444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom dairy market represents one of Europe’s most established and sophisticated dairy industries, characterized by advanced farming practices, innovative processing technologies, and strong consumer demand for premium dairy products. Market dynamics indicate sustained growth driven by increasing health consciousness, product diversification, and technological advancement in dairy processing. The UK dairy sector encompasses traditional milk production, artisanal cheese manufacturing, yogurt production, and emerging plant-based alternatives that complement conventional dairy offerings.

Consumer preferences have evolved significantly, with growing demand for organic dairy products, functional foods, and premium artisanal offerings. The market demonstrates resilience through diverse distribution channels including supermarkets, specialty stores, online platforms, and direct-to-consumer sales. Regional variations across England, Scotland, Wales, and Northern Ireland contribute to market complexity, with each region maintaining distinct dairy traditions and consumer preferences.

Technological innovation continues reshaping the industry landscape, with automated milking systems, precision farming techniques, and advanced processing equipment enhancing productivity and product quality. The market experiences steady growth at approximately 3.2% CAGR, supported by robust domestic consumption and strategic export opportunities to European and international markets.

The United Kingdom dairy market refers to the comprehensive ecosystem encompassing milk production, processing, distribution, and consumption of dairy products across England, Scotland, Wales, and Northern Ireland. This market includes traditional dairy farming operations, commercial processing facilities, retail distribution networks, and end-consumer purchasing patterns for various dairy categories including fluid milk, cheese, butter, yogurt, cream, and specialty dairy products.

Market scope extends beyond conventional dairy to include organic products, lactose-free alternatives, functional dairy foods, and artisanal specialty items. The definition encompasses both domestic production and imported dairy products, creating a complex marketplace where local producers compete alongside international brands while serving diverse consumer segments with varying preferences for quality, price, and product attributes.

Strategic analysis reveals the UK dairy market as a mature yet dynamic sector experiencing transformation through consumer preference evolution, technological advancement, and regulatory changes. The market demonstrates strong fundamentals with established supply chains, sophisticated processing capabilities, and diverse product portfolios meeting varied consumer needs across demographic segments.

Key performance indicators highlight steady market expansion driven by premium product adoption, organic segment growth at 8.5% annually, and increasing demand for functional dairy products. The market benefits from strong domestic production capabilities, with UK farms producing approximately 75% of domestic dairy requirements, supplemented by strategic imports for specialized products and seasonal demand fluctuations.

Competitive landscape features established multinational corporations alongside regional cooperatives and artisanal producers, creating market segmentation that serves both mass market and premium niches. Innovation focus centers on product development, sustainable packaging, and supply chain optimization to meet evolving consumer expectations and regulatory requirements.

Market intelligence reveals several critical insights shaping the UK dairy industry’s trajectory and competitive positioning:

Primary growth drivers propelling the UK dairy market include evolving consumer preferences toward health-conscious food choices, increasing disposable income enabling premium product purchases, and growing awareness of dairy products’ nutritional benefits. Health and wellness trends significantly influence market dynamics, with consumers seeking products containing probiotics, added vitamins, and reduced sugar content.

Demographic factors contribute substantially to market expansion, including aging population segments requiring calcium-rich foods, young families prioritizing nutritious options for children, and health-conscious millennials driving organic and natural product demand. The market benefits from strong cultural affinity for dairy products, with traditional consumption patterns supporting baseline demand across all demographic groups.

Innovation momentum accelerates market growth through new product development, improved processing technologies, and enhanced packaging solutions extending product shelf life and convenience. Retail channel diversification expands market reach through supermarket expansion, specialty store growth, and online platform development, making premium dairy products more accessible to diverse consumer segments.

Government support for domestic agriculture and food security initiatives provides market stability through favorable policies, research funding, and export promotion programs that strengthen the UK dairy industry’s competitive position in international markets.

Significant challenges facing the UK dairy market include rising production costs driven by feed price volatility, energy cost increases, and labor shortages affecting farm operations and processing facilities. Regulatory compliance requirements create operational complexity and cost burdens, particularly for smaller producers adapting to evolving food safety standards and environmental regulations.

