444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia dairy alternatives market represents a rapidly evolving sector within the country’s food and beverage industry, driven by changing consumer preferences, health consciousness, and environmental awareness. This dynamic market encompasses a diverse range of plant-based products designed to replace traditional dairy items, including milk alternatives, cheese substitutes, yogurt alternatives, and butter replacements. Australian consumers are increasingly embracing these innovative products as viable alternatives to conventional dairy offerings.

Market dynamics indicate substantial growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects the growing acceptance of plant-based nutrition among Australian households, supported by improved product quality, enhanced taste profiles, and increased availability across retail channels. Urban centers particularly demonstrate strong adoption rates, with metropolitan areas showing 65% higher consumption compared to rural regions.

Consumer demographics reveal that millennials and Generation Z constitute the primary driving force behind market expansion, representing approximately 58% of total consumption. These younger demographics prioritize sustainability, health benefits, and ethical consumption patterns, making them natural advocates for dairy alternative products. Health-conscious consumers across all age groups are increasingly recognizing the nutritional benefits and digestive advantages offered by plant-based alternatives.

The Australia dairy alternatives market refers to the comprehensive ecosystem of plant-based products specifically designed to substitute traditional dairy items while maintaining comparable nutritional profiles, taste characteristics, and functional properties. This market encompasses products derived from various plant sources including almonds, oats, soy, coconut, rice, and emerging alternatives like pea protein and hemp.

Dairy alternatives represent more than simple substitutes; they constitute a fundamental shift toward sustainable, health-conscious consumption patterns that align with modern Australian lifestyle preferences. These products serve consumers seeking lactose-free options, those following vegan or vegetarian diets, individuals with dairy allergies, and environmentally conscious buyers prioritizing reduced carbon footprints.

Market scope extends beyond basic milk replacements to include comprehensive product categories such as plant-based cheeses, yogurts, ice creams, butter alternatives, and specialized nutritional products. The sector encompasses both established multinational brands and innovative local Australian companies developing unique formulations tailored to domestic taste preferences and nutritional requirements.

Australia’s dairy alternatives sector demonstrates remarkable resilience and growth potential, positioning itself as a significant component of the nation’s evolving food landscape. The market benefits from strong consumer acceptance, innovative product development, and supportive retail infrastructure that facilitates widespread distribution and accessibility.

Key growth drivers include increasing lactose intolerance awareness, rising environmental consciousness, and expanding health and wellness trends among Australian consumers. The sector shows particular strength in premium product segments, where consumers demonstrate willingness to invest in high-quality alternatives that deliver superior taste and nutritional benefits. Retail penetration has reached 78% across major supermarket chains, indicating mainstream market acceptance.

Competitive landscape features a balanced mix of international brands and domestic innovators, creating a dynamic environment that fosters continuous product improvement and market expansion. The sector benefits from Australia’s strong agricultural foundation, which supports local ingredient sourcing and manufacturing capabilities, reducing supply chain dependencies and enhancing product freshness.

Future prospects remain highly favorable, with projected growth rates suggesting continued expansion across all major product categories. The market demonstrates resilience against economic fluctuations, supported by fundamental shifts in consumer behavior and dietary preferences that transcend temporary market conditions.

Consumer behavior analysis reveals significant insights into purchasing patterns and preference drivers within the Australian dairy alternatives market. Research indicates that taste quality remains the primary consideration for 72% of consumers, followed closely by nutritional content and price competitiveness.

Market maturation indicators suggest the sector is transitioning from early adoption to mainstream acceptance, with established brands expanding product lines and new entrants focusing on specialized niches and innovative formulations.

Health consciousness represents the most significant driver propelling Australia’s dairy alternatives market forward. Growing awareness of lactose intolerance, dairy allergies, and digestive sensitivities motivates consumers to seek plant-based alternatives that offer similar nutritional benefits without associated health concerns. Medical recommendations increasingly support plant-based nutrition for various health conditions, creating sustained demand growth.

Environmental sustainability concerns drive substantial consumer interest in dairy alternatives, as Australian consumers become increasingly aware of traditional dairy farming’s environmental impact. Plant-based alternatives typically require significantly less water, land, and energy resources while producing lower greenhouse gas emissions. Climate change awareness motivates environmentally conscious consumers to make purchasing decisions that align with sustainability goals.

Dietary trend adoption continues expanding across Australian demographics, with veganism, vegetarianism, and flexitarian lifestyles gaining mainstream acceptance. These dietary approaches naturally drive demand for high-quality dairy alternatives that support nutritional requirements while maintaining meal enjoyment and satisfaction. Social media influence amplifies awareness and adoption of plant-based eating patterns.

