444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea dairy alternatives market represents a rapidly evolving segment within the nation’s food and beverage industry, driven by changing consumer preferences, health consciousness, and environmental awareness. South Korean consumers are increasingly embracing plant-based alternatives to traditional dairy products, creating substantial opportunities for manufacturers and retailers across the country. The market encompasses a diverse range of products including plant-based milk, cheese alternatives, yogurt substitutes, and ice cream made from various plant sources such as soy, almond, oat, and rice.

Market dynamics in South Korea reflect a significant shift toward healthier lifestyle choices, with younger demographics particularly driving adoption rates. The market is experiencing robust growth at a CAGR of 12.3%, indicating strong consumer acceptance and expanding product availability. Retail distribution channels have adapted rapidly to accommodate this growing demand, with major supermarket chains and convenience stores dedicating increased shelf space to dairy alternative products.

Consumer behavior patterns show that South Korean buyers are motivated by multiple factors including lactose intolerance concerns, environmental sustainability, and perceived health benefits. The market has witnessed increased investment from both domestic and international companies seeking to capitalize on this growing trend. Product innovation continues to drive market expansion, with manufacturers developing locally-adapted flavors and formulations that appeal to Korean taste preferences.

The South Korea dairy alternatives market refers to the comprehensive ecosystem of plant-based products designed to replace traditional dairy items in Korean consumers’ diets. This market encompasses all non-dairy substitutes including beverages, spreads, frozen desserts, and cooking ingredients derived from plant sources rather than animal milk.

Dairy alternatives in the South Korean context include products manufactured from soybeans, almonds, oats, rice, coconut, and other plant-based ingredients that provide similar nutritional profiles and culinary applications as conventional dairy products. The market represents both imported international brands and domestically produced alternatives specifically formulated for Korean consumer preferences and dietary habits.

Market scope extends beyond simple milk substitutes to include comprehensive product categories such as plant-based cheese, butter alternatives, yogurt substitutes, and specialty items like dairy-free ice cream and coffee creamers. This definition encompasses both retail consumer products and ingredients used in food service applications across South Korea’s restaurant and hospitality sectors.

South Korea’s dairy alternatives market demonstrates exceptional growth potential driven by evolving consumer preferences and increasing health awareness among the population. The market has experienced significant expansion across multiple product categories, with plant-based milk leading adoption rates while cheese and yogurt alternatives show promising growth trajectories.

Key market drivers include rising lactose intolerance awareness, environmental consciousness, and the influence of global health trends on Korean consumers. Approximately 68% of South Korean adults experience some degree of lactose intolerance, creating a substantial target market for dairy alternatives. Younger demographics, particularly millennials and Generation Z consumers, show the highest adoption rates and willingness to pay premium prices for quality alternatives.

Market challenges include taste preferences traditionally favoring dairy products, higher price points compared to conventional dairy, and the need for continued consumer education about nutritional benefits. However, product innovation and improved formulations are addressing these concerns, with many consumers reporting satisfaction with current alternative options.

Competitive landscape features both international brands and emerging domestic producers, creating a dynamic market environment with continuous product launches and marketing initiatives. The market shows strong potential for sustained growth as consumer acceptance increases and distribution channels expand throughout South Korea.

Consumer adoption patterns reveal several critical insights about the South Korean dairy alternatives market. Urban consumers demonstrate significantly higher adoption rates compared to rural populations, with Seoul and Busan leading market penetration. The following key insights shape market understanding:

Health consciousness serves as the primary driver propelling South Korea’s dairy alternatives market forward. Lactose intolerance prevalence among the Korean population creates substantial demand for digestible alternatives, with many consumers experiencing improved digestive comfort after switching to plant-based options. Nutritional awareness continues expanding as consumers seek products with added vitamins, minerals, and protein content comparable to traditional dairy.

Environmental sustainability concerns increasingly influence purchasing decisions among South Korean consumers, particularly younger demographics. Climate change awareness and understanding of dairy farming’s environmental impact motivate consumers to seek more sustainable alternatives. Corporate sustainability initiatives by major Korean companies also drive demand as businesses seek environmentally responsible ingredient sourcing.

Lifestyle trends including veganism, flexitarianism, and clean eating philosophies contribute significantly to market growth. Social media influence and celebrity endorsements of plant-based diets create positive associations with dairy alternatives. Fitness and wellness culture in South Korea promotes plant-based nutrition as part of healthy lifestyle choices.