Consumer dietary shifts toward plant-based alternatives present competitive pressure, with dairy-free products gaining market share among health-conscious and environmentally aware consumers. Price sensitivity in certain market segments limits premium product adoption, particularly during economic uncertainty when consumers prioritize value over premium features.

Supply chain disruptions create operational challenges through transportation cost increases, packaging material shortages, and distribution network complications affecting product availability and pricing stability. Climate change impacts pose long-term risks to dairy farming through extreme weather events, changing precipitation patterns, and temperature fluctuations affecting milk production and feed crop yields.

International trade uncertainties following Brexit implementation continue creating market volatility through changing import/export regulations, tariff structures, and market access conditions affecting both domestic producers and international suppliers operating in the UK market.

Emerging opportunities within the UK dairy market center on premium product development, sustainable production practices, and innovative distribution channels that align with evolving consumer preferences and market trends. Organic segment expansion offers substantial growth potential, with current penetration rates suggesting significant room for market share increases across all dairy categories.

Functional food development presents lucrative opportunities through products targeting specific health benefits, including immune system support, digestive health, and nutritional supplementation for aging populations. Artisanal and craft dairy segments continue expanding, with consumers willing to pay premium prices for unique flavors, traditional production methods, and local sourcing credentials.

Export market development offers growth potential through international demand for high-quality UK dairy products, particularly in Asian markets where British food products enjoy positive brand recognition. Technology integration creates opportunities for operational efficiency improvements, product innovation, and supply chain optimization that can enhance competitiveness and profitability.

Sustainability initiatives provide differentiation opportunities through carbon-neutral production, regenerative farming practices, and circular economy approaches that appeal to environmentally conscious consumers while potentially reducing operational costs through efficiency improvements.

Complex market dynamics shape the UK dairy industry through interconnected factors including consumer behavior evolution, technological advancement, regulatory changes, and competitive pressures from both traditional dairy producers and alternative product manufacturers. Supply and demand balance fluctuates seasonally, with milk production patterns influenced by weather conditions, feed availability, and farming practices.

Price dynamics reflect global commodity markets, local production costs, and consumer willingness to pay premium prices for quality and specialty products. The market demonstrates price elasticity variations across different product categories, with basic dairy products showing higher price sensitivity compared to premium and specialty offerings that command stable pricing despite cost fluctuations.

Competitive dynamics intensify through market consolidation among major players, while simultaneously creating opportunities for niche producers specializing in artisanal and organic products. Innovation cycles accelerate product development timelines, requiring continuous investment in research and development to maintain market relevance and competitive positioning.

Distribution channel evolution transforms market access patterns, with online sales growing at 15% annually and specialty retail channels expanding to serve premium product segments. MarkWide Research analysis indicates that market dynamics will continue evolving through technological integration and changing consumer preferences toward health-focused and sustainable dairy products.

Comprehensive research approach employed multiple data collection methodologies to ensure accurate market analysis and reliable insights into UK dairy market trends, competitive landscape, and growth opportunities. Primary research included structured interviews with industry stakeholders, dairy farmers, processing companies, retailers, and consumers across different demographic segments and geographic regions.

Secondary research encompassed analysis of government statistics, industry reports, trade association data, and academic studies related to dairy production, consumption patterns, and market trends. Quantitative analysis utilized statistical modeling to identify growth patterns, market share distributions, and correlation factors affecting market performance across different product categories and regional markets.

Data validation processes included cross-referencing multiple sources, expert consultation, and trend analysis to ensure accuracy and reliability of market insights and projections. Market segmentation analysis employed demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific preferences, purchasing patterns, and growth potential.

Competitive intelligence gathering involved analysis of major market players, their product portfolios, pricing strategies, distribution channels, and market positioning to understand competitive dynamics and identify market opportunities for different types of dairy producers and processors.