Product quality improvements eliminate traditional barriers to dairy alternative adoption, with modern formulations delivering taste, texture, and functionality that closely match conventional dairy products. Innovation investments by manufacturers result in products that satisfy even discerning consumers who previously avoided plant-based alternatives due to quality concerns.

Price sensitivity remains a significant constraint for widespread dairy alternatives adoption, as many plant-based products command premium pricing compared to conventional dairy items. Economic pressures on household budgets can limit consumer willingness to pay higher prices for alternative products, particularly during periods of economic uncertainty or inflation.

Taste and texture preferences continue challenging some product categories, despite significant improvements in formulation quality. Certain consumers maintain strong preferences for traditional dairy characteristics that current alternatives struggle to replicate perfectly. Sensory expectations developed through lifelong dairy consumption create high standards that some plant-based products cannot yet meet consistently.

Nutritional concerns arise among health-conscious consumers who question whether plant-based alternatives provide equivalent nutritional benefits to traditional dairy products. Protein content, calcium absorption, and vitamin profiles require careful consideration and often supplementation to match dairy nutritional standards, creating complexity for consumers seeking optimal nutrition.

Market education needs persist as many consumers lack comprehensive understanding of dairy alternatives’ benefits, preparation methods, and optimal usage applications. Information gaps can lead to suboptimal product experiences that discourage continued adoption and positive word-of-mouth recommendations.

Product category expansion presents substantial opportunities for market growth, particularly in specialized segments like plant-based cheese, yogurt, and dessert alternatives. Innovation potential remains high for developing products that address specific consumer needs, dietary restrictions, and taste preferences while maintaining competitive pricing structures.

Regional market penetration offers significant growth potential, especially in rural and regional Australian communities where dairy alternatives adoption rates remain below urban levels. Educational marketing and targeted distribution strategies can unlock these underserved markets while building brand loyalty among new consumer segments.

Export opportunities emerge as Australian dairy alternatives manufacturers develop products that meet international quality standards and taste preferences. Asia-Pacific markets show particular promise for Australian brands seeking expansion beyond domestic boundaries, leveraging Australia’s reputation for high-quality food products.

Foodservice integration represents a growing opportunity as restaurants, cafes, and institutional food providers increasingly incorporate dairy alternatives into their offerings. Professional kitchen adoption can drive consumer trial and acceptance while creating substantial volume opportunities for manufacturers.

Supply chain evolution continues reshaping the Australian dairy alternatives market, with manufacturers investing in local ingredient sourcing, production capacity expansion, and distribution network optimization. Vertical integration strategies enable better quality control, cost management, and supply security while supporting sustainable business practices.

Consumer education initiatives play crucial roles in market development, as brands invest in awareness campaigns, product sampling programs, and educational content that helps consumers understand benefits and optimal usage of dairy alternatives. Digital marketing proves particularly effective for reaching target demographics and building community around plant-based lifestyle choices.

Regulatory environment influences market dynamics through food safety standards, labeling requirements, and nutritional guidelines that shape product development and marketing strategies. Government policies supporting sustainable agriculture and environmental protection indirectly benefit the dairy alternatives sector.

Competitive intensity drives continuous innovation and improvement across all market participants, resulting in better products, competitive pricing, and enhanced consumer value propositions. Market consolidation trends may emerge as successful brands seek to expand market share through strategic acquisitions and partnerships.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Australia’s dairy alternatives market dynamics. Primary research includes consumer surveys, industry interviews, and retail channel analysis that provide direct insights into market behavior and trends.

Secondary research incorporates industry reports, government statistics, trade association data, and academic studies that offer broader context and historical perspective on market development. Data triangulation ensures research findings accuracy by comparing multiple information sources and validating key insights through cross-referencing.

Market segmentation analysis examines consumer demographics, geographic distribution, product categories, and purchasing behavior patterns to identify growth opportunities and market dynamics. Competitive intelligence tracks major market participants, product launches, pricing strategies, and market share developments.

Trend analysis identifies emerging patterns in consumer behavior, product innovation, and market evolution that influence future growth prospects. Forecasting models incorporate multiple variables including economic indicators, demographic trends, and industry developments to project market trajectories.

New South Wales leads Australia’s dairy alternatives market, accounting for approximately 35% of national consumption, driven by Sydney’s large population, diverse demographics, and high concentration of health-conscious consumers. Urban density supports extensive retail distribution networks and facilitates rapid adoption of new product innovations.