Product innovation and improved taste profiles address historical barriers to adoption, making dairy alternatives more appealing to mainstream consumers. Convenience factors such as longer shelf life and ambient storage capabilities provide practical advantages over traditional dairy products. Government health initiatives promoting diverse nutrition sources indirectly support dairy alternative consumption.

Traditional dietary preferences present significant challenges to dairy alternatives market expansion in South Korea. Cultural attachment to conventional dairy products, particularly in traditional Korean cuisine and beverages, creates resistance to alternative options. Taste expectations developed through lifelong dairy consumption make it difficult for alternatives to achieve complete consumer satisfaction across all product categories.

Price premiums associated with dairy alternatives limit market accessibility for price-sensitive consumers. Manufacturing costs for plant-based alternatives often exceed traditional dairy production, resulting in retail prices that may discourage widespread adoption. Economic sensitivity during uncertain times can reduce consumer willingness to pay premium prices for alternative products.

Limited product availability in certain regions and retail channels restricts market growth potential. Distribution challenges particularly affect rural areas where traditional dairy products maintain stronger market presence. Supply chain complexities for imported alternatives can result in inconsistent product availability and higher costs.

Nutritional concerns regarding protein content, vitamin B12, and calcium levels in some dairy alternatives create hesitation among health-conscious consumers. Processing methods and additive content in some products raise questions about naturalness and health benefits. Regulatory uncertainties regarding labeling and marketing claims for dairy alternatives may limit promotional activities and consumer education efforts.

Product diversification presents substantial opportunities for market expansion beyond traditional categories. Korean-specific flavors and formulations tailored to local taste preferences could significantly increase consumer acceptance and market penetration. Functional dairy alternatives incorporating probiotics, enhanced protein content, and traditional Korean ingredients offer differentiation opportunities.

Foodservice sector expansion represents untapped potential as restaurants, cafes, and institutional food providers increasingly seek dairy alternative options. Coffee shop integration of plant-based milk alternatives aligns with South Korea’s robust cafe culture. School meal programs and corporate cafeterias present opportunities for bulk sales and consumer education.

E-commerce growth provides platforms for direct consumer engagement and education about dairy alternatives. Subscription services and online-exclusive products could build consumer loyalty and provide market insights. Digital marketing strategies targeting health-conscious consumers through social media and influencer partnerships offer cost-effective market development approaches.

Export potential for successful Korean dairy alternative brands could expand market opportunities beyond domestic boundaries. Technology partnerships with local food manufacturers could reduce production costs and improve product availability. Government support for sustainable food initiatives may provide favorable conditions for market development and consumer adoption.

Supply chain evolution significantly impacts South Korea’s dairy alternatives market dynamics. Local manufacturing capabilities are expanding as companies invest in production facilities to serve growing domestic demand. Import dependencies for certain ingredients and finished products create both opportunities and vulnerabilities in market supply.

Consumer education initiatives by manufacturers and retailers drive market awareness and adoption rates. Sampling programs and in-store demonstrations help overcome taste barriers and build consumer confidence. Nutritional labeling improvements provide transparency that supports informed purchasing decisions.

Competitive intensity increases as more players enter the market, leading to improved products and competitive pricing. Innovation cycles accelerate as companies seek differentiation through unique formulations and packaging solutions. Market consolidation may occur as successful brands acquire smaller competitors or form strategic partnerships.

Regulatory environment continues evolving to address dairy alternative products, potentially affecting labeling requirements and marketing claims. Quality standards development ensures consumer safety while supporting market credibility. Trade policies regarding imported ingredients and finished products influence market accessibility and pricing structures.

Comprehensive market analysis for South Korea’s dairy alternatives market employed multiple research methodologies to ensure accurate and reliable insights. Primary research included consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand market intelligence. Secondary research incorporated industry reports, government statistics, and trade association data to provide comprehensive market context.

Consumer behavior analysis utilized both quantitative and qualitative research approaches. Online surveys reached diverse demographic groups across South Korea to understand purchasing patterns, preferences, and barriers to adoption. Focus group discussions provided deeper insights into consumer motivations and product evaluation criteria.

Market sizing methodology combined multiple data sources to establish accurate market parameters. Retail audit data from major chains provided sales volume and value information across product categories. Import/export statistics supplemented domestic production data to create comprehensive market pictures.