England dominates the UK dairy market with approximately 68% market share, driven by large-scale commercial operations, major processing facilities, and high population density creating substantial demand for diverse dairy products. Southern England demonstrates strong preference for premium and organic products, while northern regions maintain traditional consumption patterns with emphasis on value and quality.

Scotland contributes significantly to market dynamics through specialized products including traditional cheeses, premium butter, and organic milk production. Scottish dairy farms benefit from favorable climate conditions and grassland quality, producing approximately 18% of UK dairy output while maintaining strong export capabilities to European markets.

Wales represents a growing market segment with increasing focus on organic and sustainable dairy production, contributing 8% of national production while developing reputation for artisanal cheese and specialty dairy products. Welsh dairy cooperatives demonstrate strong community integration and sustainable farming practices that appeal to environmentally conscious consumers.

Northern Ireland maintains distinct market characteristics through cross-border trade relationships and specialized product development, contributing 6% of UK dairy production while serving both domestic and Republic of Ireland markets. Regional specialization creates unique product offerings and protected designation opportunities that enhance market value and consumer recognition.

Market leadership is distributed among several major players, each maintaining distinct competitive advantages and market positioning strategies:

Competitive strategies focus on product innovation, brand differentiation, sustainable production practices, and supply chain optimization to maintain market position and capture growth opportunities in premium segments.

Product-based segmentation reveals distinct market categories with varying growth patterns and consumer preferences:

Distribution channel segmentation shows evolving patterns:

Consumer segmentation identifies distinct purchasing behaviors and preferences across demographic groups, enabling targeted marketing strategies and product development initiatives.

Fluid milk category demonstrates stability with evolving consumer preferences toward organic, grass-fed, and locally sourced options. Premium milk products command higher margins while conventional milk faces price pressure from retail competition. The category benefits from consistent demand patterns and established distribution networks across all retail channels.

Cheese segment represents the most dynamic category with strong growth in artisanal varieties, aged cheeses, and specialty products featuring unique flavors and production methods. British cheese varieties gain international recognition, creating export opportunities and premium positioning in domestic markets. The segment shows resilience to economic fluctuations through diverse price points and applications.

Yogurt and fermented products experience rapid expansion driven by health trends, with Greek yogurt, probiotic varieties, and plant-based alternatives capturing significant market share. Innovation focus centers on functional benefits, flavor variety, and convenient packaging formats appealing to busy lifestyles and health-conscious consumers.

Butter and spreads maintain traditional market position while adapting to health trends through reduced-salt varieties, grass-fed options, and premium artisanal products. Seasonal demand patterns influence production planning and inventory management, with holiday periods driving significant volume increases.

Dairy farmers benefit from stable demand patterns, premium pricing opportunities for quality products, and cooperative structures that provide market access and bargaining power. Technology adoption enables efficiency improvements, animal welfare enhancements, and environmental sustainability that align with consumer preferences and regulatory requirements.

Processing companies gain advantages through product diversification opportunities, value-added processing capabilities, and brand development potential that creates competitive differentiation. Scale economies in processing and distribution provide cost advantages while enabling investment in innovation and quality improvement initiatives.

Retailers benefit from dairy products’ role as traffic drivers, consistent demand patterns, and opportunities for private label development that enhances margins and customer loyalty. Premium product categories provide higher profit margins while meeting consumer demand for quality and specialty offerings.

Consumers enjoy access to diverse, high-quality dairy products with improved nutritional profiles, convenient packaging, and transparent sourcing information. Product innovation continues expanding choice options while maintaining competitive pricing across different quality tiers and specialty categories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness trends dominate market evolution, with consumers increasingly seeking dairy products offering functional benefits, reduced sugar content, and enhanced nutritional profiles. Probiotic products experience particularly strong growth, with manufacturers developing innovative formulations targeting specific health benefits and consumer demographics.

Sustainability consciousness influences purchasing decisions, driving demand for products with environmental credentials including carbon-neutral production, regenerative farming practices, and sustainable packaging solutions. Local sourcing gains importance as consumers seek to support domestic agriculture while reducing environmental impact through shorter supply chains.