Victoria represents the second-largest regional market, with Melbourne’s cultural diversity and strong café culture driving demand for plant-based alternatives across multiple product categories. Regional Victoria shows growing acceptance as awareness campaigns and product availability expand beyond metropolitan areas.

Queensland demonstrates strong growth potential, particularly in coastal regions where health and wellness trends align with outdoor lifestyle preferences. Brisbane and Gold Coast markets show above-average adoption rates, while regional Queensland presents opportunities for market expansion through targeted distribution strategies.

Western Australia exhibits unique market characteristics, with Perth consumers showing strong preferences for locally-produced alternatives and premium product segments. Agricultural regions present interesting dynamics as traditional dairy farming communities gradually embrace alternative products for personal consumption.

South Australia and Tasmania represent emerging markets with significant growth potential, supported by increasing retail availability and consumer education initiatives. Adelaide’s food culture and Tasmania’s focus on premium, artisanal products create favorable environments for dairy alternatives expansion.

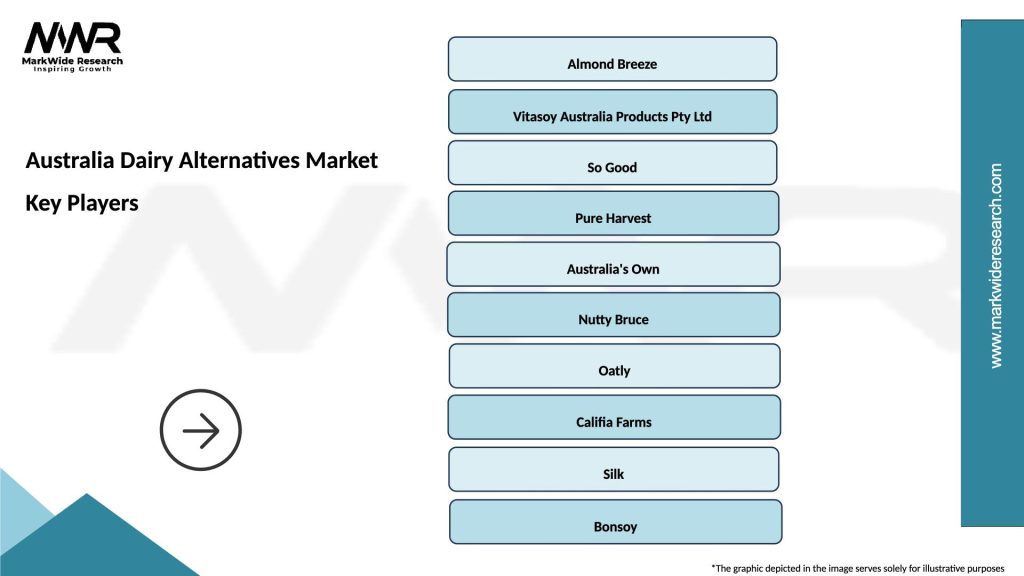

Market leadership in Australia’s dairy alternatives sector features a dynamic mix of international brands and innovative domestic companies, creating a competitive environment that drives continuous product improvement and market expansion.

Competitive strategies focus on product differentiation, taste optimization, nutritional enhancement, and sustainable packaging solutions. Brand positioning varies from mainstream accessibility to premium artisanal offerings, allowing companies to target specific consumer segments effectively.

Innovation competition drives rapid product development cycles, with companies investing heavily in research and development to create unique formulations that address specific consumer needs and preferences. Market share dynamics remain fluid as new entrants and product innovations continuously reshape competitive positioning.

Product category segmentation reveals distinct market dynamics across different dairy alternative types, with each segment demonstrating unique growth patterns, consumer preferences, and competitive landscapes.

By Product Type:

By Source Material:

Plant-based milk alternatives dominate market share and consumer awareness, serving as the gateway product for dairy alternatives adoption. Oat milk shows particularly strong growth momentum, with 45% year-over-year growth driven by superior taste characteristics and environmental sustainability messaging. Almond milk maintains market leadership through established distribution networks and broad consumer acceptance.

Cheese alternatives represent the fastest-growing segment, despite starting from a smaller base, as product quality improvements address traditional taste and texture limitations. Artisanal cheese alternatives command premium pricing while mass-market options focus on affordability and accessibility. Melting properties and cooking functionality drive product development priorities.