Competitive intelligence gathering involved systematic monitoring of product launches, pricing strategies, and marketing initiatives across key market players. Distribution channel analysis examined product availability and positioning across various retail formats. Trend analysis incorporated social media monitoring and consumer sentiment tracking to identify emerging market directions.

Seoul metropolitan area dominates South Korea’s dairy alternatives market, accounting for approximately 45% of total consumption. Urban concentration in the capital region reflects higher consumer awareness, income levels, and product availability. Premium product segments show particularly strong performance in Seoul, with consumers demonstrating willingness to pay higher prices for quality alternatives.

Busan and surrounding regions represent the second-largest market segment, with growing adoption rates among younger consumers. Port city advantages include easier access to imported products and diverse cultural influences that support alternative food adoption. Regional preferences show slightly different flavor profiles compared to Seoul consumers.

Daegu and Incheon markets demonstrate steady growth with increasing retail presence of dairy alternatives. Industrial city characteristics create opportunities for foodservice applications in corporate dining facilities. Distribution expansion in these regions supports broader market accessibility.

Rural and smaller urban areas show lower adoption rates but represent significant growth potential. Traditional dietary preferences remain stronger in these regions, requiring targeted marketing and education efforts. Price sensitivity tends to be higher in rural markets, creating opportunities for value-positioned products. Distribution challenges in remote areas limit product availability but present opportunities for e-commerce solutions.

Market leadership in South Korea’s dairy alternatives sector includes both international brands and emerging domestic players. Competitive dynamics reflect diverse strategies ranging from premium positioning to value-focused approaches. The following companies represent key market participants:

Strategic positioning varies significantly among competitors, with some focusing on health benefits while others emphasize taste or environmental sustainability. Innovation leadership drives competitive advantage through unique formulations and packaging solutions. Distribution partnerships with major retailers provide crucial market access for both domestic and international brands.

Product category segmentation reveals distinct market dynamics across dairy alternative types. Plant-based milk represents the largest segment, with soy milk maintaining traditional leadership while oat and almond alternatives gain market share. Yogurt alternatives show rapid growth as consumers seek probiotic benefits without dairy consumption.

By Source Material:

By Distribution Channel:

Plant-based milk category demonstrates the most mature market development with established consumer habits and broad retail availability. Soy milk maintains market leadership through competitive pricing and familiar taste profiles, while oat milk captures premium segments with superior coffee compatibility and creamy texture. Consumer preferences vary by usage occasion, with different products preferred for cereal, coffee, and direct consumption.

Dairy-free yogurt alternatives represent the fastest-growing category with annual growth rates exceeding 25%. Probiotic benefits drive consumer interest as health awareness increases. Texture improvements through advanced fermentation techniques address historical consumer complaints about consistency and mouthfeel.

Plant-based cheese alternatives face the greatest consumer acceptance challenges due to taste and texture expectations. Processed cheese alternatives for cooking applications show better adoption than direct consumption products. Innovation focus on melting properties and flavor development could unlock significant market potential.

Dairy-free ice cream benefits from indulgent positioning and seasonal consumption patterns. Premium pricing acceptance is highest in this category as consumers view it as occasional treats. Flavor innovation incorporating Korean preferences like green tea and red bean creates differentiation opportunities.

Manufacturers benefit from expanding market opportunities and premium pricing potential in South Korea’s dairy alternatives sector. Product differentiation through unique formulations and local flavor adaptations creates competitive advantages. Brand building opportunities exist for companies that successfully educate consumers about product benefits and establish market presence early.

Retailers gain from higher margin products and increased customer traffic from health-conscious consumers. Category expansion allows retailers to capture growing consumer segments while differentiating from competitors. Private label opportunities in dairy alternatives provide retailers with exclusive products and improved margins.

Consumers benefit from increased product choice and improved health outcomes through dairy alternative consumption. Digestive health improvements for lactose-intolerant individuals provide significant quality of life benefits. Environmental consciousness satisfaction appeals to consumers seeking sustainable consumption choices.

Food service operators can attract health-conscious customers and accommodate dietary restrictions through dairy alternative offerings. Menu diversification opportunities include specialty beverages and dishes featuring plant-based ingredients. Cost management benefits may emerge from longer shelf life and ambient storage capabilities of some alternatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional ingredient integration represents a major trend shaping South Korea’s dairy alternatives market. Probiotic additions to plant-based yogurts and drinks appeal to consumers seeking digestive health benefits. Protein fortification addresses nutritional concerns while vitamin and mineral supplementation ensures alternatives provide comparable nutrition to traditional dairy products.

