observation data for scientific studies and academic research. Satellite imagery supports climate research, environmental studies, and geographic analysis with historical data archives and continuous monitoring capabilities. Collaboration opportunities with international research communities enhance scientific understanding and knowledge sharing.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming the Russia satellite imagery services market. Advanced machine learning algorithms enable automated pattern recognition, change detection, and predictive analysis capabilities. Real-time processing capabilities allow for immediate data interpretation and decision support, enhancing the value proposition of satellite imagery services.

Small Satellite Constellations are revolutionizing market dynamics by providing more frequent revisit times and cost-effective imaging solutions. These systems offer enhanced temporal resolution and improved data availability for time-sensitive applications. Commercial space development in Russia supports the deployment of innovative small satellite systems for specialized imaging requirements.

Cloud-based Service Delivery is transforming how satellite imagery services are accessed and utilized by end users. Cloud platforms enable scalable data processing, storage, and distribution while reducing infrastructure requirements for customers. Software-as-a-Service (SaaS) models provide flexible access to satellite imagery and analytics tools with subscription-based pricing.

Multi-sensor Data Fusion combines satellite imagery with other data sources to create comprehensive intelligence products. Integration with weather data, IoT sensors, and ground-based observations enhances analysis accuracy and provides holistic situational awareness. Data integration capabilities become increasingly important for delivering actionable intelligence to decision makers.

Government Policy Initiatives have strengthened support for domestic satellite imagery services through strategic development programs and increased funding allocation. Recent policy changes emphasize the importance of geospatial intelligence for national security and economic development. Regulatory frameworks are evolving to balance security requirements with commercial market development needs.

Technology Partnerships between Russian companies and international satellite operators have expanded service capabilities and market reach. These collaborations provide access to advanced satellite systems and global data networks while maintaining domestic expertise. Joint ventures enable technology transfer and capability development in specialized application areas.

Infrastructure Investments in ground stations, data processing centers, and communication networks have enhanced service delivery capabilities across Russia’s territory. Modernization of existing facilities and deployment of new infrastructure support improved data quality and processing speed. Capacity expansion initiatives address growing demand for satellite imagery services.

Commercial Market Development initiatives focus on expanding satellite imagery services beyond traditional government applications. New service offerings target commercial enterprises, research institutions, and international customers with specialized requirements. Market diversification strategies reduce dependence on government contracts while creating new revenue opportunities.

MarkWide Research analysis indicates that market participants should prioritize technology innovation and service integration to maintain competitive positioning in the evolving satellite imagery services landscape. Investment in artificial intelligence capabilities and automated processing systems will be critical for meeting growing demand for real-time analytics and decision support services.

Strategic partnerships with international satellite operators and technology providers offer opportunities for capability enhancement and market expansion. Companies should focus on developing complementary relationships that provide access to advanced technologies while leveraging domestic expertise and market knowledge. Collaboration strategies should balance technology access with regulatory compliance and security requirements.

Market diversification beyond traditional government applications presents significant growth opportunities in commercial and international markets. Service providers should develop specialized offerings for emerging applications such as smart cities, precision agriculture, and environmental monitoring. Customer education initiatives can accelerate adoption of satellite imagery services in new market segments.

Operational efficiency improvements through automation and process optimization will be essential for maintaining profitability in an increasingly competitive market environment. Investment in advanced data processing capabilities and streamlined service delivery models can reduce costs while improving customer satisfaction. Quality assurance systems ensure consistent service delivery and customer retention.

Market growth prospects remain highly positive for the Russia satellite imagery services sector, with sustained demand expected across government, commercial, and research applications. MWR projections indicate continued expansion driven by technological advancement, application diversification, and increasing recognition of geospatial intelligence value. The market is positioned for robust growth with annual expansion rates maintaining strong momentum.

Technology evolution will continue transforming service capabilities through enhanced satellite systems, advanced analytics, and improved data processing technologies. Artificial intelligence integration will become standard practice, enabling automated analysis and predictive capabilities that enhance service value. Innovation cycles in satellite technology will create opportunities for service differentiation and competitive advantage.

Application expansion into new market segments will drive sustained growth as organizations across various industries recognize the strategic value of satellite imagery services. Smart city development, climate monitoring, and precision agriculture represent particularly promising growth areas with significant potential for service expansion and revenue generation.

International collaboration opportunities will enhance market development through technology sharing, capacity building, and market access expansion. Strategic partnerships with global satellite operators and service providers will strengthen Russia’s position in the international satellite imagery services market while supporting domestic capability development.

The Russia satellite imagery services market demonstrates strong growth potential driven by diverse application requirements, technological advancement, and increasing recognition of geospatial intelligence value across multiple sectors. Government sector demand continues providing market stability while commercial applications offer substantial expansion opportunities through precision agriculture, infrastructure monitoring, and environmental assessment services.

Market dynamics favor continued growth with supportive government policies, advancing satellite technologies, and expanding application areas creating favorable conditions for service providers. The integration of artificial intelligence and advanced analytics capabilities transforms traditional satellite imagery into comprehensive intelligence platforms that deliver enhanced value to end users.

Competitive positioning requires continuous innovation, strategic partnerships, and market diversification to capitalize on emerging opportunities while addressing evolving customer requirements. Success in this market depends on balancing technological capability development with cost-effective service delivery and customer relationship management.

The future outlook for Russia’s satellite imagery services market remains highly positive, with sustained growth expected across all major application segments and geographic regions, positioning the sector as a critical component of Russia’s digital economy and strategic capabilities.

What is Satellite Imagery Services?

Satellite Imagery Services involve the collection, processing, and distribution of images captured by satellites. These services are used in various applications such as agriculture, urban planning, and environmental monitoring.