Yogurt alternatives benefit from growing probiotic awareness and health-conscious consumption patterns. Greek-style alternatives show strong performance, appealing to consumers seeking high protein content and thick, creamy textures. Flavor innovation drives category expansion with unique combinations and seasonal offerings.

Specialty categories including butter alternatives and ice cream substitutes show promising growth potential as product quality reaches parity with traditional dairy options. Premium positioning allows these categories to maintain healthy margins while building consumer loyalty through superior taste experiences.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and growing consumer acceptance that supports sustainable business growth. Innovation investments yield competitive advantages through unique product formulations and improved manufacturing processes that enhance quality while reducing costs.

Retailers gain from higher margin opportunities, increased customer traffic, and enhanced brand positioning as forward-thinking establishments that cater to evolving consumer preferences. Category expansion allows retailers to capture growing market segments while differentiating from competitors.

Consumers enjoy expanded choice, improved product quality, and alignment with personal values regarding health, sustainability, and ethical consumption. Nutritional benefits include reduced saturated fat intake, elimination of lactose-related digestive issues, and access to diverse plant-based nutrients.

Agricultural stakeholders benefit from new crop demand, diversified income streams, and opportunities to participate in sustainable farming practices. Local sourcing initiatives support regional economic development while reducing supply chain environmental impacts.

Environmental stakeholders gain from reduced resource consumption, lower greenhouse gas emissions, and decreased land use associated with plant-based agriculture compared to traditional dairy farming. Sustainability metrics demonstrate measurable environmental benefits that support broader climate goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional nutrition integration emerges as a dominant trend, with manufacturers incorporating probiotics, vitamins, minerals, and specialized nutrients that provide health benefits beyond basic nutrition. Protein enhancement particularly drives product development as consumers seek plant-based alternatives that match or exceed dairy protein content.

Sustainability messaging becomes increasingly sophisticated, with brands providing detailed environmental impact data, carbon footprint calculations, and supply chain transparency information. Packaging innovations focus on recyclable materials, reduced plastic usage, and sustainable sourcing that aligns with environmental consciousness.

Flavor sophistication advances rapidly, with artisanal and gourmet options expanding beyond basic vanilla and chocolate to include unique combinations, seasonal offerings, and culturally-inspired flavors. Barista-quality products specifically target coffee culture, emphasizing frothing properties and taste compatibility with espresso-based beverages.

Local sourcing emphasis grows stronger as consumers prefer products made with Australian-grown ingredients, supporting local agriculture while reducing transportation environmental impacts. Transparency initiatives provide detailed ingredient sourcing information and production process details that build consumer trust and brand loyalty.

Personalization trends emerge through customizable nutrition profiles, dietary restriction accommodations, and specialized formulations for specific health conditions or lifestyle requirements. Digital engagement supports personalized marketing and product recommendations based on individual consumer preferences and purchasing history.

Manufacturing capacity expansion continues across major market participants, with significant investments in production facilities, equipment upgrades, and supply chain infrastructure that support growing demand. Automation integration improves production efficiency while maintaining quality consistency across larger production volumes.

Strategic partnerships between dairy alternatives manufacturers and traditional food companies create synergies that accelerate market development and distribution expansion. Acquisition activities consolidate market position while providing resources for continued innovation and growth.

Research collaborations with universities and research institutions advance product development capabilities, focusing on nutrition optimization, taste improvement, and sustainable production methods. MarkWide Research indicates that innovation partnerships drive 23% faster product development cycles compared to independent research efforts.

Retail format diversification expands beyond traditional supermarkets to include specialty health stores, online platforms, and direct-to-consumer channels that provide enhanced customer engagement and market reach. E-commerce growth accelerates, particularly following increased online shopping adoption during recent years.

International expansion activities increase as successful Australian brands seek growth opportunities in Asia-Pacific markets, leveraging Australia’s reputation for high-quality food products and stringent safety standards. Export development programs support market entry and brand establishment in target international markets.

Product differentiation strategies should focus on unique value propositions that address specific consumer needs, whether through superior taste, enhanced nutrition, sustainability credentials, or specialized applications. Innovation investments must balance quality improvements with cost management to maintain competitive pricing structures.

Market education initiatives require sustained investment to build consumer understanding and trial behavior, particularly in regional markets where dairy alternatives awareness remains limited. Sampling programs and in-store demonstrations prove effective for converting curious consumers into regular purchasers.

Distribution strategy optimization should prioritize channel diversification while maintaining strong relationships with key retail partners. Online presence becomes increasingly important for reaching younger demographics and providing convenient purchasing options that support repeat purchases.