Korean flavor localization emerges as companies adapt products to local taste preferences. Traditional ingredients like black sesame, green tea, and sweet potato create unique product offerings that resonate with Korean consumers. Reduced sweetness levels compared to Western formulations align with Korean taste preferences for subtle flavors.

Sustainable packaging initiatives gain importance as environmental consciousness increases among consumers. Recyclable materials and reduced packaging waste become key differentiators for environmentally focused brands. Refillable container programs and bulk purchasing options appeal to eco-conscious consumers.

Premium positioning strategies focus on quality and artisanal production methods. Small-batch production and organic certifications command higher prices while building brand prestige. Limited edition flavors and seasonal offerings create consumer excitement and repeat purchases.

Manufacturing capacity expansion by major Korean food companies demonstrates commitment to the dairy alternatives market. Maeil Dairies invested in dedicated plant-based production lines while Pulmuone expanded soy-based product manufacturing. Technology partnerships with international companies bring advanced processing capabilities to Korean facilities.

Retail channel expansion includes dedicated dairy alternatives sections in major supermarket chains. Lotte Mart and E-Mart increased shelf space allocation while convenience stores like CU and GS25 expanded product selections. Online grocery platforms developed specialized dairy alternatives categories with detailed product information.

Product launch acceleration shows increasing market activity with monthly new product introductions. Local flavor innovations include Korean pear milk and traditional grain-based alternatives. International brand entries bring global expertise while domestic startups focus on niche segments and innovative formulations.

Marketing campaign intensification includes celebrity endorsements and social media influencer partnerships. Educational initiatives by industry associations promote dairy alternatives benefits while sampling programs in retail locations drive trial and adoption. Health professional endorsements provide credibility for nutritional claims and health benefits.

Market entry strategies should prioritize urban markets with high consumer awareness and disposable income. MarkWide Research analysis indicates that Seoul and Busan offer the best initial market opportunities for new entrants. Partnership approaches with established Korean food companies can provide distribution access and local market expertise.

Product development focus should emphasize Korean taste preferences and functional benefits. Flavor localization proves crucial for market acceptance, with subtle sweetness levels and traditional ingredient integration showing positive consumer response. Nutritional enhancement through protein fortification and vitamin supplementation addresses key consumer concerns.

Distribution strategy recommendations include multi-channel approaches combining traditional retail with e-commerce platforms. Convenience store partnerships provide crucial impulse purchase opportunities while online subscription services build consumer loyalty and provide market insights. Foodservice channel development offers significant growth potential through cafe and restaurant partnerships.

Marketing communication strategies should emphasize health benefits and environmental sustainability. Consumer education initiatives prove essential for overcoming taste barriers and building product understanding. Digital marketing approaches targeting younger demographics through social media and influencer partnerships show highest engagement rates and conversion potential.

Market expansion trajectory indicates continued robust growth for South Korea’s dairy alternatives sector over the next five years. Consumer acceptance rates are projected to increase significantly as product quality improvements and price competitiveness develop. MWR projections suggest the market will experience sustained growth at a CAGR of 15.2% through 2028, driven by increasing health consciousness and environmental awareness.

Product category evolution will likely see expanded offerings in cheese alternatives and functional beverages. Technology advancement in fermentation and processing techniques will improve taste profiles and nutritional content. Local manufacturing expansion should reduce costs and improve product availability across all regions of South Korea.

Consumer demographic shifts will continue favoring dairy alternatives as younger generations become primary household purchasers. Health trend integration with fitness and wellness culture will drive premium product demand. Environmental regulations and sustainability initiatives may provide additional market support through policy frameworks favoring plant-based alternatives.

Competitive landscape evolution will likely include market consolidation as successful brands acquire smaller players or form strategic partnerships. Innovation acceleration will continue as companies seek differentiation through unique formulations and packaging solutions. Export opportunities may develop for successful Korean dairy alternative brands seeking regional expansion throughout Asia.

South Korea’s dairy alternatives market represents a dynamic and rapidly expanding sector with substantial growth potential driven by changing consumer preferences, health consciousness, and environmental awareness. Market fundamentals remain strong with increasing consumer acceptance, expanding distribution channels, and continuous product innovation supporting sustained growth trajectories.