Premium product adoption continues expanding across all dairy categories, with consumers willing to pay higher prices for quality, unique flavors, and artisanal production methods. Craft dairy movement mirrors trends in other food categories, with small-scale producers gaining market recognition and retail distribution opportunities.

Digital transformation affects both production and marketing, with smart farming technologies improving efficiency while online marketing and direct-to-consumer sales channels create new market opportunities. Convenience packaging innovations address busy lifestyle needs while maintaining product quality and extending shelf life.

Recent industry developments highlight significant changes in market structure, technology adoption, and strategic positioning among major market participants. Consolidation activities continue reshaping competitive landscape through mergers, acquisitions, and strategic partnerships that create larger, more efficient operations with enhanced market reach.

Technology investments accelerate across the industry, with major players implementing automated processing systems, precision farming equipment, and digital supply chain management solutions. Sustainability initiatives gain momentum through industry-wide commitments to carbon neutrality, renewable energy adoption, and circular economy practices.

Product innovation intensifies with launches of functional dairy products, plant-dairy hybrid offerings, and premium artisanal varieties targeting specific consumer segments. MarkWide Research data indicates that new product introductions increased by 22% annually over recent periods, reflecting industry focus on differentiation and market expansion.

Export market development expands through trade agreements, quality certifications, and marketing initiatives promoting UK dairy products in international markets. Regulatory adaptations following Brexit implementation create both challenges and opportunities for industry participants adapting to new trade relationships and market access conditions.

Strategic recommendations for industry participants focus on leveraging market opportunities while addressing competitive challenges and evolving consumer preferences. Product portfolio diversification should emphasize premium segments, functional foods, and sustainable production methods that align with long-term market trends and consumer values.

Technology investment priorities should include automation systems, data analytics capabilities, and supply chain optimization tools that improve operational efficiency and product quality while reducing costs. Sustainability initiatives require immediate attention to meet consumer expectations and regulatory requirements while potentially reducing operational expenses through efficiency improvements.

Market expansion strategies should consider both domestic premium segments and international export opportunities, particularly in markets where British dairy products enjoy positive brand recognition. Partnership development with retailers, foodservice operators, and specialty distributors can enhance market access and brand visibility across different consumer segments.

Innovation focus should prioritize health-focused products, convenience packaging, and unique flavor profiles that differentiate offerings in competitive market segments. Brand building investments in marketing, consumer education, and transparency initiatives can strengthen market position and support premium pricing strategies.

Long-term projections indicate continued market growth driven by population increase, health consciousness, and premium product adoption across all demographic segments. Market evolution will likely favor producers who successfully integrate sustainability practices, technology advancement, and consumer-centric product development strategies.

Growth opportunities appear strongest in organic dairy, functional foods, and artisanal product categories, with projected growth rates of 6-9% annually over the next five years. Export market potential remains significant, particularly for premium British dairy products in Asian and North American markets where quality and brand reputation provide competitive advantages.

Technology integration will accelerate, with artificial intelligence, automation, and precision farming becoming standard practices that improve efficiency, quality, and sustainability metrics. Consumer preferences will continue evolving toward products offering health benefits, environmental responsibility, and unique experiences that justify premium pricing.

MWR analysis suggests that successful market participants will be those who adapt quickly to changing consumer preferences while maintaining operational efficiency and product quality standards. Market consolidation may continue among smaller players while creating opportunities for niche producers specializing in premium and specialty segments.

The United Kingdom dairy market demonstrates resilience and growth potential despite facing challenges from alternative products, cost pressures, and regulatory changes. Market fundamentals remain strong, supported by consistent consumer demand, established infrastructure, and opportunities for premium product development that align with evolving consumer preferences.

Success factors for industry participants include embracing sustainability practices, investing in technology and innovation, and developing products that meet health-conscious consumer demands while maintaining competitive pricing across different market segments. Strategic positioning in premium and specialty categories offers the best prospects for sustainable growth and profitability.