Sustainability communication must be authentic and substantiated with measurable data that resonates with environmentally conscious consumers. Transparency initiatives build trust and differentiate brands in an increasingly crowded marketplace where consumers seek authentic values alignment.

Regional expansion planning should consider local taste preferences, distribution infrastructure, and competitive dynamics that vary across different Australian markets. Gradual market entry allows for learning and adaptation while building sustainable market presence.

Market trajectory indicates continued robust growth across all major dairy alternatives categories, supported by fundamental shifts in consumer behavior, ongoing product innovation, and expanding retail availability. MarkWide Research projects the sector will maintain strong momentum with sustained double-digit growth rates over the next five years.

Technology advancement will drive significant improvements in product quality, manufacturing efficiency, and cost competitiveness that address current market limitations. Precision fermentation and cellular agriculture technologies may introduce revolutionary products that blur the lines between traditional and alternative dairy products.

Consumer demographics evolution suggests growing mainstream acceptance as younger generations with established plant-based preferences represent increasing portions of total purchasing power. Generational transition will naturally expand the target market beyond current early adopters and health-conscious segments.

Market maturation will likely result in category consolidation, premium segment growth, and increased focus on specialized applications that serve specific consumer needs. International expansion opportunities will provide growth avenues for successful Australian brands seeking to leverage domestic market success.

Regulatory environment evolution may introduce clearer labeling standards, nutritional requirements, and sustainability metrics that provide structure and consumer confidence while potentially creating barriers for smaller market participants. Industry standardization will support continued market development and consumer acceptance.

Australia’s dairy alternatives market represents a dynamic and rapidly evolving sector that has successfully transitioned from niche specialty products to mainstream consumer staples. The market demonstrates remarkable resilience and growth potential, supported by fundamental shifts in consumer preferences, ongoing product innovation, and expanding retail infrastructure that facilitates widespread accessibility.

Key success factors include continuous product quality improvements, effective consumer education, strategic distribution expansion, and authentic sustainability messaging that resonates with environmentally conscious consumers. The sector benefits from Australia’s strong agricultural foundation, innovative food technology capabilities, and supportive regulatory environment that encourages healthy competition and consumer choice.

Future prospects remain highly favorable, with projected growth rates indicating sustained expansion across all major product categories and geographic regions. The market’s evolution from early adoption to mainstream acceptance creates opportunities for both established players and innovative newcomers to capture growing consumer demand while contributing to Australia’s sustainable food system development.

Strategic positioning for long-term success requires balanced focus on product excellence, market education, distribution optimization, and authentic brand values that align with evolving consumer expectations. The Australia dairy alternatives market stands poised for continued growth and innovation, representing a significant component of the nation’s food industry future.

What is Dairy Alternatives?

Dairy alternatives refer to plant-based products that serve as substitutes for traditional dairy products. These include items like almond milk, soy yogurt, and coconut cheese, catering to consumers seeking lactose-free or vegan options.

What are the key players in the Australia Dairy Alternatives Market?

Key players in the Australia Dairy Alternatives Market include companies like Almond Breeze, So Good, and Vitasoy, which offer a variety of plant-based milk and yogurt products. These companies are competing to capture the growing demand for dairy-free options among consumers.

What are the growth factors driving the Australia Dairy Alternatives Market?

The Australia Dairy Alternatives Market is driven by increasing health consciousness, a rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, environmental concerns related to dairy farming are prompting consumers to explore plant-based alternatives.

What challenges does the Australia Dairy Alternatives Market face?

Challenges in the Australia Dairy Alternatives Market include competition from traditional dairy products, consumer skepticism about taste and texture, and regulatory hurdles regarding labeling and health claims. These factors can hinder market growth and consumer acceptance.

What opportunities exist in the Australia Dairy Alternatives Market?

Opportunities in the Australia Dairy Alternatives Market include the potential for product innovation, such as fortified dairy alternatives and new flavors. Additionally, expanding distribution channels and increasing consumer education can further enhance market penetration.

What trends are shaping the Australia Dairy Alternatives Market?

Trends in the Australia Dairy Alternatives Market include the rise of clean label products, increased interest in sustainability, and the development of new formulations that mimic the taste and texture of dairy. These trends reflect changing consumer preferences towards healthier and more ethical food choices.

Australia Dairy Alternatives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Cafés, Restaurants, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Convenience Stores |

| Packaging Type | Cartons, Bottles, Tetra Packs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Dairy Alternatives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at