Key success factors for market participants include understanding local taste preferences, developing competitive pricing strategies, and building comprehensive distribution networks. Consumer education and product trial opportunities prove essential for overcoming traditional dairy preferences and building market share. Innovation focus on functional benefits and Korean flavor profiles creates differentiation opportunities in an increasingly competitive landscape.

Future market development will likely benefit from continued urbanization, rising disposable incomes, and generational shifts toward health-conscious consumption patterns. Technology advancement and local manufacturing expansion should improve product quality while reducing costs, making dairy alternatives more accessible to mainstream consumers. The market’s evolution from niche health product to mainstream food category positions South Korea as a significant growth opportunity within the global dairy alternatives industry.

What is Dairy Alternatives?

Dairy alternatives refer to plant-based products that serve as substitutes for traditional dairy products. These include items like almond milk, soy yogurt, and coconut cheese, catering to consumers seeking lactose-free or vegan options.

What are the key players in the South Korea Dairy Alternatives Market?

Key players in the South Korea Dairy Alternatives Market include companies like Seoul Milk, Daesang, and CJ CheilJedang, which are actively involved in producing a variety of dairy alternative products, among others.

What are the growth factors driving the South Korea Dairy Alternatives Market?

The South Korea Dairy Alternatives Market is driven by increasing health consciousness among consumers, a rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, innovative product offerings and marketing strategies are contributing to market growth.

What challenges does the South Korea Dairy Alternatives Market face?

Challenges in the South Korea Dairy Alternatives Market include competition from traditional dairy products, consumer skepticism regarding taste and texture, and regulatory hurdles related to labeling and health claims. These factors can hinder market penetration and growth.

What opportunities exist in the South Korea Dairy Alternatives Market?

Opportunities in the South Korea Dairy Alternatives Market include expanding product lines to include fortified options, targeting niche markets such as lactose-intolerant consumers, and leveraging e-commerce platforms for wider distribution. The increasing demand for sustainable products also presents growth potential.

What trends are shaping the South Korea Dairy Alternatives Market?

Trends in the South Korea Dairy Alternatives Market include the rise of clean label products, increased interest in organic and non-GMO ingredients, and the development of innovative flavors and formulations. Additionally, the market is seeing a shift towards environmentally friendly packaging solutions.

South Korea Dairy Alternatives Market

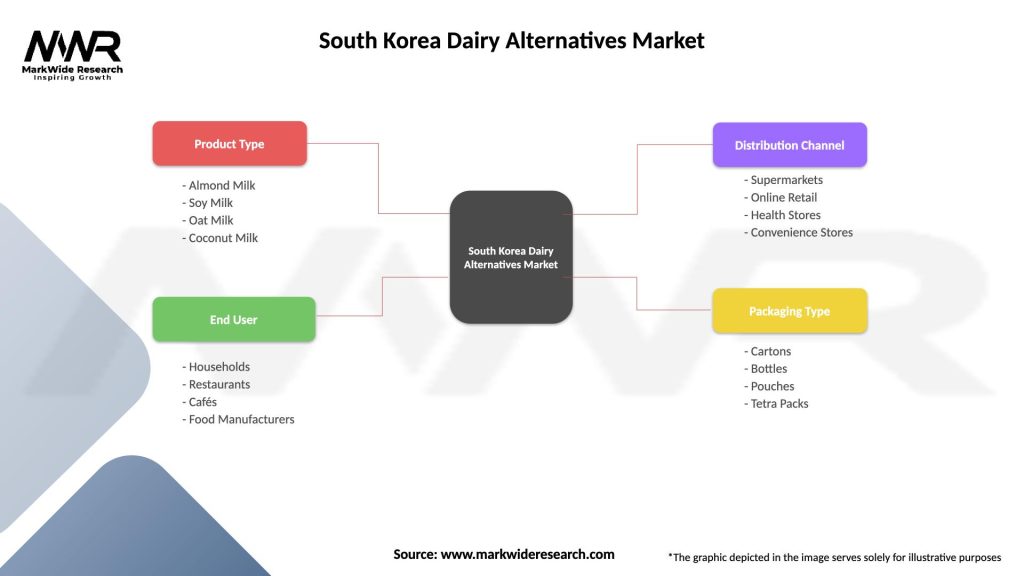

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Restaurants, Cafés, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Dairy Alternatives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at