Future market development will likely reward companies that successfully balance traditional dairy expertise with innovative approaches to product development, marketing, and distribution. The UK dairy market’s evolution toward premium, sustainable, and health-focused products creates opportunities for both established players and emerging brands willing to invest in quality, innovation, and consumer relationships.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. This includes a variety of items such as milk, cheese, yogurt, and butter, which are integral to many diets and cuisines worldwide.

What are the key players in the United Kingdom Dairy Market?

Key players in the United Kingdom Dairy Market include Dairy Crest, Arla Foods, and Müller, which are known for their extensive range of dairy products. These companies compete in various segments such as liquid milk, cheese, and yogurt, among others.

What are the growth factors driving the United Kingdom Dairy Market?

The United Kingdom Dairy Market is driven by increasing consumer demand for dairy products, the rise of health-conscious eating, and innovations in dairy processing. Additionally, the popularity of plant-based alternatives is influencing traditional dairy consumption patterns.

What challenges does the United Kingdom Dairy Market face?

The United Kingdom Dairy Market faces challenges such as fluctuating milk prices, stringent regulations on food safety, and competition from non-dairy alternatives. These factors can impact profitability and market stability for dairy producers.

What opportunities exist in the United Kingdom Dairy Market?

Opportunities in the United Kingdom Dairy Market include the growing trend of organic dairy products, the expansion of online grocery shopping, and the potential for innovative dairy-based health products. These trends can help companies tap into new consumer segments.

What trends are shaping the United Kingdom Dairy Market?

Trends shaping the United Kingdom Dairy Market include the increasing demand for lactose-free products, the rise of functional dairy items enriched with probiotics, and sustainability initiatives aimed at reducing the environmental impact of dairy farming. These trends reflect changing consumer preferences and regulatory pressures.

United Kingdom Dairy Market

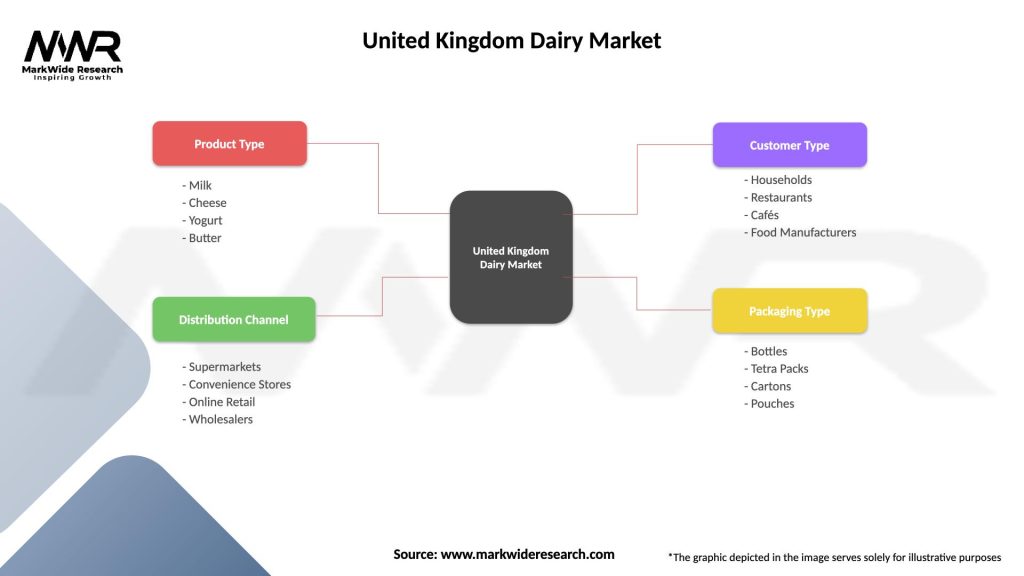

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Wholesalers |

| Customer Type | Households, Restaurants, Cafés, Food Manufacturers |

| Packaging Type | Bottles, Tetra Packs, Cartons, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Dairy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at