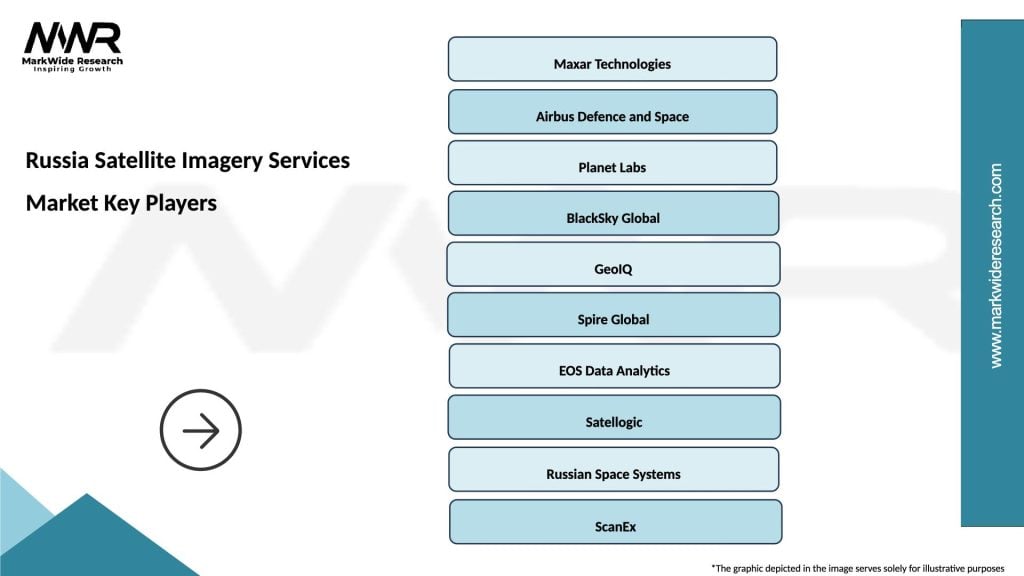

What are the key players in the Russia Satellite Imagery Services Market?

Key players in the Russia Satellite Imagery Services Market include Russian Space Systems, ScanEx, and Skanex, among others. These companies provide a range of satellite imagery solutions for different sectors.

What are the growth factors driving the Russia Satellite Imagery Services Market?

The growth of the Russia Satellite Imagery Services Market is driven by increasing demand for geospatial data in agriculture, urban development, and disaster management. Additionally, advancements in satellite technology enhance image resolution and accessibility.

What challenges does the Russia Satellite Imagery Services Market face?

Challenges in the Russia Satellite Imagery Services Market include regulatory restrictions on data sharing, high operational costs, and competition from international providers. These factors can hinder market expansion and innovation.

What opportunities exist in the Russia Satellite Imagery Services Market?

Opportunities in the Russia Satellite Imagery Services Market include the growing use of satellite data in climate change research and smart city initiatives. There is also potential for partnerships with tech companies to enhance data analytics capabilities.

What trends are shaping the Russia Satellite Imagery Services Market?

Trends in the Russia Satellite Imagery Services Market include the increasing use of artificial intelligence for image analysis and the rise of small satellite constellations. These innovations are making satellite imagery more accessible and cost-effective.

Russia Satellite Imagery Services Market

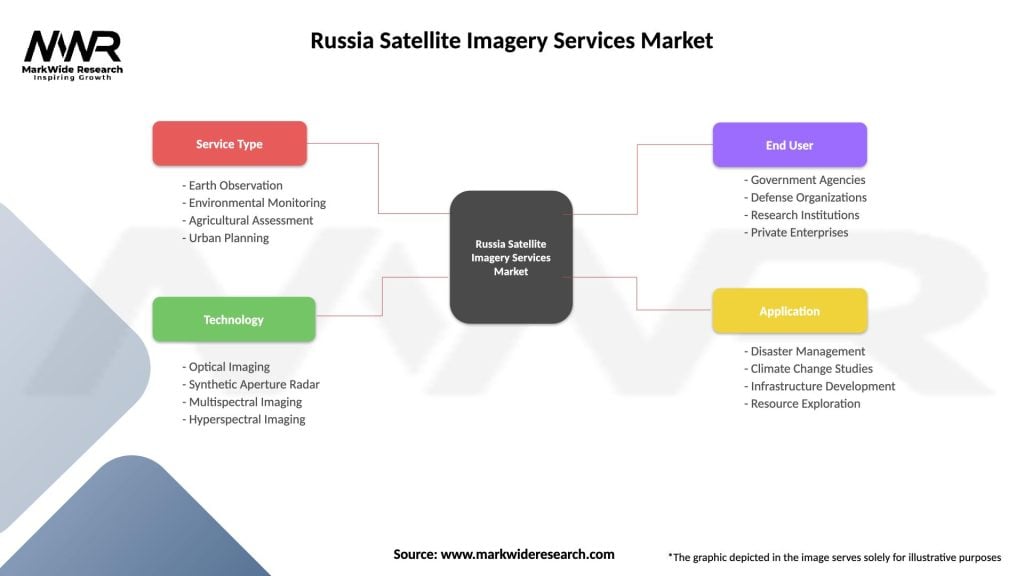

| Segmentation Details | Description |

|---|---|

| Service Type | Earth Observation, Environmental Monitoring, Agricultural Assessment, Urban Planning |

| Technology | Optical Imaging, Synthetic Aperture Radar, Multispectral Imaging, Hyperspectral Imaging |

| End User | Government Agencies, Defense Organizations, Research Institutions, Private Enterprises |

| Application | Disaster Management, Climate Change Studies, Infrastructure Development, Resource Exploration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia Satellite Imagery Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at